Sole Proprietorship Examples: Small Business Ideas You Can Start Today

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Dreaming of being your own boss? A sole proprietorship is the easiest way to make it happen. With minimal setup and full control, you can start a small business today—whether it’s freelancing, running a local shop, or building an online service.

In this article, we’ll share inspiring sole proprietorship examples you can launch with little investment—and show you how a Converged AI Workspace (hello, ClickUp!) can help you manage it all from day one.

Running a successful solo proprietorship or small business isn’t easy, especially when you’re competing against larger companies with deep pockets and expansive footprints. But AI can help level the playing field.

Check out our playbook on how small businesses can thrive in the age of AI. Learn how you can consolidate disconnected (and expensive) tools, reduce time-consuming processes, and capture lost context iinstantly with one Converged AI Workspace. Do more with less and put an end to work sprawl today.

A sole proprietorship is a simple business entity that doesn’t require formal incorporation. As a sole owner, you handle everything from daily operations to business growth, and the earnings are reported directly on your personal tax return.

In simple words, a sole proprietorship means you and the business are the same—there’s no legal separation. You own it, you run it, and you keep the profits. But you’re also personally responsible for any losses, debts, or legal issues.

When you’re ready to scale up officially, it’s smart to draft clear service agreements with your clients or partners. Depending on what you sell, you might also need additional paperwork, like a commercial invoice or industry-specific licenses and permits, to stay compliant.

👀 Did You Know? The Internal Revenue Service automatically considers you a sole proprietor if you are the only owner and are operating under your legal name (not under a Doing Business As name).

A sole proprietorship is simple to set up, but it comes with its own perks and challenges.

Let’s dive into the advantages first.

In most countries, sole proprietors have a straightforward business structure when it comes to taxes. As a solo business owner in the US, you must file Form 1040 for your personal tax return and include Schedule C to report business profits and losses.

Unlike employees, small business owners operating as sole proprietors typically do not have withholding taken from their earnings, so they’re responsible for paying taxes directly.

In addition, you’ll likely need to pay self-employment taxes—covering Social Security and Medicare—along with federal and state income taxes on your business income.

Sometimes rules between states might differ, so ensure you familiarize yourself with all applicable tax regulations so you can stay compliant.

If you’re turning a hobby into a business, there are still local and government rules you’ll need to follow. The good news is that the regulatory burden is lighter for sole proprietors than for other business structures.

📌 For example, in many states like California, you need a local business license, but you may not need to file complex formation documents like a limited liability company or corporation.

Managing finances can be relatively easy for sole proprietors. Since you’re essentially paying yourself, there’s no need for complex payroll systems. However, to keep things organized, you might consider opening a separate business bank account to streamline your finances.

While a sole proprietorship has many benefits, it comes with its challenges. Let’s take a look at some of them.

One of the major drawbacks of a sole proprietorship is unlimited personal liability. If a business faces a lawsuit or accumulates debt, the owner’s personal assets, like their home or savings, could be at risk.

A sole proprietorship does not offer personal liability protection, unlike LLCs or corporations, which provide a separate legal entity from their owners.

Sole proprietors often struggle to attract investors or secure substantial funding. Scaling the business can be challenging without the ability to issue stock or bring in multiple investors.

Once you reach a certain level, growth might require restructuring your business into a more complex entity, such as an LLC or corporation, to gain access to larger financial resources.

Tracking your business’s financial health can be more challenging without formal accounting processes.

You may feel less in control of your finances, which can lead to problems with budgeting, tax preparation, and long-term planning. Plus, you cannot sell stock to raise money, limiting the options for attracting significant investment.

🎉 Fun Fact: Kevin Plank founded Under Armour as a sole proprietorship in his grandmother’s basement in Washington DC, selling moisture-wicking shirts from his car trunk. Starting with athletes at local games, it grew into a global sportswear giant. From basement brainstorming to billions—proof that grit and a great idea can score big!

Sole proprietorships aren’t limited to one type of work—they span across industries. From creative services and retail to consulting and tech, there are countless ways to turn a simple idea into a thriving business. Let’s look at some real-world sole proprietorship examples across industries to spark your own inspiration.

Freelancers often operate on a smaller scale, but they enjoy a high degree of control and flexibility.

Here’s a deeper dive into a few key freelance fields:

Freelance writing is a quintessential sole proprietorship. Writers typically offer their services directly to clients, often in niches like business content creation, copywriting, blogging, news story reporting, or technical writing. As a freelancer, the writer has complete control over what projects to take on, how much to charge, and how to structure their workday.

However, many freelance writers struggle to find consistent work without a built-in customer base or company infrastructure. They often spend time marketing themselves, networking, and managing client relationships. Despite the challenges, freelance writing is a low-barrier entry point for those skilled in writing, making it a popular choice for many.

💡 Pro Tip: A freelance writer can use ClickUp to build a content calendar, track client briefs, and automate reminders for follow-ups—all from a single dashboard.

Graphic designers also thrive under the sole proprietorship model. Whether they are creating logos, brochures, videos (if they have animation and video editing skills), or entire branding packages, they offer their skills directly to businesses and individuals. Often, they choose to work independently rather than within a corporate structure, which provides greater flexibility and creative freedom.

As a sole proprietor, a graphic designer handles all aspects of the business, from working with clients to managing the business’s finances. They also enjoy the tax advantages of running their own business, including deductions for software, marketing, and equipment expenses.

Coaching can be a very fulfilling way to operate as a sole proprietor. Coaches can specialize life coaching, career coaching, or personal development and offer private or group sessions. Like tutors, coaches typically set their own rates and work with clients one-on-one, offering personalized attention.

The primary benefit of coaching as a sole proprietor is the ability to teach and help others while maintaining a flexible schedule. Coaches also enjoy low overhead costs because they can temporarily work from home or rent space.

Retail and e-commerce are some of the most popular paths for sole proprietors. From setting up a local boutique to running an online store, these businesses let you start small, test the market, and scale at your own pace—all while keeping full control.

📌 John Pemberton produced the syrup for Coca‑Cola and first sold this from a pharmacy for five cents a glass as a soda fountain drink.

If you’ve ever bought something unique from an online marketplace, chances are you’ve supported a sole proprietor. Online shops are incredibly accessible, especially with platforms like Etsy, Shopify, and eBay, which allow people to sell products directly to customers.

From handmade jewelry to vintage clothing, these businesses run on a personal level, where the owner is the face of the brand. Running an online shop has its perks as well. You can work from anywhere, control your product line, and set your own prices.

However, it’s also a lot of work. Owners handle everything from designing product listings to fulfilling orders and addressing customer concerns. While tools like CRM software are available to help manage the business, it can still feel like wearing multiple hats.

📮ClickUp insight: 92% of knowledge workers use personalized time management strategies. But, most workflow management tools don’t yet offer robust built-in time management or prioritization features, which can hinder effective prioritization.

ClickUp’s AI-powered scheduling and time-tracking features can help you transform this guesswork into data-driven decisions. It can even suggest optimal focus windows for tasks. Build a custom time management system that adapts to how you actually work!

Local boutique stores often create a sense of community by offering unique products that chain stores may not carry. The owner decides what products to sell, how to price them, and how to market the store. Many boutique owners rely on word-of-mouth marketing and social media to build a steady stream of customers.

📌 Sears is a notable example of a company that started as a sole proprietorship and that grew into a massive enterprise. Initially founded by Richard Warren Sears, the company started as a mail-order business selling jewelry and watches.

While it eventually transitioned into a partnership and a much larger corporation, its humble beginnings as a sole proprietorship show the potential of this business model.

Running a business from home is a popular option for many sole proprietors. It provides flexibility, lowers overhead costs, and offers a good work-life balance.

Let’s look at a few examples of home-based businesses:

If you’ve ever enjoyed rosemary sourdough bread, or a custom birthday cake tailored to your 8-year old’s exacting design and dietary reuirements, you may have supported a sole proprietor baker. Many bakers operate from home, using their kitchens to create products for special events or regular customers.

The beauty of being a home-based baker is that you can take on a manageable number of orders without the overhead of renting commercial kitchen space. You can build customer loyalty by creating niche, personalized confections.

📌 Kate Schade launched her company, Kate’s Real Food, as a sole proprietor, selling energy bars at a local market in Victor, Idaho. As her business gained traction, she began selling across the U.S. and internationally. Then she transitioned from a sole proprietorship to a corporate structure to support her growing operations.

Do you know how to craft handmade jewelry or turn photos into stunning portraits? If so, you’re looking at the perfect opportunity for a sole proprietorship.

As we mentioned above, many entrepreneurs today take their businesses online through platforms like Shopify or Etsy. But with the potential tax benefits of registering as a sole proprietor, this setup can work well for individuals who pay personal income tax and don’t have many business expenses to claim.

📌Sarah Blakely started her company, Spanx, with $5,000 in savings, operating as a sole proprietor out of her apartment. She handled everything from patenting her idea to sales calls. This simple structure allowed her to get started quickly and retain full control before eventually scaling into a global billion-dollar brand.

Home-based businesses can also include service providers like pet groomers, house cleaners, or personal trainers. For instance, a personal trainer may offer one-on-one sessions or group classes, all from the comfort of their own home or at a local gym.

While service-based businesses have great potential, they often require significant networking and a strong local customer base to thrive.

👀 Did you know? 63% of marketers track word-of-mouth referrals by directly asking customers how they heard about their business. Tracking through digital methods came in second, with 31% of experts using this approach. Only 6% admitted to making guesses.

Independent contractors are perhaps the most straightforward example of sole proprietorships. They include:

Plumbers provide essential services, from fixing leaks to installing new pipes. Many plumbers operate their own businesses, offering specialized expertise to homeowners and businesses alike.

Managing a plumbing business as a sole proprietor means handling everything from scheduling to customer service. Plumbers often use task management software or tools to track appointments, invoices, and service calls, which helps keep things organized.

📖 Also read: Time-Tracking Software for Small Businesses

Like plumbers, electricians are in high demand and often run their own businesses. Whether installing lighting, wiring new buildings, or fixing electrical issues, electricians can usually work as independent contractors, offering services on a project-by-project basis.

However, electricians must keep up with certifications, tools, and legal requirements to run their businesses.

Landscaping businesses are often one-person operations that provide lawn care, gardening, and seasonal maintenance services. Many landscapers start their businesses after gaining experience in the field, using their expertise to build a loyal customer base.

While landscaping businesses can be highly profitable, they require good equipment, a strong work ethic, and an ability to manage both the physical labor and the business aspect.

📖 Also read: What is Customer Communication Management (CCM)?

As a sole proprietor, you are responsible for every aspect of your business. But as you gain more clients and your workload grows, it can quickly become overwhelming. That’s where the right tools and technology come into play, making it easier to succeed.

One of the best tools for managing your workload is ClickUp, the world’s first Converged AI Workspace that helps you centralize tasks, documents, and workflows in one customizable, easy-to-use platform.

For solo content writers, ClickUp means access to ClickUp Brain and premium external AI models like ChatGPT, Claude, and Gemini. For sole proprietors working as contractors, it’s perfect for tracking invoices, jobs, and materials, not to mention, packed with templates to set up projects. There’s something for every solopreneur on the platform, and next-generation AI Agents that serve as a handy executive assistant.

ClickUp empowers you to work smarter, stay organized, and achieve more—all without the complexity or cost of enterprise tools. It’s your business command center, designed to help you thrive.

For example, ClickUp’s Project Management Solution lets you track progress, make data-driven decisions, and stay organized. Here’s how ClickUp can help manage your sole proprietorship:

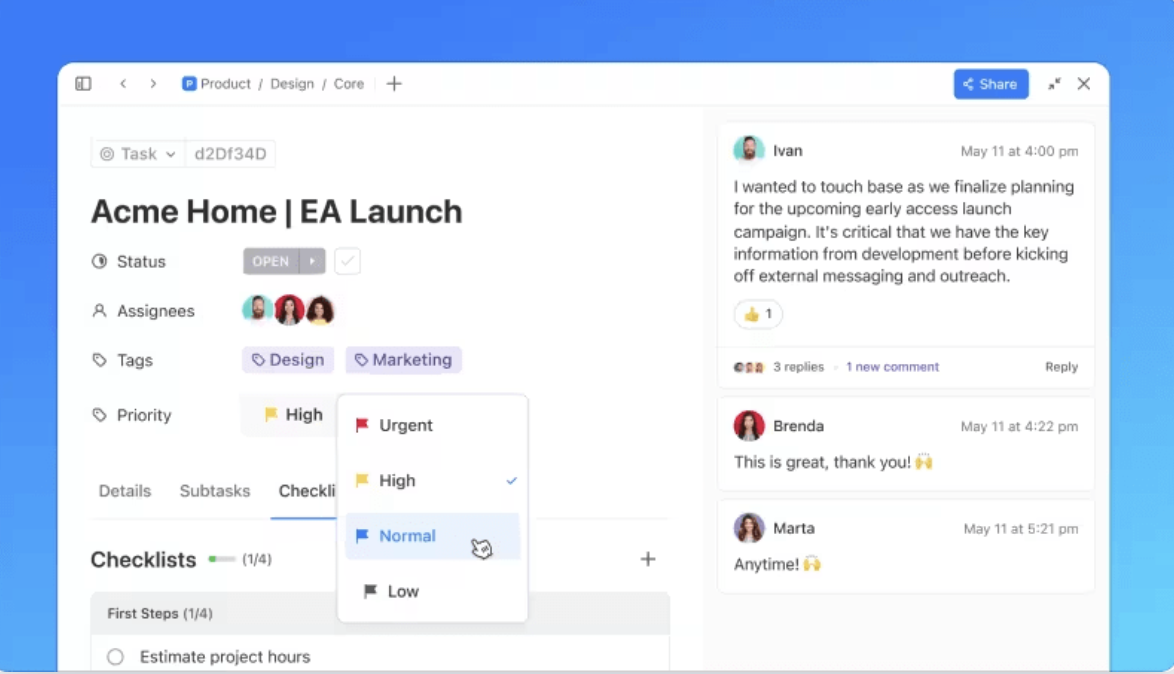

If you need to keep everything in order, ClickUp Tasks offers advanced task management and collaboration features, including real-time commenting, discussions, and prioritization. You can set up to five priority levels, allowing you to categorize tasks, highlight urgent deliverables, and focus on what drives progress.

ClickUp Brain is designed to address the unique challenges faced by sole proprietors. It helps you manage every aspect of your business efficiently without a large team. It acts as your digital assistant, streamlining daily operations so you can focus on what matters most—growing your business.

Here’s how you can find instant answers in ClickUp👇

Additionally, you can simplify your to-do list by creating and organizing tasks that suit your business needs. Use ClickUp Custom Fields to categorize customer inquiries, inventory restocks, and marketing campaigns.

As Joao Correa, senior freelance designer, puts it:

It’s easier than Asana, more complete than Trello (even in the free version!) and easier to use than Basecamp…And the ability to integrate with other services like Google Calendar, made me choose clickup rather the competition.

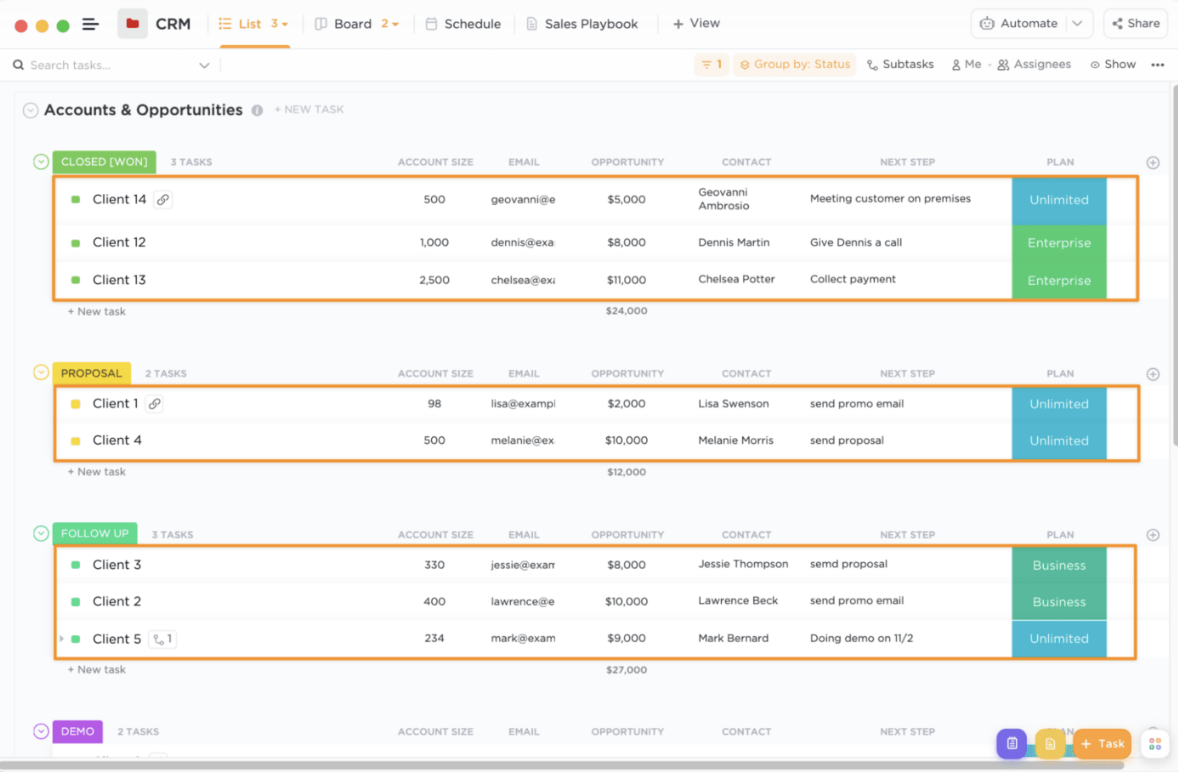

Similarly, ClickUp for CRM lets you manage client relationships in one centralized place. It tracks:

💡 Pro Tip: Using CRM templates alongside project management keeps your project and customer data in one place, saving you time switching between different tools.

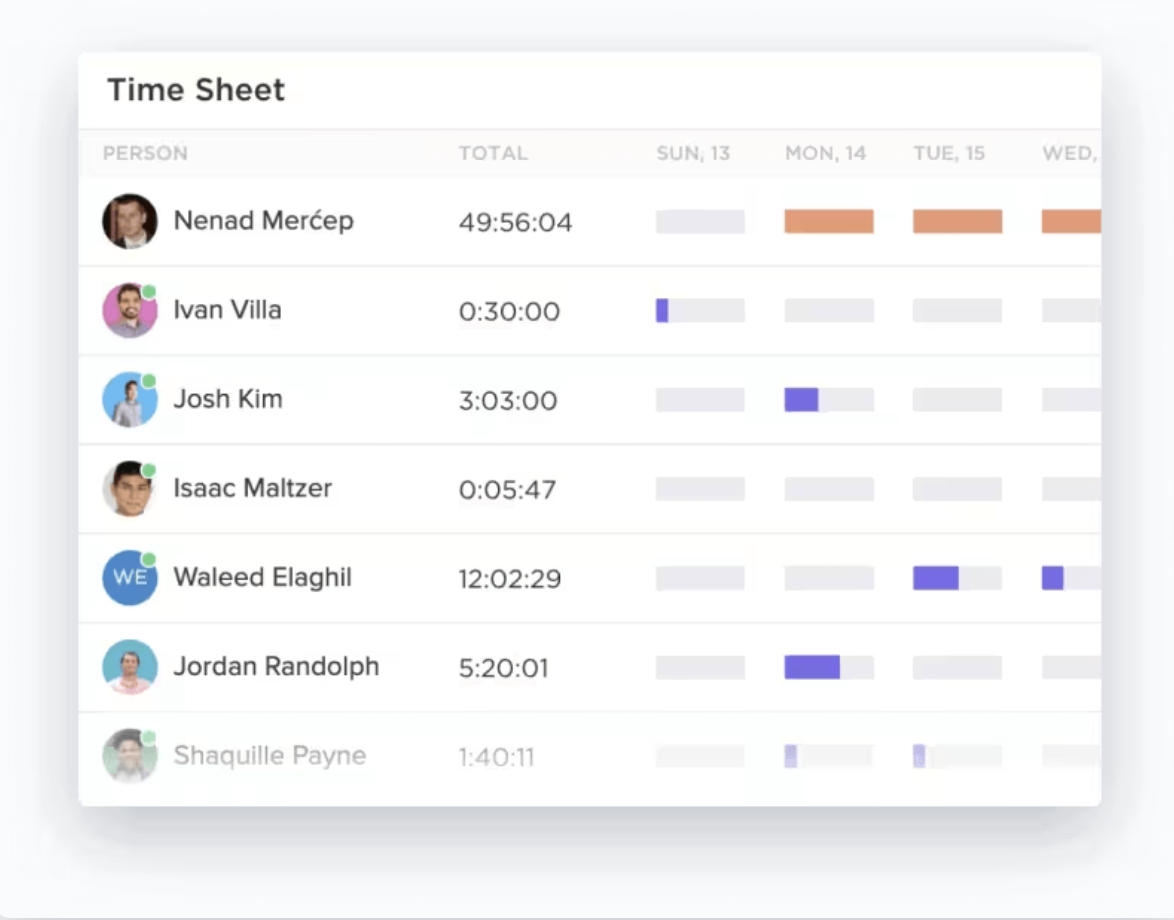

Sole proprietors can use ClickUp’s Project Time Tracking to track hours worked, create customizable timesheets, and generate detailed reports. Marketing consultants can also use this feature to see which campaigns consume more time and resources, allowing them to optimize their strategies.

Check out this video to know more about time tracking in ClickUp.

Once you have tracked your time and tasks, set clear targets and monitor progress with ClickUp Goals. By linking individual tasks and projects to broader business objectives, you ensure your team remains focused and aligned.

With tools like weekly scorecards and shout-outs, you can motivate everyone to stay on track and drive towards success.

The functionality doesn’t stop there. With analytics, you can dive deeper into key metrics and gain insights into customer behavior, market trends, and operational performance.

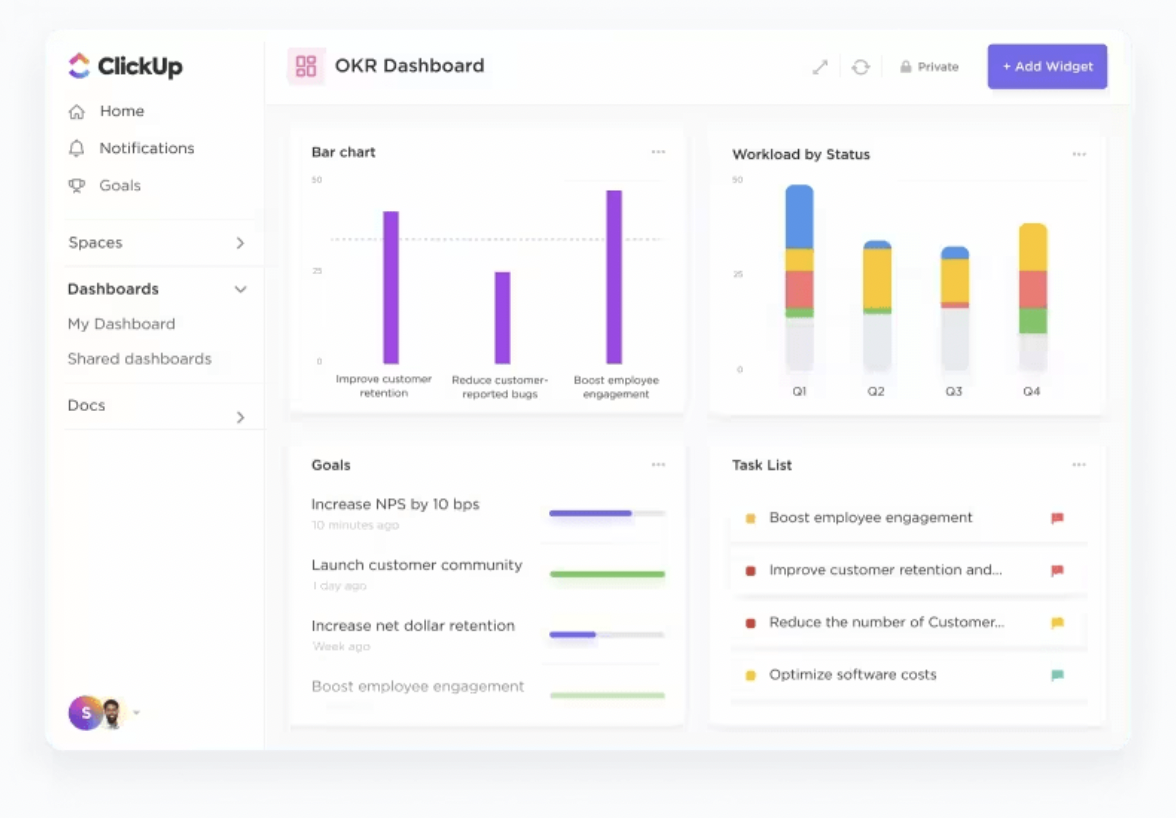

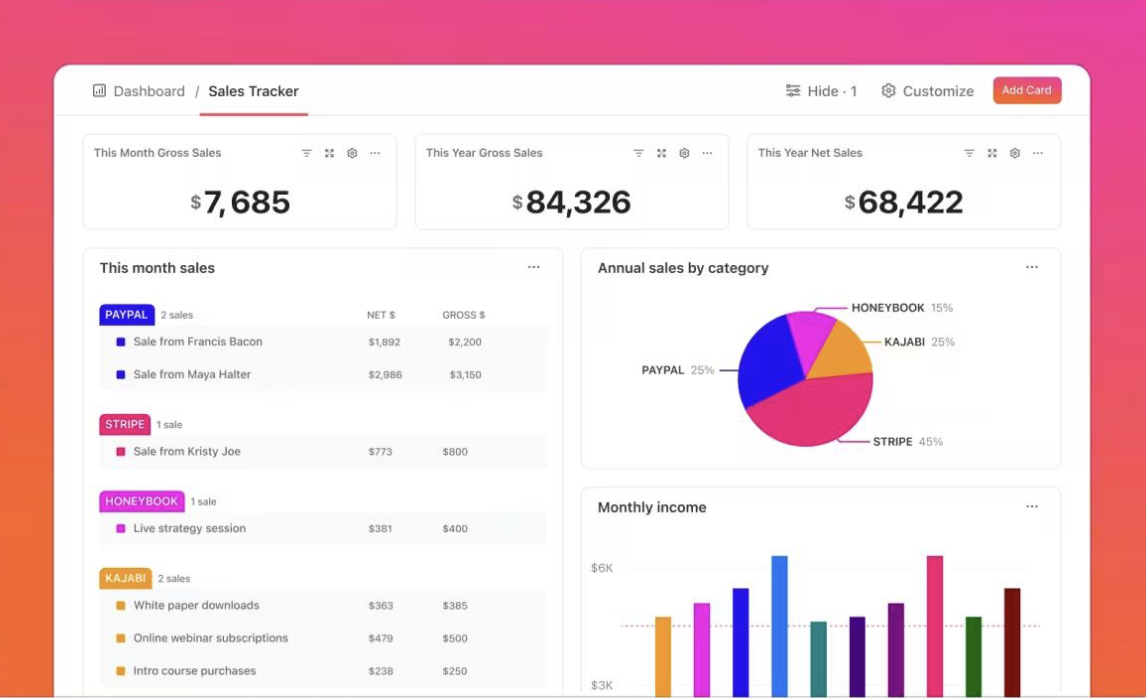

Moreover, custom widgets on ClickUp Dashboards allow you to track KPIs, progress, and other business metrics, making it easier to make data-driven decisions.

When it comes to budgeting, ClickUp Finance helps you track your goals, accounts, and profits. Create custom dashboards to monitor budget allocations, spending, and profitability. The platform also offers powerful Excel-like features, letting you handle budgeting and expense tracking all in one place.

For recurring tasks like monthly bills, ClickUp automatically generates new tasks once a payment is made. Add Custom Fields to track specifics like budgeted amounts, actual spending, vendor information, and payment dates.

A sole proprietorship is simpler to manage than you might think. With this clarity, you can confidently decide if it’s the right fit for your business.

As you set up, choosing a robust task management tool is key. ClickUp empowers you to organize your workflow, streamline client communication, and boost productivity—so you can scale your business efficiently and achieve results with confidence.

© 2026 ClickUp