Late payments have become a surprisingly common occurrence in the business world. According to a 2022 late payments report, a whopping 87% of businesses struggle with delayed invoice payments, which leads to time-cost repercussions and increases the accounts receivables workload.

Poor billing practices are some of the most common reasons behind late payments. An invoice filled with errors or unclear components will not only slow down your cash inflow but may also be perceived as sloppy and unprofessional by your client.

In this guide, we’ll demystify the complexities of the client billing process, which should be all about consistency, professionalism, and efficiency. 🧑💼

We’ll show you how to bill a client through three aspects:

- Steps to establish a well-functioning billing system

- Tips for following up on missed payments

- Practical ways to simplify client billing with the right software

By the end, you’ll be able to maneuver your billing logistics to facilitate timely payments and build long-term client relationships.

Understanding Client Billing: The Basics

Client billing is crucial for maintaining a healthy cash flow and ensuring a business venture’s financial stability. It’s not just a singular process for sending out invoices but more of an integrated approach encompassing a variety of practices within a particular timeframe, say monthly, quarterly, or annually.

A client billing solution involves creating detailed invoices with itemized goods and services, provided along with the unit price, quantity sold, and total amount due.

Depending on the jurisdiction of your business, the process may include computing and adding relevant taxes, fees, or discounts. Next, you can build your client billing system around various billing methods. For example, you could:

- Charge by the hour

- Bill at a flat rate for a project

- Adopt a subscription or retainer billing system

- Incorporate revenue- or cost reduction-based pricing

Choose the method that best reflects the value you offer and aligns with client expectations—it’s all about building trust and transparency.

An ideal client billing system also focuses on centralizing records, tracking the progress of payments, and optimizing processes to improve efficiency.

How to Develop an Effective Billing System: Steps and Best Practices

Getting your billing system in top shape is a smart move—but it requires work. You need to create a smooth process that not only makes transactions a breeze but also adds an extra touch of efficiency and professionalism to your financial operations.

If you’re new to developing billing systems, here’s a step-by-step process you can follow:

- Analyze your current client billing logistics in terms of pricing models, compliance requirements, etc. You can consider SWOT or GAP analysis to see how the system could be improved

- Get your accounting or billing team on board to brainstorm and finalize a billing system

- Choose a suitable billing or project management software (like ClickUp) to support your billing processes digitally

- Provide training videos or written manuals to help your team handle the billing system

- Review and optimize the system at regular intervals

As you roll up your sleeves and work on implementing a functional billing system, we recommend adopting these three best practices to boost your invoicing processes further.

1. Keep your proposal or statement of work transparent

Crafting a proposal or statement of work (SOW) is more than just putting pen to paper; it’s about laying the foundation for successful client collaboration. SOWs aim to specify precisely what you will be working on, as well as the deliverables, deadlines, and costs. Being open and honest about your terms and conditions is essential because it will pave the way for a fruitful working relationship.

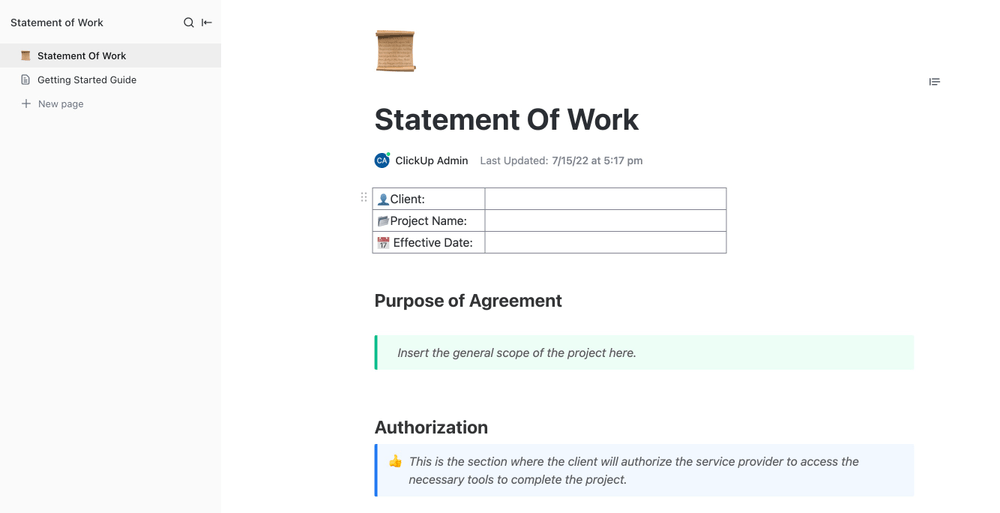

If you or your team need help writing professional proposals, use the ClickUp Request for Proposal (RFP) Statement of Work Template. It helps create transparent, standardized, and comprehensive SOWs, minimizing billing conflicts down the line.

Once your client signs the proposal, it becomes a legally binding agreement that protects both parties. If any billing dispute arises, this document can be referenced as a source of truth to resolve the issue.

2. Implement a consistent invoicing schedule

Establishing and adhering to a consistent invoicing schedule fosters process predictability and streamlines your cash flow. It’s essential to set specific billing dates that align with your client’s payroll cycle.

Whether you opt for a weekly, bi-weekly, or monthly billing frequency, the key is to stick to the schedule religiously. This consistency is a preventative measure to avoid confusion and reduce the risk of late or missed payments.

3. Provide detailed invoices for hassle-free transactions

According to invoicing statistics by Skynova, almost two-thirds of late payments can be traced back to inaccuracies in the invoicing process. This underscores the non-negotiable nature of having a billing system that serves as a precise, error-free communication tool.

Most managers would consider an informative invoice to include the following:

- Company’s name, address, and contact information

- Client’s name, address, and contact information

- A detailed breakdown of services rendered or products supplied

- The total amount due, including easy-to-follow parameters about taxes or additional fees

- Bank details for payment

Four Tactics for Following Up on Missed Payments

No matter how sophisticated your billing system is, there can always be situations when a client misses a payment. While it’s an uncomfortable position to be in, it’s crucial to navigate it professionally.

Here are four tactics to help you address the issue with finesse, ensuring that your client relationships remain intact and overdue payments get resolved amicably.

1. Set up clear expectations with polite communication

Remind the client of the established payment terms, deadlines, and any applicable penalties for late payments.

Craft a reminder message that is both firm and respectful. You can gently highlight the overdue payment, specifying the amount and due date. Express empathy if the situation calls for it and provide any necessary clarification to further demonstrate your commitment to a collaborative and sustainable partnership.

Having a robust written contract serves as your first line of defense here.

Since the agreement outlines project details, pricing, timelines, and the payment process, it becomes the reference point for expectations. So, leverage this as a supporting document for clear communication when following up on missed payments.

2. Set up automated reminders

An automated payment reminder system works as a gentle yet persistent nudge, reminding clients of upcoming or overdue payments without the need for constant manual intervention. By tailoring the reminders to align with client preferences, you enhance the user experience and contribute to a more personalized and considerate communication approach.

However, it’s essential to strike a balance between persistence and patience. While automatic payment reminders are a valuable tool for ensuring timely payments, they shouldn’t overwhelm the client or strain relationships.

3. Offer flexible solutions

If you’ve encountered a situation where a client has missed a payment, it’s important to follow up with them and offer some extra solutions to resolve the issue. You can:

- Consider offering an alternative payment plan to ease their burden. For example:

- Divide the total payable into smaller, manageable installments

- Agree on a realistic timeline for payments

- Allow for different payment methods, such as:

- Check

- Bank transfer

- Credit or debit card

- Digital wallets

The crux of this practice is to make the client feel supported while they fulfill their commitment.

4. Use legal action as the last resort

It’s unreasonable to go easy on a client if your business constantly suffers because of their inability to honor their commitments. Legal action may become necessary as a final recourse if all communication and payment recovery attempts prove unsuccessful.

One option is enlisting the services of a factoring or collection agency. These are professional groups that can efficiently handle the debt recovery process, albeit at a cost—typically a percentage of the amount recovered.

Alternatively, experts recommend consulting with an attorney to explore legal options. Small claims court is generally suitable for minor amounts, while larger receivables may require proceedings in a civil court.

Know that legal action, in most cases, leads to you losing business with the client. It should be a last-resort solution after all other negotiation avenues and CRM strategies have failed.

Use Project Management Software for Efficient Client Billing

To an extent, the financial stability of small business owners and professionals rides on how well they handle client billing processes.

You can no longer rely on manual records or extensive spreadsheets to help you out—they’re time-consuming and can be unreliable. The solution? Use a project management software tool to bring structure to your billing system!

Project management tools are all-in-one solutions that can simplify many aspects of billing by unifying diverse financial processes within a centralized platform. For instance, tools such as ClickUp not only offer a comprehensive CRM solution but also provide time tracking capabilities, client overviews, and automated reminders. On top of that, they come with numerous templates that will make your billing process more manageable.

Let’s find out how you can leverage some of ClickUp’s handy features to enhance your billing efficiency and accuracy!

1. Visualize billing workflows with the ClickUp CRM solution

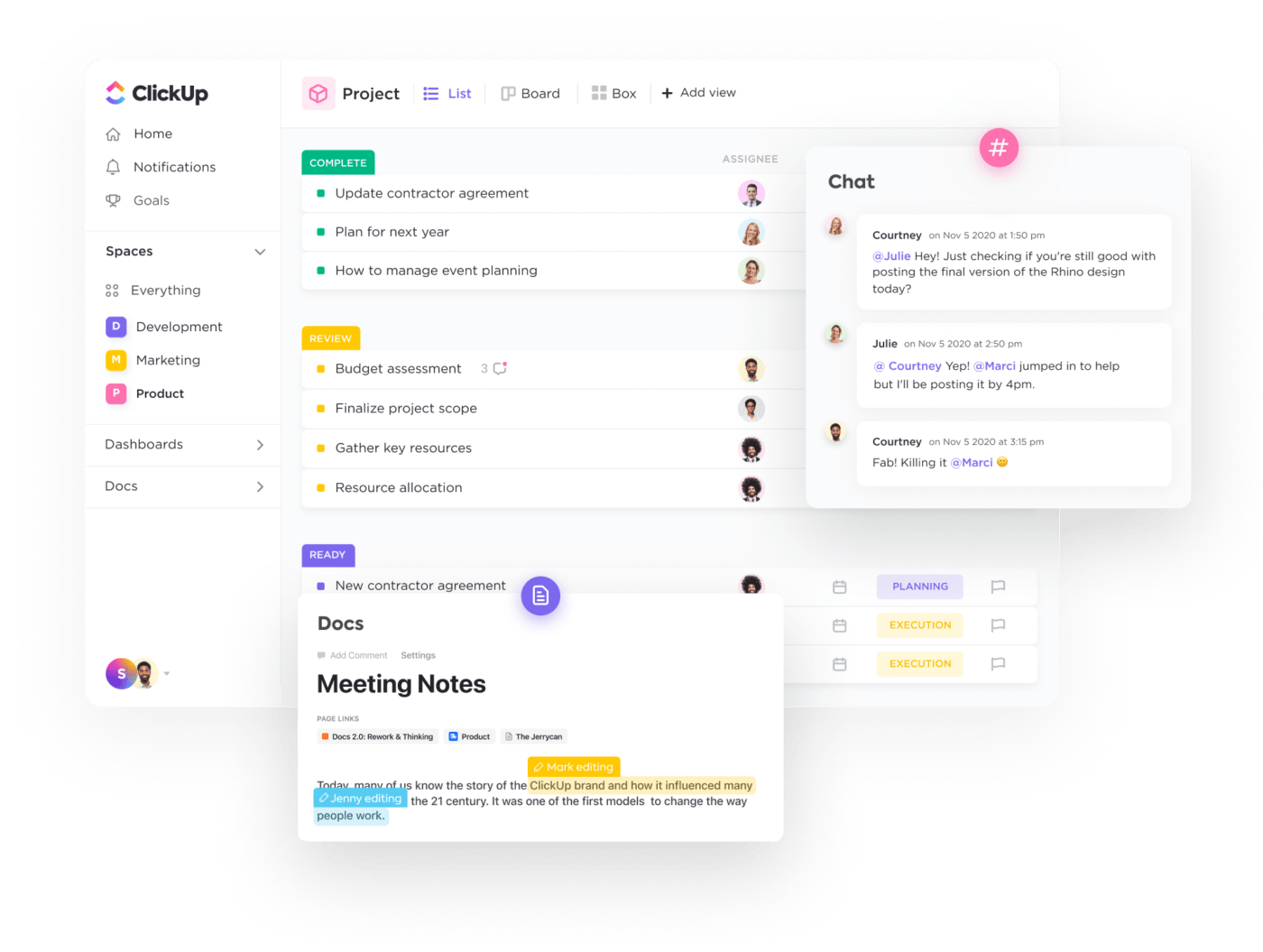

Billing processes tend to get complicated as your business grows because there’s the need to tackle more complex projects. But with the highly scalable ClickUp CRM suite, handling both clients and billing practices is easy and effective!

With ClickUp, you can centralize all account management info and tasks and create a customized Workspace with flexible data viewing options. This helps you or your team access accurate data about the work done and the billing model to fast-track the invoicing process.

Whether you want to track payment due dates, orders, or inventory levels, the platform makes working with clients easy as pie! Here’s a glimpse into some other handy CRM functionalities within ClickUp:

- Hierarchy of Folders and Lists to organize client info as you like

- ClickUp Docs to write and store documents like SOPs and proposals

- Easy-to-use native and third-party integrations with invoicing software and other tools

- Numeric fields to calculate items like deal size and revenue faster

- Filters and tags to find specific billing information

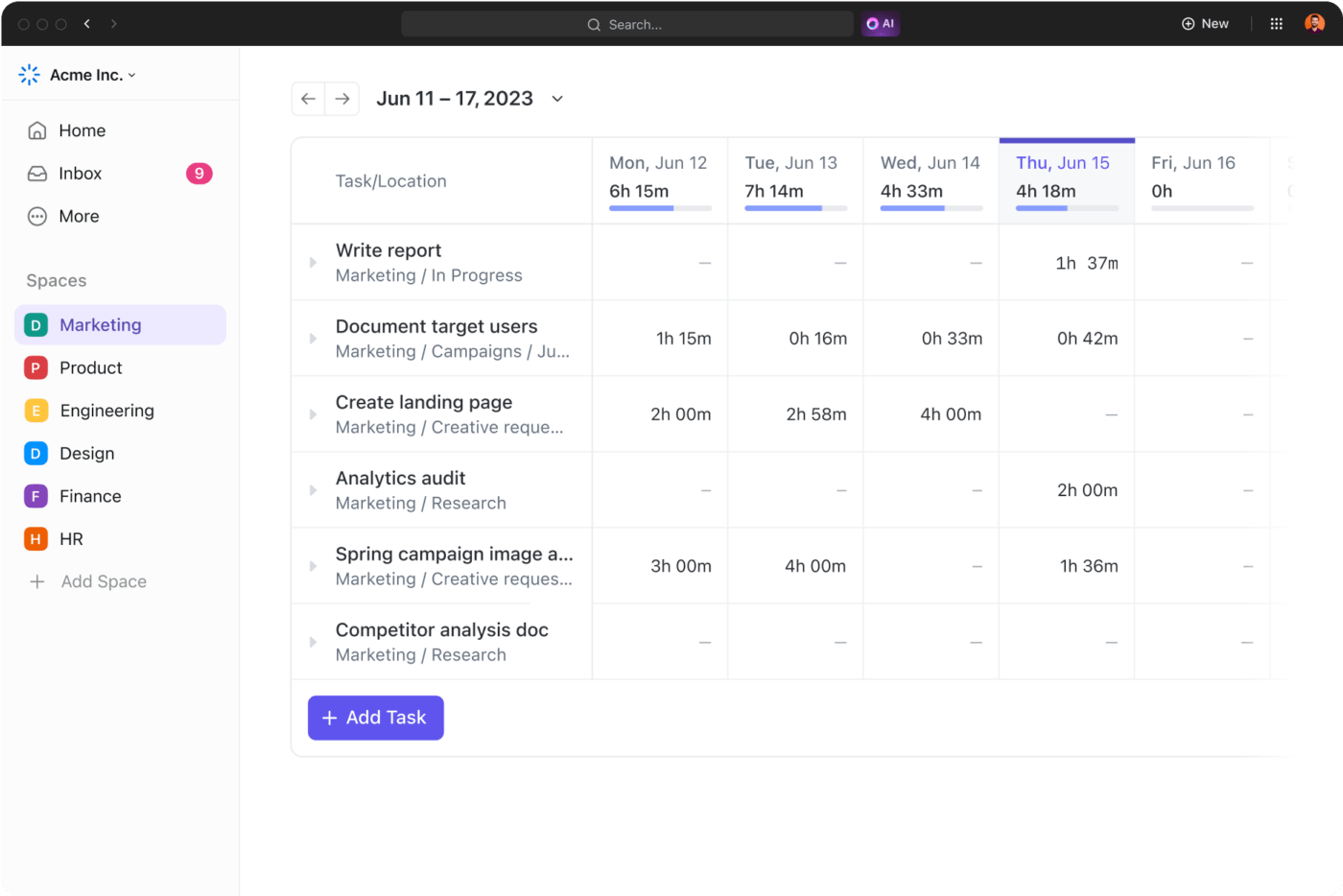

2. Use time tracking to record and track billable hours

Professions like medical and legal consultancy typically require a time-based billing model. For the invoices to be accurate, you need a reliable time tracker to record everyday tasks, projects, and meetings.

Old-school timekeeping methods, such as maintaining timesheets or spreadsheets, often lead to billing errors and inconsistencies due to their extensive nature. Tracking billable hours through a dedicated app is a more sensible solution. A 2023 time tracking study suggests that companies using software with timekeeping features were 44% less likely to commit payroll slip-ups.

If you’re billing at an hourly rate, the ClickUp Time Tracking tool can help you collect payments with greater accuracy. It offers a no-fuss interface to precisely track the hours both you and your team invest toward a client. Run multiple timers simultaneously to ensure transparent billing across ongoing projects.

With built-in reports and annotation options, your clients can see exactly where their money is going, building trust and emphasizing the value of your services. By optimizing your time usage, you’ll see a tangible boost in profitability—which is a win-win on any good day! ✌️

Do you run an on-the-go, service-based business? Record and show billable hours from anywhere using ClickUp’s free mobile app or Chrome extension!

Bonus: Explore the top time tracking software tools for Mac users!

3. Enjoy comprehensive customer overviews with ClickUp views

ClickUp views are like your collection of glasses for different occasions. Just like you choose specific glasses for reading, driving, or enjoying the scenery, ClickUp’s views give you different perspectives for various tasks, each designed to enhance how you see and handle your client accounts and billing workflows.

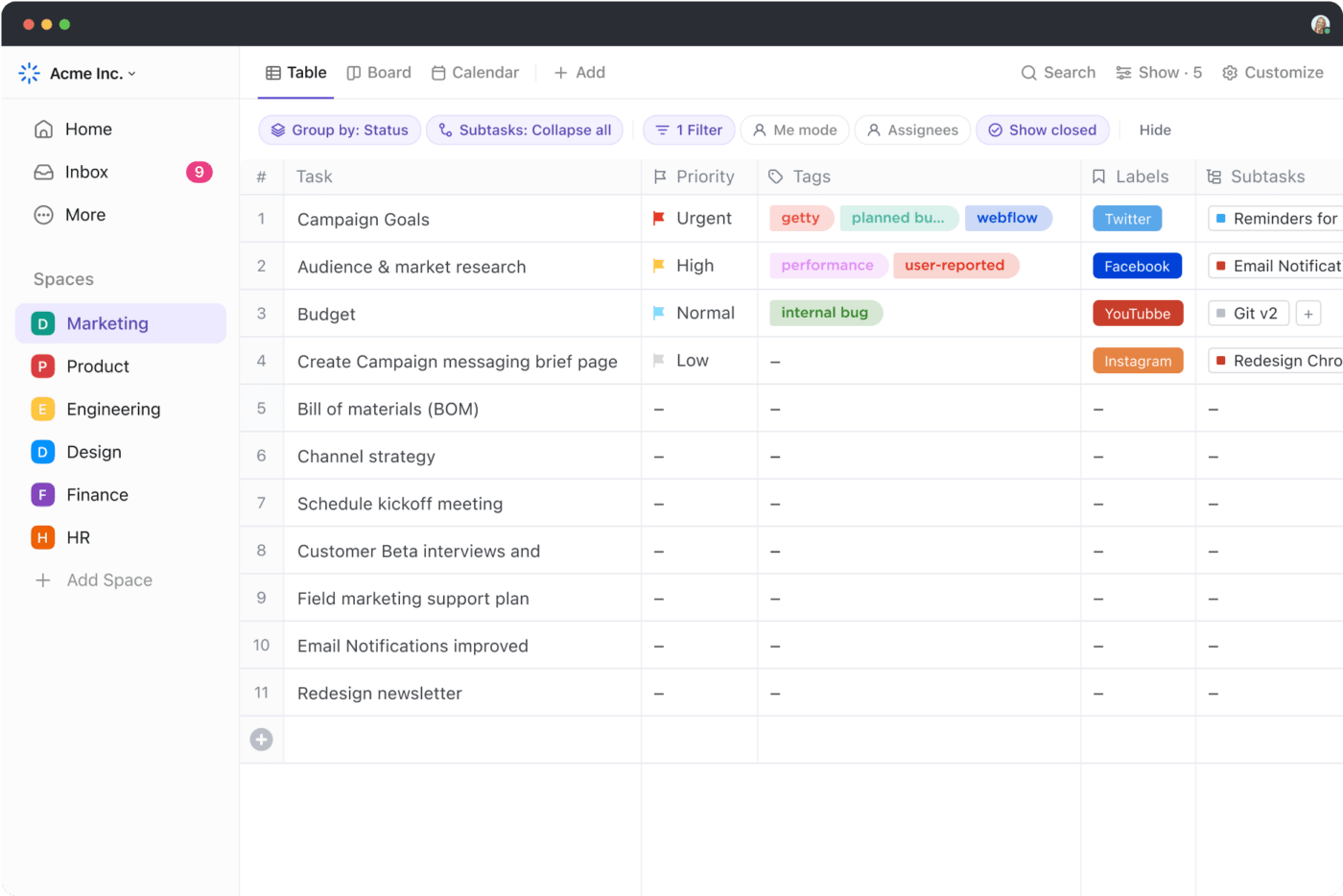

For instance, let’s zoom in on two particularly valuable views for billing: Task view and Table view. They give you an overview of your customers and accounts, consolidating all billing information into one platform.

Task views

Task views offer various ways to look at your billing tasks, and you get to decide how to group, sort, and filter them.

You can further customize these views into layouts like Lists, Calendars, and Gantt Charts at your convenience. And the cool part? This customization works across the board, giving you a big-picture overview—the Everything view—of all your billing workflows.

Quick tip: Give each Task view a name that makes sense to you. For example, name one Due if it shows tasks sorted by their due dates. Or call another one Client XYZ if it filters out account-specific billing information. Besides labeling, you can also pin priority views for greater accessibility.

Table view

If you fancy lightning-fast spreadsheets and dynamic visual databases, the Table view is your command center for organizing and overseeing billing tasks. Imagine managing budgets, recording and handling client information, and streamlining billing tasks—all within a responsive and intuitive table format.

ClickUp’s Custom Fields make it easy to record specific billing details, such as Due Date, Payment Method, and Currency, ensuring invoicing processes are efficient and organized.

4. Use Automation in ClickUp to enhance efficiency in billing processes

Billing clients can be a tedious admin job involving multiple steps, which makes the whole process error-prone. Luckily, you can minimize the manual workload by automating specific repetitive tasks or recurring payments. According to a B2B survey, 71% of experts foresee automation as the pivotal invoicing trend of 2023!

The ClickUp Automations feature revolutionizes the billing landscape by allowing you to streamline tasks and run routine processes like clockwork. Use over 100 pre-built options or create your own automations for actions like status updates, due date reminders, and billing follow-ups.

Setting up ClickUp Automations requires no coding knowledge.

5. Leverage ClickUp templates to make billing processes consistent

Invoicing and CRM templates are the unsung heroes for many startups and small business owners. They promise consistency and accuracy of invoices while adding structure to your billing journey.

ClickUp has a collection of billing templates for numerous use cases. Here are our favorite picks:

- ClickUp Invoices Template: Swiftly generate professional invoices with auto-fill fields and facilitate one-click delivery, all while seamlessly tracking payments within the same platform

- ClickUp Billing Process SOP Template: Ensure precision and efficiency by standardizing billing procedures, save time by automating repetitive tasks, and maintain an organized workflow to eliminate errors and monitor payment deadlines

- ClickUp Freelance Invoice Template: Working as a freelancer? Use this invoice template to create professional invoices, centralize tracking of payments and deadlines, and store client information securely

- ClickUp Legal Case Tracking and Billing Template: Use this template to monitor active legal cases, billable hours, and progress and efficiently organize client information in a user-friendly, no-code database

- ClickUp Billing System Project Proposal Template: Create professional and customizable proposals and consolidate billing processes with built-in project tracking and calculation tools

Bill Clients with Confidence: Explore ClickUp

Our recommended best practices and feature suggestions will help you set up an effective billing system in no time! You’ll be chasing fewer missed payments and have more time to build client relationships and plan your finances.

Sign up for free to see how ClickUp can enhance your billing workflows! It’s a top-rated tool with an excellent Help Center for new users. 🌻