Top 10 monday.com Templates for Accounting in 2026

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

For small business owners, accountants, and finance teams, regularly managing and reporting on cash flow, budgets, or financial reports can seem daunting.

That’s why we’ve rounded up the top monday.com accounting templates to make your life a little easier.

From tracking expenses to managing balance sheets, these templates are built to help you spot issues early, track progress, and keep your accounting workflows running smoothly, without the tab overload.

We’ll also introduce you to a solid alternative to a Monday.com accounting template: ClickUp’s roster of accounting templates!

If you’ve ever built timelines your team ignored or to-do boards they abandoned, it’s time to adopt better features. Here’s what you should look for in a good monday.com accounting template:

These monday.com accounting templates give accounting firms and small teams the clarity they need to make crucial decisions faster. Let’s explore them together!

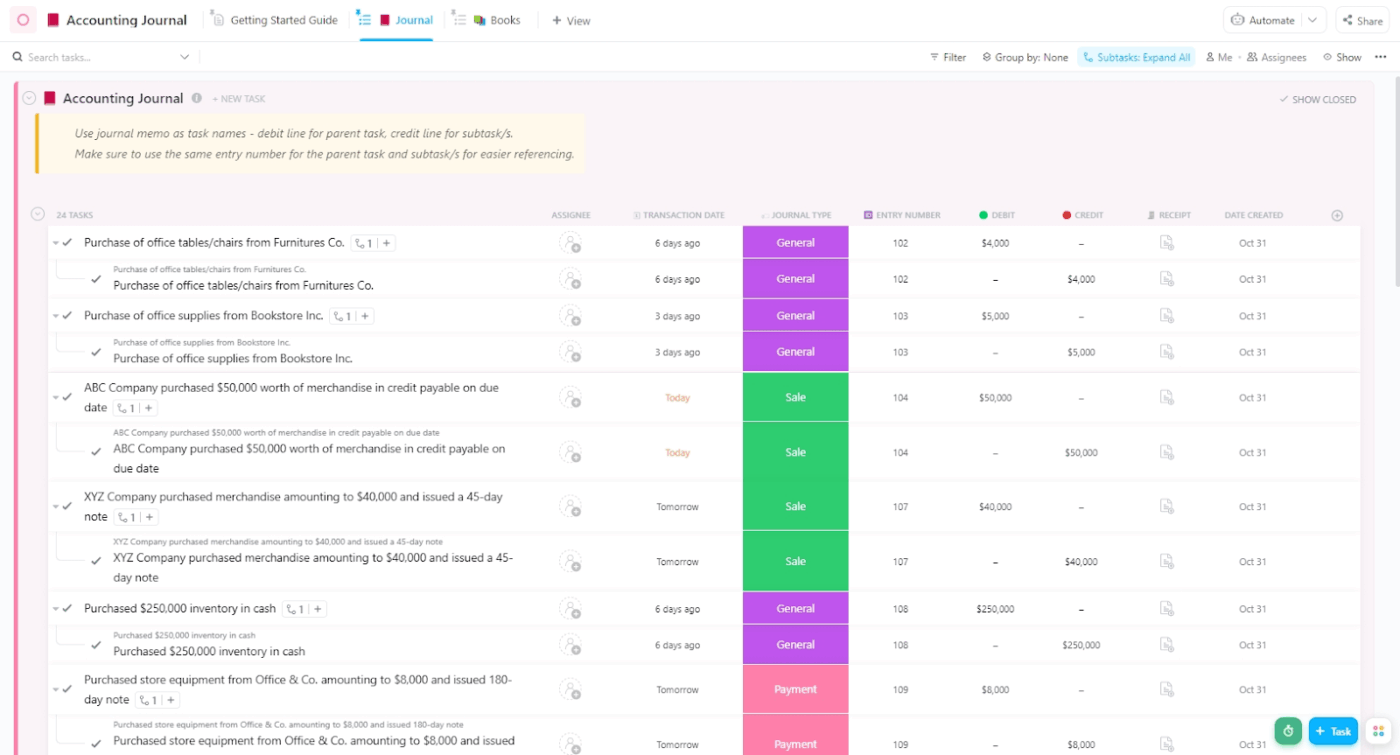

When team members add a new expense, they can quickly tag it with preset categories like travel, office supplies, or equipment in the monday.com Expense Tracking Template. The template automatically calculates totals and streamlines calculations.

With this template, you can:

🔑 Ideal for: Small business owners and finance teams who want a reliable way to monitor and manage expenses.

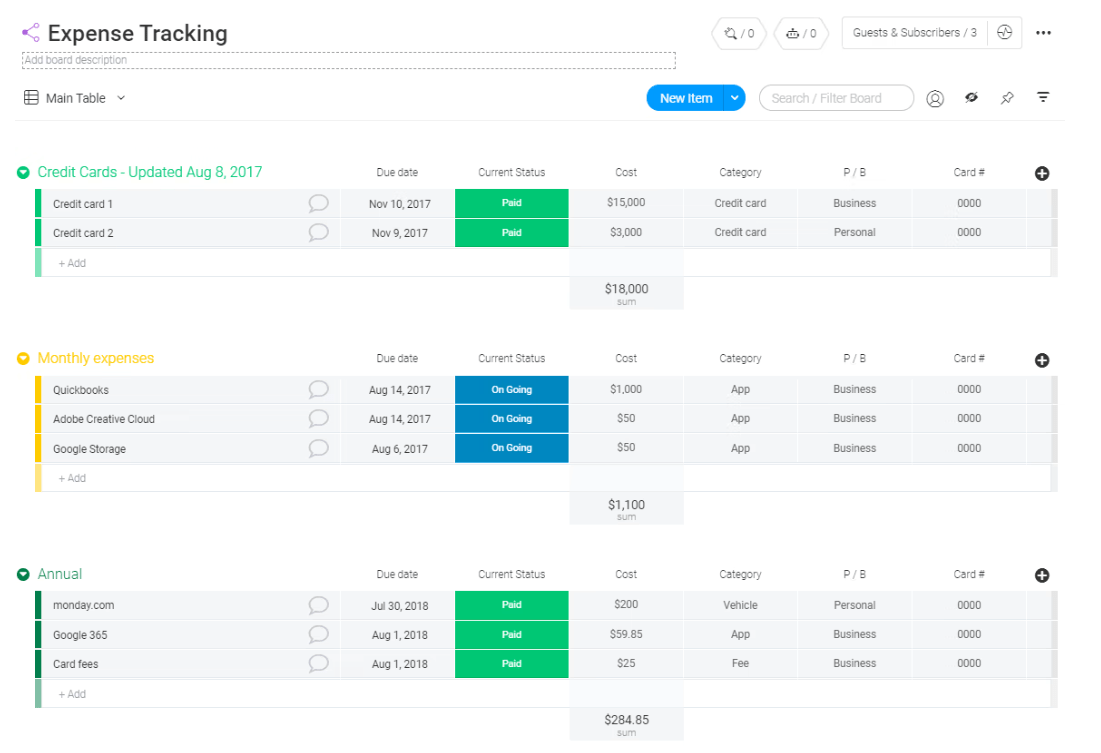

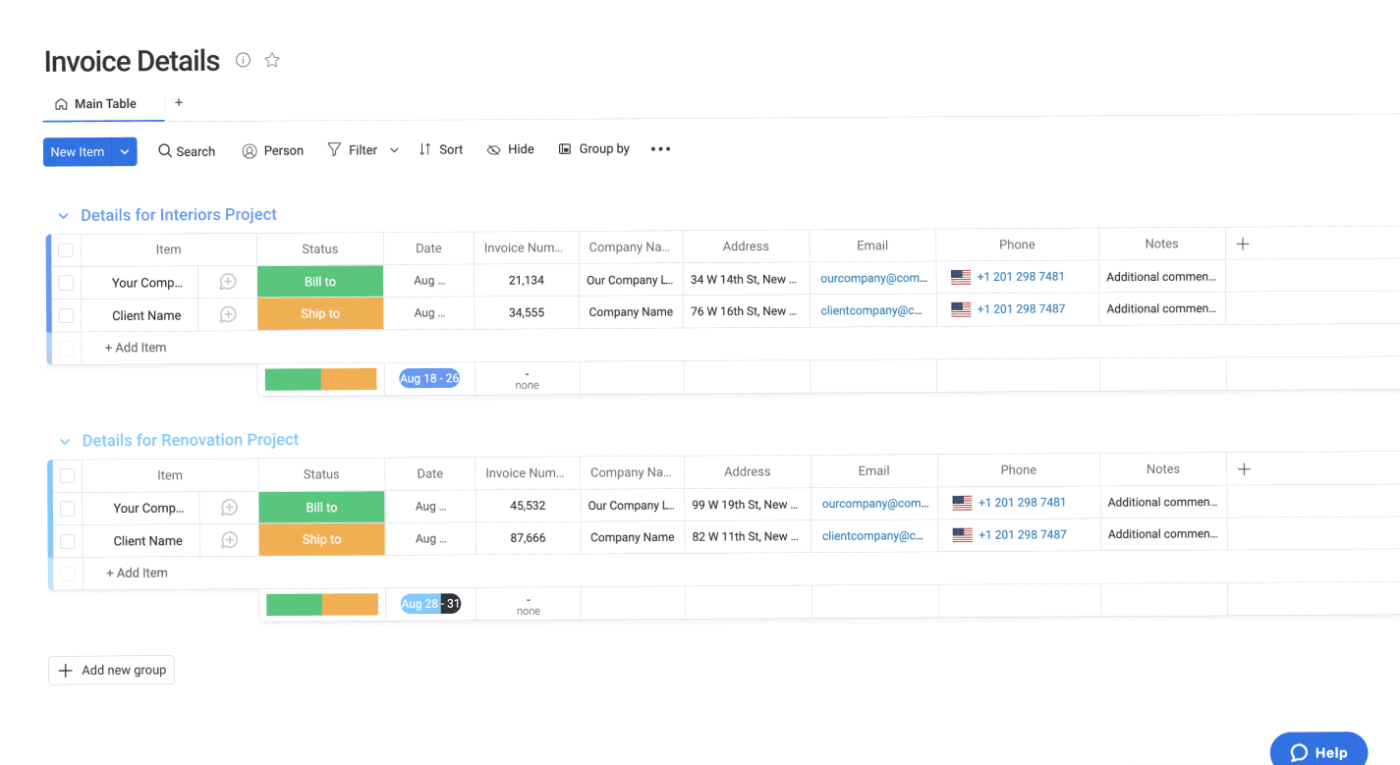

Are you manually entering the same clients’ details repeatedly? The monday.com Invoice Template includes a drag-and-drop layout, automated fields, and syncing options to make this process easier.

With this template, you can:

🔑 Ideal for: Freelancers and small businesses needing fast, professional invoicing without repetitive entry.

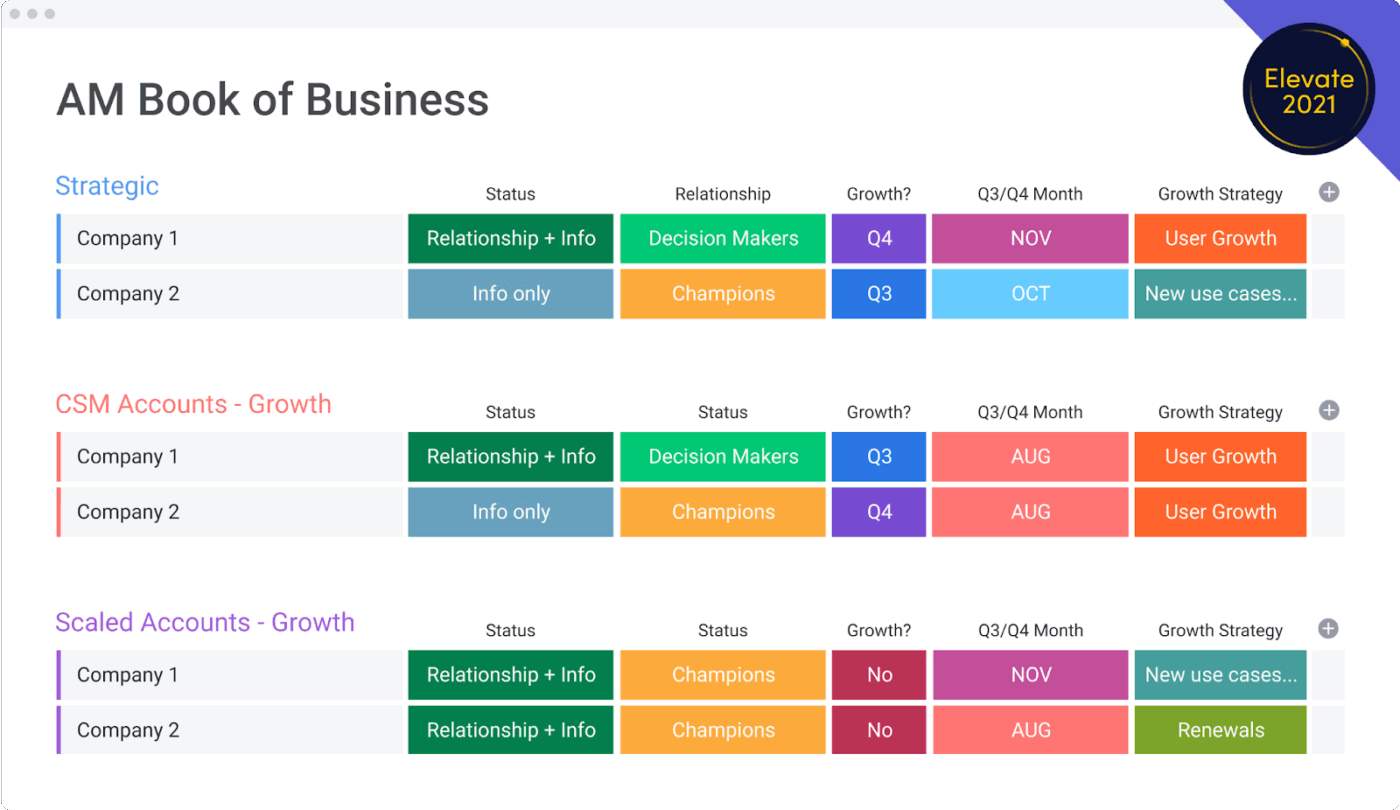

If you’re wrapping up the quarter while juggling client relationships, pending contracts, and legal approvals, the monday.com Account Management Template might be worth a look.

It brings sales and finance teams into one organized workspace so that you can stay on top of your pipeline, track contract progress, and manage communication—all without endless email threads or spreadsheet chaos.

This template will help you:

🔑 Ideal for: Revenue and operations teams juggling accounts, contracts, and internal collaboration.

📮 ClickUp Insight: Context-switching is silently eating away at your team’s productivity. Our research shows that 42% of disruptions at work come from juggling platforms, managing emails, and jumping between meetings. What if you could eliminate these costly interruptions?

ClickUp unites your workflows (and chat) under a single, streamlined platform. Launch and manage your tasks from across chat, docs, whiteboards, and more—while AI-powered features keep the context connected, searchable, and manageable!

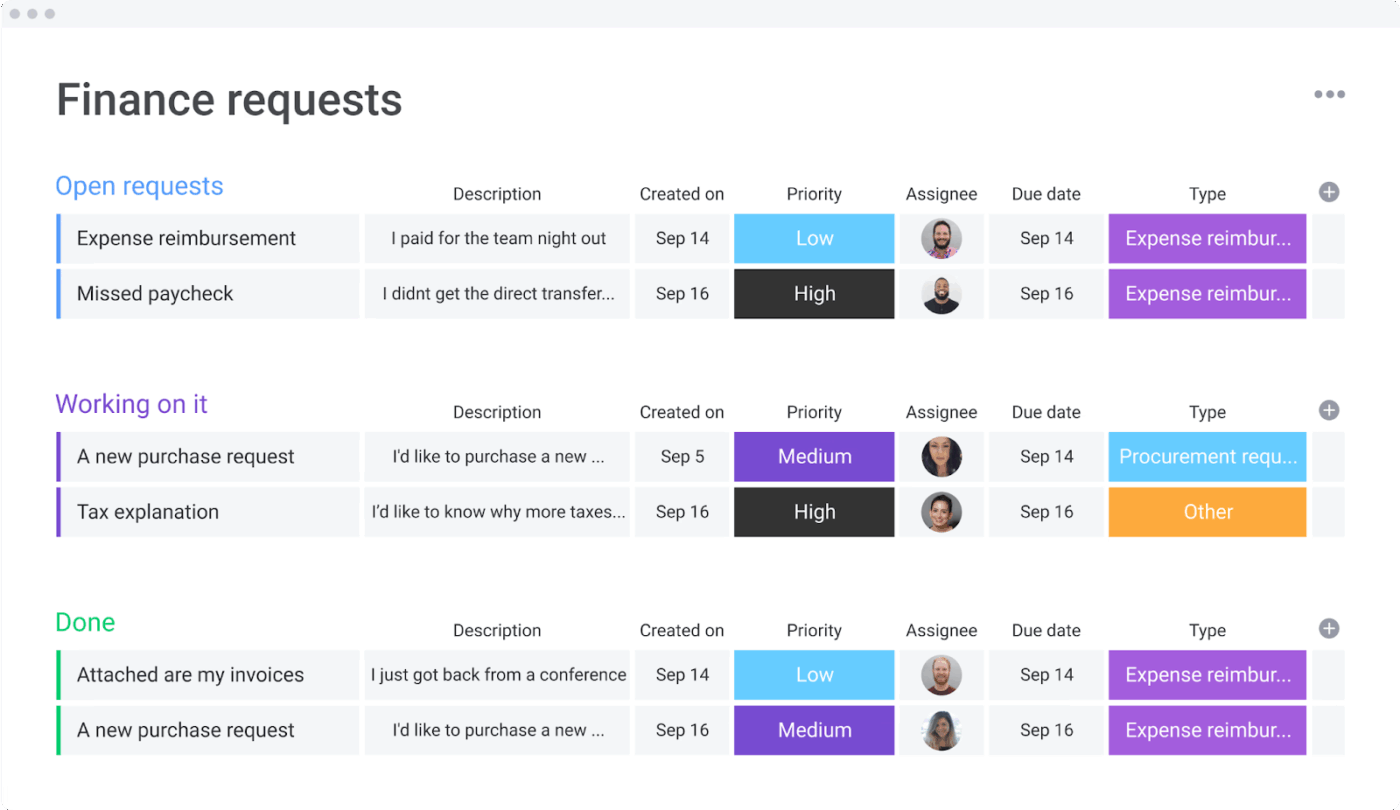

Imagine your finance inbox is overflowing—one employee is asking for a laptop upgrade, another is submitting a client reimbursement, and someone else needs budget approval.

The monday.com Finance Requests Template helps you manage everything in one centralized system. From purchase approvals to expense reimbursements, you can tailor the process for both requestors and reviewers, keep things moving smoothly, and ensure everything stays compliant and audit-ready without the inbox chaos.

Use this template and:

🔑 Ideal for: Finance and ops teams handling high volumes of internal budget and purchase requests.

💡 Bonus: If you want to:

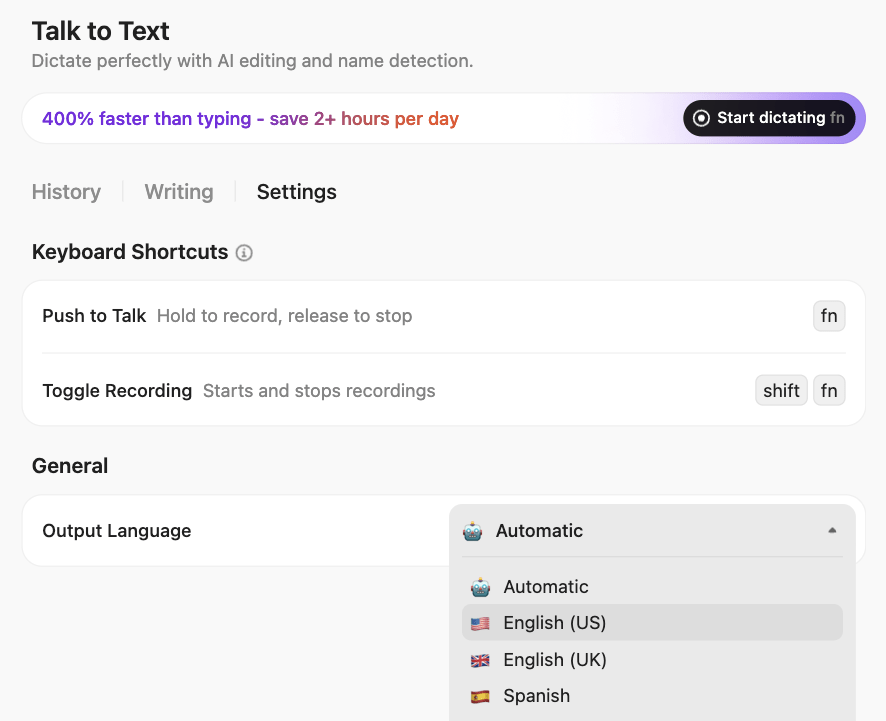

Try ClickUp Brain MAX—the AI Super App that truly understands you, because it knows your work. Ditch the AI tool sprawl, use your voice to get work done, create policy documents, assign tasks to team members, and more.

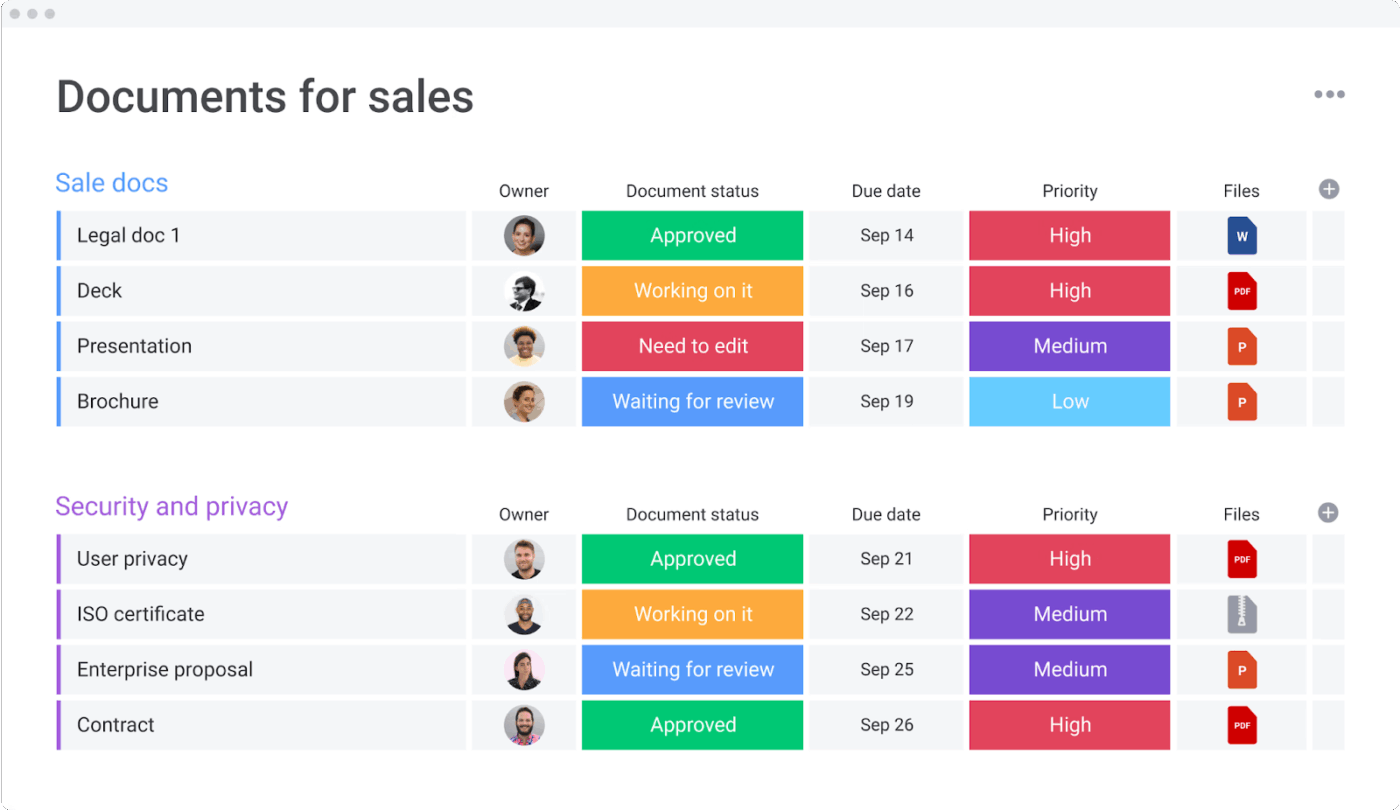

The monday.com Supporting Sales Material Template brings all your sales enablement content—brochures, case studies, email templates, decks, white papers—into one organized, collaborative space.

It helps your sales and marketing teams stay aligned, deliver the right assets faster, and keep deals moving without last-minute scrambling or outdated files.

Use this template to:

🔑 Ideal for: Sales enablement and marketing teams managing collateral production and distribution.

🧠 Fun fact: The term “Accountant” has Latin roots. It comes from the Old French “compter,” derived from the Latin “computare,” meaning “to calculate.”

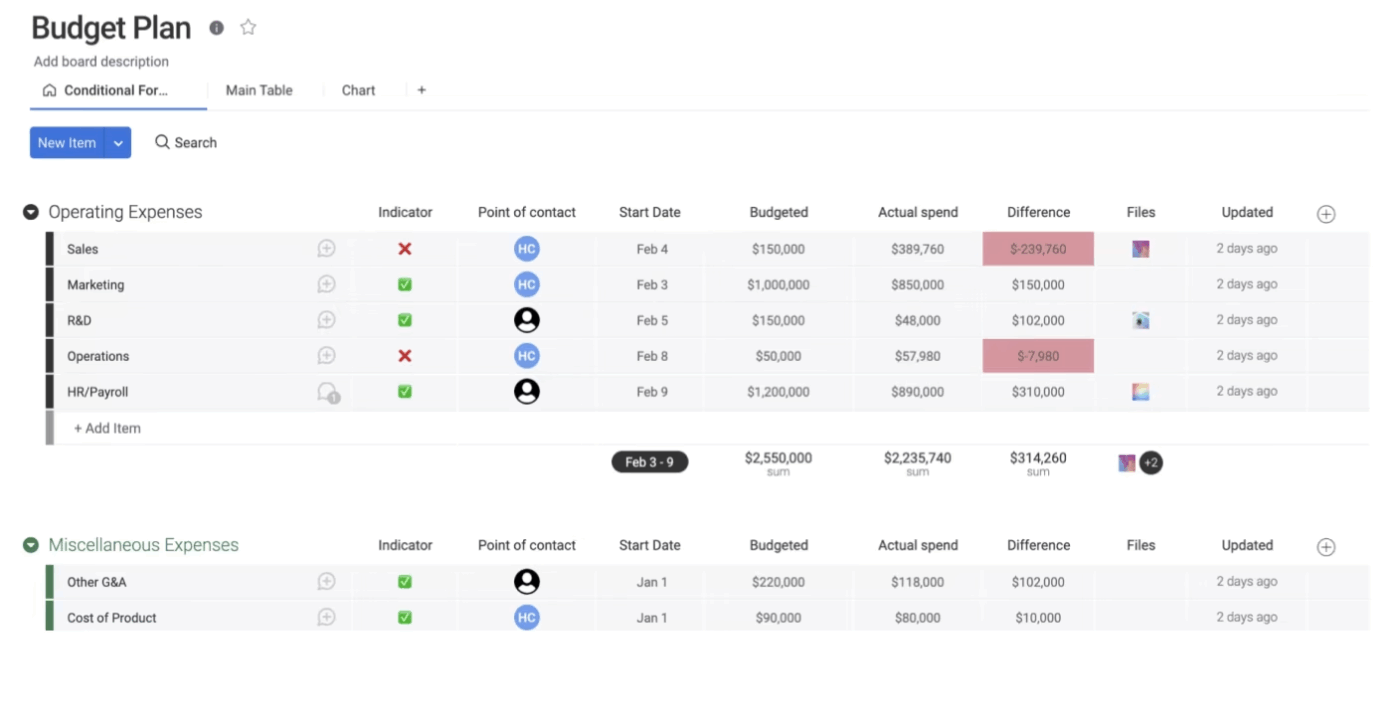

The monday.com Budget Tracker Template helps you break down costs by category, upload receipts or supporting docs, and automate approvals or alerts when limits are hit. It gives you a real-time view of where your money’s going—so you can make informed decisions without guesswork.

Customize this template to:

🔑 Ideal for: Department leads and project managers managing dynamic, multi-category budgets.

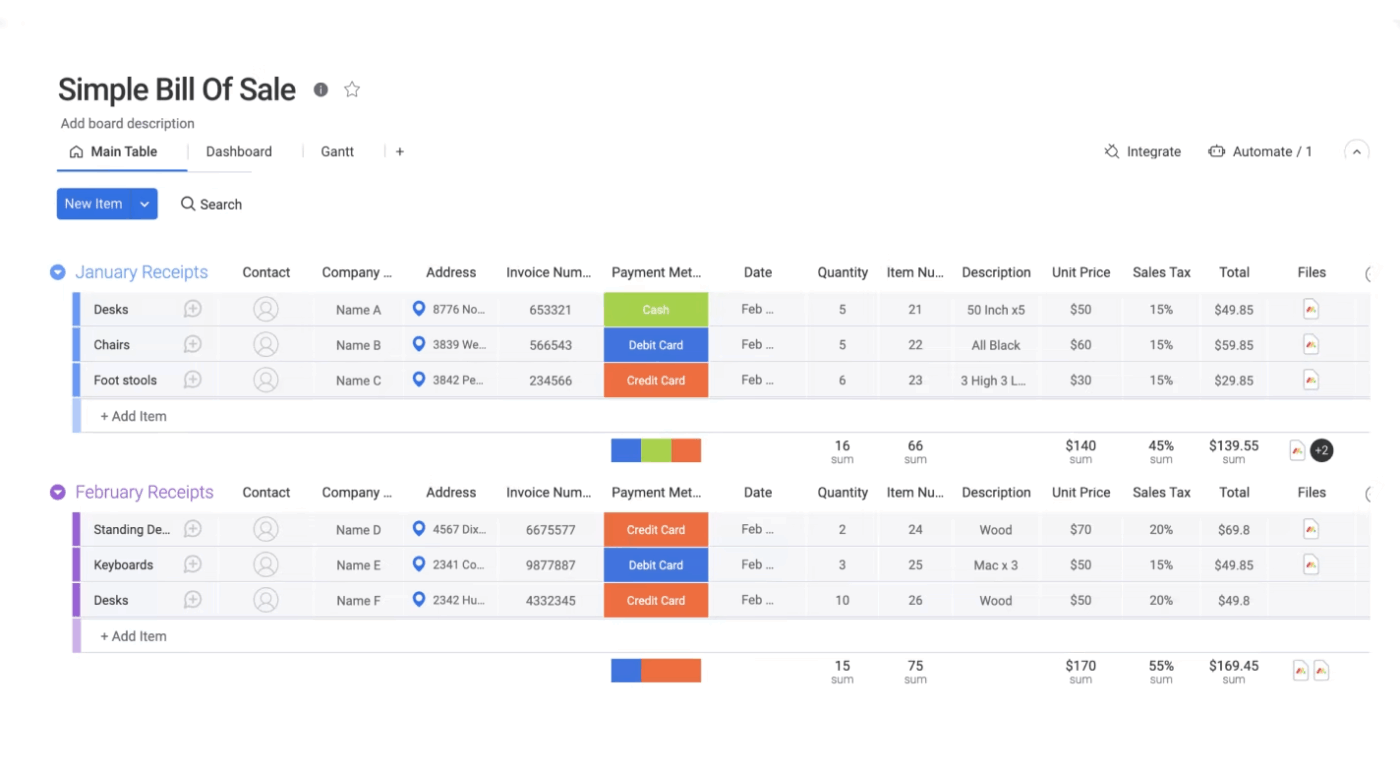

Need to keep track of who paid for what, when, and how? The monday.com Bill Tracker Template gives you a clear, reliable way to document sales, monitor payments, and stay organized—especially when managing multiple transactions across clients or departments.

With this template, you can:

🔑 Ideal for: Freelancers and small teams trying to bill clients while handling sales and services.

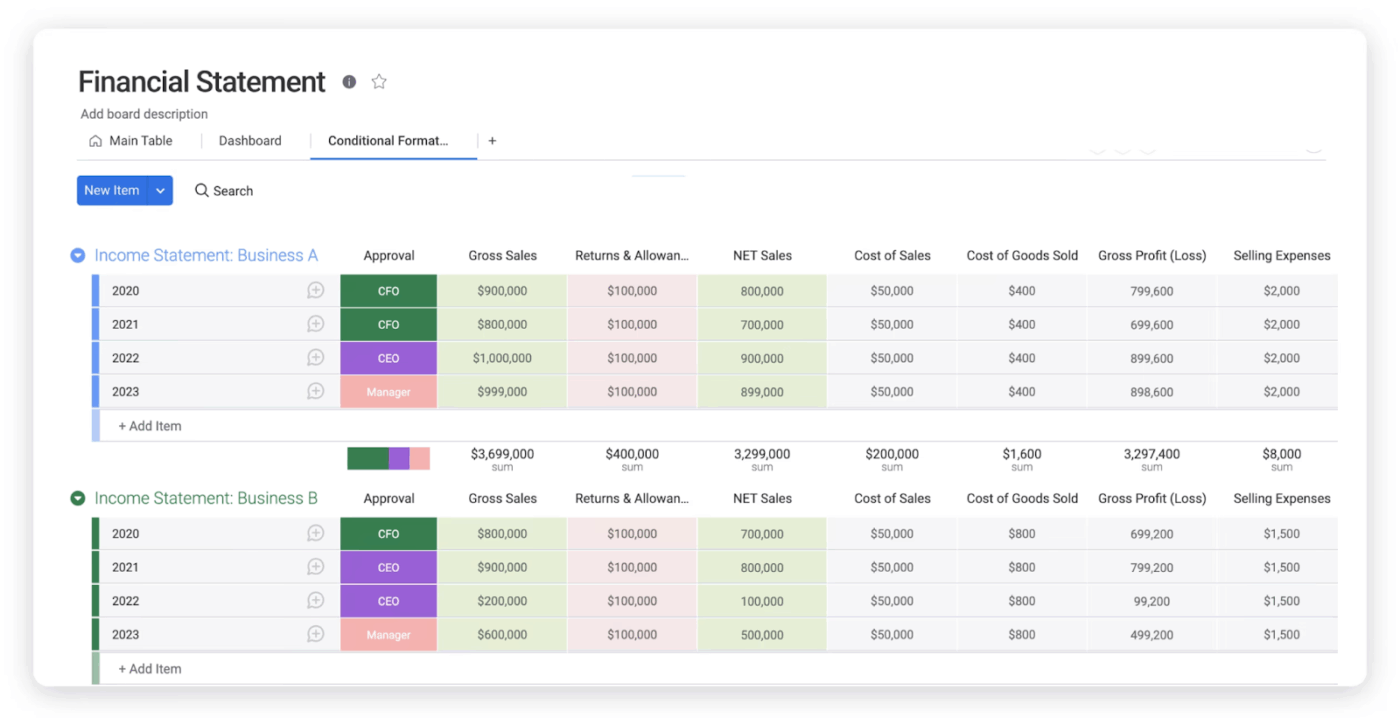

Getting ready for a quarterly review or investor pitch—and juggling income statements, cash flow summaries, and balance sheets across different tools?

The monday.com Financial Statement Template brings all your key financial data into one centralized dashboard. It keeps your accounting team, leadership, and stakeholders aligned and provides a clear view of your company’s financial health without the headaches of version control.

This template lets you:

🔑 Ideal for: Finance leaders who need to centralize reporting and investor-ready financials.

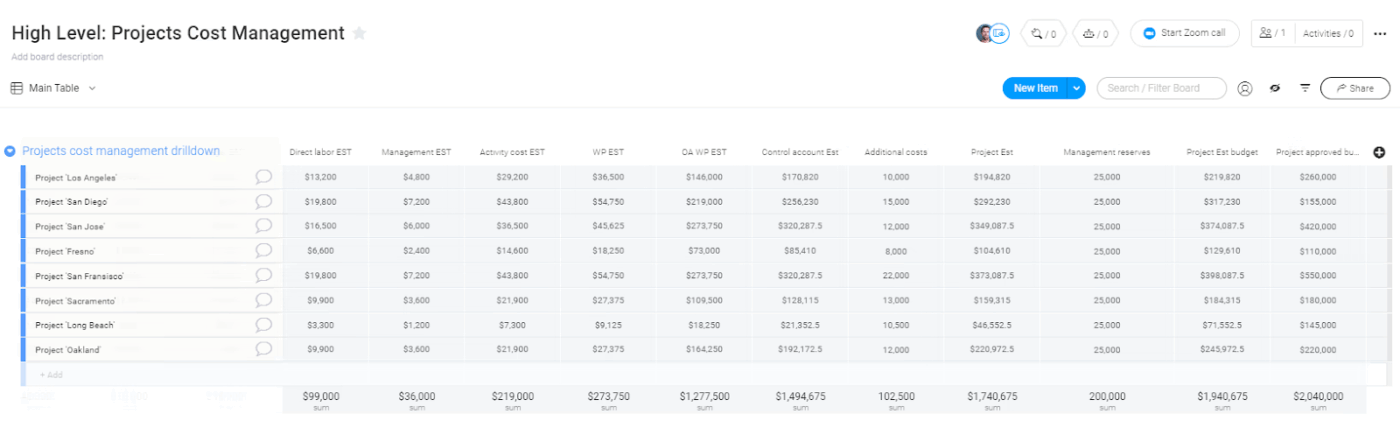

If you’ve ever struggled to track project expenses, stay within budget, or manage cost changes on the fly, the monday.com Project Cost Management Template can help. It offers a centralized, customizable workspace to plan budgets, monitor actual spend, and make real-time adjustments with ease.

With built-in automations, visual dashboards, and collaborative tools, this template helps you stay aligned with stakeholders and keep every financial detail under control—no spreadsheets required.

This template lets you:

🔑 Ideal for: Finance leads and project owners presenting budgets for approval or managing proposal workflows.

If you’ve ever juggled high-value accounts, struggled to standardize follow-ups, or lost visibility into client health, the monday.com Account Management by Compass template is here to help.

It provides a centralized space to log interactions, monitor account performance, and streamline onboarding—keeping your strategic relationships organized and proactive.

With this template, you can:

🔑 Ideal for: Bookkeepers and businesses managing receivables and payables at scale.

While monday.com offers flexible templates and visual workflows, it can fall short for complex accounting or finance needs.

Here’s why you should consider monday alternatives:

ClickUp, the everything app for work, combines project management, knowledge management, and chat—all powered by AI that helps you work faster and smarter.

Unlike monday.com, where tasks, docs, and communication often live in separate silos, ClickUp offers a unified space to manage accounting processes from start to finish.

In a ClickUp vs monday.com comparison, what truly sets ClickUp apart is how much you can customize—no rigid templates or limited views. And with built-in AI for improved accounting, your team can streamline financial workflows without sacrificing accuracy, collaboration, or control.

We’ve got you covered with plug-and-play accounting templates:

Say you manage multiple vendor invoices while handling team requests and the tax season. And bam! One payment’s information gets caught up in another. Chaotic, right?

The ClickUp Accounts Payable Template helps you avoid these lapses by giving you a centralized view of every invoice, status, and due date. You can track payment progress and reduce accounting errors.

Customize this template to:

🔑 Ideal for: Bookkeepers and finance teams managing recurring vendor payments and approval workflows.

🧠 Fun fact: November 10 is International Accounting Day. Celebrated annually, this day honors the profession and commemorates the publication of Pacioli’s seminal work on accounting in 1494.

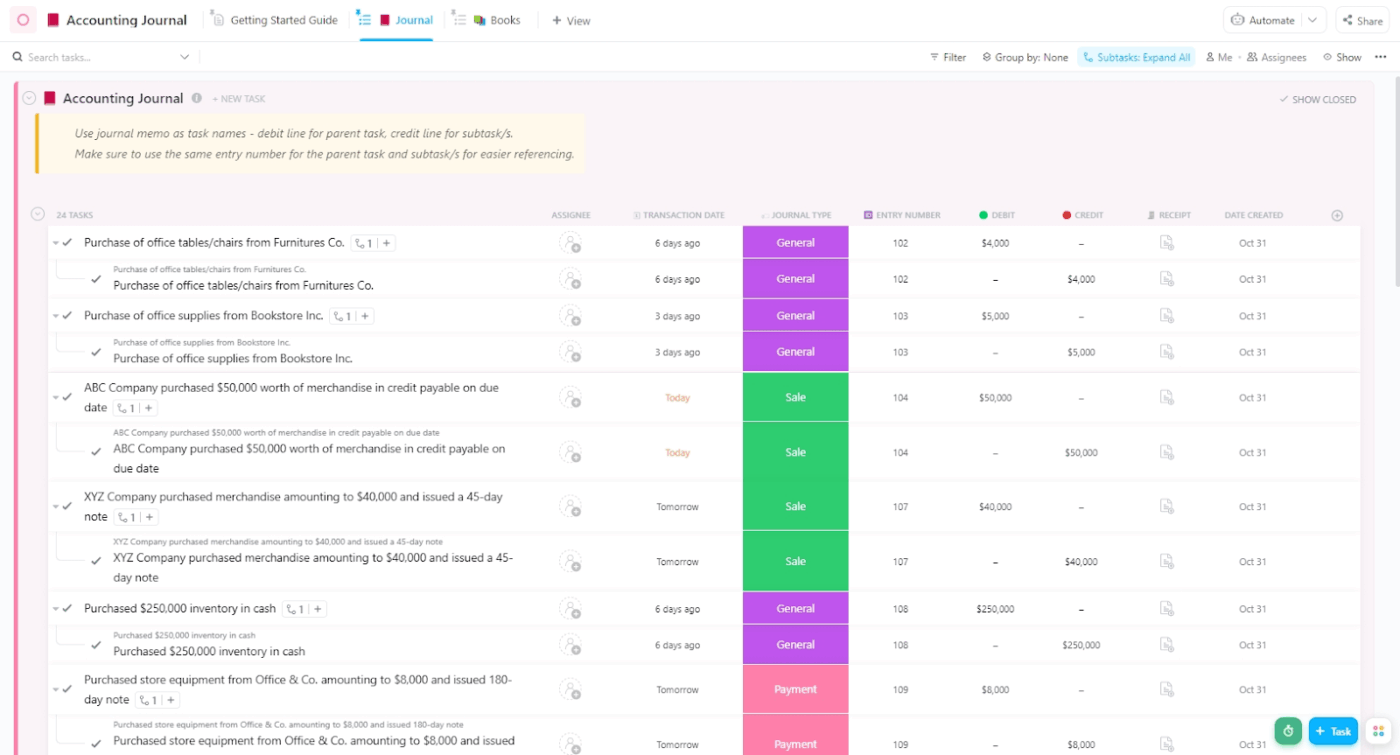

Need to record each debit and credit entry across multiple accounts? The ClickUp Accounting Journal Template can log transactions accurately, keep them organized, and convert them into useful reports for monthly and quarterly reviews.

Use this template to:

🔑 Ideal for: Accounting professionals who need a reliable, organized ledger system for double-entry bookkeeping.

💡 Pro Tip: With ClickUp Brain, teams can automatically generate summaries, draft follow-up messages, and populate financial documents with fewer manual steps. That means less copy-pasting and more time spent on decisions that actually move the business forward.

If you run a small accounting firm, a customizable workflow to manage invoices and income projections can be handy. The ClickUp Accounting Template gives you a workspace where your financials, invoices, and reports live harmoniously, making tracking easier.

With this template, you can:

🔑 Ideal for: Small business owners and freelancers who want a versatile system to manage their finances holistically.

👀 Did you know? Only 44% of businesses have automated their accounts receivable processes to improve their financial performance.

Imagine you’re a freelancer manually creating invoices each month, spending more time formatting columns than actually working with clients. That’s where the ClickUp Invoice Template could make a real difference.

Instead of juggling spreadsheets and scattered email threads, you might benefit from a fully customizable, branded template streamlining your billing cycle. It helps keep everything—from client details to payment status—in one organized space, so you can focus more on your work and less on chasing totals.

You can use this template to:

🔑 Ideal for: Freelancers and service providers who need a polished, repeatable system for billing clients consistently.

If you manage dozens of clients’ invoices and struggle to stay updated about who’s paid what, the ClickUp Invoice Tracking Template is your go-to. It provides real-time insight into every invoice’s status so you always know whether to mark it complete or follow up.

This template helps you:

🔑 Ideal for: Accounting teams and business owners managing a high volume of client invoices who need better visibility.

📣 Customer voice: Escritorio E., a small business owner, says on G2:

ClickUp has helped us solve a lot of problems at our accounting office. Before using it, it was hard to keep track of all the tasks we had to do for different clients and projects. Now, with ClickUp, we have everything organized in one place. I can easily see what needs to be done, when it’s due, and who is responsible for it…

One of the best things is that we can set up recurring tasks for the things we need to do every month, which saves us time and helps make sure we don’t forget anything. It’s also really helpful to have all the team’s work visible, so we can stay on top of deadlines and make better decisions about who should work on what. Thanks to ClickUp, our office is much more organized, and we are able to get more work done without feeling overwhelmed. It’s made a big difference in how we manage our clients and our daily work.

You’re sourcing a new vendor for your growing business and must compare multiple bids. But your inbox is cluttered, spreadsheets are inconsistent, and you don’t know who’s yet to respond. Solve this issue with the ClickUp Request for Quote Template.

Use this quote template to:

🔑 Ideal for: Operations managers and purchasing teams who need to manage vendor sourcing and decision-making.

Pulling reports from five different sources to understand your business’s financial health? It’s bound to cause confusion between your teams. The ClickUp Summary of Financial Accounts Template consolidates all this data so your cash flow, account balances, and performance trends are clear and easy to monitor.

This template allows you to:

🔑 Ideal for: Financial analysts and accounting leads who want a real-time, high-level view of all company accounts.

💡 Pro tip: Already using monday.com? Migrate all your projects, templates, and Custom Fields into ClickUp in just one click. Go to Workspace settings > Choose ‘Import’ > Select monday.com.

Bring over users, tasks, boards, and more; ClickUp will map them automatically.

The ClickUp Finance Management Template is for you if you regularly run quarterly reviews, manage budget approvals, and track multiple departmental spending. It automates budget management, tracks goals, and brings visibility to every layer of financial planning and execution.

This template lets you:

🔑 Ideal for: Finance teams and department heads managing complex financial projects across teams and timeframes.

The end of each month brings challenges of collecting receipts, inputting data, or summarizing departmental spending before deadlines. Use the ClickUp Monthly Expense Report Template to make the process easier. Log, review, and report your business expenses confidently with this ready-to-go document.

Use this available template to:

🔑 Ideal for: Financial managers and team leads who need a monthly rhythm for reviewing and reporting expenses.

Your business team travels, meets clients, and pays for coffees, while your accounting department tries to process the receipts promptly. With the ClickUp Business Expense and Report Template, you can keep both these teams on the same page to track expenses from submission to approval.

Leverage this template to:

🔑 Ideal for: Finance teams and operations managers overseeing multi-employee expense tracking and reimbursements.

Say you’re running a small bookkeeping firm and managing multiple clients, deadlines, and financial reports. Adding the ClickUp Bookkeeping Firm Template could bring structure to that endless madness.

From onboarding new clients to managing recurring tasks like reconciliations, monthly reports, and follow-ups, this template provides a clear framework for organizing your workflows without digging through spreadsheets or sticky notes.

This template is ideal to let you:

🔑 Ideal for: Bookkeeping firms and solo accountants managing high client volume with a need for structured workflows.

Whether you’re running an event, offering services, or handling internal orders, the ClickUp Payment Form Template can be a handy addition. It lets you securely collect payment data, monitor transaction status, and trigger automated follow-ups—all without leaving your ClickUp workflows. It’s a simple way to stay organized and ensure nothing slips through the cracks when money’s involved.

With this template, you can:

🔑 Ideal for: Retailers, service providers, or internal finance teams processing payments through forms and workflows.

👀 Did you know? Low-performing teams are four times more likely to juggle 15+ tools to get work done. In accounting, that means data lives in too many places, updates fall through the cracks, and your team spends more time switching tabs than actually doing the work.

Templates are a great way to start streamlining information, but for real accounting efficiency, you need more than just a basic structure. Your system should adapt to your team’s pace, and scale as your business grows.

While monday.com does offer a variety of accounting templates, it often lacks the flexibility, collaboration tools, and unified view that modern teams need.

ClickUp, on the other hand, gives you a fully customizable workspace where accounting, project tracking, documentation, and communication all stay in sync. You can organize finances, tasks, and updates in one organized space—no scattered tools, no duplicate work.

If your current workflow feels fragmented or too manual, switch to something built for clarity and speed. Sign up for ClickUp; it’s free to get started.

© 2026 ClickUp