What is Rule of 40 for SaaS and How to Calculate

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Startups, by nature, tend to be turbulent. In a startup, you can expect big ambitions, audacious bets, and risky decisions made in pursuit of something that’s never been done before. With such speed and scale, it’s easy to lose sight of what success means.

So, startups use financial KPIs as a way to stay grounded to performance in the real world. The rule of 40 is an important one in this regard.

In this blog post, let’s learn what it is, how to calculate it, and how you can integrate it into your financial dashboards.

The rule of 40 is a general formula for measuring the financial success of SaaS-based software companies. It sets the baseline for SaaS success. It has two components:

The rule of 40 states that a SaaS company’s YoY growth rate + EBITDA margin ≥ 40%.

Let’s say you are growing at 10% year-on-year. And your profit margin is 30%. Your rule of 40 is met because 10+30 = 40! On the other hand, if you’re growing at 80% every year, you’re allowed a loss of 40% and still meet the rule of 40.

The rule of 40 is applicable to SaaS companies at scale, making $50 million in revenue.

The rule of 40 is especially useful in the SaaS industry for its subscription-based business model and startup-like attitudes. This means a few things:

✅ Recurring revenue model: A SaaS business relies on recurring revenue (calculated monthly or yearly). Acquisition and retention play complementary roles. Any success metric needs to incorporate this.

✅ Growth-focus: Startups often focus exclusively on growth, spending indiscriminately on acquisition. A good success metric has to balance sustainable growth with profitability.

✅ Investment-readiness: Until a startup reaches a steady state, it depends almost entirely on venture capital. Demonstrating that you meet the rule of 40 assures investors of the financial prudence of the startup.

Now let’s see how to put the rule of 40 into practice.

Calculating the rule of 40 is simple. You just need two values from your company’s financials. However, simple doesn’t always mean easy. Here’s a framework you can use to calculate the rule of 40.

The first step is to measure your revenue growth rate as compared to the previous year. You can choose the annual recurring revenue (ARR), monthly recurring revenue (MRR), or the total revenue for the previous year and the current year.

Making this choice is based on your individual situation:

With that in hand, calculate your year-on-year growth using the following formula.

YoY Growth % = ((Current year revenue – Last year revenue)/Last year revenue)*100

For example, if your last year’s revenue is $50 million and the current year’s revenue is $55 million, the growth % would be:

YoY growth = ((55-50)/50)*100 = 10%

Calculating the profitability margin is slightly more complex, involving multiple choices. You have the choice of net income, profit after tax, net cash flow, and GAAP margin. However, the advised metric is gross profit or EBITDA.

EBITDA = ((Revenue – operating expenses)/Revenue)*100

For example, if your total operating expenses for the current year come to $35 million, the EBITDA and the revenue is $55 million, the gross profit would be:

Gross profit = ((55 – 35)/55)*100 = 36%

The heavy lifting is done. Now, add the above values and compare them against the benchmark, 40.

10% (YoY growth) + 36% (gross profit) = 46% which is > 40%

This shows that your SaaS business is performing well. 🙂 Congratulations! Here are some alternative scenarios.

If the YoY revenue growth rate is more than 40%, you can afford to lose your profit margin. For instance, you can reduce your profit margin with discounts or offers, still staying strong on the rule of 40.

For example, if the YoY revenue growth is 45% and the profit margin is -4%, your rule of 40 score is 41%, still healthy.

Successful startups at scale tend to have higher profit margins. If your YoY growth is a mere 5%, but your profit margin is 50%, your score is 55. So, you still had a good year.

The point is simple now. If you have a 10% growth rate with a 10% profit margin, you’re not in a successful and investable place.

Now that you’ve calculated your rule of 40 once, time to automate it.

Any average startup has its data scattered across multiple SaaS tools and platforms. For instance, your sales data might be in your CRM, granular metrics in SaaS analytics tools, and financial info in spreadsheets. Consolidate your information and set up a comprehensive real-time tracking mechanism using an all-in-one project management tool like ClickUp for finance teams.

Bring data from various platforms into ClickUp. Integrate your CRM, payment platforms, or even spreadsheets to capture updated information.

Include the rule of 40 as a SaaS KPI in your dashboard. Use the various widgets on ClickUp Dashboards to monitor the rule of 40 in whatever format you prefer.

Use ClickUp’s KPI Template to effortlessly integrate it as part of your regular performance measurement. Keep sales and profits within the context of the work you do. Set up custom statuses to visually call out if you’re going over 40.

Set up ClickUp Automations for repetitive workflows. For instance, you might set up a custom status named ‘not met’ when the rule of 40 score falls below 40. This can automatically trigger messages to specific individuals or tag a sales leader for escalation.

In the long run, this will significantly reduce the operational costs of managing startup finances and help you reach your profitability goal.

For inspiration, here’s how our quality excellence team uses ClickUp.

There are dozens of SaaS KPIs already. So, why do we need another?

The rule of 40 is unlike traditional metrics, such as profit margin, return on investment (ROI), free cash flow, etc. It is designed to serve the unique needs of SaaS businesses. Here’s how.

Decision-making: Rule of 40 sets the baseline for what success is. It grounds the business in the world. It alerts startup leaders to an unstable financial state if the rule of 40 score falls below threshold.

Balance: The two components of the rule of 40—growth and profitability—are often seen as the opposite of each other. That you have to sacrifice one to gain the other. For such cases, the rule of 40 helps find the right balance between the two.

Benchmarking: The rule of 40 is a simple, memorable benchmark for companies in the SaaS industry. It helps demonstrate reliability and attractiveness in SaaS conferences and investor meetings.

Investment attractiveness: Speaking of investors, rule of 40 was designed by Brad Feld, a venture capitalist. It is a key metric for a venture capitalist to measure the viability of a startup for investment. Startups that overshoot the rule of 40 attract investors more easily, securing higher valuation as well.

The punch line is that you can lose money if you are growing faster, the minimum point of happiness is 40% annual growth rate.

You’ve calculated the rule of 40 and understand why it’s important. Now, let’s see what you can do with that information.

The rule of 40 can be an important strategic lever for the business. It is a goal that can be met from various angles. Here are a few.

To achieve your rule of 40 scores, you can increase revenue growth or profitability. Before you create a strategy, define your goal.

In fact, if revenue increase is your goal, you’ll invest in customer acquisition, retention, engagement, etc. If increasing profitability is the goal, you’ll focus on cost savings, automation, SaaS operations management, etc. Choose your path first.

Think of your marketing expenses as a fraction of your total yearly revenue. Focus on ROI, i.e., the dollar revenue growth for every dollar spent on marketing. At an early stage, you might have low revenue and profits. Work toward increasing growth first and then balance it with profitability.

Identify the best avenues of sales and double down on them. Choose channels that produce maximum revenue at minimum expenses. Eliminate any kind of wastage in your customer acquisition processes. Streamline growth with focused SaaS marketing strategies.

Consistently reduce operational costs. As your company grows, the expenses are bound to increase. Monitor closely, eliminate unnecessary expenses, and optimize the necessary ones to maintain a healthy EBITDA.

Times will change, so be adaptable. Adjust your goals to consistently have a good rule of 40 score.

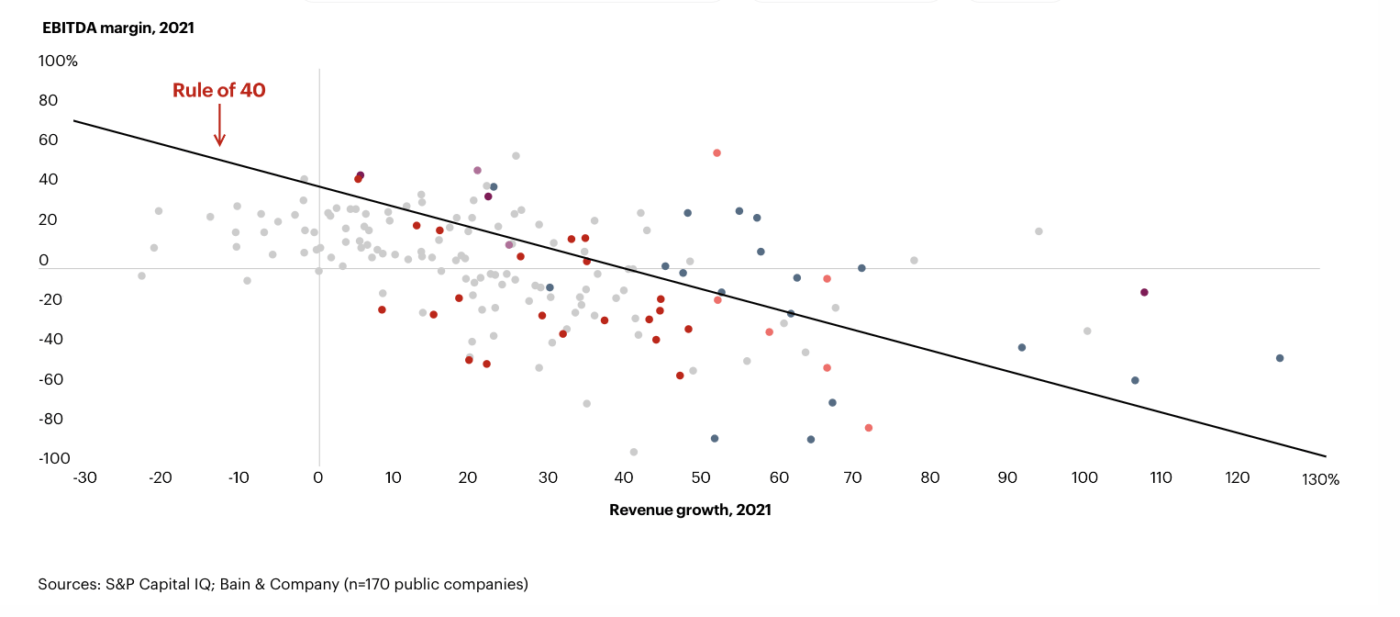

Bain & Company finds that “most companies don’t beat the rule of 40.”

Only the best performers, such as Datadog, Zoom, ServiceNow, and category champions, like Microsoft and Adobe, do. That becomes yet another point to show the value of a metric like that. Here are a couple of SaaS examples with impeccable rule of 40 scores.

Salesforce’s FY24 annual report posted $34.9 billion in revenue with an 11% YoY revenue growth and a 30.5% non-GAAP operating margin. That makes the rule of 40 score 41.5%, which shows that the company is performing well.

This shows a couple of things:

At the other end of the spectrum, Databricks, the AI and data analytics company has a rapid growth rate of 70% year-on-year ARR in FY24. This means that even with a profit margin of 30% in the negative, they can maintain their rule of 40 score.

As great as it looks, the rule of 40 also comes with a bunch of limitations you need to pay attention to. Here are some patterns to avoid.

Ill-defined metrics: The rule of 40 is often static, meaning 40 is the goal to reach. In pursuit of that, startups may be tempted to adjust the definition of revenue growth or profit margin. This should absolutely be avoided.

Dramatic changes: To achieve the rule of 40 score, startups often spend too much in an acquisition or freeze all expenses, adversely affecting the startup’s journey. Avoid this by tracking the rule of 40 at regular intervals and adjusting organically.

Narrow point of view: Startups often assume the rule of 40 is a sales and marketing problem. In fact, great companies make the product a critical sales and marketing engine, reaping exponential results.

Overlooking other metrics: The rule of 40 only takes two important financial metrics into account. This doesn’t give you the complete picture.

Restricted to SaaS: A major drawback of the rule of 40 is its lack of adaptability to industries. If you’re not in the SaaS business, it’s best to leave the rule of 40 aside.

Whether you’re in stealth mode, starting up, scaling up, or preparing for an IPO, you need to know how you’re performing. Traditionally, the question one would ask is: Are you profitable?

In the startup world, that question doesn’t paint the full picture. It doesn’t account for scenarios where you haven’t reached the point of scale to be profitable, or you’re no longer chasing growth at all costs.

This is where the rule of 40 is helpful. It helps you manage the dual goal of maximizing revenue and increasing profits. Tracking the rule of 40 helps you stay grounded in the middle of the chaos.To track the rule of 40 and other financial metrics in real-time, you need a comprehensive SaaS management software like ClickUp. Try ClickUp today for free!

© 2026 ClickUp