How to Bill a Client Professionally

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

You completed the project on time and sent the invoice. That’s when things started getting weird. The client came back saying the payment terms were different from what they were expecting.

They expected the VAT to be inclusive of the total billing, whereas you thought it was to be charged in addition to the services provided. Any consultant, freelancer, or small business owner would find this relatable. To save you some heartburn, we’ve written this guide for you.

In this guide, we show you how to bill a client, pro tips to gettng it right the first time, and how to use ClickUp to automate your client billing process.

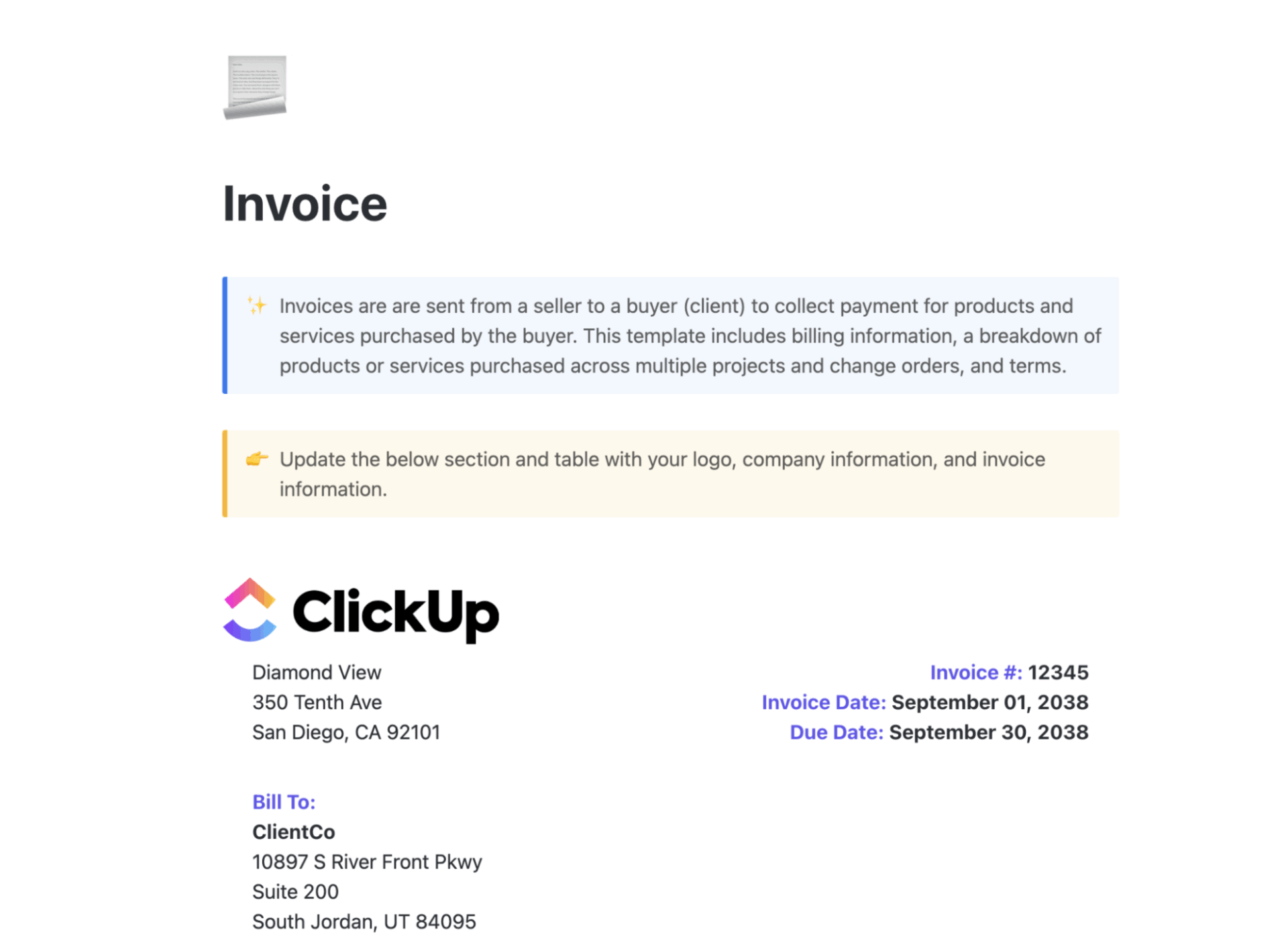

The ClickUp Invoice Template helps you easily create, manage, and track client invoices, making your billing process more organized. With custom statuses, fields, and multiple views, this template streamlines invoicing for businesses and freelancers.

There’s no one-size-fits-all answer. The right time depends on your project type and what you’ve agreed upon with your client. Here are five common billing approaches:

In upfront billing, you send an invoice before the project starts, and the client releases upfront payment in whole or in part before you begin.

Best for: First-time clients, one-off strategy projects, or small projects (less than 2 weeks)

Examples:

If you charge upfront, have that conversation during your first meeting or discovery call. You’ll be able to overcome objections or hurdles that would complicate the business relationship from the get-go.

It saves you from investing too much time and energy in a client who doesn’t agree with your payment structure.

In milestone-based billing, you define project stages and associate each with a payment. At the end of each stage, you typically send an invoice for the services rendered.

Best for: Projects with clear phases (e.g. branding, website builds, reports)

Examples:

When the project is complicated, consultants prefer the milestone billing invoicing process as the client is incentivized to provide timely feedback and approval. The payment process depends on meeting pre-defined goals.

💡 Pro Tip: A project timeline template maps key phases, deadlines, and handoff points. It gives your client a visual roadmap of what to expect and when to pay.

With dates and deliverables locked in, it’s easier to hold both parties accountable. The template makes the billing process easier and prevents scope creep and payment delays.

In the post-completion billing model, as soon as you complete the work, you invoice clients and add a due date (usually 15–30 days).

Best for: Corporate clients with procurement departments

Examples:

Post-completion billing is often non-negotiable when working with larger companies. Their finance teams usually follow strict vendor approval and payout cycles.

If you’re using this model, always ensure your paperwork is in place: a signed contract, agreed deliverables, payment details ironed out, and clear payment terms. It’s also wise to factor in payment delays when forecasting your cash flow.

👀 Did You Know: 68% of businesses experience errors on more than 1% of their total invoices. Consider using invoicing software to automate calculations, validate required fields, and keep all client billing details consistent. This reduces manual errors and ensures invoices are approved faster.

Ina. recurring billing or retainer model, the client pays a fixed amount at regular intervals (usually monthly), often, but not necessarily for, for a set number of hours or deliverables.

Best for: Ongoing services (e.g., content, design, advisory, ops)

Examples:

This billing method suits clients who need consistent support and don’t want to renegotiate fees every time. For you, it means predictable income and smoother workload planning.

But retainers only work when the scope is clear and respected on both sides. Be sure to define what’s included, how unused hours are handled, and when you’ll revisit the terms, say, every 3 or 6 months.

⚡ Template Archive: Free Commercial Invoice Templates

In the time and materials billing model (also known as hourly billing), you log time as you go and invoice regularly (weekly, biweekly, or monthly).

Best for: Open-ended work (consulting, troubleshooting, coaching) and clients with variable time usage

Examples:

Hourly billing gives you flexibility and makes sense when the project scope is evolving or unclear. But you must also justify how time is spent.

For client satisfaction and to build trust, share regular updates and time logs, especially if the client isn’t seeing immediate deliverables. You can also offer capped hours per week/month to give clients budget control without locking yourself into fixed fees.

💡 Bonus: Here, you can use ClickUp’s Project Time Tracking feature to log working hours directly on each task—either by starting a live timer or manually entering time. You can add notes, categorize entries, and generate time reports for invoicing or internal tracking.

ClickUp also integrates with tools like Harvest and Everhour if you want deeper reporting or to connect it with billing software.

Once you know what to include in your invoice, you can templatize it and send invoices faster.

| Invoice element | What to Include |

| Your information | Your name, business name (if any), contact details, and tax ID if applicable |

| Client information | Client’s full name, company name, address, and email |

| Invoice number | A unique, sequential ID (e.g., INV-0012) to track invoices |

| Invoice date | The date you’re sending the invoice |

| Due date | When payment is expected (e.g., “Due within 15 days”) |

| Project/Service description | Brief summary of the work (e.g., “Website wireframes – Phase 1”) |

| Breakdown of charges | Itemized list: hours worked, deliverables, quantity, rate per unit/hour |

| Subtotal | Total before taxes or discounts |

| Taxes (if applicable) | Refund policy, late payment terms, or thank-you message |

| Total amount due | Final payable amount |

| Payment Instructions | Bank details, PayPal link, etc. |

| Terms and notes otes | Refund policy, late payment terms, or thank-you message |

You can either do this manually or use free invoice templates to standardize this process.

If you’re wondering how to bill a client for the first time, follow these steps.

Before you send that invoice, make sure the client agrees that the work is complete or that the milestone is met. Both parties should be on the same page.

Then once you submit the invoice through a pre-decided channel (email, hand-delivered, raised on an ERP platform etc.), get your client to acknowledge the receipt and give their sign-off. Ideally, this acknowledgement writing so that you have a clear paper trail of the client billing process.

Here’s how to keep the billing process friction-free:

Why this matters: Prevents invoice disputes, missed expectations, or “we thought this was included” conversations.

Now, manually doing this for 1-2 clients over spreadsheets is fairly simple.

But as your business grows, it’s easy to lose track of what’s been delivered, approved, and ready to bill.

ClickUp, the everything app for work, centralizes your project work, task tracking, and client approvals. When all your work, invoices, and billing reside under one roof, you don’t have to deal with jumping between multiple tools, and waste time hunting down context across email, chat, and call transcripts—in other words, Work Sprawl.

Here’s how to use ClickUp as your invoicing software.

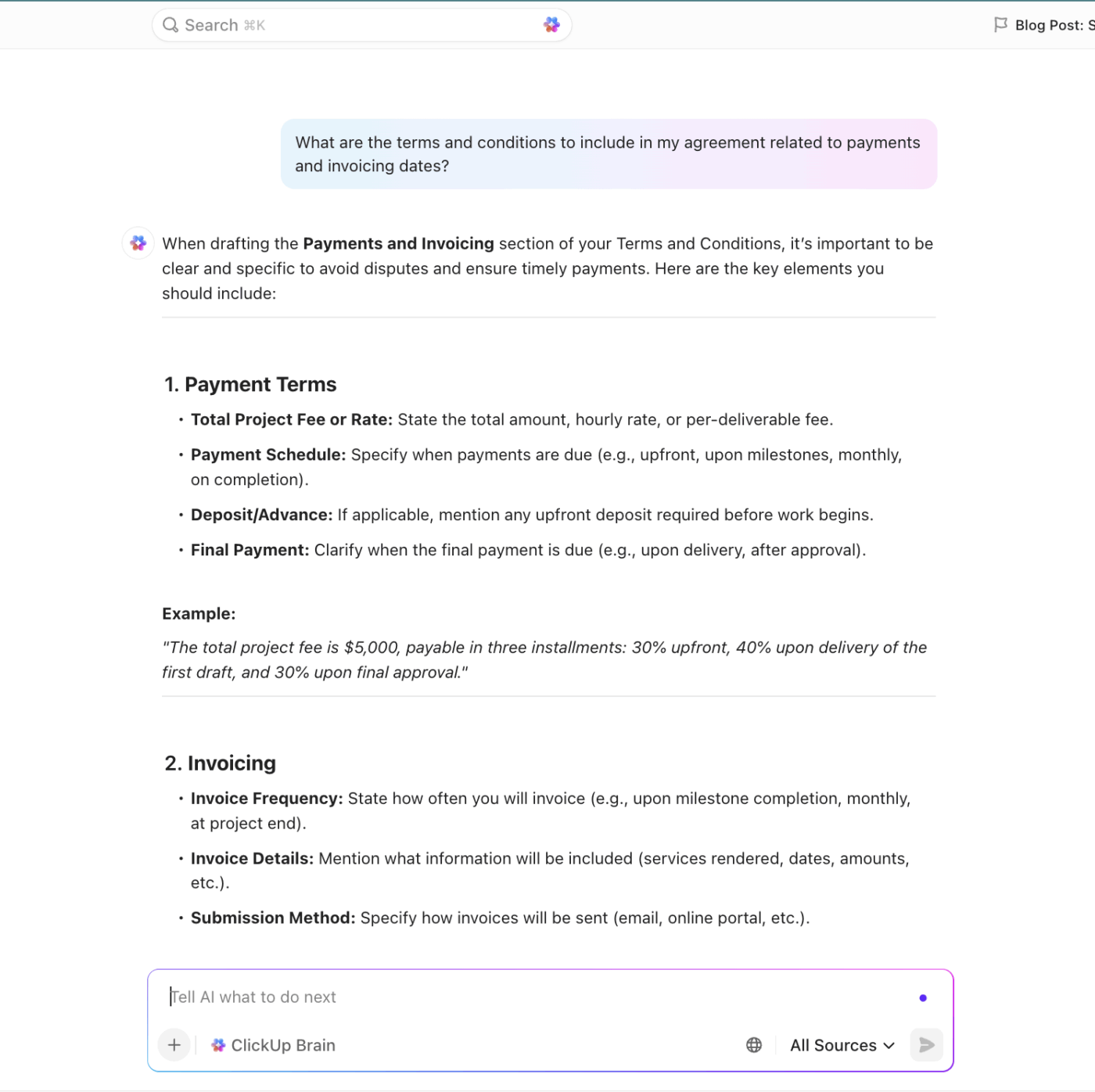

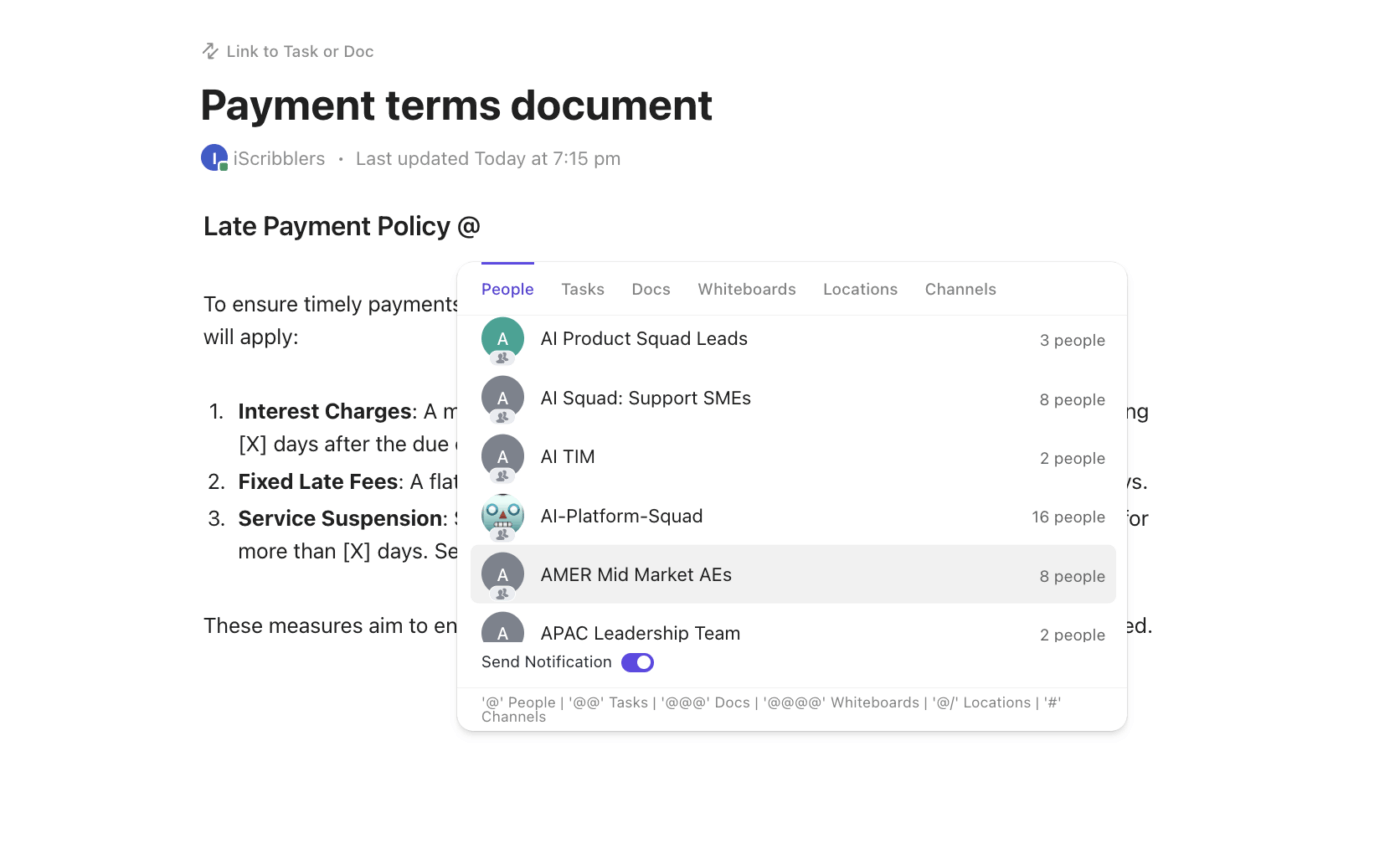

Use ClickUp’s built-in AI assistant, ClickUp Brain, to generate invoice summary emails. You can add the deliverables, milestones, terms, and everything else associated with the project, or simply ask Brain to collect that information from relevant tasks on ClickUp, and Brain will draft the email for you.

If you need to follow up to ask for payments, set up ClickUp Reminders to nudge your when a due date has passed. ClickUp Brain does that for you as well. You can even use Brain to draft the payment terms and conditions for your freelance business.

What’s more, throughout your project, Brain does the analysis heavy-lifting for you. Have a detailed report and need a summary? Ask Brain to do it.

Need to extract the key talking points from conversation threads? Brain does that for you, too. In short, Brain is your AI writing assistant throughout the entire project roadmap.

🎥 Watch: How to use ClickUp for generating invoices?

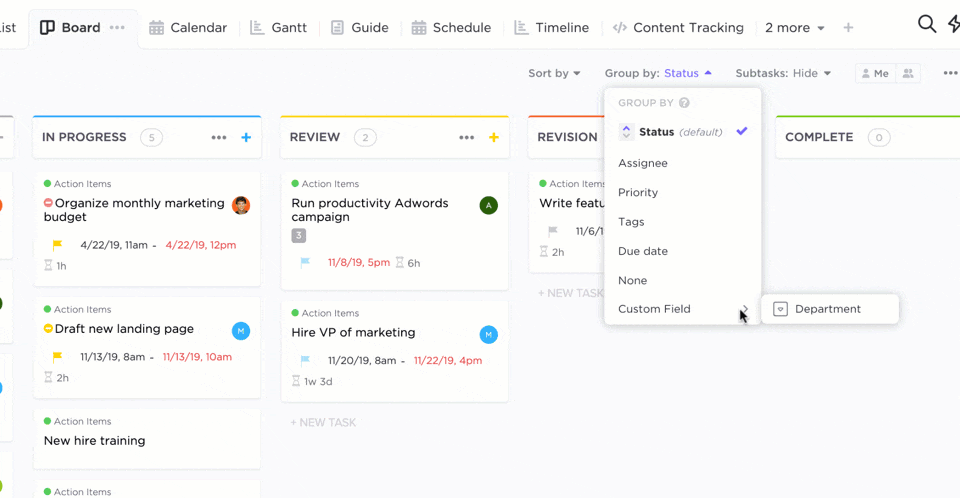

Professional project billing starts with clear project tracking. You need a visual way to track project progress, so you can know what’s ready to bill and avoid client disputes.

Using ClickUp’s Kanban Board, you can see every deliverable’s status at a glance. This visual workflow prevents revenue from getting stuck in limbo because you forgot to invoice for a completed task.

👀 Did You Know? As per a study by Consulting Success, here are the popular pricing models consultants use: 37% use a project rate, 26% use a value-based rate, 21% use an hourly rate, 13% use a monthly retainer, and 3% use a performance-based model.

With a pre-built invoicing template, you can plug and play your project and business details, and voila. You’re ready to send it.

If you’re already managing tasks, deliverables, and time tracking in ClickUp, it makes sense to keep your invoicing process integrated.

You can use ClickUp’s Invoice Template to bring everything into one place, from logging billable time to generating and organizing invoices.

Here’s how this template works for you:

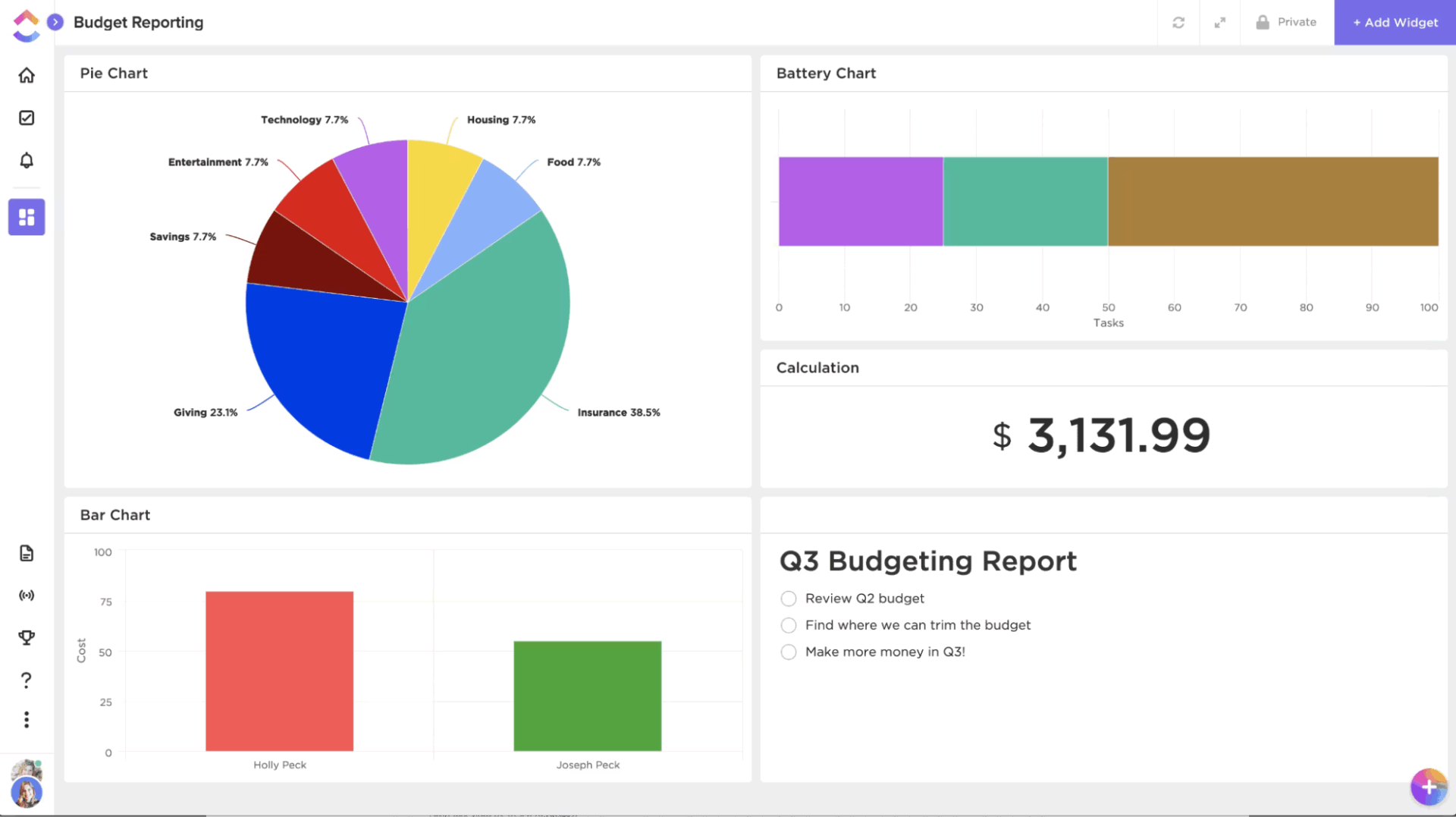

And if you want to scale beyond solo consulting, ClickUp for Finance Teams gives you a more structured setup. It expands invoicing into a complete financial operations hub. From tracking budgets and expenses to monitoring client payment history, everything happens within the same platform where your work happens.

What’s more, you can automate your invoice math with ClickUp’s Formula Fields. Add calculations directly inside ClickUp tasks.

For example, you can auto-calculate totals, add taxes, track outstanding balances, and forecast income across projects based on billable hours logged. These billing features make sure you get paid on time and avoid mistakes or missed payments.

⚡ Template Archive: Freelancer Templates to Manage Workloads

Friendly Tip: Even with templates in place, pulling together the right details for every invoice can feel repetitive. This is where ClickUp Brain MAX takes invoicing one step further.

When it comes to filling in client-specific and project-related information, an incorrect project ID, a missing due date, or a name is likely to cause payment delays.

ClickUp makes this process easier by letting you standardize details with Custom Fields. Instead of retyping client data or digging through old invoices, you can create fields that automatically surface in every invoice task.

Here’s how to set it up:

For agencies or businesses with tiered or usage-based billing, Custom Fields let you capture details of each pricing structure—whether it’s hourly rates, retainer models, or project-based fees. This makes it easy to see exactly which pricing arrangement applies to each client.

Pair this with ClickUp’s invoicing features—like linking billable hours directly to tasks, attaching receipts or agreements, and marking invoices as Paid/Unpaid—to maintain a complete financial trail inside the same workspace where your projects live.

At this stage, you can even use the beginner-friendly ClickUp Payment History Template to record and store information about your customers and monitor payment histories to identify potential issues. Beyond just logging transactions, you can track missed or delayed payments and spot recurring patterns that might affect your cash flow.

💡 Pro Tip: Use Formula Fields to automate calculations like “Hours Logged × Hourly Rate” or “Subtotal + Tax.”

The more clearly you define your payment terms, the less room there is for disputes.

Here’s what to include in your payment terms:

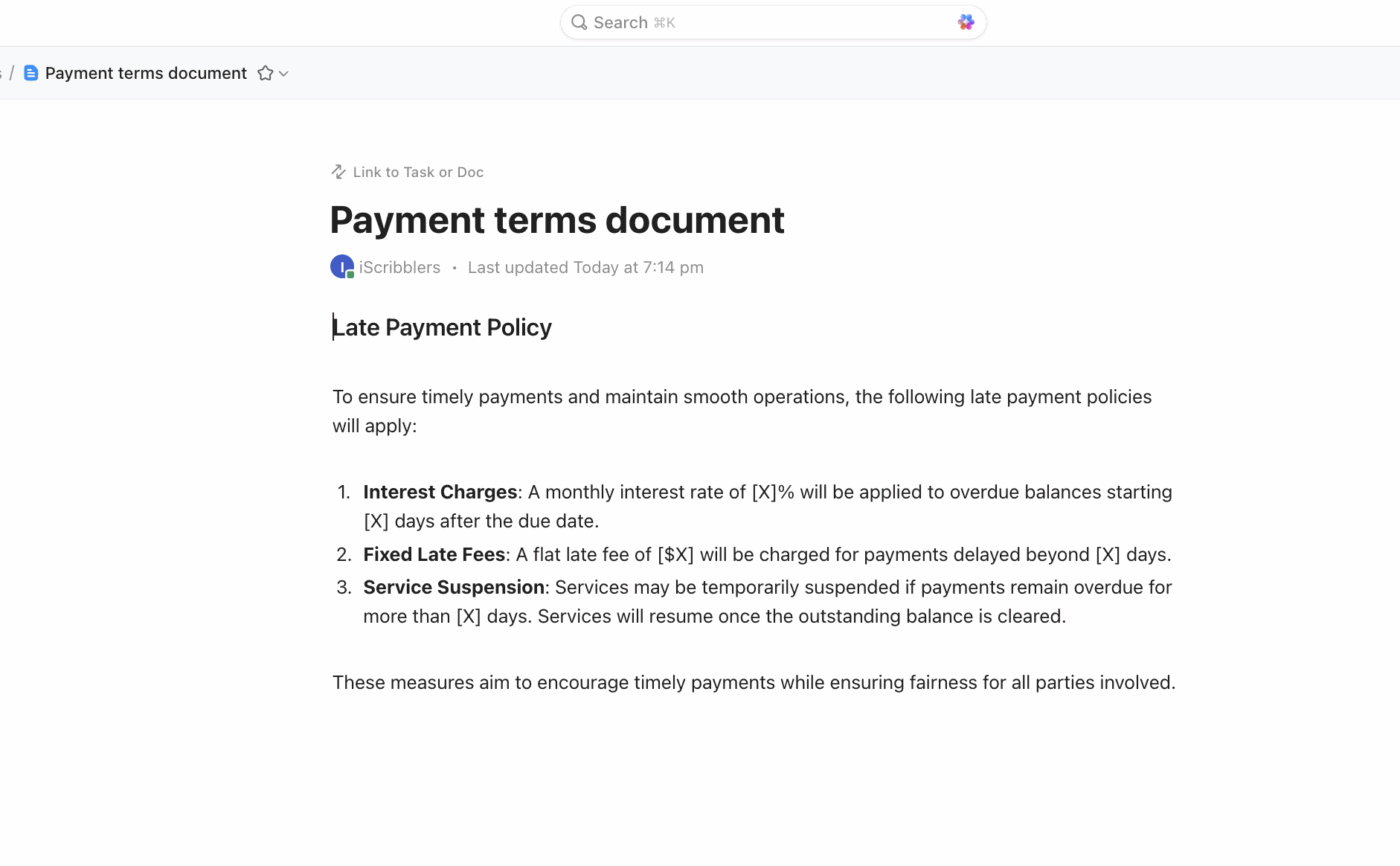

ClickUp Docs is where you store all information about the payment terms and is accessible by all stakeholders.

Create a Payment Terms Template in ClickUp Docs with standardized language (e.g., Net 15, late fees, accepted methods). Duplicate this Doc each time you onboard a client, and tweak it for project-specific needs. And link the Doc directly to the client’s project or billing list so the team has access.

The best part of Docs is that you get version control capabilities. Suppose a client negotiates payment cycles or late fee terms. Instead of updating random invoices, keep all versions in ClickUp Docs with timestamps.

Example: Client A agreed to Net 15, no late fees → stored in “Client A Terms” Doc

👀 Did You Know? Over 44% of mid and upper-sized companies report that at least a quarter of their invoices are delayed each month. Over 6% of companies report that three-quarters of their invoices are delayed.

The last thing you want is your invoice being rejected by the client’s finance team, sending you back to square one.

What to review at this stage:

For collaborative review, use ClickUp Docs’ commenting and assignments to tag teammates or finance reviewers. The built-in suggestion mode lets reviewers propose edits without overwriting your draft.

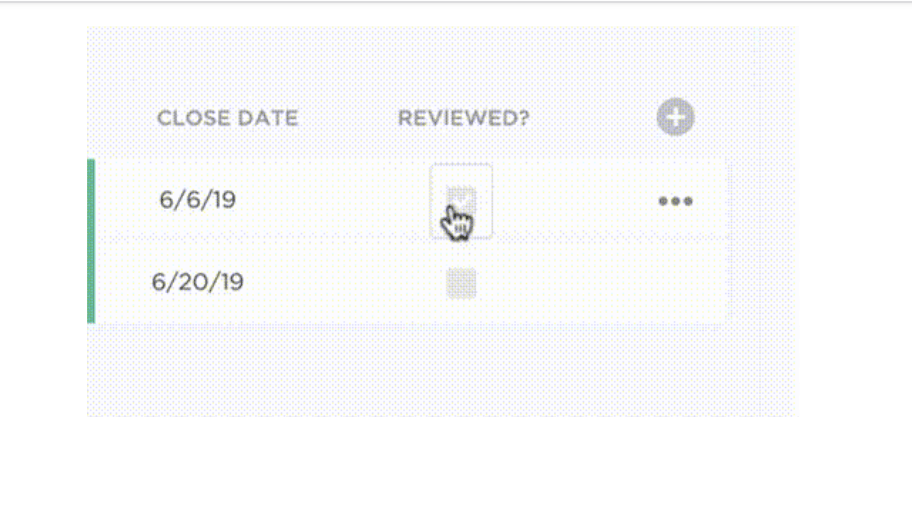

Custom field validation also helps. Create mandatory Custom Fields like Invoice #, Due Date, and Total Amount.

When fields are missing, it’s instantly visible on the task, reducing human error. Add a “Reviewed: Yes/No” dropdown field so invoices cannot be sent until marked as reviewed.

📮 ClickUp Insight: Context-switching is silently eating away at your team’s productivity. Our research shows that 42% of disruptions at work come from juggling platforms, managing emails, and jumping between meetings. What if you could eliminate these costly interruptions?

ClickUp unites your workflows (and chat) under a single, streamlined platform. Launch and manage your tasks from across chat, docs, whiteboards, and more—while AI-powered features keep the context connected, searchable, and manageable!

When your invoice is ready, you want to make sure the right person receives it, it’s stored in the right place, and you have a system to track whether it’s been acknowledged or paid.

A few common mistakes at this stage:

ClickUp integrates with Gmail, Outlook, and other providers so you can send invoices without leaving the platform.

Additionally, ClickUp Integrations work with your finance tools, such as:

As a small business owner or agency managing multiple clients, manually sending payment reminders is both time-consuming and prone to mistakes. It’s easy to forget who you followed up with, when the last reminder went out, or which invoice is crossing into overdue territory.

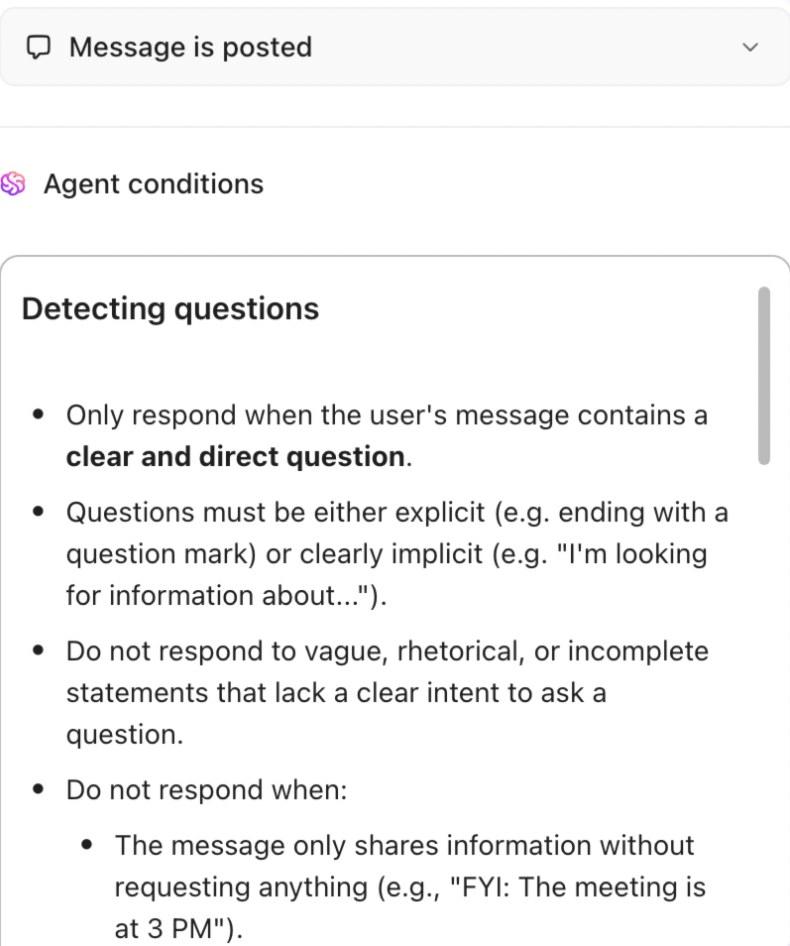

ClickUp Automations eliminate the repetitive, error-prone parts of invoice follow-ups:

Here’s a video that gives you quick hacks for using Automations within ClickUp.

For agencies handling dozens of invoices each month, Custom Autopilot Agents add intelligence to the workflow:

👀 Did You Know? Businesses that follow up with 90% or more of their invoices are likely to get paid within one week of their invoice due date.

For finance teams, invoicing means maintaining a reliable view of company-wide cash flow. When you’re managing dozens of clients and projects simultaneously, missing a single overdue invoice can affect budgets and payroll.

That’s why ClickUp Dashboards become your finance team’s central hub. It pulls together invoice data, payment statuses, and client histories into a single view.

Why do finance teams rely on ClickUp Dashboards?

⚡ Template Archive: Free Business Price Quote Templates in Word and Excel

These billing best practices help you get paid faster and reduce awkward follow-ups.

One of the most common reasons for billing disputes is unclear time records. If a client questions your invoice, having a detailed log of hours worked on specific tasks is the fastest way to resolve the issue. It also gives you insight into whether projects are profitable and how much time you spend on non-billable work.

Examples:

👀 Did You Know? A 15-employee agency is prone to losing $1.6 million in yearly revenue due to a lack of time tracking for emails, meetings, and forgetfulness.

The words you choose on your invoice can influence how quickly a client pays. Harsh or overly formal wording can create friction, while polite, professional phrasing maintains goodwill and gently nudges clients to prioritize your payment.

You could even add a short thank-you note at the bottom of your invoice to foster a positive client relationship.

💡 Pro Tip: Here are some polite ways to phrase payment requests on invoices:

Even the most organized clients sometimes miss deadlines, and without reminders, invoices can easily fall through the cracks. Consistent, structured reminders help you receive payments faster without feeling like you’re nagging.

Here’s a reminder framework you can set up in ClickUp Automations for your first invoice and the subsequent ones:

| Time frame | Reminder type | Message example |

| 3 days before due | Polite reminder | “Just a quick note — Invoice #123 is due in 3 days. Please let us know if you have any questions.” |

| On the due date | Gentle prompt | “This is a friendly reminder that Invoice #123 is due today. Thank you for your timely payment.” |

| 7 days overdue | Strong nudge | “Our records show Invoice #123 is still outstanding. Kindly process payment at your earliest convenience.” |

| 30 days overdue | Escalation nudge | “Invoice #123 is now 30 days overdue. Please confirm payment status so we can avoid any disruption to your services.” |

One of the simplest ways to encourage clients to pay faster is to reward them for doing so. Offering a small discount for early settlement improves your cash flow and builds goodwill.

Examples:

This works especially well with long-term clients who appreciate flexibility and predictability. While you sacrifice a small portion of revenue, you gain peace of mind and faster access to cash.

👀 Did You Know? Small businesses offer early payment discounts with an average rate of 4.1%. Based on an average invoice of about $10,000, it translates to roughly $411 saved per invoice.

Billing shouldn’t drain your energy or strain your client relationships. As a business owner, you shouldn’t be chasing unpaid invoices. Or when you invoice clients, the last thing you want to do is waste time on spreadsheets.

Let ClickUp turn your billing into a stress-free workflow.

With ClickUp’s Invoice Templates, Automations, and Dashboards, you gain full visibility into your cash flow and the confidence that every client invoice is accurate, professional, and on time.

Ready to simplify your billing process? Sign up on ClickUp for free.

© 2026 ClickUp