Professionals on the go can drive hundreds or even thousands of work-related miles over the year. For conventional employees on the clock, these are expendable costs you can recoup through your company’s AP department. For contractors and business owners, these miles are deductible business expenses.

But you can only get that money back or those tax savings if you have a convenient, reliable way to track your miles over the year. Today’s mileage tracker apps make it easier to automatically track your distance, your destinations, and which trips qualify as business expenses.

Find the right app with the right features so mileage tracking is an easy win instead of a tedious chore. Identify must-have features found in mileage track apps in 2024, and then compare the popular tracking apps in this list to find your favorite.

What Should You Look For in Mileage Tracker Apps?

The best mileage tracker apps are built for business users—even better, the right tracking apps will be built with professionals in your industry in mind. Rideshare drivers, real estate agents, and startup founders drive for different business purposes, and you need a tool that aligns with your needs.

As you compare different options, make sure these must-have features are available in either the free or premium version:

- Automation: There’s nothing more frustrating than arriving at a faraway destination and realizing you didn’t start your mileage tracker. Avoid this by choosing apps that automatically track all of your miles. Smart apps can guess which journeys are business-related, so you don’t have to go in and do a bunch of manual work, making workload management easier

- Exportability and integrations: Ultimately, your mileage tracking data must move from the app to IRS forms or business expense reports. Look for apps that can share the information with financial tools you (or your accountant) already use

- Lots of categorization and tag features: Good mileage tracker apps let you fill in the details about what type of business travel each drive is. You might need data fields like dates or extra functionality to distinguish between field service calls and networking events and track travel for different gig apps

- Additional functions: If they fit your business’s needs, look for in-built task management software, expense tracking, time management tools, and timesheet templates

- Financial insights: Look for apps that calculate your total expenses on travel, your tax savings, and driving trends

- Convenience and reliability: The best apps are the ones you don’t have to check on whenever you get in the car. So compare your favorite apps based on their uptime, crashes, errors, and ease of use

By looking for quality and convenience, it’s much more likely that you’ll have accurate records and an easy way to get your money back for business miles.

The 10 Best Mileage Trackers

Compare these best mileage tracking apps available in 2023. Each one offers easy-to-use tracking technology with unique features and capabilities.

1. ClickUp

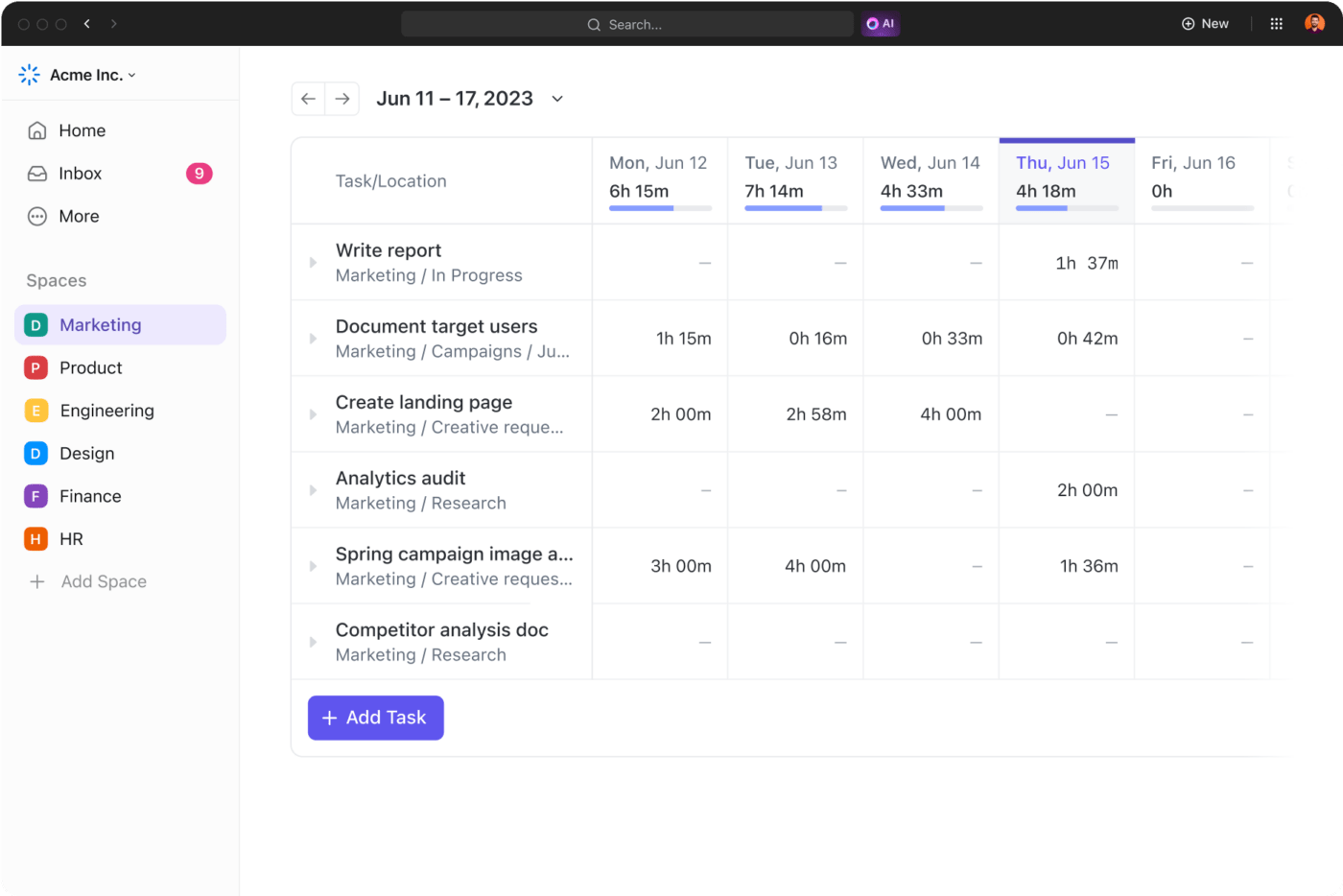

ClickUp isn’t a real-time mileage tracker—it’s everything else you need to manage personal and business trips. Solo professionals, small business owners, and business teams use it to import their mile-tracking data to create a centralized information hub.

From there, traveling professionals can transfer the data into templatized expense reports or add it to their list of tax-exempt business expenses. Managers can analyze team travel to uncover inefficiencies or make sure the budget is on track to cover the miles. Accountants and financial teams can also access the data to handle payments and tax filings.

Whether you want a calendar that houses all your travel data or a table to see how many miles your team puts in weekly, ClickUp offers versatile views and project management tools to support your efforts. You can also use specialized templates like the ClickUp Services Timesheet Template to track mileage within the context of work hours.

ClickUp best features

- Aggregate and track miles from different employees and teams in the Table view for quick insights and monitoring

- Use templates and forms within ClickUp to add data from mileage-tracking apps to reports, expense forms, and other documents

- Attach mileage information to specific projects or tasks for easy budgeting and forecasting

- Free database software functionality for in-depth tracking and report generation with database templates

- Add tasks for individual drivers, accountants, or yourself (in all your many hats) so you can analyze the mileage data and put it to work

- Combine mileage tracking with more project time tracking to see where your company resources are being used

- Communicate with ClickUp’s notes and DM features so everyone gets their data in on time

ClickUp limitations

- ClickUp doesn’t provide real-time mileage tracking; you will need to pick a mileage tracker app and integrate it with ClickUp to add the data to your project management processes

- The mobile app offers fewer features than the desktop app. Handle day-to-day tasks on your phone and then switch to your computer for heavy-duty analytics

ClickUp pricing

ClickUp ratings and reviews

- G2: 4.7/5 (2,000+ reviews)

- Capterra: 4.7/5 (2,000+ reviews)

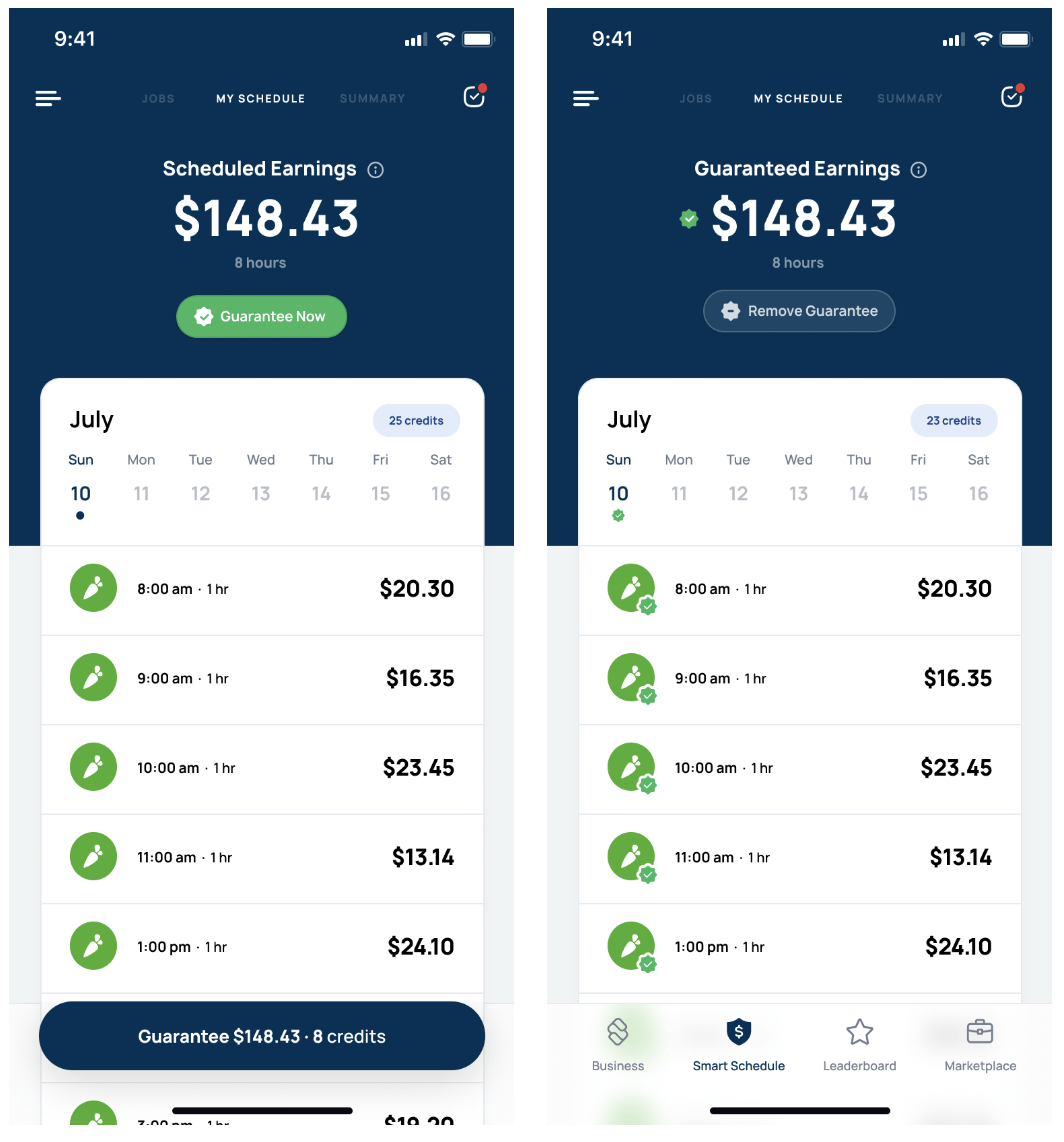

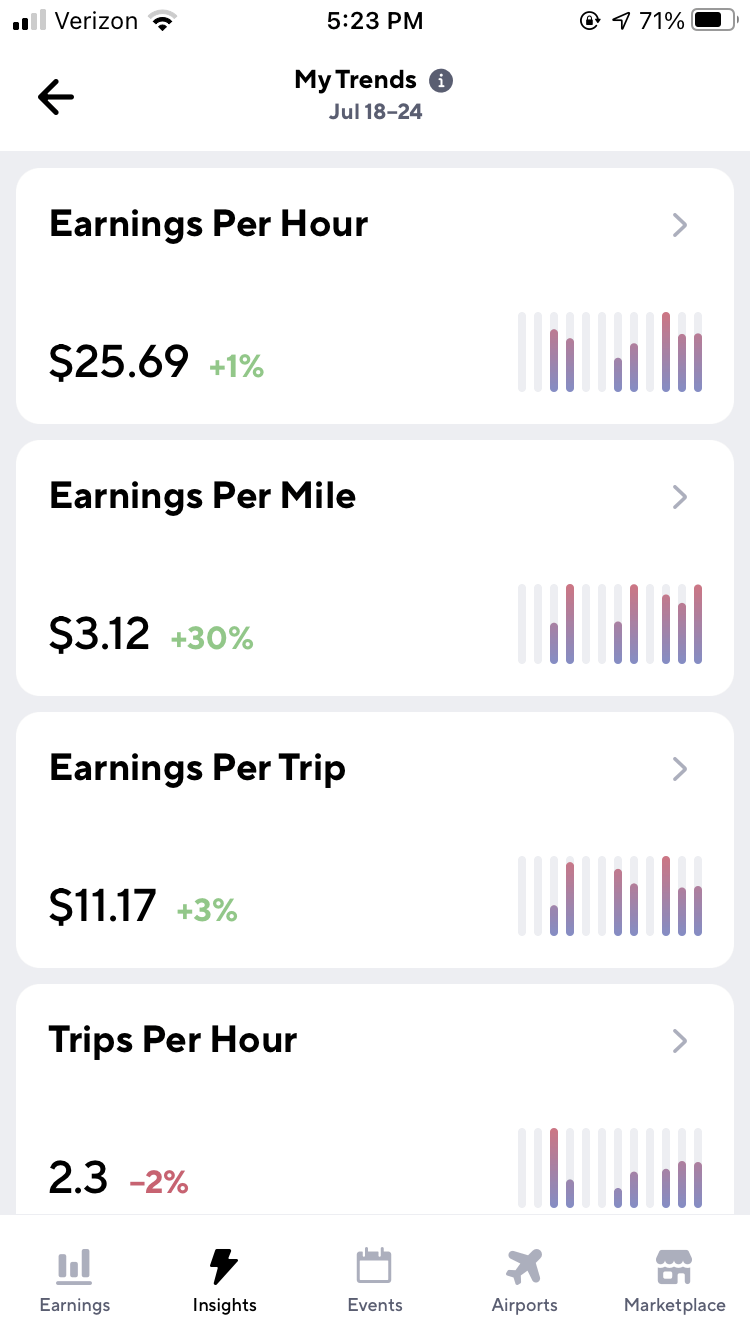

2. Solo

Time-tracking and mile-tracking are tedious job requirements if you work in the gig economy. But Solo simplifies the work with automatic mileage and expense tracking. Use this app to integrate all of your gig apps onto a single dashboard to plan your trips, track miles, and see how much you made at the end of the day.

Solo is more than a simple mileage tracker. It offers you one place to manage all your to-dos from different platforms, ridesharing apps, and delivery apps. Even better, it forecasts how much money you’ll make each day—and then pays you the difference if it overestimates your daily revenue. Many gig drivers use this app for recordkeeping, itinerary-building, and financial tracking.

Solo best features

- Integrations with popular apps like Instacart, Doordash, and Uber

- Multiple trackers for mileage, time, and forecasted income

- A guarantee for your daily pay

Solo limitations

- Manual tracking can be unreliable, according to some users

- Text can be small and hard to read

Solo pricing

- Basic: $10/month

- Pro: $15/month

- Pro Plus: $20/month

Solo ratings and reviews

- G2: No reviews available

- Capterra: No reviews available

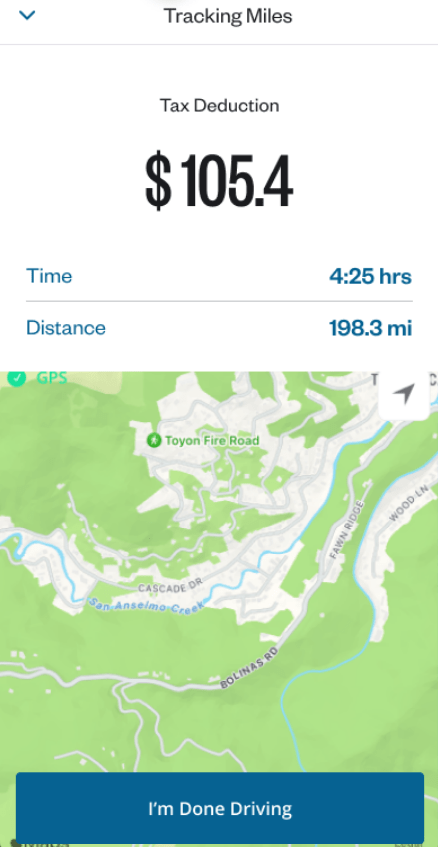

3. Stride

Stride is a free mileage-tracking app. Users can automatically track miles for all of their trips. It also helps business users find tax deductions and savings opportunities with a helpful dashboard for monitoring savings, costs, and options.

Users also use it for their personal lives, as the app offers budgeting tools and personal expense tracking. The app design is easy and intuitive, so using it is never a chore.

Stride best features

- Mileage and time-tracking right on the app home screen

- Budget features for at-a-glance money management

- Easily distinguish between personal trips and business trips

- Suggestions for finding and using tax deductions

Stride limitations

- Inconsistent notifications

- Some users report issues with mileage and route accuracy

Stride pricing

- Free

Stride ratings and reviews

- G2: No reviews available

- Capterra: No reviews available

Bonus: Travel Management Software!

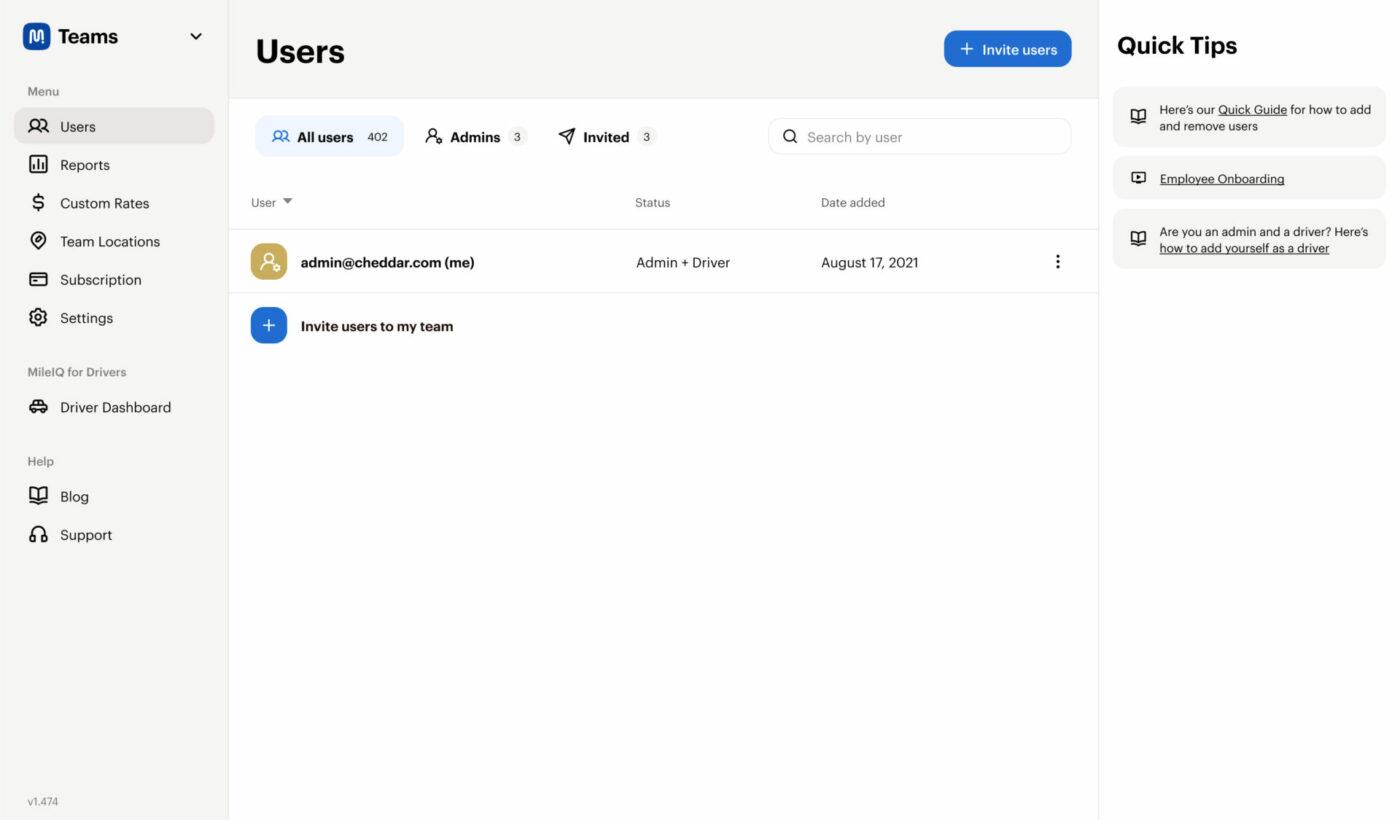

4. MileIQ

Distinguish between personal and business travel with a flick of the wrist when you use MileIQ to track your miles. The app automatically tracks all of your journeys, and you can swipe left or right to designate what type of travel each trip was.

The app is built for busy working professionals in virtually every industry. You can track miles (and savings) over time, enable work hours so you have fewer trips to sort through, and get reminders if you have any pending to-dos in the app.

MileIQ best features

- MileIQ’s dashboard makes it easy to swipe and classify drives

- Trackers show you savings and deductions over time

- Easily download monthly mileage reports as CSV or PDF files

MileIQ limitations

- The app interface can be slow while making manual edits or adjustments

- The free version limits how many drives it will track per month

MileIQ pricing

- Free

- Unlimited: $5.99/month per user

- Teams: $8/month per user

- Team Pro: $10/month per user

MileIQ ratings and reviews

- G2: 4.2/5 (66+ reviews)

- Capterra: 5.0/5 (1+ reviews)

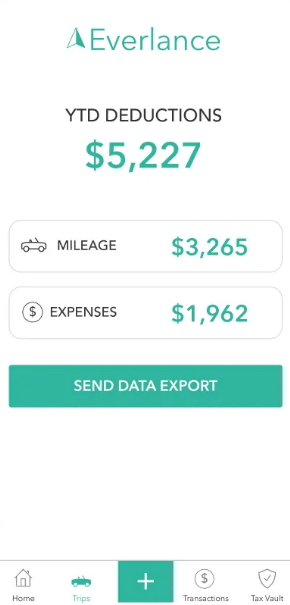

5. Mileage Tracker by Everlance

Everlance puts reporting functions front and center with its mileage tracker app. As it tracks miles, it will calculate daily, monthly, and annual deductions and expenses. Users can filter out data to focus on different periods and easily export data to their preferred financial and project management apps.

The app touts IRS-compliant features and creates plenty of documentation. It can fit the needs of virtually any company policies on expense reports, tracking, and verification.

Everlance best features

- Automatic tracking with edit features to go back and reclassify trips or break trips up into smaller journeys

- Good report generation and documentation options

- Weekly, monthly, and daily log options for easy insights and monitoring

- Clean, easy-to-navigate interface

Everlance limitations

- Free features occasionally miscategorize trips and overwrite data

- May not record trips if the phone battery is low

Everlance pricing

- Free (for individuals and businesses)

- Premium (individual): $5/month

- Premium Plus (individual): $10/month

- Business: $12/month per user

- CPM Program (businesses): $10/month per user

- FAVR Program (businesses): $33/month per user

Everlance ratings and reviews

- G2: 4.3/5 (100+ reviews)

- Capterra: 4.4/5 (64+ reviews)

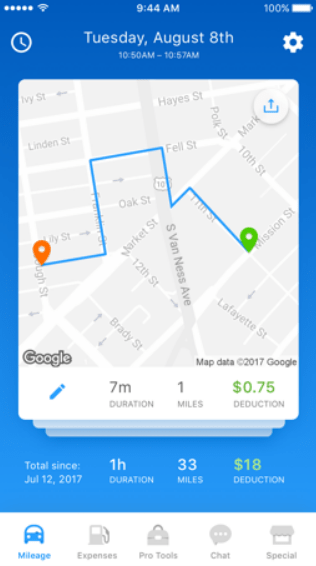

6. SherpaShare – Rideshare Driver

SherpaShare is built just for rideshare drivers. Integrate your apps with SherpaShare to plan your routes, get recommendations to optimize your route, and track your business miles.

The premium app offers additional features for users to maximize their daily income with insights like heatmaps and hotspots. The app also offers savings and coupons for SherpaShare users.

SherpaShare best features

- Real-time analytics features help drivers plan their routes for better pay

- Chat function built for the community of rideshare drivers

SherpaShare limitations

- Savings and deals tab can be distracting

- Some users find the app confusing to use

- Requires all permissions to function properly

SherpaShare pricing

- Monthly: $5.99/month

- Super Premium: $10/month

SherpaShare ratings and reviews

- G2: No reviews available

- Capterra: No reviews available

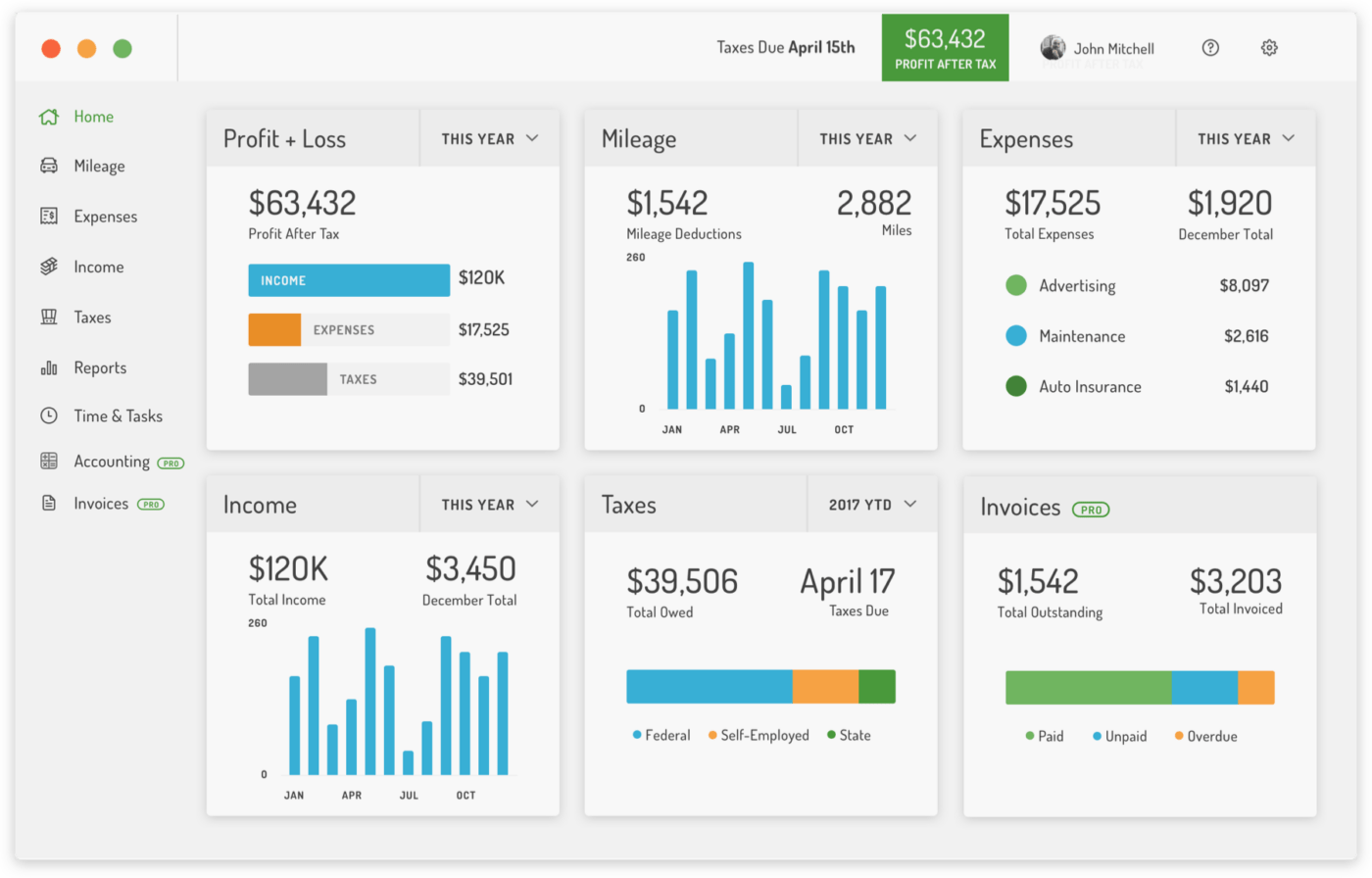

7. Hurdlr

Hurdlr is designed for self-employed users. Rather than just tracking miles and potential savings, it also tracks costs and savings relative to business profits and income. You can pull up savings over time, reports showing profit and loss, and get real-time updates about your mileage.

Users can also track business expenses outside of driving through Hurdlr. Capture receipts, log expenses, and see your business bank balance within the single app.

Hurdlr best features

- In-built tracking for revenue, expenses, and taxes on the home screen

- Integrations with thousands of different banks, as well as popular payment tools, rideshare apps, and accounting tools

- Offers dozens of different report templates

- Unlimited mileage tracking

Hurdlr limitations

- Some users experience gaps in tracking and functionality

- Can double-count bank transfers, making expense reports inaccurate

Hurdlr pricing

- Free

- Premium: $10/month

- Pro: $16.67/month (billed annually)

- Enterprise: Contact for pricing

Hurdlr ratings and reviews

- G2: 4.3/5 (23+ reviews)

- Capterra: 4.4/5 (11+ reviews)

8. Gridwise

Gridwise is built for two audiences: gig workers looking for a centralized way to track gigs and businesses that want to market to gig workers. Gig workers can sync their apps, get personalized recommendations, and strategically plan around peak hours. Businesses can place ads, reach out to drivers, and analyze the results of their campaigns.

Gridwise best features

- Interface makes it easy to prepare tax information and track deductions

- Users can sync their gig and ridesharing apps to plan their day

- Data analytics tools create personalized stats and recommendations

Gridwise limitations

- Gig mobility data is shared with advertisers

- The free version has limited event reminders and airport insights

Gridwise pricing

- Free

- Plus: $9.99/month

Gridwise ratings and reviews

- G2: No reviews available

- Capterra: No reviews available

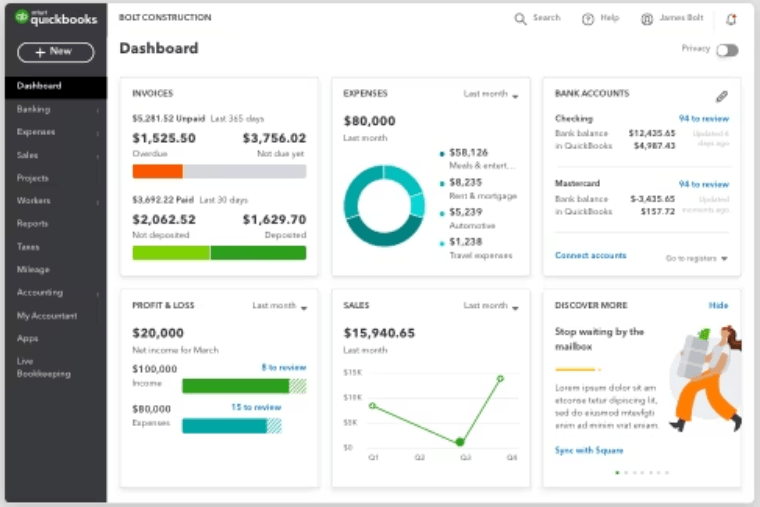

9. QuickBooks Self-Employed

QuickBooks offers a complete suite of tools for self-employed professionals and small businesses, including a mileage tracking app. Users can generate reports, see savings estimates, and easily transfer their data to TurboTax. Transferring and sharing data is easy because so many programs are under this umbrella.

This app shines when it comes to taxes and financial planning. If you want to prioritize tax deductions and clear bookkeeping, QuickBooks offers different views, reports, and features to fit your preferred workflow.

QuickBooks Self-Employed best features

- Robust built-in reporting tools for deep insights

- Estimated taxes and tax filing functions designed for self-employed users

- Offers mileage tracking, expense tracking, and receipt organization all in one place

QuickBooks Self-Employed limitations

- Many users find customer service lacking

- The mobile app is much less friendly than the desktop version

QuickBooks Self-Employed pricing

- Self-Employed: $20/month

- Self-Employed Tax Bundle: $30/month

- Self-Employed Live Tax Bundle: $40/month

QuickBooks Self-Employed ratings and reviews

- G2: 4.0/5 (3,100+ reviews for QuickBooks)

- Capterra: 3.9/5 (95+ reviews)

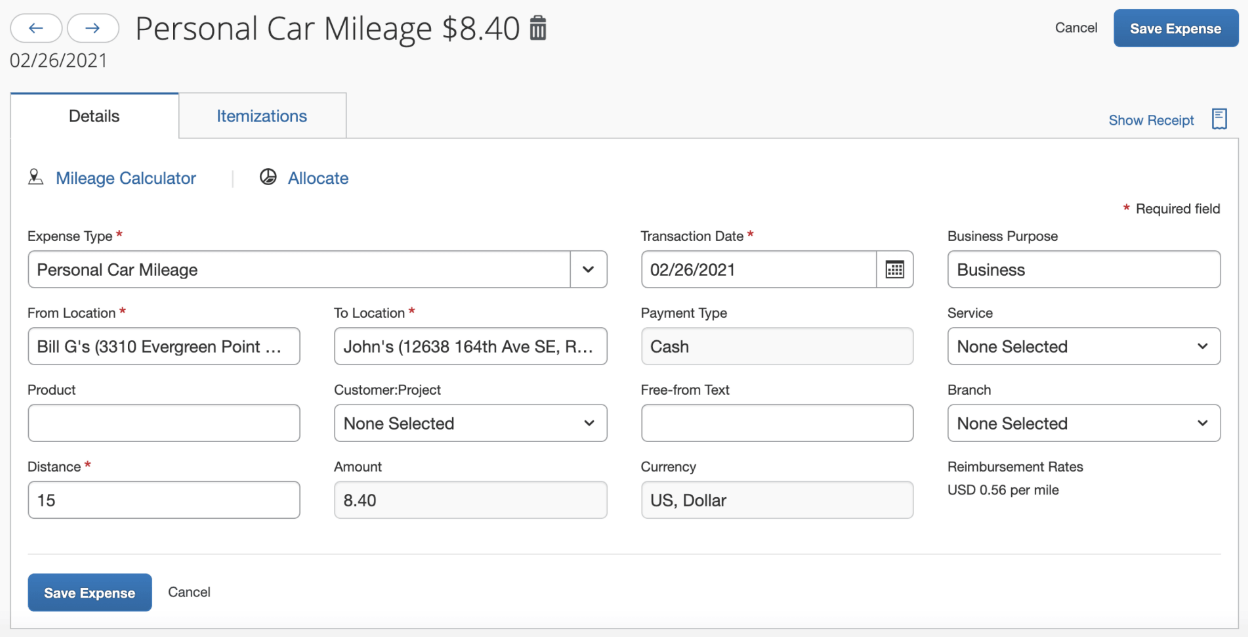

10. TripLog

Triplog offers features for both self-employed professionals and enterprise-level businesses. It integrates with popular enterprise software, including QuickBooks, SAP Concur, and Sage, to fit into any tech stack. Users and managers can track travel over time and identify areas for improved efficiency through comprehensive employee monitoring software.

TripLog offers different options for major industry verticals to serve everyone, from independent rideshare drivers to big construction teams. Individuals can plan their routes and classify trips for tax reporting. Businesses can automatically track movement and maintain oversight for their field teams.

TripLog best features

- Integrations with major platforms and an API for custom functions

- Real-time tracking for trips, fuel, and related expenses

- Optional hardware for GPS mileage tracking or Bluetooth-based tracking to optimize automatic mileage tracking

- Has time attendance software and expense tracking software options

TripLog limitations

- Automated payment feature might encounter errors during setup

- Help desk responses are reportedly slow

TripLog pricing

- Lite: Free

- Premium: $5.99/month

- Teams: $10/month per user

- Enterprise: $15/month per user

TripLog ratings and reviews

- G2: 4.7/5 (56+ reviews)

- Capterra: 4.1/5 (75+ reviews)

Track Your Miles Where You Already Manage Your Finances and To-Dos in ClickUp

Tracking your miles can save your business hundreds or thousands of dollars in taxes or missed expenses. But when you rely on manual tools, it might not seem worth the time. Choosing the right mileage tracking app makes all the difference.

Choosing the right free project management software and collaborative tracking app matters just as much. ClickUp can read data from your mileage tracker app to generate reports, monitor trends over time, and make reporting or documenting mileage expenses easier.

Sign up today for your Free Forever ClickUp account and start tracking!