Insurance Knowledge Management: How to Centralize and Share Expertise

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

If your top performers left tomorrow, how much critical knowledge would walk out the door with them?

Insurance teams run on expertise—underwriting nuances, compliance updates, claims procedures, and policy-specific resolutions. But when that knowledge lives in siloed inboxes, tribal memory, or outdated SOPs, service quality suffers. Delays multiply. Compliance risks surface, and customer frustration increases.

37% of frontline insurance agents have no access to a knowledge base, and an additional 27% struggle to find what they need using a basic keyword search.

What’s the solution?

A smarter, scalable, effective knowledge management system that lets your agents and adjusters spend less time digging and more time delivering.

In this post, we’ll unpack what insurance knowledge management really means, why it matters more than ever, the most common pitfalls to avoid, and how AI-powered knowledge management tools like ClickUp can help you centralize, share, and safeguard institutional expertise with ease.

Insurance knowledge management is the process of capturing, organizing, updating, and sharing internal know-how—everything from underwriting guidelines and compliance protocols to customer communication templates and claim resolution playbooks.

It’s about ensuring that:

🧠 Think of it as building a searchable, living brain for your insurance company—one that grows smarter over time, not more chaotic as more data flows in. The goal of these knowledge management practices isn’t just information storage but creating an ecosystem where critical knowledge flows to the right people at the right time, enabling better decision-making and consistent customer experiences.

📮 ClickUp Insight: More than half of all employees (57%) waste time searching through internal docs or the company knowledge base to find work-related information. And when they can’t? 1 in 6 resorts to personal workarounds—digging through old emails, notes, or screenshots just to piece things together.

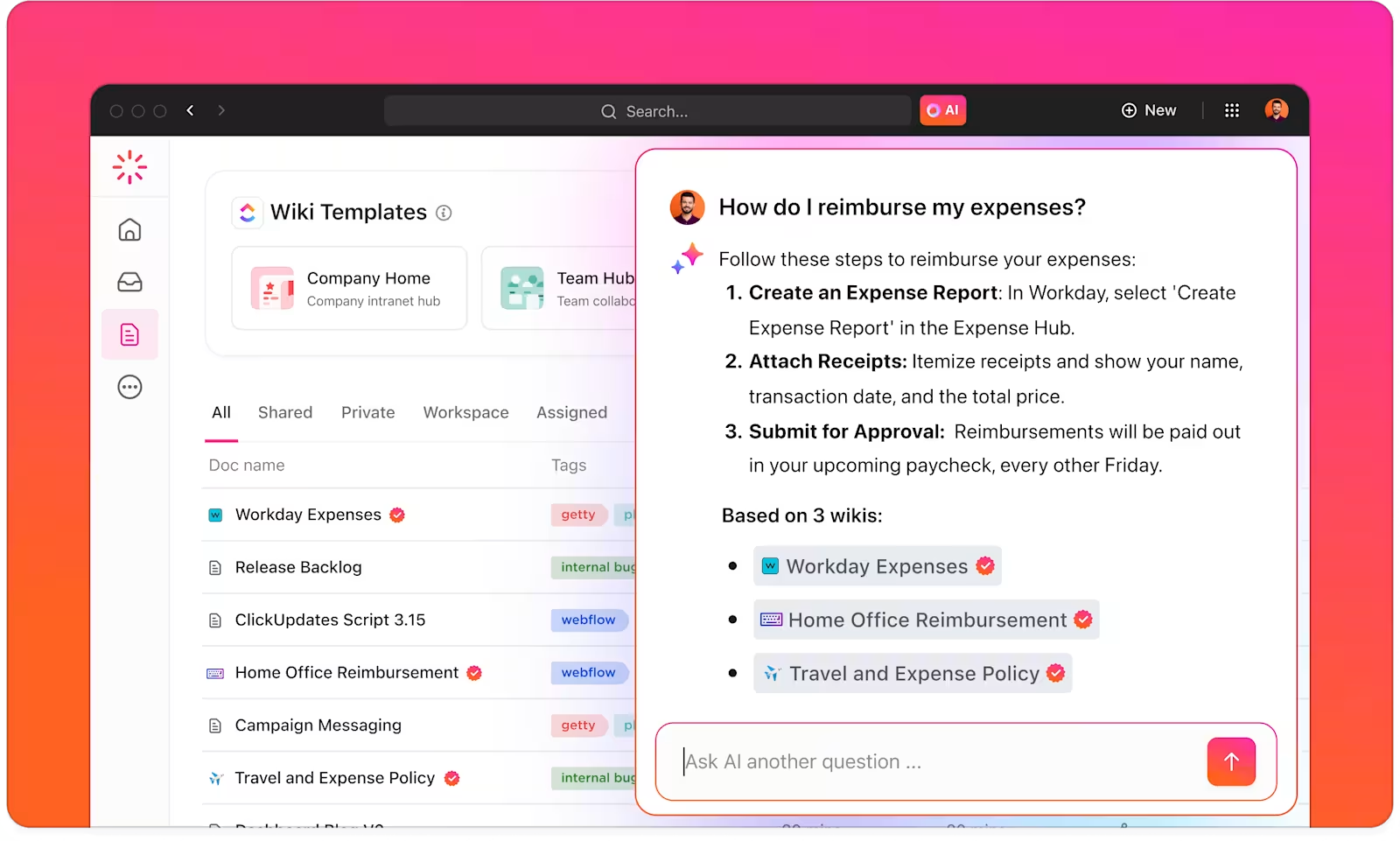

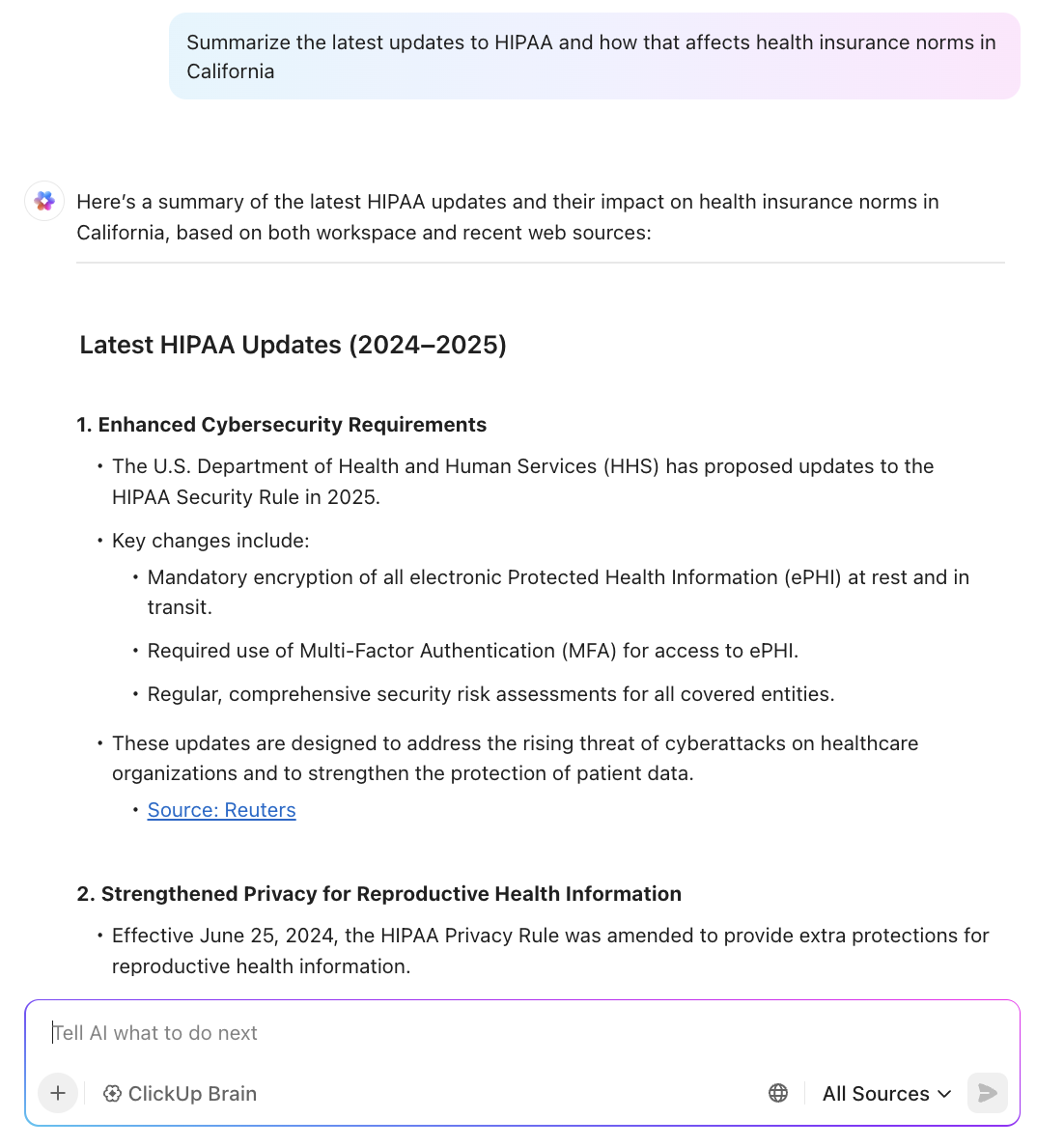

ClickUp Brain eliminates the search by providing instant, AI-powered answers pulled from your entire workspace and integrated third-party apps, so you get what you need—without the hassle.

Insurance is detail-heavy and highly regulated. One missed update in a claims SOP can mean non-compliance, and one outdated policy explanation can lead to customer churn. So when knowledge isn’t shared clearly and consistently, the cost goes beyond operational efficiency to brand reputation and legal risk.

Here’s what’s at stake:

👀 Did You Know? Nearly half of employees regularly interrupt teammates for information. And every time they do? It takes up to 23 minutes to refocus. That’s hours of lost productivity every week due to ineffective knowledge sharing.

Scattered, siloed information causing delays and customer dissatisfaction? Consolidate critical organizational resources, regulatory and compliance info, SOPs, and more, and empower your team with ClickUp’s free Knowledge Base Template.

Let’s face it: most insurance teams know they need better knowledge management—but making it happen is another story. Here are the real-world hurdles that stand in the way:

54% of agents lack a 360-degree view of customer interactions because customer data is stored on multiple channels and apps.

✅ The solution? A modern, integrated platform like ClickUp that keeps knowledge creation, task updates, and process documentation in one place—connected to how your team already works.

📮 ClickUp Insight: 46% of knowledge workers rely on a mix of chat, notes, project management tools, and team documentation just to keep track of their work. For them, work is scattered across disconnected platforms, making it harder to stay organized.

As the everything app for work, ClickUp unifies it all. With features like ClickUp Email Project Management, ClickUp Notes, ClickUp Chat, and ClickUp Brain, all your work is centralized in one place, searchable, and seamlessly connected. Say goodbye to tool overload—welcome effortless productivity.

📚 Also Read: How to use AI for documentation

The complexity of insurance knowledge—spanning regulations, policies, procedures, and customer data—makes centralization seem impossible. But what if your team’s collective expertise could be instantly accessible when needed?

Good insurance knowledge management tools turn institutional knowledge into a strategic asset that drives better decisions, faster service, and competitive advantage.

Here’s what to look for when evaluating knowledge management platforms:

🧠 Fun Fact: 57% of insurance organizations view AI as the most important technology for achieving their ambitions.

📚 Also Read: Best enterprise search software solutions

A modern insurance knowledge base isn’t just a place to “store stuff.” It’s a strategic asset. Done right, it empowers agents to make faster, more informed decisions, supports better compliance, and shortens onboarding cycles. Done wrong, it turns into a dumping ground that no one uses.

Here’s how to build a living, usable, and scalable knowledge base—plus how ClickUp’s Knowledge Management Solution helps every step of the way.

Before you create your first document, outline the boundaries of what your knowledge base will—and won’t—include.

Think of your knowledge base like a product: Who is it for? What problems is it solving? What actions do you want users to take after reading each entry?

For insurance, a well-scoped knowledge base typically includes:

Without a clearly defined scope, your knowledge base grows haphazardly. This leads to information sprawl, duplication, and confusion about which document is the “source of truth.”

🦄 How ClickUp helps: Use ClickUp Docs to create dedicated KB sections for each team or business unit. You can build a clean hierarchy with nested pages to separate topics—like Homeowners vs. Auto policies—while keeping it all within your centralized ClickUp workspace.

Understand what knowledge exists and how it moves through your organization.

Start by mapping:

🦄 How ClickUp helps: With ClickUp Docs as your knowledge management software, this audit becomes significantly more manageable. Create a structured knowledge inventory document where team leaders can collaboratively identify their department’s valuable knowledge assets. You can categorize knowledge domains by department, product line, or function, creating a comprehensive knowledge map that reveals where documentation is lacking.

Insurance knowledge is particularly complex because it spans technical policy details, regulatory requirements, and customer-facing explanations. Standardizing it will not only improve its scannability but also reduce misinterpretation during high-pressure situations like claim escalations or regulatory audits.

Even great knowledge is hard to use if every doc looks different. Standardize templates for different document types so readers know what to expect:

💡 Pro Tip: You can go one step ahead by standardizing even the formatting within these knowledge base templates—here’s a simple yet effective structure:

🦄 How ClickUp helps: Within ClickUp Docs, you can use rich-text formatting, banners, bulleted lists, highlights, and even media embeds to create master templates for each document type that include standardized sections like regulatory references, revision history, and related documents. The nested structure allows agents to quickly navigate from broad concepts (like “Auto Insurance Claims”) to specific procedures (“Total Loss Valuation Process”).

Docs support slash commands (like /table, /checklist, or /embed) so you can create SOPs with rich media, process flows, and actionable checklists.

You can use the Knowledge Base Template in ClickUp to kickstart structure and scale documentation across teams. Centralize FAQs, SOPs, workflows, and critical insights in one searchable hub.

Connect it with ClickUp Brain to auto‑summarize, tag, or even draft knowledge base entries based on context—ideal for rapid updates or onboarding new insurance agents. Pair with dashboards to track usage, document views, and search terms—spot gaps where agents aren’t finding what they need and optimize accordingly.

💡 Pro Tip: Set up a template gallery where team leads can request or duplicate templates. Use a template request form tied to Approvals workflows

Documentation that isn’t field-tested falls flat. Your best insights are trapped in the heads of experienced underwriters, adjusters, and team leads. Bring them in early.

Host working sessions or interviews to extract:

Then, empower them to own their categories long-term.

🔑 Key Insight: SMEs bring practical context and nuance. When policies get complicated or exceptions occur—as they often do in insurance—this tribal insight can make or break claim outcomes.

🦄 How ClickUp helps

💡 Pro Tip: Customize ClickUp’s Request From Template to let your agents submit requests or identify gaps in their knowledge. Auto-route these to SMEs via no-code Automations in ClickUp.

Agents shouldn’t have to go find the right doc—it should find them.

Your KB wiki needs to be embedded within their actual flow of work. That means linking SOPs, checklists, or talk tracks directly inside claim, underwriting, or customer support workflows.

📌 Examples

This cuts context-switching. It also enforces consistent behavior at scale, which is key in regulated industries.

🦄 How ClickUp helps

🤖 Bonus: Add ClickUp’s Autopilot Agents to do the heavy lifting

ClickUp’s Autopilot Agents introduce intelligent, proactive support that reduces manual oversight in insurance workflows. Autopilot Agents act based on triggers, conditions, instructions, and their accessible knowledge sources. They can reply in threads, post comments, create tasks, and update fields autonomously.

Here are some examples of how these knowledge-based AI agents help you:

1️⃣ Trigger: Task of type “New Claim” created in Claims List

2️⃣ Trigger: Task status changes to “Escalated”

3️⃣ Trigger: Tag “Urgent-Renewal” is added

🎯 Why this matters:

➡️ Autonomy: Agents take real action based on rules you define

🔁 Proactivity: They don’t wait—they act at trigger time to support compliance

⏩ Reactivity: They see changes in real-time and respond intelligently

Every outdated doc in your KB is a liability. That’s why you need to set systems to detect and flag old info—and automatically assign it for review.

For insurance teams, this might look like:

🦄 How ClickUp helps

Do you think having an effective search engine is limited to matching keywords correctly? It’s not that simple.

As your knowledge base wiki grows, so does the need for speed—and relevance. Time lost in search is time lost with the customer. When information isn’t instantly accessible, agents either escalate unnecessarily or improvise—both of which create risk.

Prioritize a smart knowledge management system that surfaces results after taking the following into account:

🦄 How ClickUp helps

ClickUp’s Connected Search transforms how agents find information, with:

The system becomes increasingly intelligent over time, understanding that when an agent searches “water damage exclusions,” they likely need specific policy language, claims examples, and customer communication templates.

💡 Pro Tip: Tag your KB documents with metadata like product line, region, team, claim type, or urgency to support faster searches.

Your KB is never “done.” Build systems that gather insights and evolve your content based on:

Running periodic audits will help you identify outdated or duplicated content and spot underused or confusing pages. You’ll also be able to create content to fill in gaps that agents are solving manually.

🔑 Key Insight: Insurance knowledge doesn’t just flow top-down—frontline agents often possess invaluable insights that should shape documentation. For example, when a claims adjuster discovers a more efficient way to process a particular claim type, they can suggest updates to the official procedure, improving efficiency organization-wide.

🦄 How ClickUp helps

A static knowledge base decays. But a continuously improved one builds trust, drives adoption, and becomes your competitive edge.

📚 Also Read: Best document collaboration software

You’ve got the blueprint. Now it’s time to make it sustainable. Implementing insurance industry knowledge management is a long-term strategy that should evolve with your team, tech stack, and regulatory landscape.

Here are proven best practices for ensuring your KM system becomes a competitive advantage and not just another tool people forget to use.

Internal knowledge is just as critical as your customer-facing tools. Assign a product owner (or team) to your knowledge base with clear KPIs:

Build a roadmap, gather feedback, and evolve it just like you would a customer product.

Every document should have a clear owner and review cadence. Set SLAs for knowledge updates after regulatory or operational changes (e.g., seven days after a new policy rollout).

Use ClickUp Tasks with Custom Fields like “Doc Owner,” “Next Review Date,” and “Policy Linked” to keep responsibility visible and traceable.

The average insurance professional needs to access information across multiple contexts—sometimes by policy type, sometimes by procedure, and sometimes by customer scenario. Design your knowledge taxonomy accordingly.

Standardized formats and templates are essential—but avoid over-engineering. Leave room for annotations and contextual notes that don’t always fit into a rigid SOP.

If your KB only makes sense to veterans, it’s not doing its job. Design it so new agents or support reps can get up to speed without hand-holding.

ClickUp’s Insurance Agent Onboarding Template can guide new hires through self-paced documentation checklists, linked docs, and embedded walkthroughs—all tracked and measured in one workspace.

Train teams to search before they ask—and reward it. But also make sure the search works.

Use analytics to identify “dead searches” (terms with no results) and continuously refine document tagging and metadata. Promote helpful docs through team channels or your KB homepage.

Knowledge that requires extra steps to access will go unused. The most successful insurance knowledge systems embed information directly into the tools and workflows agents already use.

Link Docs to tasks, automate update triggers, and surface relevant content with ClickUp’s Connected Search. The more integrated it is, the more your team will trust—and use—it.

In an industry as complex and fast-moving as insurance, the difference between average and exceptional teams often comes down to knowledge: who has it, who shares it, and how fast they can act on it.

A smart, searchable, always-current knowledge base supports your team while protecting your business. It shortens onboarding, prevents errors, improves compliance, and boosts customer satisfaction. But it only works if it’s built to be used, updated, and improved every single day.

With ClickUp, insurance leaders get more than a place to store SOPs. You get a platform that connects knowledge to action—automating updates, surfacing the right answers, and empowering every agent to operate like your best agent.

There’s nothing to gain by waiting. Sign up for ClickUp today to build a smarter knowledge management strategy!

© 2026 ClickUp