You’ve had a fantastic year professionally. You know that you and your small business have grown from strength to strength—but how do you accurately capture the impact of this growth on your bottom line?

The answer is two simple words: balance sheet. This financial statement captures a snapshot of your financial health, which can, in turn, help you make better business decisions.

Even if you go the easy route and simply hire an accountant, understanding how to make and read a balance sheet is crucial for any business owner.

This guide is here to help. Read on to learn how to make a balance sheet through a step-by-step process that will make organizing your finances a breeze.

⏰ 60-Second Summary

If you’re in a hurry, master the art of creating a basic balance sheet with this quick guide:

- Set your reporting date and period for accurate financial snapshots

- List all assets (current, fixed, intangible, etc.) and their values

- Account for liabilities, both short-term and long-term

- Calculate shareholders’ equity to determine your company’s net worth

- Ensure your balance sheet ‘balances’ using the formula: Assets = Liabilities + Equity

- Leverage tools like ClickUp to optimize the process with automation, templates, and visual dashboards

What Is a Balance Sheet?

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial health at a specific time. It details what a company owns (assets), what it owes (liabilities), and the shareholders’ investment (equity).

Balance sheets are critical because they:

- Provide a clear view of financial health

- Help assess a company’s liquidity and solvency

- Assist in making strategic financial decisions

- Offer insights for potential investors and creditors

At its core, a balance sheet is a detailed inventory of everything a company possesses and owes. This includes various financial resources and obligations that paint a complete picture of the organization’s financial standing.

Before you learn to create a balance sheet, let’s break down the key components that a business balance sheet includes:

What a company owns: Assets

Assets are the valuable resources a company controls, representing potential economic value.

These can be divided into two primary categories:

- Current assets (short-term): Cash and cash equivalents, accounts receivable, inventory, marketable securities, and prepaid expenses

- Non-current assets (long-term): Property and equipment, long-term investments, intangible assets (patents, trademarks), and accumulated depreciation

What a company owes: Liabilities

Liabilities represent the financial obligations a company must settle, creating a clear picture of its financial responsibilities.

Similar to assets, these also fall under two overheads:

- Current liabilities (short-term): Accounts payable, short-term loans, accrued expenses, taxes due, and wages payable

- Non-current liabilities (long-term): Long-term debt, bonds payable, lease obligations, and pension liabilities

Owners’ investment: Shareholders’ equity

Shareholders’ equity represents the owners’ residual claim on assets, completing the financial narrative. This broadly includes contributed capital, retained earnings, additional paid-in capital, and treasury stock.

Balancing a balance sheet

While creating a balance sheet might seem complex, one fundamental rule ties everything together: a balance sheet must always be balanced. This principle can be summed up through a simple equation:

Assets = liabilities + shareholders’ equity

This mathematical precision isn’t just a suggestion—it’s the core principle that ensures the integrity of financial reporting.

Imagine this equation as a financial see-saw. If even a single penny is out of place, it signals an error that requires immediate investigation. This precision makes each number a critical piece of the financial puzzle, offering insights beyond simple number-crunching.

👀 Did You Know? The balance sheet concept originates in double-entry bookkeeping, first popularized by Luca Pacioli, a 15th-century mathematician often called the “Father of Accounting.”

Benefits of Maintaining a Balance Sheet

Creating and regularly updating a balance sheet is more than an accounting exercise. It’s a strategic tool that can transform how you understand and manage your business finances.

Maintaining a comprehensive balance sheet gives you a powerful lens into your business’s financial health and potential.

✅ Track financial progress

A balance sheet provides a clear, real-time snapshot of your financial trajectory. It helps you understand how your assets are growing, how debt changes, and whether your equity is expanding.

Think of it as a financial GPS showing where you are and how you’re moving. 📍

💡 Pro Tip: Always compare the current balance sheet with past ones to spot trends and changes in financial health. This practice highlights growth, debt patterns, and potential red flags.

✅ Identify potential financial risks

Regularly reviewing your balance sheet can spot potential financial vulnerabilities before they become critical problems. Unusual asset changes, increasing liabilities, or declining equity can be early warning signs requiring immediate attention.

✅ Attract investors and secure funding

Investors and lenders view a well-maintained balance sheet as a sign of financial discipline and transparency.

A clean, accurate balance sheet can demonstrate your business’s financial stability, show growth potential, and increase your chances of securing loans or investments.

✅ Make informed business decisions

Balance sheets transform abstract financial data into actionable insights.

Balance sheets provide crucial financial metrics for comprehensive decision-making when integrated into a balanced scorecard approach—which measures performance across economic, customer, internal process, and learning perspectives.

✅ Ensure regulatory compliance

Many businesses are required to maintain accurate financial reports. A well-prepared balance sheet helps you meet accounting standards, prepare for potential audits, demonstrate financial responsibility, and avoid possible legal and monetary penalties.

✅ Streamline expense management

A well-maintained balance sheet provides crucial insights for expense management by revealing patterns in your liabilities and operating costs.

When you regularly track these figures, you can identify areas for cost optimization and make informed decisions about resource allocation.

How to Prepare a Balance Sheet

Creating a balance sheet doesn’t have to be intimidating. You can efficiently create accurate financial snapshots with the right approach and tools.

ClickUp is the everything app for work that combines project management, knowledge management, and chat—all powered by AI that helps you work faster and smarter.

It offers specialized features for financial management that can streamline your balance sheet creation process.

Let’s walk through each step, combining traditional accounting principles with modern solutions.

Step 1: Determine the reporting date and period

The first crucial step is establishing your balance sheet’s date and accounting period. This date represents the specific point in time for which you’re creating your financial snapshot.

Most businesses prepare balance sheets at the end of each month, quarter, or fiscal year.

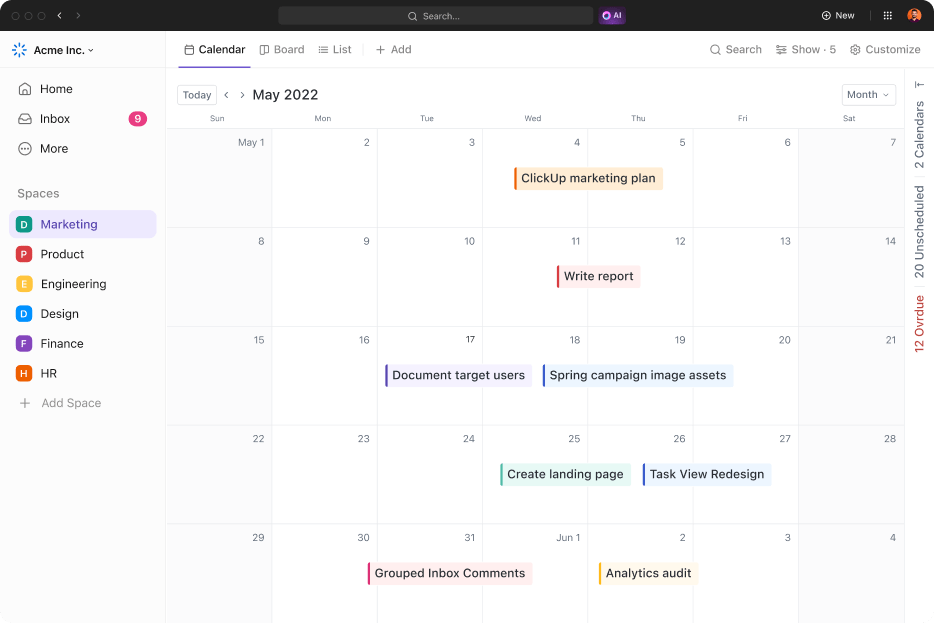

Time Management in ClickUp is super easy thanks to a bunch of features, including calendars, recurring tasks, and reminders that simplify this process by helping you organize and track reporting timelines effectively.

The ClickUp Calendar View makes it easy to set deadlines and reminders for completing your balance sheet, ensuring you stay organized throughout the process.

Setting up recurring tasks for monthly and quarterly reports gives you a clear timeline for your balance sheet preparation.

Also, the ability to link financial documents directly to calendar events keeps everything organized, ensuring your team moves through each step systematically for timely and accurate reporting.

Step 2: Identify your assets

This step involves taking a comprehensive inventory of everything your business owns. Understanding and properly categorizing your company’s assets is crucial for an accurate financial picture.

Whether you’re handling traditional bookkeeping or project accounting, maintaining clear asset categories ensures accurate financial reporting across all your business activities.

Start by listing your total assets in these categories:

- Current assets (cash, accounts receivable, inventory)

- Fixed assets (buildings, equipment, vehicles)

- Intangible assets (patents, trademarks, goodwill)

- Long-term investments (stocks, bonds, real estate)

With the ClickUp Tasks feature, create a dedicated list of assets, with each asset type (e.g., cash, accounts receivable, inventory, property) represented as a task.

Instead of juggling multiple spreadsheets, use ClickUp’s List View to bring all your asset tracking into one system. Create Custom Fields that make it simple to track asset values, purchase dates, and depreciation schedules in a single view.

Automated notifications can inform you of essential depreciation milestones, while intuitive status indicators help prioritize which asset categories need immediate attention.

🧠 Fun Fact: Saudi Aramco’s oil reserves are the highest-valued single asset ever recorded on a balance sheet, valued in trillions of dollars.

Step 3: Identify your liabilities

After cataloging your total assets, it’s time to account for what your business owes. This step requires careful attention to both short-term and long-term obligations.

Create a comprehensive list of your total liabilities:

- Current liabilities (accounts payable, short-term loans)

- Long-term liabilities (mortgages, bonds payable)

- Accrued expenses (wages payable, taxes due)

- Deferred revenue (prepayments from customers)

Managing liabilities becomes more systematic with ClickUp’s custom financial templates. These templates standardize your tracking process and help prevent common errors through built-in verification steps.

With Custom Views showing upcoming payment deadlines and automated interest calculations, managing financial obligations becomes second nature.

Step 4: Calculate shareholders’ equity

Shareholders’ equity represents the net worth of your company—what would remain if you sold all assets and paid off all liabilities. This calculation involves several components that need careful consideration.

Key elements to include when calculating owner’s equity include:

- Initial capital investments

- Retained earnings from previous periods

- Additional paid-in capital

- Treasury stock adjustments

ClickUp’s Formula Fields can automate equity calculations by subtracting total liabilities from total assets. This feature minimizes errors and saves time during preparation.

This automation works seamlessly with Custom Dashboards to provide visual insights into equity trends over time. When significant changes occur in key ratios, the system alerts you immediately, helping maintain accurate financial reporting without constant manual oversight.

Step 5: Add total liabilities to total shareholders’ equity and compare to assets

The final step involves verifying that your numbers align with the accounting equation discussed earlier. This balance sheet formula is crucial for accuracy and compliance.

Double-check all calculations, reconcile totals across categories, review historical data for inconsistencies, and conduct a final accuracy check before closing the balance sheet. Remember—if it’s not balanced, it’s no good!

The good news is that you can simplify the verification process by using ClickUp Automations. Once set up, these automated mini-programs can help you check calculations, flag discrepancies, and maintain a clear audit trail.

You can even set up automatic notifications for imbalances, ensuring you quickly catch and correct errors.

Beyond basic verification, you can track critical financial KPIs by comparing your company’s balance sheet data against industry benchmarks. Once you learn and practice these steps, you will be ready to prepare a balance sheet for your business.

However, keep in mind that in addition to mastering these steps, long-term success in balance sheet management requires developing good habits and implementing reliable systems.

Once you’ve created a balance sheet, ensuring its accuracy is just as important. But don’t worry. With some tips for consistent practices and habits, creating reliable financial reports will soon become second nature for you.

Tips for an accurate balance sheet

Your balance sheet should be a key element of a sustainable system for financial tracking.

To ensure your business balance sheet remains a reliable tool for decision-making:

- Update your financial data at consistent intervals

- Keep detailed supporting documentation for all entries

- Regularly compare current figures with historical data

- Maintain a clear audit trail for all transactions

- Set up automated alerts for unusual variations

- Cross-reference your balance sheet with profit and loss statements monthly to ensure data consistency

- Use a suite of tools designed for financial professionals

By moving from scattered systems to a unified platform or accounting software, teams can better maintain financial documentation, ensure accuracy, and collaborate effectively on financial reporting.

While many businesses use Google Sheets or its alternatives for basic financial tracking, you can manage finances like a pro with ClickUp’s Finance tools designed specifically for financial professionals.

ClickUp can enhance your financial management capabilities through specialized features that let you:

- Create and customize financial workflows to match your processes

- Generate automated reports and calculations instantly

- Build professional financial statements with ease

- Monitor key financial metrics in real-time dashboards

- Share and collaborate on financial documents securely

- Connect seamlessly with your existing financial tools

- Document and organize financial data for audit readiness

Now that we’ve covered the essentials of making a balance sheet, let’s look at an example of a completed balance sheet and understand how to leverage it to maximize benefits.

Example of a Finished Balance Sheet

Below is an example of a basic balance sheet for a fictional company, XYZ Technology Solutions. It shows how the numbers are supposed to look and how to understand them effectively using ClickUp’s features.

| XYZ Technology SolutionsFinancial Report for Fiscal Year 2024 | |

| Assets | Amount (USD) |

| Financial Assets | |

| Cash | $45,000 |

| Receivables | $28,000 |

| Total Financial Assets | $73,000 |

| Non-Financial Assets | |

| Land | $150,000 |

| Infrastructure and Equipment | $85,000 |

| Inventories | $32,000 |

| Intangibles (Software Licenses) | $15,000 |

| Others (Office Furniture) | $8,000 |

| Total Non-Financial Assets | $290,000 |

| Total Assets | $363,000 |

| Liabilities and Net Worth | Amount (USD) |

| Liabilities | |

| Loans | $120,000 |

| Leases | $24,000 |

| Others (Credit Card Debt) | $6,000 |

| Total Liabilities | $150,000 |

| Net Worth | |

| Total Assets | $363,000 |

| Total Liabilities | $150,000 |

| Net Worth | $213,000 |

This example provides a clear snapshot of the company’s financial health at the end of the fiscal year, highlighting its assets against its liabilities and equity.

Bringing your balance sheet to life with ClickUp

You can transform this static financial data into interactive, visual insights using ClickUp’s document and reporting features.

🚀 Using the ClickUp Balance Sheet Sample Template

Save time and ensure accuracy with the pre-structured ClickUp Balance Sheet Sample Template that guides you through each section.

The template automatically organizes your financial information into clear, professional sections, making it easy to input and update your data.

The template provides a structured visualization of asset categories and subcategories, liability sections, and equity components, along with space for notes and additional information.

It’s the perfect way to compile and present your financial information in a balance sheet.

This template is designed to help you:

- Automate calculations to eliminate manual errors

- Set up validation rules for maintaining data integrity

- Customize categories to match your business needs

- Collaborate with team members in real-time

- Track and compare historical financial data

🚀 Document organization and presentation

You can also create your balance sheet in ClickUp Docs, using customizable tables to organize your financial data professionally.

Using tables within your ClickUp Doc helps present numerical data in a clean, professional format. Add color-coding to highlight important metrics and trends, making it easier to spot significant changes at a glance.

This structure makes it simple to update and review your financial information regularly.

🚀 Visual reports and dashboards

Create custom ClickUp Dashboards to transform your balance sheet figures into meaningful visual insights. You can generate visual breakdowns of your asset distribution to spot trends at a glance and share them with your team members.

Set up tracking for liability trends over time and monitor key financial ratios that matter to your business. ClickUp even lets you create automated alerts for significant changes, helping you stay proactive about your financial position.

The combination of structured documentation and visual reporting helps transform your balance sheet from a static document into a dynamic financial management tool. This makes understanding your financial position and making informed business decisions easier.

Common Mistakes and How to Avoid Them

Creating a balance sheet requires attention to detail; even seasoned professionals can make mistakes. Understanding these common pitfalls can help you maintain accurate financial records and make better business decisions.

Misclassification of assets and liabilities

One of the most frequent errors in balance sheet preparation is incorrectly categorizing financial items. This confusion often stems from misunderstanding the timing and nature of financial transactions and not correctly referencing your company’s general ledger.

⚖️To maintain accuracy in your asset classification, follow these essential steps for reviewing and categorizing your financial items:

- Double-check the time horizon for each asset to ensure proper categorization

- Always ensure assets that will be converted to cash within 12 months are marked as current assets

- Carefully verify long-term investments and fixed assets are appropriately classified as non-current items

- Conduct regular reviews of prepaid expenses to confirm their classification based on usage timeline

⚖️ You also need to ensure you’re classifying your liabilities accurately. To ensure that:

- Ensure all lease obligations are correctly split between current and non-current portions

- Carefully evaluate payment schedules for all outstanding debts and obligations

- Correctly classify obligations that are due within one year as current liabilities

- Thoroughly review loan terms to categorize long-term portions of debt properly

Incorrectly calculating shareholders’ equity

The shareholders’ equity section often becomes confusing, mainly when dealing with multiple transactions over time. Many businesses struggle with tracking changes in ownership structure and adequately accounting for retained earnings.

⚖️ To avoid common equity calculation errors, watch out for these frequent mistakes:

- Failing to incorporate retained earnings from previous periods into current calculations

- Making errors in treasury stock impact assessment and valuation

- Missing recent stock issuances or buybacks in equity calculations

- Overlooking the impact of dividend distributions on total equity

✅ Implement these proven prevention strategies to maintain accurate equity calculations:

- Establish a clear audit trail system for tracking dividend payments and stock transactions

- Create and maintain detailed records of all equity-related transactions

- Set up a system to regularly reconcile retained earnings with income statements

- Implement thorough documentation processes for all changes in contributed capital

While these mistakes might seem daunting, modern tools have made it easier than ever to maintain accuracy in financial reporting.

ClickUp Task Checklists can simplify balance sheet preparation by setting up validation rules, custom formulas, and automated alerts to catch potential errors before they impact your most important financial statements.

These digital guardrails, combined with real-time collaboration features, help ensure your balance sheet remains a reliable tool for financial decision-making.

Build Better Balance Sheets with ClickUp

Learning to make a balance sheet is a great way to build your financial acumen.

Using ClickUp’s features effectively, you can create comprehensive balance sheets that accurately reflect your company’s financial status. From setting up custom templates to automating calculations, ClickUp streamlines the entire process while ensuring accuracy and collaboration.

The platform’s visual reporting tools help transform complex financial data into clear insights, making it easier for stakeholders to understand your company’s financial position.

Take control of your financial reporting. Sign up for ClickUp today!