SOX Compliance Checklist: The Ultimate Guide

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Disclaimer: This article is intended to provide a compliance checklist on SOX and tools that can help. It is not intended to be a substitute for professional legal or financial advice.

SOX, an abbreviation for the Sarbanes-Oxley Act, is an essential element of financial regulation for companies. It is a set of rules designed to keep company finances transparent and protect investors.

Think of it as a financial health check-up for companies. Like you’d go to the doctor for a routine check-up, businesses undergo SOX audits to ensure they’re in optimal financial shape.

These audits are the benchmarks through which companies showcase their transparency, accountability, and honesty with investors.

In this article, we will explore SOX compliance and corporate responsibility in detail, discuss its key components, common compliance challenges that businesses face, and tools to facilitate it.

SOX, short for the Sarbanes-Oxley Act, is like a rulebook for public companies to follow ethical financial practices that ensure sound corporate governance. The US federal law mandates that organizations adhere to specific financial reporting, information security, and auditing requirements to prevent the possibility of corporate fraud.

The SOX Act was created in 2002 after large, publicly traded companies like Enron, Tyco, and WorldCom got caught misrepresenting their financial records. The spate of financial fraud incidents and scandals contributed to the 2002 financial crisis.

This prompted the creation of a legal act to ensure that all public companies are honest and transparent so stakeholders like investors (bankers, shareholders, the general public, etc.) can trust what the companies tell them about their financial data.

With the introduction of SOX, companies now have a legal obligation to be more cautious and transparent when handling and reporting their finances—much like GDPR compliance demands extra care when processing personal data.

SOX is mainly for the big players in the business world, especially those dealing with large amounts of customer data.

Here are a few other examples:

But even if you’re not on this list (e.g. small, private companies or startups), following SOX principles is wise as it helps prevent fraud, improves corporate governance, and helps protect against security breaches.

Let’s set aside the legal jargon for a second and break this down.

Think of SOX compliance requirements as the main ingredients in your ‘keeping the company honest’ recipe.

Here’s a quick rundown of key SOX Compliance requirements:

In terms of SOX, internal controls are like the locks and alarm systems that keep a company’s financial information safe and accurate.

Companies need to set up and maintain these controls to safeguard personal data. It ensures no one is cooking the books or ‘accidentally’ misplacing a few million dollars.

An example of an internal controls process would be the segregation of duties (SOD), where multiple people are not involved in critical tasks such as payment approvals. This also ensures that there is no conflict of interest among powerful stakeholders within the organization. This aims to prevent possible manipulation of sensitive financial information.

Financial reporting is all about being honest and clear when telling the world about your company’s financial situation.

Companies must ensure their financial reports are accurate, complete, and submitted on time. That expensive company yacht cannot be hidden in the ‘office supplies’ category!

Proper reporting also helps comply with legal obligations (like GDPR compliance)—via transparent handling of personal data.

Data security is a big deal for companies, especially with their growing dependency on cloud storage and an increase in security breaches. Companies must safeguard their financial data from hackers, nosy competitors, or anyone else who shouldn’t be peeking at their numbers.

This means setting up strong passwords (and “password123” won’t make the cut), using encryption, and ensuring that only the right people can access sensitive information, among other things.

Like the GDPR checklist, these practices help data processors maintain security controls and data privacy.

Also Read: How to Create a Compliance Checklist

SOX requires companies to have a system for employees to report suspicious activity without fear of getting fired or demoted.

For example, if you notice someone in accounting falsifying the numbers or hiding expenses, you can report it anonymously. The company is legally required to protect you from retaliation.

Similar to a data subject who can file a complaint with the supervisory authority under GDPR, this rule allows employees to speak up. They can do so without worrying about job security.

Companies must keep detailed records of all their financial activities, from sales transactions and expense reports to payroll records. Think of it as a financial diary that tracks every penny coming in and going out.

This audit trail helps prove that the company follows the rules and makes it easier to spot any irregularities. It further helps settle disagreements by showing clear proof of data processing activities and ensuring accountability by tracking who approved or started each transaction.

Just as GDPR mandates recording data processing operations, SOX confirms transparency in all financial dealings.

💡Point to Remember: SOX compliance requirements exist to protect investors, employees, and the public from financial foul play. Achieving SOX compliance helps keep things honest in the business world. It provides extra protection similar to the General Data Protection Regulation (GDPR) for securing customer data.

The checklist below provides an overview of the key steps to achieve and maintain SOX compliance.

Start by creating an adequate internal control structure. This is the foundation of your compliance plan. Make sure you implement reliable and accurate financial reporting. Assign clear roles to everyone involved in maintaining these controls.

Developing effective procedures and using them consistently across your organization is crucial. Think of it like how a data protection officer manages personal data processing in companies that follow GDPR rules.

Set up a system for constant monitoring and regular audits. This helps you catch and fix issues early. Schedule a regular SOX audit and frequent check-ups of your financial statements, practices, and incident management system.

It’s like getting a financial health check every year, and it keeps your organization’s fiscal matters in proper shape. These reviews are similar to how companies regularly monitor their compliance with data protection authorities.

Keep detailed notes on all your financial processes, decisions, and changes. This creates a clear paper trail for future reference.

Good record-keeping makes it easier to report to regulators, showing that you’re serious about following the rules. It’s comparable to how a data protection impact assessment reflects transparency in handling personal data under GDPR.

Must Read: Struggling to keep on top of your financial and operational data records? Check out our curated list of the 10 Best Record Management Software and Systems in 2024

Create thorough training programs for all your staff. Make sure everyone understands the SOX compliance audit checklist requirements and their part in it. Hold regular training sessions to keep everyone up-to-date on compliance standards and best practices.

This approach is similar to GDPR compliance checklists, which ensure staff are aware of data subject rights and how to handle sensitive data appropriately.

Assess potential financial risks regularly, set security safeguards, and develop strategies to mitigate and reduce risk effectively. This includes dealing with cybersecurity threats, market changes, and weaknesses in your internal controls to minimize security incidents.

Being proactive about risk management is critical. It’s like performing data protection impact assessments for high-risk data processing under GDPR.

Use full-proof tech solutions to manage and protect your financial data. This includes installing secure databases and encryption methods. Ensure your data handling practices meet SOX requirements, especially in data integrity and security areas.

Like GDPR, which governs the processing of personal data, SOX focuses on protecting financial information from unauthorized access or misuse.

Steering SOX compliance can be tricky, with several challenges that organizations must address to keep on the regulatory tracks.

Handling large volumes of data securely is a big challenge. Organizations collect data constantly, and they need to manage it while keeping it safe from unauthorized access.

Data controllers must conduct data protection impact assessments to protect personal data during processing. This is especially important for sensitive data, like biometric data, which needs strong security measures.

Another hurdle is keeping up with changing compliance requirements. SOX regulations, like those of the GDPR, can change and evolve, and organizations need to adapt quickly.

Companies should communicate new compliance measures using clear and plain language so everyone understands. Regular training sessions help keep everyone informed and compliant.

Sometimes, there’s a mismatch between who owns the controls and daily operations. Control owners may not fully integrate compliance responsibilities into their routines, leading to gaps.

For example, if a data protection officer doesn’t regularly engage in data processing activities, it can result in non-compliance with data protection requirements.

Having too much documentation can make compliance efforts harder.

While detailed records are necessary, overly complex documentation can hide important compliance results. For effective compliance management, it’s vital to create concise, easily accessible forms.

Managing third-party vendors adds complexity to SOX compliance. Organizations must ensure vendors follow the same compliance standards, especially in data governance and processing activities.

This requires regular and systematic vendor compliance monitoring to ensure they meet legal obligations and protect personal data.

To make SOX compliance more manageable, you can use several compliance management tools and software solutions to streamline various process aspects.

Here are a few:

Also Read: How to Use AI for Data Governance

So far, we have covered what SOX compliance stands for, some of its key requirements, and some of its everyday challenges.

However, one thing is for sure—there are many steps and procedures that teams have to follow to ensure compliance. This becomes difficult for large companies where different teams need a common platform to delegate, approve, and review tasks.

Fortunately, we have just the right tool for you—ClickUp, an all-in-one platform for your compliance needs. Let’s explore its features together.

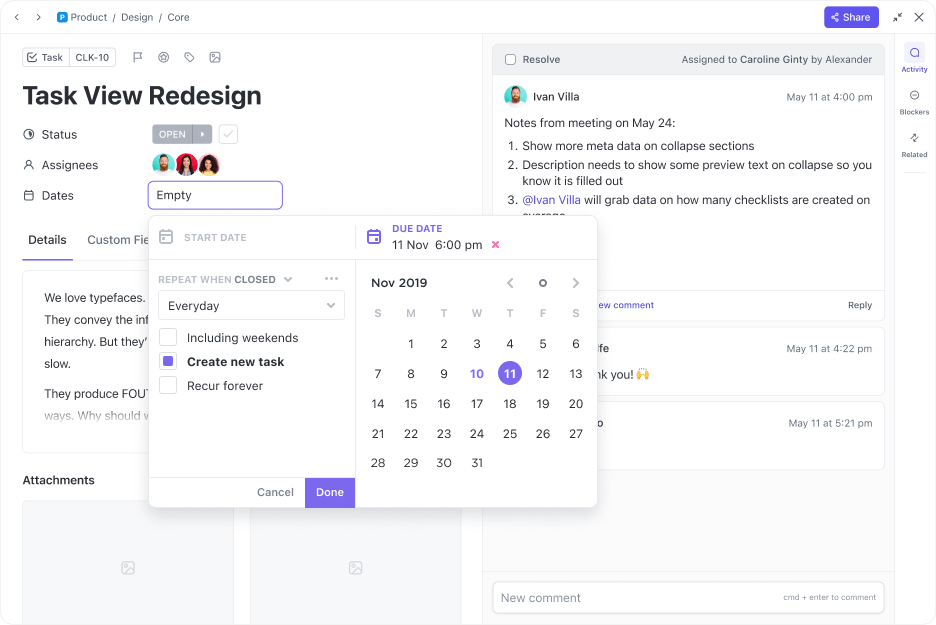

ClickUp Tasks helps simplify complex SOX compliance audit checklist processes by breaking them down into smaller, more manageable steps.

You can create individual tasks for each section of SOX, assign them to team members, and set due dates to ensure timely completion. This structured approach helps keep the audit process organized and on track.

Additionally, ClickUp allows you to track the progress of each task, set reminders, and collaborate with your team in real-time. This helps in the scheduled completion of compliance processes that ultimately help teams focus on their objectives.

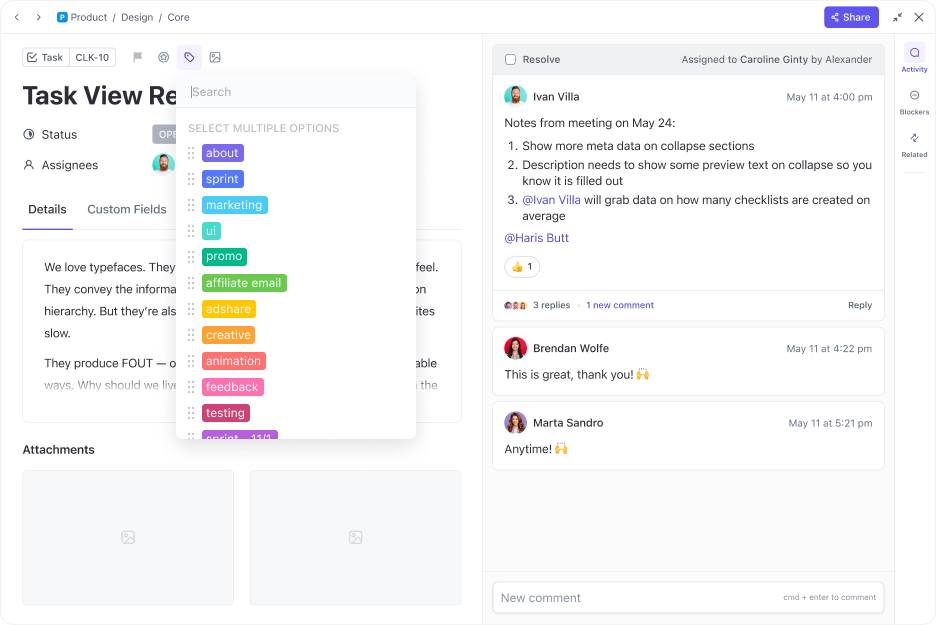

Tasks can also be customized with specific fields, such as risk level, control type, or the relevant SOX section. These customizable fields organize all necessary details and make it easier to identify areas that require special attention.

ClickUp Docs provides a centralized space for storing all your compliance-related documentation, including policies, procedures, data processing records, and evidence of compliance.

It ensures that all necessary documents are easily accessible and well-organized in one place, facilitating better management and quick retrieval when needed. The version history feature is crucial in creating audit trails by tracking document changes over time.

It is also particularly useful for handling subject access requests or providing reports to data protection authorities, as it offers a reliable log of modifications made to any compliance-related documents.

For enhanced security, ClickUp also includes permission settings that allow you to control who can access sensitive compliance documents. Moreover, the system aligns with GDPR and SOX standards, ensuring your documentation remains secure and compliant with key data protection and accountability regulations.

ClickUp’s features make it easier to handle your compliance processes and conduct risk assessments. Here’s how they can assist in maintaining SOX compliance.

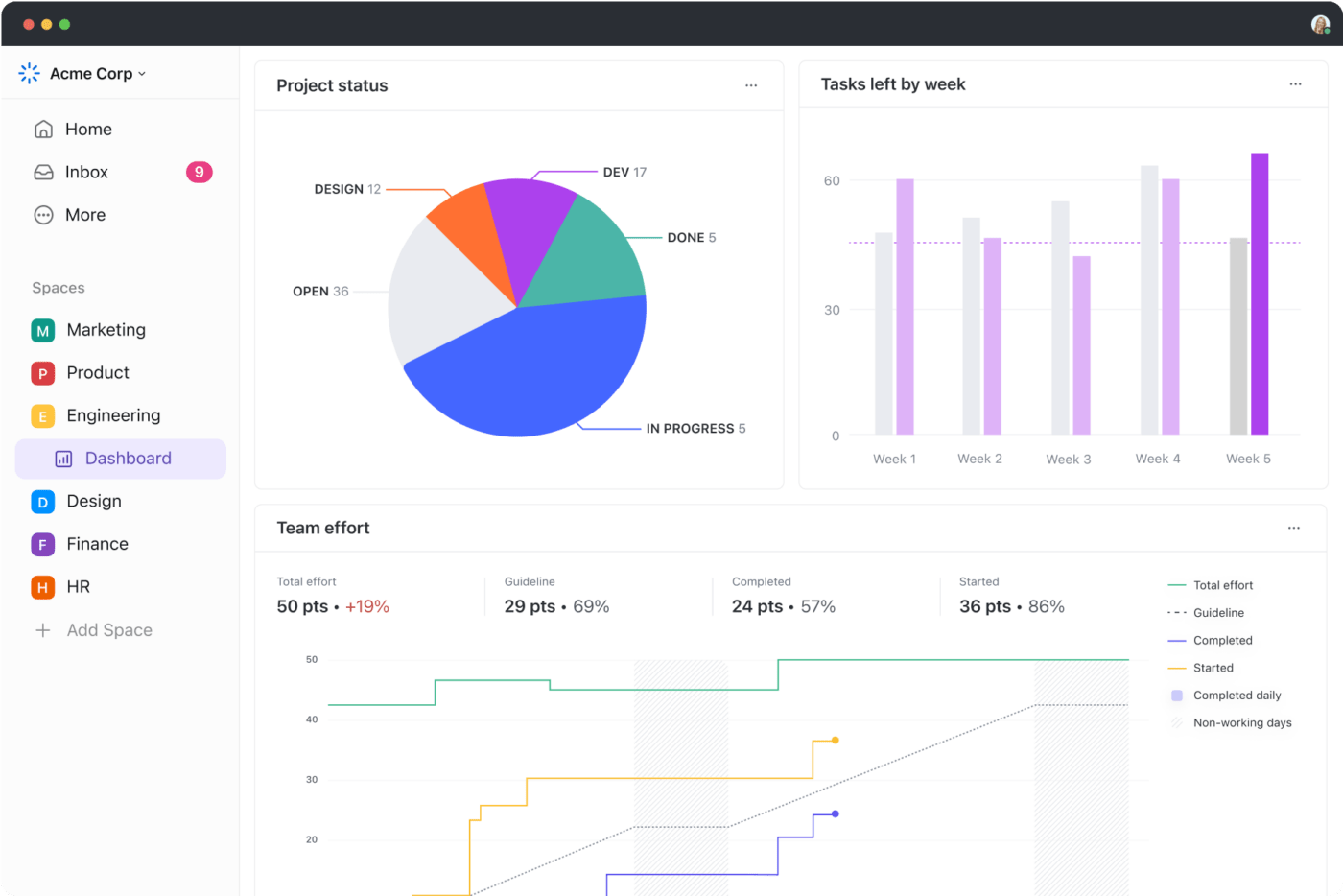

ClickUp Dashboard provides a visual snapshot of your compliance status, allowing you to spot concerns or potential issues quickly.

Custom views can be tailored to track various aspects of compliance, such as control effectiveness or audit findings. This way, your team stays informed and can focus on high-priority areas.

With ClickUp’s Board view, you can prioritize risks based on their potential impact and likelihood.

This feature helps identify areas that need attention, ensuring a proactive approach to risk management. Like you would evaluate large-scale data processing under GDPR, ClickUp helps you effectively address and mitigate risks.

Using ClickUp Custom fields, you can assign risk scores and mitigation strategies to each compliance task or control.

It can help you by offering a comprehensive, data-driven approach to risk management. By quantifying risks, your team can focus on mitigating the most pressing issues, ensuring better compliance outcomes.

ClickUp Automation simplifies repetitive tasks like sending reminders for control testing or escalating high-risk issues.

While ClickUp’s features are super easy to use for SOX compliance, there’s an even easier method of carrying out your compliance work: templates.

Wait, there’s more. In addition to features that make compliance easy, ClickUp also has a bunch of templates to help you. They are great for making compliance processes more efficient by offering a structured approach—this helps save time and reduce the risk of errors. They’re especially useful for SOX compliance as they make complex audit processes easier to understand.

The ClickUp Compliance Project Plan Template is an all-in-one tool to elevate compliance efforts. It offers a structured approach to managing complex compliance requirements by breaking down the different processes into manageable steps.

Key features of this template include:

The template is handy for risk managers and compliance teams working on various regulations like GDPR or HIPAA. It offers a clear framework for defining rules, assigning tasks, setting deadlines, tracking progress, and recording results—critical in confirming that your organization fulfills its compliance essentials.

Understanding SOX requirements and implementing the compliance processes can be a bit overwhelming for any organization. But the good news is, it doesn’t have to be hard to stay compliant and diligent.

With the right tools, strategies, and processes in place, it’s easy to adhere to the regulations and sometimes even rewarding. This is especially true if you use tools like ClickUp, which offer easy-to-use templates and a whole bunch of features that help you track, manage, and approve all your compliance tasks.

Ready to take charge of your compliance processes?

Sign up at ClickUp today and pave the way to 100% SOX compliance!

© 2026 ClickUp