10 Best Brex Alternatives in 2026 (Reviews & Pricing)

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Brex is a SaaS platform that provides corporate cards and spend management software to mid-market and venture-backed (large) companies. It uses AI-powered algorithms within its platform to detect fraud, make data-driven decisions, manage cash flows, and provide business-tailored solutions.

However, Brex may not suit the requirements of all businesses, especially smaller ones. And that creates a need for a worthy alternative.

So, we’ll discuss the best alternatives to Brex to help small businesses with business expense management.

Expense management platforms offer many features. Here are the top features you should consider before making the selection:

Now that you know what to look for while selecting an ideal expense management solution, let’s check out the top Brex Alternatives in 2024.

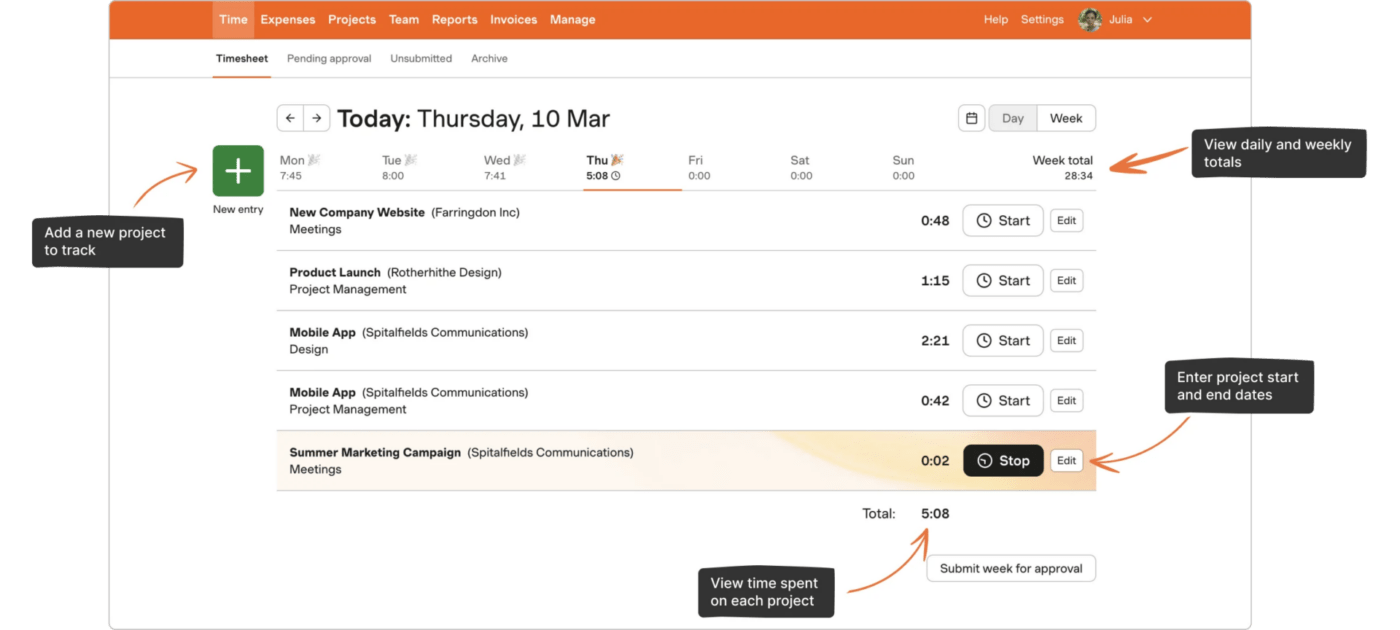

Harvest is a time-tracking app ideal for small teams and businesses.

It helps you track your projects’ time across all platforms. You can connect it with other business apps and integrations like Asana and Slack.

Harvest lets you create invoices, collect payments, and integrate with accounting software like Xero and QuickBooks.

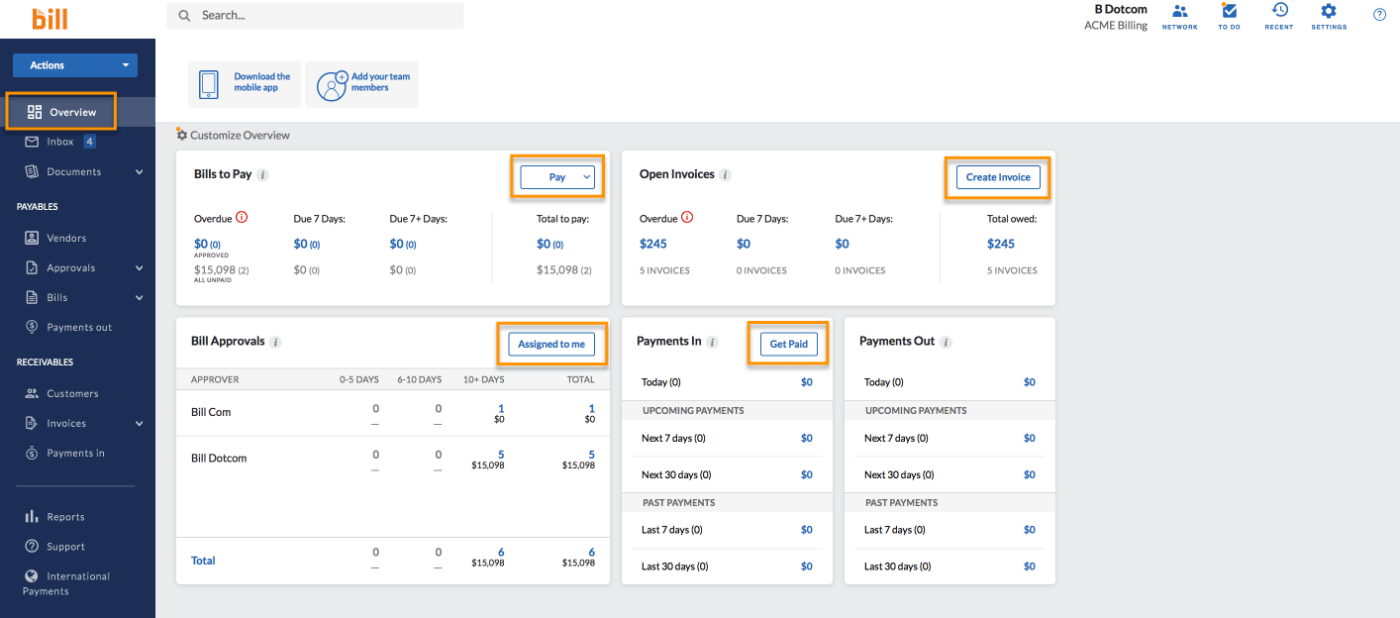

BILL Spend & Expense helps automate expense reports, budgets, and reimbursement processing.

It has an automated expense reports option and saves time manually adding credit card statements. It also helps create separate cards for each subscription with customized limits.

With its expense management software and virtual cards, you can get real-time insights into employee spending and protect yourself from fraud. Users appreciate the tool’s ability to accommodate multiple payment options.

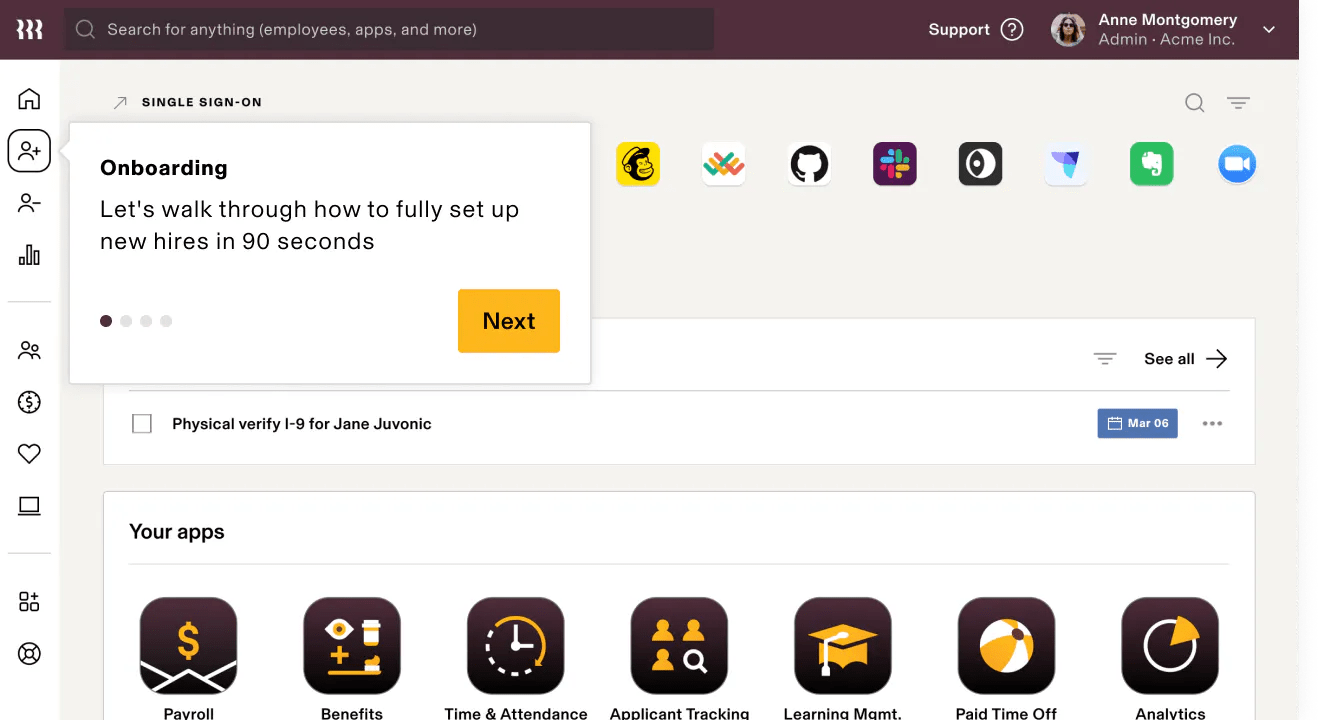

Rippling offers the option to reimburse employees in their local currency and provide reports in any language.

You get to create a role-based approval chain that automatically adjusts with your business changes.

The expense management software quickly builds customized policies and saves time on manual revisions.

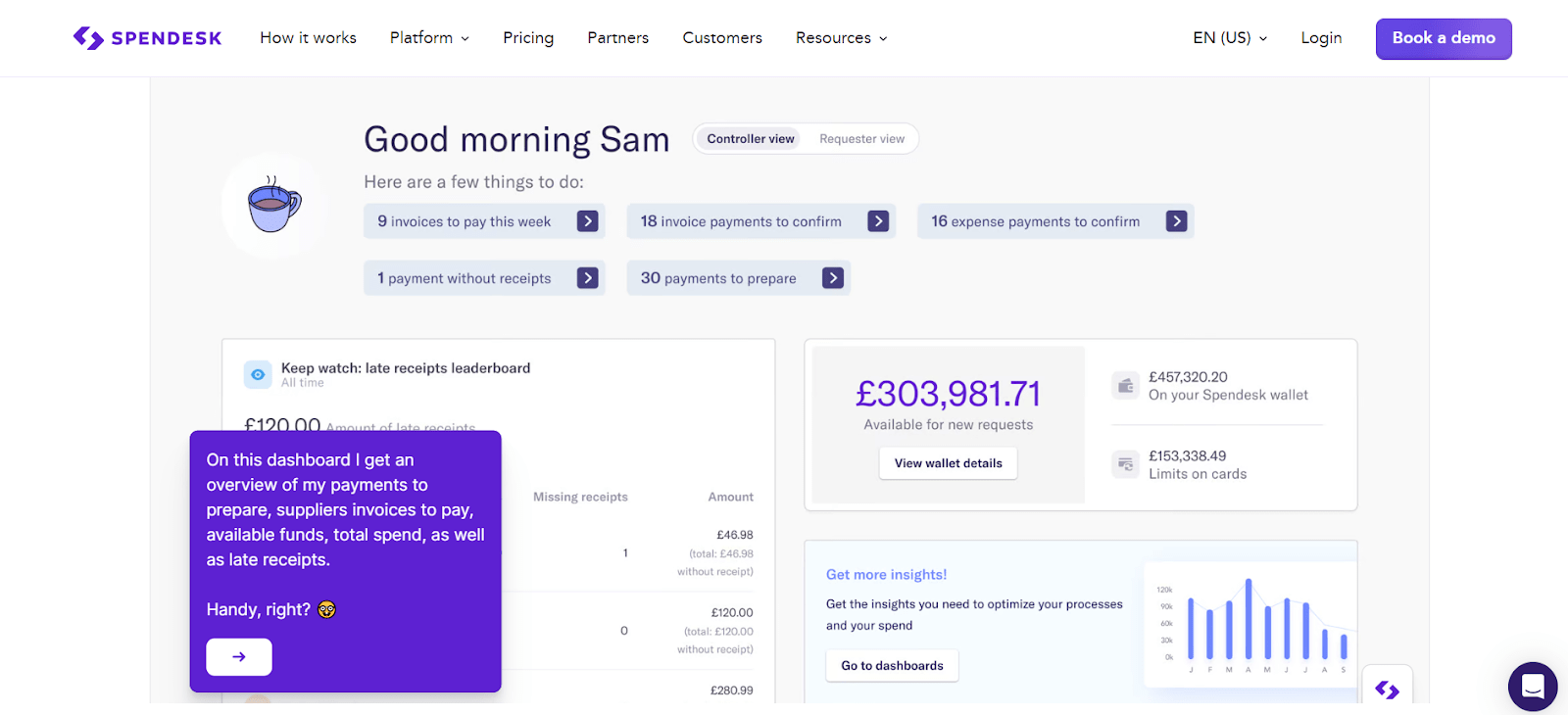

Spendesk is a seven-in-one cloud-based spend management solution that helps businesses manage their invoice payments, payrolls, corporate cards, and more.

It helps create digitized expense reports without paperwork, making the employees’ reimbursement process quick and easy.

The platform uses Optical Character Recognition (OCR) technology to scan and store your uploaded invoices or receipts. You can integrate it with third-party apps like Xero, Slack, and Netsuite.

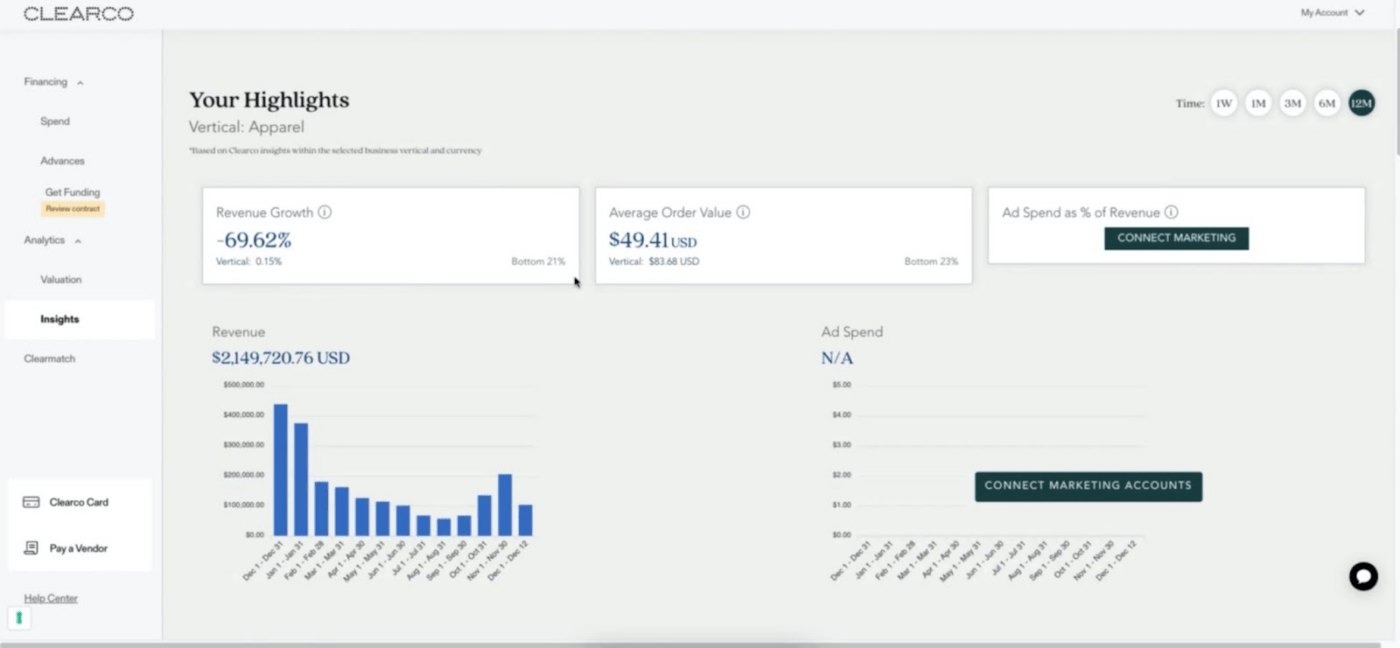

Clearco helps e-commerce businesses manage their invoices and payments. It supports all your inventory, marketing, legal and financial fees, and shipping and logistics expenses.

It’s appreciated for its all-in-one, user-friendly dashboard. The platform supports four currencies: EUR, CAD, USD, and GBP.

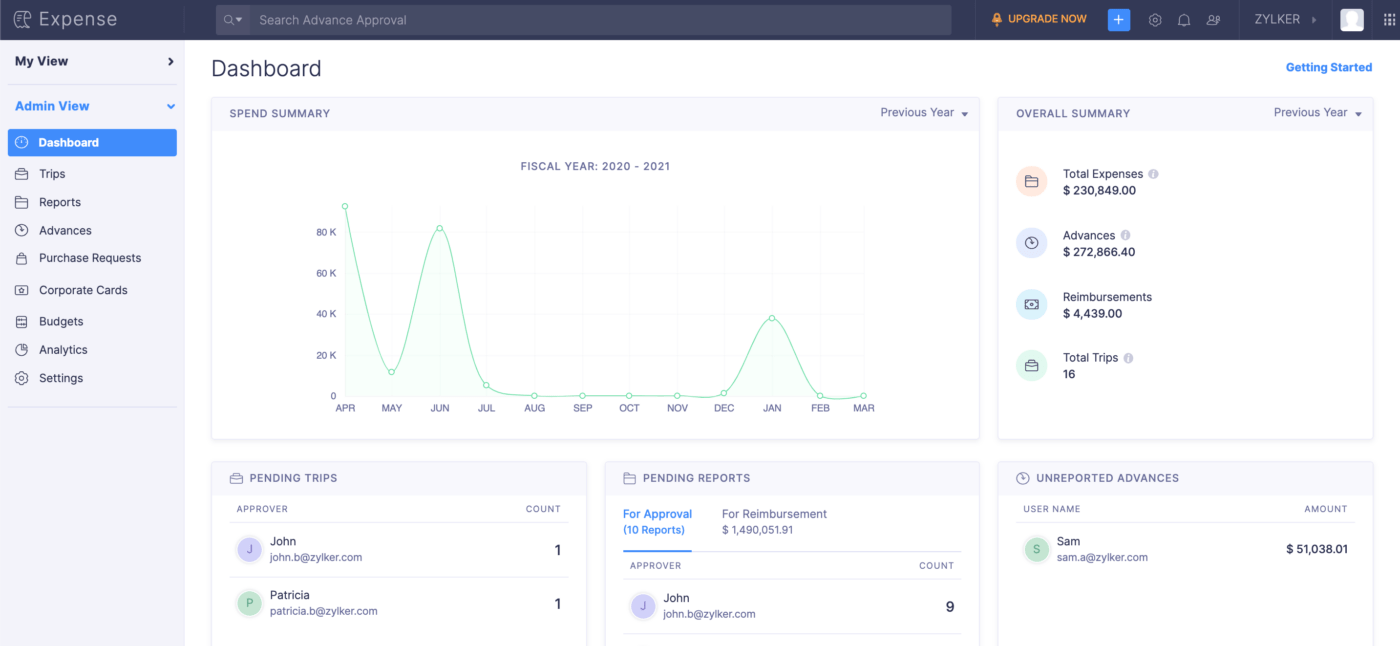

Zoho Expense is a web-based mobile application that manages business travel and spending expenses. It has automated travel expenses and reporting.

It sets receipt tracking with an auto-scan receipt option by integrating cloud applications. It saves your copies for life and ensures safe time-tracking.

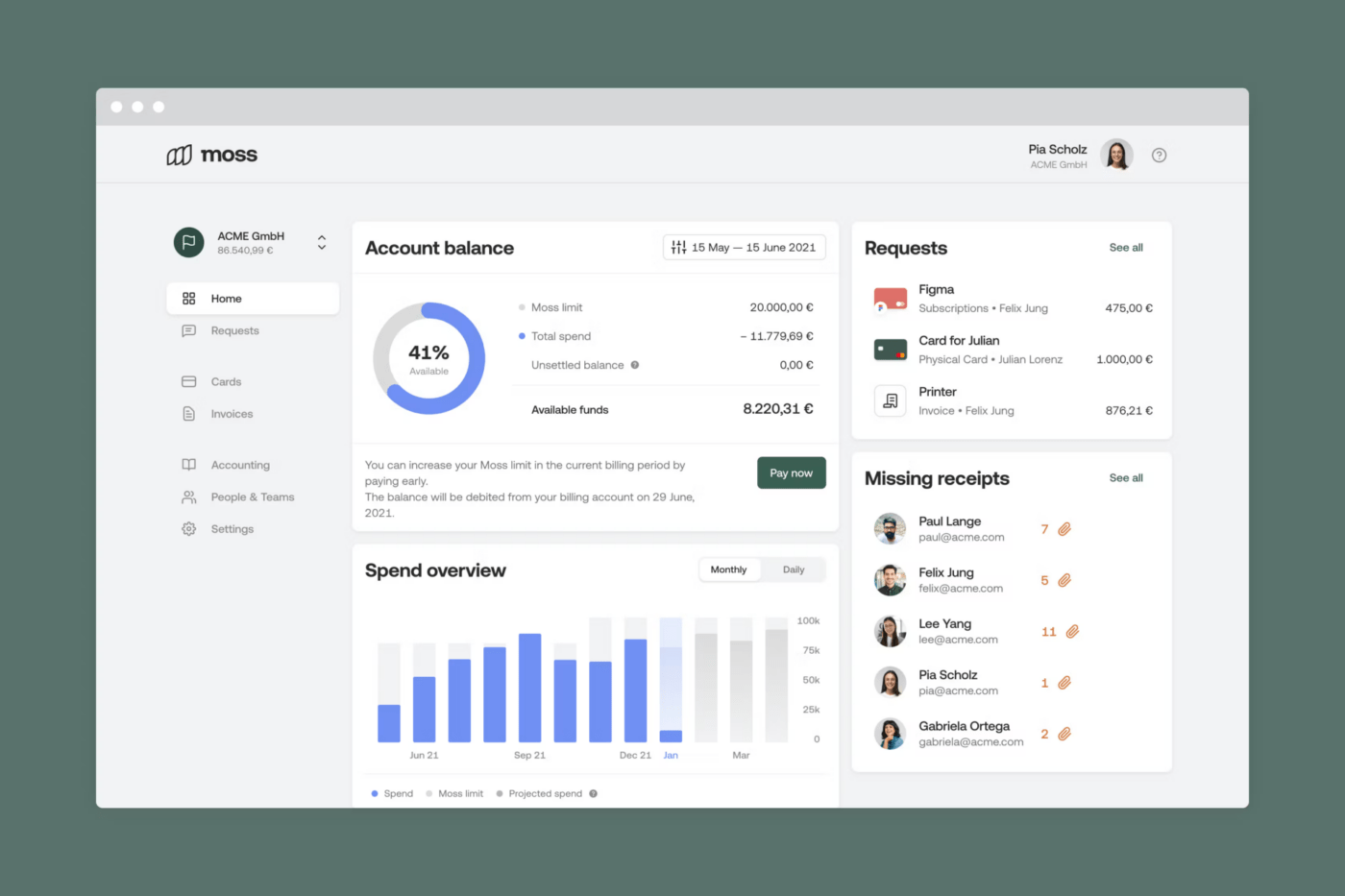

Moss provides corporate cards for start-ups and digital companies.

You can adjust individual card limits in real-time from your dashboard. It also comes with an option to set spending limits on each card. Users appreciate the platform for having expenses, invoices, and cards in one place.

It lets you set automated administrative tasks with different categories to your company’s workflow, including VAT rate and cost center.

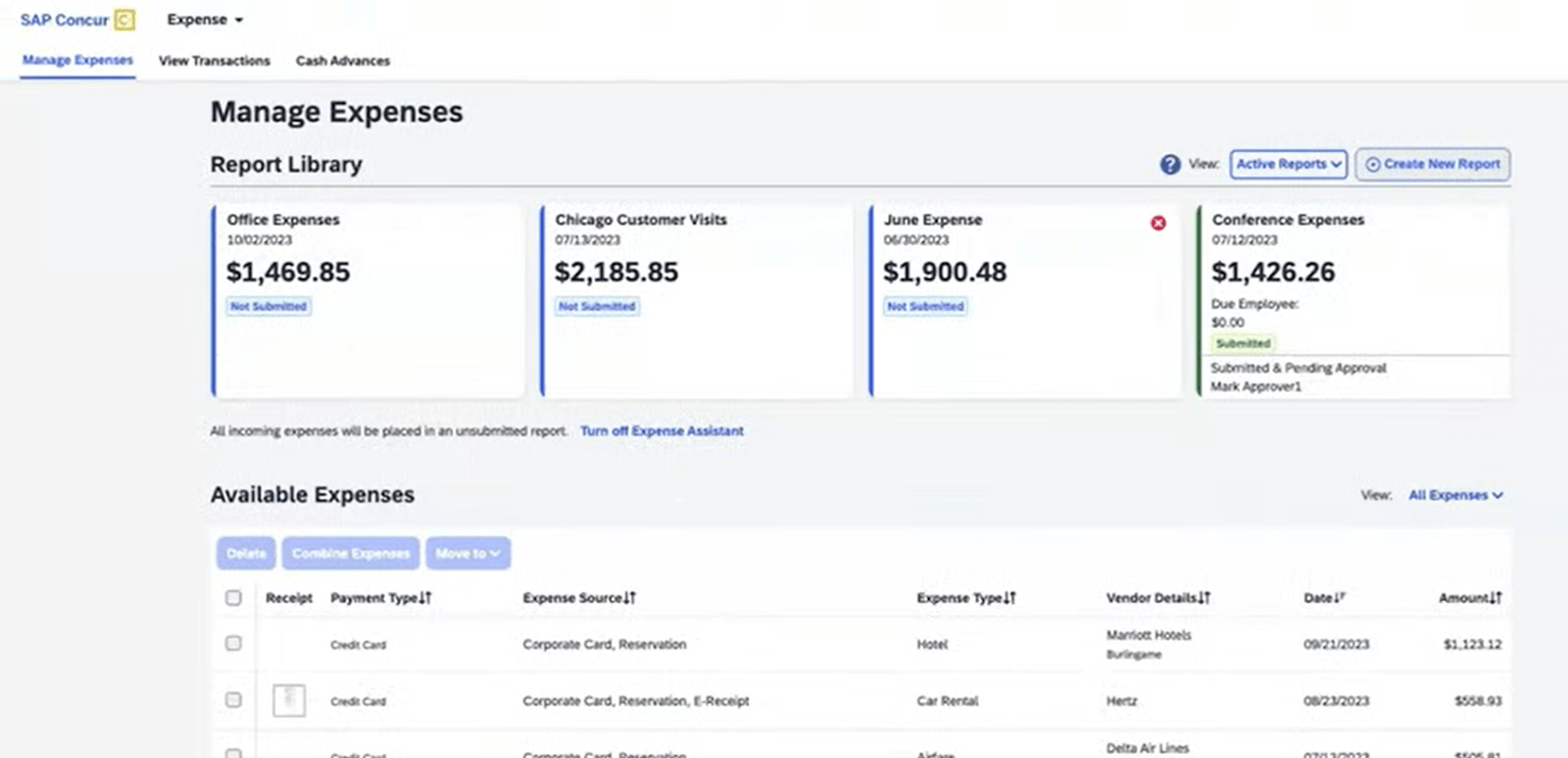

Concur offers integrated and automated expense management software that tracks expenses using AI and real-time data.

You can interpret data and get insightful reports. The tool lets you detect errors like duplicates and activities that do not comply with company policies through your dashboard.

The platform offers a self-guided demo without capturing credit card details.

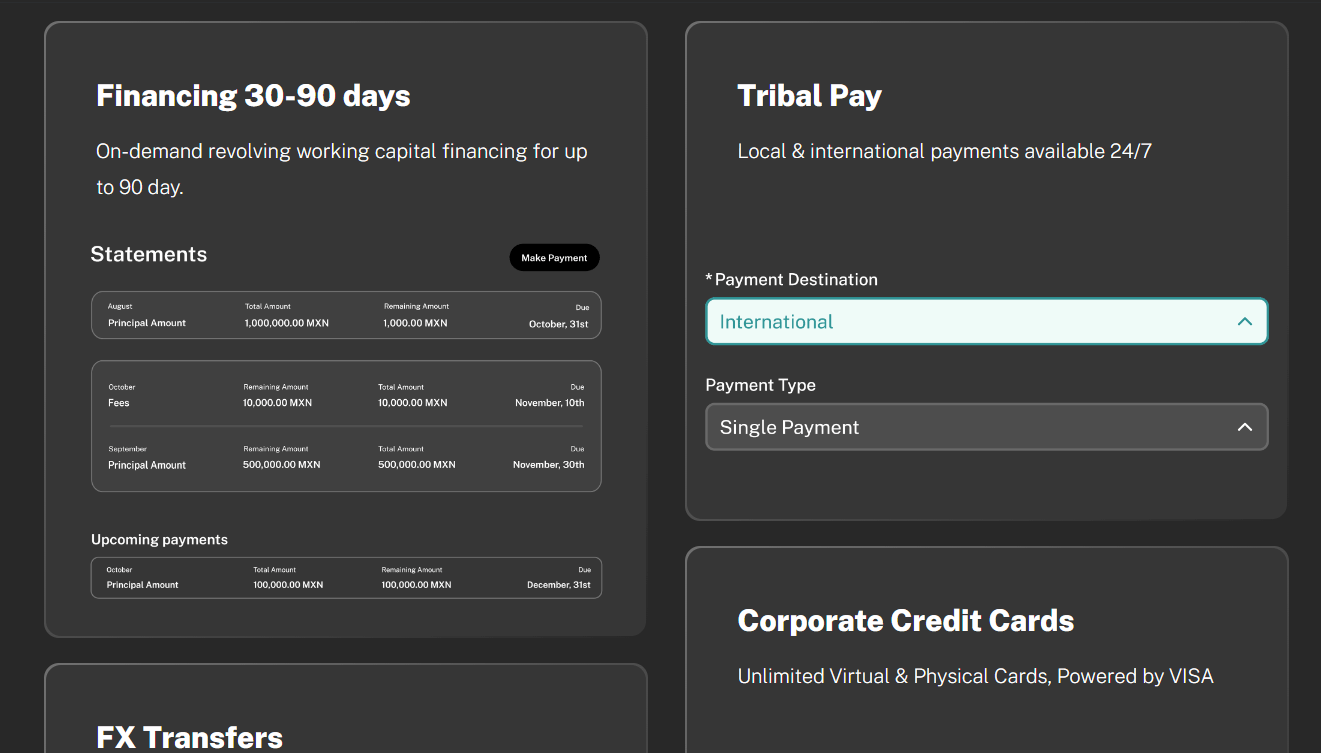

Tribal Credit is a corporate card for start-ups and medium-sized enterprises (SMEs).

It monitors and analyzes your business operation in real-time through your dashboard. The dashboard gets activated when you provide the last three months’ bank statements, your company’s article of incorporation, and your tax ID number.

The expense management platform is noted for offering lines of business credit as high as $1,000,000.

Ramp provides corporate card and spend management solutions specially designed for mid-market finance teams.

It allows you to set reminders for repayments and missing items and an auto-lock option for potential suspicious transactions.

The software creates custom workflows with pre-set budget templates. You can also set auto-limits and submission requirements on all your corporate cards.

While Brex and similar expense management software handle financial tasks and reports, project management platforms like ClickUp focus on task management and collaboration among team members for smooth project completion with maximum productivity.

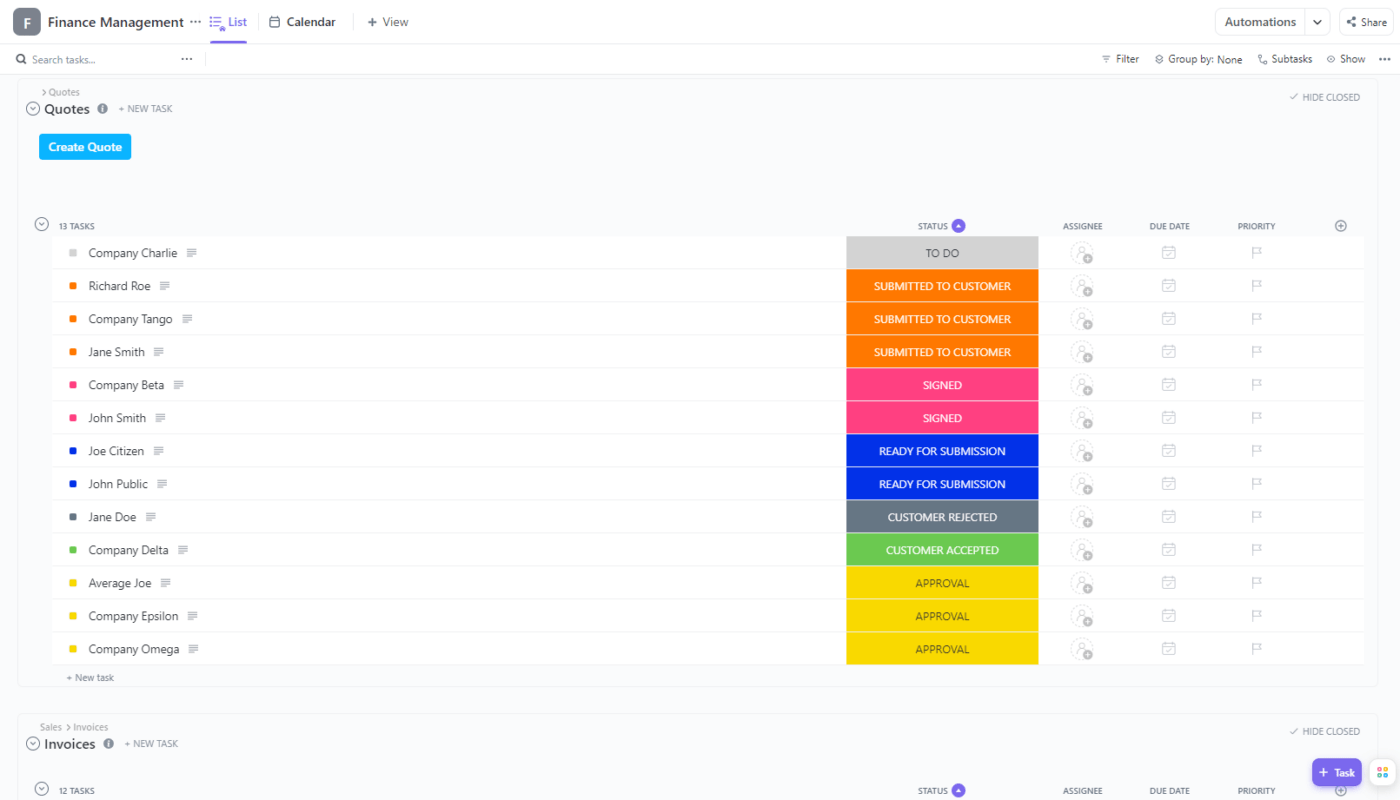

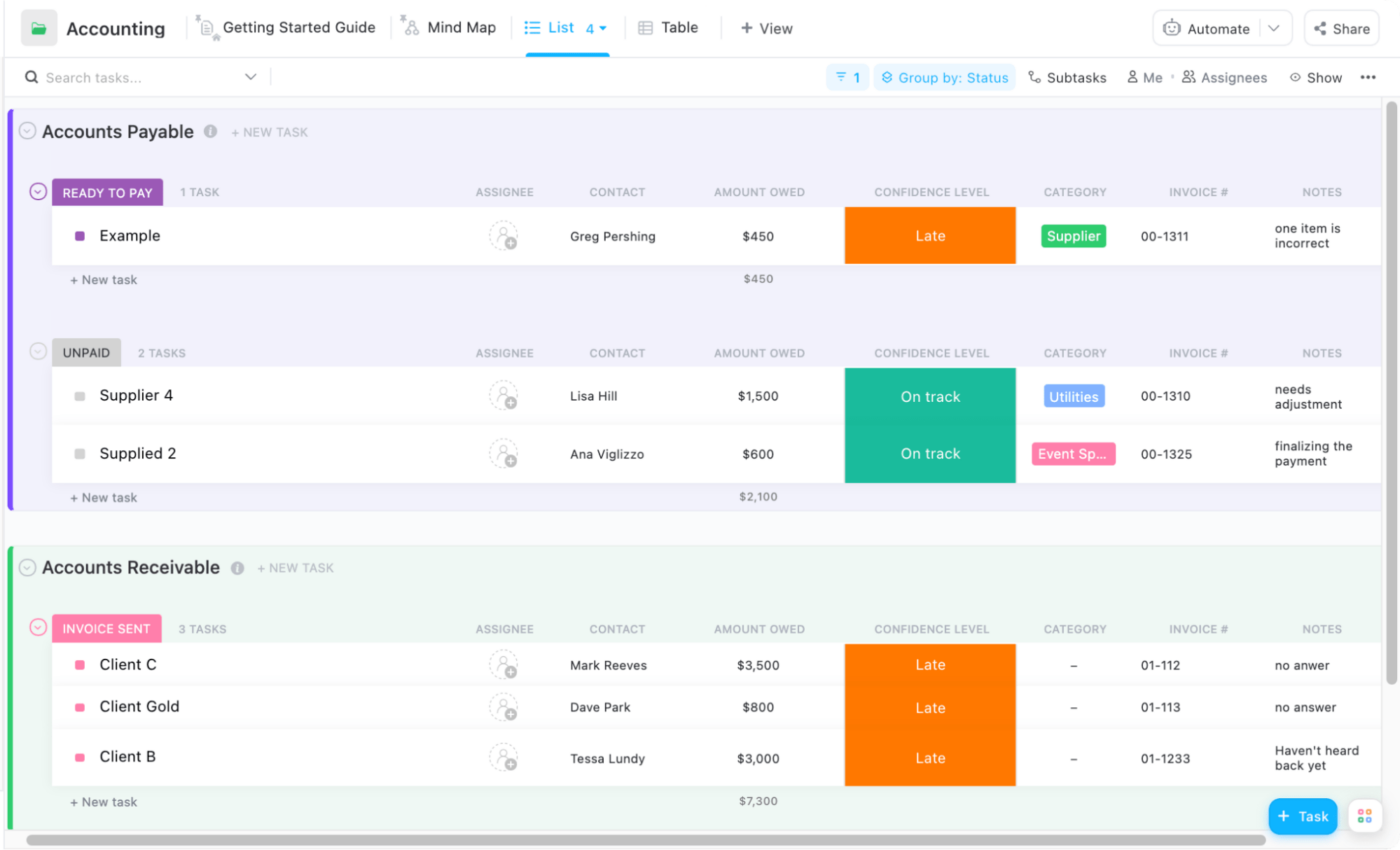

Use ClickUp’s Finance Management Templates to manage your financial tasks efficiently. With these templates, your finance teams will easily track financial KPIs, manage their accounts, and calculate their profits and expenses.

All you need is to sign up for ClickUp Finance Management Templates. Apply this template to the space or folder you want to work on. Add relevant team members, and your Workspace is ready.

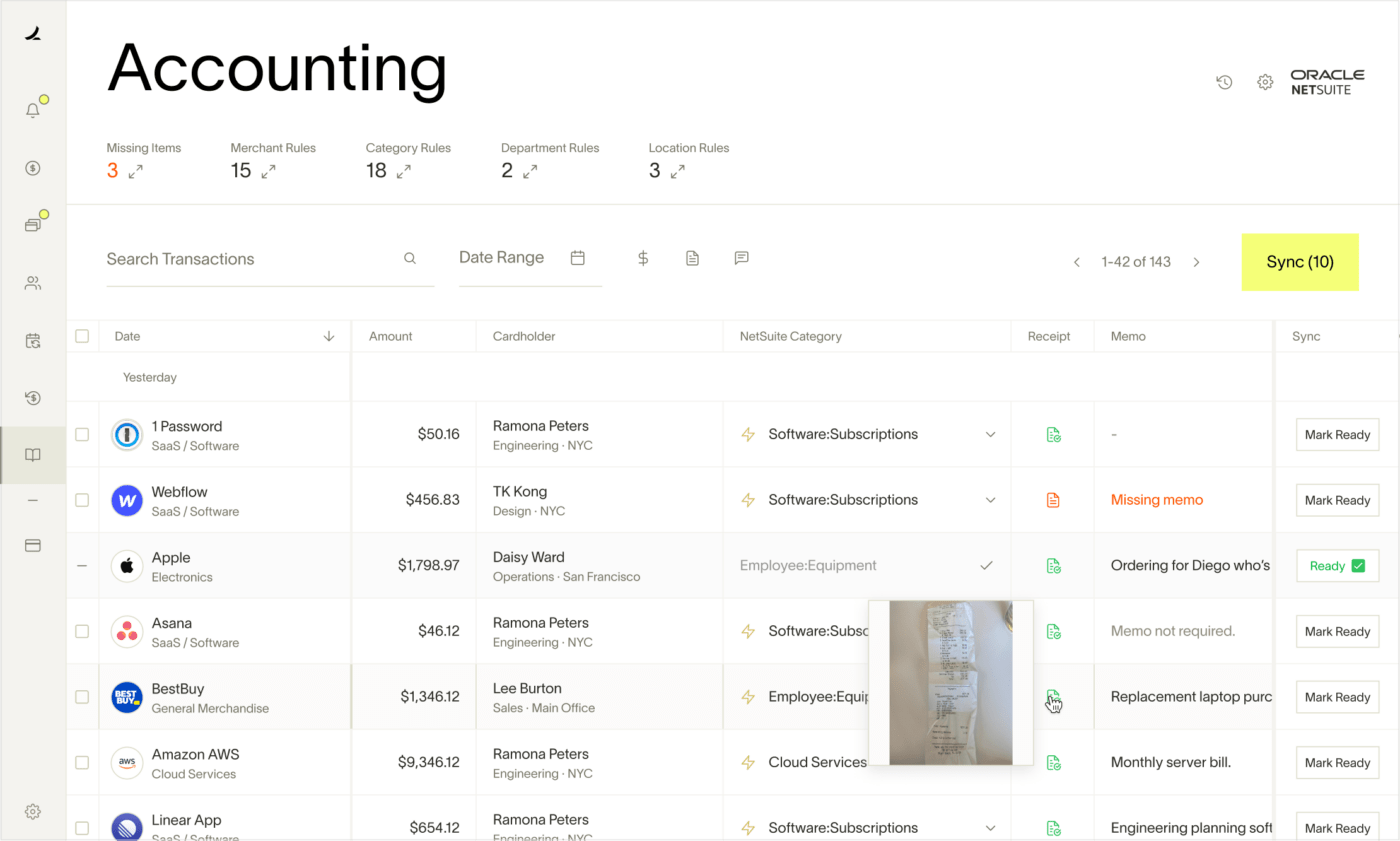

ClickUp also helps track and manage your clients with shareable reports created with ClickUp’s Accounting Project Management Software.

You will also be able to track and manage project budgets for clients with spreadsheets organized into a visual database using the tool. These spreadsheets allow you to link tasks, attach or embed any documents, and export data.

Choosing the right alternative to Brex depends on the needs of your team and business. Specialized tools will cater to your unique needs. But tools like ClickUp will help you keep your employees and clients updated with all the information and manage multiple projects.

You get the maximum outcomes when you streamline your process in one place. With features like task collaborations, integrations, and workflow customization, ClickUp focuses on solving different aspects of your finance project management. Try ClickUp today! ?

© 2026 ClickUp