Hiring Independent Contractors: Smart Strategies for Business Growth

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Disclaimer: This article is intended to provide general advice and best practices on hiring independent contractors. It is not intended to be a substitute for professional legal or financial advice.

Running a business often means wearing multiple hats and juggling numerous responsibilities.

As the workload increases, meeting deadlines without overwhelming your team can become challenging. You know you need extra help, but hiring a full-time employee feels like too much of a commitment.

Sounds familiar? Many small business owners and startup leaders face the same dilemma—needing specialized skills without the cost of a permanent hire.

This is where independent contractors come in. They provide the ideal balance of flexibility and expertise without the long-term obligations of a full-time employee.

However, employing independent contractors isn’t as simple as posting a job ad. It involves thoroughly vetting candidates, correctly classifying them, and ensuring legal compliance.

In this blog, we will walk you through each step of the process of hiring an independent contractor so you can focus on what you do best—grow your business.

Let’s start with the basics—why should you hire independent contractors?

It’s not just about expanding your team; it’s about bringing in the right expertise exactly when you need it. Independent contractors provide a strategic advantage by offering specialized skills that can drive your business forward.

And the numbers back this up:

In 2023, nearly 37% of the U.S. workforce consisted of independent workers. This trend shows that businesses increasingly rely on these experts to stay flexible and meet evolving market demands.

Here’s how hiring independent contractors gives your business a real advantage:

Deciding to hire an independent contractor is the first step. The real challenge? Finding candidates who fit the role and can deliver exceptional results.

Let’s break down what you should look out for in the “right” independent contractor for your business:

For example, if you’re outsourcing project management to develop a custom CRM system, you’ll want a contractor experienced in managing similar-scale projects. They should excel at leading teams, managing risks, using agile methods, and meeting deadlines—skills crucial for keeping the project on track.

Conversely, if you’re hiring a contractor for marketing analysis, focus on their problem-solving abilities. Look for someone who can provide specific examples of turning around a campaign that may face a sudden performance drop.

💡 Pro Tip: Before you seal the deal with your new contractor, make sure you cover crucial details:

Ready to hire an independent contractor? While the process can seem challenging, especially for small teams without a dedicated HR department, a clear plan will help you streamline it.

Here are seven steps to guide you, ensuring you employ the right person and set them up for success:

A well-crafted employment brief is essential for attracting talent and ensuring a smooth working employer-employee relationship.

Here’s how to hire the best candidates:

But let’s be honest—creating job descriptions from scratch for every position is a tedious, time-consuming task that distracts you from more strategic priorities.

You need a solution that simplifies the process and enhances your hiring strategy. AI recruitment tools can be helpful in this regard. They automate job description creation, ensuring consistency and precision while freeing up your time for more strategic tasks.

That’s where ClickUp steps in—a comprehensive productivity tool designed to boost efficiency and enhance collaboration. Let’s explore its features as we go along.

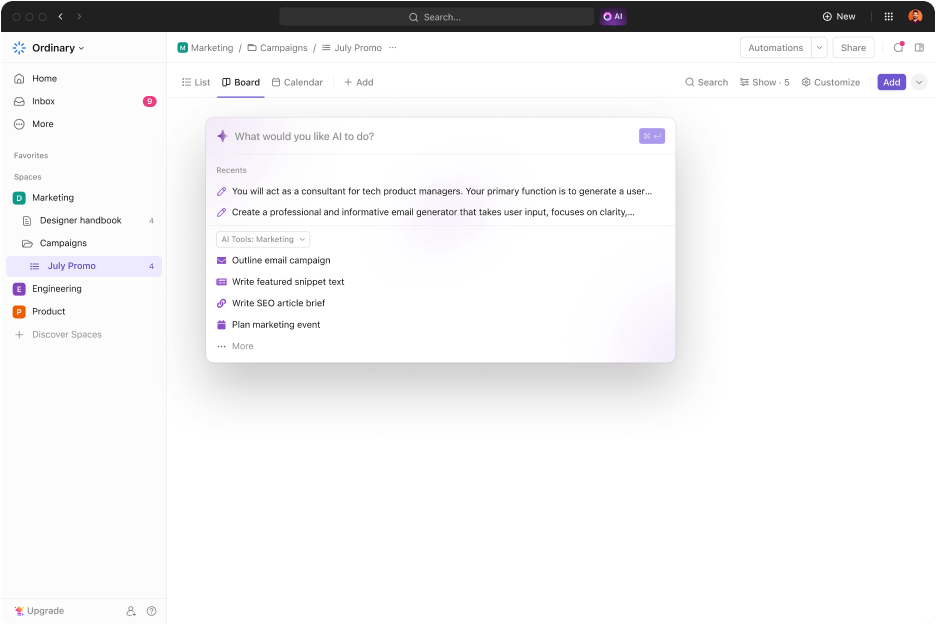

You can use ClickUp Brain to write spot-on and professional job descriptions. Its AI Writer feature offers role-specific prompts tailored for HR tasks, such as ‘Create job listing,’ to help generate detailed illustrations for any role and industry.

Input the job title or other relevant information, and the AI will craft a tailored brief. You can also adjust the tone and creativity to match your company’s style, ensuring your job descriptions are comprehensive and well-structured.

After posting your job ad, reviewing applications, and shortlisting candidates, it’s essential to determine their employment status before making a final decision.

According to the IRS, independent contractors are different from full-time employees. They are self-employed individuals who have control over how they perform their work and use their tools or equipment. They are also responsible for paying their self-employment taxes, including Social Security and Medicare.

Misclassifying an employee as an independent contractor can result in penalties, back taxes, and the need to provide ‘back pay’ for minimum wage and overtime. These issues could be costly and disruptive to your business. That’s why it’s vital to apply the correct criteria when defining a worker’s status to ensure compliance and avoid potential issues.

Here’s how you can do it:

The U.S. Department of Labor (DOL) and the IRS have set clear guidelines for specifying the correct classification. The DOL’s new rule, effective March 11, 2024, revises how independent contractor employment status is analyzed under the Fair Labor Standards Act (FLSA).

This rule replaces the previous 2021 IC Rule, which primarily focused on the nature of control and the opportunity for profit or loss. The updated rule adopts a more balanced approach, giving equal weight to all six factors—no single factor is conclusive.

Here’s a breakdown of the six factors to consider:

To back their independent contractor status, gathering the proper documentation is essential.

Here’s what you need to request:

In addition to federal laws, stay informed with all applicable State-level regulations as well and ensure you comply with them.

💡 Pro Tip: You can use consulting templates to make this process easier. This way, you can efficiently gather all necessary documentation and maintain compliance with both federal and state regulations.

As a potential employer, make sure you conduct a thorough background check before hiring an independent contractor. This step ensures the candidate is reliable, qualified, and free of issues that could disrupt your project.

Here’s a streamlined approach to verifying their skills and avoiding potential risks:

Interviews are more than skills assessments—they’re critical to gauging how a candidate communicates, works in teams, and fits into your project.

But, without a structured approach, your interview process can quickly become inefficient, leading to poor hiring decisions.

Ready-made interview templates will help you hire and interview better. These templates offer a consistent framework, ensuring each interview is thorough and covers all critical aspects while maintaining fairness.

ClickUp’s Interview Process Template stands out for its ability to simplify and elevate the entire interview process. This free template provides a step-by-step guide with customizable questions tailored to your industry’s needs.

Here’s how it helps:

So you’ve finalized your independent contractor—what’s next?

It’s time to lock it all in with a solid contract. This well-crafted document is crucial for setting clear expectations and protecting you and your contractor.

But what if you miss important details or get bogged down in legal jargon? For instance, overlooking workers’ compensation terms might result in disputes. If you forget to include reimbursable expenses or confidentiality clauses, you could face unexpected costs or breaches of sensitive information.

That’s where pre-made service agreement templates come in handy. They simplify the process, protect your interests, and lower the risk of unforeseen issues.

ClickUp’s Freelance Contract Template is an excellent choice for crafting professional agreements. It includes all the essential components and offers customizable sections designed for freelance work. Fill in your details, and you’ll have a polished, professional contract ready.

This template helps you to:

Just remember, while the template is a great starting point, be sure to seek professional legal advice before you finalize your contract documents.

Once your new independent contractor is ready to join, ensuring a smooth and engaging onboarding experience is essential. Kick things off with an orientation session to introduce them to your company’s policies, procedures, and team culture.

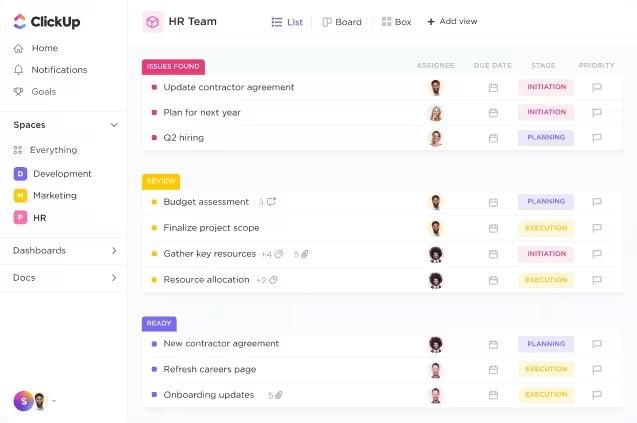

ClickUp’s all-in-one HR management platform, with its intuitive interface, makes this process effortless for teams of any size. It helps you save time and ensures a seamless transition for your new contractor.

In addition, use the following features to enhance the onboarding experience:

Bonus Tip: Use employee onboarding software to automate and streamline the onboarding process. It ensures a smooth transition by managing tasks and tracking progress effectively.

Completing a thorough checklist of legal requirements after hiring independent contractors is crucial to ensuring compliance. Familiarize yourself with relevant federal employment taxes and forms for accurate documentation, and consult a qualified legal professional specializing in independent contractor agreements before moving ahead.

You can use the checklist to help track some of the requirements:

If you’ve paid a contractor $600 or more and didn’t use a credit card or third-party payment service, you must complete Form 1099-NEC and file it with the IRS as required. This form details the contractor’s earnings and is essential for accurate tax reporting. Consult your CPA (Certified Public Accountant) to decide if you need to file any 1099 forms with your State as well

Ensure compliance with labor laws, such as the Fair Labor Standards Act (FLSA). This law sets standards for minimum wage, overtime pay, record keeping, and child labor in the United States.

Now that you’ve mastered the basics of hiring independent contractors, take your process to the next level with these free HR templates. They streamline applicant tracking, improve evaluations, and enhance workflow management, making your recruitment process more efficient.

Let’s check out the top template options to elevate your hiring strategy:

ClickUp’s Candidate Hiring Template can be your go-to for effortless candidate management. It seamlessly integrates with ClickUp Forms, Google Forms, Typeform, and other application tools. This template consolidates all candidate data into one platform to simplify workflow and enhance decision-making.

Here’s how it helps:

When evaluating different independent contractors, ClickUp’s Hiring Selection Matrix Template simplifies the process and ensures fair, informed decisions. This tool enhances organization and transparency, helping you make the best choice for your company.

This way, it helps you to:

Want to capture and store candidate information, track applications, and maintain organized records all in one place? ClickUp’s Recruiting & Hiring Folder Template makes this vision a reality. This comprehensive toolkit revolutionizes your talent-sourcing process.

Here’s how it simplifies your hiring:

A hiring checklist is crucial for streamlining your onboarding process and keeping track of all tasks efficiently. The ClickUp Hiring Checklist Template can be your ultimate ally in this journey. This interactive template outlines every step of your hiring process, ensuring you stay on top of details and deadlines.

Here’s how it helps:

After hiring, your independent contractors are ready to dive into their roles. But here’s a secret: their success hinges on more than their skills. It’s important to give them the right tools and technologies to shine. Here are some expert strategies to help you out:

Even though independent contractors might not be full-time employees, they need proper onboarding to understand your company’s culture, tools, and processes.

Invite contractors to your ClickUp workspace with tailored guest access to streamline this process. This feature allows you to pick and choose what contractors can see and interact with, ensuring your proprietary information remains secure.

Customize workspaces and dashboards to fit their specific roles, making the onboarding experience smooth and efficient.

Break down projects into precise, manageable tasks to get your independent contractors off to a strong start. This approach helps independent contractors start strong, ensuring they understand each step, meet deadlines, and stay organized throughout the project.

You can use ClickUp Tasks to map out every detail, set due dates, and add subtasks for each step. This way, it streamlines the workflow, enhances clarity, and keeps everything on schedule.

Promote open lines of communication to ensure everyone is on the same page, even when working with remote contractors.

Set up regular check-ins through email, video calls, or a project management tool. Ensure contractors know who to contact for different issues and establish a protocol for updates.

Outline the payment structure in the contract, including rates, payment milestones, and due dates.

Whether you’re paying hourly, per project, or based on milestones, ensure these details are agreed upon and thoroughly documented to avoid any misunderstandings.

Additionally, use a reliable payment system to manage transactions efficiently.

Automate payments where possible to ensure timely compensation and maintain a transparent record of all financial interactions. This approach not only simplifies the process but also builds trust with your independent contractors by ensuring they are paid promptly and accurately.

On that note, you can simplify payment processing with ClickUp’s Independent Contractor Invoice Template. Using this template, independent contractors can create, track, and process invoices efficiently.

Here’s how it helps:

Bonus: Use contractor estimate templates for seamless project management and detailed estimates. These templates streamline the process, ensuring accuracy and consistency in your budgeting and planning.

Investing in the growth of your independent contractors offers long-term benefits for your projects. Provide them with access to learning resources, training materials, and knowledge bases to enhance their skills and expertise.

Take the time to understand their working styles, preferences, and motivations. Show genuine appreciation for their contributions and make them feel valued as part of the team.

By boosting strong relationships and supporting their development, you increase the likelihood of retaining top talent and building a dependable network of contractors.

Hiring independent contractors can significantly benefit your business. Ensuring their success requires setting clear expectations, maintaining open communication, and equipping them with the right tools.

ClickUp streamlines every aspect of contractor management, from defining job roles and tracking progress to handling documents and onboarding—all within a single, powerful platform. This simplifies the process and enhances efficiency, ensuring that your contractors are well-integrated and aligned with your business goals.

Ready to elevate your recruitment efforts and hire top talent with ease?

Sign up on ClickUp and transform your independent contractor hiring process today!

© 2026 ClickUp