How Agencies Can Track Project Budgets Accurately

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

An agency once delivered a stunning rebrand for a client. Everyone loved it. The client was thrilled. The team celebrated. Then the finance director ran the numbers and discovered they’d lost $12,000 on the project. 📉

This happens at agencies everywhere. You quote a project at 40 hours, your team logs 65, and somehow nobody notices until invoicing time.

Most agencies know they’re bleeding money somewhere. They just can’t pinpoint where until the damage is done. By the time you realize a project went sideways, you’re already explaining to your business partner why this month’s numbers look terrible.

This guide breaks down how agencies can track project budgets. We’ll cover time tracking systems, early warning signs, and how ClickUp helps manage project budgets and profitability. 💰

Keep your projects profitable and your sanity intact. With the ClickUp Budgeted Project Management Template, you get full control over every dollar and finally see how agencies can track project budgets the smart way.

Here’s where agencies usually hit roadblocks when managing project budgets. 💳

Your team is running five campaigns for three different clients, all happening at once.

Designer A works on Client X in the morning and Client Y after lunch. Writer B splits their week between two projects. Who’s tracking where those hours actually go?

When campaigns overlap, it’s easy to lose track of who’s doing what and where. One misplaced hour here, another there, and suddenly your margins have vanished.

🧠 Fun Fact: The first advertising agency was founded in 1800 by James ‘Jem’ White in London. His agency, RF White & Son, began in Warwick Square, and his very first client was his old school, Christ’s Hospital.

You know your developer logged 40 hours this month. But are you sure which clients or specific projects to divide those hours between, or in what proportion? Without a clear connection between the work being done and the budget it’s eating into, you’re basically flying blind.

This is where agency project management breaks down for most teams. Good luck explaining overages to clients when you can’t show them exactly where their money went. 😶🌫️

The client asks for ‘just one small change.’ Then another. Before you know it, your team has spent an extra 15 hours on revisions nobody budgeted for.

Meanwhile, that stock photo license you thought was $50 turned out to be the extended license at $250. These surprises add up fast, but most agencies only notice them when it’s too late to course-correct.

💡 Pro Tip: Build a decision fatigue buffer into your estimates. Add 5-10% extra hours for approvals and revisions when multiple stakeholders are involved. This prevents last-minute crunches and keeps your timelines achievable.

Most agencies review their budgets weekly, if that. By the time you realize a project is 80% over budget, you’ve already blown past the point where you could have done something about it.

You need to know today—not next Monday—that Client Z’s campaign is trending toward a loss. Without proper project accounting software, you’re always looking at yesterday’s numbers.

Your account managers all track budgets differently. One uses a spreadsheet, another relies on memory, and a third has some elaborate system nobody else understands.

When clients ask for updates, you’re scrambling to compile numbers from four different places, hoping they all match. This inconsistent approach to project cost management leaves everyone frustrated and confused.

💡 Pro Tip: Monitor level of effort vs. impact for every task. Track which tasks take the most hours but deliver the least client value. Reallocate resources or adjust pricing to ensure time spent aligns with revenue and impact.

Budgets have a sneaky way of vanishing before the project’s even halfway done. Let’s fix that. ⚒️

Here are a few smart ways to stay on top of your project budgets using ClickUp’s Creative Agency Management Software, paired with the ClickUp Finance Project Management Solution.

The most profitable agencies engineer early warning systems into every dollar they allocate. Break one $10,000 number into protected work streams with built-in decision points that force you to course-correct before margins disappear.

For example, you could structure a $10,000 product launch like this:

When any category hits 80%, you have three clear options: absorb the overage, reduce scope elsewhere, or bill the client for a change order. The key is making that decision while you still have 20% runway left, not when you’re already over.

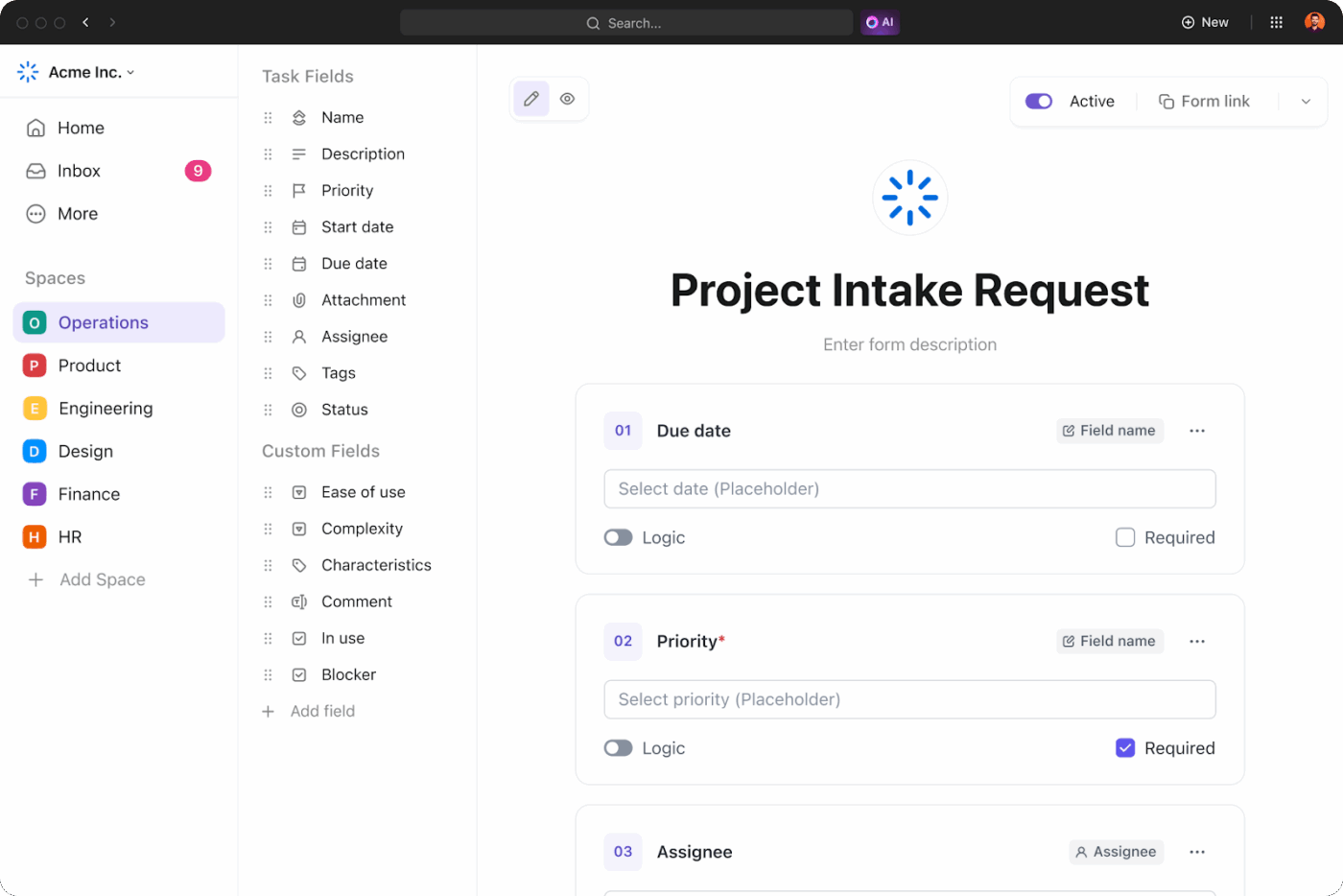

To do this, ensure you’re capturing costs with each task. You could do this using Custom Fields in ClickUp. Using the Money or Formula Custom Fields types, capture project costs in as much detail as you need within ClickUp Tasks.

As your team logs time or updates costs, the field updates automatically. You’ll always know how close you are to hitting your financial targets, without asking for manual reports or waiting for finance to catch up.

To streamline planning, try the ClickUp Budgeted Project Management Template. It gives you ready-to-use fields like Project Budget, Remaining Budget, and Projected Cost so you can see exactly what you’ve planned vs. what you’re spending.

You can switch between different views—Budget View for a clear snapshot of costs, Project Schedule View to track deadlines, and Phases of the Project to see which stages eat up the most resources. This project budget template gives you one clear place to monitor spending, spot overruns early, and make decisions that keep your team and profits on track.

A healthy operating budget requires two layers of visibility: how your team spends time and how much each task costs.

Time tracking gives you the diagnostic data to catch these patterns early. When you log hours at the task level, you can compare what you estimated against what happened. That gap tells you everything:

You can’t fix what you can’t see.

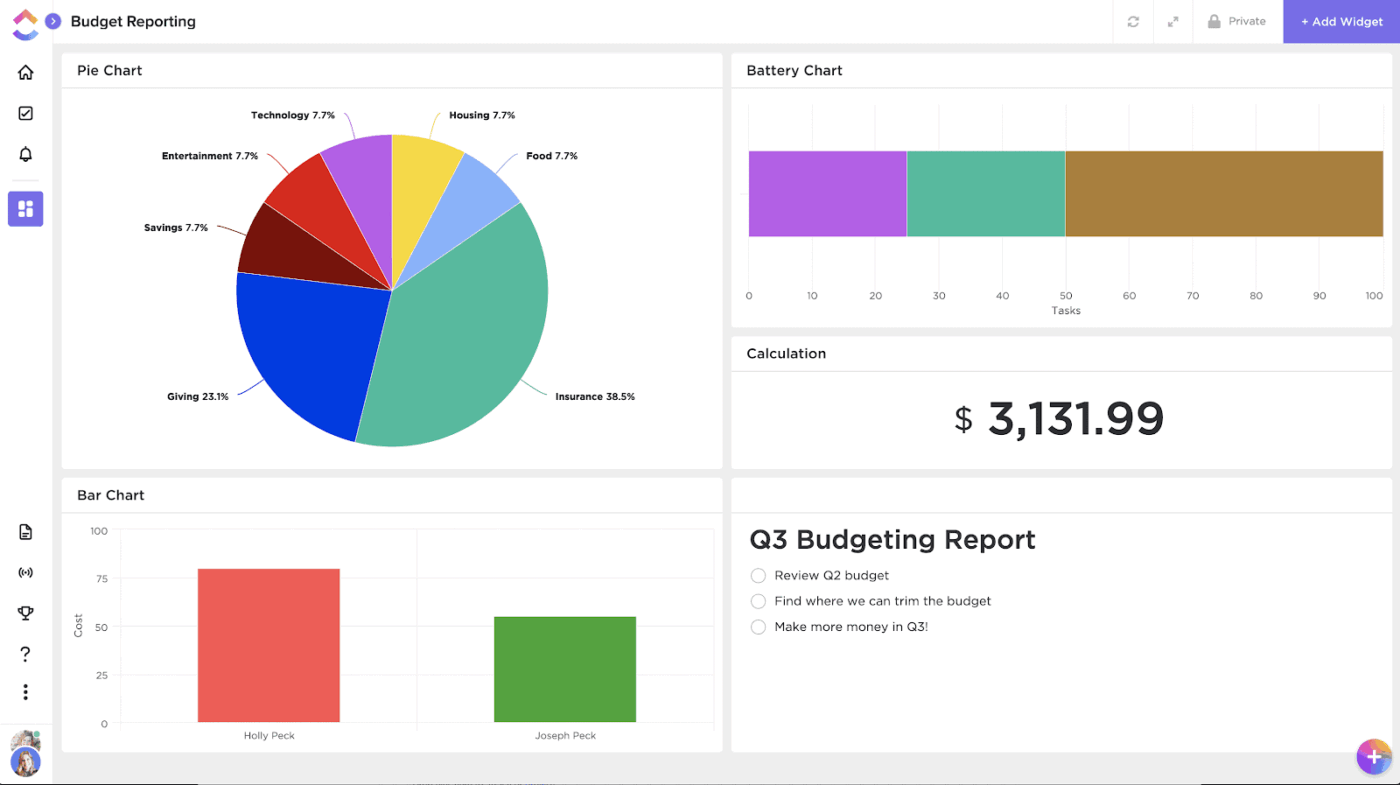

ClickUp Project Time Tracking embeds logging directly into each task. Your designer clicks start when they open Figma, stops when they switch to another project.

At the end of the week, you see 12 hours logged on social graphics that you budgeted 6 for. That’s your signal to either push back on revisions, reallocate hours from another deliverable, or flag the overage for a change order. The earlier you catch it, the easier the conversation.

But individual task data doesn’t tell you the full story. You need to zoom out and see who’s drowning and who’s coasting (yes, we’re talking about resource allocation!).

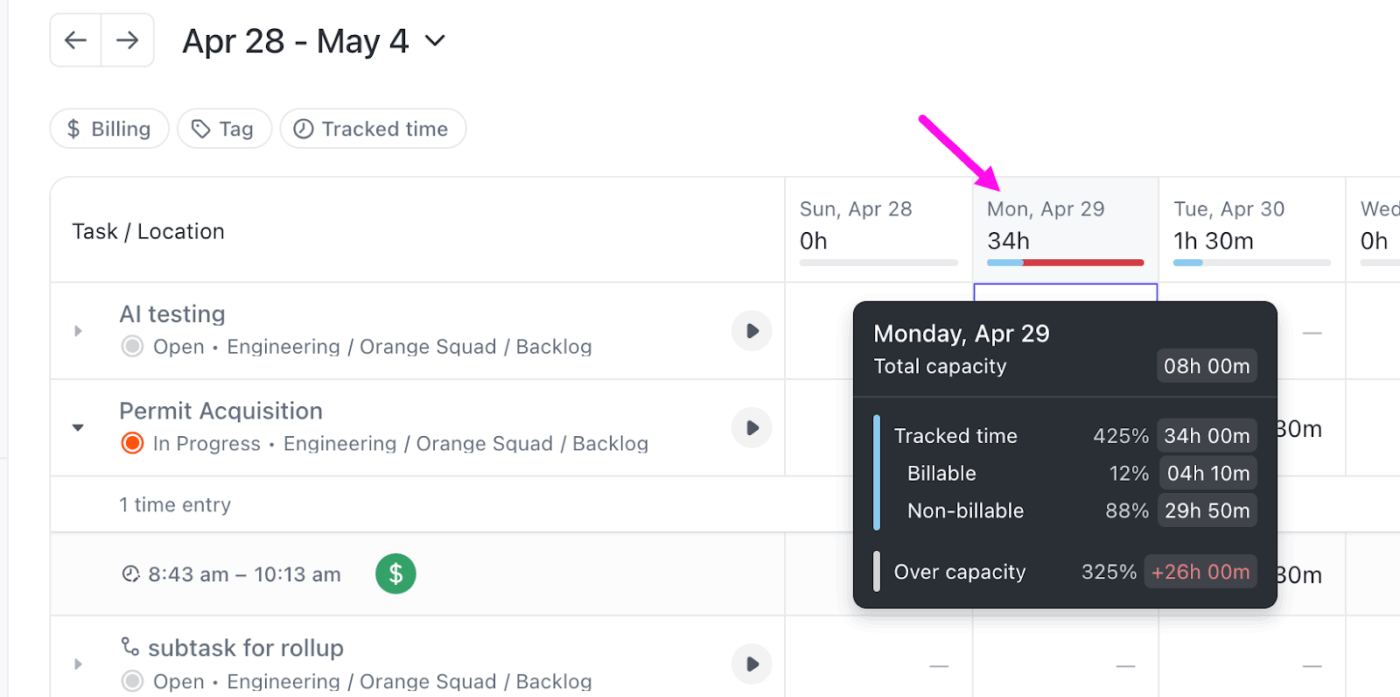

ClickUp Workload View maps every team member’s capacity across all active projects.

You see at a glance that Designer A is overloaded on Campaign A, while Designer B has room to absorb the Campaign B graphics you’ve been delaying. Reassign the work before the deadline compresses, and you avoid the panic tax—rush fees, weekend hours, or shipping subpar work because you ran out of time.

You’re in a client call when they ask how much of their $15,000 budget remains. You fumble through three browser tabs, but by the time you cobble together an answer, you’ve lost credibility and wasted eight minutes that could’ve been spent solving actual problems.

This fragmentation doesn’t disappear when you scale. It multiplies. 🙃

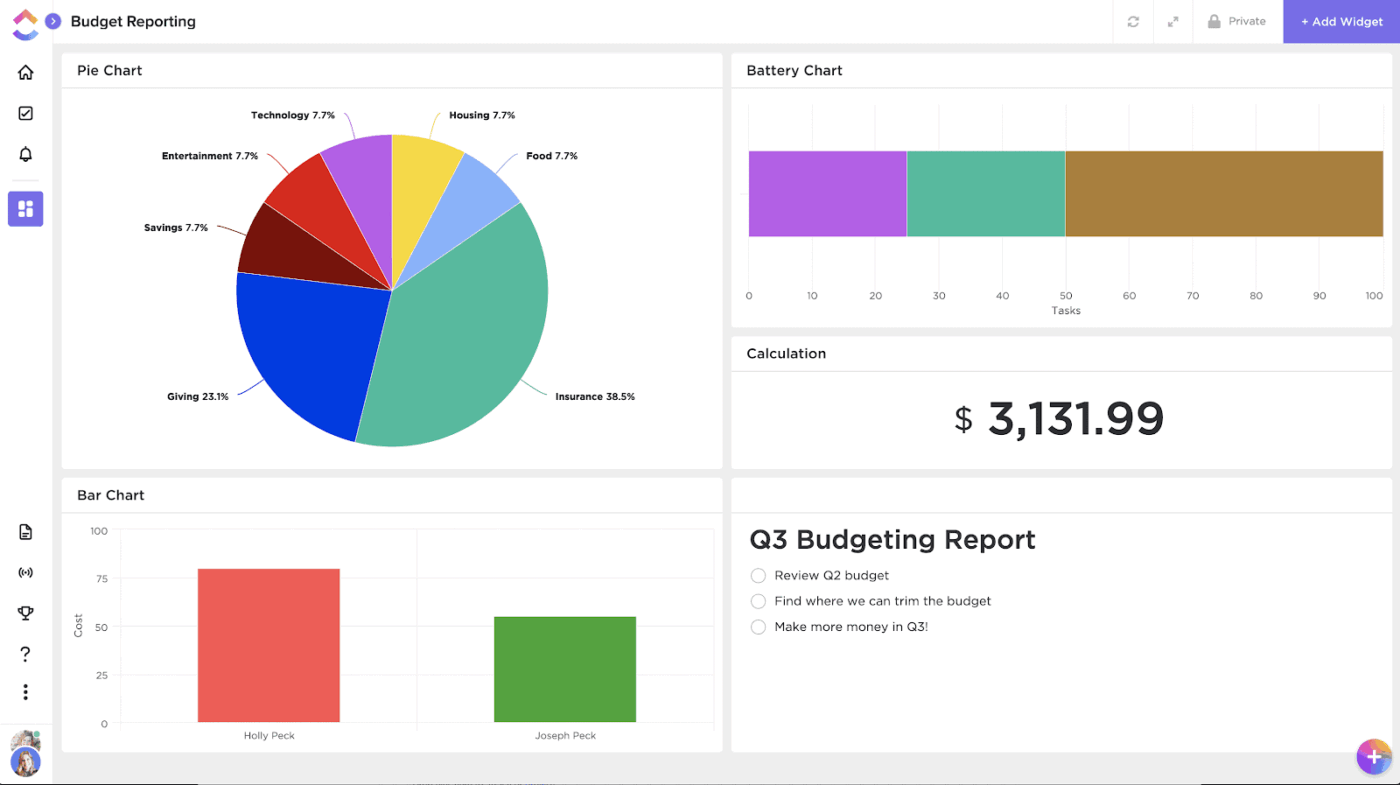

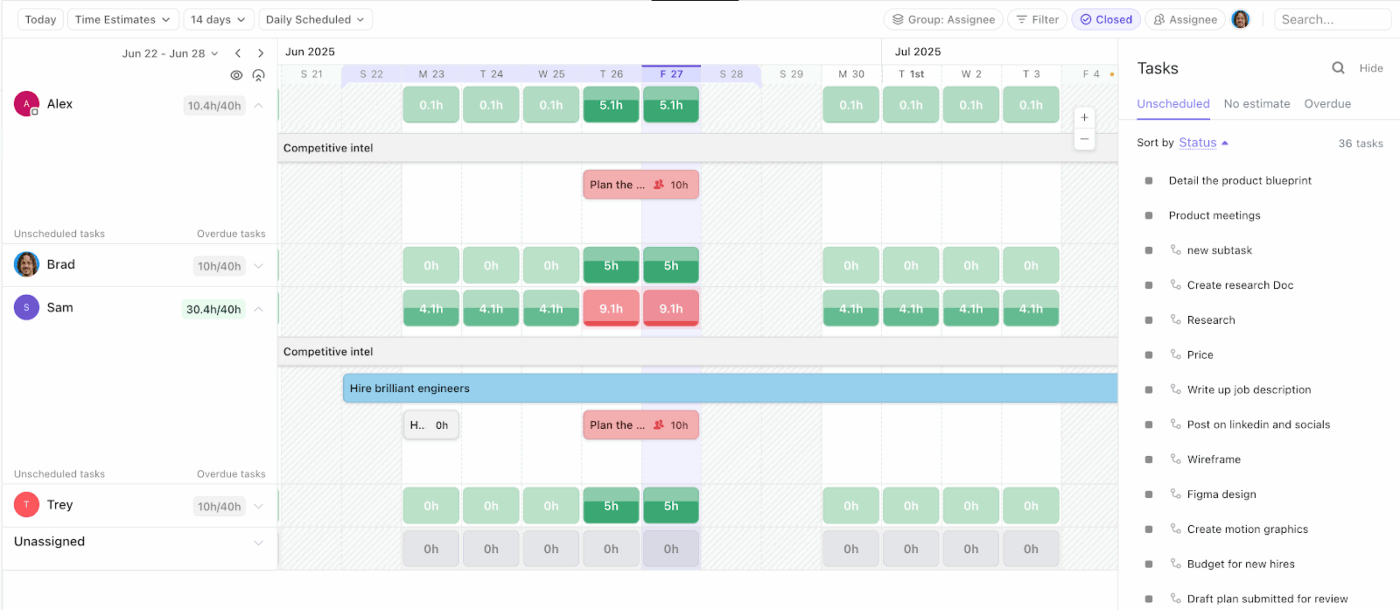

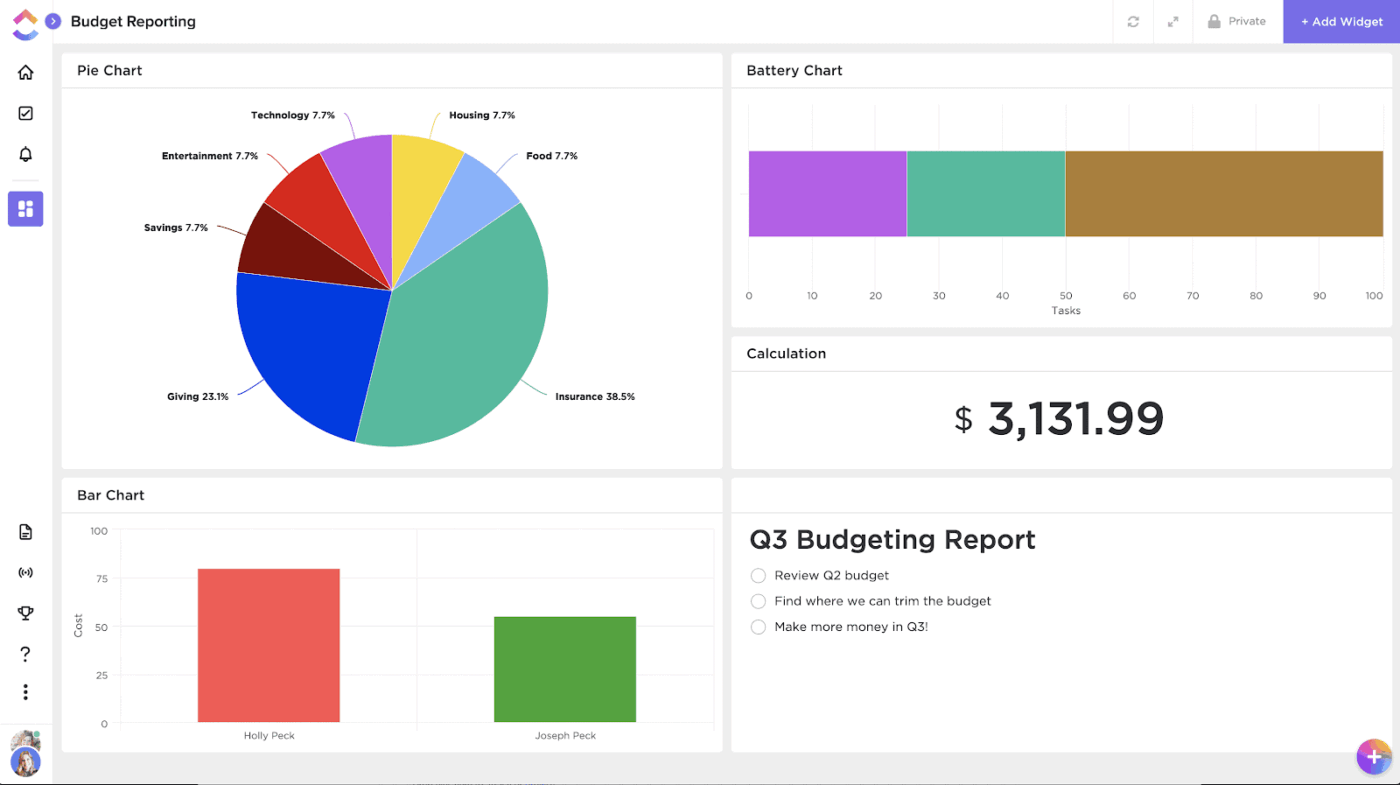

ClickUp Dashboards function as your financial command center.

Build one that pulls live data from every active project:

You’re seeing what’s happening right now, which means you can intervene while intervention still matters.

That visibility gives you three immediate moves: freeze non-essential tasks, bill the client for expanded scope, or absorb the overage and document the gap for future pricing.

You can also use the reporting tool to schedule reports for stakeholders and add AI Cards to surface insights and trends automatically.

🧠 Fun Fact: In the Agency Growth Benchmark Study, 74% of agencies grew revenue in the previous year, and nearly half of them grew it by 25% or more.

Your videographer sends an invoice. Your producer forwards it to finance. Finance asks which campaign it belongs to. Your producer digs through emails and replies with the project code. Finance enters it manually into QuickBooks, but logs the wrong amount.

Now your Campaign B budget shows phantom money, and you’re making resource decisions based on bad numbers.

The fix starts with centralizing where expenses get submitted and approved.

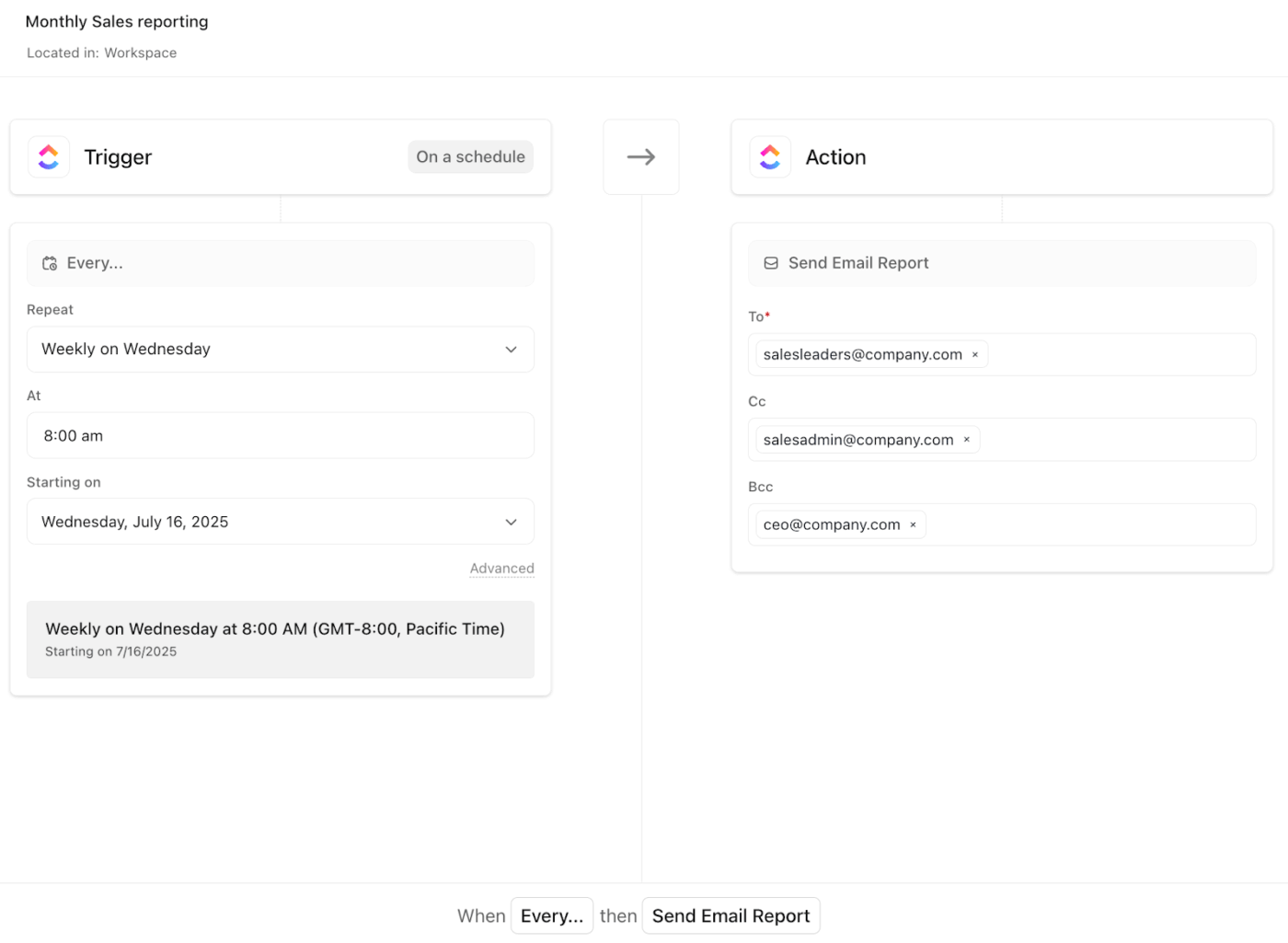

Create a ClickUp Form where project team members submit expenses with required fields: amount, vendor, campaign name, receipt upload, and category. Each submission becomes a task with all the context your finance lead needs.

Plus, you can use the ClickUp and QuickBooks Sync Integration to synchronize customers, products, services, and invoices between both apps.

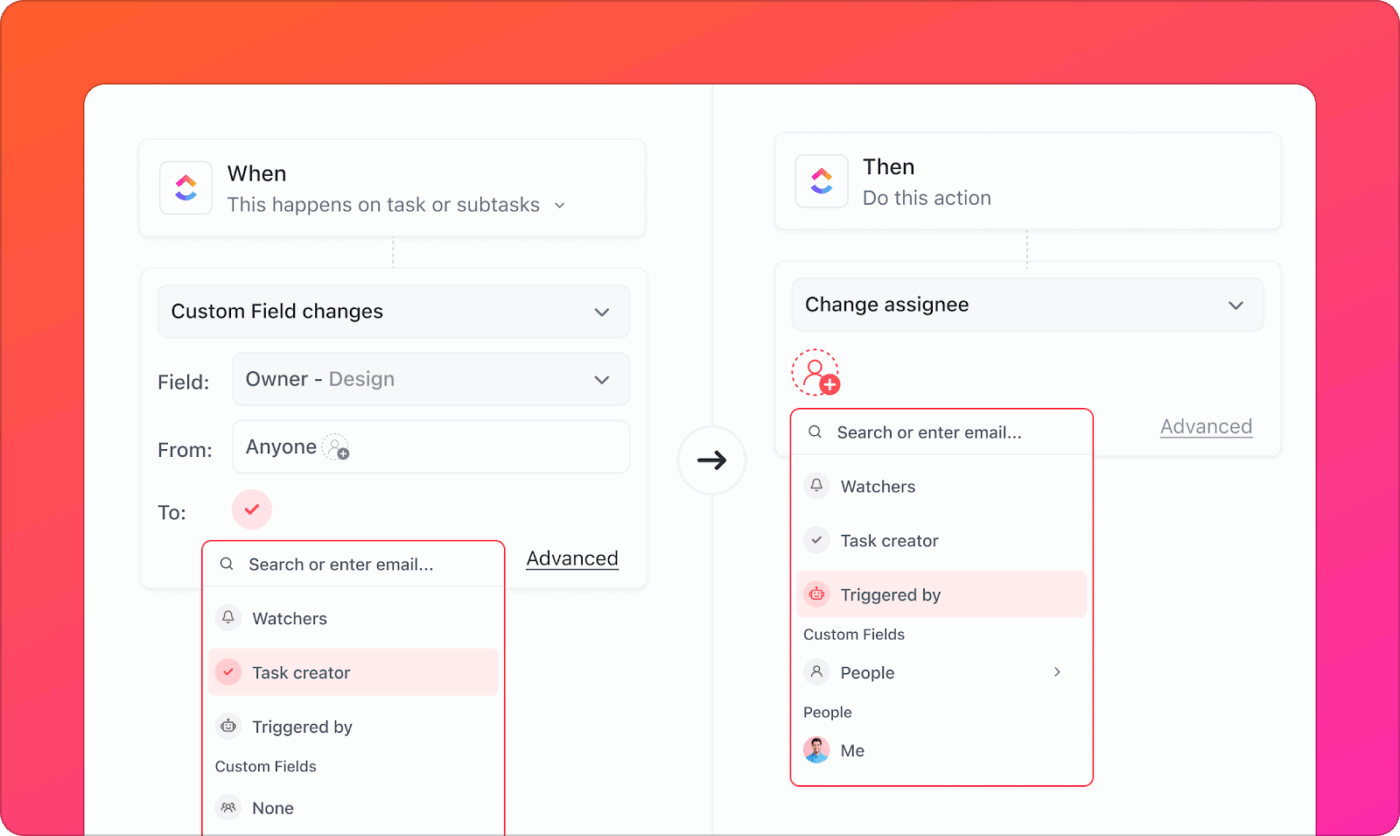

Now use ClickUp Automations to eliminate the follow-up work that normally eats another 10 minutes per expense:

Configure your workflow once in ClickUp for Agencies, then let the system handle routing and calculations while your team delivers client work.

🤝 Friendly Reminder: The contract you choose can make or break your budget. Time and Materials allows you to bill for every extra hour and deliverable, so scope creep is less intimidating. Fixed Fee puts most of the risk on your side, which clients love, but can crush your margins when changes pop up.

You closed a $15,000 rebrand with a 9% margin when you projected 28%. Design ate 40% more hours than estimated, but three weeks later, nobody remembers why.

The agencies hitting 25-30% margins consistently treat every project as a diagnostic.

They ask: What did we estimate? What actually happened? Why was there a gap? They track estimation accuracy by phase, revision velocity, approval lag time, and scope change triggers.

After 10-15 projects, patterns emerge: enterprise clients add 18% to timelines, committee approvals need 25% more revision rounds, vague briefs kill budgets.

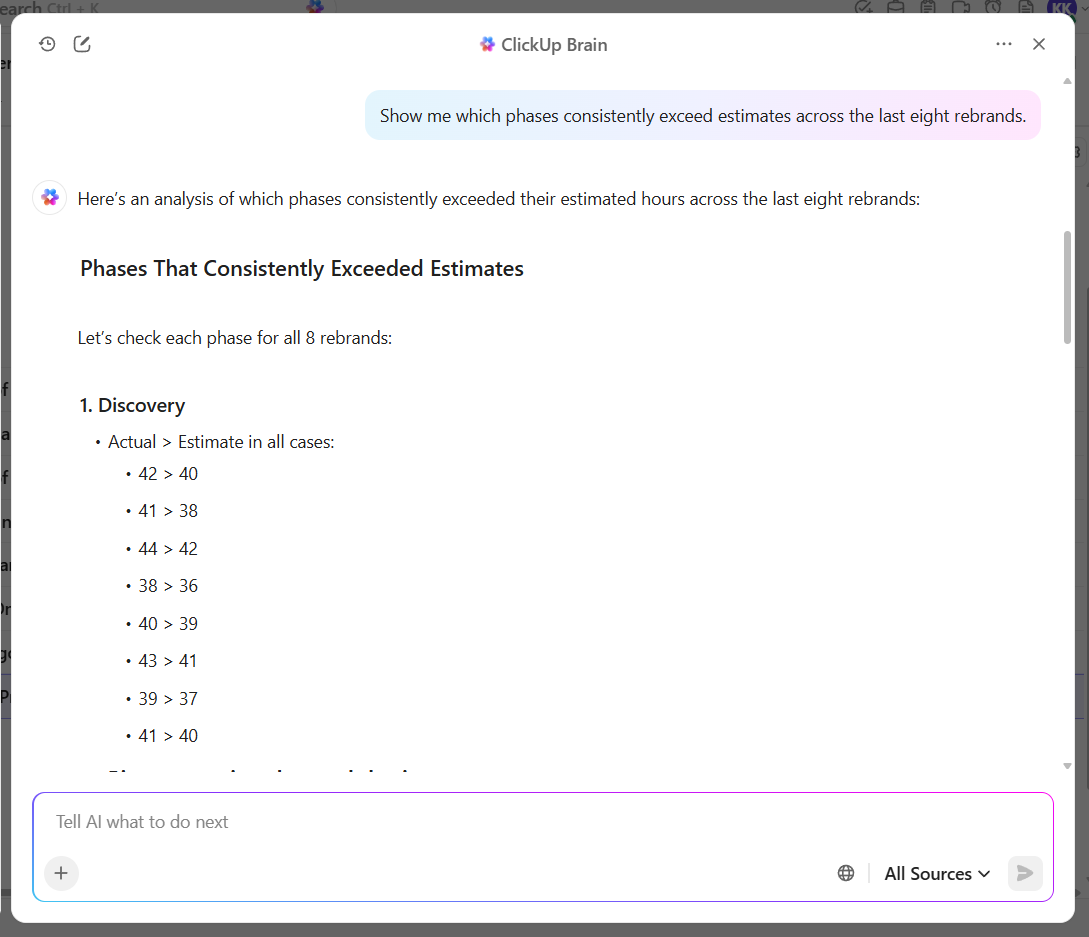

ClickUp Brain, the integrated AI assistant within the marketing agency software, makes this process quick and actionable. Since it lives where your work is, you can just ask for a summary of spending vs. budget, uncover where costs exceeded or fell short, and highlight tasks that had the most impact on your financial outcome.

✅ Try this prompt: Show me which phases consistently exceed estimates across the last eight rebrands.

This approach shows how agencies can track project budgets while turning each project into a learning opportunity for smarter planning.

📮 ClickUp Insight: 78% of our survey respondents make detailed plans as part of their goal-setting processes. However, a surprising 50% don’t track those plans with dedicated budget tracking tools. 👀

With ClickUp, you seamlessly convert project goals into actionable tasks, allowing you to conquer them step by step. Plus, our no-code Dashboards provide clear visual representations of your progress, showcasing your progress and giving you more control and visibility over your work. Because “hoping for the best” isn’t a reliable strategy.

💫 Real Results: ClickUp users say they can take on ~10% more work without burning out.

Budget reviews either drive real decisions or they become another Friday meeting where everyone nods, says ‘looks good,’ and goes back to putting out fires. The difference comes down to whether you’re reviewing the right metrics and whether those metrics actually trigger action.

Build your review cadence around two rhythms: weekly operational checks (to keep you honest on the numbers) and milestone-based assessments (to catch the drift before it becomes a crisis).

Together, they create a system where problems surface early enough that you can actually do something useful with the information.

Your weekly review needs three diagnostic metrics:

Make these reviews an essential part of your marketing agency process. Gather your project managers, finance lead, and account managers for 15 minutes each week. Each person brings their piece of the puzzle.

When a campaign hits 50% of its timeline, that’s your checkpoint to assess whether the second half will stay on budget or blow up. When any project consumes 70% of its allocated budget, automate an immediate review regardless of where you are in the calendar.

Learn more about automating these workflows with ClickUp here:

🚀 ClickUp Advantage: Set Reminders in ClickUp for your team or yourself to review budgets at specific milestones or weekly intervals.

For instance, you could set a reminder every Friday to check each campaign’s expenses against projected budgets. When the reminder pops up, your team can update costs, review task progress, and make adjustments immediately.

💡 Pro Tip: Keep your budgets and client communication on track with ClickUp’s Project Plan for Creative Agencies Template. It helps you organize tasks, track budgets, and share updates seamlessly, so your team and clients always stay aligned.

The worst budget conversations happen at project end when you’re explaining an overrun the client never saw coming. They thought everything was fine because nobody told them otherwise.

The agencies that avoid this treat budget communication as a strategic tool. When your client sees they’ve consumed 65% of their media budget at the campaign midpoint, you can collaborate on solutions together: shift spend to better-performing channels, extend the timeline, or add budget for tactics that are working.

Send a brief budget snapshot every two weeks for longer campaigns. Answer three questions: Where do we stand now? What’s driving the spend? What decisions do we need to make together?

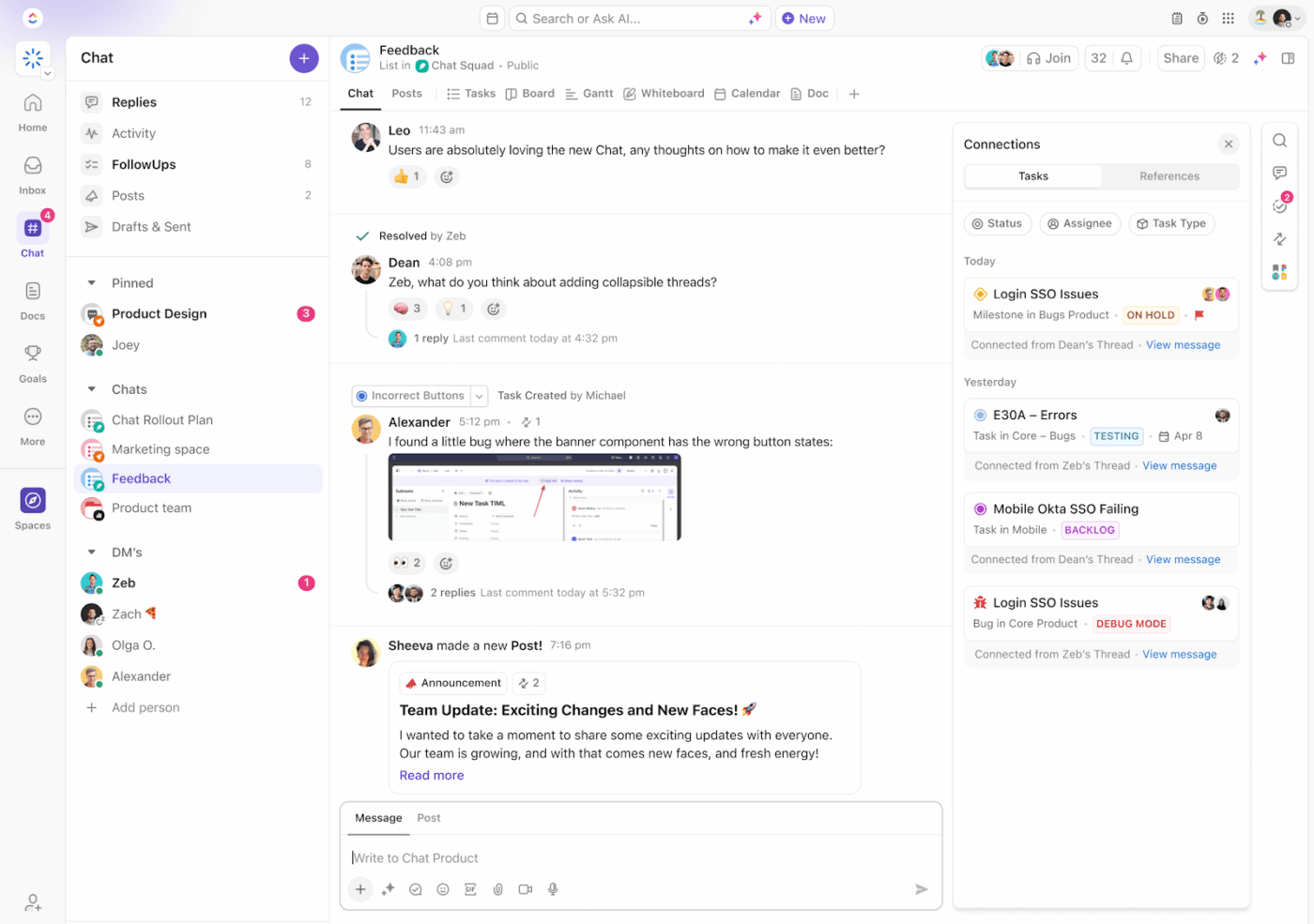

ClickUp Chat makes sharing budget updates simple. You can create dedicated channels for each client or campaign, post updates on budget status, and attach relevant docs or tasks.

For instance, after completing a weekly budget check, you can send a quick summary to the client with charts showing remaining budget and upcoming expenses. Stakeholders can ask questions or provide approvals directly in Chat, keeping conversations and financial context in one place.

Dayana Mileva shares her thoughts on using ClickUp at Pontica Solutions:

With ClickUp, we went one step ahead of the game and created dashboards where our clients can access and monitor performance, occupancy, and projects in real time. This allows clients to feel connected to their teams, especially given that they are located in different countries, and sometimes even on different continents

🌟 Bonus: ClickUp Brain MAX, the desktop AI companion, can be a powerful tool for monitoring project budgets by leveraging its AI-powered search, summarization, and automation features.

Understanding how agencies can track project budgets is one thing. Building the operational discipline that actually protects your margins is another. 👀

Try these best practices to support your efforts.

Fixed budgets shatter the moment a client pivots strategy or your top-performing channel suddenly doubles in cost.

Your contingency buffer should live between 10-15% of the total project budget. This gives you breathing room when the scope expands, timelines stretch, or complexity surprises you. Without it, every unexpected twist forces you to either sacrifice margin or have an uncomfortable conversation with your client about additional costs.

The smarter move is breaking monthly budgets into phase-based releases:

This structure lets you reallocate mid-flight. When organic content crushes it and paid ads underperform, you can shift those media dollars toward more content production before the campaign wraps.

Every dollar needs a name attached to it.

Let one project manager own the full financial picture of a campaign—tracking, approvals, variance reporting, all of it. They’re your single source of truth. But ownership cascades down from there. Your creative leads need spending authority so purchasing a stock photo doesn’t require two days of lag time.

Your account managers carry a different responsibility:

Weekly budget ownership check-ins force each person to surface anything trending wrong. When everyone guards their section of the budget, problems get caught while you can still fix them.

📖 Also Read: Estimate Templates to Assess and Disclose Costs

The clients who become long-term partners are the ones who never feel blindsided by budget news. They see the financial story unfolding throughout the project, which means when adjustments are needed, they’re part of the solution.

Real-time budget dashboards give clients visibility whenever they want it. They can track spending without waiting for you to compile a report or schedule a call.

Pair that access with biweekly snapshots that distill the complexity into three questions clients actually care about: where we stand right now, what’s driving the spend, and what decisions we should make together in the coming weeks.

💡 Pro Tip: Create a client dashboard to give clients a clean view-only access to their project financials without exposing your internal notes, other client data, or how you calculate margins. You can also try client portal templates to standardize what information gets shared.

Predicting expenses means stopping the cycle of expensive surprises. You’re looking for the signals that scream ‘this project is about to eat your profit’ before you’re too deep to fix it.

The agencies that nail this know that most budget disasters follow predictable patterns, and those patterns leave breadcrumbs you can track.

AI can process your historical project data to surface correlations you’d miss manually:

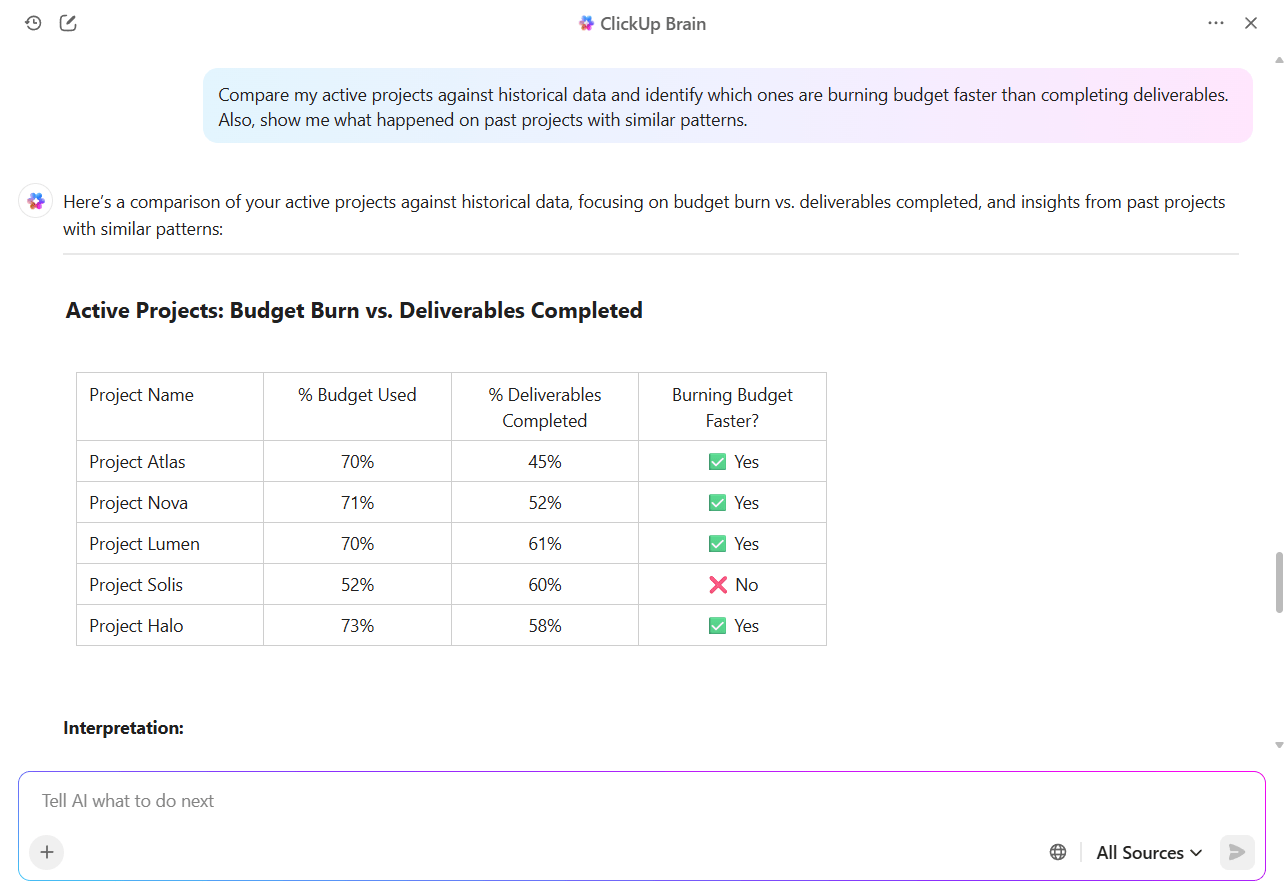

🚀 ClickUp Advantage: Use ClickUp Brain to predict expense patterns. It analyzes your history and flags which active campaigns show early warning signs within the project management software.

✅ Try this prompt: Compare my active projects against historical data and identify which ones are burning budget faster than completing deliverables. Also, show me what happened on past projects with similar patterns.

Once you know your patterns, pricing becomes evidence-based. That $18,000 rebrand splits into $18,000 for single decision-makers and $23,500 for committee-driven accounts.

AI also tracks real-time velocity on current projects—when you’re two weeks in, burned 55% of budget but completed 30% of deliverables, it flags that this gap matches patterns that preceded previous overruns.

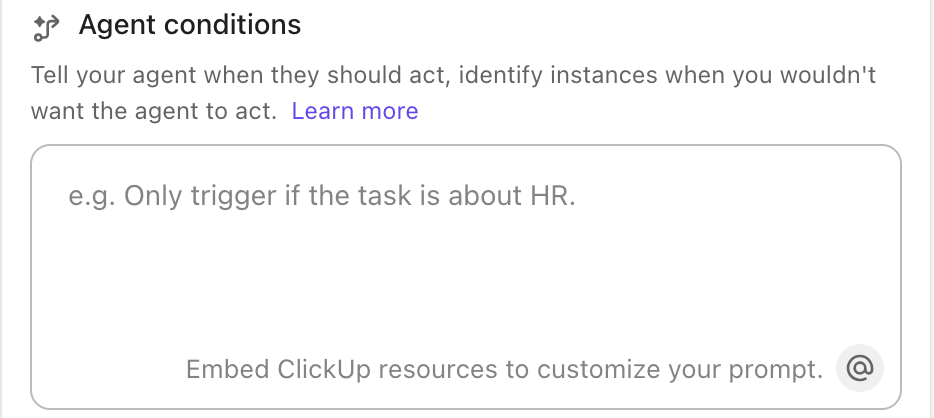

💡Pro Tip: AI Agents in ClickUp can be your 24/7 early warning system! Use a Prebuilt Agent to send daily/weekly project updates in the relevant Chat channel, and set up a Custom Agent using our no-code builder to warn you when a budget threshold is breached.

Cost control in project management gets tricky when small slip-ups creep in. Let’s call out some common pitfalls that can throw budgets off track. 👇

| Pitfall | Why it happens | How to avoid it |

| Treating retainers like fixed budgets | Retainers often disguise uneven workloads. Some months end up light, others far heavier, which makes actual costs appear balanced when they are not | Track effort against deliverables inside the retainer and review utilization monthly |

| Forgetting vendor pass-through costs | Subcontractor fees, ad spend, and freelance invoices often get logged late or overlooked, which inflates margins on paper | Record external costs as soon as they occur and tag them to the correct campaign |

| Underestimating revision cycles | Creative work rarely follows a straight line. Multiple revisions quickly consume more hours than budgeted | Build buffer hours for revisions based on past project history and enforce clear limits |

| Tracking budgets by project instead of campaign | Campaigns often include multiple projects such as ads, web pages, and events. Tracking each one separately hides the actual spend | Roll up reporting at the campaign or client level for an accurate total |

| Ignoring seasonality in resource use | Busy periods like launches or holidays increase overtime and external vendor costs, which skews average spend | Forecast seasonal spikes and adjust allocations before campaign kickoff |

🔍 Did You Know? Cost overrun distributions are rarely normal; they follow a fat-tailed distribution. This means most projects are fine, but the few extreme overruns are huge. Agencies ignoring the risk of rare, expensive scenarios often end up eating major losses.

Every agency has that one project that looks smooth on the surface until the final invoice lands. The numbers tell a different story, and you’re left wondering how things slipped.

Staying profitable means staying connected to your budgets, your time, and your team’s output. Once you see how the money moves, you can steer every project with confidence.

ClickUp’s project management software makes that part effortless. You can track budget goals, keep an eye on expenses, forecast costs with AI, and generate reports that show progress in real time. The result is a clear financial picture for every project and fewer end-of-month surprises.

So go ahead, give your budgets the structure they deserve. Sign up for ClickUp today! 📝

Agencies can track multiple client budgets by keeping separate budgets for each project and monitoring actual spend against planned costs. Using a centralized tool like ClickUp for cost and resource management helps see everything in one place without confusion.

Tools like ClickUp, Microsoft Excel, or other dedicated project management tools can alert project teams when spending is close to the limit, let you adjust allocations, and give real-time visibility into costs.

Yes. ClickUp lets agencies link budgets to tasks and time entries, so you can see how hours worked impact costs and keep projects on track financially.

Agencies should check budgets at least weekly or at every major project milestone. Frequent reviews help catch overruns early and adjust plans as needed.

Keep all costs recorded in one place, compare actual vs. planned spend regularly, update budgets with changes in scope, and make reports clear and easy to read for both teams and clients.

© 2026 ClickUp