Implementing the Customer Onboarding Process in Banking

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

When customers choose a bank, several questions may buzz through their minds: Is their money safe here? Can they trust this institution? Is this bank the best option for their financial needs?

The answers start unfolding during the customer onboarding process, a critical phase where banks can lay a strong foundation for a lasting relationship.

This phase is your opportunity to build trust, answer queries, and reassure new clients that you can help them achieve their short and long-term financial goals.

But here’s the stark reality: a new global survey by Forrester reveals that over 64% of banks lose potential deals due to inefficient, time-consuming onboarding processes.

In fact, more than 20% have lost between 26% and 50% of new business opportunities because of these hurdles. Poor onboarding risks losing customers and can also lead to significant revenue loss and potential legal issues.

Let’s explore why customer onboarding in banking is important and how you can improve this process to avoid these pitfalls and secure customer retention.

The customer onboarding process sets the tone for a client’s banking experience. It is a critical bridge between securing a new customer and fostering a long-term banking relationship.

Effective onboarding is crucial since it’s a new client’s first extensive interaction with your bank. It’s the most important part of your client acquisition strategies and impacts everything from customer satisfaction and retention to the likelihood of selling additional services.

Conversely, a cumbersome process can push potential customers away, costing banks money and damaging their reputations.

As banking services evolve, so does the method of welcoming clients. Digital onboarding leverages technology to streamline processes and enhance user engagement, contrasting sharply with the slower, manual methods of traditional onboarding.

Let’s compare the digital onboarding approach with the conventional one to see why more and more banks are transitioning to digital solutions:

| Aspect | Traditional onboarding | Digital onboarding |

| Duration | Several days to weeks | A few minutes to a few hours |

| Customer effort | High, requires physical presence and paperwork | Low, can be completed remotely |

| Error rate | Higher due to manual entry | Reduced through automation |

| Customer satisfaction | Often lower due to delays and inconvenience | Higher due to efficiency and convenience |

| Cost for bank | Higher due to manual labor and physical materials or supplies | Lower with digital tools and automation |

| Regulatory compliance | Challenging to update and maintain | Easier to adapt to changing regulations |

Transitioning to a digital-first approach allows for a more customer-centric onboarding process. This strategy reduces the effort required from clients, personalizes their journey, and improves customer-centricity by minimizing waiting times.

Successful onboarding in banking hinges on practical, customer-focused elements that make the process smooth and engaging. Here are some key aspects that can transform onboarding:

Technology plays a pivotal role in customer onboarding within the banking sector. It speeds up the entire process and enhances accuracy, security, and user satisfaction. Banks increasingly leverage advanced technologies like AI, machine learning, and blockchain to streamline data verification, personalize customer interactions, and secure sensitive information.

Customer onboarding tools like ClickUp are revolutionizing how banks onboard new customers by providing an all-in-one platform to manage and enhance the user experience. ClickUp provides multiple onboarding and customer journey templates so that banks can tailor each step of the onboarding process to meet specific customer needs.

Let’s take a look at these templates:

The ClickUp Customer Onboarding Template is designed to make the customer onboarding experience faster, more efficient, and highly personalized. Banks and financial institutions can use this template to ensure that every new customer experiences a smooth transition from signup to full-service usage.

The template facilitates a better understanding of customer needs, allows for the customization of the onboarding journey, collects essential feedback, and measures the success of the onboarding initiatives. With this template, banks can:

ClickUp also provides other valuable templates that complement the main onboarding template, simplifying customer management and engagement. These include:

Banks must address potential hurdles proactively, from ensuring data accuracy to maintaining robust security measures. This ensures that customers feel confident and supported as they begin their banking relationship. Here are the top four challenges you must know about:

During digital onboarding, it may be challenging to maintain the integrity of customer data due to manual entry mistakes or incomplete form submissions. These inaccuracies can affect everything from account setups to credit assessments and require robust verification mechanisms. The challenge is to maintain the reliability of data without complicating the customer experience.

You must ensure that the data collected is clean and verified to avoid errors that can delay the process or cause compliance issues. For this, you can:

Digital onboarding processes involve complex technologies and systems that bank employees may not be familiar with, leading to potential inefficiencies and customer dissatisfaction.

Your team must be well-trained and equipped with the knowledge to handle the technology and processes involved in digital onboarding. You must:

With the increasing prevalence of digital transactions, customer concerns about data privacy and security are more pronounced than ever. In digital onboarding, banks collect sensitive information that, if mishandled, can lead to severe privacy breaches and undermine trust in the institution.

Implement robust security measures such as encryption and two-factor authentication to protect customer data. Besides this, you must:

Customers expect a seamless onboarding experience, whether they interact with a bank online, via mobile, or in person. However, integrating multiple channels to provide a consistent onboarding experience has a few hurdles.

Disparate systems and platforms can lead to fragmented customer journeys, where data isn’t shared effectively across channels, causing delays and confusion. Banks may find it challenging to integrate these various platforms so that customer information flows seamlessly from one channel to another, maintaining continuity and coherence throughout the onboarding process.

Develop an integrated onboarding strategy that ensures consistency across all channels. You can utilize an omnichannel platform to synchronize data and processes in real time. Implement software that integrates all points of contact and allows you to provide a seamless transition for customers regardless of how they choose to engage.

Use the ClickUp Board View to develop an integrated onboarding strategy that ensures consistency across all platforms. Establish a Kanban board to represent the entire onboarding process. Use columns to represent different stages of the journey, such as “Application Received,” “Verification in Progress,” “Documentation Submitted,” and “Onboarding Complete.”

Create a dedicated card for each customer. As customers progress through the onboarding process, move their cards from one column to the next, visually tracking their journey. Analyze the movement of cards between columns to identify any delays or bottlenecks. If cards are stuck in a particular stage for an extended period, investigate the reasons and take corrective action.

To set your bank apart, implementing onboarding practices that stand out is key. Here’s how you can ensure your onboarding not only meets but exceeds customer expectations:

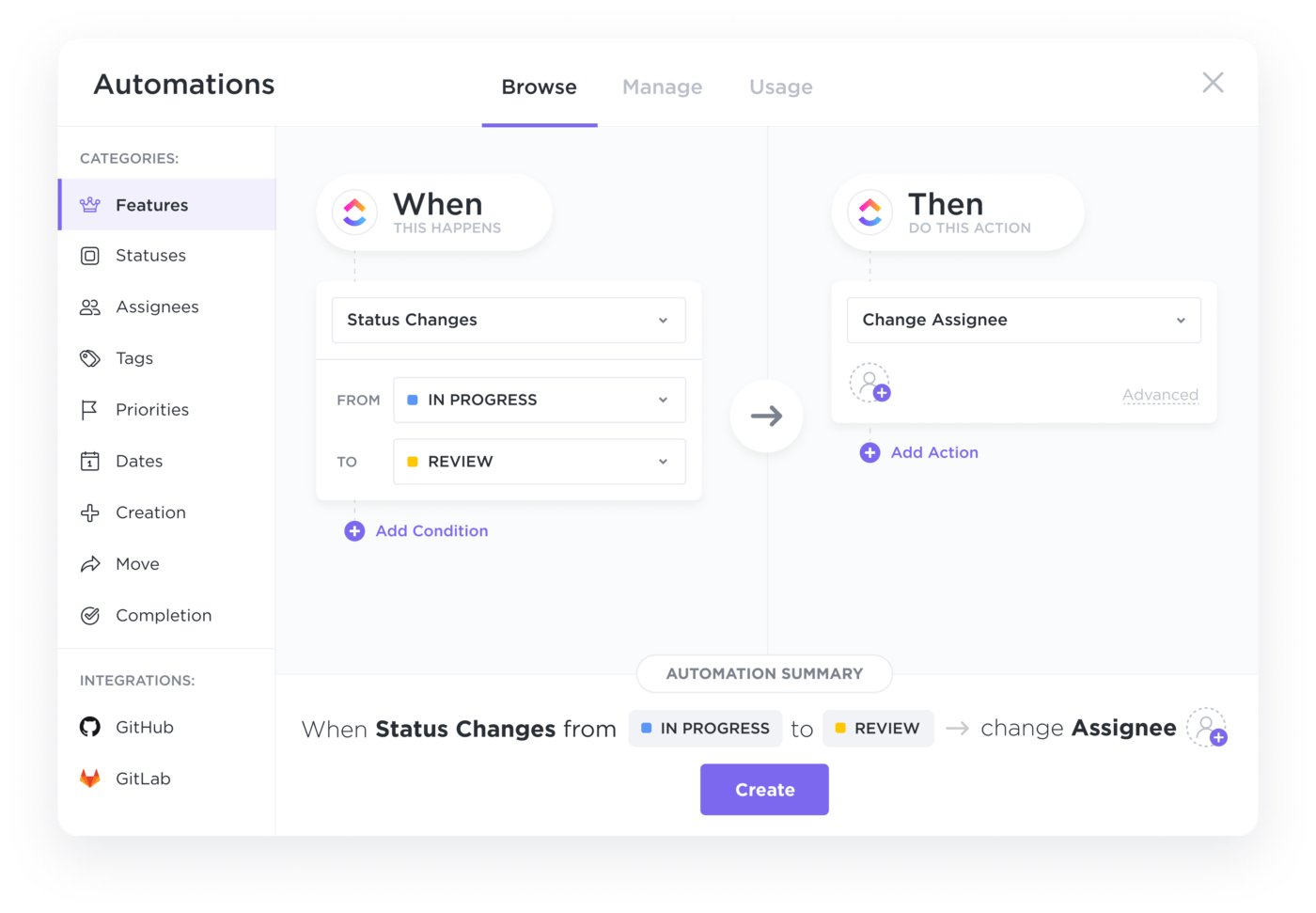

Automate your onboarding to make it as quick and hassle-free as possible. For instance, you can use ClickUp Automations to sync data across systems so your customers don’t have to enter the same information multiple times.

Banks like DBS have leveraged AI to pre-fill forms and validate documents instantly, significantly cutting down the time customers spend onboarding.

💡 Pro Tip: Use ClickUp’s Automations to trigger specific actions based on form submissions, ensuring data consistency and timely processing.

Nothing sweetens the deal like a good incentive. Consider offering new account bonuses or reduced fees for early adoption of additional services.

For example, Chase Bank offers a cash bonus for new accounts when customers set up direct deposit, making the onboarding experience seamless and rewarding.

Use the data collected during onboarding to offer tailored banking products that meet individual customer needs.

By showing customers that you understand their financial goals, such as Citi does by recommending credit cards based on spending habits during onboarding, you make their lives easier and boost your sales.

💡 Pro Tip: Use ClickUp’s Custom Fields to store customer data, such as spending habits, which can be analyzed to personalize product offerings effectively.

Interactive tools such as video tutorials, interactive guides, and step-by-step walkthroughs can significantly enhance the onboarding experience by making complex banking procedures easier to understand.

This approach helps reduce the cognitive load on new customers who may be overwhelmed by the array of services and protocols. For instance, banks like Wells Fargo use interactive mobile app guides to help new users navigate their banking app, which enhances user comprehension and engagement right from the start.

💡 Pro Tip: You can create and manage these interactive guides on ClickUp using Docs and allow new users to access this helpful content directly within the platform. Utilize ClickUp Brain, the platform’s inbuilt AI assistant, to analyze how users interact with these documents and tailor the onboarding process based on user behavior and feedback.

Deploy AI-driven chatbots to guide customers through the onboarding process. Chatbots can provide immediate answers to common queries, assist in filling out forms, and offer personalized advice based on the data entered by customers.

This real-time assistance can significantly improve customer satisfaction by reducing frustration during the onboarding process. Barclays, for example, uses chatbots to offer a 24/7 assistance service, helping new customers navigate their banking setup any time of the day.

Effective onboarding ensures customers grasp the full value of your services or products, which can significantly reduce churn. By engaging customers early and often, you help them navigate any initial hurdles and reassure them that they’ve made the right choice. This fosters a stronger commitment and reduces the likelihood of them leaving for a competitor.

Utilizing client onboarding software can help you continuously gather actionable feedback to refine this process. Besides, you can use customer profile templates to maintain detailed records, enhancing personalization and customer experience throughout the onboarding process.

The ClickUp Customer Satisfaction Survey Template is a vital tool for businesses aiming to enhance their customer onboarding experiences. This template allows you to quickly set up and distribute customized surveys to gather critical feedback from customers.

By understanding customer satisfaction levels and identifying specific pain points, you can make informed decisions to improve your onboarding process. The template is designed to help you easily capture, manage, and analyze customer feedback, ensuring a continuous improvement cycle that leads to higher customer retention and satisfaction.

Bonus: 10 Best CRM for Banking

In addition to customers, efficient onboarding is crucial for new hires, ensuring they feel integrated and valued from day one. Proper training, clear job expectations, and early engagement are crucial in building loyalty and a sense of belonging, which encourages long-term retention.

Banks that invest in thorough onboarding programs report higher employee satisfaction and lower turnover rates. This proves that the initial investment in a solid onboarding strategy pays off in sustained employee engagement and productivity.

Customer onboarding is your chance to make a lasting first impression. Efficient onboarding boosts customer satisfaction, cements loyalty, and sets the stage for long-term relationships. Today, technology and digital transformation are redefining how banks engage with customers right from the start.

Advanced tools and platforms like ClickUp offer innovative solutions to streamline customer onboarding in banking and enhance user experiences with just a few clicks. ClickUp simplifies your processes and provides valuable insights that help personalize customer journeys, ensuring every new client feels valued and enhancing customer loyalty.

Ready to transform your banking customer onboarding process?

Start with ClickUp today and experience the difference a seamless digital journey can make.

© 2026 ClickUp