Free Startup Budget Templates to Plan, Track & Optimize Finances

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

More than two-thirds of startups never deliver a positive return to investors. And it’s not necessarily because of a flawed idea or business model. Sometimes, money management is the problem.

It usually starts small. A few business expenses you didn’t expect. A stretch on hiring. A marketing bill that hits too early. Before long, you’re watching your balance shrink with no clear way to stop it.

That’s where a solid startup budget template comes in. It helps you map out what you’ll spend, what you’ll earn, and what it’ll take to keep going. You don’t need to build it from scratch, and you don’t need to guess.

In this guide, you’ll find the top free, easy-to-use startup budget templates to track expenses, plan for growth, and stay one step ahead of the chaos.

🧠 Fun Fact: The word budget comes from the Latin bulga, meaning “small pouch.” This led to the Old French bougette, diminutive of bouge, meaning ‘leather bag’.

A startup budget template is a format to organize your startup costs, forecast revenue, and keep track of actual expenses. It includes common line items like rent, software, payroll, and marketing. You can use a startup budget template to help build a business budget that reflects your priorities.

For early-stage founders, it’s a practical way to estimate burn rate, monitor overhead expenses, and stay aligned with long-term financial goals.

Many templates also support building a profit and loss statement and spotting gaps before they become problems.

Whether you’re in pre-launch mode or scaling fast, a budget gives your startup the discipline to grow with focus. And with the right template, you can spend less time building spreadsheets and more time building your business.

To get the most out of your startup budget template, make sure the one you choose includes the following capabilities:

👀 Did You Know? Undercapitalization is one of the top reasons startups fail. So, when building a startup budget, don’t just focus on units of goods sold—zoom out and consider the big picture. Factor in loans, overhead, and how you’ll allocate resources over time. Ensuring you have access to flexible funding and a clear view of your cash flow runway is key to staying afloat and scaling smart.

The following templates will help you track costs, plan ahead, and stay lean. Use them to see where your money’s going and how long it will last. Pick the one that suits you best and start budgeting!

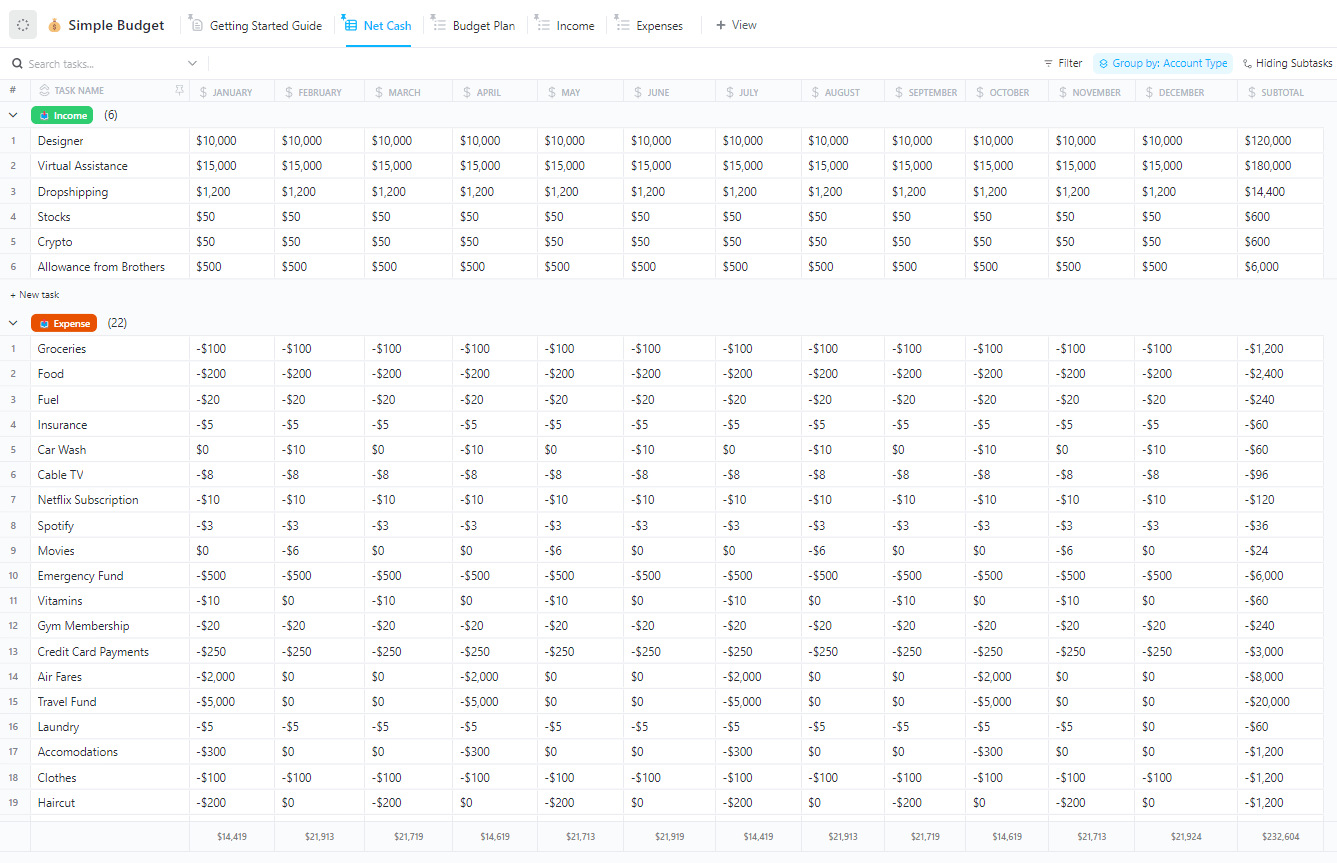

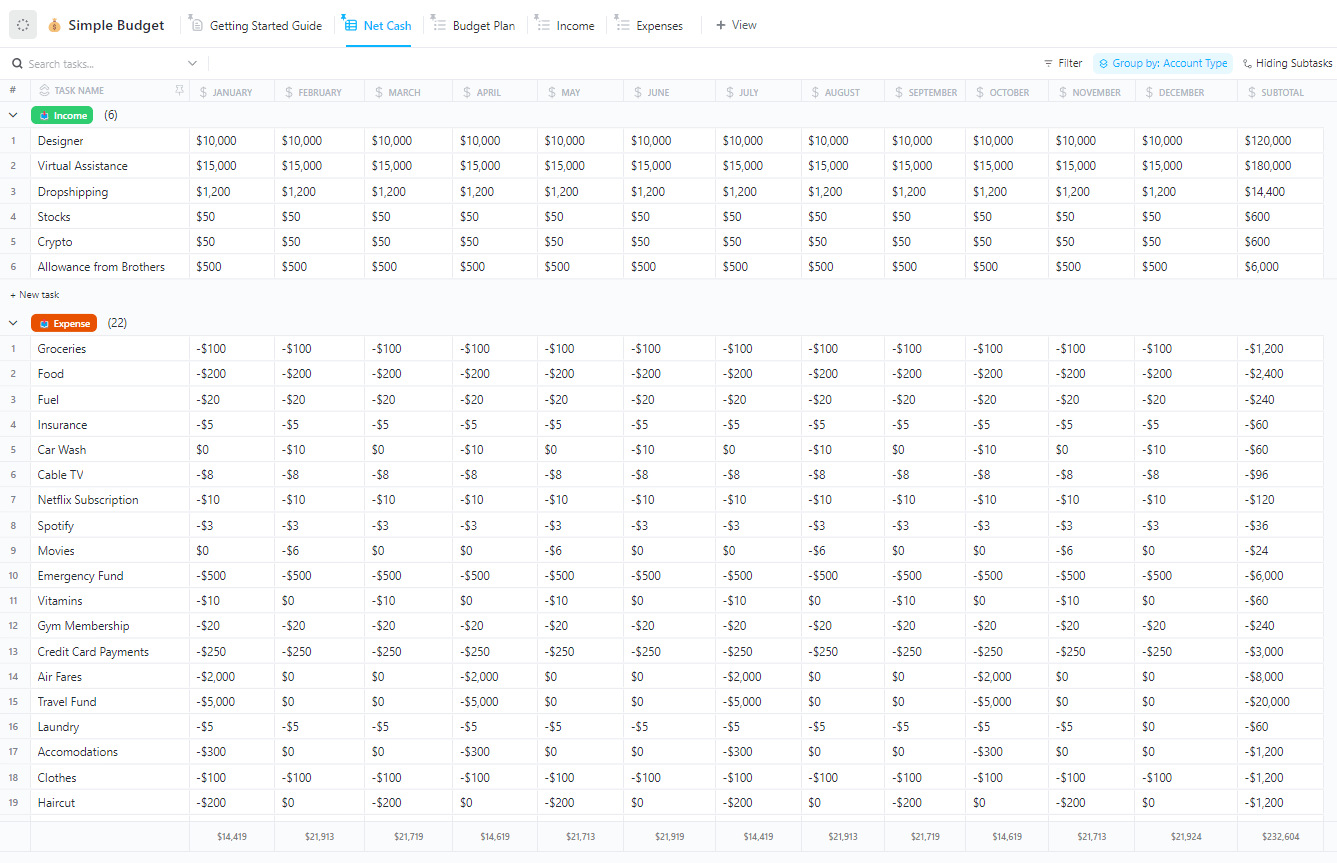

If you’re starting from zero, the ClickUp Simple Budget Template gives you a clean way to build your startup budget without overcomplicating things. It breaks your finances down into just what you need: income, expenses, and monthly totals.

Add ClickUp Custom Fields for details like budgeted amounts, actual spend, vendor information, and payment dates, so you always know exactly where your money is being

Use this template to:

🔑 Ideal for: Founders who need a basic, editable budget template to stay in control from day one.

Every marketing campaign costs something. The ClickUp Marketing Budget Template helps you stay sharp by breaking your budget down by type, goal, and return. This template is your way to see what and how each campaign is doing.

Use this template to:

🔑 Ideal for: Startups running lean campaigns across multiple channels who need to stay focused on ROI.

💡Bonus: ClickUp for Finance Teams offers a streamlined solution for managing and forecasting budgets. You can build custom ClickUp Dashboards to get a high-level view of where your money is going, track budget allocations, monitor actual spending, and see profits all in one place and in real time.

Running a project without a clear structure is risky—costs pile up, timelines slip, and no one knows where things stand. The ClickUp Project Budget with WBS Template gives you the structure you need to manage budgets without losing track of the work.

Use this template to:

🔑 Ideal for: Startup founders and project managers who want to control costs and hit deadlines without overcomplicating the process.

👀 Did You Know? Only 29% of projects finish successfully. Most fail because of scope creep, misalignment, or unclear goals—risks that could easily destabilize a fledgling startup. A clear project scope fixes that. It sets expectations, defines what’s in or out, and keeps your team focused on what matters. It’s how you finish what you start.

Need help writing one? Read ClickUp’s full guide on how to define and manage project scope.

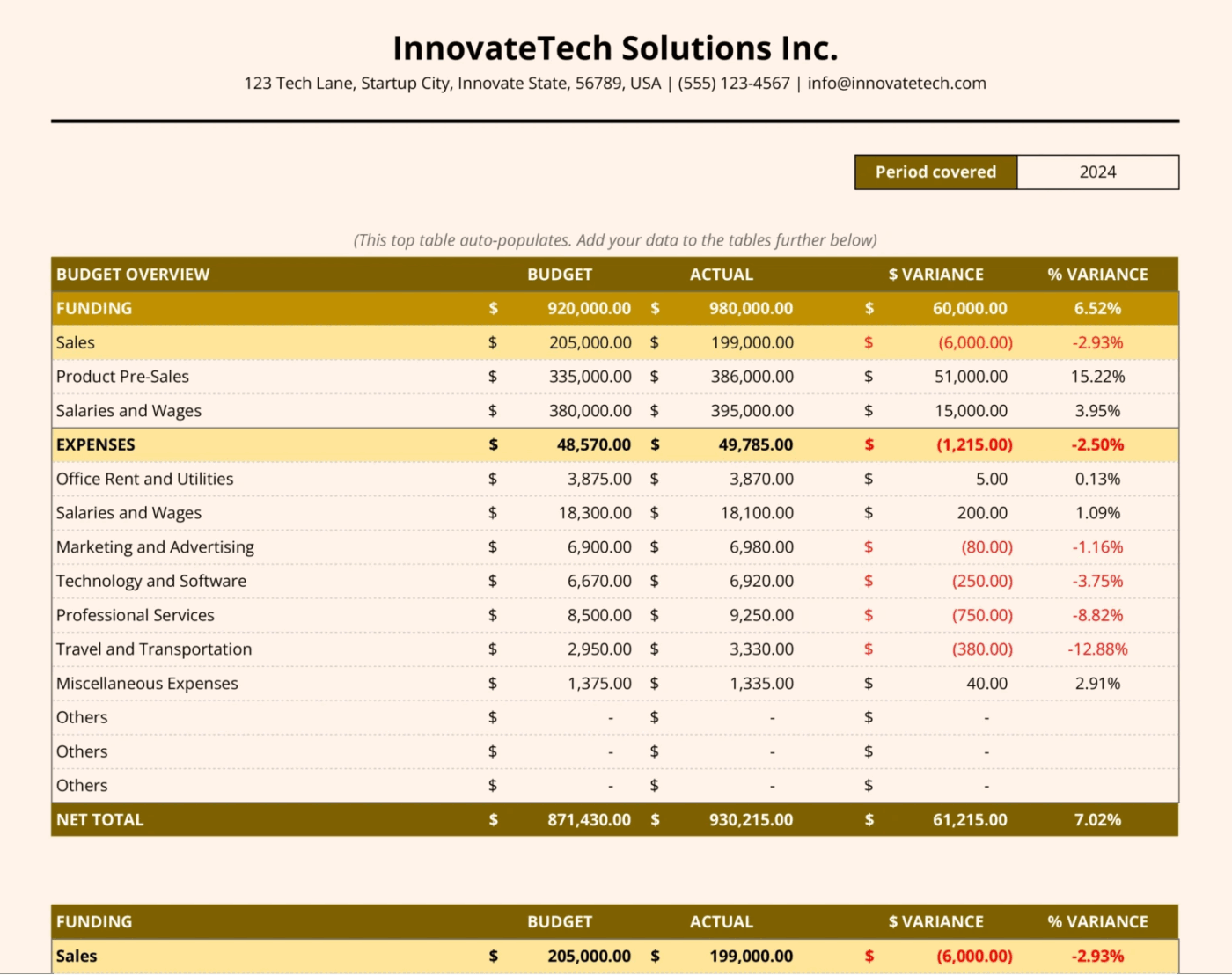

The ClickUp Business Budget Template is built for founders who need a clear view of what’s coming in, going out, and falling behind. It allows you to track projected and actual expenses across teams, stores, or departments.

Use this template to:

🔑 Ideal for: Business owners who need a simple way to manage company finances without digging through spreadsheets.

💡 Bonus: If you want to make things faster and easier for your team by—

Try ClickUp Brain MAX—the AI Super App that truly understands you, because it knows your work. This isn’t another AI tool to add to your collection. This is the first Contextual AI app that replaces them all.

Events bleed money if you’re not careful. The ClickUp Event Budget Template helps you stay ahead by tracking costs line by line. It’s built for planners who need to see the whole thing at a macro and micro level together—what’s spent, what’s pending, and what’s left.

Use this template to:

🔑 Ideal for: Startup teams or solo planners managing events with tight margins and no room for surprises.

Running a project without tight budget control? Risky. The ClickUp Budgeted Project Management Template gives you structure to manage costs, timelines, and tasks without losing track.

Use this template to:

🔑 Ideal for: Project managers who need to maintain financial oversight while keeping projects on track.

Every project has moving parts, and each one costs money. ClickUp Project Cost Management Template helps you stay ahead by tracking every expense, its approval status, and where it sits in the process. It’s made for teams juggling multiple budgets and sign-offs who need to prevent hold-ups and keep spending on track.

Use this startup budget template to:

🔑 Ideal for: Project managers who need tighter control over spending, especially when multiple stakeholders need to review each item.

💡 Pro Tip: Want to keep your projects on budget and avoid financial surprises? Project budget software can help you track expenses, forecast costs, and stay financially organized from start to finish.

The ClickUp Budget Proposal Template is for teams that need to pitch project costs with structure and speed. It lays out every line item—from one-time fees to overhead expenses—and keeps the approval process simple.

Use this template to:

🔑 Ideal for: Project leads and startup teams creating budget requests that need to be sharp, fast, and ready for sign-off.

📖 Also Read: Free Budget Proposal Templates in Excel and ClickUp

At a startup, small costs add up fast. Coffee runs, software subscriptions, travel receipts—if you don’t track them, you eventually lose them. The ClickUp Monthly Expense Report Template helps you log all of it in one place.

Use this template to:

🔑 Ideal for: Founders and finance leads who need a clean, repeatable way to report team expenses.

👀 Did You Know? The first use of budget relative to financial planning comes from a 1733 pamphlet, The Budget Opened, by William Pulteney, the 1st Earl of Bath. Pulteney used the term budget to critique the government’s fiscal policy on wine, among other things.

Numbers don’t lie—but they can hide. The ClickUp Budget Report Template brings them out into the open for transparency. It’s designed to review how your startup budget compares to real-world performance.

Use this template for:

🔑 Ideal for: Startup founders and finance leads who want a no-fuss way to review spending and keep goals in check.

When you manage finances, timing matters. A delay in one task can hold up a dozen more. This ClickUp Finance Management Template helps you keep every step moving—from initial request to final sign-off.

Use this template for:

🔑 Ideal for: Finance teams handling multiple approvals, payment cycles, and task deadlines—without the clutter

📮 ClickUp Insight: More than half of employees struggle to find the information they need at work. While only 27% say it’s easy, the rest face some level of difficulty—with 23% finding it very difficult. When knowledge is scattered across emails, chats, and tools, wasted time adds up fast.

With ClickUp, you can turn emails into trackable tasks, link chats to tasks, get answers from AI, and more within a single workspace.

💫 Real Results: Teams are able to reclaim 5+ hours every week using ClickUp—that’s over 250 hours annually per person—by eliminating outdated knowledge management processes. Imagine what your team could create with an extra week of productivity every quarter!

The ClickUp Financial Analysis Report Template helps you extract clarity from financial chaos. It’s designed for teams that need to pull numbers, spot patterns, and explain their meaning without building a report from scratch.

Use this template for:

🔑 Ideal for: Financial analysts and startup teams who need to present clean, actionable insights to leadership or investors.

The ClickUp Account Management Template helps you keep tabs on your happy clients, and the ones who are churning. Track onboarding, renewals, and churn signals in one view. Prioritize accounts that matter most and make sure no relationship falls through the cracks. It’s proactive client management—built into your daily workflow.

Use this template for:

🔑 Ideal for: Customer success teams and account managers who need a clear, repeatable way to manage client relationships.

📖 Also Read: Best Accounting AI Software & Tools

The ClickUp General Ledger Template is your digital ledger—cleaner than a spreadsheet and built for teams that care about accuracy. Record every debit, credit, and reference in one place. Whether you’re reconciling statements or prepping for tax season, this keeps your records clear, searchable, and audit-ready.

Use this template for:

🔑 Ideal for: Finance leads and bookkeepers who need a reliable way to track cash flow without building a system from scratch.

If your books are off, this is where you look first. The Accounting Journal Template by ClickUp gives you a structured place to record transactions—date, account, amount, and notes—all in one view.

Use this template for:

🔑 Ideal for: Bookkeepers and finance teams who want a dependable way to track daily transactions and keep project accounting records clean.

If you’re used to Excel, you can also use ClickUp Formula Fields, which feel familiar to Excel but lets you crunch numbers directly within your tasks! Check out the video below! 👇🏼

You don’t need a CFO only to understand your financial position. The ClickUp Balance Sheet Template helps you list assets, liabilities, and equity in one structured view—so you can make informed decisions without the noise. It’s fast to use, easy to update, and made for teams who need a clear snapshot.

Use this template for:

🔑 Ideal for: Small business owners and finance teams seeking a straightforward way to manage and review financial positions.

💡 Pro Tip: Entrepreneurs should regularly review and verify their balance sheets for accuracy and completeness, not just at year-end but throughout the year.

This means checking for mathematical errors, ensuring all assets and liabilities are properly classified, and cross-referencing with other financial statements for consistency. By doing so, you’ll catch discrepancies early and maintain a clear understanding of your business’s financial health.

This Spreadsheet Startup Budget Template from Coefficient helps you lay it all out—startup costs, projected revenue, funding sources, and actual expenses—so you can see where your money’s going and how long it’ll last.

Use this template to:

🔑 Ideal for: Founders building their first business budget and needing a clear, editable model to forecast cash flow and stay on track.

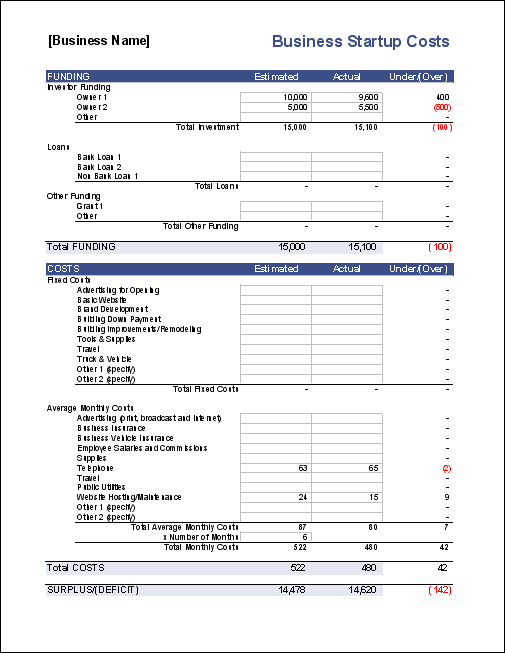

Unexpected costs can wreck a launch. This Excel Business Start-Up Costs Template helps you map out everything early—equipment, licenses, marketing, inventory, and more—so you’re not caught off guard when the bills hit.

It’s built for flexibility and clarity, whether you’re starting from your kitchen or opening a storefront.

Use this template for:

🔑 Ideal for: Entrepreneurs who want a straightforward way to plan and manage their business launch expenses.

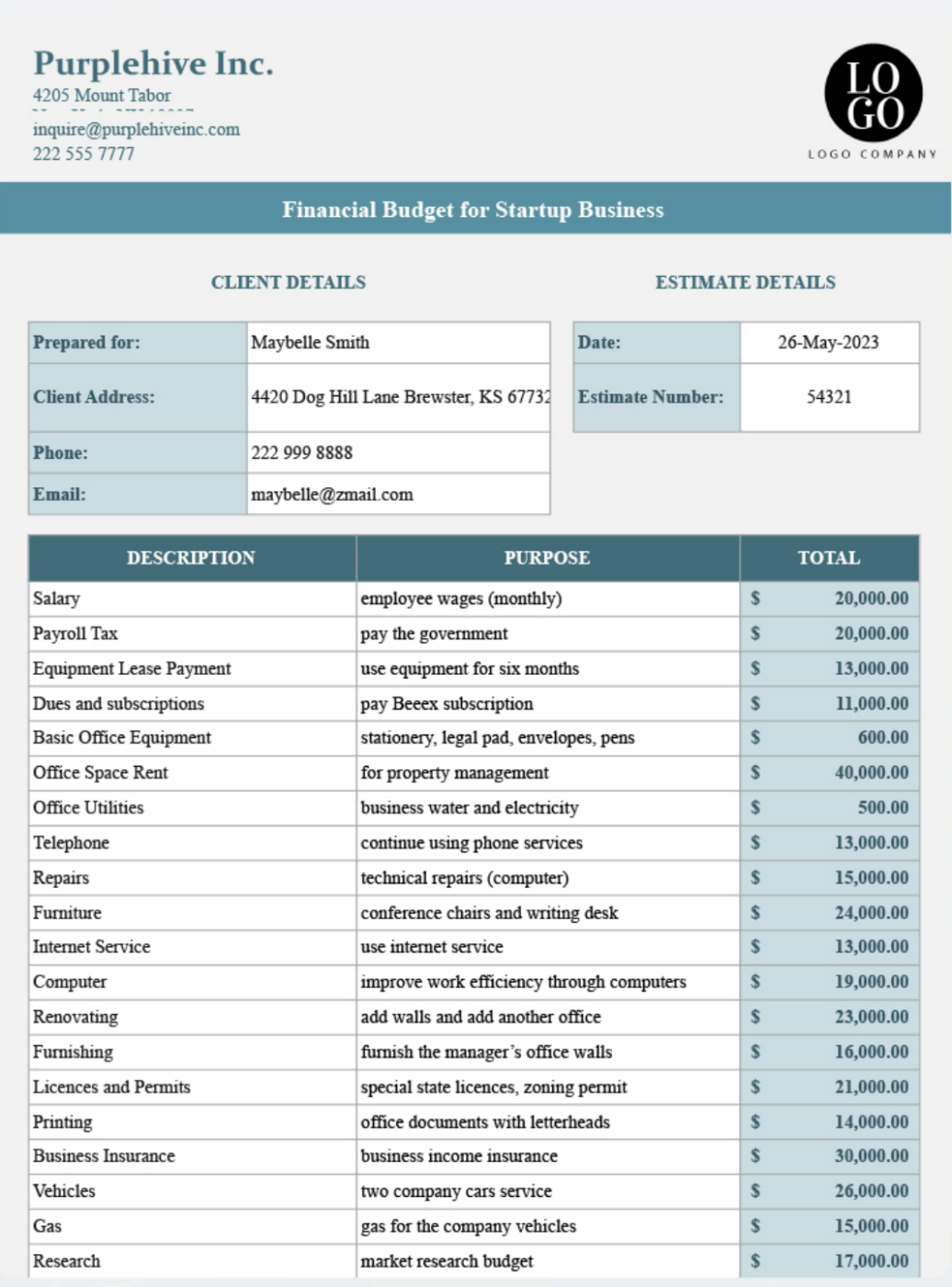

Every startup needs a basic budget before making big moves. This Startup Budget Template gives you just enough structure to plan early expenses without overcomplicating things. This template is available in multiple formats, including Word, Excel, Google Docs, and Google Sheets.

Use this template for:

🔑 Ideal for: First-time founders building their business budget from scratch and looking for a printable, editable place to start.

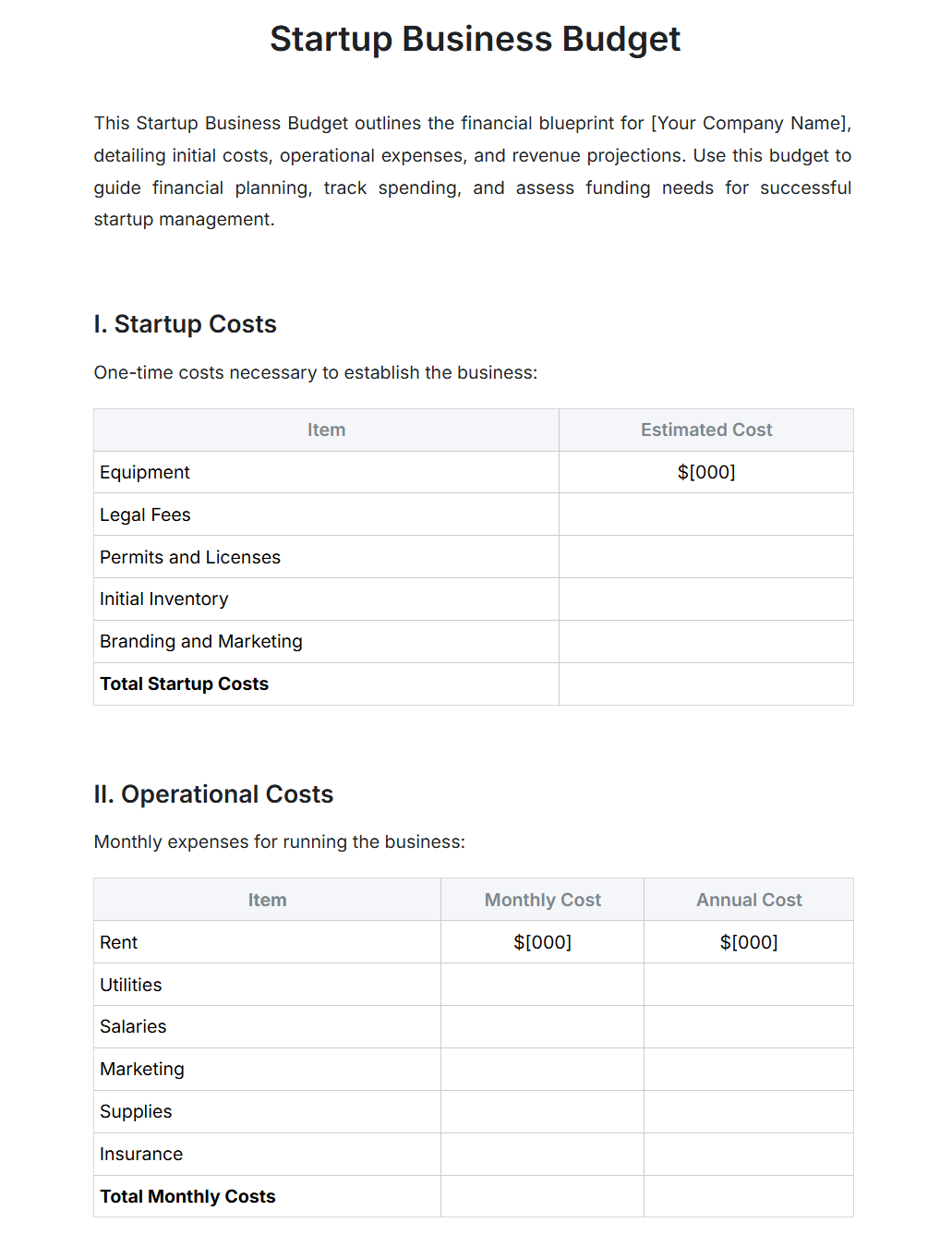

Launching a startup demands clear financial planning. The Startup Financial Budget Template gives you a blank slate to outline your initial expenses, operational costs, and projected revenues. Designed for simplicity, it allows you to customize entries to fit your specific business model.

This template is available in Word, Excel, Google Docs, and Google Sheets formats and is easily editable and adaptable to your choice of platform.

Use this template to:

🔑 Ideal for: Entrepreneurs who need a lightweight tool to organize their budget and stay focused on what matters.

A solid budget isn’t just a nice-to-have—it’s a matter of survival, especially if you’re a startup. With ClickUp, you don’t need to build one from scratch. You get ready-made startup budget templates to track expenses, estimate runway, and monitor cash flow—without juggling spreadsheets.

ClickUp brings your planning, tracking, and reporting into one place. You can tag expenses, flag overruns, and compare projections to reality—fast. Whether you’re budgeting for a project, a team, or the whole company, ClickUp helps you stay lean and make confident decisions.

And with 1,000+ free templates, you’ll find one that fits your style, your team, and your growth.

Ready to take control of your finances? Sign up with ClickUp for free today.

© 2026 ClickUp