Are you looking for a way to get your finances in order and take control of your bank account? With the world being what it is today, money management has become more important than ever. Developing good budgeting habits can be the key to creating financial stability in life, allowing you to save for the things that really matter.

Read on to see how having a personal budget plan can empower you with better money management skills and provide an easier way to keep track of your finances. What's more, you'll learn how the personal budget template in ClickUp is one of the best ways to keep track of your finances and can set you on a path towards achieving greater financial independence!

Read on to see how having a personal budget plan can empower you with better money management skills and provide an easier way to keep track of your finances. What's more, you'll learn how the personal budget template in ClickUp is one of the best ways to keep track of your finances and can set you on a path towards achieving greater financial independence!

What are the benefits of creating a personal budget?

Making your personal budget may take some effort—but the work can pay off big time (no pun intended). That's because a personal budget can:

- Help you identify your spending patterns, enabling you to make better financial decisions

- Allow you to prioritize and plan for long-term goals such as retirement or college savings

- Enhance your ability to stick with a budget and reach financial goals more quickly

- Give you the flexibility to adjust your spending as needed

- Help you prepare for unexpected expenses, minimizing the impact of emergency costs on your finances

Now that you know why a personal budget can be helpful, it's time to lean what goes into making one.

What are the key elements of a personal budget?

There are a few important features that every personal budget should include, such as:

- Income: The total amount of money you have coming in each month

- Savings: The portion of your income for savings is essential

- Necessities: The basic costs required to live, such as rent or mortgage payments, food expenses and utility bills

- Discretionary expenses: The amount of money you have left over after taking care of necessities

- Debt payments: Any debt repayment that needs to be made

You may consider creating a budget spreadsheet to include all this info—but free budgeting templates like the one in ClickUp have more functionality and are easier to use.

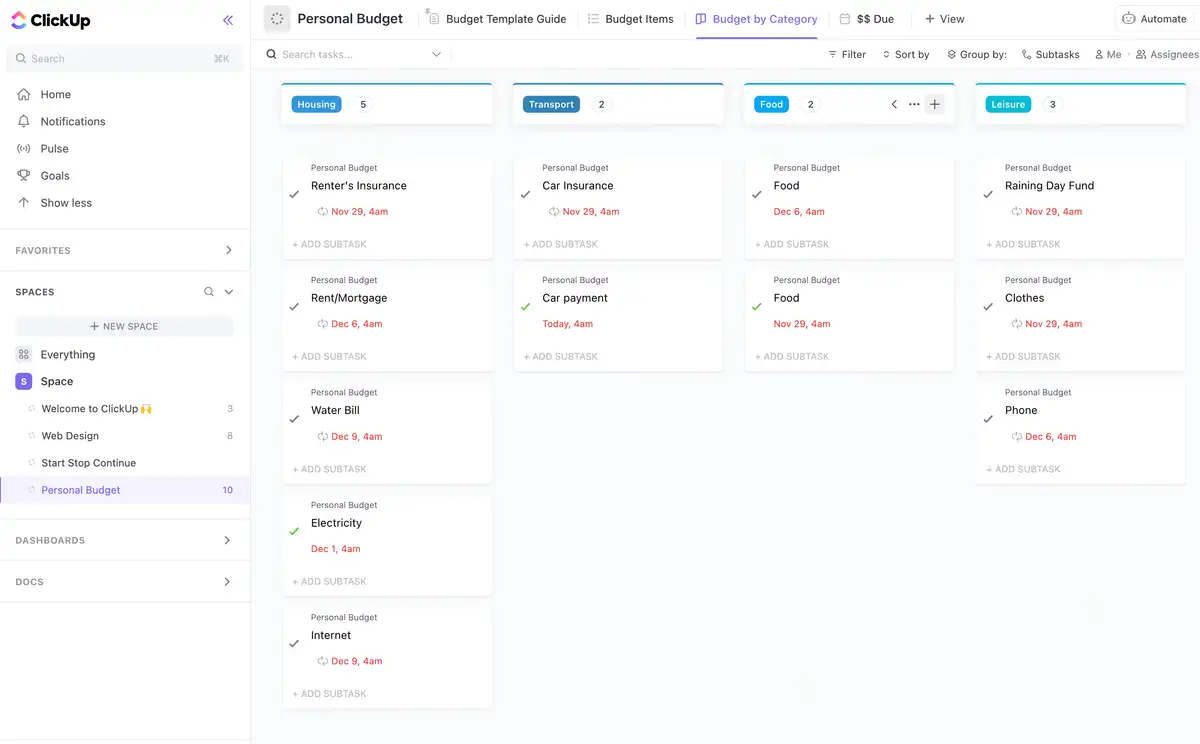

Pictured: Expense categories seen in Board view in ClickUp.

How to create a personal budget.

Creating a personal monthly budget can be intimidating at first, but it doesn't have to be complicated. By using the budgeting template in ClickUp and following the steps outlined below, you can start taking control of your finances and putting yourself on track to meet your goals. With practice, budgeting can become second nature and you’ll be well on your way to achieving greater financial independence.

- Establish your goals.

It's important to decide on what you want to accomplish with your monthly budget. Do you want to save for a vacation, build up an emergency fund, or pay off debt? Knowing what you’re working towards will help keep you motivated and give you something to work towards.

Use a Doc in ClickUP to brainstorm ideas

for your financial goals.

- Track your spending.

You need to have a good idea of where your money is going before you can start budgeting. Take a couple of weeks and write down all of your purchases, from the smallest coffee to the rent check. Figuring out all your actual expenses will help you track where your money is being spent and identify areas where you can cut back.

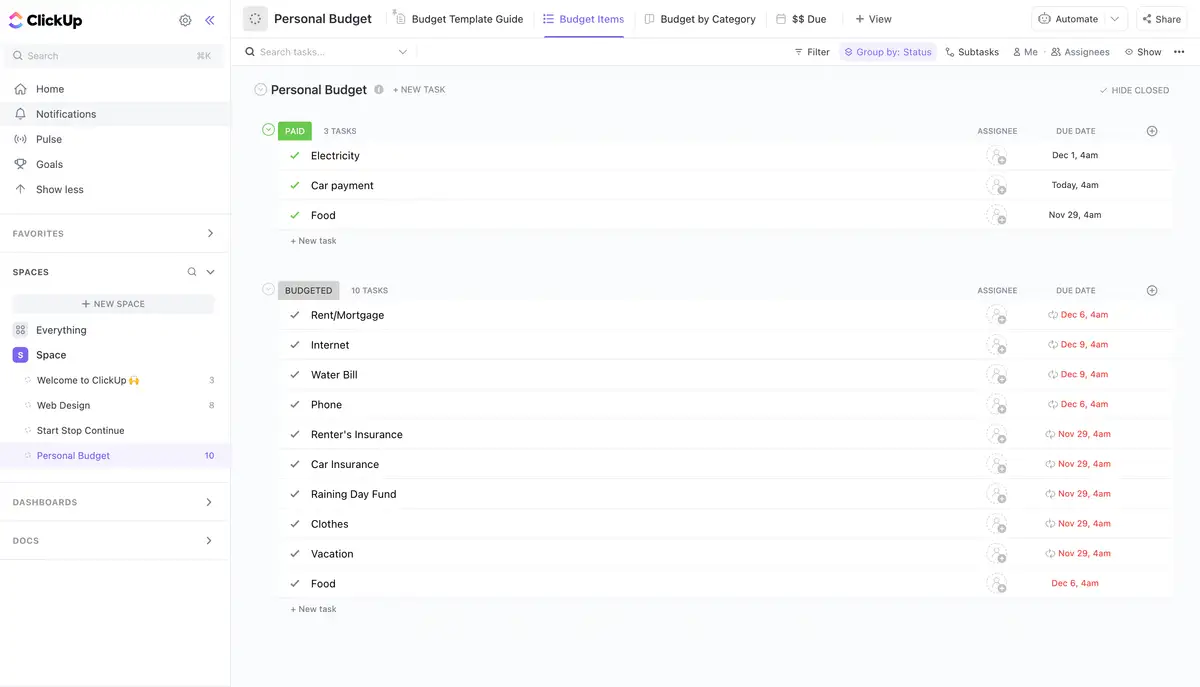

Create tasks in ClickUp to categorize expenses and track spending items

such as housing, transportation, groceries, etc.

Pictured: Budget items seen in List view in ClickUp.

- Calculate your monthly income.

Gather all of your sources of income, including salary and any other sources, such as investments or money from family.

Create custom fields in ClickUp

to add up your monthly expenses.

- Calculate your expenses.

Add up all of your fixed costs, such as rent and car payments. Then, add in the variable costs like groceries and entertainment. Don’t forget to include savings in as one of your expense categories.

Create custom fields in ClickUp

to total your spending across categories.

- Allocate your money.

Now, it's time to start allocating the money you have towards your goals. Put the largest portion of your income towards spending on necessities and then break down the rest into categories such as entertainment, debt payments or savings.

Use tasks in ClickUp to create spending categories

and assign budgeted allowances.

- Monitor and adjust.

It’s important to keep an eye on your budget and make adjustments as needed. If you find that you’re spending more than you intended in one category, take a look at where else you can cut back.

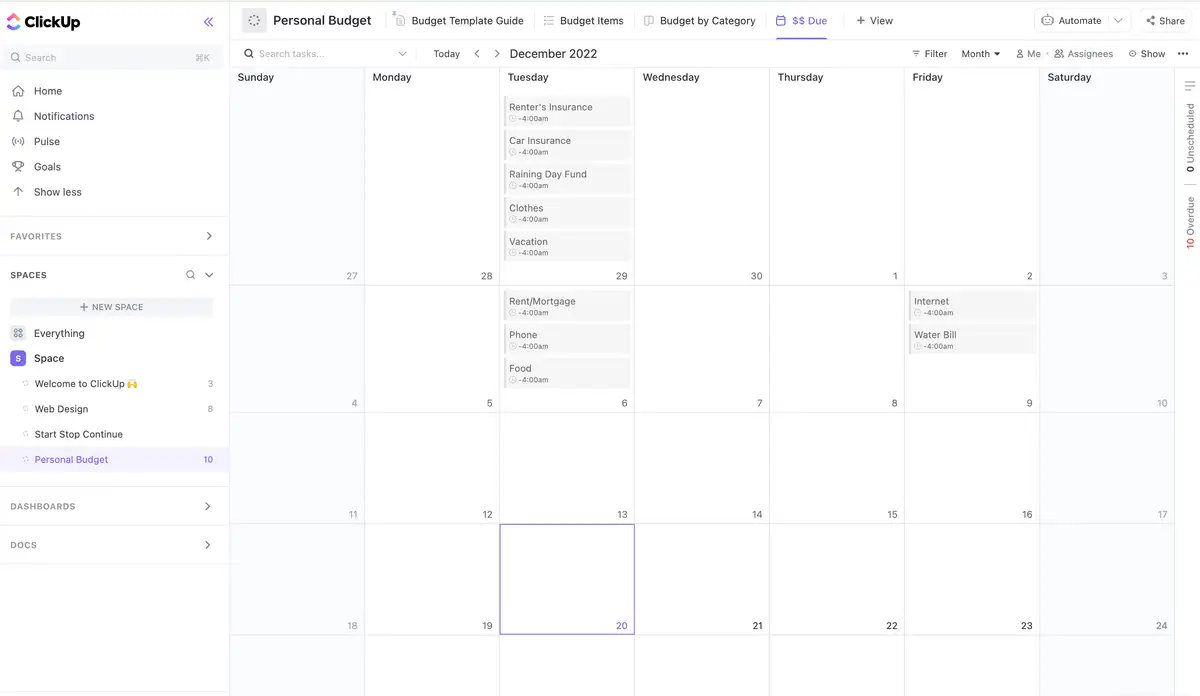

Use the Calendar view in ClickUp

to visualize when payments are due on a monthly basis.

Pictured: Bill payment due dates seen in Calendar view in ClickUp.

Personal budgeting tips.

Creating and following a monthly budget is one of the best ways to manage your personal finances and reach your financial goals, but it can be challenging to stick with it. Here are some tips that can help you stay on track:

- Automate bill payments wherever possible to save you time and ensure regular bills are always paid when they're due

- Create an emergency fund so that unexpected expenses don’t impact your budgeted spending

- Set realistic financial goals and break them down into smaller steps that are easier to achieve

- Make sure to build in some flexibility with your budget—life happens and there may be times when you need to adjust your spending

- Calculate all of your expenses and review them regularly to make sure you’re staying on track

- Make use of budget templates featured in technology solutions like ClickUp to easily set goals, track income and expenses, and manage your finances in one place

- Celebrate small wins along the way to recognize the progress you’re made towards achieving your goals

Common budgeting pitfalls to avoid.

Creating a budget can be an important step in taking control of your finances, but it’s easy to make mistakes that can derail your progress. For example, not setting realistic financial goals can easily lead to misallocating funds and/or getting overwhelmed.

What's more, many people who have trouble sticking to their budget fail to regularly track their spending and actual costs. It’s the only way you can measure how well you are sticking to your plan. Without this information, it’s difficult to make adjustments when needed.

Finally, it's very easy to overlook setting aside money for emergencies—but that can be a surefire way to through your budget out of whack. That's why you should set aside a little money each month to cover any unexpected expenses.

Key takeaways

Creating a personal budget can be one of the best ways to take control of your finances and move towards greater financial independence. With a proper budget, you'll be able to track your income, identify spending habits, prioritize long-term goals, and plan for unexpected costs. Plus, ClickUp's personal budget template makes it easy to track income and expenses, set goals, and manage your finances in one place. By following the steps outlined above, you can set yourself on a path towards greater financial freedom! So don't wait any longer—start creating your budget today!