Free Balance Sheet Excel Templates: Your Key to Financial Clarity

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Love it or hate it, keeping our finances in check is a non-negotiable part of adulting. And when it comes to your business, hitting financial goals and maintaining solid records can make or break it.

But what’s a key element of sound financial management? A clear, organized balance sheet that shows the true health of your company.

A well-prepared balance sheet doesn’t just offer clarity—it builds credibility and ensures you’re prepared for any financial curveballs. That’s why businesses of all sizes are turning to adaptable, easy-to-use balance sheet templates.

Read on as we explore why these free balance sheet templates, whether in Excel or other formats, are game-changers for financial clarity. 📈

A good balance sheet template not only simplifies data entry but also provides a clear, actionable view of your company’s financial health. 💰

Here are the top features to look for in an effective balance sheet Excel template:

💡 Pro Tip: Looking for a way to streamline your itemized lists for stock tracking, budgeting, and auditing? Consider using inventory templates.

These templates will help you:

Choosing the right balance sheet template is crucial for optimizing your financial tracking and ensuring accurate reporting.

Here are some efficient balance sheet Excel templates to help maintain a clear and organized view of your business’s financial position:

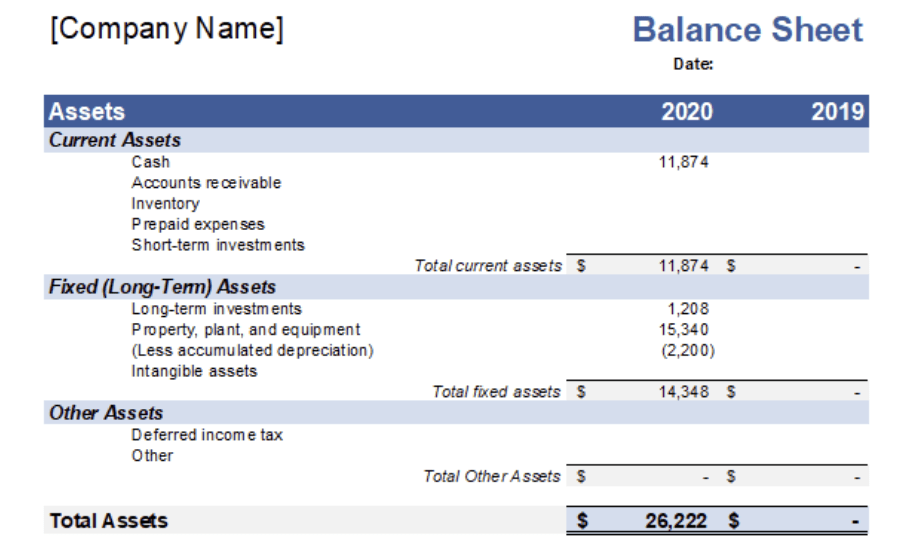

The Excel Balance Sheet Template by Microsoft 365 offers a dynamic approach to tracking your company’s financial standing.

This template features sections dedicated to current assets, liabilities, and equity, complete with integrated formulas to ensure that your balance sheet remains congruent. It is compatible with both desktop and mobile Excel versions, ensuring that you can access it from anywhere. You also get readymade balance sheet examples to inspire your own.

Whether you’re a startup or an established enterprise, the ability to modify categories and input fields ensures that your financial data reflects your unique situation. This flexibility, combined with its built-in formulas for automatic calculations, streamlines your financial tracking process and minimizes the risk of errors.

It is best suited for small and medium-sized business owners who need a comprehensive, easy-to-use financial tracking tool.

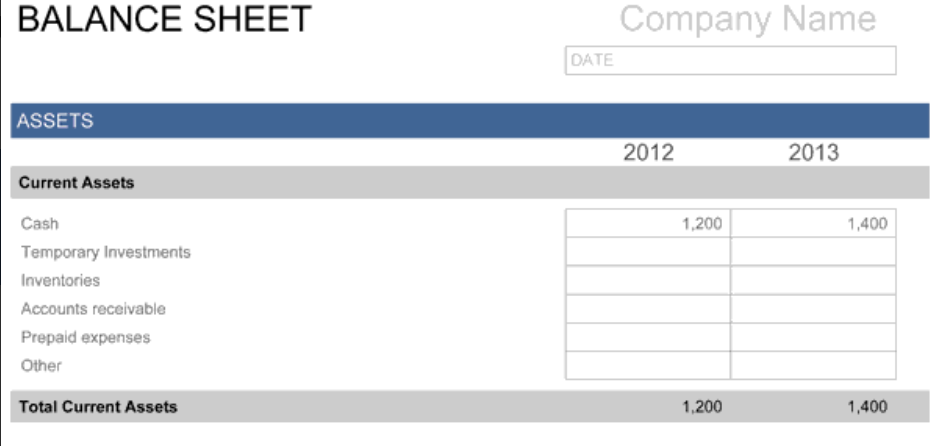

The Excel Simple Balance Sheet Template by Microsoft 365 features a sleek design that makes financial tracking aesthetically pleasing and efficient.

This template emphasizes clarity and ease of use, featuring clear categories for your current liabilities, assets, and equity. Its minimalist design allows for quick data entry and provides a concise overview of your company’s financial position, making it suitable for businesses that prefer simplicity in their reporting.

This template is ideal for freelancers or consultants who require a basic balance sheet template to quickly gain financial insights. It is also perfect for personal budgeting or capturing financial data for your smaller projects.

Vertex42’s Excel Balance Sheet Template offers a high level of customization, making it ideal for both small businesses and large enterprises. It features sections dedicated to current and long-term assets, current and long-term liabilities, and owner’s equity, complete with automated formulas for total balances and integrated financial ratios.

This template allows for multi-year financial comparisons, simplifying the process of tracking trends and analyzing business performance over time.

This template is ideal for financial analysts and business owners who need to produce advanced financial reports complete with comprehensive trend analysis.

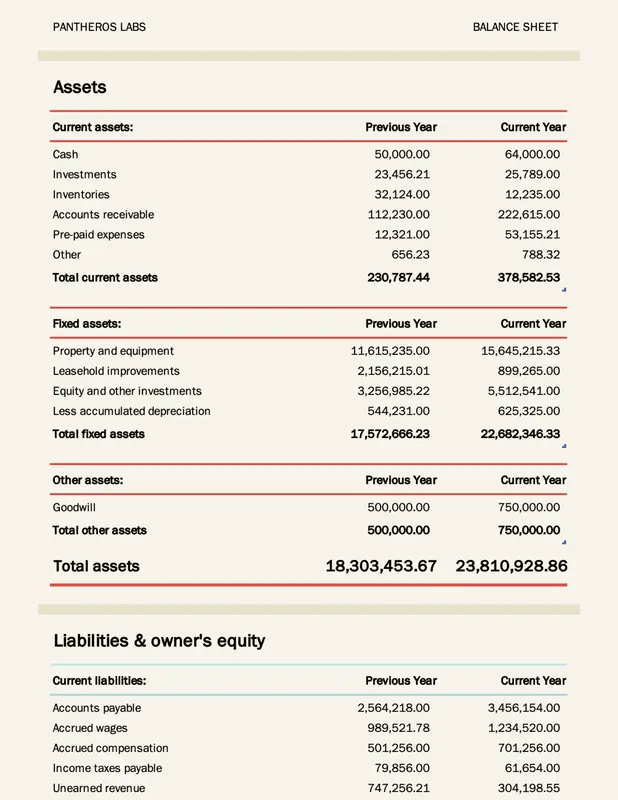

Conta’s Excel Balance Sheet Template is designed for small business owners who need a customizable and easy-to-use financial tool. This template features sections dedicated to current and long-term assets, liabilities, income taxes payable, and equity, with automatic total calculation.

You can easily customize it to fit your business needs without investing in complex financial software. This simplifies the financial tracking process and empowers business owners to take control of their financial reporting.

This template is perfect for startups or small businesses looking for a customizable, user-friendly tool that provides flexibility without the expenses tied to accounting software.

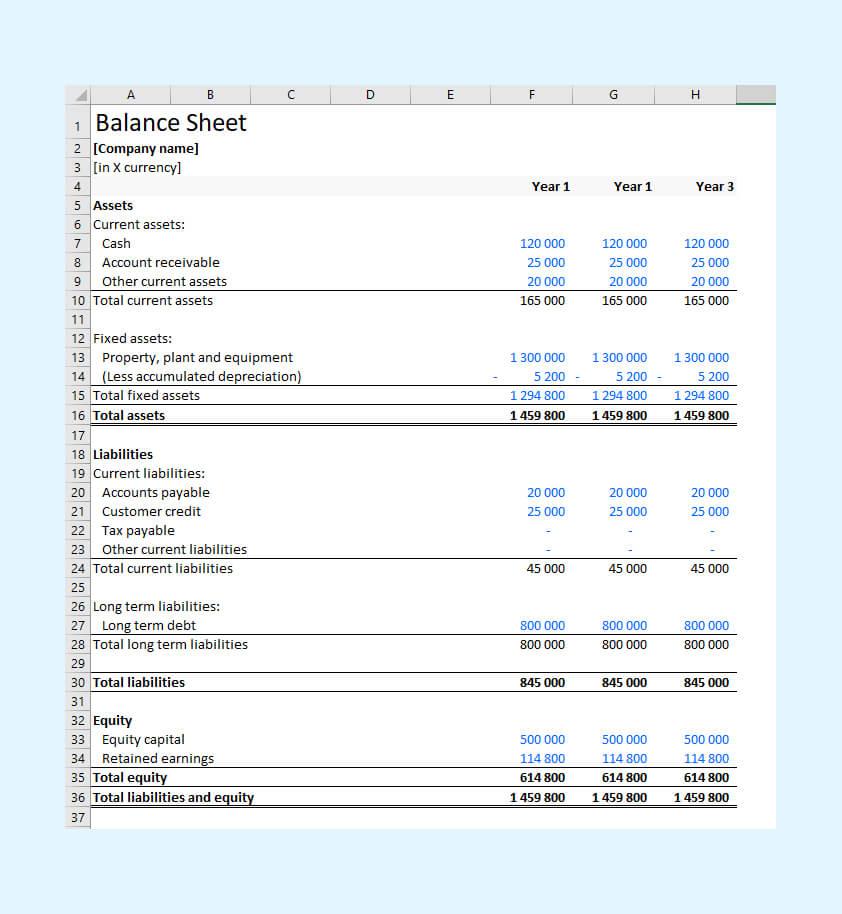

Spreadsheet123’s Excel Balance Sheet Template is crafted to help businesses monitor their financial data across three years. This template features sections dedicated to assets, liabilities, and equity, complete with formulas for seamless calculations.

The intuitive design and multi-year comparison features make it perfect for monitoring financial performance and identifying trends over time.

This tool is particularly useful for small to medium-sized enterprises that aim to track and scrutinize their financial development over a three-year period.

The Excel Balance Sheet Template by SMEToolkit is designed especially for small to medium-sized enterprises (SMEs). It offers a user-friendly design for tracking and computing what your business owns and what it owes to investors and stakeholders. Automated formulas guarantee precision in subtotals and totals, while also alerting you if your balance sheet doesn’t balance.

This template offers incredible flexibility for customization to suit different business structures.

This template is perfect for SMEs seeking loans or preparing financial documents for investors or stakeholders.

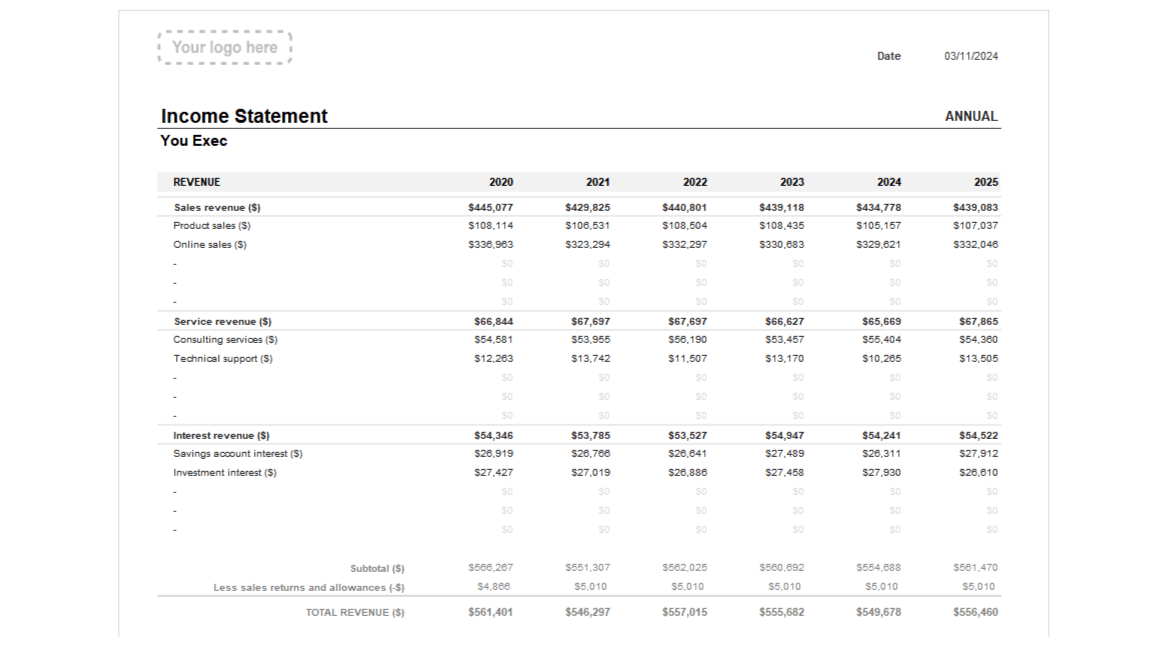

You Exec’s Excel Financial Statement Template provides an all-in-one solution, featuring a balance sheet, income statement, and cash flow statement. The template includes sophisticated financial metrics for thorough analysis.

With features like automated calculations and clear visual representations of financial data, businesses can quickly assess their financial metrics and identify trends over time.

The fact that it comes with user-friendly instructions makes it accessible even for those with limited financial expertise

This template is perfect for bigger organizations seeking an all-in-one financial reporting solution that features balance sheet data, income statements, and cash flow tracking.

🧠 Remember: Balance sheet templates are powerful tools that can help you visualize your business’s financial health, but only if used correctly.

Here are some essential tips to make the most of your balance sheet templates:

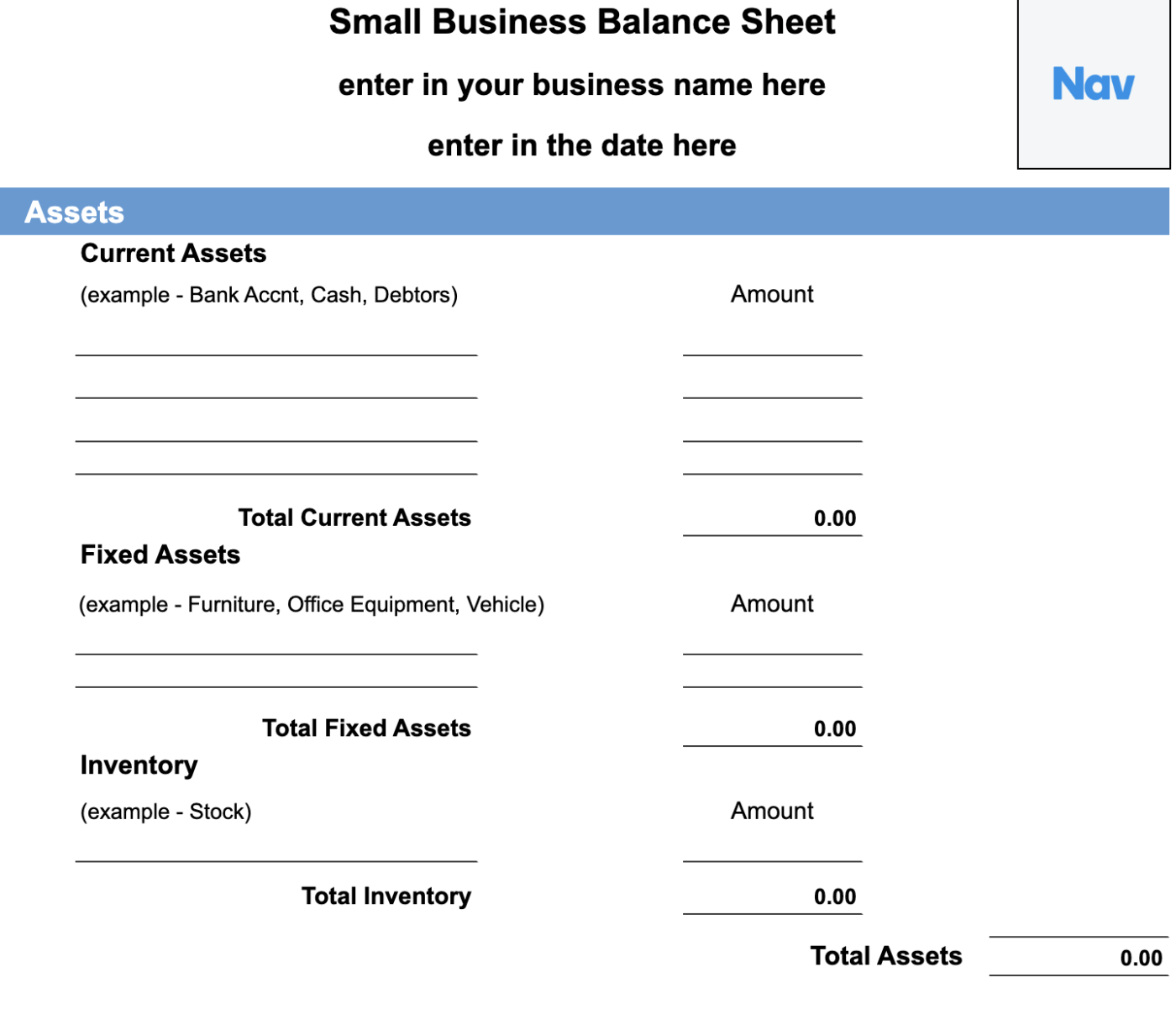

The Google Sheets Balance Sheet Template by Nav offers a flexible solution for businesses that operate within Google’s cloud-based platform.

This template offers a well-organized format for monitoring assets, total liabilities, and debt-to-equity ratio. With its Google Sheets integration, you can collaborate in real time to simplify the process of sharing financial information with your team.

This solution is ideal for businesses or teams that require real-time collaboration and easy access from the cloud.

While Excel is a popular tool for creating balance sheets due to its flexibility and ease of use, it does have its limitations.

Here are some major drawbacks to consider:

While Excel is a reliable option for crafting balance sheets, sometimes you crave more advanced tools to optimize your workflow.

This is where ClickUp comes into play. As an all-in-one productivity platform, ClickUp provides robust features and customizable templates tailored for financial management.

Managing projects or tasks easily and clearly is the main attribute of this software. There are many ways to use it but the most valuable for our team has been the capacity to track every project correctly and pop up alarms when something is going wrong.

The capacity to communicate even using file storage and comments to enrich every task/project has been super useful to keep everyone updated because with the information organized it has been possible also to use the time for innovating by simply creating a specific board for new ideas/projects to develop.

With ClickUp’s templates, you get a standout experience with unparalleled customization, detailed functionalities, and an intuitive interface that makes managing your finances a breeze.

Ready to explore some game-changing Excel alternative templates? Here are a few you won’t want to miss:

ClickUp’s Balance Sheet Template offers a flexible design for monitoring your company’s assets, liabilities, and equity, providing you with a complete perspective on its financial position.

This template is perfect for both beginners and professionals. It features Custom Fields to input financial data, Custom Statuses to track the progress of tasks related to financial reporting, and Custom Views that can be tailored to meet the unique needs of any business. It enables collaborative updates and smooth integration with ClickUp’s project management platform, making all financial data readily accessible and current.

This template is ideal for small businesses or financial teams looking for a balance sheet solution that integrates with their existing project management workflows.

The ClickUp Spreadsheet Template makes data tracking a breeze with its customizable columns and formulas. It’s an ideal solution for businesses seeking a flexible and user-friendly tool to manage various numbers, from financial data to project budgets and other business metrics.

This template lets you create dynamic spreadsheets and efficiently manage large datasets all in one place, eliminating the need to juggle multiple tools.

This spreadsheet template is ideal for teams looking to manage and analyze extensive datasets. It’s designed for businesses that need a versatile solution for monitoring financial performance, project budgets, or operational metrics.

ClickUp’s Balanced Scorecard Template helps businesses measure and manage performance from multiple perspectives, including financial, customer, internal processes, and learning and growth.

This template allows you to establish goals, monitor KPIs, and assess performance data as it happens. It seamlessly connects with ClickUp’s project management features, enabling teams to align their strategic objectives with actionable tasks.

It is perfect for leadership teams or departments that need balanced scorecard templates to manage and monitor business performance, particularly when aligning strategic objectives with everyday operations.

The ClickUp General Ledger Template offers an efficient way to monitor and organize every financial transaction in your business.

This template helps you track your net income, expenses, assets, and liabilities, ensuring your books stay balanced and compliant. Featuring customizable fields and seamless integration with other ClickUp tools, this solution is ideal for businesses seeking a flexible and comprehensive general ledger option.

This free balance sheet template is ideal for accounting teams and small businesses requiring a general ledger that integrates with project management, promoting transparency and precision in financial tracking.

➡️ Read More: 10 Free Bookkeeping Templates in Excel and ClickUp

The ClickUp Budget Report Template is designed to help businesses with strategic planning and tracking their budgets. It features customizable fields for tracking revenue, expenses, and variances, allowing you to keep an eye on budget performance as it changes over time.

ClickUp’s powerful collaboration tools allow this template to be shared across teams, ensuring everyone has real-time access to the latest financial data.

This template is perfect for finance teams, project managers, and business owners who need an effective way to manage budgets. It’s particularly beneficial for those monitoring project-based or department-specific finances.

With the Quarterly Financial Report Template from ClickUp, you can effortlessly create comprehensive financial reports each quarter. It features customizable fields designed for tracking revenue, expenses, profits, and other essential financial metrics.

With features that facilitate commenting and document sharing, everyone can stay engaged and informed throughout the reporting process. This collaborative approach not only fosters transparency but also enhances accountability within your team.

This template is a fantastic choice for finance teams tasked with preparing quarterly reports. It’s designed for businesses dedicated to keeping precise financial data and following reporting standards.

The ClickUp Accounting Journal Template allows businesses to record and monitor their daily financial transactions effortlessly. It offers a structured approach for tracking debits, credits, and balances, making sure that all accounting records stay precise and current.

This template enhances the efficiency of financial record-keeping with its customizable fields and seamless integration with other ClickUp functionalities.

It is perfect for accountants or small business owners looking for a thorough and structured tool to record and monitor daily transactions. This template ensures that financial records remain precise and compliant.

In the world of business, mastering your finances is key to thriving, not just surviving. The right tools can help you effortlessly navigate the complexities of financial tracking, giving you more time to innovate and grow.

While balance sheet Excel templates are good for creating balance sheets, they have their limitations—such as a lack of advanced features and flexibility—that can hinder your financial tracking as your business evolves.

Enter ClickUp, your ultimate productivity powerhouse!

This all-in-one platform doesn’t just simplify project management—it revolutionizes financial oversight with its superior templates.

These customizable templates enhance your ability to track and analyze financial data and provide real-time collaboration features that Excel simply can’t match.

So why wait? Sign up on ClickUp today and take better control of your finances!

© 2026 ClickUp