Project Financial Management: How to Control Costs and Keep Projects Profitable

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

💸 Budgets don’t usually explode overnight—they unravel bit by bit. A higher vendor quote here, a delayed milestone there, or an unplanned change order can quietly push costs off track until fixing them feels impossible.

That’s where project financial management comes in. Done right, it stops small overruns from snowballing into budget blowouts. By tracking expenses in real time, spotting variances early, and making quick adjustments, you keep every dollar driving project success.

In this guide, we’ll break down practical strategies, proven tools, and best practices to help you control your project budget, avoid financial surprises, and maximize ROI—without slowing momentum. 🚀

Take control of your finances with the ClickUp Finance Management Template. Track budgets, expenses, invoices, and financial goals in one organized, customizable workspace. 💰📊

Project financial management or project accounting is the process of planning, tracking, and controlling a project’s money from kickoff to delivery. It covers budgeting, cost estimation, forecasting, billing, and profit management.

💡 Why does it matter?

Because staying on budget is every bit as critical as hitting deadlines. Too often, teams obsess over timelines and deliverables while costs quietly spiral out of control. The result? Overspending, missed targets, and shrinking margins. And it’s not just about “keeping receipts”. Smart financial oversight needs to begin in planning and stay active through every phase of the project.

📌 History proves the point. During the Golden Gate Bridge construction, engineers relied on cost-control strategies—like swapping expensive materials for practical alternatives and optimizing methods to reduce waste. These moves kept spending in check without sacrificing quality, a reminder that financial discipline underpins successful delivery.

🧐 Did You Know? Many teams confuse project execution with financial control, but tracking the project’s financial aspects is as important as meeting deadlines.

Finally, it’s essential to distinguish project financial management from general financial management. While the latter takes a company-wide view, project financial management zooms in on specific initiatives—with fixed budgets, finite resources, and immovable deadlines.

Here’s how the two stack up:

| Aspect | General Financial Management | Project Specific Financials |

| Scope | Organization-wide | Individual projects |

| Focus | Overall financial health | Project cost, revenue, and profit |

| Timeframe | Ongoing | Project duration |

| Metrics | Profitability, revenue, cost center analysis | Budget vs. actual, burn rate, margin per project |

| Responsibility | Chief financial officers (CFO), finance department | Project managers, project accountants |

| Risk control | Market and operational risks | Budget overruns, missed billing, and scope creep |

🧠 Fun fact: Value engineering was born at General Electric during World War II when material shortages forced engineers to get creative. Purchasing Engineer Lawrence Miles and his team discovered that cheaper substitutes performed better and reduced costs.

Not every organization has a dedicated project accountant—but every team running projects benefits from financial oversight. Here’s who needs it most:

They need visibility into how projects connect to revenue, margin, and overall business strategy. For small businesses, the founder or CFO often plays this role.

They’re closest to delivery and scope, so tying costs to timelines and resource allocations ensures projects stay realistic and profitable.

Finance teams connect project outcomes with broader financial health. They monitor risks, track utilization rates, and spot variances that could impact cash flow.

With limited capital, even minor overruns can make or break growth. Early financial discipline ensures sustainable scaling.

Since billable hours drive revenue, accurate financial management ensures client contracts are profitable, and resources aren’t oversold.

💡 Pro Tip: No matter the size of your team, project financial management turns “best guesses” into informed decisions by linking money to milestones.

🎬 When Netflix greenlights a new product line or original series, the spotlight is on the creative team.

But behind the scenes, financial oversight is just as critical as storytelling. Every script, contract, and production schedule ties back to budget controls that decide whether a show becomes profitable—or turns into a costly misstep.

For example: When Netflix greenlighted Stranger Things, it didn’t just fund a TV series—it made a calculated financial projection. Netflix analytics predicted over 100 million viewers, aligning a $500 million production budget with expected demand. This precision ensured decisions weren’t based on intuition but complex data, enabling it to invest confidently in binge-worthy content.

💡 This modern example mirrors what most organizations face: even the best ideas fail if the finances don’t align.

📊 Why project financial management matters: Effective project financial management does more than keep costs in check—it transforms project delivery and drives long-term business growth. The value lies in control where it matters most: at the project level. That control depends on balancing three factors:

When that balance is right, here’s what happens 👇

A well-managed budget shows where you stand financially and where you’re heading. By tracking metrics like earned value and Cost Performance Index (CPI), you can see performance mid-stream and make smarter adjustments before minor issues become major overruns.

📌 Case in point: Take NASA’s Jet Propulsion Laboratory, for example—they reportedly reduced project costs by 25% over five years by introducing detailed cost-risk analysis and earned value tracking.

Financial management isn’t just about avoiding overspend—it’s about choosing the right bets. By weighing costs against potential value, you can prioritize projects with the highest ROI, ensuring your team’s energy accelerates growth instead of getting tied up in low-impact work.

📌 Case in point: Amazon is a strong example; by using agile project planning and cost-benefit analysis, they reportedly cut project expenses by 20% over two years.

💡 Pro Tip: Evaluating financial feasibility before execution ensures resources are used wisely and the project remains profitable.

Tracking project budgets in real time helps you spot patterns and allocate resources where they matter most. That means people, tools, and time always align with the highest priorities.

📌 Case in point: One large retail chain implemented real-time expense monitoring and quickly identified overspending patterns. This allowed them to negotiate better vendor pricing and save significantly across projects.

When every dollar is tied to the scope from day one, you’ll spot financial red flags early—and fix them before they spiral into margin killers.

Strong expense management practices make this possible, helping teams track real-time costs and protect margins as projects scale.

🧐 Did You Know? 96% of financial planning and analysis (FP&A) professionals use spreadsheets for planning, and 93% rely on them for reporting daily or weekly.

📊 Marketing campaigns: Linking expenses to results

Think about a marketing campaign spread across social, search, and email. Without discipline, budgets vanish fast. 💸

By managing project expenses channel by channel and tying every dollar to key metrics like conversions or cost per lead, you know exactly what’s driving results.

Keep a small contingency fund for unexpected ad spikes, and you’ve built the foundation for real project profit.

That’s how effective project management keeps creative work financially sound. ✅

Poor project financial management can derail even the most well-planned initiatives. Without consistent tracking and forecasting, you risk:

🧐 Did You Know? McKinsey found that large IT projects run 45% over budget, take 7% longer than planned, and deliver only about half their expected value. Ouch. 🤕

🔑 The good news: Controls put you in charge of outcomes—not at the mercy of budget blowouts

Project financial management requires more than tracking a lump-sum budget—it’s about understanding how individual cost drivers behave. Labor fluctuates with staffing, vendor contracts may introduce hidden fees, and software subscriptions often scale as projects grow. PMOs need this visibility before they can forecast spending or optimize cash flow.

Once you’ve identified cost drivers, the next step is building a resource plan. Break each driver into measurable units:

📌 Step 1: Allocate resources across your project

Once resources are defined, map them to the project scope. A Work Breakdown Structure (WBS) helps divide the project into smaller tasks and assign resources where needed most.

📌 Step 2: Estimate costs consistently

Calculate costs using proven methods like parametric or analogous estimating. Remember to include indirect expenses—like office rent or utilities—since they impact profitability as much as direct costs like labor or software.

📌 Step 3: Keep budgets under control

Project budget templates give you a framework to plan costs upfront and the structure to monitor spending as the project moves forward.

💡 Pro Tip: Project Budget Templates cut setup time and make budgets repeatable, so your team spends less time formatting and more time managing.

As the everything app for work, ClickUp has built-in tools and 1,000+ templates for project cost management, budgeting, and auditing.

This template makes it easy to track budgets and build a WBS in seconds—so you can see exactly where resources go and stay in control from start to finish.

With it, you can:

👉 One template, one source of truth: track costs, assign resources, and manage responsibilities without switching tools.

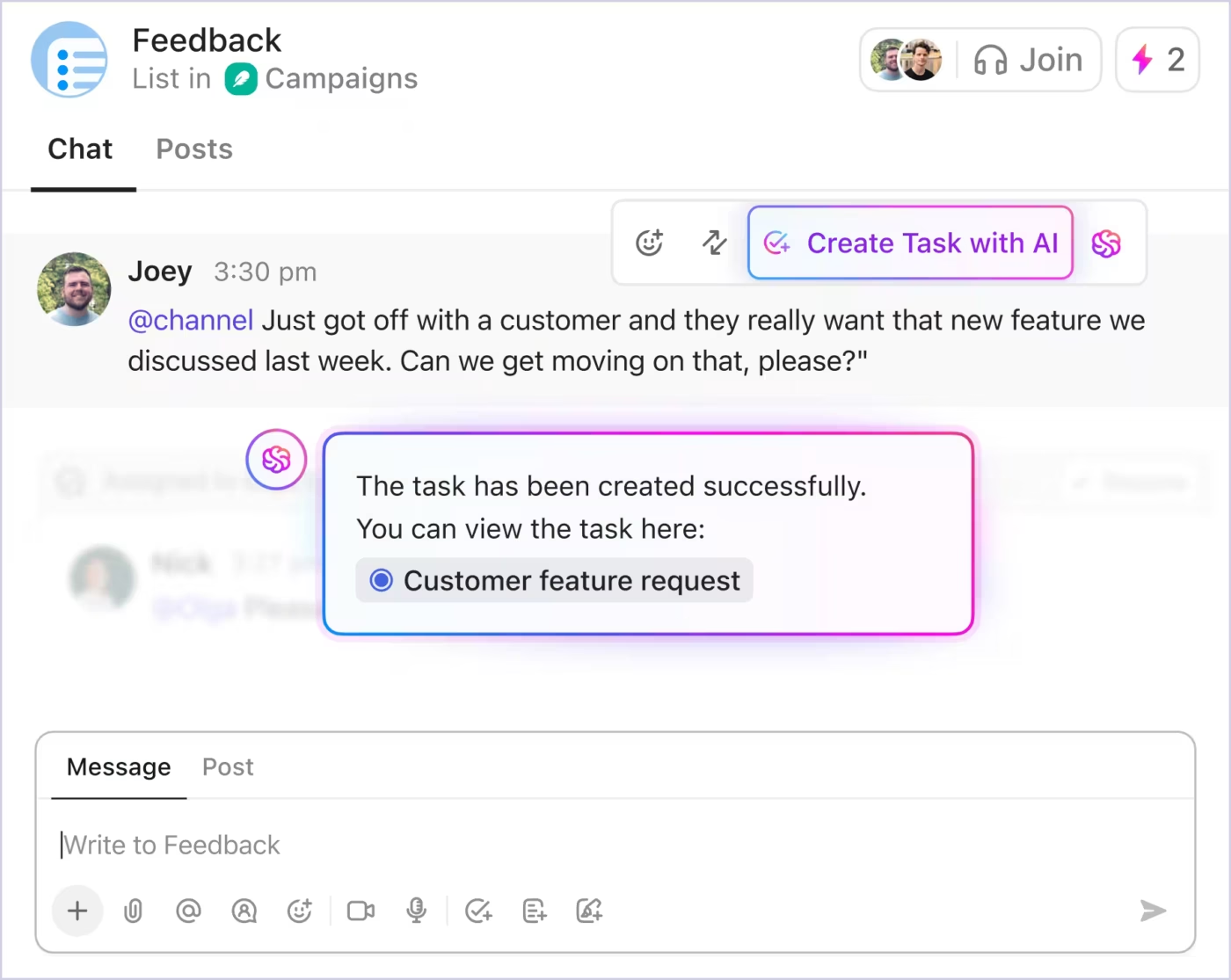

💡 Pro Tip: Use ClickUp Chat to collaborate with your finance and project teams in real time. Discuss budget changes, share files, and keep all financial conversations linked to your project workspace for easy reference.

Once the budget is set, the next step is applying cost estimation methods—and tracking actuals against them. Three common approaches:

No matter which method you use, the key is tracking actuals often and adjusting before minor issues snowball. When costs slip, find the root cause—scope creep, underestimates, or resource shifts—and use that insight to sharpen future forecasts.

Instead of wrestling with spreadsheets, use a system that automates cost tracking and updates your budget in real time. We’ll look at the best options later in this guide 👇

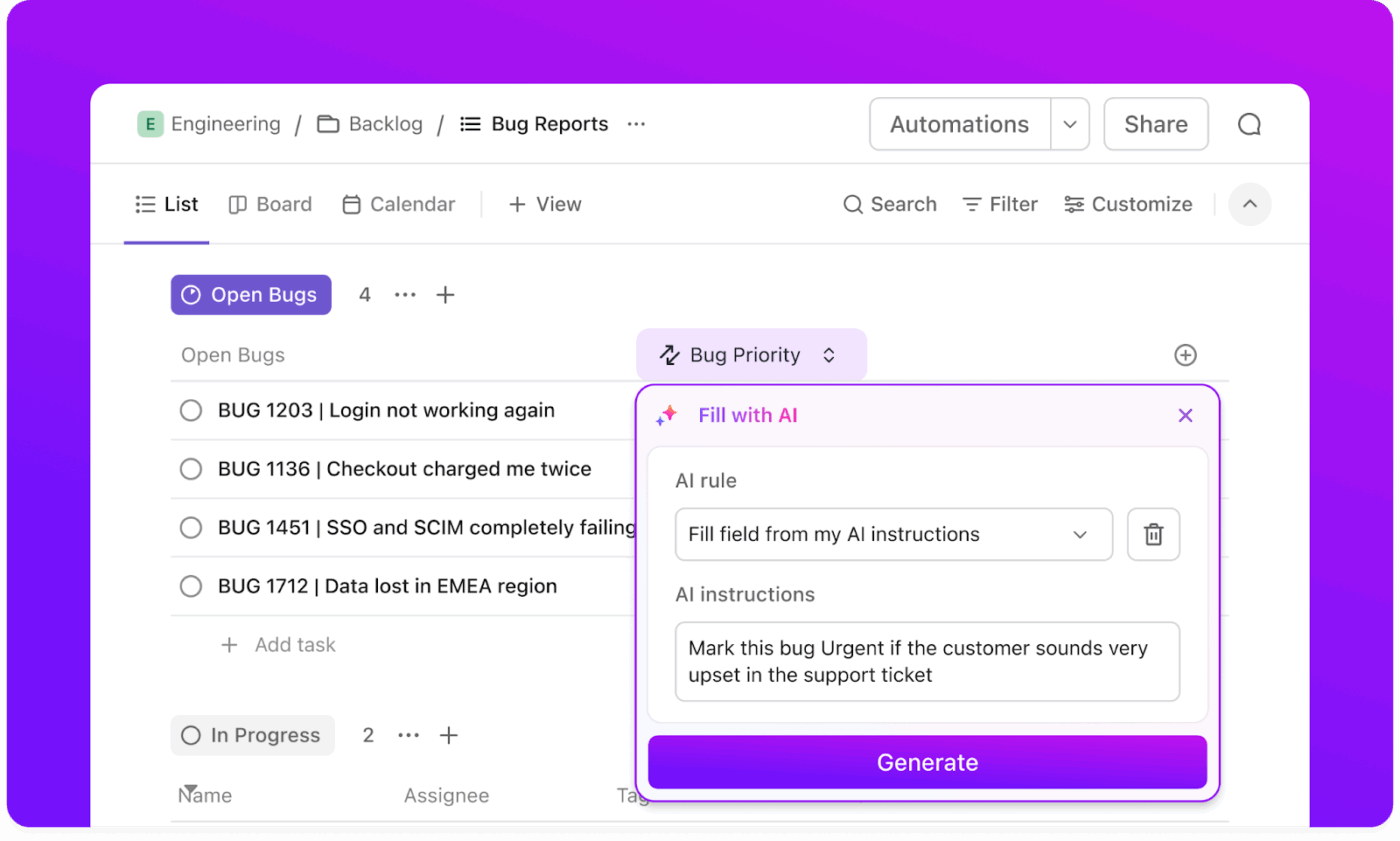

🧐 Did You Know? With ClickUp Custom Fields, you can directly track estimated vs. actual costs on each task. Set up automations to alert you when costs exceed estimates, and use ClickUp’s Time Tracking to monitor billable hours for accurate cost allocation. 📊

AI forecasting keeps financial planning tied to real-time progress, automatically adjusting predictions as new data flows in. To build reliable forecasts, focus on:

Once the forecast is in place, layer in variance analysis—comparing planned vs. actual outcomes. Every variance is insight: maybe a client paid late, or a vendor charged more than expected. Feeding those lessons back into your forecasting cycle makes each projection sharper.

Traditionally, this process relied on spreadsheets and delayed reports. In the AI era, those limits are fading.

The result? Project managers, finance leads, and executives spend less time crunching numbers and more time making smarter calls.

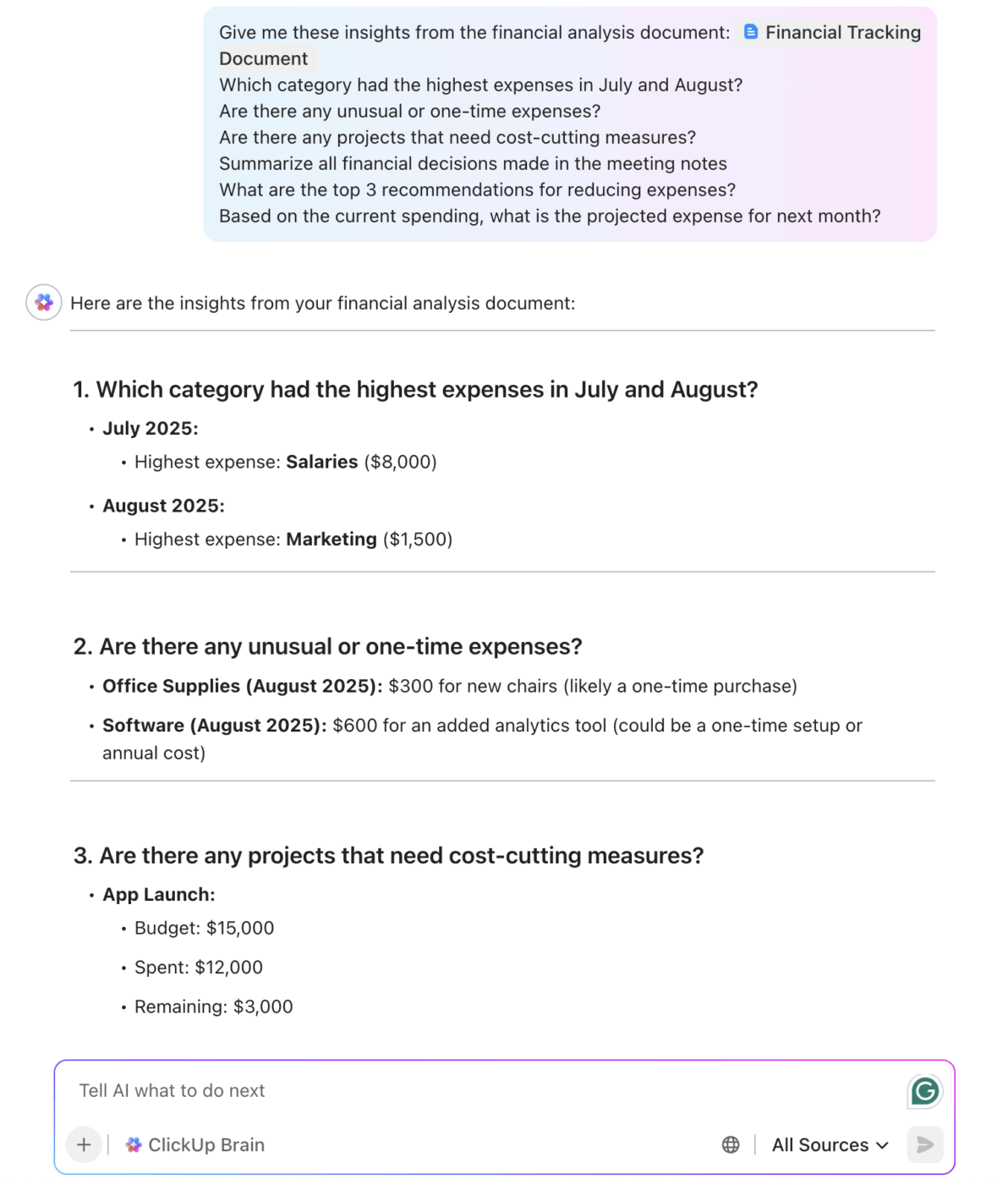

👉 Later in this guide, we’ll show how ClickUp Brain and ClickUp AI Agents deliver these capabilities—automating variance reports, forecasting cash flow, and keeping projects financially on track.

💡 Pro Tip: Once set up, ClickUp AI Agents can automatically generate variance reports, forecast cash flow from live project data, and send recurring AI summaries 🤖 so stakeholders stay updated without extra effort.

Cash flow stays healthy when financial activity ties directly to project work. Focus on practices like:

For revenue recognition, apply the percentage-of-completion method when progress can be measured over time. Avoid front-loading revenue, which paints an inaccurate picture of project health. If a client delays payment, log it as a variance and flag the risk early so finance can prepare backup funding.

💡 Pro Tip: Use ClickUp Automations to trigger reminders for invoice due dates and milestone-based billing. Integrate with QuickBooks or Xero to sync financial data and streamline revenue recognition.

For teams still manually handling parts of invoicing, invoice templates can provide a simple way to stay consistent while transitioning toward a fully automated system.

Financial reporting turns raw numbers into visibility. Go beyond surface-level dashboards—include KPIs that reflect both performance and risk. Each report should cover:

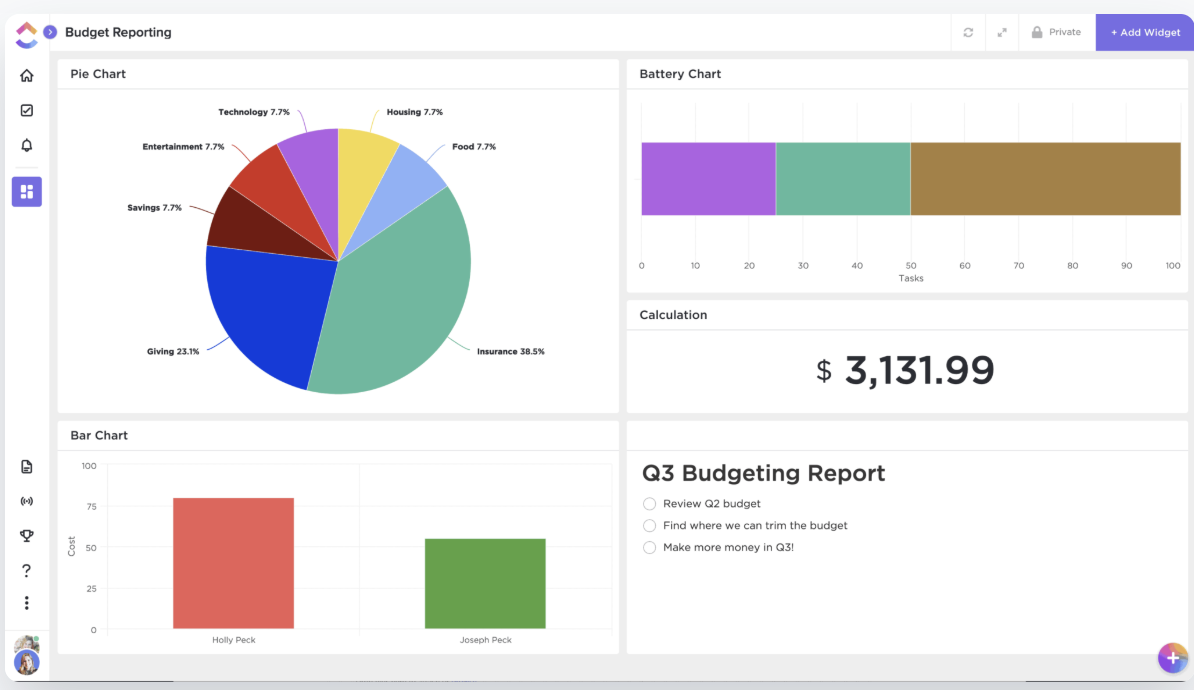

📊 Visuals matter. Burn rate graphs, CPI/SPI charts, and cost curves make it easier for decision-makers to grasp trends at a glance. Add a one-page executive summary upfront—covering CPI, cost variance, forecasted end cost, and key risks—so busy stakeholders can absorb the essentials quickly.

💡 Pro Tip: One of the most important project financial management practices is connecting money to milestones. When you align managing project financials with the project schedule, you create checkpoints across the project lifecycle that show whether spending matches progress.

This makes it easier to monitor project costs in real time and evaluate project performance accurately—not just at the end but at every delivery stage.

🔍 Example: Imagine a product launch project broken into design, development, and marketing phases. If the design phase takes longer than planned, it can trigger unexpected overtime costs. By linking those costs directly to the project schedule, you can spot overruns early instead of being blindsided later in the project lifecycle.

How ClickUp helps:

When Berlin’s Brandenburg Airport finally opened in 2020—nearly a decade late—it had already blown through billions in unexpected costs. What began as a promising infrastructure project became infamous for budget overruns, mismanagement, and missed forecasts. The lesson? Even with the best plans, financial blind spots can sink a project long before delivery.

Balancing budgets with project constraints is rarely straightforward. Teams often run into challenges like:

🧐 Did You Know? ClickUp’s permission settings let you control who can view or edit financial data, reducing the risk of errors or unauthorized changes. 🛠️

Traditional project financial management relied on spreadsheets, manual reporting, and reactive adjustments. In the AI era, those limits are fading. AI brings speed, accuracy, and real-time insights into every financial decision.

Here’s how AI changes the game 👇

The result? Project managers, finance leads, and executives spend less time crunching numbers and more time making informed decisions.

👉 Later in this guide, we’ll show how ClickUp Brain and AI Agents deliver these capabilities—automating variance reports, forecasting cash flow, and keeping projects financially on track.

While the fundamentals of project financial management stay consistent, how you apply them differs by industry:

ROI and profitability rise as your team gets better at predicting costs, setting prices, and meeting deadlines. Effective project cost management turns each project into an opportunity to refine processes and strengthen future results.

Practical tips to strengthen your project’s financial management:

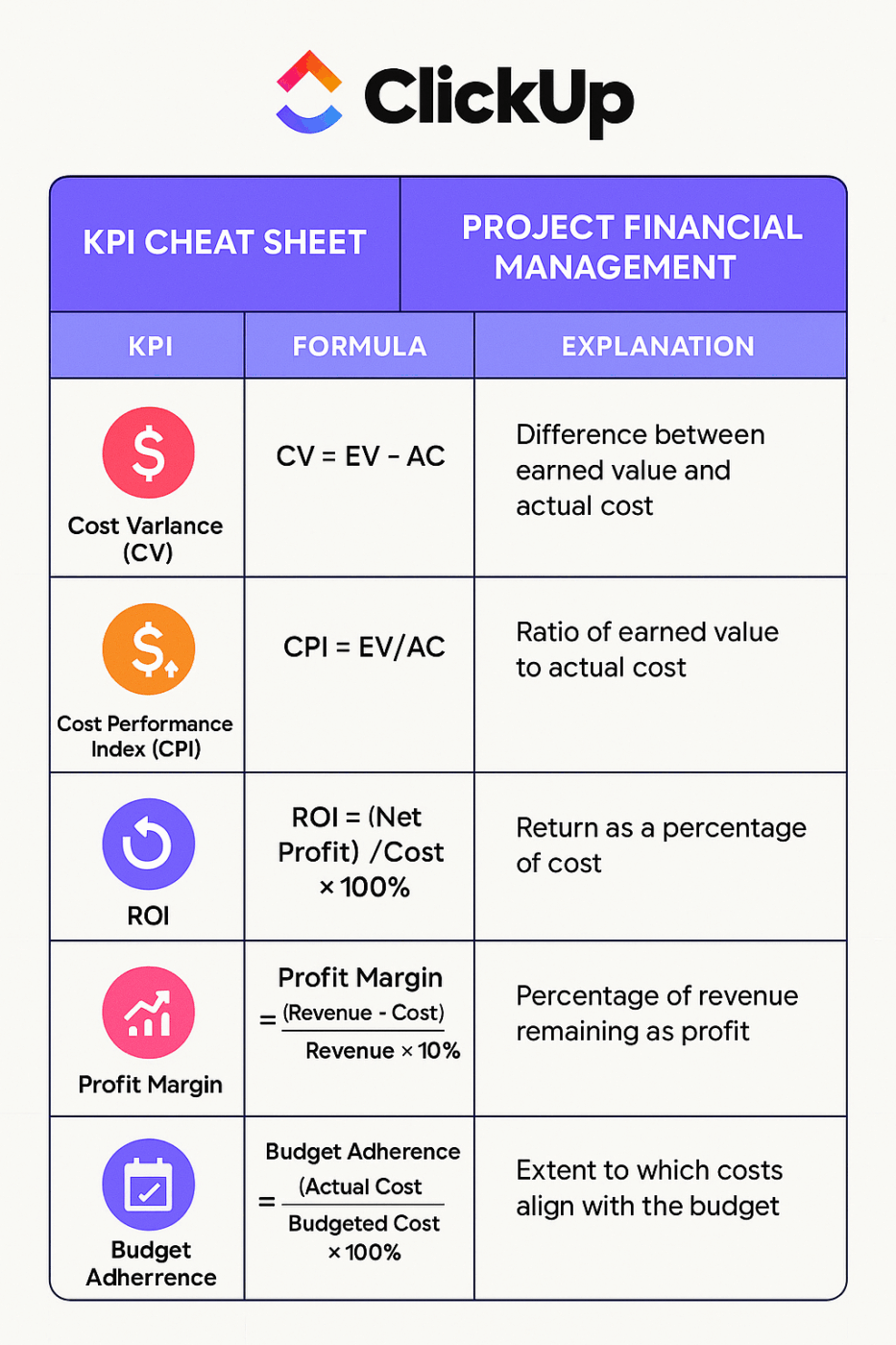

Clear KPIs give you benchmarks to track a project’s financial health and spot problems early. Some of the most useful include:

📊 Common KPIs to track

Tracking only works if you review consistently. Weekly reviews are best for most projects, though monthly may work for longer-term initiatives.

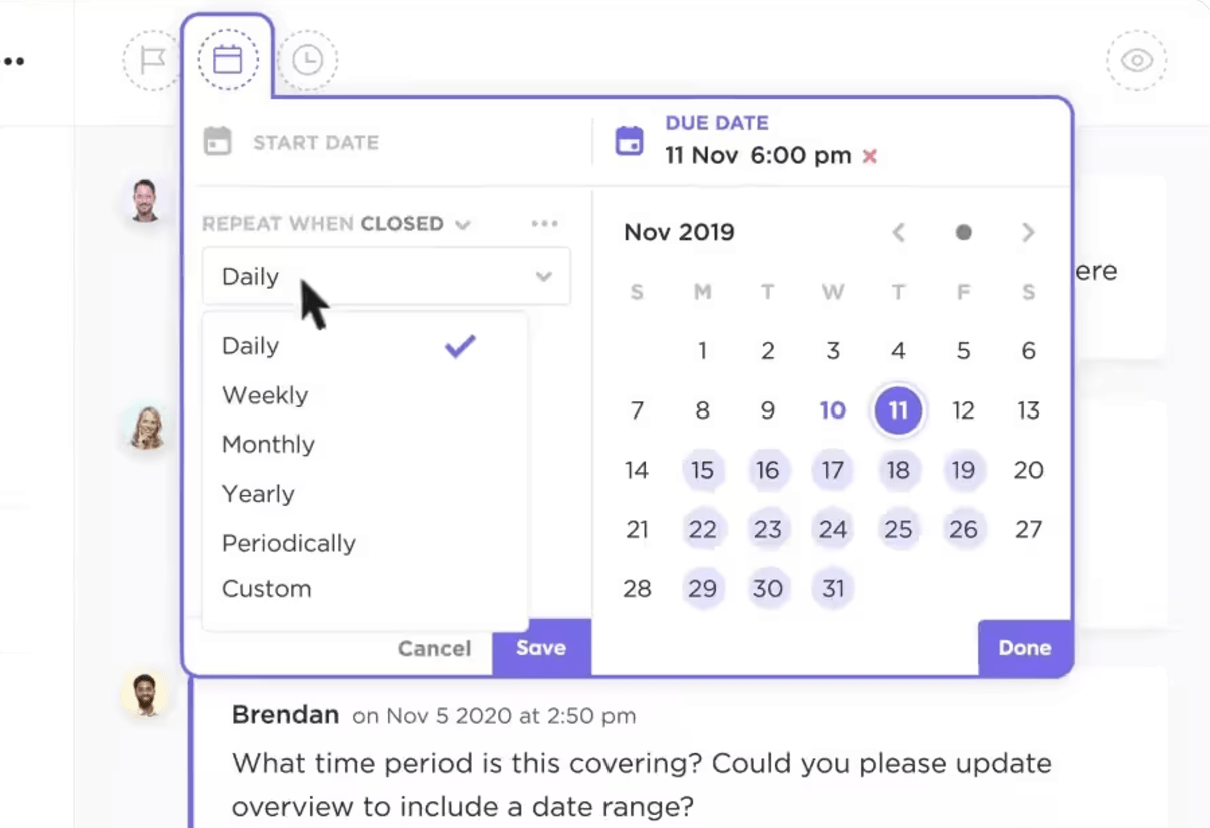

💡 Pro Tip: 🔄 Automate weekly or monthly financial reviews with ClickUp Recurring Tasks and Reminders, ensuring your team never misses a budget check-in.

Financial workflows break down fast when teams don’t talk. If delivery leads skip updates to finance or ops, the numbers stop matching reality.

Set clear expectations across departments and hold short, frequent syncs. These quick check-ins surface hidden delays, mismatched budget assumptions, and timing issues before they escalate.

Every completed project is data you can use to sharpen the next one. For example, if you’re pricing a website redesign, check last quarter’s project:

Patterns from past work improve planning accuracy and take the guesswork out of pricing.

Your tech stack shapes how well you manage project finances. Real-time project management platforms give you one place to track hours, costs, and capacity—and to adjust before issues snowball.

Choose tools based on the KPIs you need to measure, feature compatibility, and how they fit your current systems. A strong toolset lets teams spend less time chasing numbers and more time making decisions that matter.

💡 Pro Tip: Monitor external costs like supplier bills and additional expenses when monitoring KPIs.

To evaluate whether your project’s finances are healthy, keep these industry benchmarks in mind:

💡 Pro Tip: Use CPI (Cost Performance Index) and CV (Cost Variance) to catch financial red flags before they become irreversible.

Managing project finances gets harder when teams are spread across locations, tools, and time zones. Without a central system, budgets slip, approvals stall, and numbers don’t match reality. That’s where project financial management tools come in—giving your team a shared view of budgets, actuals, and forecasts.

ClickUp is the world’s first Converged AI Workspace—bringing tasks, budgets, and reporting into one place powered by next-gen AI. It gives teams a clear view of where projects stand, where costs are drifting, and what needs attention before it becomes a problem.

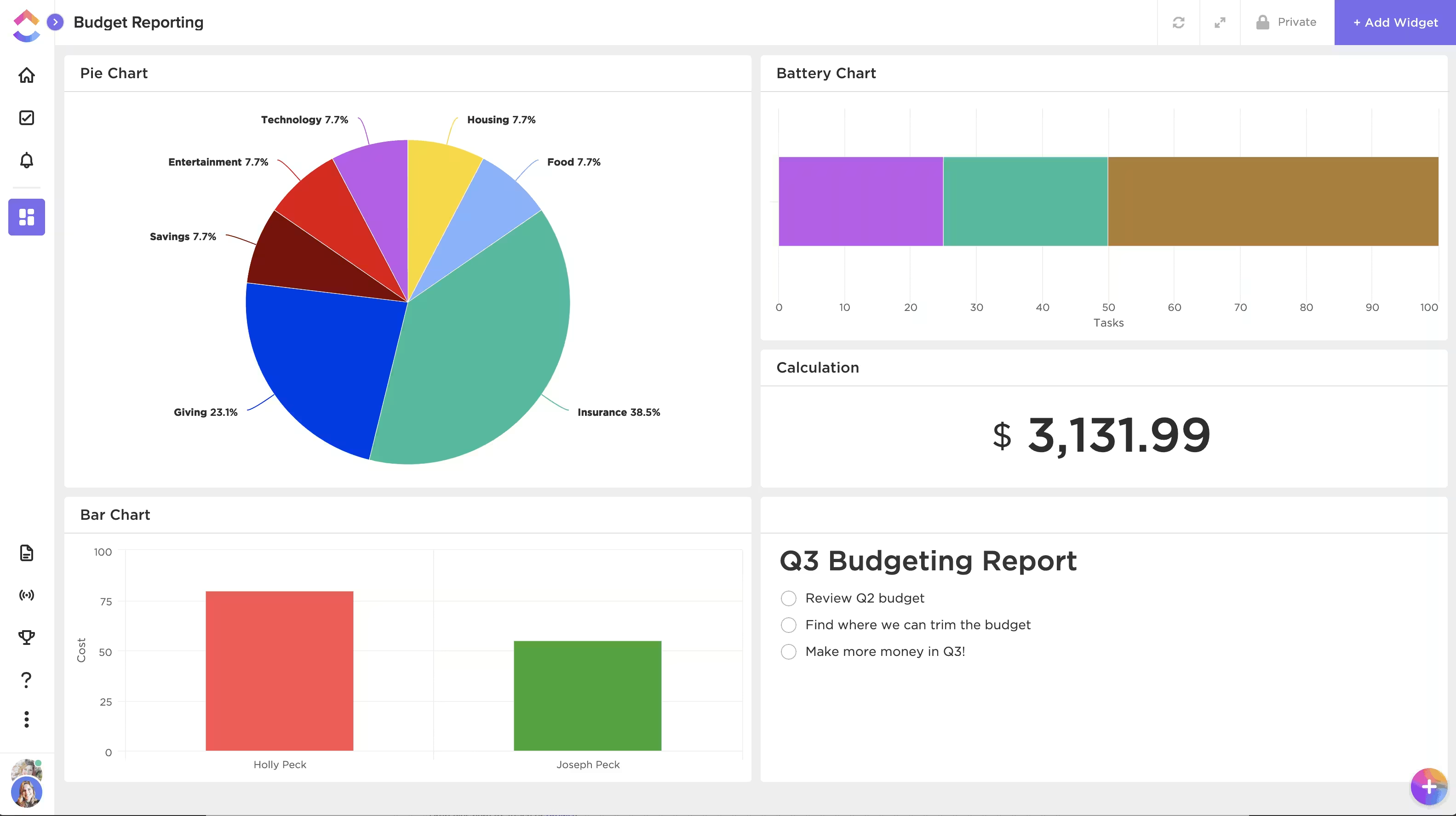

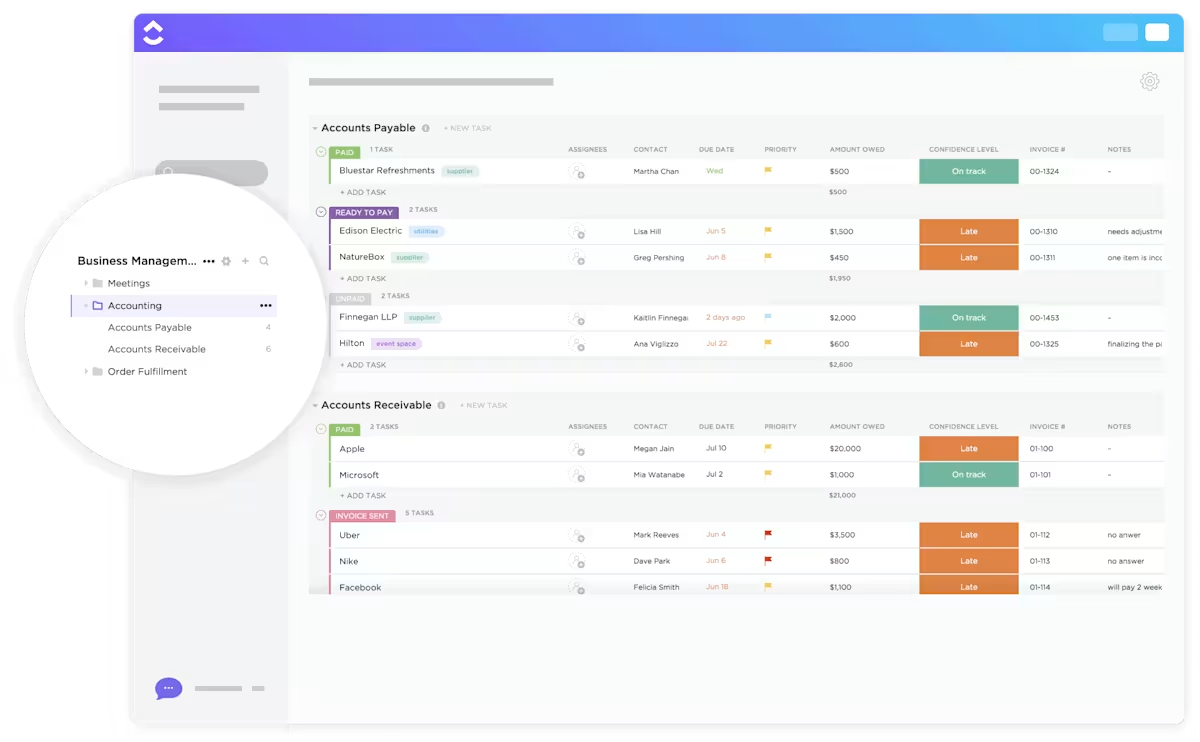

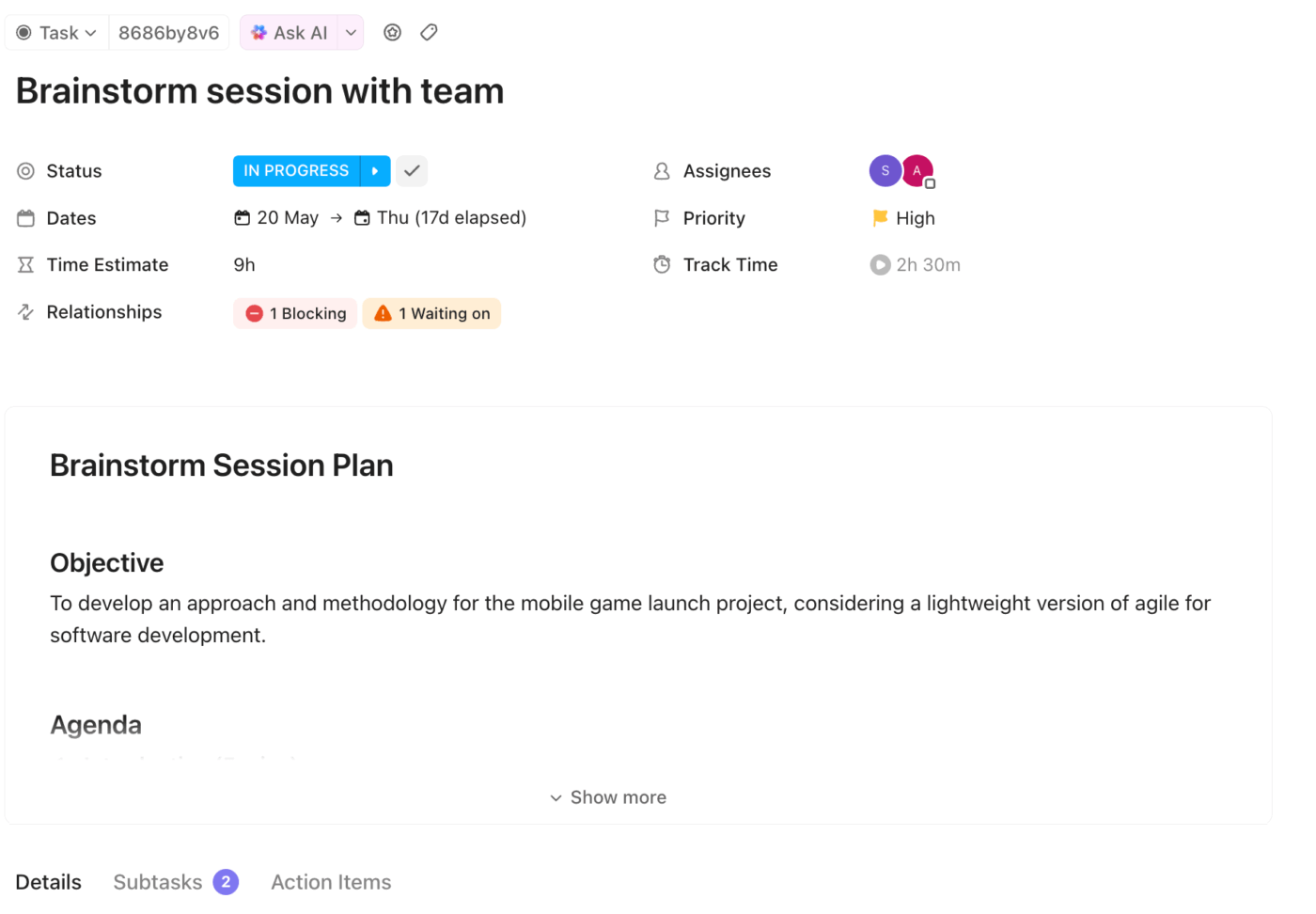

ClickUp for Project Management allows you to manage financial workflows within the same workspace where your team tracks tasks and timelines. Instead of combing through spreadsheets, see your entire budget at a glance with ClickUp Dashboards. With 50+ customizable widgets, you can track expenses, budget utilization, and margins in real time.

ClickUp Dashboards also put finance teams in control of every dollar. Instead of static spreadsheets, you get real-time visibility into spend, burn rate, and margin—refreshed automatically as tasks move forward.

Need to present updates? Share interactive dashboards with leadership or export clean reports to CSV/PDF in seconds.

And with ClickUp for Finance Teams, your budgets, approvals, and workflows live side by side with project tasks—so financial oversight happens where the work does, not weeks later in disconnected tools.

💡 Pro Tip: Use visuals to make financials crystal clear. Pair burn rate graphs, CPI/SPI charts, and cost curves with a one-page executive summary covering CPI, cost variance, forecasted end cost, and key risks.

Financial tracking can be tedious—ClickUp Brain makes it faster and smarter. It summarizes cost reports, forecasts cash flow, and surfaces insights you’d otherwise dig for. With ClickUp Brain Max (desktop + talk-to-text), you can capture budget notes or meeting decisions on the fly, and they’ll flow straight into your workspace.

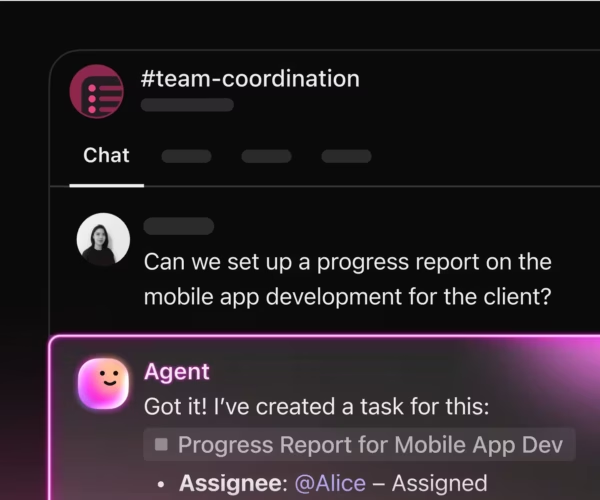

The ClickUp AI Notetaker integrates with any meeting platform—Zoom, Teams, or Google Meet—automatically records discussions, highlights risks, and turns follow-ups into actionable ClickUp Tasks. That means financial decisions move seamlessly from conversation to execution, no matter where the meeting happens.

🎥 Juggling budget reviews, vendor negotiations, and financial planning? The video above shows how ClickUp’s AI Notetaker helps you stay focused on the numbers, while AI turns your meeting conversations into actionable, traceable items.

And with ClickUp AI Agents, you can set up agents to monitor expenses, generate variance reports, or forecast cash flow continuously. Think of them as always-on financial assistants, spotting issues and surfacing insights before you ask.

Forget chasing people for approvals or sending reminders. ClickUp Automations handle the repetitive work—bill payment alerts, budget review reminders, and reporting deadlines. For example, mark a task as Completed, and ClickUp can instantly notify a manager, assign the next task, or move it into review.

Skip the manual follow-ups. Automations handle repetitive work—bill payment alerts, budget review reminders, or reporting deadlines. For example, when a ClickUp Task moves to Completed, Automations can automatically notify a manager, assign the next task, or shift it into review.

Why start from scratch? ClickUp includes 1,000+ free templates—like the ClickUp Finance Management Template.

With this template, you can:

The template also includes tools for managing tasks, projects, resources, and budgets, so your financial activities stay connected and results-driven.

📮ClickUp Insight: 39% say financial instability is their biggest fear when considering a portfolio career—uncertainty is the top roadblock.

Instead of guessing where your time and money go, ClickUp lets you track every hour spent on each project with built-in time tracking. You can tag tasks by client or income stream, log billable hours, and use Custom Fields to record rates or payments.

With Dashboards in ClickUp, you see exactly how much time you’re investing, what it’s worth, and which projects are most profitable—all in real time.

ClickUp plugs into 1,000+ apps, including QuickBooks, Xero, and Zapier connections for tools like Financial Cents. That means expenses, invoices, and reports flow into one system—no more copy-pasting numbers or reconciling across silos.

Marcos Vinícius Costa de Carvalho, Business Analytics Analyst, says:

I use ClickUp organizing my sprint planning, checking the statuses of my tasks and from my colleagues. We use it to help and accelerate our daily meetings from our Scrum ritual. It helps me out getting to know the progress of my sprint, the progress of my tasks and to keep an organized backlog for all of my errands.

Most finance tools track numbers. ClickUp connects the numbers to the work.

Example: Tracking a project budget in ClickUp

👩💼 Scenario: You’re managing a product launch. Here’s how ClickUp keeps your budget under control:

1️⃣ Custom Fields → Add Budgeted Amount, Actual Spend, and Variance to project tasks. Every time your team logs an expense, these fields update automatically

📊 Dashboards → Start your day with a ClickUp Dashboard that shows total spend, remaining budget, and burn rate—all in real time

⚡ Automations → Midweek, spending spikes. A ClickUp Automation alerts you: “Design costs exceeded budget by 10%.” It even assigns a review task to the project lead

🔗 Integrations → On Friday, your finance team checks QuickBooks. Thanks to ClickUp’s QuickBooks integration (or Zapier), expenses are already synced—no manual reconciliation

💡 Pro Tip: Centralize all project financials in ClickUp to cut software costs and kill silos. With budgets, tasks, and reporting in one place, you eliminate delays, reduce errors, and give every team real-time visibility.

Workfront by Adobe is designed for large, complex teams that need to manage every aspect of project finances in one place. Stakeholders, vendors, and internal departments can track hard and soft costs, fixed expenses, project spending, and resource charges—all without hopping between multiple systems.

Teamwork, on the other hand, is a leaner option for teams that just want straightforward cost tracking and budgeting. Its reporting dashboards let you visualize financial metrics, team capacity, and budget performance. Just note: most of the advanced features sit behind a paid plan.

Project finance isn’t static. Here are trends shaping the next five years:

Only 31% of CFOs say they’ve seen measurable value from adopting new tech because most project tools aren’t built for financial clarity across teams, timelines, and budgets.

✅ ClickUp changes that.

💰 From budgeting and financial reporting to task tracking and real-time dashboards, ClickUp puts all your project financials in one place. No more scattered spreadsheets—just live data, clear costs, and early warnings before problems derail delivery.

Sign up for ClickUp for free and take the first step toward smarter financial management. 🚀

Project accounting involves tracking project-specific financial transactions and reporting on them for compliance and transparency. Project financial management goes further—it tracks, plans, forecasts, and controls costs to ensure the project stays within budget and maximizes ROI.

Start with a detailed budget linked to your scope of work, assign resources to each deliverable, and track actual vs. planned costs in real time using project management software. Adjust resource allocation or scope as soon as cost variances appear to prevent overruns.

The best choice depends on your team size, industry, and complexity. ClickUp is a strong all-in-one option for managing budgets alongside tasks, timelines, and resources, while tools like Workfront suit large enterprises, and Teamwork is ideal for client-service teams needing invoicing integration.

Project financial management improves productivity by real-time aligning budgets, resources, and timelines. When costs and performance metrics are tracked together, teams can make faster decisions, avoid wasted effort, and redirect resources to the highest-value activities.

AI-powered tools like ClickUp Brain boost productivity by automating variance analysis, forecasting risks, and turning meeting notes into actionable financial tasks. Thus, teams spend less time chasing numbers and more time delivering results.

The most common risks include:

These risks can derail projects and erode margins without proper visibility before teams have time to react.

ROI (Return on Investment) in project financial management is measured by comparing the net profit generated by a project to its total costs: ROI=Net ProfitTotal Cost×100\text{ROI} = \frac{\text{Net Profit}}{\text{Total Cost}} \times 100ROI=Total CostNet Profit×100

For example, if a project costs $200,000 and generates $300,000 in profit, ROI = 50%. Beyond profit, ROI can include intangible returns like customer retention, time saved, or reduced SaaS costs through tool consolidation—metrics that ClickUp Dashboards can track alongside financial KPIs.

Some of the most critical KPIs include:

Tracking these KPIs consistently helps project managers and finance leads anticipate issues early and make corrective adjustments.

© 2026 ClickUp