Free Household Budget Templates for Google Sheets

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Many of us intend to tackle household expense tracking (with the best intentions!) but frequently put it off. Starting from scratch can be daunting, leaving you staring at a blank file and wondering where to begin.

Free templates from Google Sheets provide a framework for you to easily input your financial data and gain insights into your spending habits.

Here is a list of the best free household budget tracking tool templates on Google Sheets, plus some great alternatives from ClickUp.

These templates help you manage your income, save time, monitor your expenses, and pave the way for a more financially secure future.

🔍 Did You Know: 55% of Americans are uncertain about their financial decisions, especially when managing income, debt, savings, and retirement plans.

A well-designed household budget template in Google Sheets helps individuals and families manage their finances, track spending, and plan.

Here are the key features an ideal household budget template should include:

🧠 Fun Fact: The most common priorities for saving are for emergency funds (48%), investments (36%), retirement planning (35%), and travel savings (34%).

🎁 Bonus Read: The Psychology of Money Summary: Key Takeaways & Review

If you want to simplify your budget and expense management, Google Sheets templates are a great place to start.

These templates come pre-built with categories for personal expenses, bills, savings goals, and more, making it easier to monitor your financial health.

Here’s a handpicked list of the top Google Sheets templates for monthly and annual budget planning:

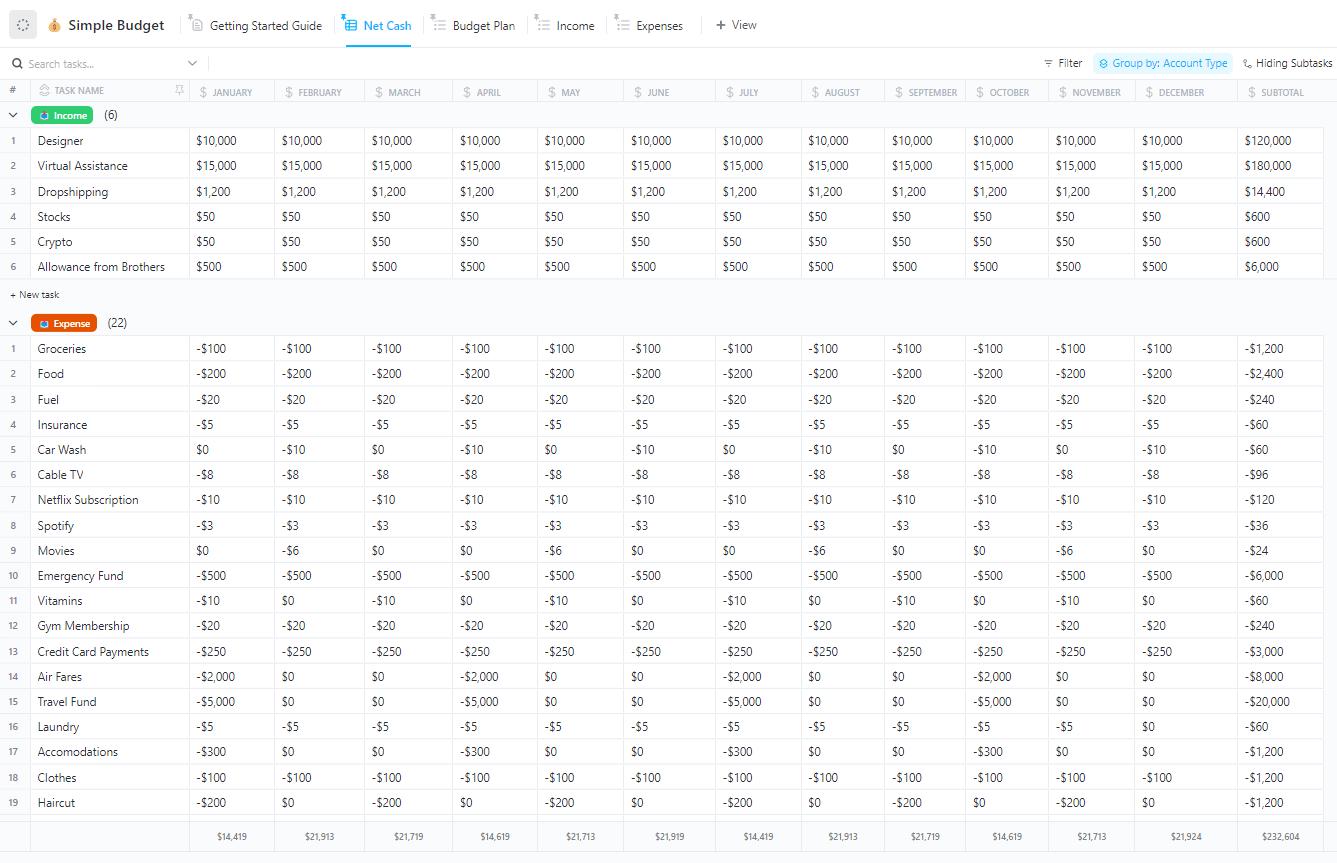

A growing family juggling school expenses, groceries, and weekend activities often struggles to track where the money goes. The Google Sheets Family Monthly Budget Template by GooDocs uses a structured grid to document income sources and expenses.

Color-coded sections separate essentials like housing and utilities from discretionary spending, helping families maintain better awareness and control over monthly cash flow. Whether you’re budgeting for groceries, school supplies, or emergency funds, everything is laid out so you can track how every dollar is spent.

Ideal for: Families who want to build smarter money habits, stay on top of monthly bills, and save more together.

💡 Pro Tip: Dreaming of crushing your short- and long-term goals? Check out these 1-5-10 year goal examples to map your personal and professional journey! It’s a simple way to set clear milestones and stay focused through every phase of life.

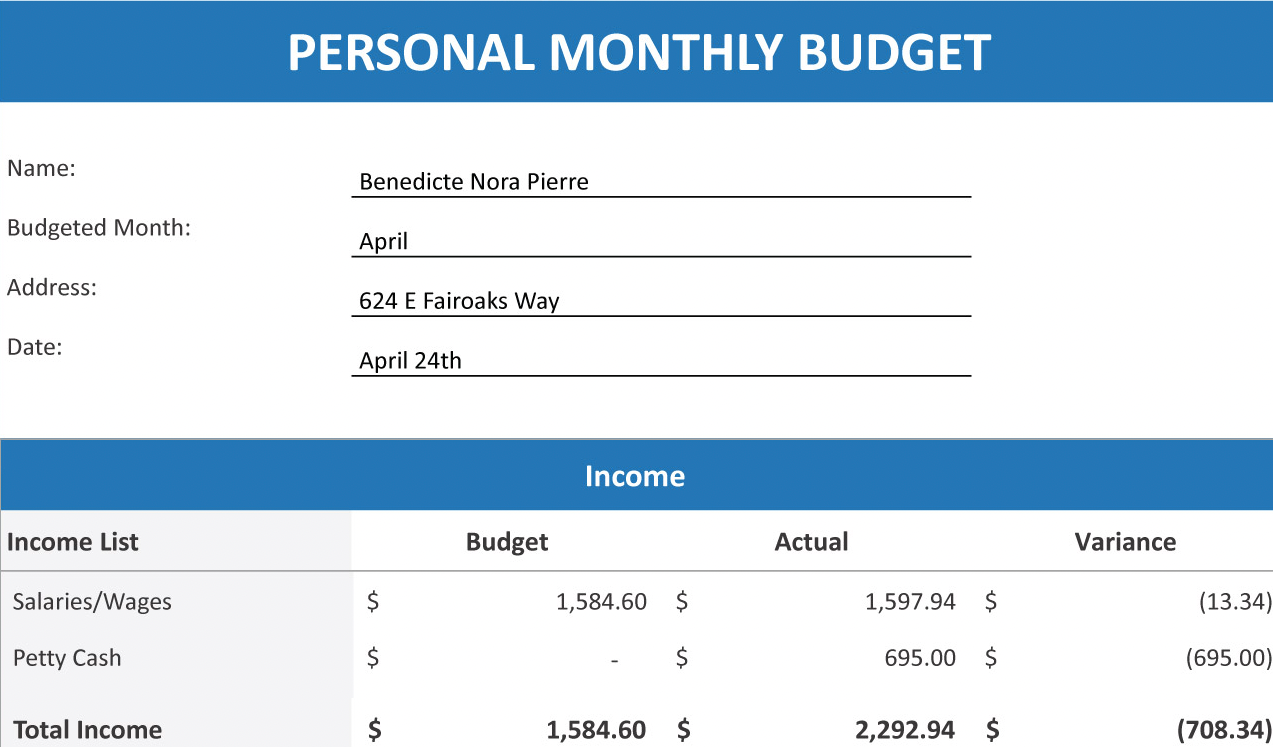

The Simple Household Monthly Budget Spreadsheet Template by Template.Net simplifies budgeting by focusing on the essentials without compromising clarity. Its minimal design is perfect for users who want to focus on the numbers without getting lost in cluttered layouts.

Rows for income and major expenses are pre-labeled, making data entry fast and repeatable month after month. The template also includes sections for savings and debt repayment, making it easy to get a complete view of your financial health at a glance. It is a helpful solution for beginners.

Ideal for: Individuals or households who want a clean, distraction-free budget planner to manage everyday expenses easily.

🧠 Fun Fact: Nearly 54% of people track their expenses manually, while only about 21% use budgeting apps. Additionally, 24.4% utilize other digital tools, such as calculators or spreadsheets, for their household budgeting.

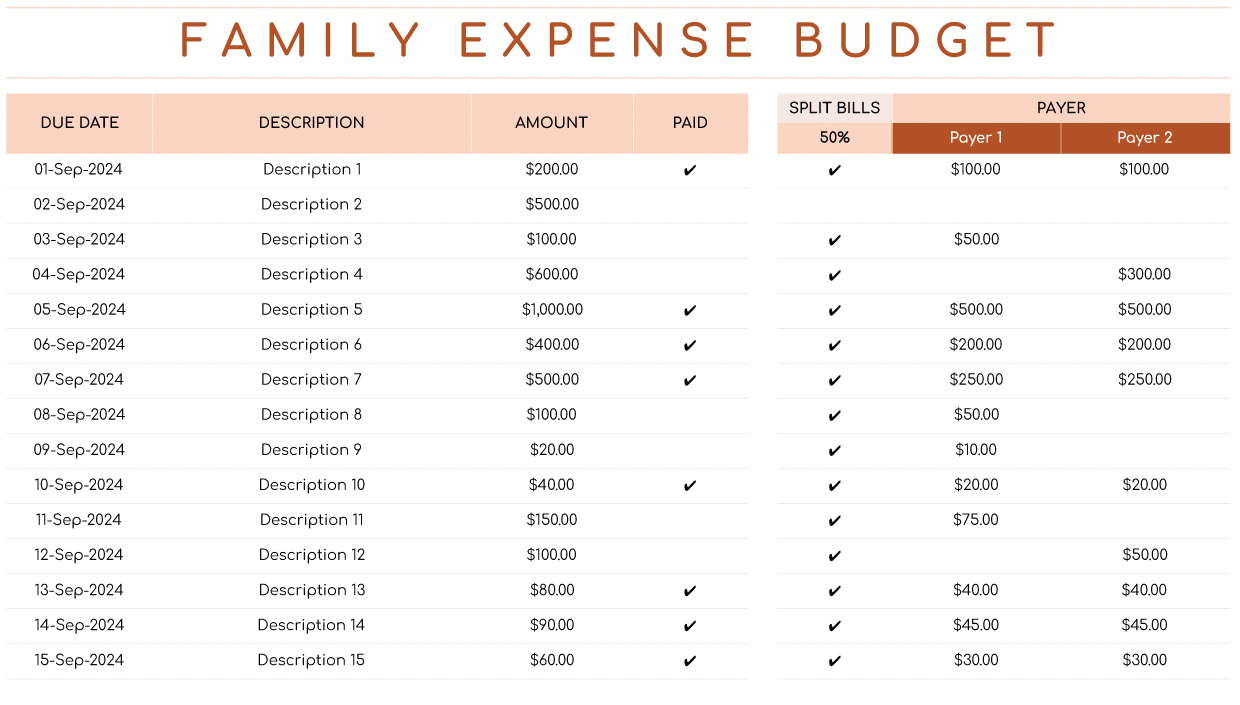

Unexpected utility hikes or one-off repair bills often throw household finances off balance. The Google Sheets Household Expense Budget Template by Template.Net offers detailed tracking for recurring and surprise expenses—from fixed expenses like rent and insurance to variable costs such as entertainment or groceries.

It auto-calculates totals and gives a quick visual snapshot of your financial position month-to-month, reducing the guesswork in budgeting. Budget categories come pre-filled, and the layout supports dynamic adjustments across weeks and months.

Ideal for: Families and individuals who want a more detailed, category-specific view of their household spending habits.

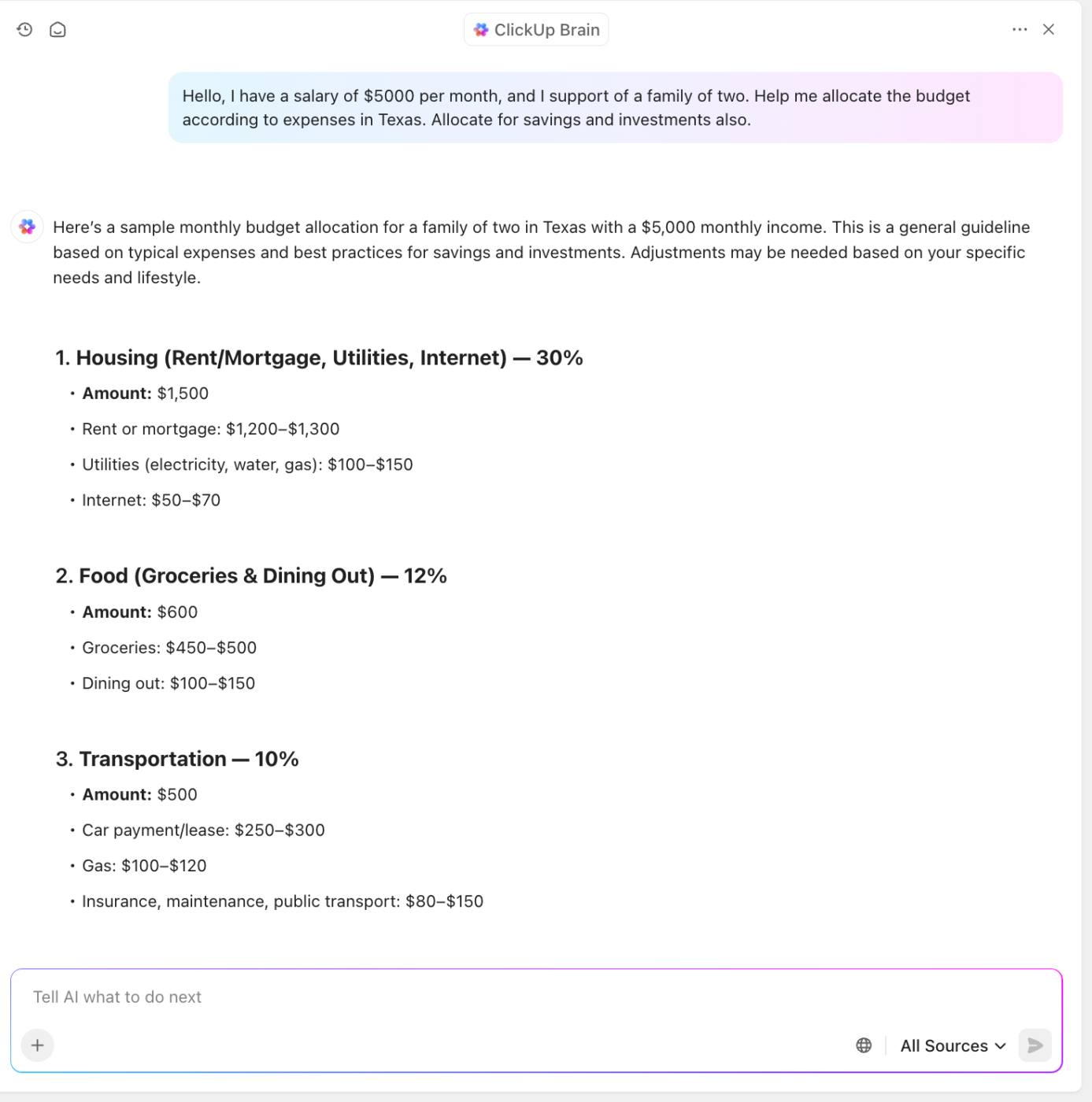

💡 Pro Tip: If you need help getting started on your financial plans, you can ask ClickUp Brain, an AI personal assistant. Here’s how:

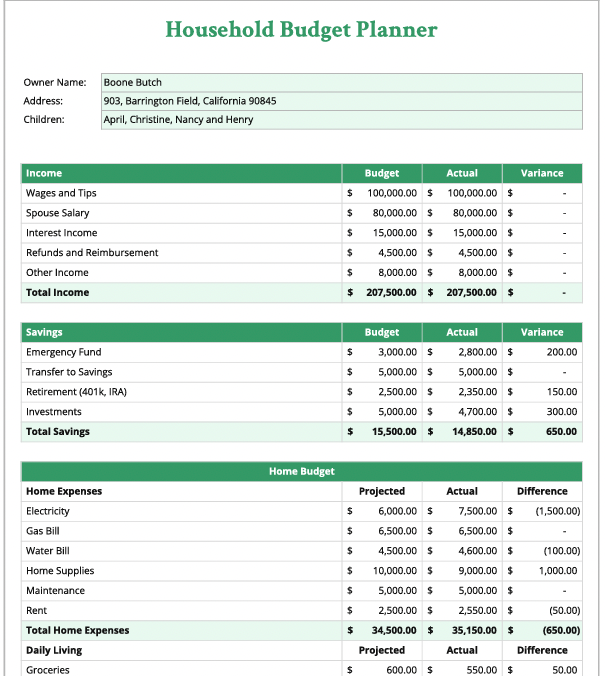

Many families like to review where the extra funds could come from—the Google Sheets Household Budget Planner Template by Template.Net supports forward-thinking financial decisions. It balances planning and tracking by combining projected income, anticipated spending, and savings goals into one cohesive dashboard.

The template also lets you log various sources of income alongside recurring and variable expenses. It then calculates your monthly savings automatically, providing instant insights into your financial health.

Ideal for: Families creating proactive financial plans around upcoming life events or seasonal expenses.

While Google Sheets offers a flexible and accessible platform for creating and managing household budgets, it’s important to acknowledge its limitations compared to dedicated budgeting software.

Some of these limitations include:

➡️ Read More: Best Google Sheets Alternatives & Competitors

If you’re looking for additional household budget template options beyond Google Sheets, there are several excellent alternatives from ClickUp, the everything app for work.

These budgeting spreadsheet templates help you streamline your budgeting and household management in just a few minutes:

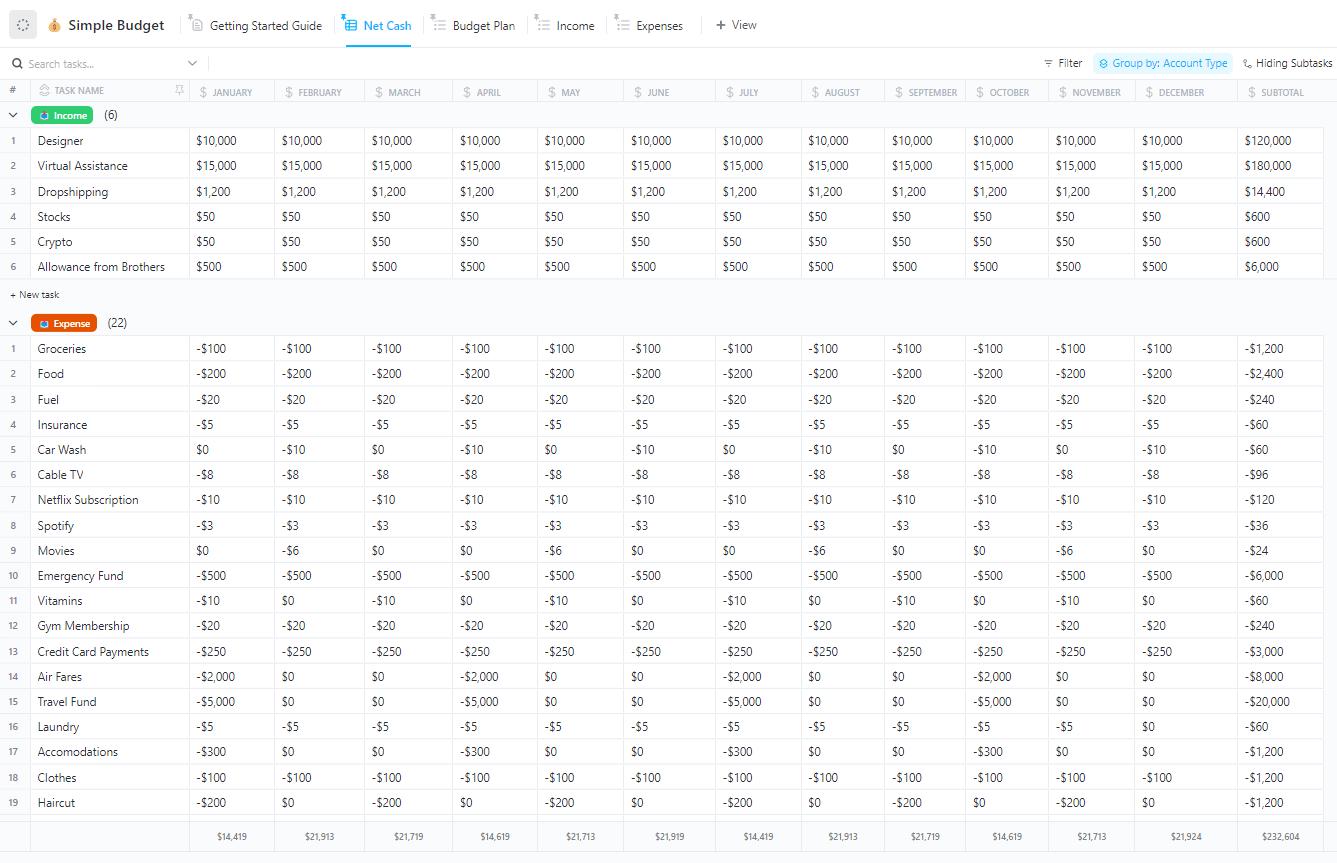

The ClickUp Simple Budget Template makes it easy to manage your day-to-day finances. With a clean layout and intuitive setup, you can quickly track income, expenses, and savings all in one place—perfect for individuals and families who want a straightforward budgeting solution.

Instead of getting lost in complicated spreadsheets, this template keeps your financial data clear and organized. With this budgeting tool, you’ll be able to visualize spending patterns, identify areas to cut costs, and confidently plan for future financial goals—all without the hassle.

Ideal for: Anyone looking for a straightforward, easy-to-use template to manage household expenses and savings goals.

Here’s what Philip Storry, Senior System Administrator at SYZYGY, had to say about using ClickUp:

Prior to using ClickUp, different teams used a variety of tools, which made coordination more difficult, and meant that staff moving to another team had to learn new products as well as new workflows. ClickUp has solved these problems for us and helped break up operational silos by making it easy to work across teams. Our stakeholders – whether clients or management – can now track the progress of work quickly and easily at no additional cost.

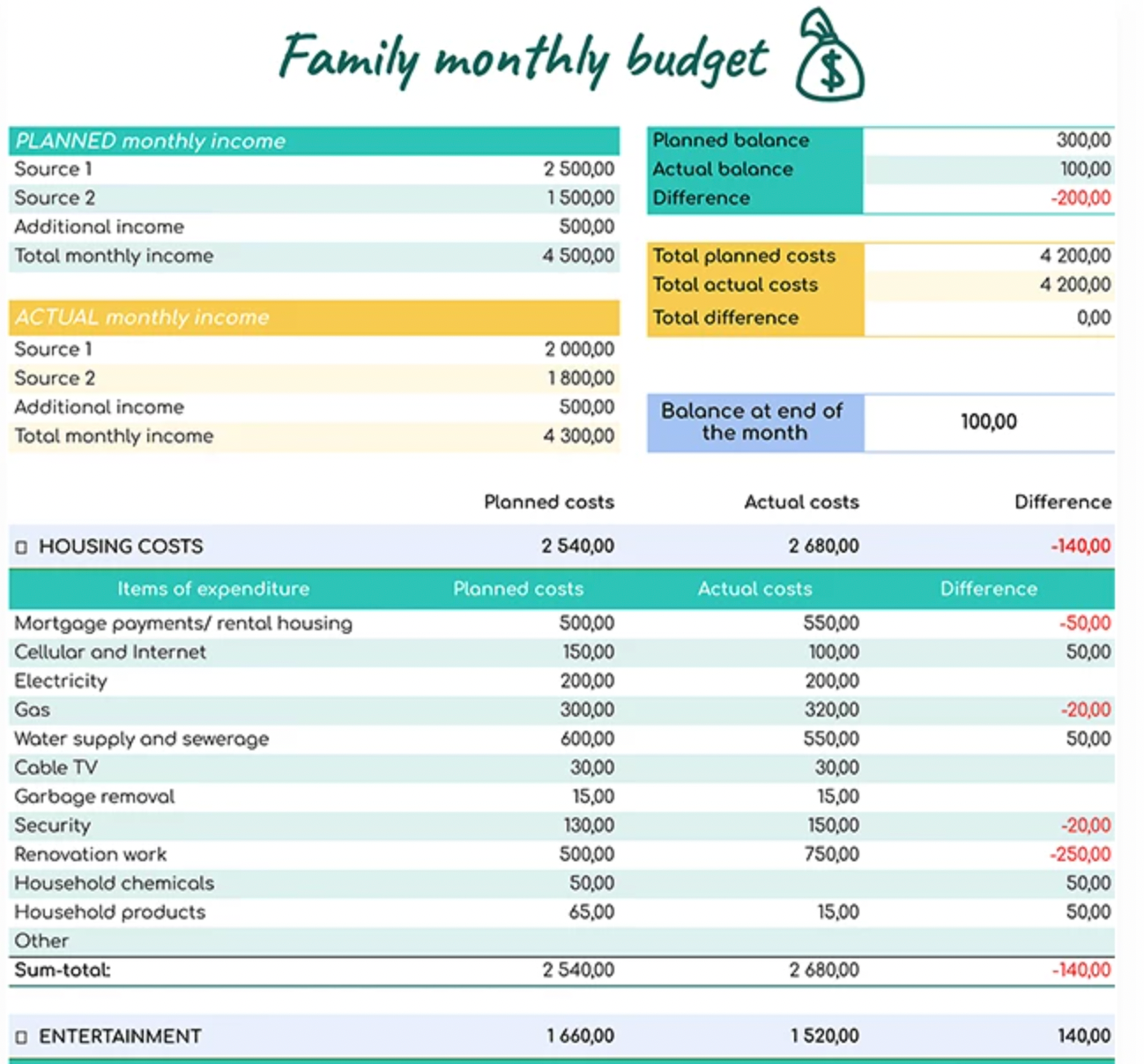

The ClickUp Personal Budget Template helps you take full control of your finances with a personalized touch. Easily categorize your expenses, set custom savings goals, and monitor cash flow so you can stay on top of your financial wellness every month.

This template provides a structured, easy-to-use space where you can adjust your budget as your life evolves, helping you build a strong financial foundation.

Moreover, this template uses ClickUp Tasks instead of relying on formulas to connect money management with everyday planning.

Ideal for: Individuals or families who want a detailed yet simple way to track their monthly spending and savings goals while maintaining financial discipline.

🎥 Learn how to keep track of personal tasks with this video rundown:

➡️ Read More: Best Accounting AI Software & Tools

The ClickUp Personal Budget Plan Template empowers you to create a realistic, actionable financial strategy tailored to your lifestyle. With a flexible system that grows with you, plan monthly budgets, monitor spending habits, and set achievable savings targets.

Instead of waiting for a financial wake-up call, use this template to take proactive control. You’ll have a clear roadmap to manage debt, build emergency funds, and meet long-term money goals while maintaining complete visibility of your financial journey.

Ideal for: Anyone looking for an exhaustive budget planning tool that offers long-term financial tracking while keeping monthly and yearly goals in focus.

📮 ClickUp Insight: 78% of our survey respondents make detailed plans as part of their goal-setting processes. However, a surprising 50% don’t track those plans with dedicated tools. 👀

With ClickUp, you seamlessly convert goals into actionable tasks, allowing you to conquer them step by step. Plus, our no-code Dashboards provide clear visual representations of your progress, showcasing your progress and giving you more control and visibility over your work. Because “hoping for the best” isn’t a reliable strategy.

💫 Real Results: ClickUp users say they can take on ~10% more work without burning out.

The ClickUp Budget Report Template makes financial reporting easy and transparent. With structured sections for planned vs. actual expenses, revenue breakdowns, and variance tracking, you’ll always know where your money is going—and where you need to optimize.

This annual budget template provides a centralized hub for creating detailed business budget reports, allowing you to manage all your financial activities in one simple transaction tracker.

Ideal for: Individuals, families, or small business owners who need to generate clear, actionable budget reports with visual tracking.

➡️ Read More: Best Project Cost Management Software to Stay on Track

The ClickUp Finance Management Template is your go-to tool for organizing every aspect of your financial life. Manage budgets, track invoices, monitor expenses, and oversee investments within one easy-to-navigate workspace.

This template optimizes financial operations, helping you get the complete picture of your financial health. Additionally, it goes beyond monthly budgeting to provide a command center for household finances, with each financial responsibility becoming a trackable, time-sensitive task.

Ideal for: Households, freelancers, and businesses that manage multiple financial accounts, services, and savings priorities and want a clear, comprehensive view of their finances at all times.

Students moving out for the first time often underestimate how fast small expenses add up. The ClickUp College Budget Template introduces structure to help students manage rent, books, transport, and daily costs.

This template makes budgeting simple and intuitive for students, helping them focus more on studying and less on stretching their next meal budget. It also combines budgeting with time management, so financial tracking fits into a student’s academic workflow.

Ideal for: College students looking for a simple yet effective way to manage their finances and avoid financial stress.

🎥 Here’s a quick video guide to healthy work habits for a successful career:

The ClickUp Monthly Expense Report Template helps you easily track and organize your monthly spending. From fixed expenses like rent to variable costs like groceries and entertainment, you’ll have a clear snapshot of your financial habits.

Forget trying to remember where your money went at the end of the month. This template gives you a simple, structured way to monitor expenses and spot trends—empowering you to budget smarter and save more.

Ideal for: Individuals or businesses seeking full control over their monthly expenses and making data-driven financial decisions.

➡️ Read More: Free Monthly Budget Templates to Manage Expenses

Choosing the right Google Sheets budget template is crucial to helping you take the first step towards achieving your financial goals.

The templates we’ve highlighted offer various options for different needs, whether you want to start tracking spending, manage an annual budget, or plan for the future. However, if you’re looking for more advanced features, automated tracking, or enhanced collaboration, ClickUp is your go-to option.

1000+ library templates designed to help you manage your budgets, allow you to fetch data from multiple sources automatically, analyze it in a broader view, and understand exactly where you are spending your money.

ClickUp also doubles down as a comprehensive tool for managing household and personal finances, business budgets, and more in a single platform.

Sign up for free on ClickUp today and ace your financial goals! 🚀

© 2026 ClickUp