10 Best CRM for Private Equity in 2026

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Private equity operates at a rapid pace, with deals, investors, and portfolio companies constantly in motion—there’s always something to keep track of.

When information is scattered across emails and spreadsheets, things get messy, and missed details can mean missed opportunities.

A solid CRM (customer relationship management) keeps everything in one place. From managing deal flow to tracking investor relationships, the right tool can save time and keep your team on the same page.

If you’re looking for the best CRM for private equity, here are 10 options that deliver value. ✉️

Here are our recommendations for the best CRM for private equity:

The right CRM for private equity firms should help you manage deals, track investor relationships, and keep everything organized. A good one makes your job easier, not more complicated.

Here’s what to look for when choosing a CRM:

📖 Also Read: Best CRMs for Consulting

Not all CRM alternatives are built for private equity. You need one that can handle complex deal pipelines, track investor relationships, and enhance portfolio management.

Here are 10 best private equity CRM solutions designed to do exactly that. 📝

ClickUp is the everything app for work, bringing deal flow, investor relations, and task management under one roof. Project management features integrated into the ClickUp CRM Solution help private equity firms track prospects, manage accounts, and oversee customer interactions without juggling multiple tools.

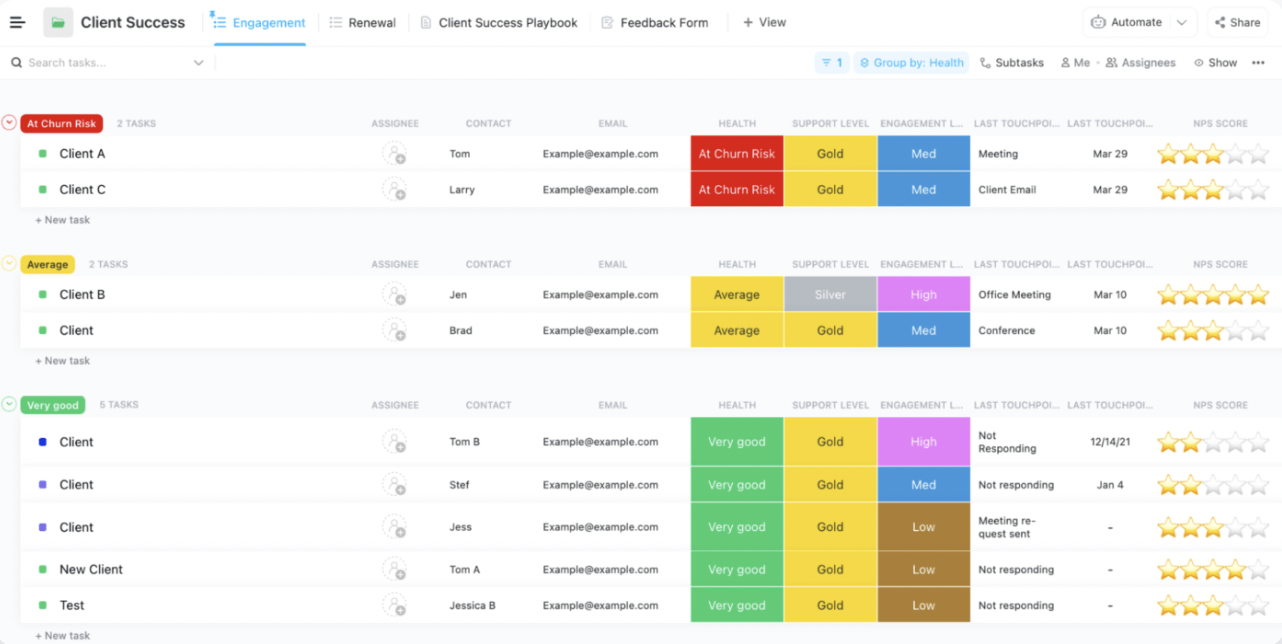

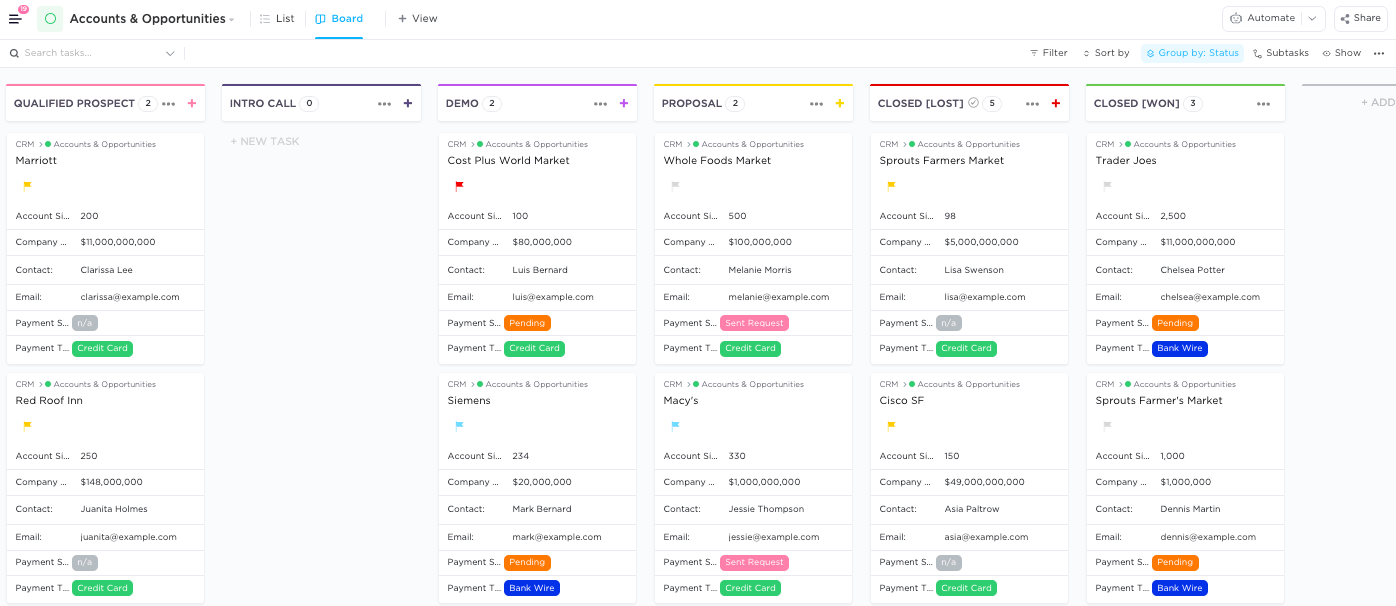

With 10+ customizable ClickUp Views, including List, Kanban Board, and Gantt, ClickUp lets you visualize pipelines, monitor customer relationships, and stay on top of every deal. List View can display every deal, sorted by stage, while Board View provides a drag-and-drop interface for tracking progress.

For instance, a private equity team evaluating tech startups can create a board where each column represents a different funding stage, ensuring a clear view of potential investments.

To keep a pulse on performance, ClickUp Dashboards bring all key metrics into one place.

Instead of pulling reports from different tools, private equity professionals can create a dashboard displaying revenue trends, valuation changes, and outstanding due diligence tasks.

An investment firm monitoring portfolio companies can instantly see financial health, workload distribution, and deal progress, ensuring that decisions are based on real-time data.

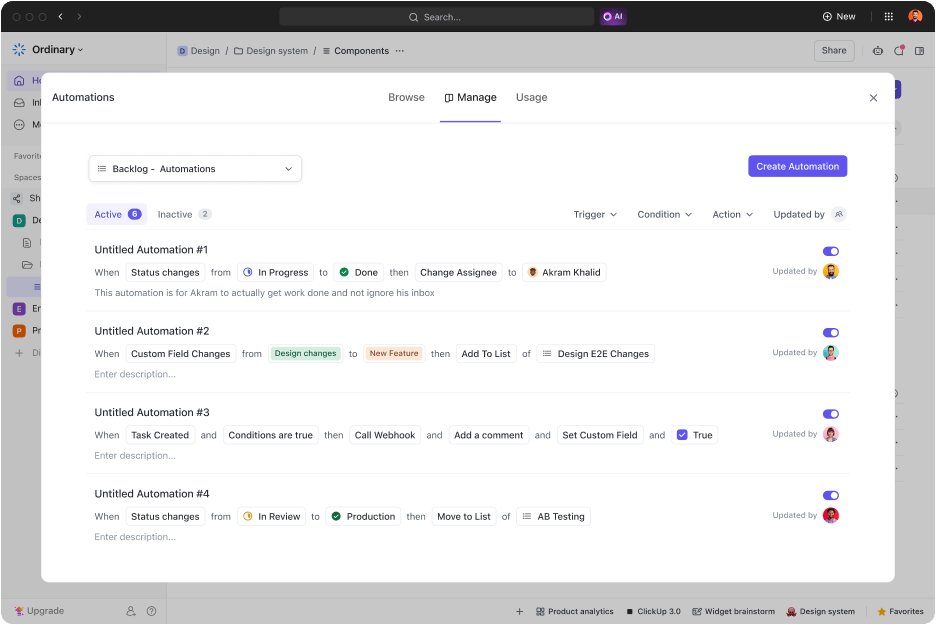

Repetitive tasks slow teams down, but ClickUp Automations takes care of them.

When an analyst updates a deal’s status to ‘Due Diligence,’ automation can instantly assign legal reviews, notify stakeholders, and update related tasks. This keeps the team focused on high-value work.

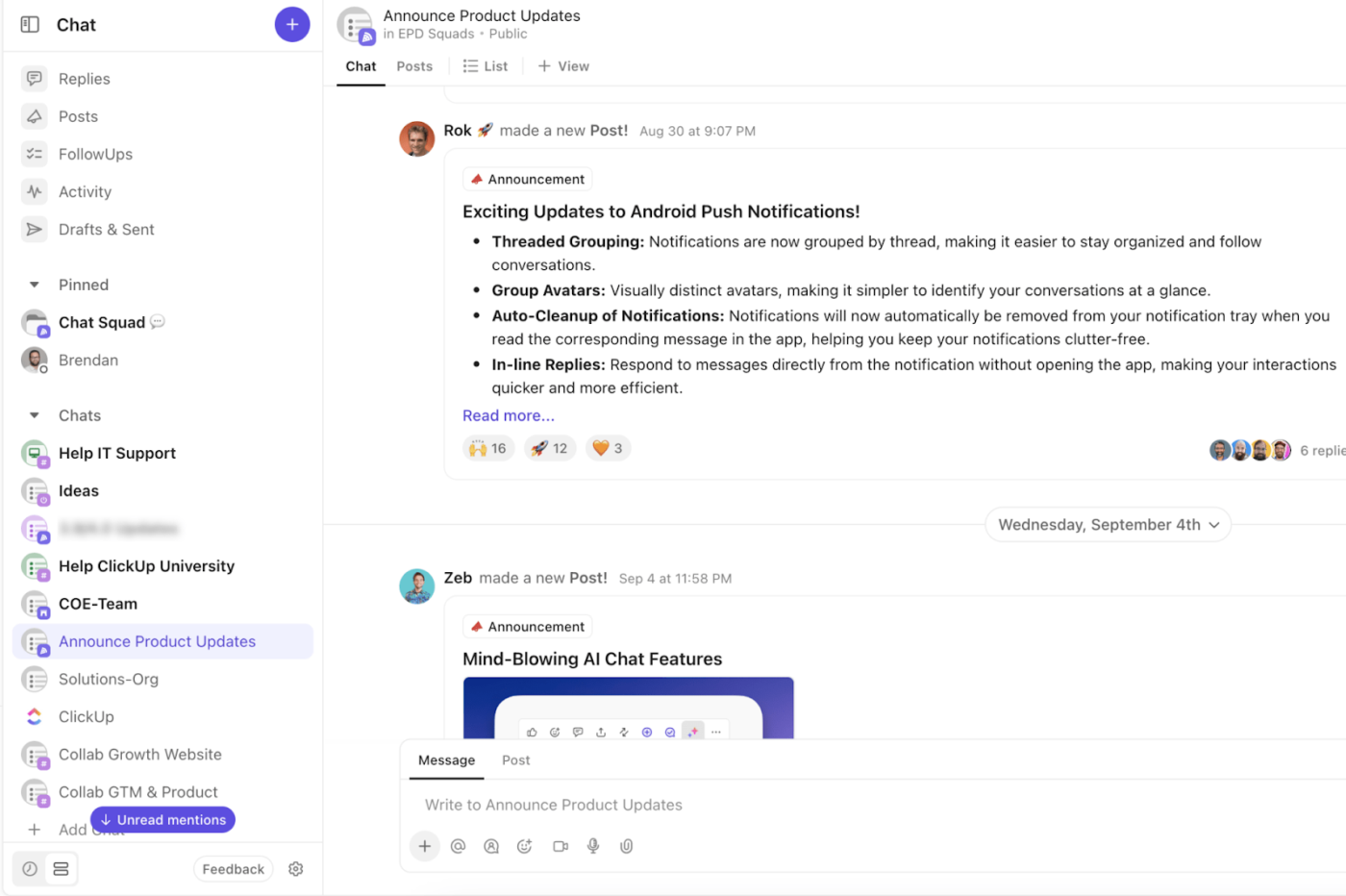

ClickUp Chat makes collaboration effortless by keeping all deal-related conversations in one place.

Knowing that critical discussions are always accessible allows teams to focus on deep work instead of worrying about missing important updates.

Need to catch up after time away? AI-powered summaries provide a quick recap of missed conversations so returning team members can get up to speed without scrolling through endless messages.

Why build a CRM from scratch when you can start with a proven system?

The ClickUp CRM Template helps businesses track sales, manage leads, and improve customer relationships without the complexity of setting everything manually.

It offers multiple Views to simplify CRM management. Sales Process View helps teams track leads through the pipeline, while Welcome View ensures a personalized experience for every customer.

You can also invite members or guests to collaborate directly within ClickUp, making it easy to manage relationships at every stage.

Here’s what a G2 reviewer had to say about ClickUp,

I love the versatility of ClickUp and that our team can customise it to suit any situation – it’s not just a project management tool; it’s a whole Operational Hub for us! We manage everything from Client work to our CRM and love the flexibility of options and the in-built automations. We also love that ClickUp is constantly evolving and that they listen to their clients!

📮 ClickUp Insight: Around 35% of our survey respondents rate Monday as the least productive day of the week. Unclear priorities at the start of the workweek could be a contributing factor here.

ClickUp eliminates this guesswork by enabling you and your team to set clear priority levels on all assigned tasks. Plus, you get ClickUp Brain, a powerful AI assistant that answers all your questions. With ClickUp, you always know exactly what needs to be done and when.

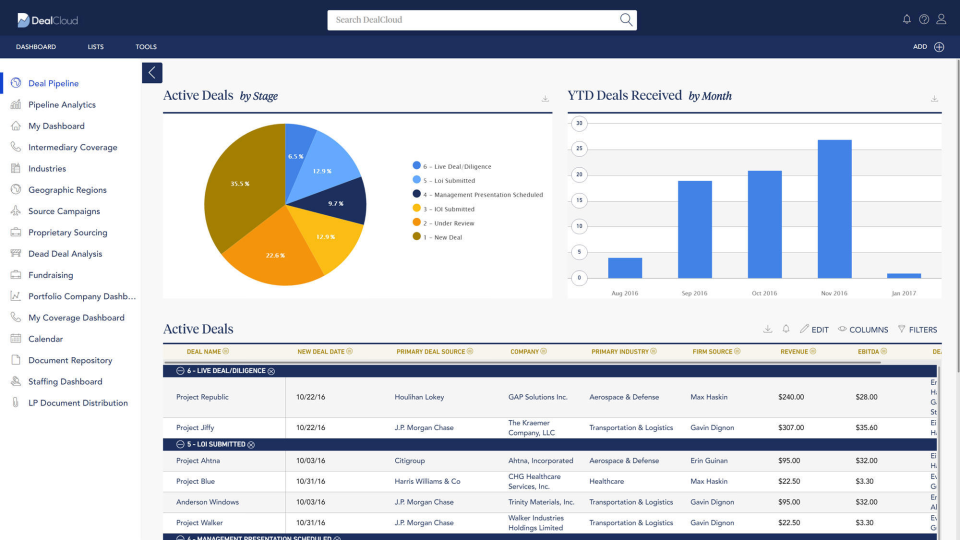

Private equity firms face unique challenges when managing complex deal pipelines, and DealCloud addresses these pain points head-on. The customizable CRM stands out for its deep understanding of PE (private equity) workflows—from initial sourcing to post-close monitoring.

Deal teams particularly value how it connects relationship intelligence with deal data, making it easier to spot patterns and opportunities. The integration capabilities with Capital IQ and PitchBook streamline due diligence, while customizable dashboards adapt to different investment strategies.

For venture capital firms handling multiple deals simultaneously, the platform’s automated tracking and real-time updates help maintain momentum across the entire deal lifecycle.

Here’s a Capterra reviewer’s opinion on DealCloud,

The DealCloud platform is architected for a number of deal making verticals such as PE, IB, specialty lending, etc. But the beauty of the platform is that these “out of the box” use cases can be further configured to our specific business workflows. We have continued to evolve our DealCloud solution as our business evolves.

🔍 Did You Know? The first private equity firm, American Research and Development Corporation (ARDC), was founded in 1946 by financier Georges Doriot. ARDC is famous for its early investment in Digital Equipment Corporation (DEC), which became one of the first high-growth companies to receive private equity funding.

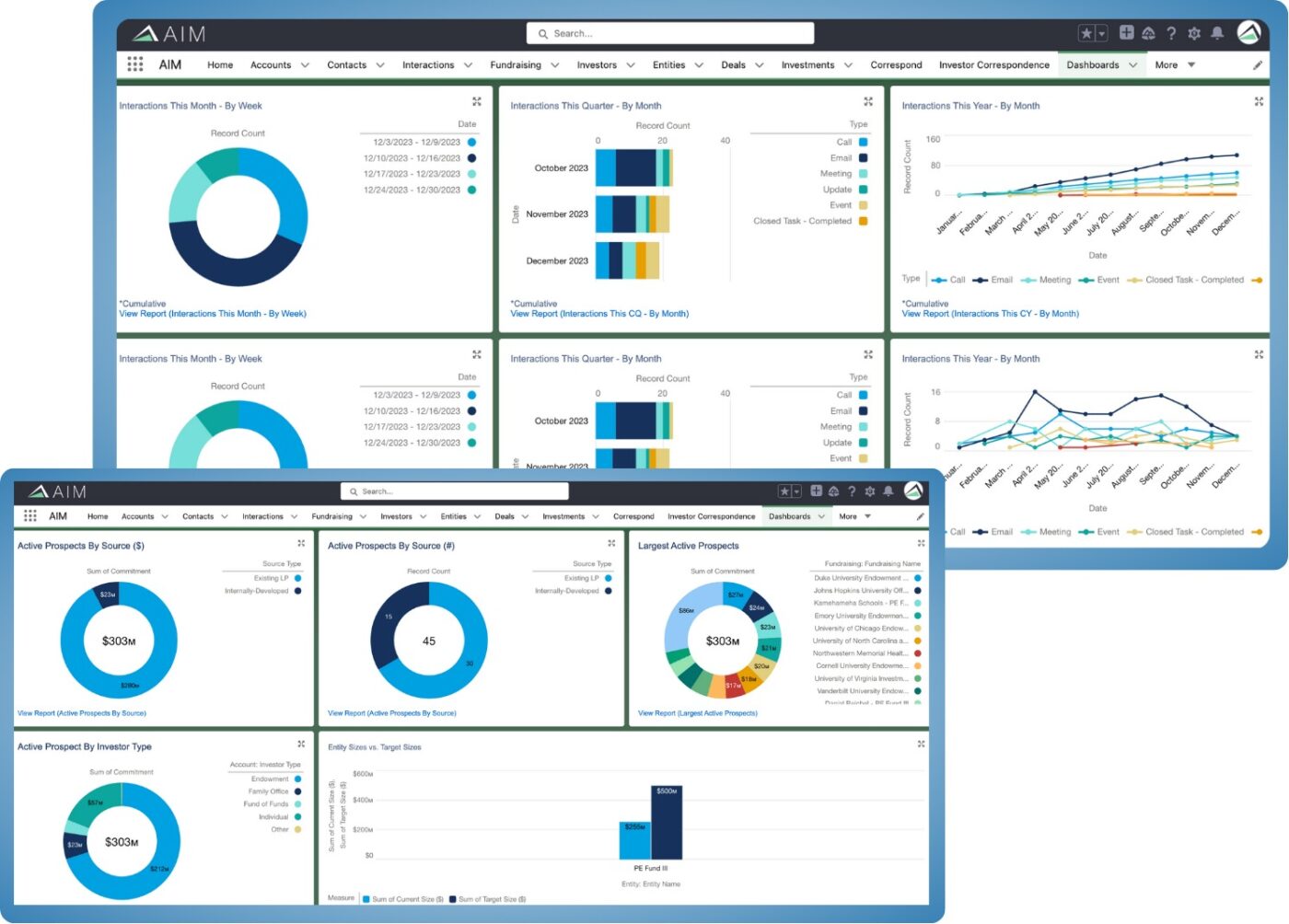

Altvia brings clarity to the often complex world of investor relations in private equity firms. The platform excels at refining LP (limited partner) communications and reporting, making it especially valuable during fundraising seasons.

It maintains detailed investor profiles, including communication preferences and investment history, which proves invaluable for relationship building. The automated reporting capabilities significantly reduce the time spent on quarterly updates, while the secure investor portal keeps LPs informed without overwhelming the IR (investor relations) team.

💡 Pro Tip: Not all deals make it into the formal pipeline, but tracking the ones that didn’t proceed—along with reasons why—helps refine future deal sourcing. Create a ‘Shadow Pipeline’ in your CRM to revisit deals when conditions change.

4Degrees approaches relationship management in private equity from a unique angle, focusing on the quality and potential of network connections.

This cloud-based CRM software analyzes communication patterns across the firm to uncover valuable relationship insights that might otherwise remain hidden. Deal teams find particular value in its ability to identify warm introduction paths to target companies and key decision-makers. Automated relationship scoring helps prioritize outreach efforts, while interaction tracking ensures that no valuable connection goes cold.

🧠 Fun Fact: Some private equity firms have produced massive wealth for their founders. For example, Blackstone’s founder, Stephen Schwarzman, has a net worth of over $20 billion, and Carlyle Group’s founders, like David Rubenstein, have seen similar success.

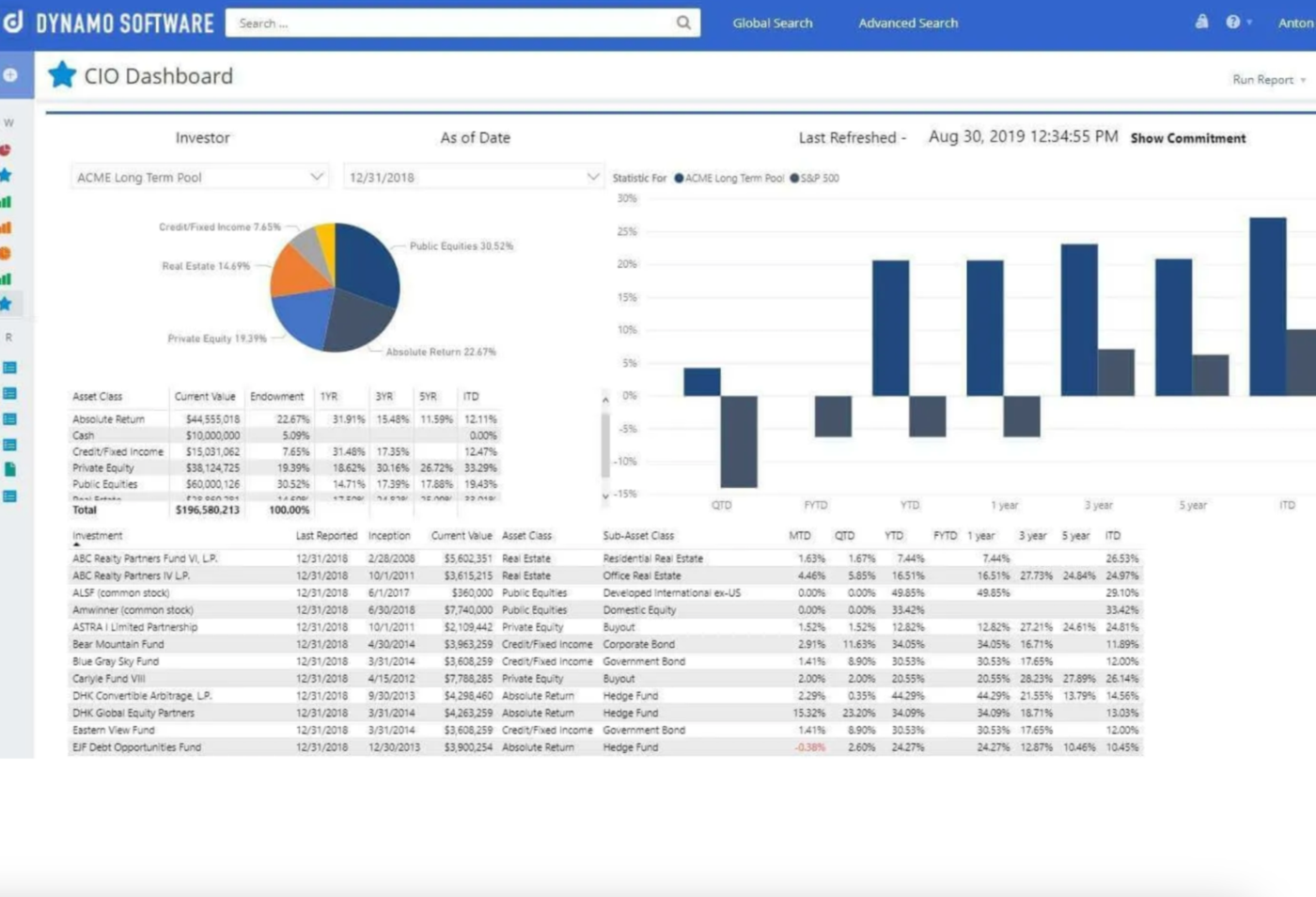

Dynamo takes a different approach to private equity CRM software by focusing heavily on the operational side of fund management.

It specifically helps middle and back-office teams with its robust accounting integrations and automated reconciliation capabilities. The platform excels at managing subscription documents and investor onboarding workflows while maintaining detailed audit trails for compliance purposes.

For firms juggling multiple fund structures, Dynamo offers tools that simplify complex fund operations.

Let’s look at what a G2 reviewer has to say about Dynamo,

I like that it is laid out in a way where you can see everything, and you can also change it so that you can see things in a different way, depending on how your mind operates.

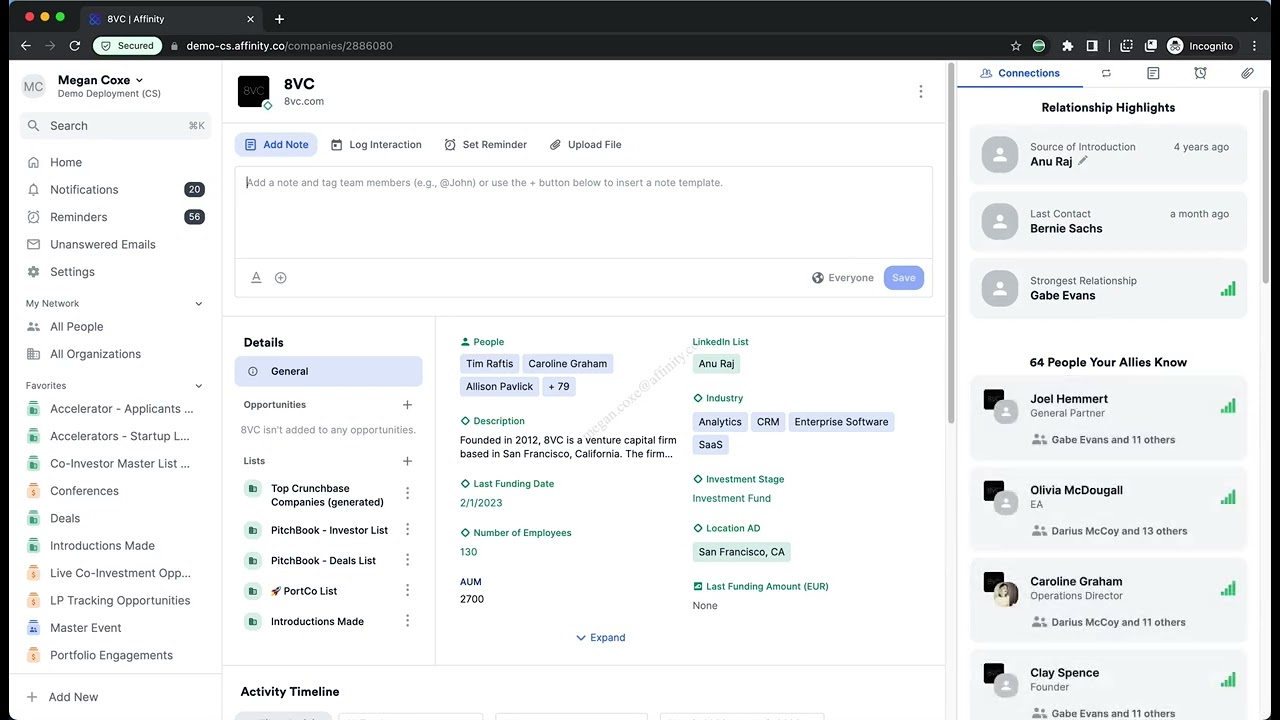

Affinity stands out by automatically capturing relationship data without manual input. It leverages AI to analyze communication patterns and identify promising investment opportunities.

Deal teams value how it eliminates manual data entry while maintaining accurate relationship records. The platform excels at identifying patterns in deal flow and relationship networks that might be missed through conventional tracking methods.

For firms focused on expanding their deal pipeline, Affinity’s automated intelligence gathering and pattern recognition capabilities prove especially valuable.

🔍 Did You Know? The 1980s are often called the ‘Golden Age’ of private equity, especially because of the rise of leveraged buyouts (LBOs).

Built on the Salesforce platform, Navatar approaches private equity CRM from a process-first perspective. The solution specializes in industry-specific workflows that match how PE firms operate.

Its standout aspect is how it handles complex, multi-stage deal processes while maintaining compliance requirements. Navatar delivers private equity-specific solutions that combine customization with ready-to-use functionality, eliminating the need for extensive technical setup.

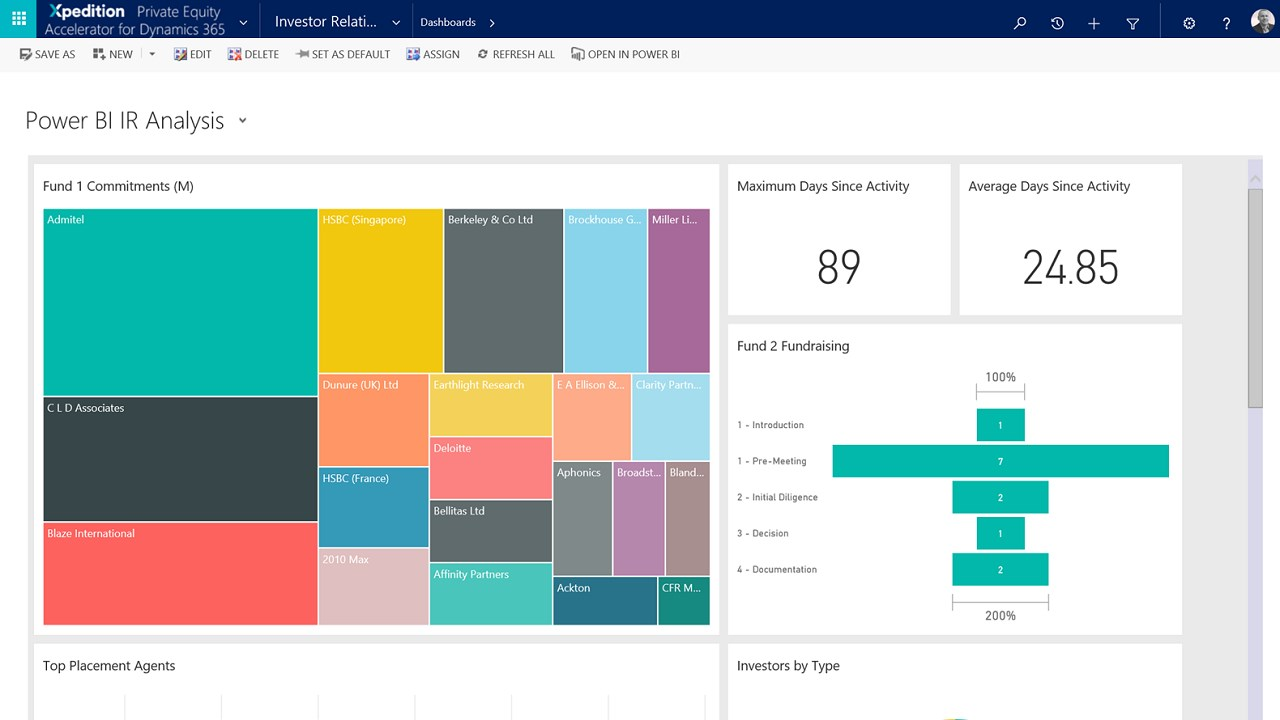

Built on Microsoft Dynamics 365, Xpedition brings a fresh approach to PE firms already invested in the Microsoft ecosystem. It bridges the gap between deal management and everyday Microsoft tools like Outlook, Teams, and Power BI.

You can save significant time through native integration with Excel financial models and PowerPoint pitch decks. Unlike other CRMs that require teams to adopt entirely new workflows, Xpedition enhances existing Microsoft-based CRM processes while adding PE-specific capabilities.

With secure, full-featured mobile access, Xpedition ensures seamless decision-making on the go. AI-powered enhancements with Microsoft Copilot further personalize investor interactions, automate routine tasks, and provide intelligent insights, allowing teams to focus on high-value activities.

💡 Pro Tip: Private equity deals take years to mature, so choose a CRM built for long-term relationship management. A good CRM tracks every interaction—from the first pitch to the exit—ensuring you maintain continuity and strategic engagement over 5-10 years.

Clienteer, now part of Dynamo Software through the acquisition of Imagineer Technology Group, is a market-leading CRM and investor relations platform designed for private equity and investment firms. This CRM software example focuses on essential PE operations without the bloat of enterprise solutions.

Its streamlined approach to deal management and investor relations suits teams that want to maintain institutional-grade processes without dedicating resources to complex system management. Clienteer simplifies the transition from spreadsheets to a dedicated private equity CRM, providing firms a seamless way to manage investor relations and deal flow.

Here’s a G2 reviewer’s take on Clienteer,

Clienteer is an intuitive and highly configurable relationship management platform designed specifically for hedge funds and institutional asset managers to assist in the areas of investor relations, sales & marketing, operations, compliance, and the various workflows related to these activities. It includes a comprehensive suite of features wrapped in an easy to use and powerful user interface, allowing users to manage communications with their investors and prospects while also keeping track of client accounts and transactions.

🔍 Did You Know? Michael McCafferty is known as the ‘Father of CRM’ for inventing TeleMagic, the first CRM software, in 1985.

SatuitCRM takes a broader approach, serving PE firms that also manage other alternative investments. It is explicitly designed for buy-side investment professionals, including institutional asset managers, private equity firms, hedge funds, wealth managers, and alternative investment firms. The tool excels at handling hybrid investment strategies and complex fund structures.

The solution particularly benefits firms managing both direct investments and fund-of-funds strategies, offering tools that adapt to various investment approaches.

Additionally, regulatory compliance is seamlessly integrated into the platform, allowing firms to manage growing private equity industry regulations with automated workflows and built-in compliance tools.

Here’s what a Capterra reviewer said about this tool,

Very satisfied in how we keep track now of all our contacts, businesses, deal opportunities, etc. Saving much time as there is only 1 database (hence, data input is done only once), after which you can easily get intelligence out of the system in a very intuitive way.

📖 Also Read: Best CRM Software for Service Businesses

Private equity is a high-stakes game. It’s not for those who hesitate, forget, or lose track. Every meeting, every investor, every deal—it all needs to be accounted for, or you risk falling behind.

ClickUp CRM keeps everything in place with custom dashboards, powerful automations, and flexible views designed for private equity.

Your pipeline? Clear.

Your tasks? Tracked.

Your team? Always in sync.

No guesswork, no scrambling, no wasted time. Just fast, efficient deal management that puts you ahead—where you belong. The best firms aren’t drowning in spreadsheets and scattered notes. They run on ClickUp. If you’re serious about private equity, this is your next move. Sign up for ClickUp today! ✅

© 2026 ClickUp