10 Free Payroll Templates in Excel & ClickUp

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

When the time comes to pay your employees for their hard work, having an organizational process in place is key. You want to be sure you’re paying them for the correct number of hours and also that you’re keeping track of the organization’s payment history.

While you can certainly do this by hand using a calculator, there are faster and better ways to get the job done. Tallying up hours for each employee at a larger business simply isn’t a good use of your time. This is where payroll templates come in.

Using a payroll template ensures accuracy, provides valuable payment data history, and makes managing your budget simpler. Best of all, the time you save doing payroll tasks by hand can be better spent on reaching goals and building up your business.

In this article, you’ll learn more about what a payroll template is and how to pick one that works for your business. We’ll share 10 free payroll templates from ClickUp and Excel to try today to manage payroll more efficiently.

A payroll template is a tool that tracks and documents hourly rates and tax rates in each employee’s state and country. It also accounts for deductions so you can pay your employees correctly. There are weekly, monthly, and yearly payroll template options, making it easy to send out payments for different types of contracts.

Payroll templates typically include basic employee information such as name, hours worked, compensation due, and tax home details. This essential information is automatically duplicated from week to week or month to month so you can create a continuous payment schedule.

Most templates also include sections for paid time off (PTO), sick leave, and overtime hours. These additional categories help with tracking your employees and keeping your payroll process organized.

Essentially, payroll templates are a great option for business owners who don’t want to shell out the big bucks to outsource project management or accounting tasks. Payroll management templates let you take control of budgets, avoid miscalculations, and ensure payments are sent out on time, all while saving money.

Ready to find the perfect payroll template for your company? Before we dive into a few of the templates we use regularly, it’s good to know what to look for when choosing one.

A good payroll template should include:

Now that you know what to look for in a payroll template, it’s time to consider your options and choose the best one for your business.

Here we’ve compiled a list of 10 free payroll templates to streamline the payroll process. Whether you run a small business with a handful of employees or a large firm with multiple departments, there’s an option to make your payroll processing easier. ✨

Avoid miscalculations and streamline your payment workflows with ClickUp’s Payroll Report Template. The tool makes it easy to collect and store employee information including the employee’s name, ID number, role, and basic contact information.

The payroll template also features sections for the employee’s department, PTO credits, and tax withholdings.

Customize the template to include the desired pay period, whether you’re paying weekly, biweekly, monthly, or yearly. List out hourly, monthly, or yearly salaries along with overtime pay rates.

One of the best features of this ClickUp template is built-in time tracking. Have your employees track the time spent on tasks during their work hours. This information is then automatically populated in your payroll report to speed up payments.

Payroll tracking and developing payment processes can be complex, particularly if you need to pay people based on the services they provide. That’s where ClickUp’s Services Timesheet Template comes in.

Use this timesheet to keep track of an employee’s billable hours and services. This makes creating a pay schedule easier and keeps all important payment information in one place.

📮ClickUp Insight: 92% of knowledge workers use personalized time management strategies. But, most workflow management tools don’t yet offer robust built-in time management or prioritization features, which can hinder effective prioritization.

ClickUp’s AI-powered scheduling and time-tracking features can help you transform this guesswork into data-driven decisions. It can even suggest optimal focus windows for tasks. Build a custom time management system that adapts to how you actually work!

Start by creating a spreadsheet, making sure to include columns for the dates, start and end times, types of services performed, the employee’s name, and the number of hours worked. Enter data as the employee provides services, and calculate total hours to determine pay on a weekly or monthly basis.

The template also provides insights into how much you’re spending across projects. Use it to inform how you allocate resources and to manage budgetary expectations. Hop into the Board view to get an overview of all services provided and payments made, filtered by project type or employee.

Eliminate mistakes, reduce the time you spend on administrative tasks, and speed up payroll processing with the Payroll Project Plan Template from ClickUp. This template is particularly useful for larger companies or small businesses that have more complex payroll needs.

The template works as a project plan for all of your payroll procedures. First, use the payroll budget template to create a project charter and document the deliverables and resources you’ll need to handle employee pay.

Next, identify team members who play an active role in the payroll process and automatically create tasks for them. These can be one-off tasks like creating payroll procedures and documentation for freelancers.

There are also options for recurring tasks and reminders for standard payment procedures like monthly payroll.

If you don’t have a payroll system in place, you need one. The Payroll Implementation Project Plan Template from ClickUp takes a complex and time-consuming task and makes it easier to handle than ever before. It creates a road map to all of your payroll processes, ensuring accuracy, compliance, and security.

Use the template to set up your payroll system, streamline onboarding employees, and monitor data entry for all payment-related tasks. Get started by conducting research on the type of payroll system or HR software you need to handle employee pay.

Next, use the template to identify stakeholders in your accounting, HR, and IT departments who will play a role in the payment process. Then choose a payroll service or payroll software. Set a timeline and budget estimates for getting the system up and running.

Finally, prepare documentation for each step including employee timesheets, pay slips, and payroll register templates. Use ClickUp Docs to store these documents, and create tasks for employees to fill out their time cards and for accounting team members to process payments.

ClickUp’s Payroll Summary Report Template lets you record all payroll data and payroll costs in one convenient location. Quickly view year-to-date payments, check out paid time off credits, and add remarks for special circumstances or to note previous payment issues.

Use the HR template to document payroll information, including an employee’s contact information and employee salaries. Record how often you’ll pay the employee, whether it’s on a monthly basis for hourly workers or biweekly for salaried employees. Fill out the information for payroll deductions, including Social Security and income tax withholdings.

All of this information is key to staying within your payroll budget. This template offers detailed insights into who is being paid what and tracks payments for things like PTO and sick leave for complete ownership of payroll management.

Plus, it’s vital information if there’s ever a legal issue surrounding employment hours or wages.

If you run a small business or need to keep track of expenditures at a larger firm, ClickUp’s Payment History Template simplifies payroll management. Use it to track all payments made by your company, whether you’re focused on salaried employee payouts or paying freelancers for work on specific projects.

Use the Client Table view to list out all employees and the payment total. You can also fill out the payment method and upload a copy of the payment invoice.

Switch over to the All Items view to see a list of all the payments you’ve made. Filter by employee to instantly see a record of their payment history, or narrow it down by department to get insights into budgeting.

Create formulas to quickly calculate payroll taxes or pay rates based on weekly, monthly, or hourly parameters. Use the Payment Receipt form to instantly add new payment records to the list. Share the form with contractors and freelancers so they can automatically add their payment requests to the queue.

The Simple Payment Agreement Template from ClickUp is an easy way to establish terms and expectations for company payroll. It’s also useful for businesses that need to record loan terms when working with freelancers as part of contractor management systems.

This template features a simple layout with standard payment agreement language. Fill out basic information including dates, names, and payment amounts. Enter the payment schedule and list any conditions for nonpayment.

ClickUp’s Payment Form Template makes it easy to track invoices and payments made to employees or customers. To use it as part of your payroll process, start by creating a payment form using the template. Fill out the information for the employee’s name, contact information, and method of payment.

Set up automations so that a completed form triggers a new task to process the payment. Customize the automations to fit your business needs, and assign tasks to the correct departments.

Next, hop into the Payment Tracker view to see a list of all current and past payment forms. Use filters to narrow down the view by payment method, employee, or pricing. Upload receipts to track all relevant information in one simple dashboard easily.

Use the Board view to get a broad overview of all payments in progress, new orders, and payments completed. Open up a task card to get more detailed information on the specific payment at hand.

Did you know ClickUp also lets you track time by creating custom timesheets for your team? Find out how to make the most of it in this quick video!

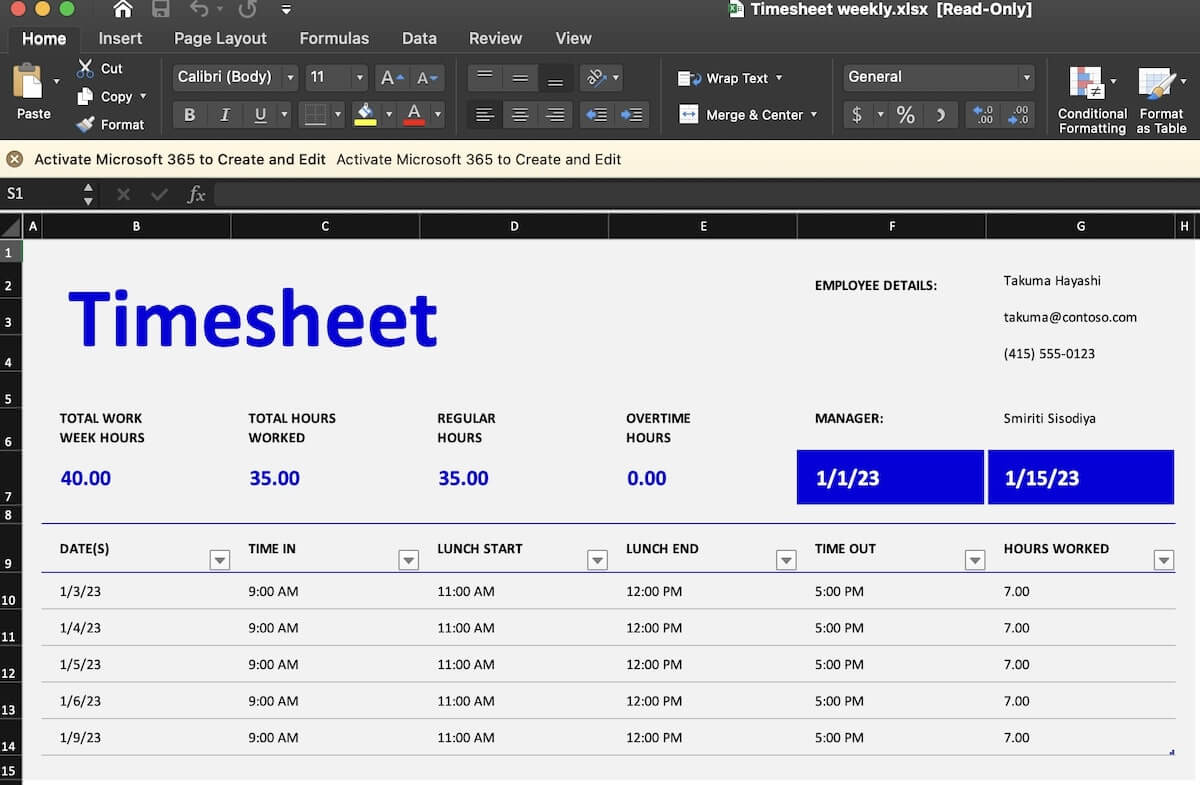

Timesheet templates are a great way to keep track of the amount of time an employee spends performing duties for the job. The Excel Timesheet for Payroll Template from Microsoft 365 is a simple-to-use worksheet designed for use in Microsoft Excel.

Assign a timesheet to each employee, and have them fill out the time in and time out each day. Make sure they document their lunch breaks. Enter formulas in the mini payroll calculator to have it generate the total number of hours worked per week automatically.

Include sections for pricing and any withholdings in the Excel payroll template. Use the payroll sheet template to generate weekly, biweekly, or monthly payments to each employee.

This template is best for small businesses or firms that work with contractors and freelancers. Since it’s just a timesheet and not part of a larger project management tool, it may be too simple for organizations with numerous departments and many salaried employees.

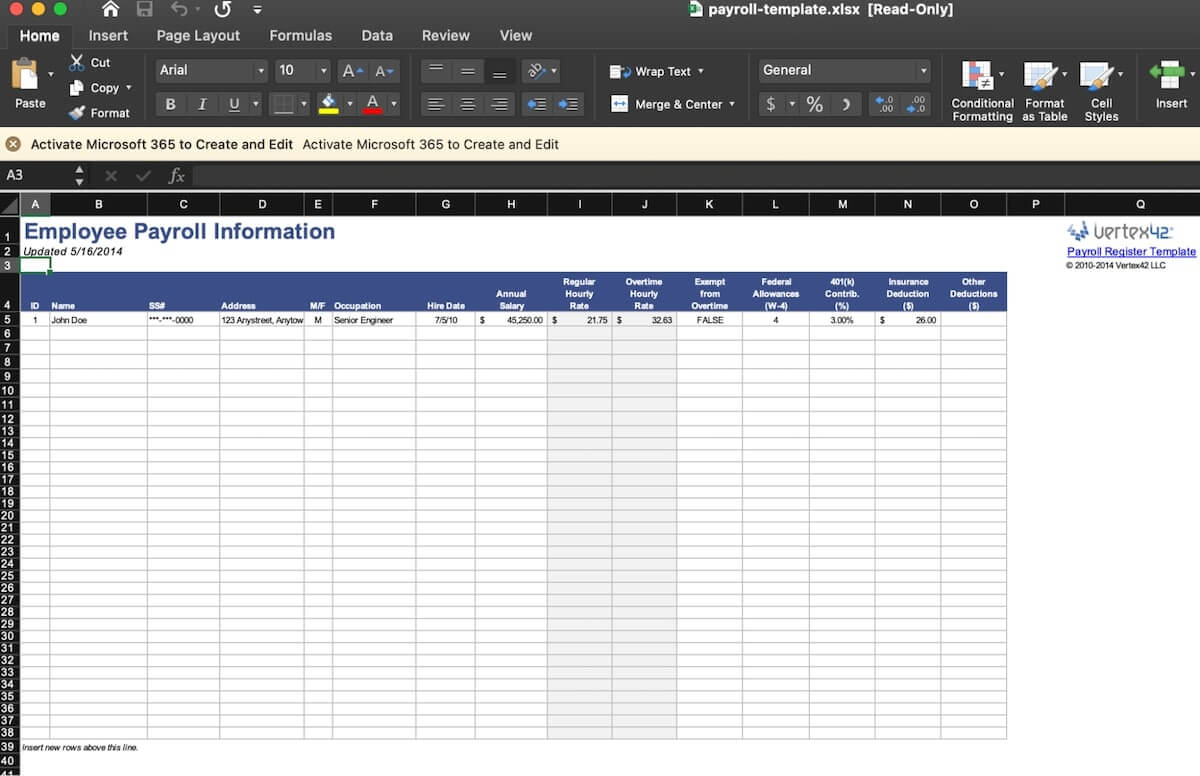

If you have an accountant or online payroll service but still want internal documentation like an employee payroll register, use the Excel Employee Payroll Template from Vertex42. The Excel monthly payroll template is designed for small business owners who just need to keep track of payroll information and don’t have to actually issue the payments.

Use the Employee Info tab to record the employee’s name, contact info, hire date, salary information, and allowances. In the Payroll Register worksheet tab, document the number of hours the employee worked, payment dates, and tax information.

Complete the payroll budget template to get a more sortable breakdown of your budget.

Bonus: Google Docs Budget Templates!

Whether you run a large firm with dozens of employees or manage a small business with a mix of contractors, freelancers, and salaried employees, you need a streamlined payroll process. Use these payroll templates to custom-build a payroll system that works for your business.

Download ClickUp today to get started with smoother and more efficient processes. From simple payment forms for freelancers to more complex systems designed to record all payroll payments, there’s something to drive your business forward.

© 2026 ClickUp