Which AI Stack is Right for Fintech Startups

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Everyone’s shipping AI features—fraud detection, credit scoring, chat support, you name it. But under the hood, models drift, metrics lag, and teams guess what changed.

The issue isn’t intelligence—it’s the feedback loop.

When systems don’t learn from outcomes, fraud slips through. Approvals become inconsistent, and compliance teams scramble to explain decisions no one remembers making.

The AI-in-finance market is set to hit $41.16B by 2030, yet McKinsey reports leaders are adopting more cautiously as budgets tighten and ROI expectations rise.

That’s why your AI stack matters. The right one keeps transactions secure and compliant, automates decisions transparently, and helps teams move faster with confidence.

📖 Also Read: Best AI Content Creation Tools

Our editorial team follows a transparent, research-backed, and vendor-neutral process, so you can trust that our recommendations are based on real product value.

Here’s a detailed rundown of how we review software at ClickUp.

A practical fintech stack has one job: turn raw financial data into safe, understandable decisions that scale. To build AI systems that actually learn and protect margins, here’s the architecture modern fintech teams rely on.

Trustworthy AI starts with clean, well-governed data.

Your data layer should ingest:

Use relational databases for structured, high-integrity data like balances, limits, and underwriting decisions. Then pair them with cheap object storage for raw logs, model artifacts, and historical snapshots.

Key requirements for this layer:

Done right, this layer becomes the source of truth for financial reporting, risk models, and data analytics across the company.

💡 Pro Tip: If you want inspiration on how to present this info to leadership, you can borrow layout ideas from ClickUp’s data dashboard examples.

AI workloads in financial technology often fluctuate. You see onboarding spikes, settlement peaks, and fraud surges around holidays or major campaigns.

A dependable fintech stack typically relies on:

Treat infrastructure as code. That way, environments for backend services (APIs, jobs, workers) stay consistent and easy to reproduce in staging and production.

📖 Also Read: Data Dashboard Examples

Every sensitive financial transaction starts with one question: Who is this, and should they be allowed to do this right now?

Key capabilities here:

Gen AI can help teams summarize cases and draft suspicious activity reports. But user trust and regulatory compliance still rely on clear human oversight.

📖 Also Read: Marketing Analytics Software Tools

This is the millisecond decision layer that protects margins while keeping satisfied customers moving.

A typical fraud detection system combines:

For payments, this layer sits directly inside the payment flow. For lending and wealth tech, it often runs earlier to pre-qualify users, set limits, or adapt pricing.

Visa, for instance, reported its AI-based risk controls blocked around 80 million fraudulent transactions worth $40 billion in 2023 without slowing card approvals.

These are good benchmarks for what modern fraud detection systems should aspire to.

The model layer turns your data into decisions across fraud detection, credit underwriting, personalization, and customer operations.

Core concepts:

As your fintech stack grows, this is also where you manage model lifecycle and cost. It’s the layer that keeps model development efficient instead of chaotic.

Choosing tools for each layer of your fintech AI stack can quietly create a new problem: work sprawl. KYC lives in one system, fraud rules in another, model cards in a shared drive, and audit notes in email.

Every new tool you add for data, models, or monitoring risks becomes one more place to check. That slows you down every time you try to ship or explain a decision.

That’s why you need two things at once:

In the steps below, we’ll remain tool-agnostic and focus on selecting the right components for your fintech stack.

After that, we’ll look at how ClickUp acts as the orchestration layer on top of those choices, so your AI tools, workflows, and teams can stay connected.

Start by defining your outcomes:

Pick 3–5 concrete results you want in the next 90 days, such as:

Then add guardrails you can’t cross:

Turn this into a short set of acceptance criteria you’ll use to judge every tech choice. If a tool doesn’t help you hit an outcome within these guardrails, it’s a distraction.

📖 Also Read: How to Use AI for Data Analysis (Use Cases & Tools)

A smart AI stack fails if data is inconsistent or unclear.

List your core sources:

For each, define:

The goal is a documented, structured data layer that supports fraud detection, credit models, financial reporting, and compliance. You shouldn’t rely on guesswork or “secret” fields.

Avoid creating a new design for every use case.

Pick a simple baseline:

Keep the hot path as short and observable as possible. That includes payments, withdrawals, and other critical risk checks.

As you grow, you can swap components (for example, change a fraud engine or add a second warehouse) as long as you keep contracts stable and the architecture readable.

📖 Also Read: Big Data Tools for Business Analytics and Reporting

In fintech, the risk loop often pays back faster than personalization or “nice-to-have” AI.

Start with one loop that runs end-to-end:

Then incrementally layer ML models onto the same loop and widen coverage to more products (cards, ACH, wallets, lending). The key is that fraud detection and risk management should run in real time and can be explained when regulators ask questions.

Resist the urge to “modernize everything” in one go.

Pick a narrow, high-value slice, for example:

Keep the feature set tight and the rollback path simple. Measure success with:

This first use case validates your data, infra, and MLOps decisions under real traffic.

Once the first model is live, focus on making it repeatable and safe to use.

You’ll need the following:

Treat models like services. They should have owners, on-call coverage, versioning, and clear dependencies. This is also where you standardize how you document model cards, policy constraints, and approval workflows, so audits are faster and less painful.

📖 Also Read: How to Conduct User Research

As the fintech product grows, the same stack must support more users, more regions, and more checks, all without high costs or complexity.

Focus on doing the following:

Periodically review which tools still earn their place: migrate off legacy systems, consolidate overlapping services, and rework fragile parts of the stack before they become bottlenecks.

📖 Also Read: How to Conduct a Competitor Analysis (+Template)

Once the stack is in motion, the main risk becomes coordination.

ClickUp gives you a converged AI workspace that sits above your fintech stack and turns those moving parts into visible, shippable work. Here’s a quick overview of how ClickUp can support your workflow:

ClickUp combines tasks, docs, whiteboards, and chat in a single place. That way, your AI stack roadmap, risk epics, and compliance work all live in one workspace.

Sounds good? Here’s what you can do in ClickUp to manage your workspace:

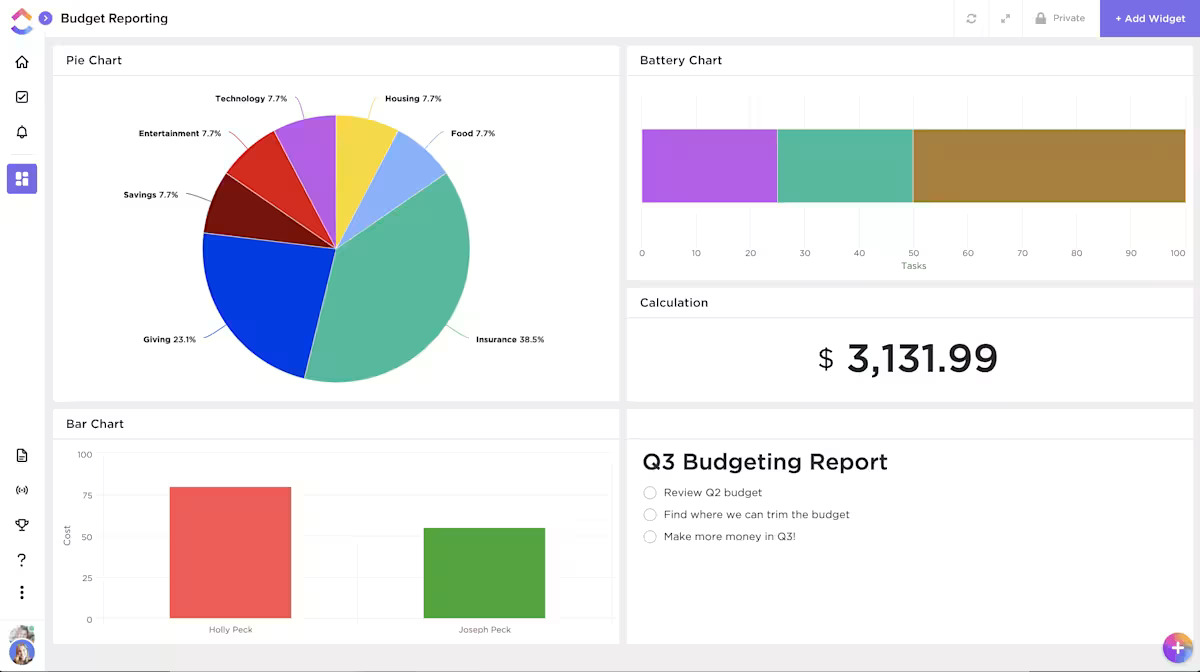

Because ClickUp Brain is built into the workspace, you get context-aware answers from your own projects and specs instead of rushing through separate AI tools.

We use it (ClickUp) to help and accelerate our daily meetings from our Scrum ritual. It helps me out getting to know the progress of my sprint, the progress of my tasks and to keep an organized backlog for all of my errands.

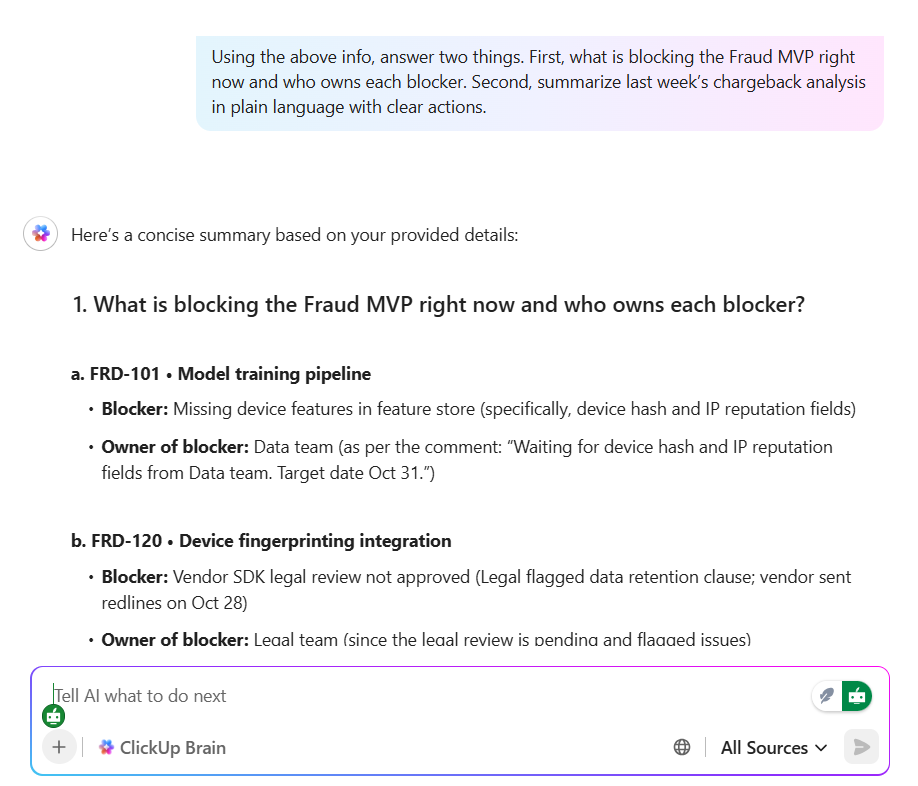

ClickUp Automations handle the routine coordination that often gets missed in AI projects. They move tasks, assign reviewers, update fields, and send notifications when states change.

You can start from 100+ templates or describe the rule in plain language and let the AI Automation Builder generate triggers and actions for you.

Additionally, we know that the Fintech workloads never sleep, but you shouldn’t have to. ClickUp Agents act as always-on helpers that monitor lists, detect changes, and trigger workflows automatically.

Whether a new drift alert hits, a PCI checklist changes, or a fraud model enters review, Agents keep teams aligned so nothing slips through cracks in high-stakes environments.

ClickUp Agents also serve as always-on AI assistants within your workspace. They listen for events, monitor lists, and run multi-step workflows, like summarizing new risk incidents, notifying the right leads, or preparing a short report on model changes.

For a fintech AI stack, that means tasks like “model v1.3 ready for approval,” “drift alert received,” or “PCI checklist updated” can trigger the right follow-ups automatically.

🎥 Thinking about creating an AI agent but overwhelmed by the setup, tools, or technical side? This tutorial breaks it down step by step, so you can build an agent that pulls data, triggers tasks, sends updates, and runs on autopilot.

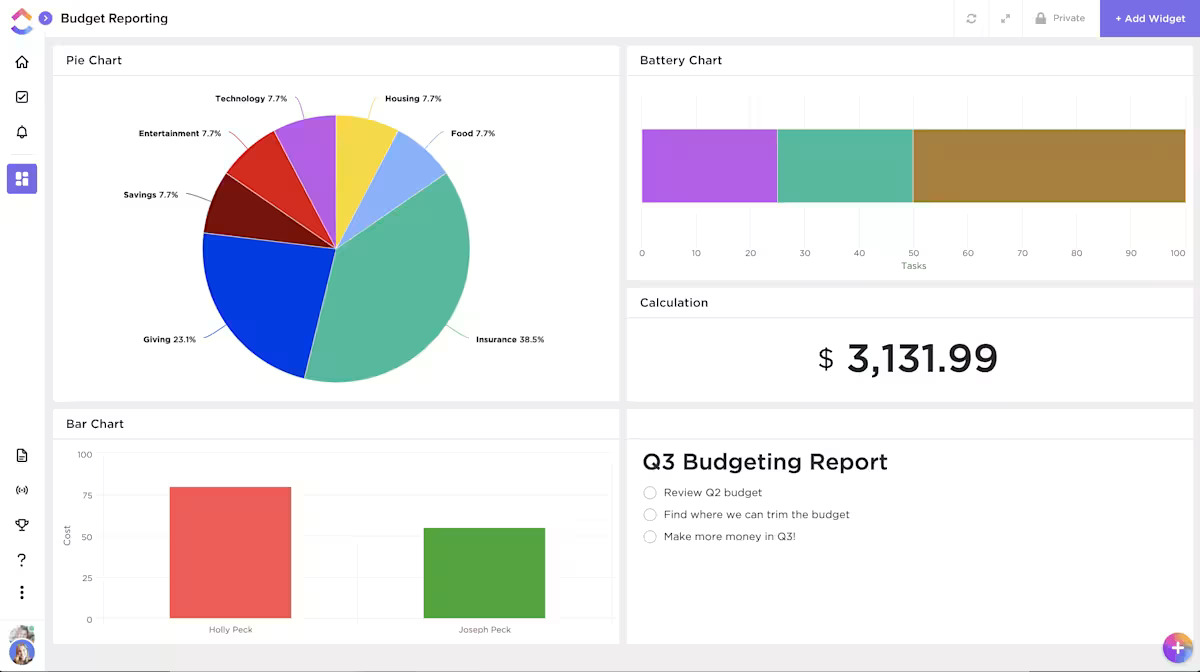

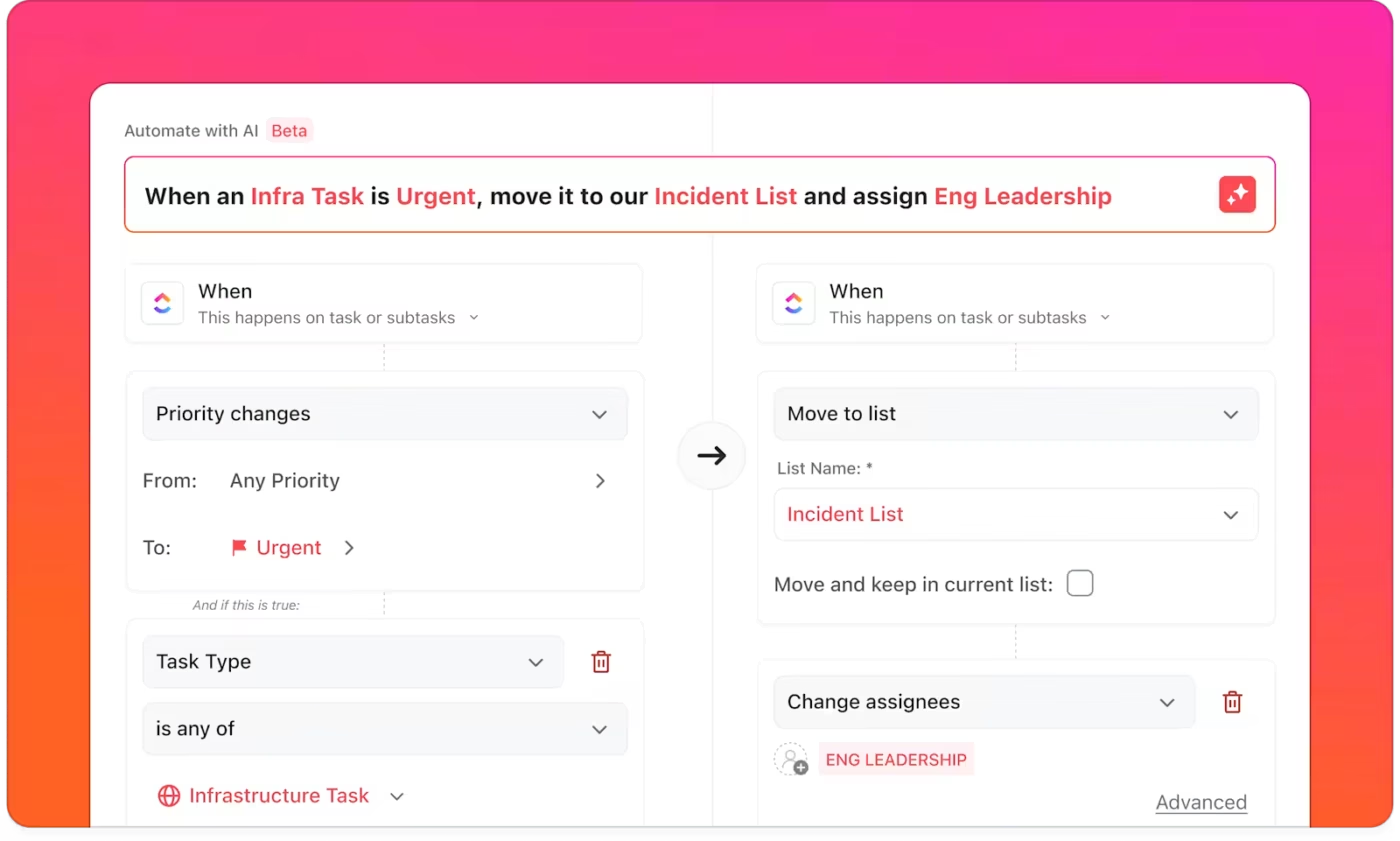

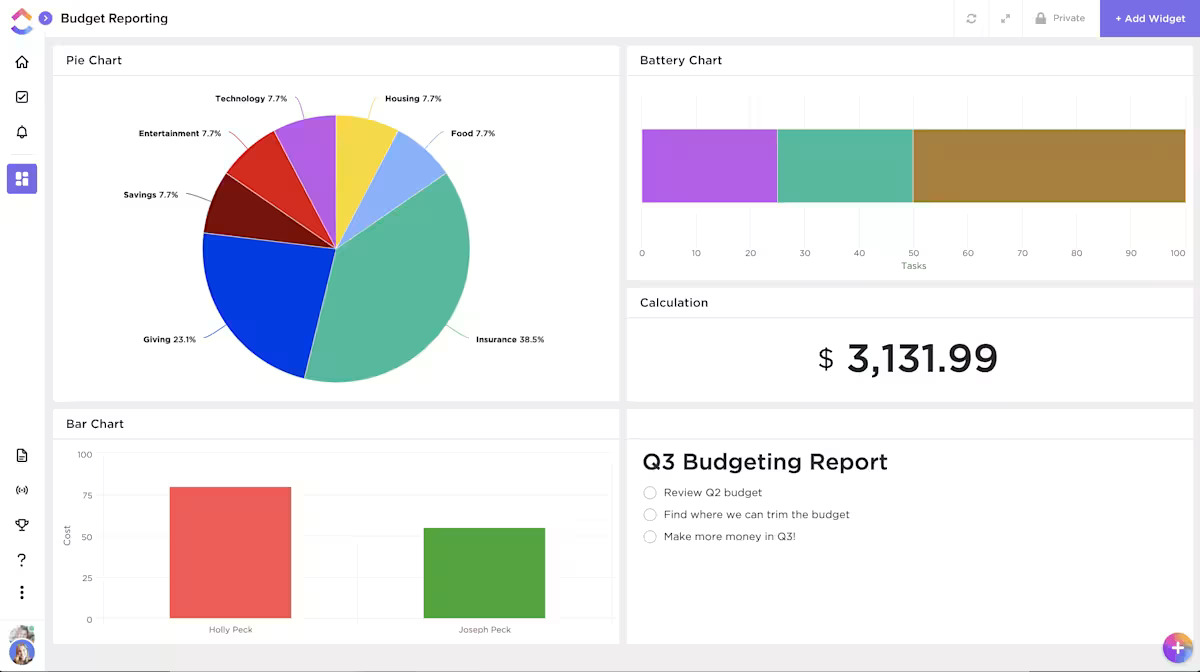

ClickUp Dashboards give you configurable views of projects and metrics in one place. You can combine charts, tables, and widgets to track anything from sprint progress to SLA breaches.

For fintech AI teams, that might include:

Instead of separate views for risk, engineering, and compliance, you receive a shared control panel that draws from the same tasks and fields.

🔍 Did You Know? Fintech is now outgrowing traditional finance: a 2025 BCG (Boston Consulting Group) report finds fintech revenues grew 21% year-over-year in 2024, compared with 6% for the broader financial services sector, and about 69% of public fintechs were profitable.

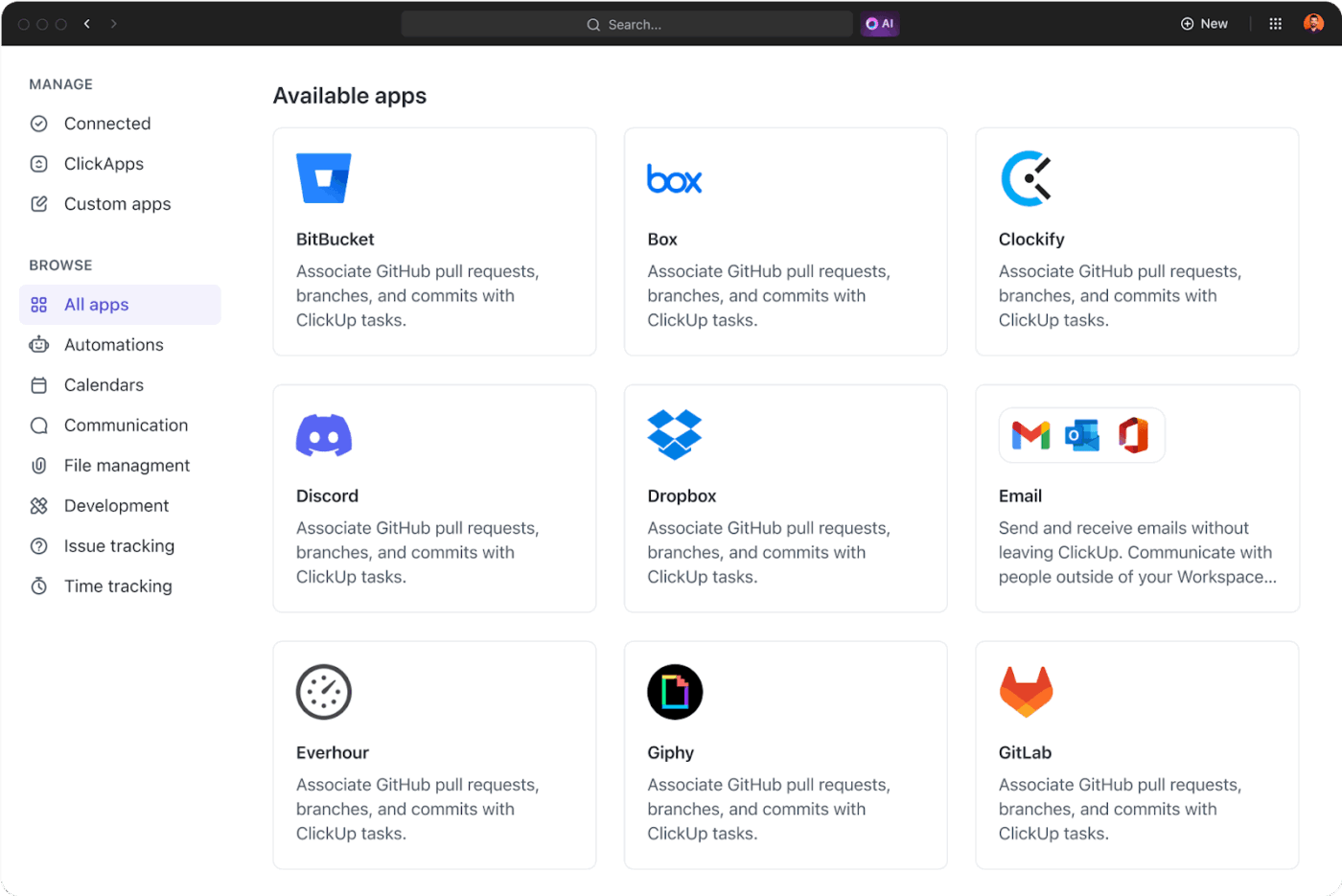

ClickUp offers integrations with 1,000+ tools, plus connectors through platforms like Make and IFTTT, so alerts and context from your stack can flow into tasks automatically.

Typical fintech setups connect:

That way, a failed fraud deployment or a new compliance ticket doesn’t just show up in yet another dashboard. It lands as actionable work in ClickUp, with owners and due dates. 🏆

🔍 Did You Know? Kenya’s M-Pesa, launched commercially in 2007, is widely cited as the world’s first major mobile money service and helped spark a broader digital financial services revolution across emerging markets.

ClickUp Brain MAX extends this orchestration to your desktop. This AI desktop companion gives you a universal AI search and chat experience across your tools, along with its feature, Talk to Text, that turns spoken updates into polished text.

You save over a day each week by dictating updates and finding buried context in seconds, all without hopping tools.

For fintech teams, that means you can:

Because ClickUp Brain and ClickUp Brain MAX follow the same privacy and SOC 2 standards as the rest of ClickUp, you can use them around sensitive financial data with clear guardrails.

🔍 Did You Know? McKinsey estimates that applying AI and advanced analytics at scale could generate up to $1 trillion in additional value every year for global banking.

Apache Kafka or AWS Kinesis gives you durable, replayable streams so your fintech apps can react quickly to financial transactions without losing messages during spikes. Teams like Nubank publicly describe Kafka as the backbone for reliable, fault-tolerant communication across high-demand banking workloads.

For persisted structured data, use PostgreSQL for transactional integrity and a warehouse like Snowflake for analytics and a feature store.

If you need proof that this pattern works at scale, Coinbase describes renovating Kafka pipelines to reduce latency and keep near-real-time analytics fresh for decision-making.

💡 Pro Tip: Maintain a simple “data contracts” ClickUp Doc for each topic (events, schemas, owners) and attach it to the corresponding engineering tasks. Additionally, link schema changes to ownership workflows, so updates don’t drift.

Your AI models will support use cases like fraud detection, credit underwriting, personalization, and claims triage. You can do the following:

Deutsche Bank, for example, has worked with Google Cloud to build the Lumina digital assistant for research analysts, using Google Vertex AI to accelerate model development and deploy AI into production workflows.

💡 Pro Tip: Create a “Model Card” template in ClickUp Docs to capture metrics like training data, fairness checks, performance metrics, monitoring, and rollback owners. Then, use ClickUp Brain to summarize training runs into one-page updates that leaders and compliance can review quickly.

📮ClickUp Insight: Nearly 88% of our survey respondents now rely on AI tools to simplify and accelerate personal tasks. Looking to generate those same benefits at work? ClickUp is here to help! ClickUp Brain, ClickUp’s built-in AI assistant, can help you improve productivity by 30% with fewer meetings, quick AI-generated summaries, and automated tasks.

This decision layer scores transactions and account events in milliseconds. You combine:

Stripe Radar is a good example of this approach. It uses data from millions of businesses and hundreds of signals to reduce fraud significantly while keeping approvals high.

👀 Fun Fact: Most card numbers have a built-in typo check. The simple “Luhn” checksum catches most single-digit mistakes and many swapped digits, which keeps insufficient data out before your fraud detection even starts.

Your API and services layer exposes clean interfaces to mobile apps, partner platforms, and internal tooling. Many fintech platforms combine:

PayPal engineers note that GraphQL became a default pattern across identity, payments, and compliance because it lets clients fetch exactly what they need and evolve without version sprawl.

📖 Also Read: How to Use Trendspotting (with Examples)

Enterprises like Capital One have published how Kubernetes-based MLOps help them support streaming decision-making and fast refits.

You need a way to move from notebooks to production safely:

💡 Pro Tip: Use a ClickUp list called “Model Releases” with tasks for each version. Then, have ClickUp Brain pull metrics from your registry (AUC, latency, drift flags) and write a short change note that reviewers can approve in the task before rollout.

Security is non-negotiable when it comes to financial transactions and identity verification. A strong security layer should do the following:

Visa notes that its AI-enabled security controls helped block about $40 billion in fraud in 2023. This is a good example of how AI-driven security features have become central to modern payment networks.

👀 Fun Fact: Your payment approval takes a world tour in a blink. An authorization request typically travels from merchant → acquirer → card network → issuer and back in real time. Many processors can complete this hop in well under a second.

For web, frameworks like Next.js and React are common for responsive fintech apps. For mobile apps, React Native and Flutter allow small teams to ship high-quality experiences across platforms.

Treat onboarding, identity verification, and chat-based customer support flows as first-class experiences. Good UX here reduces support load and builds user trust in your fintech product 💯.

💡 Pro Tip: Store UX flows in ClickUp Whiteboards and attach them to epics for easy access. Ask ClickUp Brain to propose concise microcopy variants for KYC steps or chatbot prompts, then A/B test and log results in tasks.

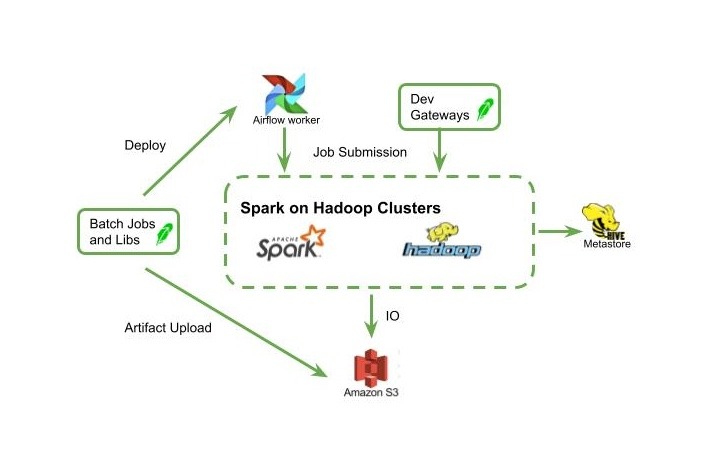

Orchestration tools like Apache Airflow or Prefect typically coordinate ingestions, retraining jobs, and backfills.

In fact, Robinhood’s teams rely on Airflow to support thousands of data pipelines across trading and brokerage operations.

For analytics, you might use Looker Studio or custom dashboards. You can use these tools to show leaders and regulators near-real-time views of risk metrics and financial operations KPIs.

💡 Pro Tip: Connect your orchestration alerts to ClickUp Integrations so that pipeline failures automatically open tasks with logs attached and assign on-call owners. That keeps your operational workflows and AI stack issues in the same command center.

Here are the practical benefits of a well-structured fintech AI stack.

When your tech stack is consistent, fintech startups can ship features like fraud detection and personalized limits in weeks rather than quarters.

Predefined data contracts, shared feature stores, and ready-to-use MLOps patterns cut down back-and-forth between data, engineering, and product teams.

📌 Example: A payments app rolls out real-time identity verification for high-risk financial transactions after seeing a fraud spike. Because the data layer, decision engine, and UX flows already share a common architecture, the team adjusts the decision rules and incorporates new risk signals, rather than rebuilding the entire stack.

🔍 Did You Know? The word “fintech” traces back to a 1993 Citicorp initiative called the Financial Services Technology Consortium, described as an early collaboration effort between banks and tech firms to drive financial innovation.

A cohesive fintech tech stack centralizes signals from devices, behavior, and financial data. That way, risk decisions are based on the full picture, not one narrow signal. Streaming scores, clear queues, and auditable notes let teams catch issues early and reduce manual churn.

You also gain better operational efficiency. This leads to fewer one-off scripts, side channels for approvals, and surprises when volumes spike.

Designing data lineage and encryption into your fintech stack turns compliance from a one-time project into a continuous process.

Decision explanations and performance reports can be tied to code and pipeline runs, making regulatory reporting easier.

💡 Pro Tip: Keep model cards, policy sign-offs, and regulatory reporting checklists inside ClickUp Tasks. Use ClickUp Brain to summarize changes each quarter for internal and external reviews.

Modern cloud infrastructure and event-driven architecture allow payment processing, lending, and investing services to scale with surges in signups.

Essential metrics, such as low-latency scoring, resilient queues, and well-defined APIs, also help maintain a stable user experience even as traffic increases.

Worried about operational expenses? Cost dashboards and regular FinOps practices help you control costs so your fintech product can grow without surprising infrastructure bills.

📖 Also Read: ROI Templates to Track Returns in Excel & ClickUp

The right tech stack for fintech turns raw events into differentiators:

Over time, proprietary signals and well-tuned machine learning models become defensible assets. With ClickUp acting as the operational backbone, you also get better visibility into which parts of the AI stack create the most revenue growth and user satisfaction.

In 2024, 79% of organizations were hit by payment-fraud attacks or attempts, per the 2025 AFP survey.

In the UK alone, £629 million was stolen in H1 2025, even as banks blocked even more.

This context is crucial: when fraud and compliance pressure increase simultaneously, weak stack decisions quickly become apparent.

Here’s where teams most often slip, and what to do instead.

Choosing the right tech stack in the fintech industry is only half the work. The other half is keeping plans, owners, decisions, and evidence in one place so nothing gets lost in tool sprawl. ClickUp gives fintech companies that backbone:

If this guide clarified your next steps, spin up a small “AI Risk MVP” project inside ClickUp.

Within a week, you’ll know if it’s the right home for your fintech product’s AI stack. Try ClickUp for free today!

An AI stack in fintech is the set of tools and systems that turn raw financial data into operational decisions.

It typically covers data storage, model training, and serving, and the interfaces that use these models for things like fraud checks, credit scoring, or customer support.

Early-stage fintech startups often begin with managed AI services for KYC, AML, and identity checks to launch faster and reduce infrastructure work. As they grow, they bring critical models in-house where they need more control over performance, costs, and regulatory expectations. At this stage, they refer to internal roadmaps and experiment tracking to guide the shift.

The highest costs come from GPU-heavy cloud infrastructure for training and inference. High-volume third-party APIs for payments, identity verification, and fraud detection follow this. Over time, specialized engineering and data science talent also add up, so many fintech companies focus on model efficiency and service consolidation to keep the tech stack sustainable.

Fintech startups treat regulations as hard constraints and design AI use cases around them from day one. They combine clear policies (for example, on data retention and explainability) with processes like human review and regular audits so customers and regulators can trust how financial data is used.

Yes. Many fintech startups begin with a simple stack focused on one or two high-impact use cases, such as fraud detection or credit scoring, plus a solid data warehouse. As they grow, they add components like feature stores, more advanced models, and event-driven systems. They expand only when the extra complexity clearly supports product goals and compliance needs.

© 2026 ClickUp