Best Sage Intacct Alternatives for Modern Finance Teams

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Ever feel your life is controlled by spreadsheets, email threads, and approvals scattered across tools? If Sage Intacct is starting to strain under multi-entity needs, advanced reporting requests, or new integrations, it’s time to explore alternatives.

The goal isn’t to rip and replace your tool usage overnight. It’s to identify an ERP system that aligns with audit rigor, financial management controls, and the realities of teams working across multiple industries.

This guide compares credible accounting software options for consolidation, project accounting, and compliance-heavy workflows. You’ll see strengths, trade-offs, and what to expect in migration.

You’ll also see how ClickUp can sit beside your ledger as a finance operations layer—centralizing tasks, approvals, close checklists, and dashboards.

Shorten your close and make reviews consistent with the ClickUp Month-End Close Checklist Template, a repeatable task list with owners, due dates, and review steps.

Here’s a quick comparison of the best Sage Intacct alternative options to help you choose the right fit based on key features, pricing, and user ratings.

| Tool | Best for | Key features | Pricing* | Ratings |

| ClickUp | Teams of all sizes handling finance operations alongside their ERP | Approvals and Automations, Close checklists with Tasks and subtasks, Custom Fields and Custom Statuses, Docs and SOPs with version history, Chat and Assigned comments, Dashboards for BvA, cash, and AR aging | Free plan available; customizations for enterprises | G2: 4.7/5 (10,500+) Capterra: 4.6/5 (4,500+) |

| NetSuite (Oracle NetSuite) | Large teams seeking global, multi-entity ERP depth | Multi-subsidiary and multi-currency consolidations, ASC 606 revenue recognition, Inventory and fulfillment, Project accounting, SuiteAnalytics dashboards, SuiteApps integrations | Custom pricing | G2: 4.1/5 (4,300+) Capterra: 4.2/5 (1,700+) |

| Acumatica | Mid- to large teams that need a flexible ERP with strong project accounting | Project accounting with budgets and WIP, Distribution and construction editions, Multi-company and consolidations, Role-based dashboards and advanced reporting, Open API and marketplace integrations | Custom pricing | G2: 4.4/5 (1,500+) Capterra: 4.5/5 (300+) |

| Certinia (FinancialForce) | Services organizations on Salesforce | PSA and project accounting, Subscription and milestone billing with ASC 606, Multi-entity and multi-currency, Salesforce-native analytics, AppExchange integrations | Custom pricing | G2: 4.1/5 (1,100+) Capterra: 4.0/5 (50+) |

| SAP S/4HANA Cloud | Enterprises standardizing on SAP | Global accounting and compliance, Embedded real-time analytics, SAP BTP extensions, Asset accounting and product costing, Role-based workspaces and approvals | Custom pricing | G2: 4.0/5 (830+) Capterra: 4.4/5 (350+) |

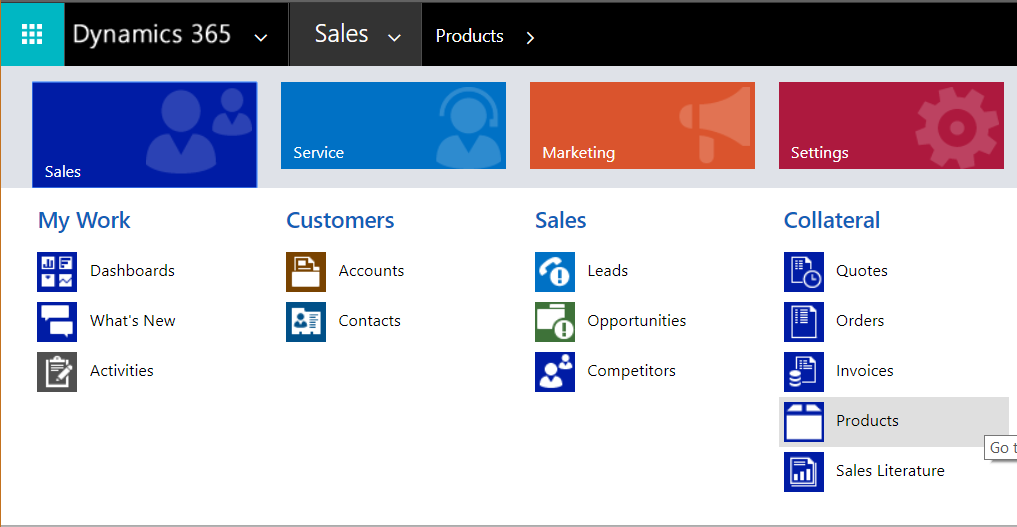

| Microsoft Dynamics 365 (Business Central / Finance) | Microsoft-centric teams at large organizations | Unified GL/AP/AR and projects, Power BI reporting, Power Automate approvals and Copilot, Native Microsoft 365 integration, Multi-company and basic consolidations | Paid plans from $70/month per user | G2: 4.0/5 (870+) Capterra: 4.1/5 (190+) |

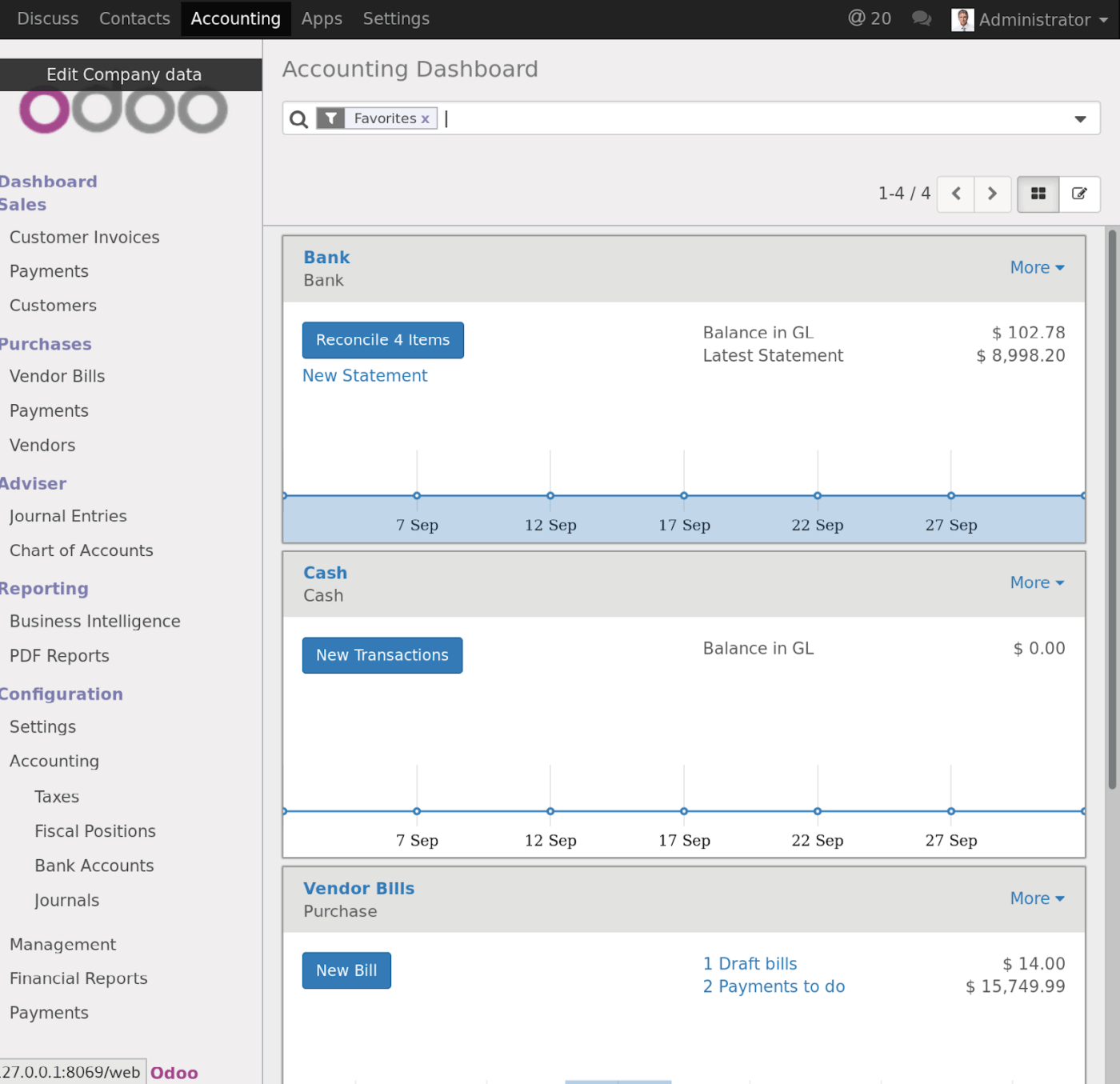

| Odoo | Mid-sized teams looking for a modular ERP with strong cost control | Integrated accounting, Inventory and MRP, Purchasing and projects, Customizable workflows, E-commerce and payments, Third-party integrations | Paid plans from $31.01/month per user | G2: 4.2/5 (310+) Capterra: 4.1/5 (1,270+) |

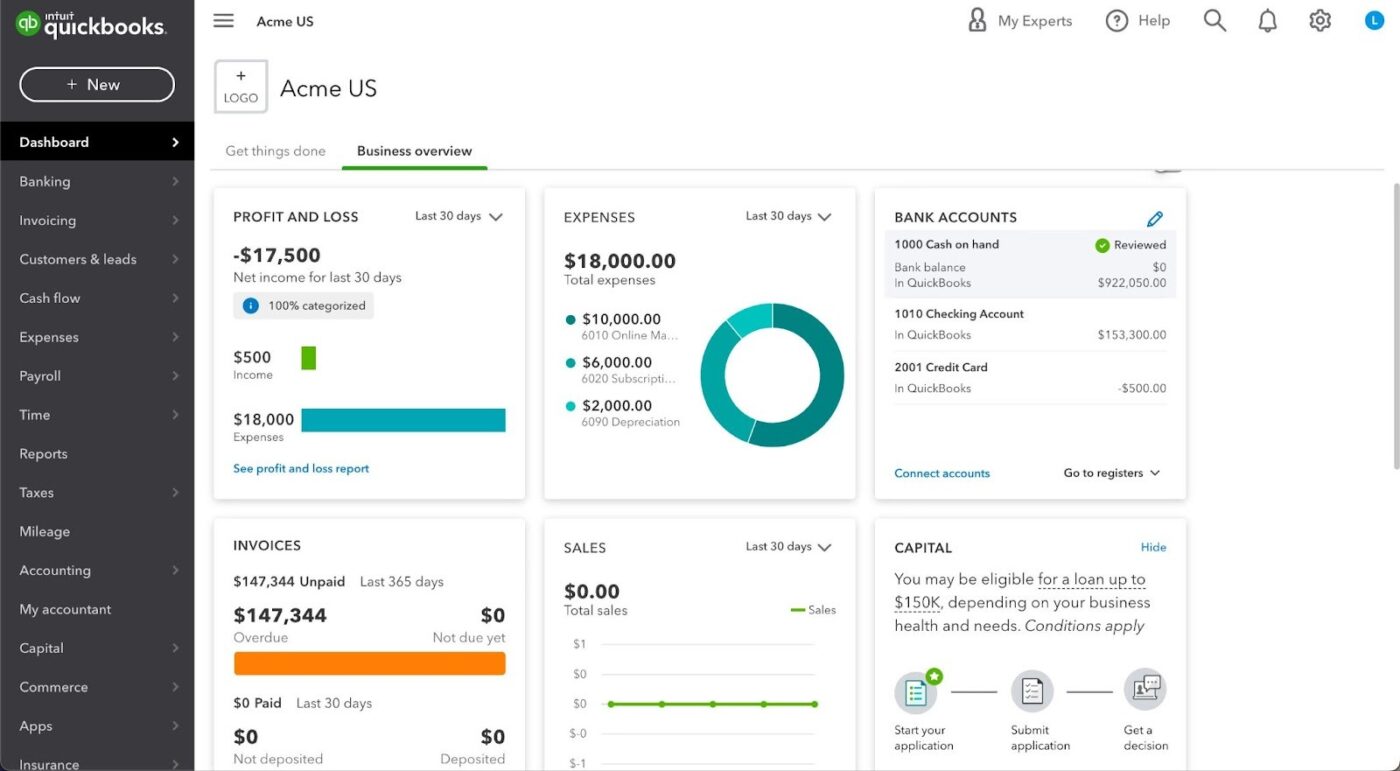

| QuickBooks (Online / Enterprise) | Small to mid-sized teams upgrading from basic accounting | Invoicing, AP/AR, Bank feeds, Time tracking and projects, Basic inventory management, Payroll and payments add-ons | Paid plans from $19/month per user | G2: 4.0/5 (3,550+) Capterra: 4.3/5 (8,170+) |

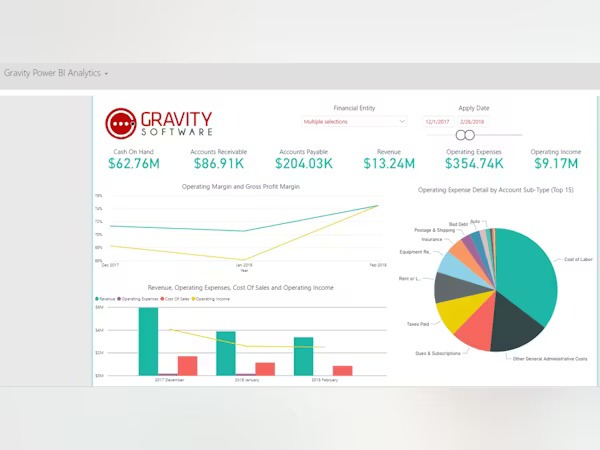

| Gravity Software | Enterprises seeking multi-entity accounting on the Microsoft Power Platform | Centralized multi-entity GL with intercompany, Dimensional reporting, Microsoft ecosystem extensions, Approvals and audit trails | Paid plans from $210/month | G2: 4.2/5 (30+) Capterra: Not enough reviews |

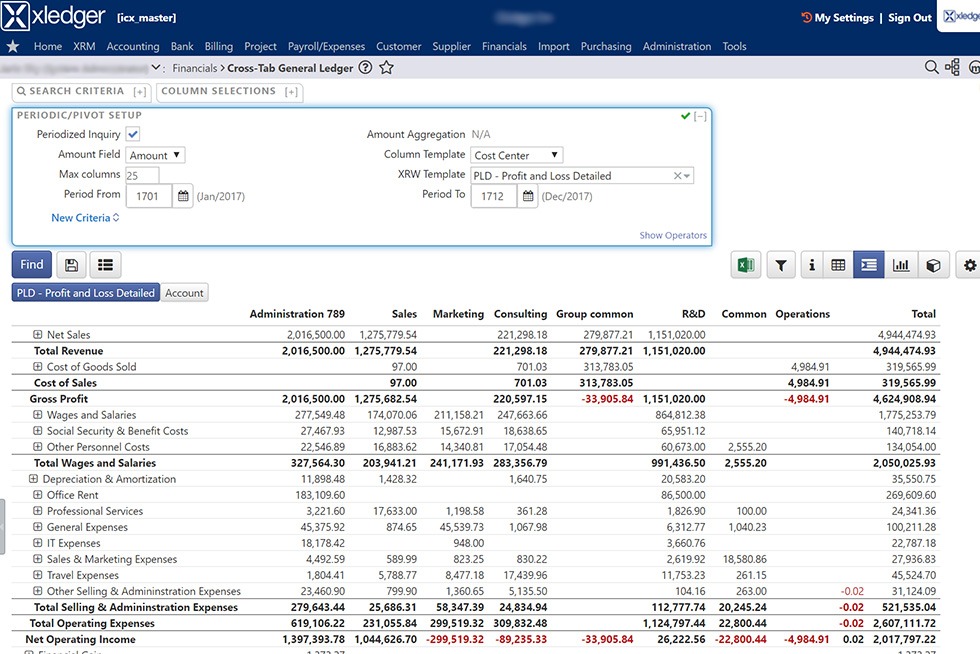

| Xledger | Cloud-native finance teams with international entities | Automated AP and bank reconciliation, Multi-company and multi-currency consolidations, Budgeting and forecasting dashboards, Built-in workflows and controls | Custom pricing | G2: 4.3/5 (50+) Capterra: Not enough reviews |

Switching core finance isn’t just a feature hunt. You want control you can trust today, plus room to scale as entities, currencies, and reporting requests grow.

Use this quick, CFO-friendly checklist to choose the ideal Sage Intacct alternative for your organization. It should do the following:

📖 Also read: Best ERP Software Tools for Resource Planning

Sage Intacct works well for many teams, but it isn’t always the right fit—especially when multi-entity needs, advanced reporting, or new integrations start to stack up. Here are the strongest alternatives to consider, plus how they compare for control, scale, and total cost.

Our editorial team follows a transparent, research-backed, and vendor-neutral process, so you can trust that our recommendations are based on real product value.

Here’s a detailed rundown of how we review software at ClickUp.

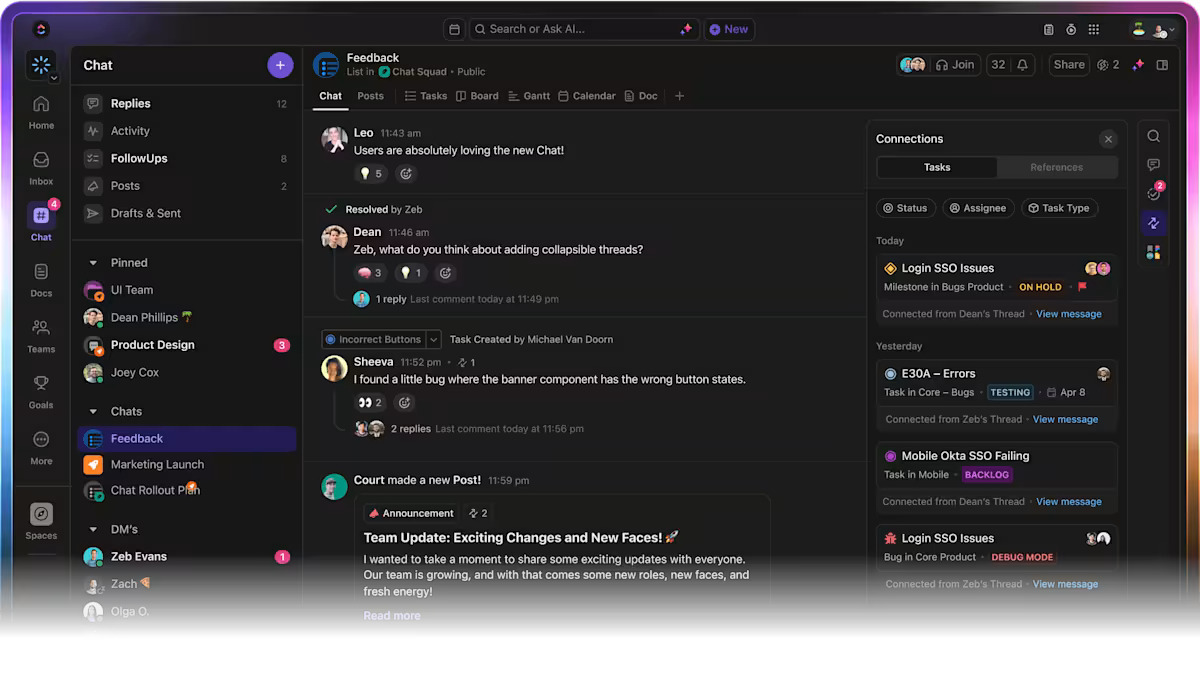

Many businesses feel the drag of work sprawl—tasks, approvals, files, and evidence scattered across email, spreadsheets, chat, and point business applications.

Layer in AI sprawl with it, and day-to-day processes then become slow and expensive.

Teams end up relying on separate systems for request intake, approvals, workforce management, and collaboration.

ClickUp for Finance Teams eliminates these problems by converging approvals, closing checklists, documentation, and real-time dashboards next to your ledger. This helps finance teams standardize processes, automate handoffs, and track progress without switching tools.

Here’s a quick overview of how you can use different ClickUp features:

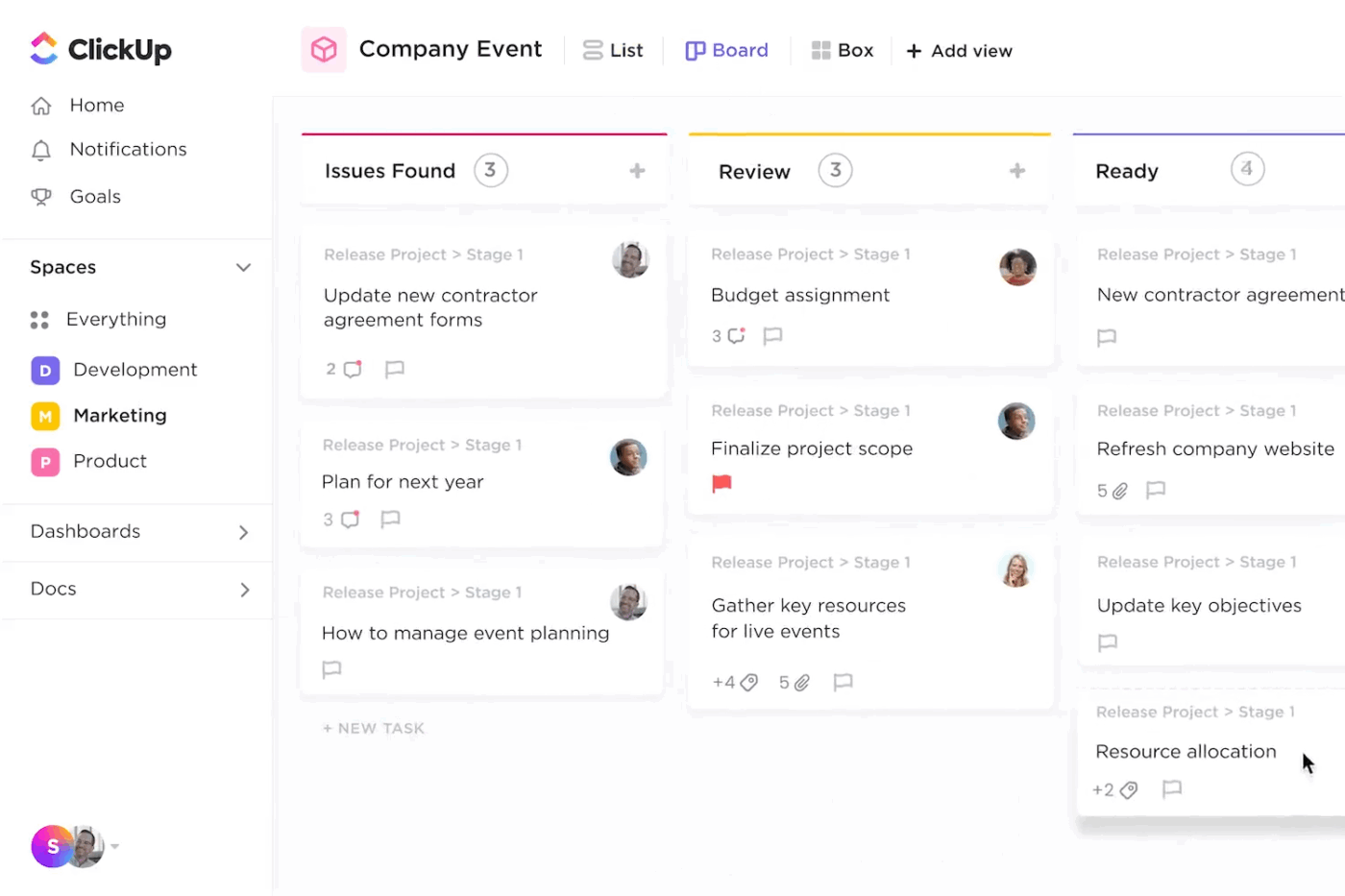

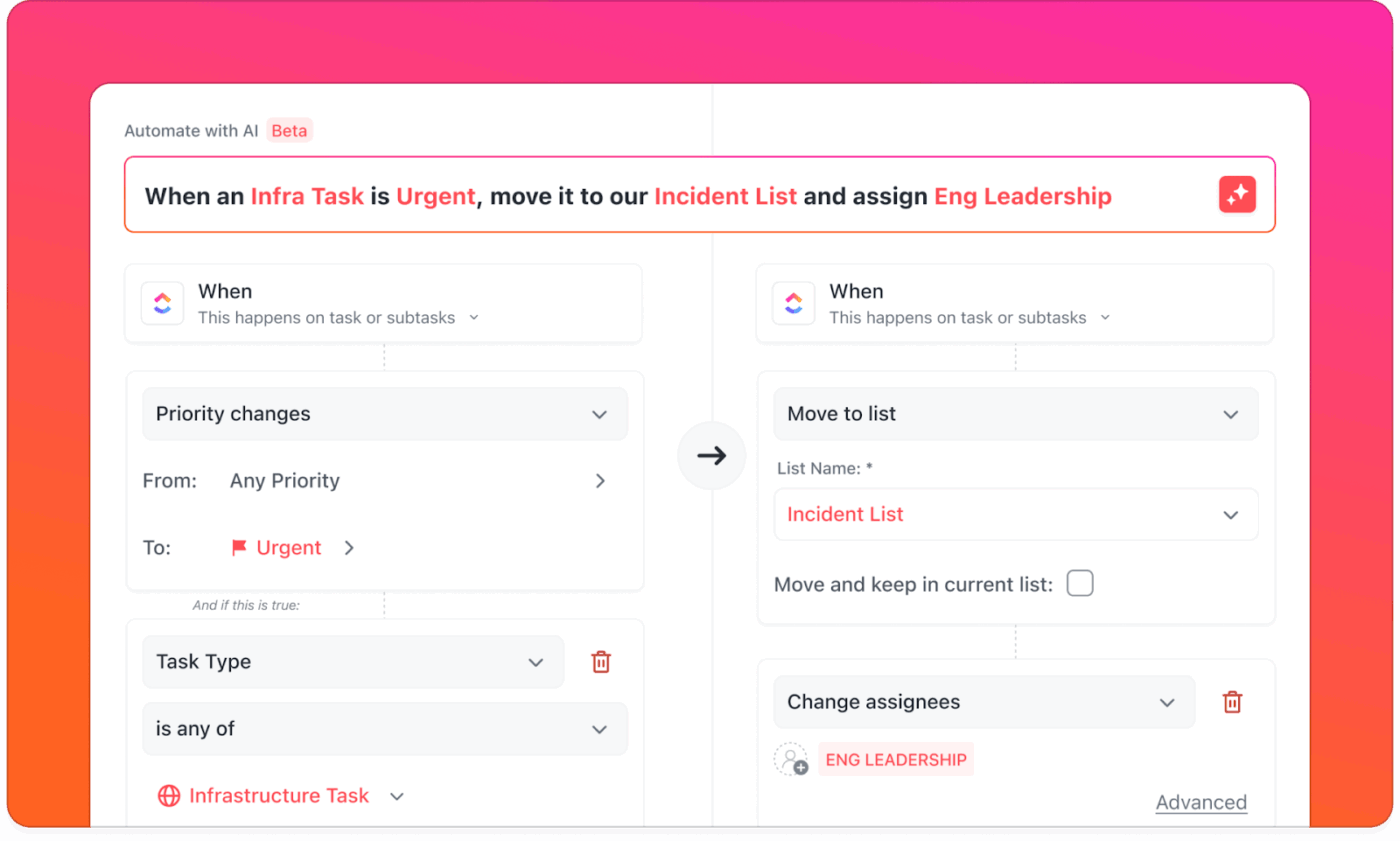

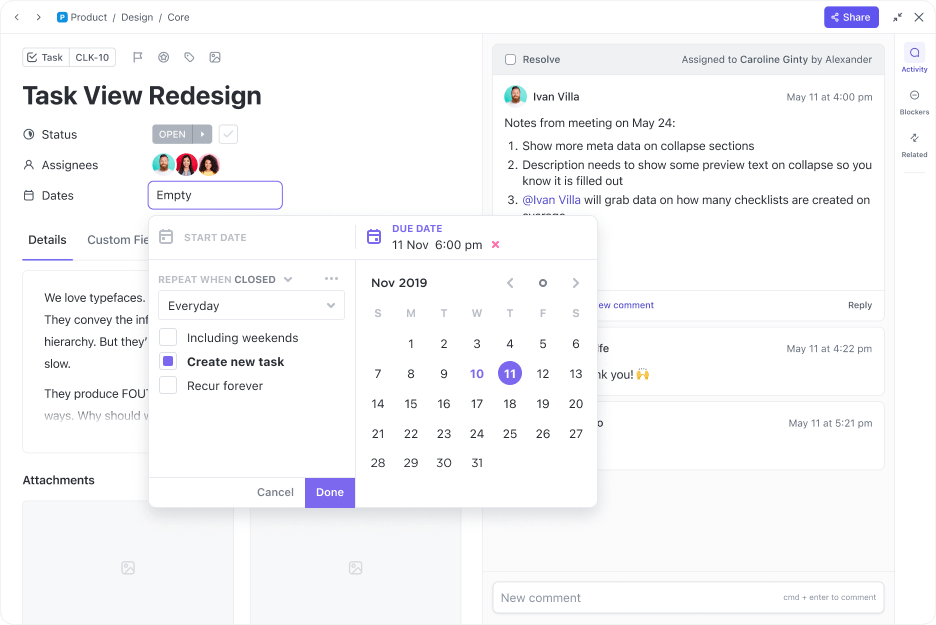

Flexible, automated approvals you control with ClickUp Automations

Stop month-end delays from email bottlenecks with ClickUp Automations, where the work moves itself. Set up simple triggers and actions once, and tasks keep moving without constant nudges.

📌Example. A bill over $10,000 routes to FP&A and the Controller. If it is tagged Rush, the due date becomes today, and a nudge lands in team chat. When required evidence is attached, the status flips to Ready to Post, and everyone is notified.

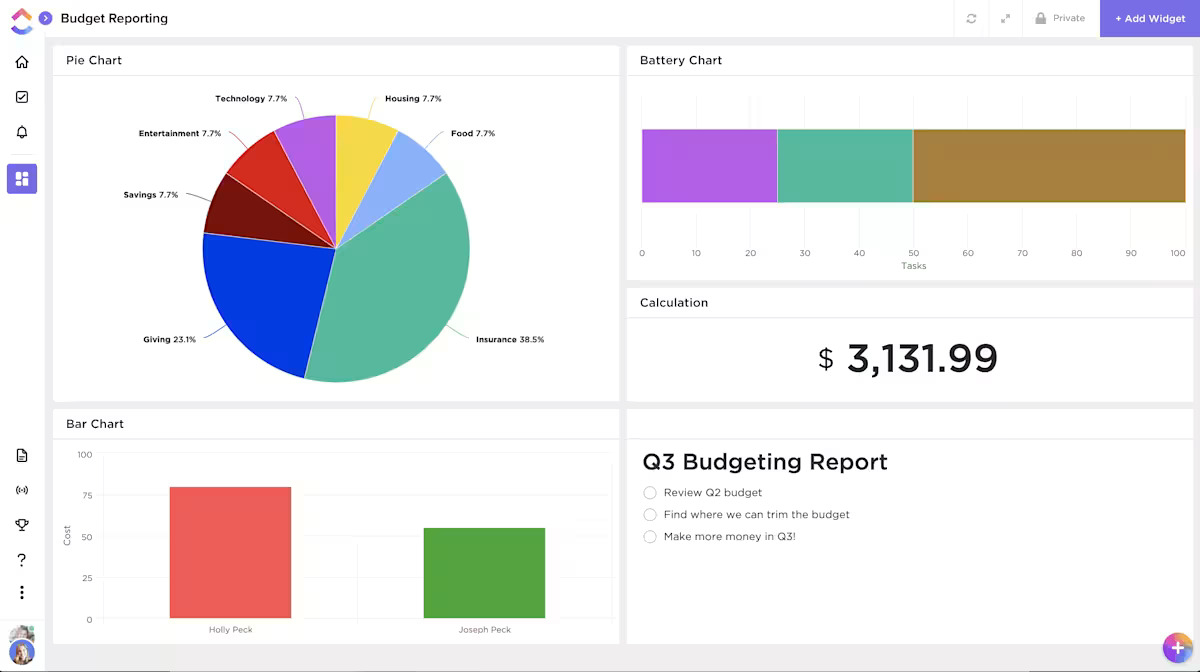

Clarity and accountability around close tasks with ClickUp Tasks

To keep prep and review visible, ClickUp Tasks assigns every step an owner and due date, with a clean interface showing what’s due today and next.

Because these tasks sit next to your ERP and other business applications, it feels like one system instead of another round of spreadsheets.

Updates that don’t break the flow of work with ClickUp Chat and Docs

Keep teams on the same page by centralizing communication.

Start a thread in the relevant task with ClickUp Chat so everybody has context. Link your SOPs in ClickUp Docs with version history so everyone works from one source of truth.

Include attachments, @assign a comment to the right reviewer, add watchers for visibility, and invite guests with narrow permissions when needed. Auditors can follow the trail quietly and stay informed without extra meetings.

This keeps multi-entity teams aligned across time zones.

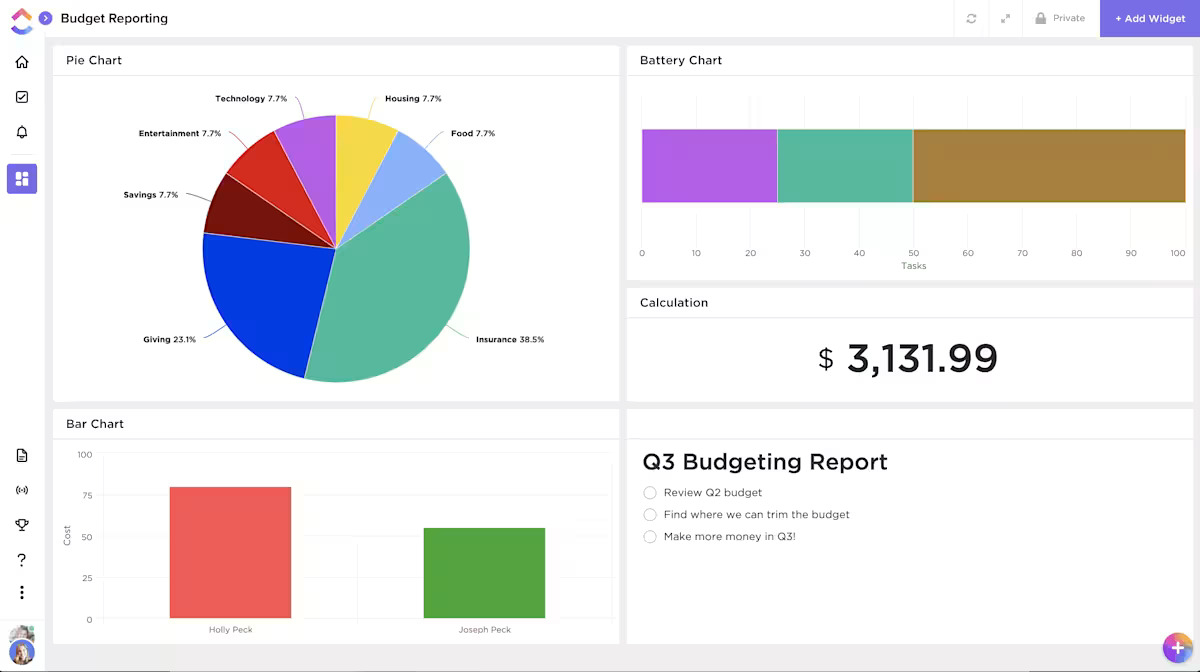

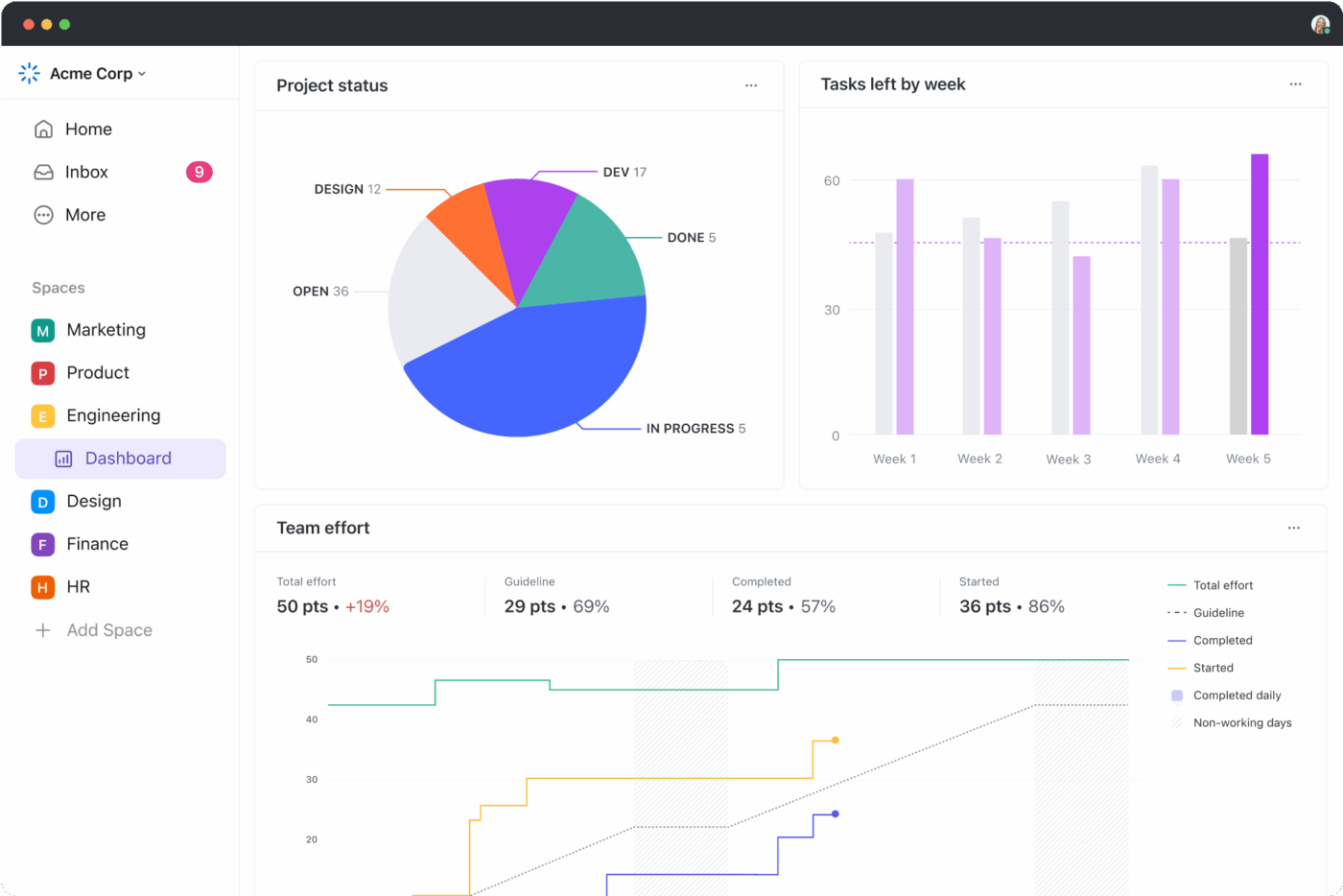

Reviews and reporting that drive change with ClickUp Dashboards

From aging to budget vs. actual numbers, track what finance cares about with customizable ClickUp Dashboards. Every widget pulls live data from tasks and Custom Fields, so you’re never looking at stale numbers.

See task completion status, overdue approvals, and urgent blockers in one screen. When something looks off, you can click once to jump into the task and fix it.

Share a live link with leadership so they see reality in real time. No spreadsheet exports and slide decks required.

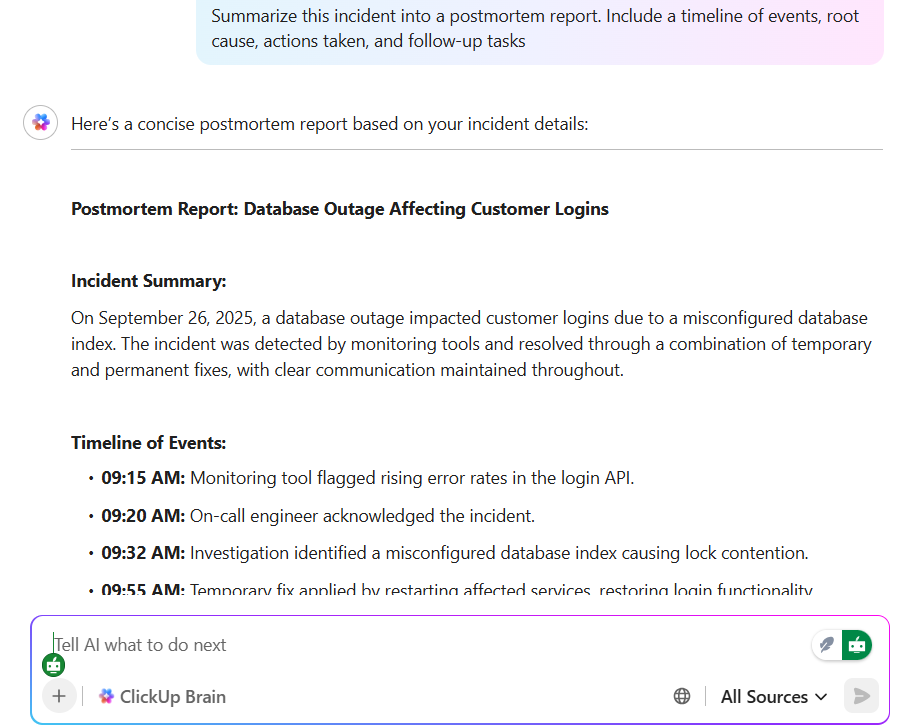

💡 Pro Tip: Speed up your close with ClickUp Brain. Ask Brain to draft flux analyses, JE narratives, and roll-forward checklists from the task context, then use ClickUp Brain MAX’s Talk to Text to capture walkthrough notes on the spot.

Layer in AI Agents to ping approvers, update statuses when evidence is attached, and publish a clean close summary for leadership—all without additional tools.

Together, ClickUp Brain and ClickUp Brain MAX help finance teams save hours each week by cutting the busywork of drafting and searching, so you can focus on analysis, cash forecasting, and closing the books instead of rewriting updates.

A G2 reviewer said:

We standardized our month-end close in ClickUp. Owners and due dates are clear, and dashboards show what’s left without chasing updates.

📖 Also read: Top ERP System Examples

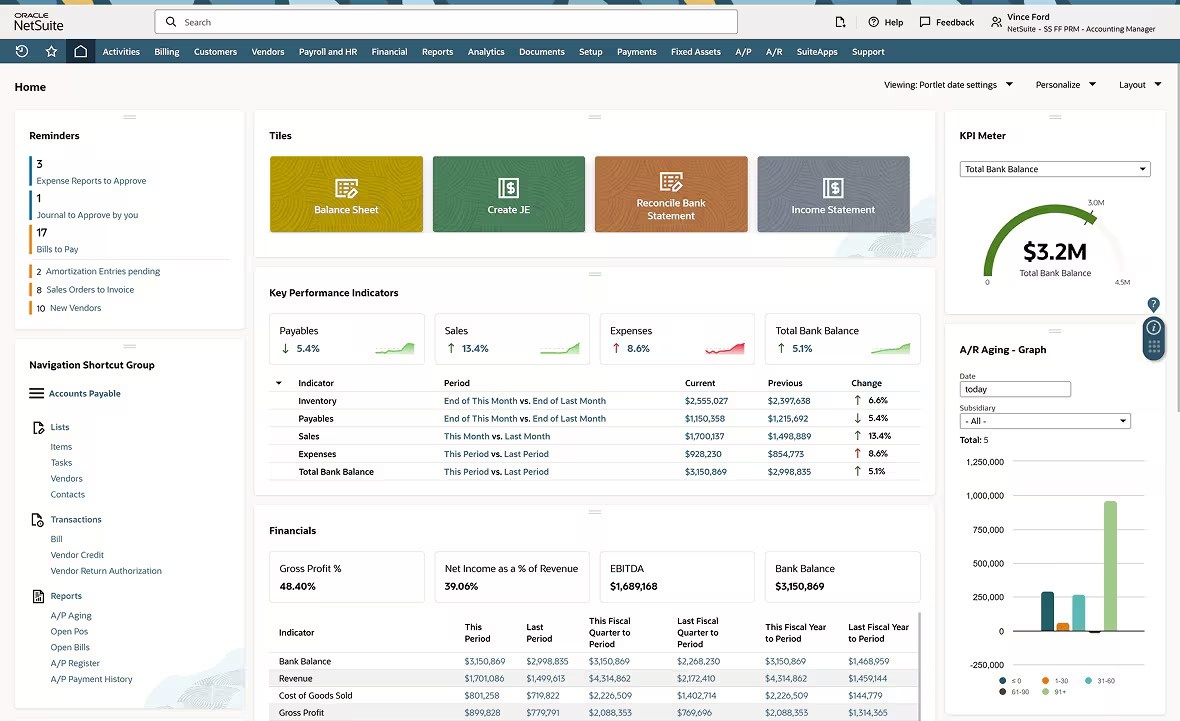

When businesses expand across entities, currencies, and tax regimes, a general accounting software setup starts to creak. NetSuite is a cloud ERP system built for multi-subsidiary consolidations, revenue recognition, and granular controls across multiple industries.

With this software, finance teams get a single source of truth for orders, billing, projects, and financial management, plus SuiteAnalytics for role-based views and KPIs.

Where it helps most is scale. Multi-entity eliminations, multi-currency revaluations, and localizations are native, so you’re not stitching separate systems together.

You can either add CRM and PSA (professional services automation) software to reduce integration overhead or retain your existing systems and connect them through SuiteTalk and SuiteApps.

A G2 reviewer said:

I really appreciate how NetSuite simplifies working across multiple markets. Its localisation features and integrations make it much easier to coordinate global projects and reduce manual effort. The visibility it gives into both financials and workflows is also a big advantage for keeping projects on track.

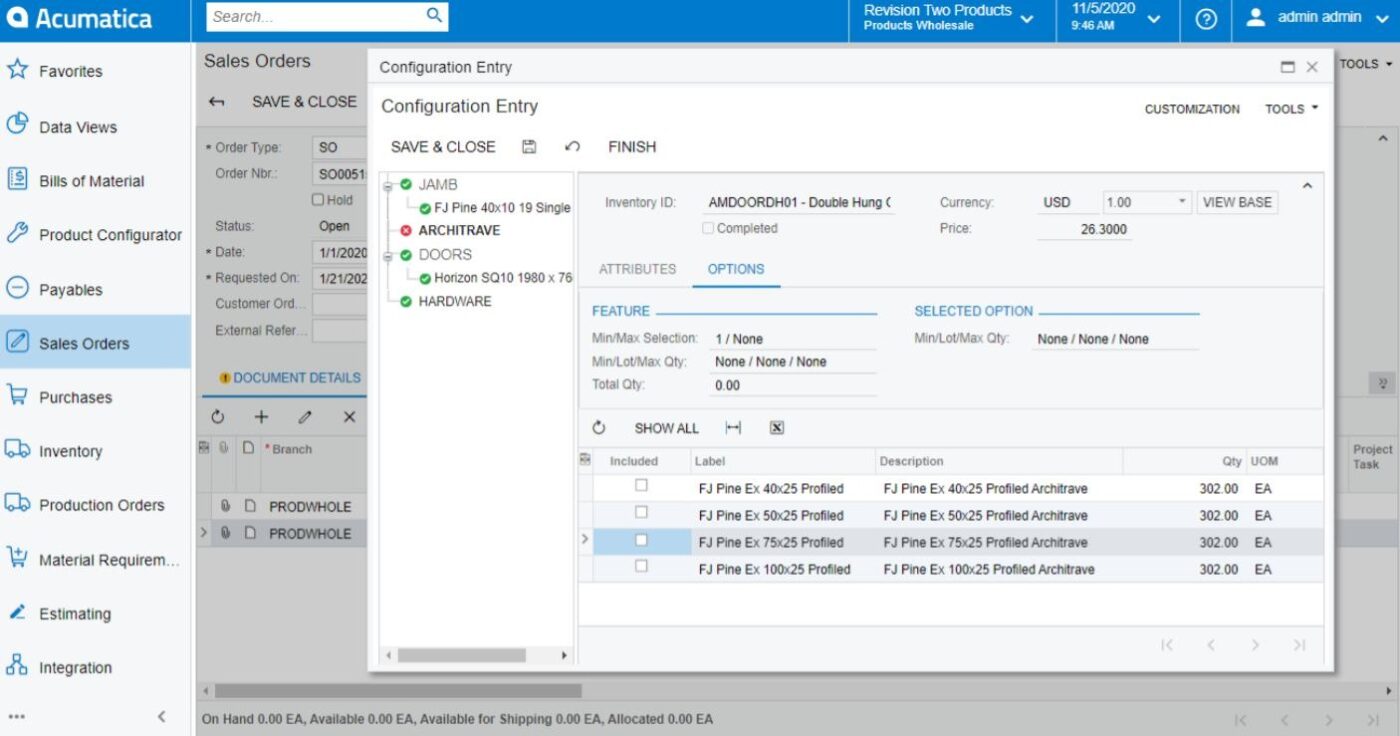

When a growing business needs deeper project accounting, distribution, and construction capabilities, Acumatica stands out. It’s a cloud ERP system built for mid-market teams that want breadth without stitching separate systems together.

Finance leaders gain control over financial management, revenue, and costs while operations run inventory, orders, and field service in one place.

Acumatica’s appeal is its flexibility. You can add modules as businesses grow, map approvals to your controls, and report by entity, project, or product line. Open APIs make integration with other systems straightforward, so your tech stack stays connected.

A G2 reviewer said:

What I really like about Acumatica is how flexible and user-friendly the system is. Once you get used to the screens, it’s pretty easy to navigate between different modules like Projects, Distribution, and Production.

📖 Also read: Best Manufacturing ERP Software (Reviews & Pricing)

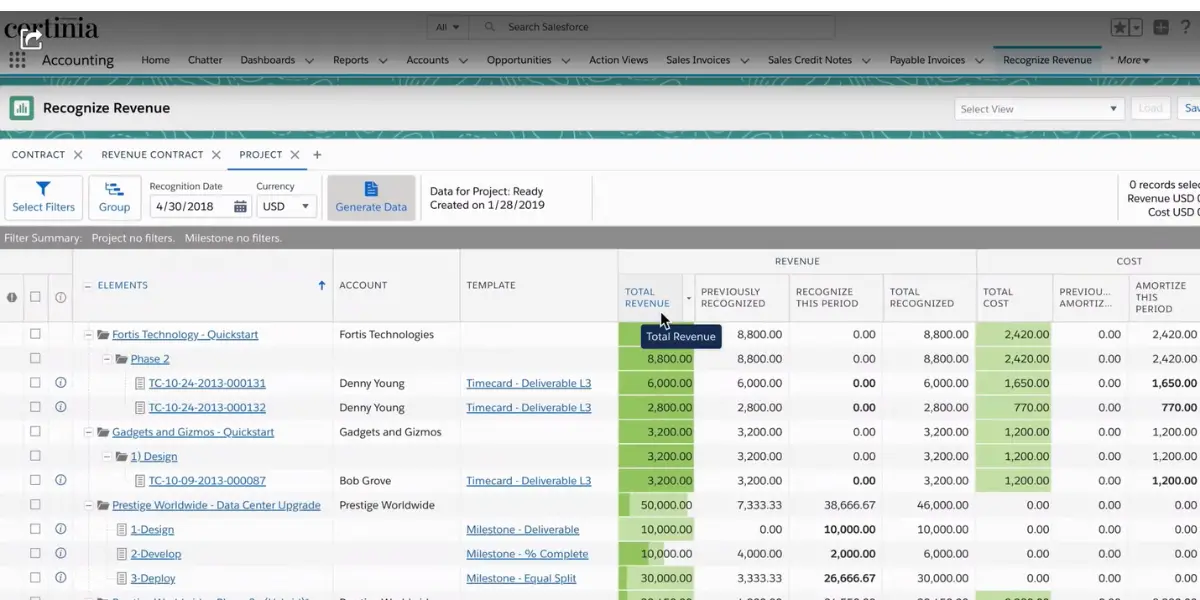

Certinia is built for services-led teams that already live in Salesforce. It brings financial management, project accounting, and PSA onto one platform, so finance, delivery, and sales work from the same CRM data. Billing, revenue, and utilization line up, which cuts rework for controllers and PMOs and helps protect margins.

Because it’s Salesforce-native, it fits the workflows you already use: approvals, objects, and dashboards. On top of that, you get subscription billing, ASC 606 revenue recognition, and multi-entity consolidations.

Resource management and forecasting give leaders a clear view of capacity and profit by project or practice.

A G2 reviewer said:

What I like best about Certinia Financial Management Cloud is its easy integration with Salesforce and how it centralizes financial data, making reporting and tracking much simpler.

📖 Also read: Real Project Management Examples for Your Team

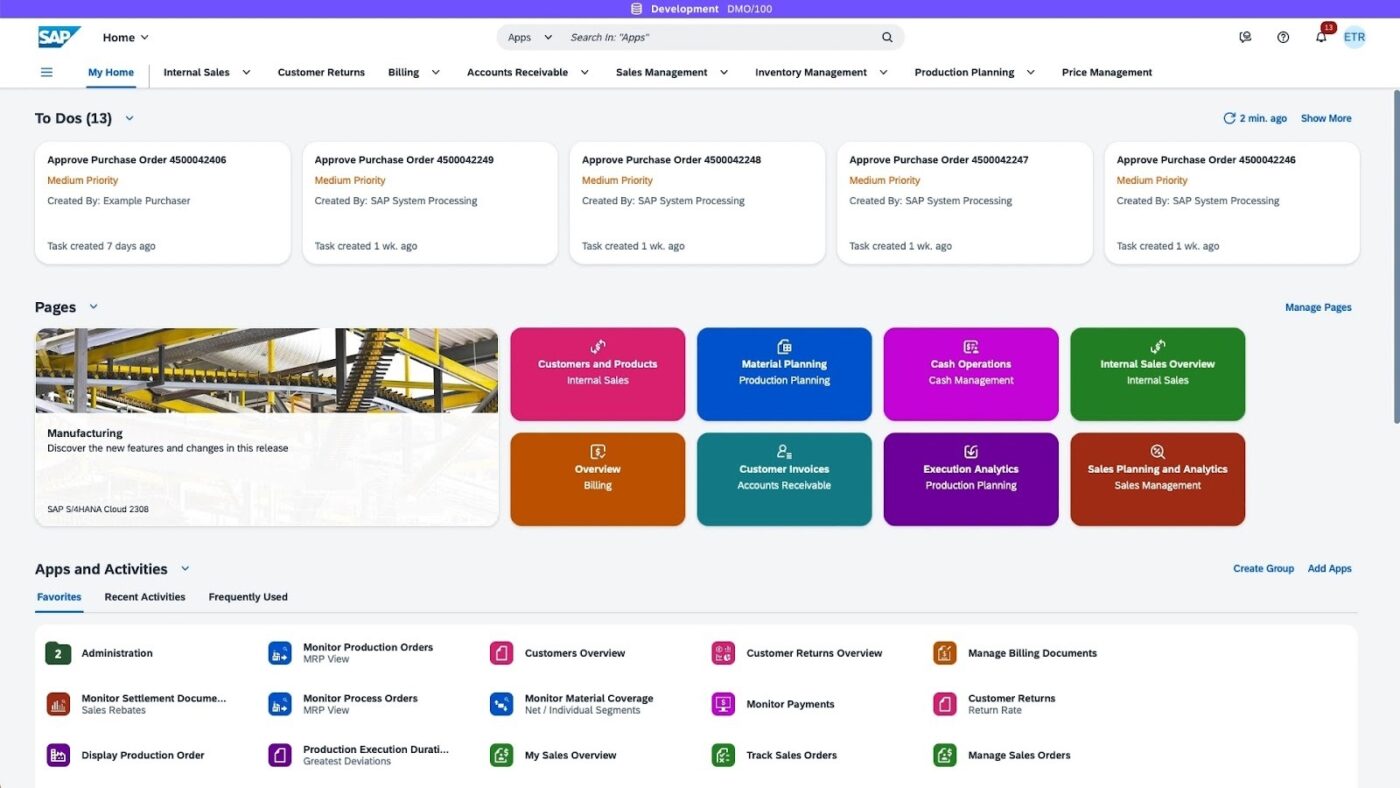

If your finance team operates across several countries, SAP S/4HANA Cloud helps standardize core accounting. You receive a global chart of accounts with local tax and statutory reporting, as well as multi-currency and localization capabilities, which reduce end-of-period workarounds.

Controls come built in. Role-based access, workflow approvals, and segregation-of-duties checks leave a clear audit trail, while order-to-cash and procure-to-pay follow defined steps so each site works the same way.

Manufacturing and regulated teams get product costing, batch or lot traceability, quality management, and asset accounting in the same system.

Reporting is embedded, with dashboards showing budgets, variances, and aging without exports, and you can drill from a KPI to the source transaction. Leaders see consistent views by entity, plant, or region.

A G2 review says:

I really like how fast everything runs—transactions and reports are super quick. For example, when I pull up inventory data, it refreshes in real-time, which helps a lot with decision-making.

📮ClickUp Insight: For 34% of our survey respondents, decision delays stem from waiting on managerial sign-off, turning simple approvals into blockers. The longer it waits, the longer you do too.

⏳With ClickUp’s Automated Approval Workflows, tasks can be auto-routed to the right approver and moved forward instantly. No more chat pings, no more inbox hunting—just smooth, hands-free progress. ✅

Dynamics 365 lands smoothly if your team already works in Microsoft 365 and Power BI. Single sign-on, Outlook and Teams integration, and a familiar interface keep ramp-up light.

Business Central suits mid-sized companies with core accounting, inventory, and light manufacturing. Projects, time, and simple approvals are built in, and bank feeds make reconciliations quick. As needs grow, add extensions from AppSource.

Dynamics 365 Finance targets larger organizations. You get stronger controls, multi-company consolidations, and budget planning, with deeper cash, credit, and tax rules. Localizations support compliance across regions.

Automation ties it together: Power Automate routes approvals and handoffs, Power Apps handles vendor requests or spend reviews, Power BI builds live dashboards, Excel add-ins speed reporting, and role security plus audit history give finance the control it needs.

A Capterra review says:

My overall experience with Dynamics 365 has been positive due to its robust integration with Microsoft tools, flexibility in customization, and powerful automation capabilities, though it’s sometimes hindered by a steep learning curve and complex configurations.

📖 Also read: Top ERP System Examples

Odoo makes it easy to get going. Most teams start with Accounting, then add Sales, Inventory, Projects, or CRM as needed. Because everything sits in one database, your numbers stay in sync.

The software helps you send invoices, match bank feeds, and track taxes. If you sell products, connect Sales and Inventory so quotes, orders, and stock stay aligned. If you run services, add Projects to track time, expenses, and delivery.

As you grow, Odoo adapts. Add approvals, checklists, and custom fields to match how you work, and tweak screens with Studio. Switch on multi-company and multi-currency when expansion starts.

You can plug in payments, tax, or e-commerce from the marketplace, turn on only the apps you need, and keep names and templates consistent so reporting stays clean.

A G2 review says:

The implementation was very detailed. Odoo gave us a proper project management team who listened carefully to our needs and also suggested ways to improve our workflows.

📖 Also read: Best Strategic Planning Software Tools

QuickBooks is accounting software for small businesses and growing teams that want the basics to work: invoicing, expenses, AP/AR, and basic reporting. Bank feeds speed reconciliations, and recurring invoices with receipt capture keep routine tasks moving.

Teams like the familiar feel. You can start the same day, track simple projects and time, and slice reports by classes or locations. QuickBooks Online plugs into payroll and payments via the app store, and quick Excel exports make sharing numbers easy.

When you need more control, QuickBooks adds deeper reporting, roles and permissions, and entry-level inventory—items, bins, reorder points—plus custom fields and memorized reports for month-end and cash reviews.

QuickBooks Enterprise offers more depth for teams outgrowing the basics. As you scale, connect CRM, bill pay, and expense tools, and keep naming and your chart of accounts tidy for smoother upgrades.

This G2 review shows how QuickBooks helps:

QuickBooks Online makes handling accounts a lot easier and more organized.

📖 Also read: Best Business Value Proposition Templates

Gravity Software is built for multi-entity accounting on Microsoft’s stack, so it feels familiar to Microsoft-centric teams. Controllers get one database for every entity instead of juggling separate files.

Intercompany is straightforward: due-to/due-from entries post in a few clicks, elimination rules keep consolidations moving at close, and a shared chart of accounts with dimensions for entity, department, or project keeps structure tight.

Reporting stays clear with role-based views and drill-downs from consolidated numbers to entries. Excel and Power BI handle slicing without rebuilding reports, while approvals and audit trails travel with the record.

Day to day, permissions map cleanly to responsibilities and workflows keep reviews consistent—making Gravity a practical Sage alternative without jumping to a full enterprise ERP.

A G2 reviewer said:

Gravity is perfect for businesses that have multiple entities (and deal with multiple currencies) as well as family or private offices. I love that transactions that are inter-company do not require additional work and that your journal entries are created for you in the back end. No more double entry!

Xledger is a cloud-first platform for multi-company finance. It automates invoice capture, routes approvals, and matches bank lines, while vendor onboarding stays clean with duplicate checks.

Consolidations are the highlight. You can roll up multi-entity and multi-currency on a schedule, set elimination rules once and reuse them, keep FX revaluation consistent, and drill from group totals down to the source entry. It connects to CRM, payroll, and tax, and the API lets you move data in and out.

Dashboards update in real time, and reporting for cash, AR, and variance is easy. Roles and audit trails keep control tight. This tool is a solid fit for distributed teams that want quick mobile approvals and a system that scales across regions.

A G2 review says:

1. It is very user-friendly as all required options are easily accessible on the home dashboard.

2. Timely updates are provided and installed in the backend without impacting work.

3. Automation of certain tasks like Bank Reconciliation has helped in saving a lot of time.

Moving from Sage Intacct is like refactoring your finance backbone. Plan the path, test the data, and give teams time to adopt new workflows.

Step 1 → Review and choose your path

Evaluate scope, entities, and must-keep reports to define requirements and shortlist alternatives to Sage Intacct

Step 2 → Map data and controls

Align CoA, entities, approvals, and reporting structures to the new platform

Step 3 → Test in a sandbox

Run a full mock of opening balances, trial balances, and a test close with sample data

Step 4→ Cut over with confidence

Freeze transactions, run final checks, migrate, then open the new period

Step 5 → Stabilize and improve

Track issues, train end users, and standardize processes with checklists and SOPs

💡 Pro Tip: Use an AI Agent in ClickUp to automatically pull financial data from your tools (like QuickBooks, Xero, or Excel), consolidate it, and generate real-time reports or dashboards. This saves hours of manual work, reduces errors, and gives finance teams instant insights for better decision-making.

Here’s a quick video explaining how you can get started:

If you’re still exploring options beyond the ones we’ve covered, here are three finance tools gaining traction for specialized workflows:

Switching ERPs is a big decision, but also a chance to simplify how finance works every day. Whichever tool you choose, the goal is the same: clean controls, clear visibility, and less time relying on email and spreadsheets.

When you choose software for your finance team, prioritize a clear user interface, dependable audit trails, tight workforce management connections, and how well the platform integrates with your existing business applications and AI tools.

For international businesses expanding internationally, compare how each vendor handles consolidations, localizations, and controls. Map the options to your growth plan and demand for scalability to avoid rework down the road.

The best alternative is the one that fits your processes today and supports the future you’re building.

That’s where ClickUp complements your ERP. It centralizes approvals, documentation, dashboards, and collaboration, so month-end, audits, and planning move faster without adding another system.

If you’re ready to streamline finance work alongside whichever ERP you adopt, try ClickUp today and bring control, context, and momentum into one place.

QuickBooks Online and Odoo offer lower entry pricing for teams with basic accounting needs, while Gravity Software provides multi-entity depth at a mid-market cost. If you’re not ready to re-platform, pair your current ledger with ClickUp as a finance operations layer to centralize approvals, close checklists, and report (often the most cost-effective near-term step). Always factor total cost beyond licenses, including implementation, integrations, and change management.

SAP S/4HANA Cloud and Microsoft Dynamics 365 ship strong native workflow engines, and Odoo’s modular apps enable flexible automation. To orchestrate work across systems, use ClickUp. Its Automations and AI can route approvals, assign tasks, post reminders, and publish close summaries alongside any ERP, so your processes run end-to-end without relying on ERP-only workflows.

Yes, but plan for implementation and change management. Smaller teams often start with QuickBooks or Odoo, then graduate to NetSuite or Acumatica as businesses grow and multi-entity complexity increases.

ClickUp centralizes close checklists, approvals, and documentation, with dashboards for real-time progress. It complements your accounting and ERP stack by reducing work sprawl and standardizing workflows.

Focus on payroll or human capital management, CRM, banking feeds, expenses, taxes, and advanced analytics. Confirm third-party integrations for multi-currency, consolidations, and data sync so financial or operational data stays consistent.

© 2026 ClickUp