A Complete Guide to the BCG Growth Share Matrix: Optimizing Portfolio Management

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Often considered a revolutionary strategic management tool, the BCG Growth Share Matrix was first introduced in 1970 by the Boston Consulting Group, spearheaded by the group’s founder, Bruce Henderson, with significant contributions from Alan Zakon and his team.

BCG Growth Share Matrix is a strategic tool that can guide you in making crucial product investment and resource allocation decisions. By assessing your products and classifying them based on their market’s growth rate and relative market share, you can effectively identify areas to invest in, divest from, or maintain.

In this article, we’ll break down the framework’s key components, go through some practical application examples, and show you how to create your own BCG Growth Share Matrix using ClickUp, the leading project management platform.

Struggling with inefficient resource allocation leads to missed growth opportunities and underperforming businesses. Eventually, you might face:

The BCG Growth Share Matrix is a long-term strategic planning tool that aims to solve all of the issues mentioned above. It guides investment decisions based on a product’s market growth rate and relative market share.

The matrix shows two essential aspects companies should consider when deciding where to invest their money: how competitive they are and how attractive the market is. These estimations are based on their current share of the market and how fast that market is growing:

The BCG Growth Share Matrix places a company’s products into four categories or quadrants based on the competitiveness and growth rates of their respective markets:

Plotting a particular product on the matrix should not be arbitrary; it should result from careful analysis using measures such as:

Each of the four categories of the BCG Growth Share Matrix has its unique characteristics and requires different strategies to perform well and generate profits. Let’s take a closer look at each to help you optimize your investment approaches.

Stars depict your business’s high-growth, high-market-share products, often poised for success and representing a significant source of revenue. As the name suggests, these are the shining stars of your product portfolio that have the potential to dominate the market.

To make the most of your Stars, here’s what you should do:

Cash Cows in the BCG Matrix are your company’s dependable, hardworking assets. They have a significant share in slow-growing markets and usually bring in a steady flow of income. They’re stable, mature, and don’t need much investment.

To make the most of them, focus on keeping their market share and making as much profit as possible.

You can use the money they make to invest in other parts of your business. You might want to try new ways to make your operations more efficient or find other ways to bring in money. But remember, you shouldn’t get too comfortable. The market can change, and an unattended Cash Cow can quickly become a Star in the best-case or a Dog in the worst-case scenario.

Dogs represent products with a low market share in industries where growth is slow, and they don’t bring in much money compared to the resources they consume. But with some smart planning, you can turn the situation around. Here’s how:

Question Marks are products that operate in high-growth industries but hold a low market share. This makes them potential winners but also risky investments. They’re the wild cards in your portfolio.

To leverage their potential, you’ll need to invest heavily and strategically. If a Question Mark can gain more market share, it could become a Star and eventually a Cash Cow. However, if it fails to gain a foothold in the market, it might become a Dog.

You’ll need to evaluate their potential carefully, considering market trends, competition, and your company’s available resources.

Creating a BCG Growth Share Matrix requires carefully looking at your products and figuring out how they’re doing in the market. Here’s how to start:

This is a solid plan, but luckily, there’s a tool that can make this process simple, quick, and effortless—ClickUp.

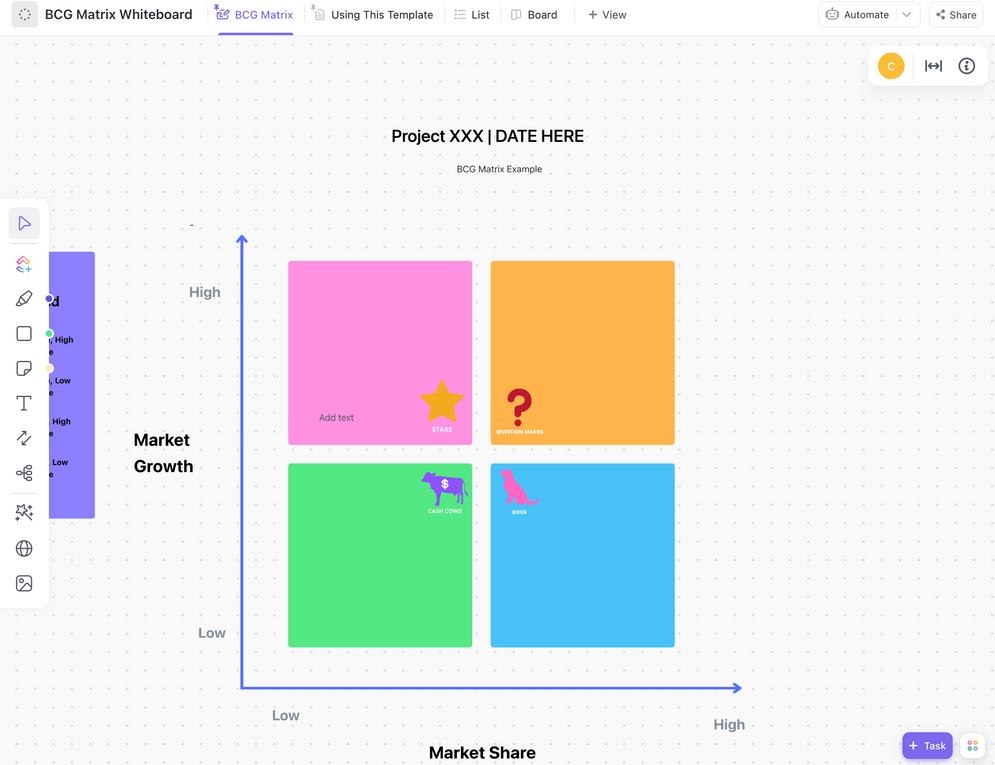

The ClickUp BCG Matrix Whiteboard Template helps medium to large companies manage their product lines more effectively. It’s a ready-made framework for classifying products based on factors like popularity, quality, and functionality.

This template is particularly useful for project and product managers because it’s easy to use and helps visualize and simplify complex information. It uses two key product management metrics—growth and market share—to categorize products into four quadrants:

Below is a quick, step-by-step guide for effectively utilizing the BCG Matrix Whiteboard Template in ClickUp:

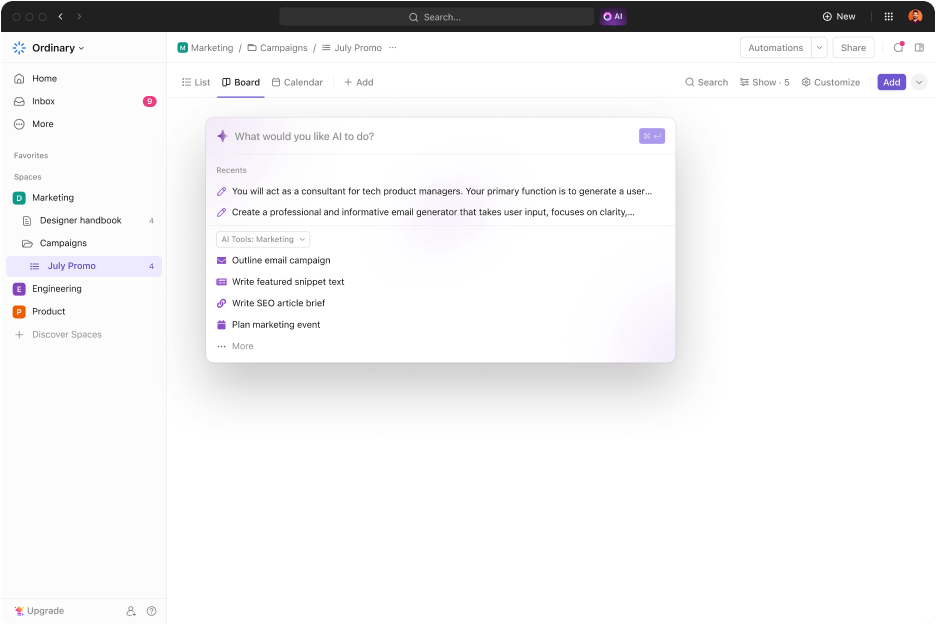

With ClickUp Brain, the platform’s neural network, you can tailor your strategies to suit your specific objectives using AI-driven insights. Whether you’re looking to spot growth prospects, refine your product lineup, or manage risks, ClickUp Brain offers the support and resources necessary for navigating the challenges of portfolio analysis and business strategy with confidence.

With automated data analysis, you’ll save valuable time and resources while gaining a deeper understanding of your portfolio’s performance. Plus, AI-powered visualizations offer a clear and concise overview, making it easier than ever to track progress and drive innovation.

Try these AI prompts for BCG Matrix analysis:

Imagine you’re a product portfolio manager at a big tech company like Apple Inc., in charge of many different products at different lifecycle stages. How do you decide what to focus on and how to design your product marketing strategies? That’s where the BCG Growth Share Matrix comes in:

In the table below, you can see a few more examples besides Apple:

| Company/Product | Relative Market Share | Market Growth Rate | Quadrant | Strategy |

| Google Search | High | Low | Cash Cow | Maintain market share, generate cash |

| Google Pixel | Low | High | Question Mark | Invest and grow, the potential to become a star |

| Netflix Streaming | High | High | Star | Invest heavily for continued growth |

| Netflix DVD Rental | Low | Low | Dog | Consider discontinuing |

While the BCG Growth Share Matrix is a valuable framework for effective resource allocation and decision making, it’s important to consider its shortcomings to fully understand its strategic implications. Like any analytical tool, the matrix has limitations that you must be aware of to make the most effective strategic decisions. Here are the most notable ones:

While the BCG Growth Share Matrix has shortcomings, it remains an invaluable tool for entrepreneurs and businesses navigating the complexities of managing product portfolios. Its simple product categorization into Stars, Cash Cows, Question Marks, and Dogs provides a simple and practical framework for strategic planning and resource allocation.

Applying the BCG Growth Matrix becomes easier than ever with ClickUp. Whether you’re a fledgling startup or an established enterprise, you can use ClickUp’s ready-made matrix templates and collaborative Whiteboards to make smart investment decisions and set your business on the path to sustainable growth. Sign up for ClickUp today and build your own BCG Growth Matrix in minutes!

© 2025 ClickUp