Compliance programs and audits used to be back‑office checkboxes.

Think manual reviews, disconnected spreadsheets, and slow reporting cycles. But those days are gone.

Regulations are evolving rapidly, enforcement is intensifying, and the consequences for falling behind are severe. For instance, any failure to proactively communicate information, protect customer data, and uphold fair practices immediately raises alarms.

Recently, the European Commission fined one of the major tech companies €500 million under the Digital Markets Act (DMA) for restricting app developers from informing users about cheaper subscription options outside the App Store. The company appealed the decision, but it has already changed its App Store rules to avoid daily fines of 5% of global revenue.

This is just one high-profile example of how regulatory pressure is increasing. And not just in big tech.

Organizations everywhere are grappling with a patchwork of laws and standards, including GDPR, CCPA, HIPAA, SOX, ESG mandates, and others. The risk of noncompliance is no longer theoretical; it can mean massive fines, reputational fallout, operational disruption, or even a failed audit.

That’s where AI-powered compliance tools come in. With continuous monitoring, automated audit trails, risk detection, and adaptive controls, an AI compliance assistant offers a smarter, scalable approach.

But what does that actually look like in practice? Let’s break it down in this blog.

What Is an AI Compliance Assistant?

An AI compliance assistant is a domain‑specialized artificial intelligence system designed to support regulatory oversight, audit readiness, and ongoing compliance. Unlike generic AI tools, it is specifically designed for compliance and risk management contexts.

An AI compliance assistant is typically:

✅ Embedded in your compliance environment and aware of your internal policies, controls, and risk frameworks

✅ Monitors data flows, logs, documents, system events, and external regulation sources in real time

✅ Flags deviations, anomalies, or potential violations for review

✅ Produces audit‑ready reports, logs, and dashboards

✅ Automates follow-up action: assigning tasks, routing escalations, updating workflows

For example, a global fintech company uses an AI compliance assistant to monitor GDPR-related data handling. When the system detects that customer data from the EU is being stored in a non-compliant region. It automatically flags the issue, notifies the data protection officer, generates an audit trail, and triggers a workflow to reroute the data and update the data inventory, without human intervention.

How it differs from general AI assistants

A general AI assistant can help draft an email or summarize a report.

An AI compliance assistant will come equipped with the knowledge to understand which regulations apply, which control maps to use, and how to document the logic and escalation path.

In effect, the AI compliance assistant is a compliance‑first, risk‑aware engine, not a general-purpose chatbot.

Let’s look at a side-by-side comparison here.

| Dimension | General AI Assistant | AI Compliance Assistant |

|---|---|---|

| Domain knowledge | Trained on broad, open-domain data; useful for general tasks like writing, summarizing, or translation. 👉 Example: Can draft an email, explain a legal term, or summarize a news article. | Trained specifically on regulatory, legal, and compliance-focused data. 👉 Example: Understands nuances of GDPR, SOX, HIPAA, or ESG frameworks and can map controls to requirements. |

| Input data | Draws from general internet data, public sources, and user prompts. 👉 Example: Uses web text to answer FAQs or provide general advice. | Ingests internal policies, compliance controls, risk frameworks, audit trails, and real-time operational data. 👉 Example: Parses your organization’s data handling policy to detect violations of PII exposure. |

| Output style | Designed for flexible, natural language interaction; useful for chat, creative tasks, or brainstorming. 👉 Example: Produces a summary in plain English or a creative blog draft. | Outputs are structured, explainable, and often formatted for audit or regulatory use. 👉 Example: Generates an audit-ready report detailing access control violations with timestamps, evidence, and references to specific policies. |

| Primary role | Enhances productivity through summarization, ideation, and task automation. 👉 Example: Drafts meeting notes or creates a content outline. | Enforces compliance by monitoring, detecting issues, and triggering workflows. 👉 Example: Flags a conflict-of-interest risk during procurement review and escalates it to compliance officers. |

| Integration | Typically used as a standalone tool or API integrated into chat apps or productivity platforms. 👉 Example: Runs inside Slack or Notion to assist with writing. | Deeply integrated into enterprise compliance infrastructure: GRC systems, ERPs, HR databases, data logs, and audit platforms. 👉 Example: Continuously scans ERP financial transactions for SOX violations, updates project compliance dashboards, and logs evidence for audits. |

🌼 Did You Know: The Digital Operational Resilience Act (DORA), introduced by the EU, strengthens the financial sector’s ability to withstand ICT-related disruptions through harmonized regulatory processes. As institutions increasingly adopt advanced AI technology, new compliance questions arise around risk management, data integrity, and third-party service oversight. DORA addresses these by requiring detailed compliance documentation and rigorous testing frameworks. Financial entities must ensure compliance with these standards to remain operationally resilient and avoid penalties, especially as AI-driven systems become more embedded in critical infrastructure.

Why Businesses Need an AI Assistant for Compliance

The business case is urgent.

85 % of executives surveyed by PWC said that compliance requirements have become more complex over the past three years, and this is consistent across industries, including financial services, industrials, consumer markets, health, and technology.

Compliance teams face mounting complexity, risk, and expectations. Here’s why AI assistants are fast becoming essential.

Regulatory pressure is intensifying

Global regulators are cracking down harder than ever. Enforcement actions against financial institutions increased by 31% resulting in fines totaling over $263 million for violations related to AML, KYC, sanctions, and transaction monitoring.

In contrast, global antitrust penalties reached $6.7 billion, more than double the amount levied in previous years.

These are not isolated cases. Regulatory bodies broadly are expanding enforcement, pushing firms to close gaps or face high-stakes consequences.

Manual compliance remains widespread and dangerous

Despite digital transformation, many firms still run vital compliance processes manually.

For instance, a survey by Wolters Kluwer found that 42% of banks, credit unions, and lenders “often” rely on manual processes for regulatory compliance, and another 31% do so “sometimes.”

This means that over 70% maintain partial dependence on manual workflows. Over-reliance on spreadsheets, disconnected reviews, and manual logging is becoming untenable under modern regulatory demands.

See how you can build a Regulatory Checklist Agent in ClickUp to help reduce such issues. 👇🏼

⚡️ Template Archive: Top Audit Plan Templates

Fines and enforcement costs are high

The cost of noncompliance is a tangible reality.

According to Corlytics, between 2020 and mid-2024, regulatory fines across financial crime, data protection, and governance totaled $47.04 billion.

Combined enforcement by the SEC and CFTC just reached $25.3 billion in fines and relief, while the UK’s Financial Conduct Authority more than tripled its fines year-over-year.

These numbers underscore regulatory expectations: compliance lapses trigger not just small penalties, but systemic financial and reputational blows.

Teams struggle to scale with growth

As organizations expand their business lines, geographies, and systems, the compliance burden also scales, often disproportionately.

New regulation regimes, data flows, system integrations, M&A, and product changes increase rule surface, while compliance teams can’t grow linearly.

An AI compliance assistant is scalable: onboarding new rules, integrating new systems, and preserving audit continuity, all without needing equivalent headcount growth.

Audit readiness is now expected

Auditors and regulators no longer accept year-end snapshots. They expect continuous evidence, logs, and assurance. Static compliance reviews are no longer enough.

According to Drata’s Compliance Trends Report, 9 out of 10 companies plan to adopt continuous compliance within the next five years. Meanwhile, 76% of organizations still using traditional, point‑in‑time compliance reports say that it’s a burden.

Out of the survey respondents, 40% of teams that continuously review their compliance are already using automation.

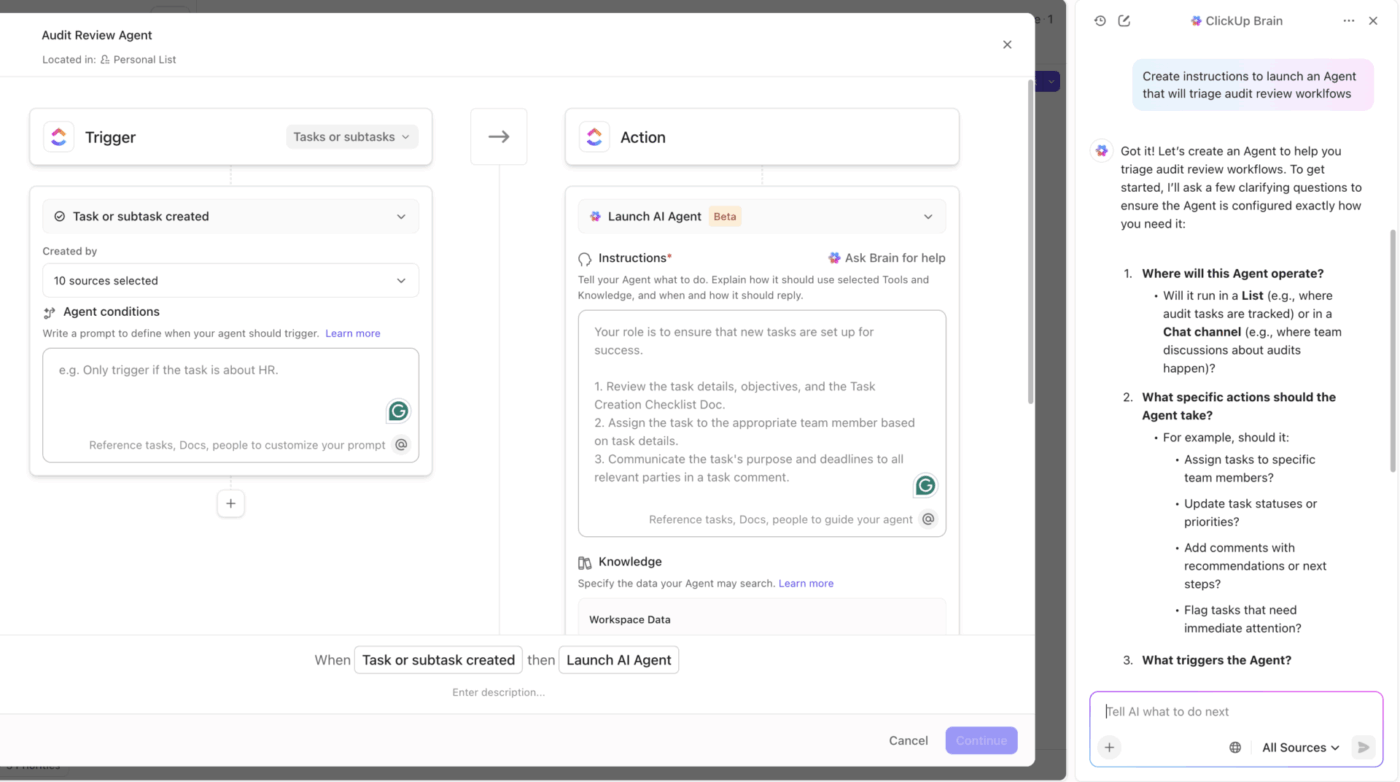

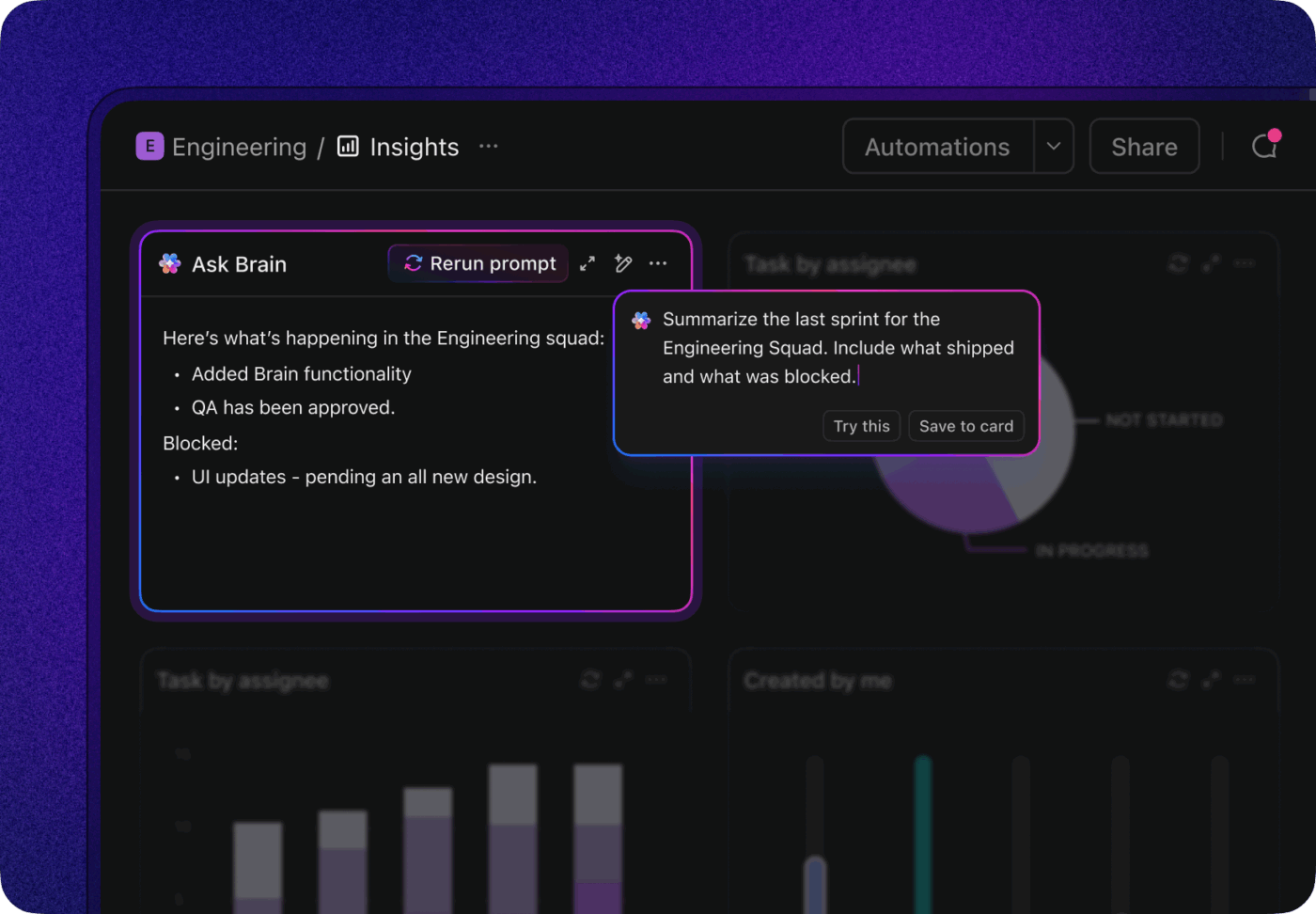

With an AI compliance assistant, organizations can maintain live dashboards, build AI-assisted agentic workflows for real-time audit trails, triggerable reports, and always-on assurance, turning compliance from a cost into a competitive differentiator.

How Shipt fixed fragmented workflows and centralized their data

Shipt, Inc., a subsidiary of Target Corporation, is a delivery service based in Birmingham, Alabama, operating in over 5,000 cities across the United States. Partnering with a variety of retailers, Shipt delivers groceries, essentials, and more.

The company is dedicated to enhancing the delivery experience and optimizing internal operations for greater efficiency.

Shipt’s Data Platform team previously struggled with project tracking scattered across various platforms, including spreadsheets and chat tools. This fragmentation led to lost information, inefficient project prioritization, and frequent miscommunication.

By centralizing all data-related requests, information, and projects onto ClickUp, Shipt created a single, verifiable source of truth for all project work and communication. The team standardized their intake process using ClickUp Forms, optimized workflows with Automations, and gained real-time visibility into project delivery through Dashboards and reporting tools.

This transformation enabled Shipt’s Data Platform team to boost efficiency, improve project visibility, and better manage workloads, empowering them to focus on growth and deliver a greater impact across the organization.

Key Features of an AI Compliance Assistant

AI compliance assistants are often mistaken for smart bots running in the background.

But they bring specific capabilities that reshape how compliance teams operate. The best ones come in and connect dots between regulations, risks, data, and decisions.

Compliance monitoring is foundational

The first thing a good AI assistant does is continuously monitor your internal systems, documents, and activities for alignment with both your internal policies and external regulatory obligations.

Instead of relying on scheduled audits or periodic checks, you get real-time monitoring that alerts you the moment something falls out of compliance. That means fewer surprises and faster intervention.

Risk detection and alerts reduce blind spots

Spotting compliance drift early is what turns reactive teams into proactive ones.

AI assistants use pattern recognition and anomaly detection to surface potential violations before they become critical. For example, if a new vendor is onboarded without following due diligence steps, or if a high-risk transaction occurs without the right documentation, the system can flag it for immediate review.

Advanced assistants also score risks by severity and urgency, automatically escalating issues when thresholds are met. The goal isn’t just alerting, but also triaging risk so your team can respond more quickly.

Audit reporting should be automated and always ready

Preparing for an audit is often a slow, painful, and disorganized process.

AI assistants remove that burden by automatically compiling audit-ready reports, documentation trails, incident logs, and compliance histories. Whether it’s an internal audit, a third-party review, or a regulatory exam, the assistant should be able to generate the required outputs in minutes.

It saves time and reduces the likelihood of gaps, inconsistencies, or missing evidence, all of which can cause delays or damage credibility during audits.

💟 Bonus: Brain MAX is your AI-powered desktop companion, purpose-built to simplify compliance for busy teams and organizations. Imagine prepping for an audit: Brain MAX can instantly search and retrieve all relevant policies, training records, and audit trails from across your workspace and connected apps—no more scrambling through folders or emails.

Need to monitor ongoing compliance? Brain MAX automatically tracks regulatory deadlines, flags missing documentation, and sends proactive reminders to your team. You can use voice commands to ask for summaries of new regulations, generate compliance checklists, or even draft policy updates using multiple leading AI models. With deep integration into your document management, email, and project tools, Brain MAX ensures every compliance action is logged, searchable, and aligned with your workflow.

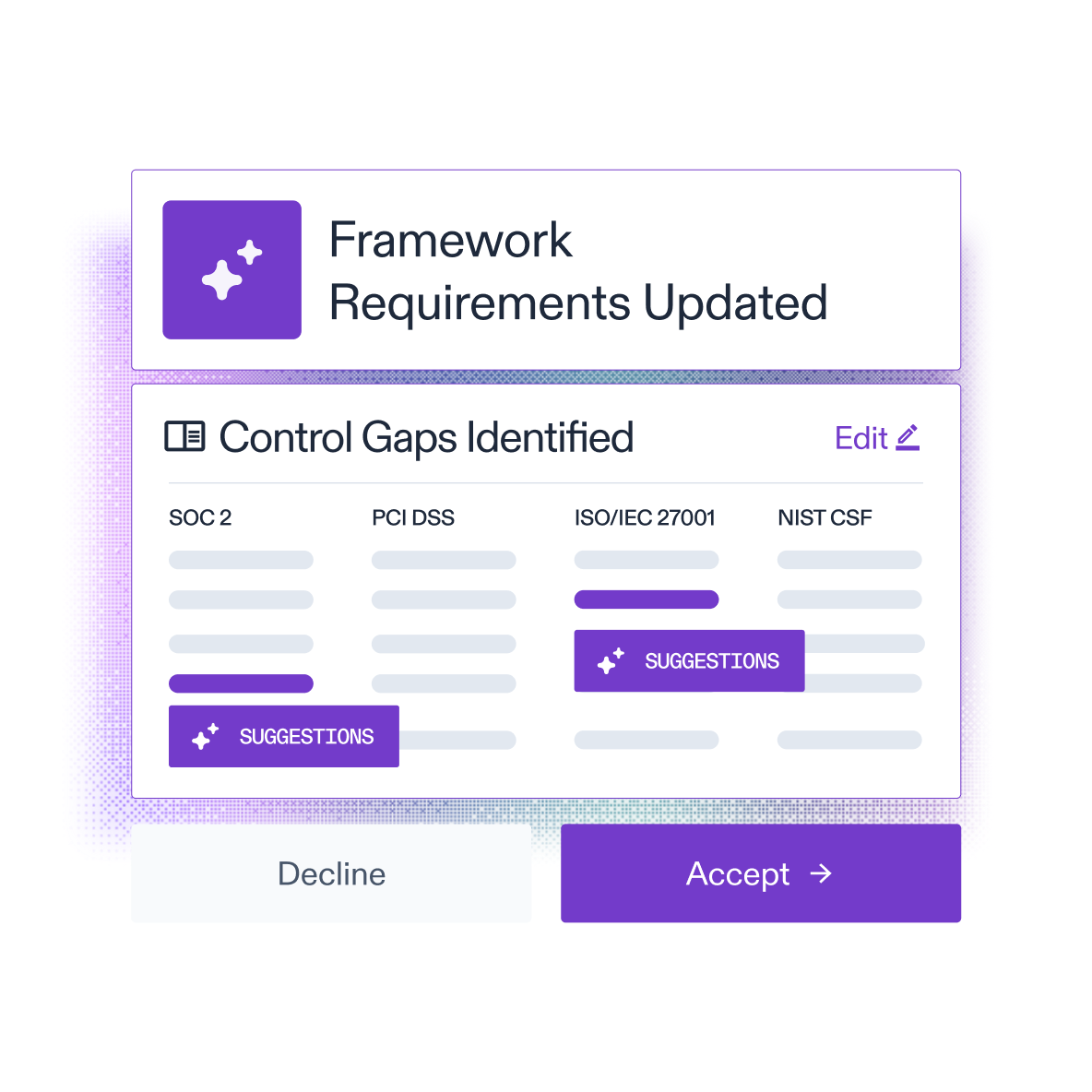

Regulation tracking keeps you ahead of change

Regulatory requirements are constantly changing, and missing an update can result in immediate noncompliance.

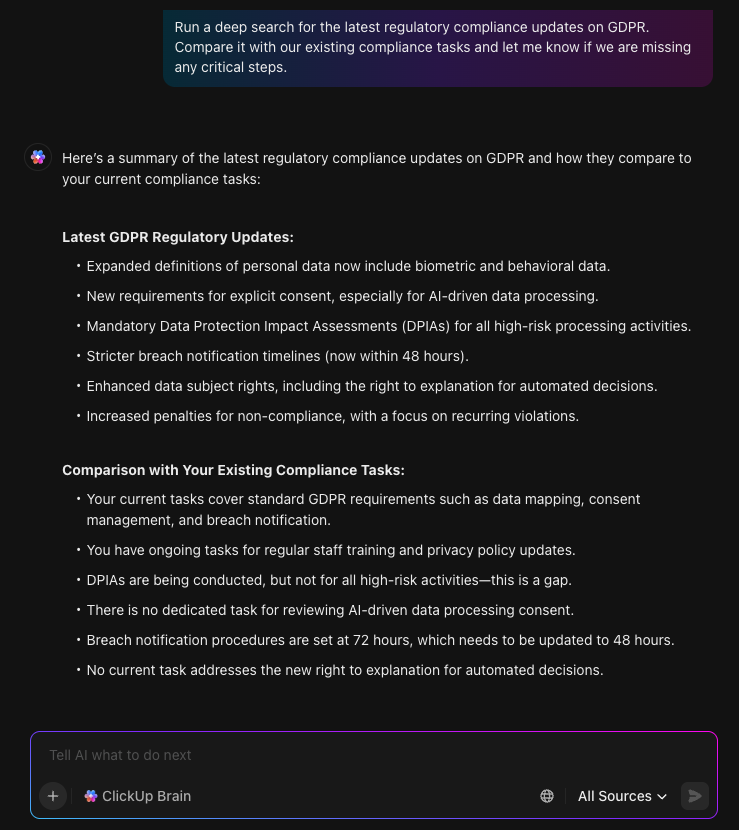

AI assistants can be configured to monitor government databases, regulatory bulletins, legal updates, and industry standards so that you don’t have to.

When something changes, the assistant can alert you, suggest necessary internal policy changes, and even highlight which parts of your operations could be affected. This kind of proactive tracking is especially valuable for companies operating across multiple jurisdictions.

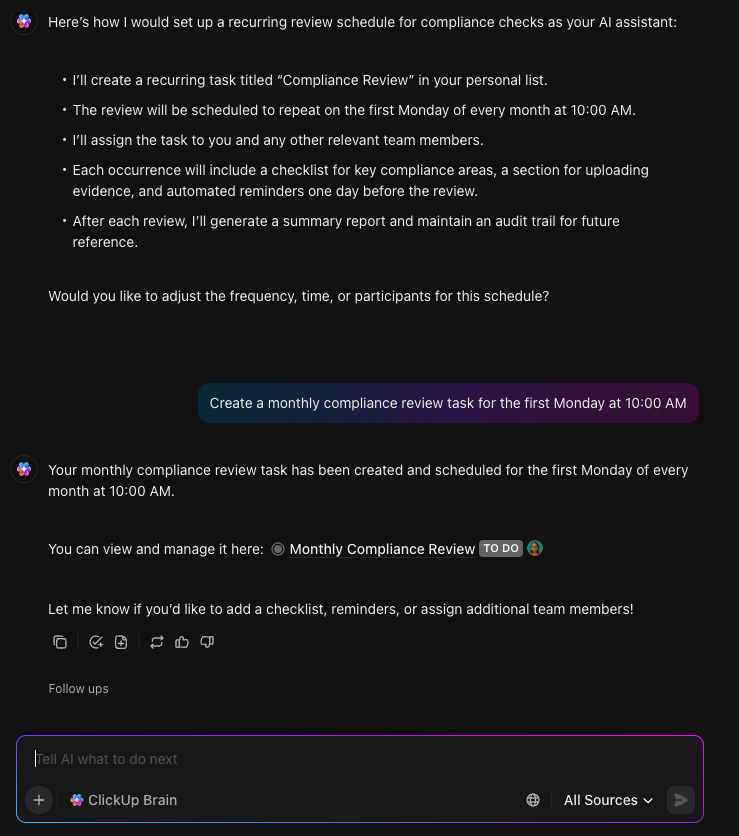

Workflow automation closes the loop

Spotting a compliance issue is the tip of the iceberg. The best AI compliance assistants automate the entire follow-up process; assigning tasks, escalating urgent issues, routing approvals, and documenting resolution steps. That means teams can focus on solving problems rather than chasing updates.

Integrations make AI assistants truly operational

To work effectively, AI compliance assistants must plug into your existing tools.

Think enterprise resource planning (ERP) systems, governance, risk, and compliance (GRC) platforms, customer relationship management (CRM) tools, HR systems, ticketing platforms, and even cloud environments.

The deeper the integration, the more complete the data, and the stronger the compliance oversight.

Natural language processing brings smarter document handling

Natural language processing (NLP) enables AI assistants to read and interpret long, complex documents — such as contracts, policies, and regulatory guidance. With NLP, the assistant can flag risky contract clauses, spot inconsistent language in your internal policies, or detect changes between different versions of a regulation.

Knowledge graphs connect the dots

Some advanced AI tools use knowledge graphs to map the relationships between policies, risks, controls, regulations, and business functions.

When a new law is introduced, the assistant can help determine which policies must be revised, which departments are affected, and what risks may be introduced.

📮ClickUp Insight: 18% of our survey respondents want to use AI to organize their lives through calendars, tasks, and reminders. Another 15% want AI to handle routine tasks and administrative work.

To do this, an AI needs to be able to: understand the priority levels for each task in a workflow, run the necessary steps to create tasks or adjust tasks, and set up automated workflows.

Most tools have one or two of these steps worked out. However, ClickUp has helped users consolidate up to 5+ apps using our platform! Experience AI-powered scheduling, where tasks and meetings can be easily allocated to open slots in your calendar based on priority levels. You can also set up custom automation rules via ClickUp Brain to handle routine tasks. Say goodbye to busy work!

Use Cases of AI in Compliance and Audit

AI compliance assistants aren’t just theoretical.

Across industries, they’re already solving real-world problems and saving teams hours of manual work every week. Let’s look at some use cases.

Data privacy and protection

With privacy regulations like GDPR, CCPA, and HIPAA tightening worldwide, using AI for data governance is a top priority. AI assistants help by monitoring who accesses sensitive data, ensuring permissions are in place, and verifying that consent records are accurate.

This is especially important for companies with large customer datasets or sensitive health or financial information. Here, AI assistants help with:

- Monitoring access to sensitive data and ensuring that permissions align with internal policies

- Verifying the accuracy of consent records and automating responses to data subject access requests (DSARs)

- Logging activities and generating audit trails to support privacy audits

- Automatically flagging potential breaches and generating notifications within legally mandated timeframes

➡️ Example: WestRock, a global manufacturing company, built a secure internal GenAI platform to support its internal audit operations. The team used AI to draft audit objectives, create risk and control matrices, generate audit request lists, and suggest audit procedures. According to Deloitte, this approach resulted in measurable gains in speed, consistency, and efficiency, allowing auditors to focus on insights and risk analysis rather than repetitive documentation tasks.

What often slows down audit processes are repetitive tasks. ClickUp Brain + AI Agents combo can take care of them for you by automating them!

Financial compliance: AML, KYC, and SOX

In finance, the stakes are even higher.

AI compliance assistants are now used to monitor transactions for suspicious patterns that may indicate money laundering, fraud, or sanctions violations.

They can:

- Detect suspicious transaction patterns indicating potential money laundering (AML) or fraud

- Verify identity documents and automate parts of Know Your Customer (KYC) onboarding workflows

- Support processes like Sarbanes-Oxley (SOX) compliance by maintaining audit logs, managing access controls, and continuously validating financial reporting integrity

➡️ Example: FTI Consulting implemented an AI-enabled platform to automate the KYC refresh process for a large multinational bank. The system consolidated data silos, extracted and validated form data, and triggered verification workflows, helping cut costs and accelerate customer onboarding. The bank used this automation as a compliance and competitive differentiation strategy.

Healthcare and life sciences

From clinical trials to patient care, compliance in healthcare is tightly regulated. In these scenarios, AI assistants help by verifying that licenses and certifications are up to date, that billing codes are used correctly, and that documentation aligns with healthcare standards.

This reduces legal exposure and helps maintain trust with both regulators and patients. Use cases here include:

- Confirming that clinical licenses, accreditations, and certifications remain current

- Validating that billing codes, documentation, and claims align with healthcare regulations

- Monitoring how sensitive patient data is stored and accessed to ensure HIPAA compliance

- Tracking patient consent forms and alerting administrators to any missing or outdated authorizations

➡️ Real-life example: Foxit’s Smart Redact Server uses AI to automatically identify and redact personally identifiable information (PII) or protected health data in documents and images. This ensures consistent privacy compliance with frameworks such as GDPR and HIPAA, cutting manual workloads and enabling secure data sharing across departments.

ESG compliance and environmental regulation

AI assistants can track organizations track their impact in the ESG space overall.

They can match your sustainability efforts against evolving disclosure requirements and alert your team when there are reporting gaps. In a global supply chain, for instance, this kind of oversight is increasingly seen as essential to reputational risk management. This includes:

- Tracking and verifying carbon emissions, waste management, and energy consumption data

- Monitoring supplier certifications and ethical sourcing requirements

- Benchmarking internal sustainability metrics against evolving disclosure frameworks

- Automatically alerting teams to reporting gaps or missed submission deadlines

➡️ Case study: EnerSys, a global power solutions company, adopted AI tools to improve the efficiency and accuracy of ESG data collection, reporting, and analysis. Their deployment helps automate tasks such as aggregating energy usage, emissions data, and supplier sustainability metrics, as well as aligning internal metrics with external disclosure frameworks—reducing manual overhead and improving consistency.

Internal audit and corporate governance

For internal auditors, AI assistants are changing the game. By automating the tedious yet essential aspects of audit preparation, such as complaince checklists, documentation, and trial validation, AI assistants enable auditors to concentrate on what truly matters: insights, root causes, and process improvements.

Some of the key applications are:

- Scheduling recurring reviews and monitoring control effectiveness in real time

- Managing audit checklists, evidence collection, and exception tracking

- Maintaining complete audit trails for regulators and executives

- Assigning and following up on remediation actions automatically

➡️ Case study: Dawgen Global, a global assurance firm, uses an “AI-first audit” approach. The methodology uses AI models to evaluate systems, controls, and risk exposures across organizations. Interestingly, it doesn’t just audit compliance but also audits the AI systems themselves, assessing fairness, accountability, and robustness to ensure that governance principles are upheld.

Benefits of Using an AI Assistant for Compliance and Audit

The value of AI compliance assistants isn’t just about time saved — though that’s a big piece.

The real benefit is how they transform the entire posture of a compliance organization: from reactive to resilient, from siloed to integrated, and from strained to strategic. Here is a breakdown:

| Key benefit | Statistics | Impact / Best practices |

|---|---|---|

| Improved visibility and risk management | 64% of companies reported better visibility; 53% faster at identifying and responding to issues | Moves organizations from reactive “detect and fix” cycles to proactive risk management |

| Higher-quality reporting and confidence in decisions | 48% generating higher-quality reports; 59% reported greater confidence in decisions | AI-powered platforms improve clarity, consistency, and real-time insights |

| Efficiency gains and cost reduction | 43% cited cost savings and increased productivity | Automation reduces manual errors and rework, enabling compliance teams to achieve more with the same headcount |

| Better resilience in the face of complexity | 77% said compliance complexity negatively impacted scaling or transformation | AI adapts automatically to regulatory changes, aligning operations with new standards |

| Stronger alignment with digital transformation | 71% plan digital overhauls in the next three years | Compliance is modernized alongside business transformation, enabling AI-assisted teams to lead |

Top AI Compliance Assistant Tools

Navigating today’s intricate regulatory environment demands more than just traditional software.

Enter AI compliance assistants: intelligent, adaptive platforms designed to transform compliance from a daunting task into a streamlined, proactive process.

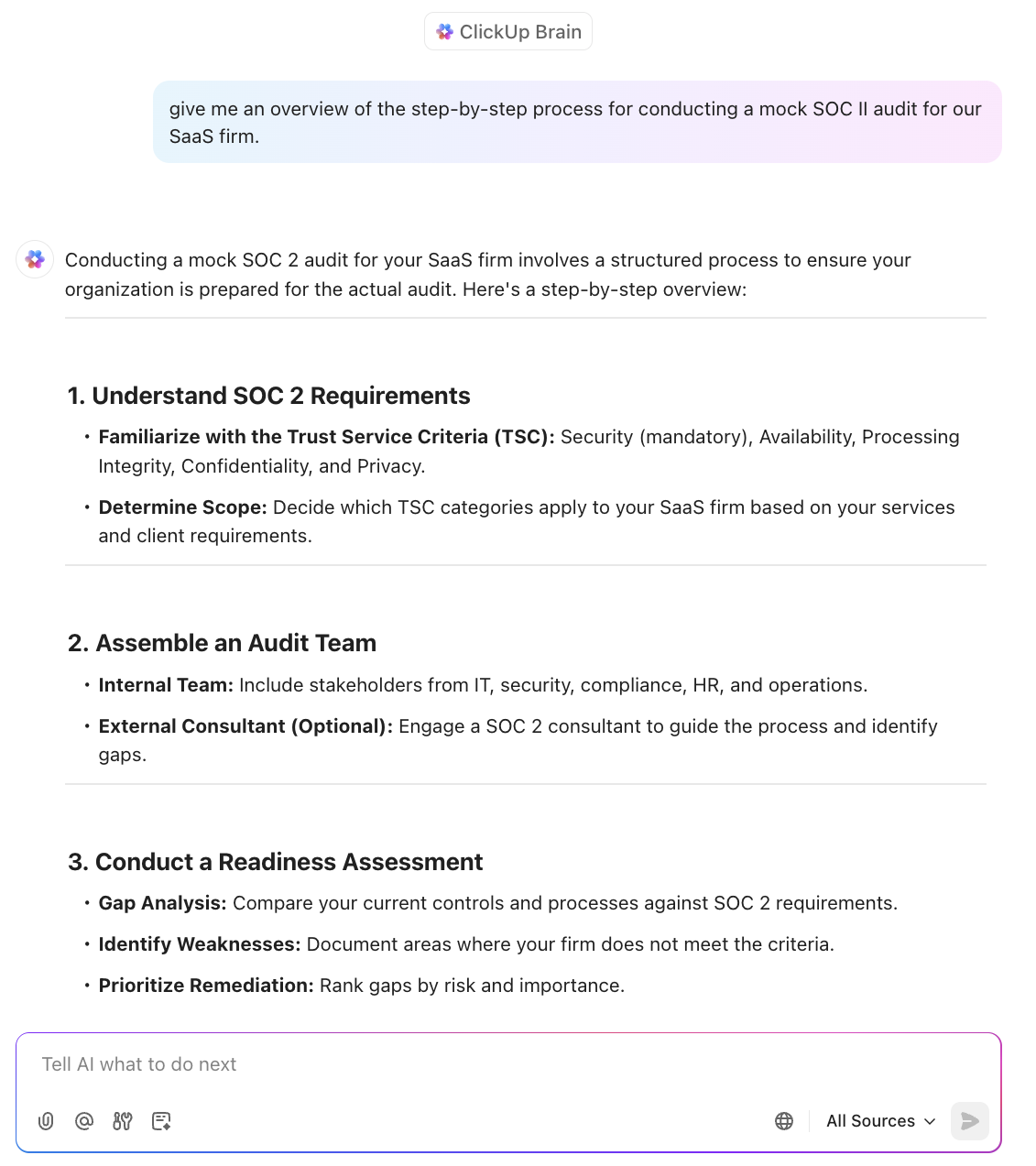

1. ClickUp Brain (Best as an all-in-one AI assistant for compliance management)

ClickUp is a converged AI workspace that brings together dozens—sometimes even hundreds—of workflows and tools into a single, unified platform.

It comes equipped with ClickUp Brain, a deeply integrated AI assistant designed to supercharge compliance and audit management workflows.

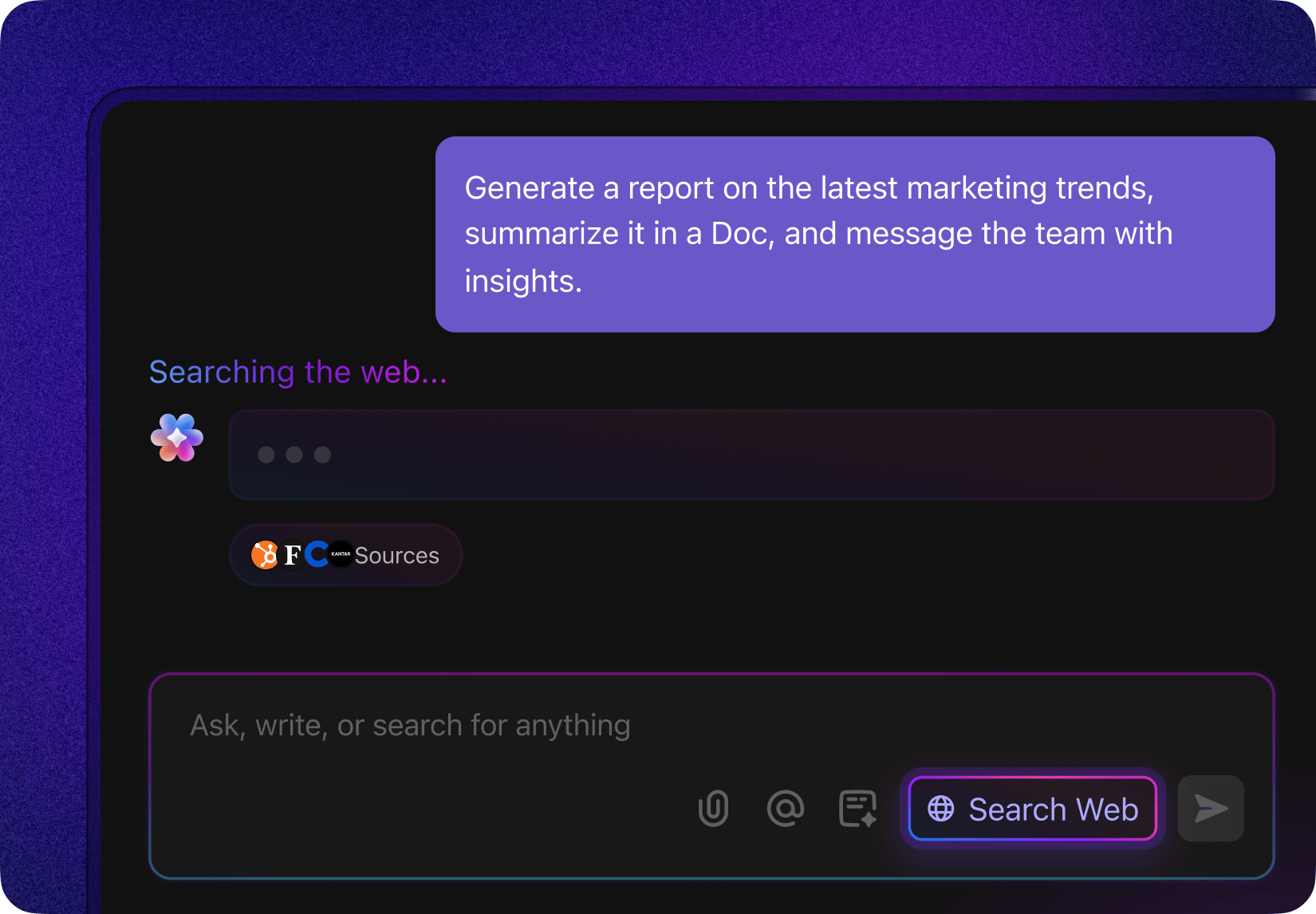

This intelligent AI partner empowers audit teams to work with multiple LLM models, run deep searches across both internal workspace data and the web, surfacing regulatory changes, emerging risks, and actionable insights. When users identify relevant findings, they can instantly convert them into trackable tasks via ClickUp Tasks with a single click. This keeps the human firmly in the loop while eliminating manual busywork.

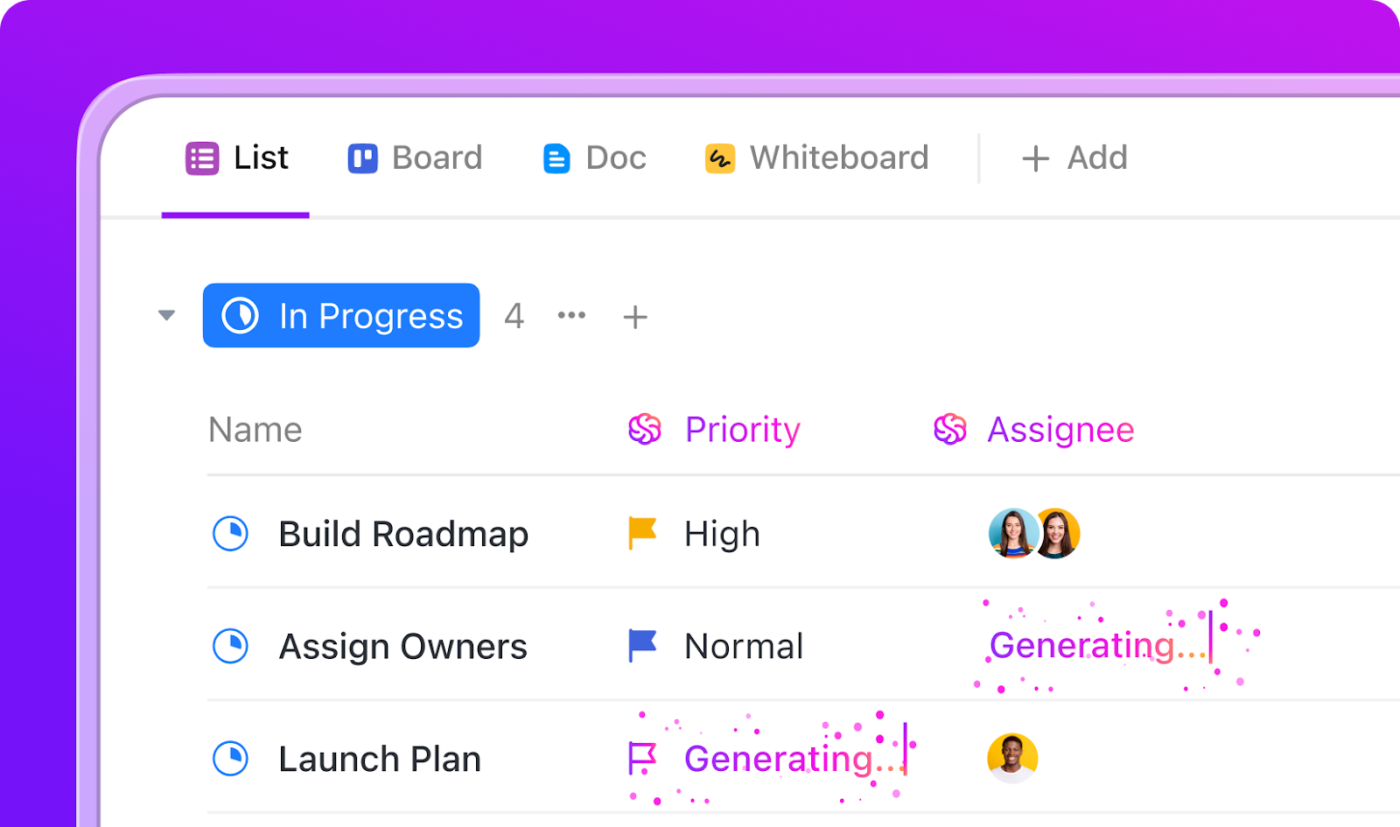

Furthermore, ClickUp’s AI Agents excel at contextual understanding, enabling users to answer audit or compliance-related questions, triage requests, and execute audit processes more efficiently. For example, when a new compliance requirement is identified, ClickUp Brain can guide users through creating specific, agentic workflows, assigning responsibilities, and building multi-step workflows, all within the ClickUp interface.

This approach ensures that every action is intentional and reviewable, with AI acting as a powerful assistant. Next, Automation in ClickUp is designed to streamline repetitive steps while maintaining oversight. Users can leverage AI to prioritize tasks, suggest assignments based on workload or expertise, and trigger workflow automations that adapt to organizational needs.

Dashboards, AI cards, and integrated chat features provide real-time visibility and collaboration, making ClickUp a true command center for your compliance management.

📣 The ClickUp Advantage for Compliance: ClickUp Brain is built with enterprise-grade security and privacy at its core. The platform is fully GDPR compliant, ensuring your data is always protected and managed responsibly. ClickUp is ISO 42001 certified, setting a global benchmark for secure and transparent AI management in the workplace.

For organizations handling sensitive health information, ClickUp is HIPAA compliant, guaranteeing confidentiality and privacy. The platform also meets AICPA SOC 2 standards, ensuring strict controls to maintain the security and confidentiality of your data and preventing it from being accessible to AI providers.

ClickUp never allows third-party AI providers to train on or retain your data, ensuring zero third-party data retention. With multi-model AI support, it unifies permissions, privacy, and security controls, giving you the flexibility to use the latest AI models without compromising data protection.

ClickUp Brain best features

- Deep search and web scanning to surface regulatory changes and compliance risks

- AI-powered assistance for brainstorming, planning, and creating audit tasks on demand

- Task assignment and prioritization suggestions based on workload and expertise

- Automation of multi-step workflows with human-in-the-loop review and approval

- ClickUp Dashboards and AI cards for real-time monitoring and actionable insights

- Integrated Chat in ClickUp for team collaboration and quick decision-making

- Seamless Integrations in ClickUp to connect with CRM, customer data, and other platforms—making ClickUp your operational headquarters

ClickUp Brain limitations

- There may be a slight learning curve, especially for teams new to AI-driven automation

ClickUp Brain pricing

ClickUp Brain ratings and reviews

- G2: 4.7/5 (9,000+ reviews)

- Capterra: 4.6/5 (4,000+ reviews)

2. AuditBoard CrossComply (Best for unified GRC and internal audit)

AuditBoard is a leading cloud-based platform designed to connect audit, risk, and compliance management. Its AI capabilities, often marketed under “AuditBoard AI,” are deeply embedded into the GRC workflows to automate repetitive tasks and enhance strategic decision-making. The platform specializes in connecting risk across the organization, making it ideal for large, complex enterprises that require seamless collaboration between internal audit, compliance, and risk teams.

AuditBoard’s AI uses domain-specific models trained on GRC data to ensure relevance and accuracy within the audit context.

AuditBoard best features

- Instantly generates drafts for risk, control, issue descriptions, and executive summaries, significantly reducing manual report writing time

- Automatically identifies and recommends mappings between risks, controls, requirements, and issues across multiple frameworks (e.g., SOX, SOC 2, ISO)

- Provides intelligent staffing recommendations and automates the creation of detailed audit test procedures and work steps

- Unifies internal audit, SOX compliance, risk management (including cyber/IT risk), and ESG reporting into a single system

AuditBoard limitations

- Primarily focused on large to mid-size enterprises, which may make the platform complex or resource-intensive for very small teams

- The initial setup and integration with all corporate systems can be extensive due to its enterprise scope

- Pricing is generally on the higher end of the market compared to tools aimed at startups/SMBs.o other AI tools

AuditBoard pricing

- Custom pricing

AuditBoard ratings and reviews

- G2: 4.6/5 (1,330+ ratings)

- Capterra: 4.7/5 (400+ ratings)

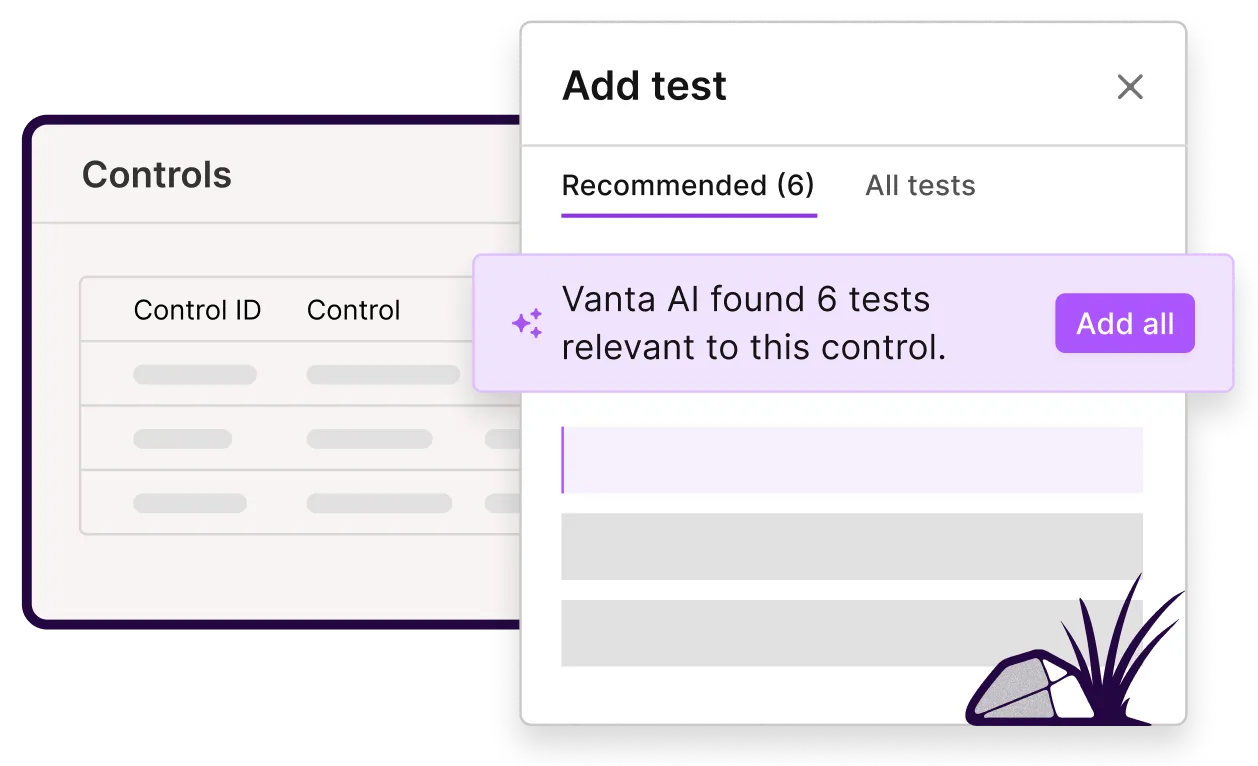

3. Vanta (Best for fast compliance certification and continuous monitoring)

Vanta is a trust management platform that excels at simplifying the process of obtaining compliance certifications like SOC 2, ISO 27001, and HIPAA quickly.

Its core AI/automation strength lies in its ability to connect to an organization’s systems and continuously monitor security controls, automating the tedious work of evidence collection. This focus on automation and user-friendliness makes it a favorite for fast-growing startups and SMBs seeking to achieve audit readiness with minimal internal resources. Vanta acts as an AI-powered co-pilot that helps maintain continuous compliance, rather than just preparing for a one-time audit.

Vanta best features

- Securely integrates with cloud providers (AWS, Azure, Google Cloud), HR, and endpoint management tools to automatically collect and update audit evidence daily

- Runs daily checks on controls and alerts users immediately when a control fails or is out of compliance, ensuring constant audit readiness

- Designed to guide users through the compliance journey and drastically reduce the time needed to achieve initial certification

- Uses AI to streamline the process of assessing and managing the compliance posture of third-party vendors

Vanta limitations

- While rapidly expanding, its historical focus has been on foundational security frameworks (SOC 2, ISO), and it may be less suitable for organizations with highly specialized or unique regulatory burdens

- The level of customization might be less than that of traditional, enterprise-grade GRC software

- Pricing can be a significant investment for the smallest of startups, though it often pays for itself by avoiding expensive manual audit efforts

Vanta pricing

- Custom pricing

Vanta ratings and reviews

- G2: 4.6/5 (1900+ reviews)

- Capterra: Not enough reviews

4. Drata (Best for real-time security and compliance automation)

Drata is a popular compliance automation platform that utilizes AI to automate evidence collection and continuous security monitoring.

Similar to Vanta, Drata is built for speed and simplicity, making it highly effective for technology companies seeking various compliance certifications. Drata focuses heavily on providing a single, comprehensive view of an organization’s security and compliance posture in real-time, greatly reducing the time and resources spent on maintaining audit readiness.

Its AI-driven approach is designed to eliminate the compliance “panic cycle” by keeping evidence and controls current 24/7.

Drata best features

- Automates the review of security controls by integrating with cloud and business applications, providing real-time visibility into compliance gaps

- Automatically maps collected evidence to the required controls across multiple frameworks, ensuring all requirements are covered

- Provides templates and a workflow for managing security policies, linking them directly to the audit controls

- Known for having a highly intuitive and easy-to-navigate dashboard, which simplifies compliance management for non-auditors

Drata limitations

- Like other compliance automation platforms, it may have limitations in supporting extremely complex, highly customized, or niche regulatory frameworks compared to traditional GRC platforms

- The quality of the audit outcome still depends on the accuracy of the system integrations and the initial setup

- Best suited for companies with a modern, cloud-native technology stack

Drata pricing

- Custom pricing

Drata ratings and reviews

- G2: 4.8/5 (1,000+ reviews)

- Capterra: Not enough reviews

5. Hyperproof (Best for multi-framework compliance and customizable workflows)

Hyperproof is a GRC and compliance operations software that uses AI to simplify the process of achieving and maintaining compliance across multiple frameworks.

It focuses on centralizing all compliance and risk management tasks. Hyperproof’s AI capabilities are designed to streamline evidence collection, conduct gap analyses, and manage vendor risk, making it a strong choice for mid-sized firms with growing compliance portfolios.

Hyperproof aims to replace spreadsheets and siloed data with an organized, automated system that is constantly audit-ready.

Hyperproof best features

- Gathers compliance evidence from integrated cloud platforms, file systems, and business tools, mapping it to controls

- Automatically identifies gaps between your current controls and the requirements of new compliance frameworks you wish to adopt

- Excellent at cross-mapping controls across different standards (SOC 2, ISO 27001, PCI DSS, GDPR, etc.), allowing a single piece of evidence to satisfy multiple audits

- Offers flexibility for GRC teams to tailor compliance workflows to their organization’s unique processes and risk appetite

Hyperproof limitations

- While strong for mid-market and growing firms, it might lack some of the deep, specialized features found in massive enterprise systems like MetricStream

- The level of customization, while a strength, can also require more setup time compared to turnkey solutions like Vanta or Drata

- Its user base is generally more focused on technology and security compliance frameworks

Hyperproof pricing

- Custom pricing

Hyperproof ratings and reviews

- G2: 4.5/5 (100+ reviews)

- Capterra: 4.8/5 (50+ reviews)

⚡️ Template Archive: Free Risk Assessment Templates in Excel & ClickUp

AI Assistant For Compliance vs. Traditional Compliance Software

A recent survey of 4,214 internal audit professionals found that 39% of internal auditors already use AI tools, and 41% plan to adopt within the next 12 months.

Meaning AI adoption in internal audit is projected to double to ~80% by 2026.

This isn’t just a technology fad. Over half of the respondents in the survey cited productivity and efficiency gains as the leading benefit of AI adoption.

The reason is simple: traditional tools help you record compliance; AI helps you reason about it.

Below is a side-by-side snapshot of how the two paradigms differ in concept, capability, and business impact:

| Compliance dimension | Traditional compliance software | AI compliance assistant |

|---|---|---|

| Regulatory updates | Manual updates lag weeks or months behind. Teams must recode rule logic whenever new guidance is released. A 2025 Carahsoft study notes that regulators issue 200–250 alerts daily—an impossible task for humans to track manually. | AI models scrape and semantically analyze regulatory feeds, automatically flagging only relevant changes. Some platforms report filtering out 95% of irrelevant alerts, reducing alert fatigue. |

| Document review & audit prep | Manual policy mapping and control testing eat up weeks. Reviewers read hundreds of pages of contracts or evidence. | NLP-based assistants summarize, classify, and extract key obligations in minutes. As we saw previously, WestRock’s audit team used GenAI to draft audit objectives and risk matrices in a fraction of the usual time. |

| Cross-department coordination | Compliance data sits in silos. Finance, legal, and operations, each running their own system. Insights don’t flow easily. | AI agents can ingest multi-source data, normalize formats, and surface unified dashboards that speak “plain English.” This allows non-technical users to query compliance exposure conversationally. |

| Alert accuracy/noise | Rule-based alerts flood dashboards with false positives. Analysts spend up to 70% of their time clearing non-issues. | ML-driven filtering learns from analyst feedback, reducing false positives in mature deployments. Alerts are contextual and ranked by confidence score. |

| Reporting & remediation | Reports are static PDFs that summarize what went wrong after the fact. | AI assistants generate real-time dashboards and predictive indicators, helping teams spot compliance drifts before they become breaches. |

| Scalability | Adding more data means more staff or licenses. | AI scales with computation, one model can process millions of transactions or documents concurrently. |

| Governance transparency | Fully auditable, but inflexible. Every rule change requires revalidation. | AI requires explainability layers, e.g., showing which documents or phrases drove each recommendation, blending transparency with adaptability. |

Challenges & Considerations Before Adopting AI Compliance Assistants

Despite its promise, AI adoption in compliance comes with a unique set of challenges.

Organizations must navigate technical, operational, and governance challenges to realize AI’s full potential.

❗️One major barrier is the skill gap. According to Thomson Reuters, many audit professionals lack the expertise to manage and leverage AI technologies effectively. Training and change management are critical to avoid underutilization.

❗️Data privacy and security are paramount. Compliance data is sensitive, and AI systems must adhere to strict security protocols to prevent breaches or unauthorized access.

❗️Governance maturity varies widely. Only 26% of organizations have fully integrated generative AI standards into their compliance governance frameworks, leaving many exposed to risk. Without robust policies, AI adoption can lead to compliance gaps or unintended bias.

❗️Cost and integration complexity also demand attention. AI tools require upfront investments and seamless integration with existing systems, which can be resource-intensive.

📖 Read More: How to Overcome Common AI Challenges

Future Of AI In Compliance & Audit

The trajectory of AI in compliance and audit points toward near-universal adoption and deeper integration across business functions.

KPMG’s global study finds ~99% of companies expect to pilot or use AI in financial reporting by 2027, signaling near-universal deployment across finance functions in the next few years.

Let’s look at some of the key trend callouts here:

Employee compliance: a big opportunity, a big runway

Adoption inside employee-monitoring and regulatory-intelligence stacks is still early but accelerating. One industry study finds that only ~9% of firms have adopted advanced automated regulatory-intelligence platforms today, but over 60% expect to be ready or adopt more sophisticated AI tools by 2030—a signal that firms view employee-level compliance automation as a multi-year transformation.

Maturity gap: governance separates winners from laggards

Not every organization will capture the same value. Surveys and market studies show a stark maturity divide: 76% of high-maturity organisations report they’ve integrated AI across risk and compliance functions, compared with only ~6% among the lowest-maturity peers. In short, firms that pair AI with governance, data discipline, and change management pull ahead quickly.

Culture shift inside audit shops: The Deloitte example

Large audit firms are a bellwether. In the UK, Deloitte’s internal AI chatbot (PairD) is now used by nearly 75% of audit staff at least monthly, showing how conversational AI is moving from experimentation to daily workflow augmentation in audit teams. That cultural normalization shortens the runway for enterprise adoption elsewhere.

A reality check: adoption ≠ maturity

Regulators and reviewers are sounding cautionary notes: while usage grows rapidly, oversight and measurement lag. The UK’s regulator has flagged that major accounting firms are not yet systematically measuring the effect of AI on audit quality; a reminder that scale without controls creates risk as well as benefit. This is where company-wide AI policies can make a difference.

How To Choose The Right AI Compliance Assistant

Choosing the right AI compliance assistant is a strategic decision that requires careful evaluation across multiple dimensions.

Start by thoroughly assessing your compliance workflows to identify where AI can deliver the most impact—whether it’s automating audit scheduling, risk scoring, or regulatory updates. Here is a step-by-step guide:

Step 1: Map your compliance workflows first

- Audit your current pain points. Where do time and human effort bottleneck (e.g., audit scheduling, evidence collection, policy mapping)?

- Identify high-impact automation targets like document summarization, regulatory tracking, or risk scoring

- Quantify potential gains (hours saved, error reduction, faster audits) to define success metrics before vendor evaluation

Step 2: Match the solution to your industry’s regulatory depth

- Finance & healthcare: Prioritize AI platforms with domain-trained models for sector-specific frameworks (e.g., Basel III, HIPAA, SOX)

- Other industries: Consider flexible, low-code assistants like ClickUp AI, which adapt to diverse compliance models and documentation flows

- Verify that the vendor continuously retrains models against updated laws and standards

Step 3: Evaluate integration and interoperability

Your AI assistant should connect seamlessly with existing systems: ERP, GRC platforms, document management tools, and calendars.

Be sure to ask vendors about API access, data import/export options, and real-time sync capabilities. Because integration maturity directly impacts accuracy, user adoption, and ROI.

Step 4: Demand transparency and explainability

Regulators now expect AI outputs to be auditable. Ensure that the chosen system provides:

- Source citations for each recommendation or output

- Explainable decision logic (why a risk was flagged, what data informed it)

- Version control and audit logs for AI-driven decisions

Transparent models build trust with both regulators and internal reviewers.

Step 5: Balance pricing with scalability

- Assess total cost of ownership—including licenses, data storage, and customization

- Choose a model that can scale with your organization’s growth and expanding regulatory footprint

- Always request demos and trial periods to test usability, support quality, and update cadence

Step 6. Prioritize governance and vendor accountability

Vendors who embed ethical AI governance tend to align better with long-term compliance goals.

- Review how the provider handles data privacy, model retraining, and bias monitoring

- Ask for documentation on security certifications (e.g., ISO 27001, SOC 2)

Build Smarter Compliance Workflows With ClickUp

The compliance landscape is evolving rapidly, and AI compliance assistants are no longer optional—they are essential. By automating complex workflows, offering real-time risk insights, and enabling proactive governance, these tools reduce costs, improve accuracy, and empower compliance teams to focus on strategic priorities.

Yet, success demands thoughtful selection, robust governance, and investment in people and processes. ClickUp AI’s intelligent, flexible platform exemplifies how organizations can harness AI to meet today’s regulatory challenges and prepare for the future.

Transform risk management into a strategic advantage that drives resilience and growth. Try ClickUp’s AI Assistant today!

Frequently Asked Questions

An AI Compliance Assistant is a digital tool that uses artificial intelligence to help organizations manage, monitor, and streamline compliance processes. It can analyze large volumes of data, surface regulatory changes, suggest actions, and automate repetitive compliance tasks—always keeping a human in the loop for final decisions.

AI assistants help with audits by organizing evidence, tracking deadlines, surfacing relevant regulations, and suggesting next steps. They can run deep searches across internal and external data, assist in drafting audit documentation, and automate routine follow-ups, making the audit process faster and more accurate.

Industries with strict regulatory requirements benefit most, including finance, healthcare, insurance, manufacturing, technology, and government. Any sector that faces frequent audits, complex reporting, or evolving compliance standards can gain efficiency and reduce risk with AI compliance tools.

AI is highly reliable for monitoring large data sets, identifying anomalies, and flagging potential compliance issues. However, it should be used as an assistant—final reviews and decisions should remain with human experts to ensure accuracy and context.

AI is used to scan for regulatory changes, monitor transactions, detect suspicious patterns, automate reporting, and prioritize risks. It helps teams stay proactive by surfacing emerging threats and suggesting mitigation steps, all while reducing manual workload.

Traditional compliance software provides tools for tracking, reporting, and managing compliance tasks. An AI compliance assistant adds intelligence—analyzing data, suggesting actions, automating repetitive work, and learning from user feedback to improve over time.

No, AI cannot fully replace human compliance officers. While it can automate routine tasks and provide valuable insights, human judgment, ethical considerations, and contextual understanding are essential for effective compliance management.

Reputable AI compliance assistants are built with strong security measures, including encryption, access controls, and compliance with data privacy regulations. However, organizations should always review a tool’s security certifications and practices before handling sensitive information.