Brex is a SaaS platform that provides corporate cards and spend management software to mid-market and venture-backed (large) companies. It uses AI-powered algorithms within its platform to detect fraud, make data-driven decisions, manage cash flows, and provide business-tailored solutions.

However, Brex may not suit the requirements of all businesses, especially smaller ones. And that creates a need for a worthy alternative.

So, we’ll discuss the best alternatives to Brex to help small businesses with business expense management.

What Should You Look for in Brex Alternatives?

Expense management platforms offer many features. Here are the top features you should consider before making the selection:

- Dashboards: For easy navigation and quick access to your expense reports

- Mobile app: Be able to manage and review your cards, expenses, and payments due from anywhere

- Automated approval process: To experience a faster workflow by setting daily expense limits or pre-authorized approval amounts to ensure you have an audit trail

- Digital receipt capture: Enable saving of time in recording expenses and reducing the risk of lost receipts through features like Optical Character Recognition (OCR) technology

- Mileage tracker: For the automatic calculation of mileage based on country laws for companies and teams that travel often

- Real-time reporting and analytics: Support well-informed decisions for your business and expenses

The 10 Best Brex Alternatives to Use in 2024

Now that you know what to look for while selecting an ideal expense management solution, let’s check out the top Brex Alternatives in 2024.

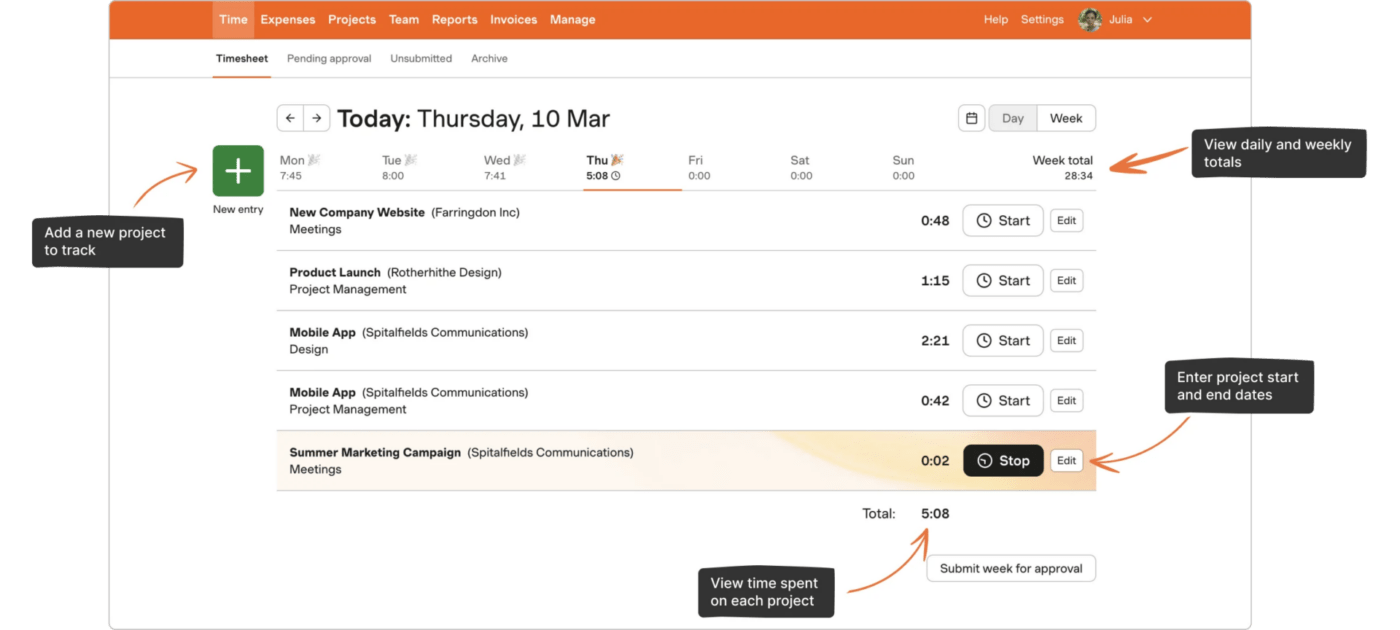

1. Harvest

Harvest is a time-tracking app ideal for small teams and businesses.

It helps you track your projects’ time across all platforms. You can connect it with other business apps and integrations like Asana and Slack.

Harvest lets you create invoices, collect payments, and integrate with accounting software like Xero and QuickBooks.

Harvest best features

- Track time across all platforms: browser, desktop, and mobile

- Assign budgets to projects and monitor their use

- Analyze cost and time consumption using reporting tools

- Streamline your invoicing by integrating online payments from PayPal and Stripe

Harvest limitations

- Non-admin accounts have to add all information manually

- Keeping track of past changes is difficult as it does not consider changed rates in history

Harvest pricing

- Harvest: Free

- Harvest Pro: $12/month per seat

Harvest ratings and reviews

- G2: 4.5/5 (700+ reviews)

- Capterra: 4.6 (500+ reviews)

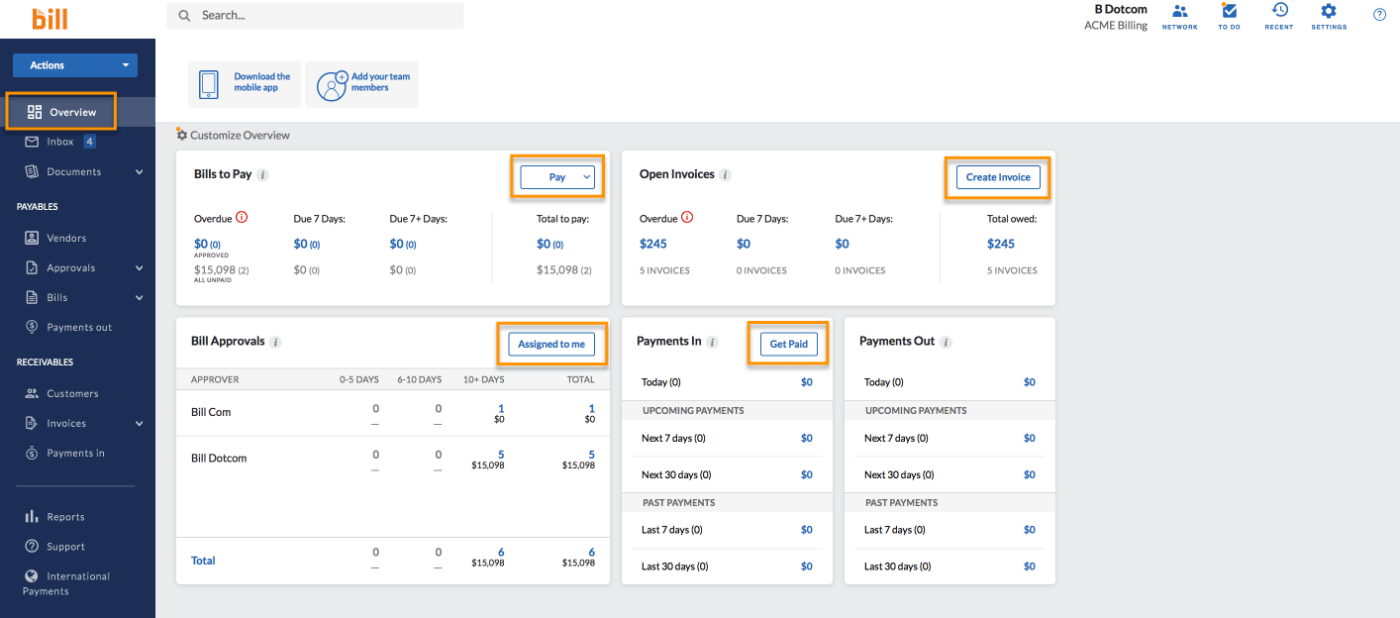

2. BILL Spend & Expense

BILL Spend & Expense helps automate expense reports, budgets, and reimbursement processing.

It has an automated expense reports option and saves time manually adding credit card statements. It also helps create separate cards for each subscription with customized limits.

With its expense management software and virtual cards, you can get real-time insights into employee spending and protect yourself from fraud. Users appreciate the tool’s ability to accommodate multiple payment options.

BILL Spend & Expense best features

- Generate automated expense reports without reconciling credit card statements

- Create separate cards for each subscription with a limit

- Track out-of-pocket expenses and reimbursement requests with mobile receipt upload and push notifications for approvals

BILL Spend & Expense limitations

- Can’t reset your virtual card subscription until the first business day of the month

- There is no option to split recurring charges to multiple budgets automatically

BILL Spend & Expense pricing

- Free

BILL Spend & Expense ratings and reviews

- G2: 4.5/5 (1,100+ reviews)

- Capterra: 4.7 (400+ reviews)

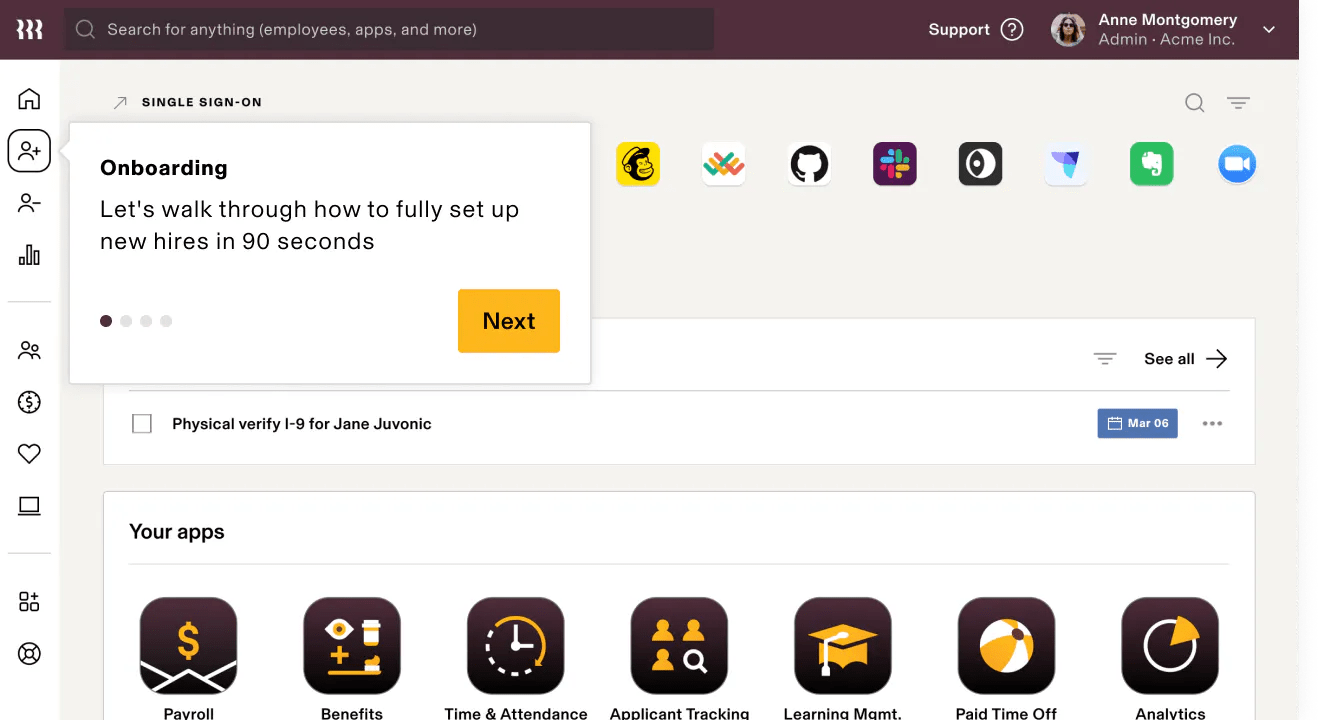

3. Rippling

Rippling offers the option to reimburse employees in their local currency and provide reports in any language.

You get to create a role-based approval chain that automatically adjusts with your business changes.

The expense management software quickly builds customized policies and saves time on manual revisions.

Rippling best features

- Instantly catch receipt mismatches, even if they are in different languages

- Build a role-based approval chain that automatically updates as per your business changes

- Access in-depth spending reports for every team member

Rippling limitations

- Slow response time while implementing reports

Rippling pricing

- Starts at $7/month per user

- Custom pricing

Rippling ratings and reviews

- G2: 4.8/5 (2,100+ reviews)

- Capterra: 4.9/5 (2,900+ reviews)

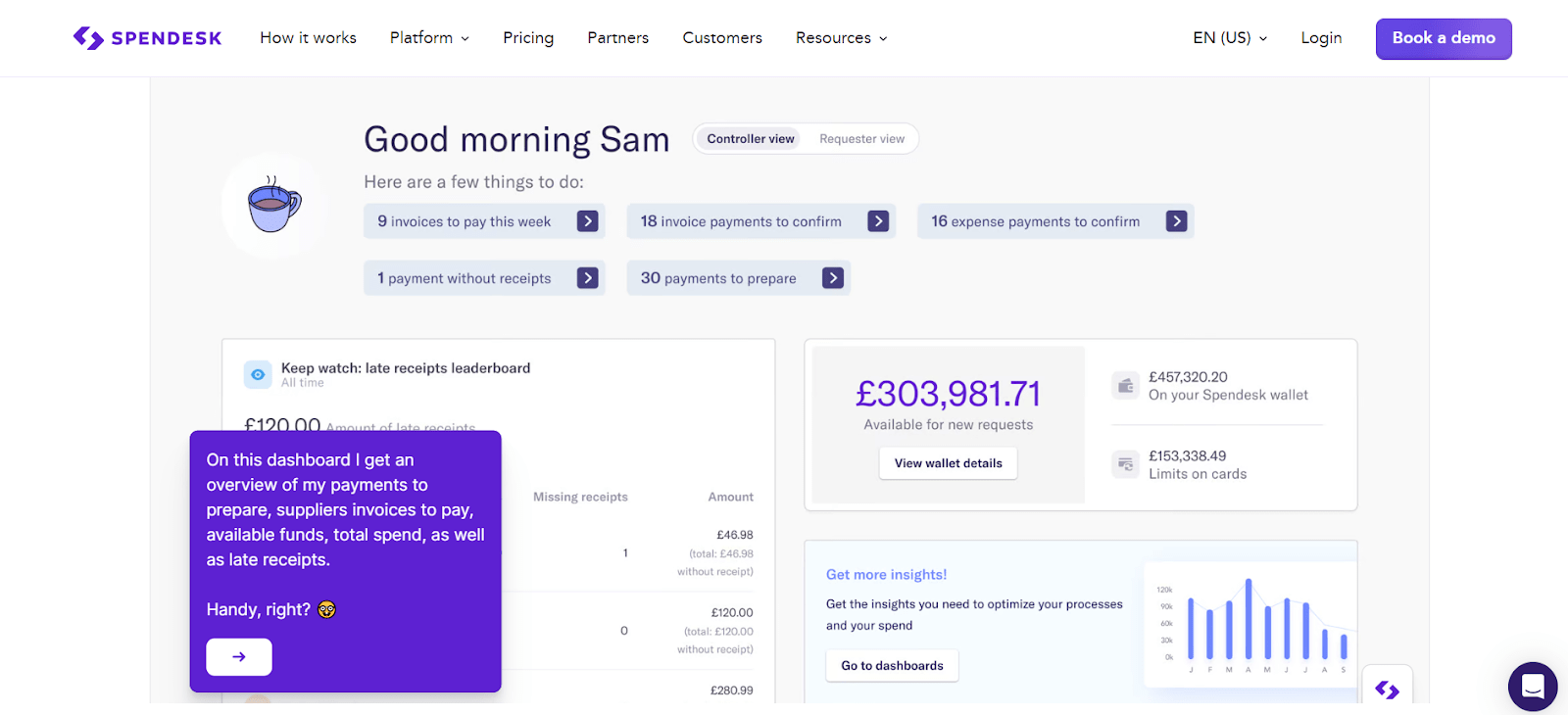

4. Spendesk

Spendesk is a seven-in-one cloud-based spend management solution that helps businesses manage their invoice payments, payrolls, corporate cards, and more.

It helps create digitized expense reports without paperwork, making the employees’ reimbursement process quick and easy.

The platform uses Optical Character Recognition (OCR) technology to scan and store your uploaded invoices or receipts. You can integrate it with third-party apps like Xero, Slack, and Netsuite.

Spendesk best features

- Keep track of expense management through virtual and physical cards

- Digitize expense reports for easy reimbursement of employee expenses with no paperwork

- Set company spending limits and pre-payment approvals

- Automate tasks like VAT extraction, receipt reconciliation, and expense account allocation

Spendesk limitations

- Expensive for small businesses

- Although the dashboard is user-friendly, setting up your business bank account is challenging

Spendesk pricing

- Custom pricing

Spendesk ratings and reviews

- G2: 4.7/5 (300+ reviews)

- Capterra: 4.8/5 (200+ reviews)

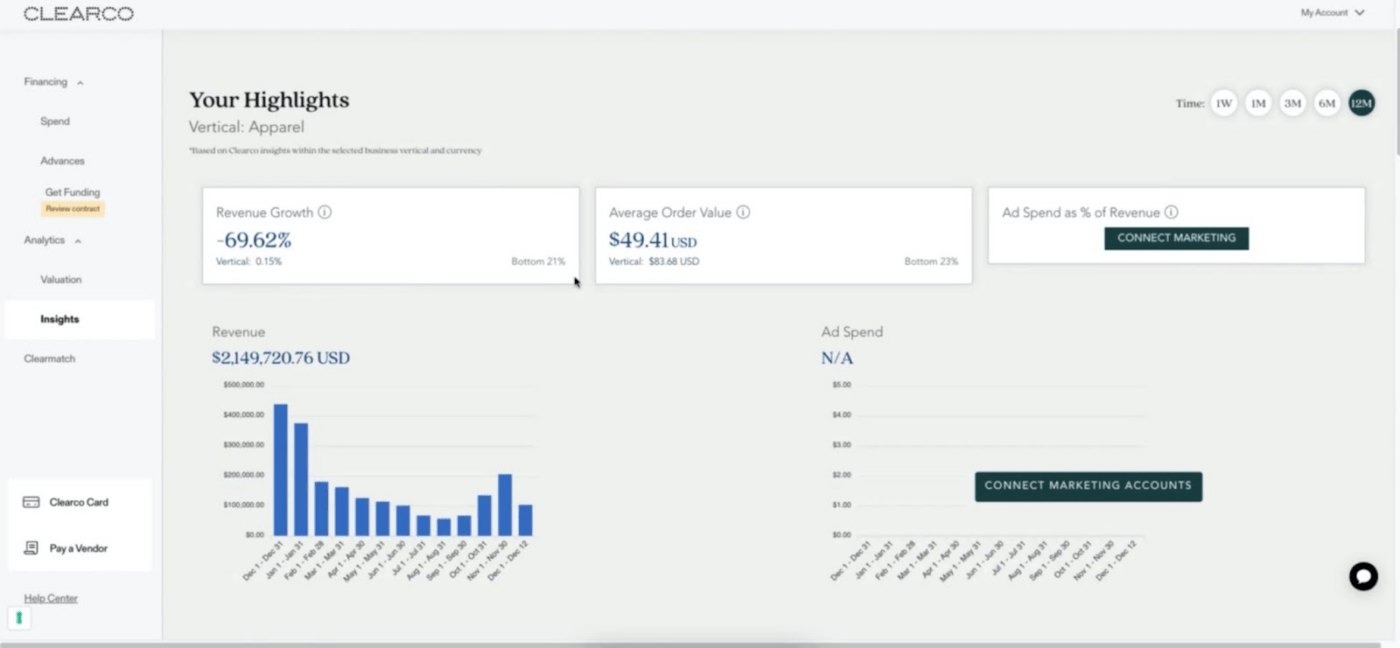

5. Clearco

Clearco helps e-commerce businesses manage their invoices and payments. It supports all your inventory, marketing, legal and financial fees, and shipping and logistics expenses.

It’s appreciated for its all-in-one, user-friendly dashboard. The platform supports four currencies: EUR, CAD, USD, and GBP.

Clearco best features

- You can get equity fee capital as a tech startup

- It offers the possibility to borrow up to $20 million

- No credit check for businesses running for six or more months

Clearco limitations

- Available for e-commerce and SaaS businesses only

- Works for only corporations or LLCs

Clearco pricing

- Custom pricing

Clearco ratings and reviews

- G2: 4.6/5 (300+ reviews)

- Capterra: 4.4/5 (300+ reviews)

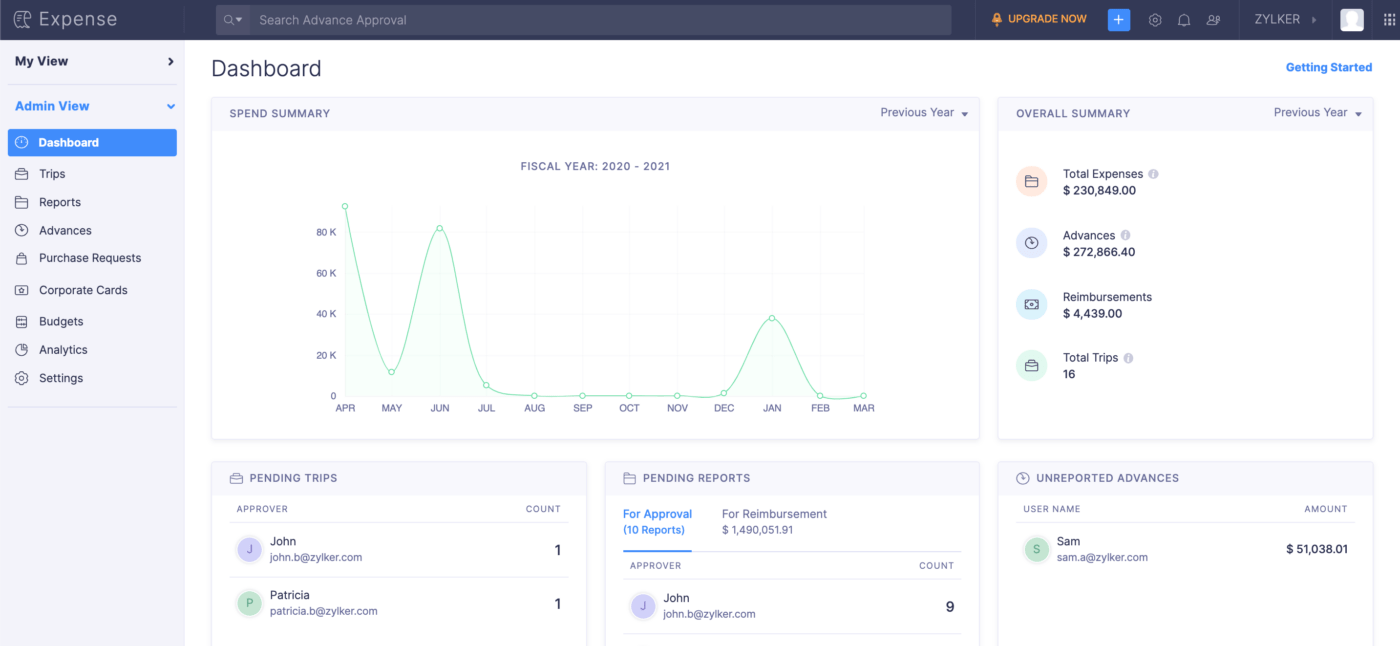

6. Zoho Expense

Zoho Expense is a web-based mobile application that manages business travel and spending expenses. It has automated travel expenses and reporting.

It sets receipt tracking with an auto-scan receipt option by integrating cloud applications. It saves your copies for life and ensures safe time-tracking.

Zoho Expense best features

- Track advance payments and reports with high-degree customization for quick and effective processes

- Customize expense creation forms and choose fields to fill during expense submission

- You can use multi-currency uploading options

Zoho Expense limitations

- Learning curve for beginners

- Occasional platform interruptions

Zoho Expense pricing

- Free: Up to 3 users

- Standard: $3/month per user

- Premium: $5/month per user

- Enterprise: $8/month per user

Zoho Expense ratings and reviews

- G2: 4.5/5 (1000+ reviews)

- Capterra: 4.6/5 (900+ reviews)

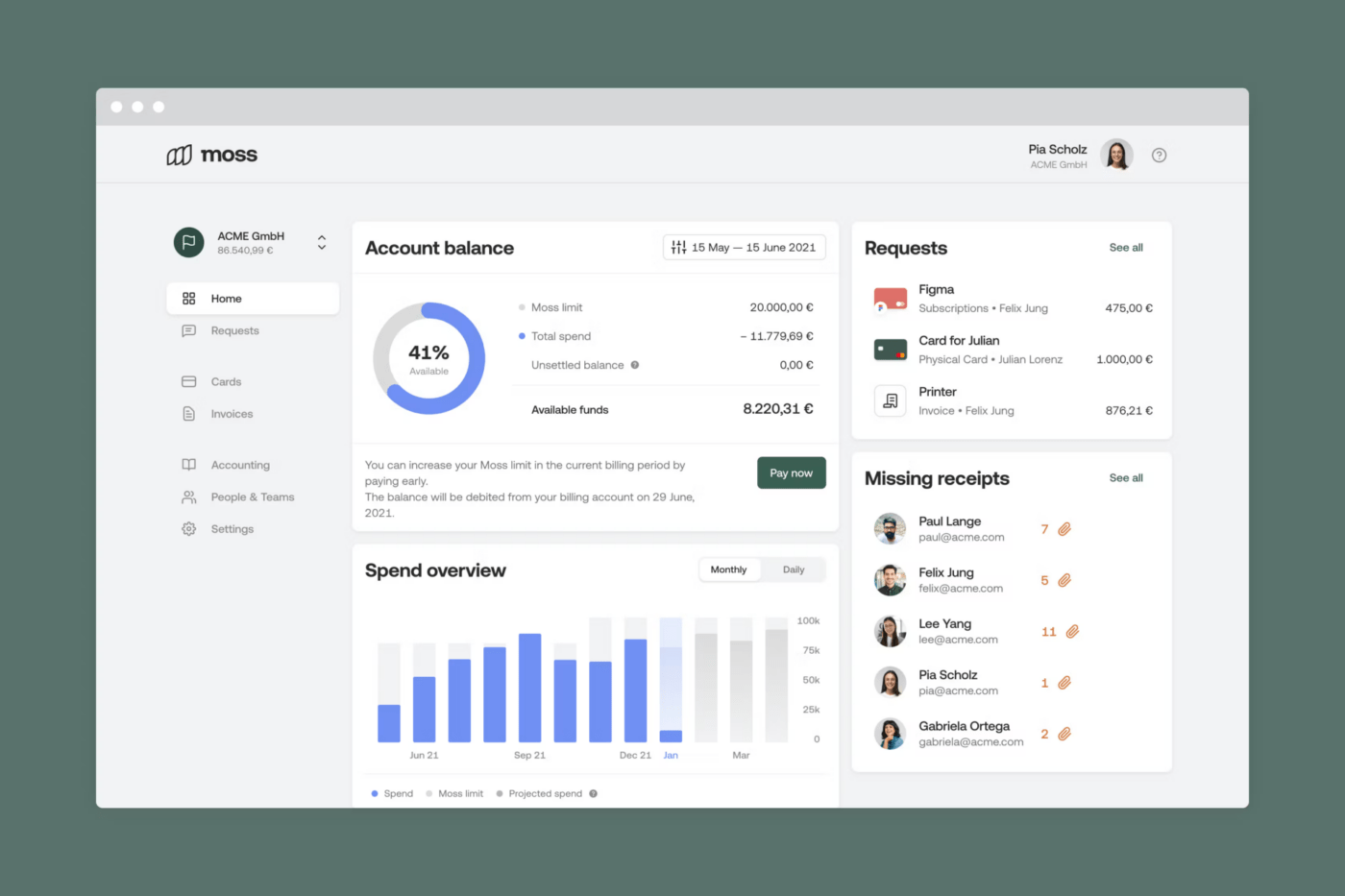

7. Moss

Moss provides corporate cards for start-ups and digital companies.

You can adjust individual card limits in real-time from your dashboard. It also comes with an option to set spending limits on each card. Users appreciate the platform for having expenses, invoices, and cards in one place.

It lets you set automated administrative tasks with different categories to your company’s workflow, including VAT rate and cost center.

Moss best features

- You can get unlimited debit and credit cards

- Claim up to 0.4% cashback for both physical and virtual cards

- Integrate with ERP and accounting software like XERO, DATEV, and Exact Online

Moss limitations

- Lower cashback than other expense management software

- Requires team assistance for demo and financial account setup

Moss pricing

- Smart Cards: Custom pricing

- Customized Plan: Custom pricing

- Complete Spend Management: Custom pricing

Moss ratings and reviews

- G2: 4.8/5 (30+ reviews)

- Capterra: 4.8/5 (50+ reviews)

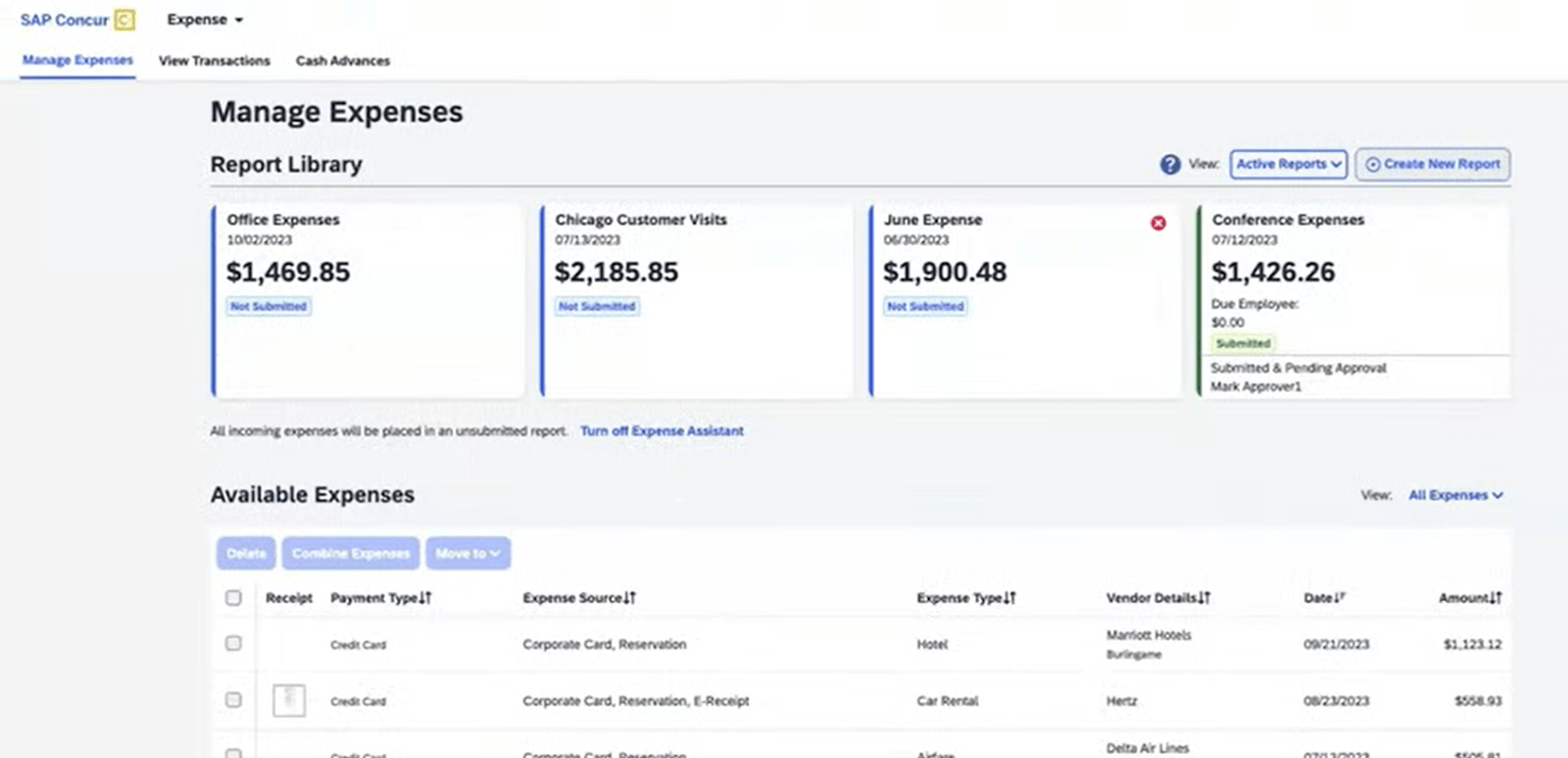

8. Concur

Concur offers integrated and automated expense management software that tracks expenses using AI and real-time data.

You can interpret data and get insightful reports. The tool lets you detect errors like duplicates and activities that do not comply with company policies through your dashboard.

The platform offers a self-guided demo without capturing credit card details.

Concur best features

- Track expense analysis and reporting with AI accounting tools and machine learning

- Create and categorize expense entries through AI

- Upload receipts to expense reports directly

- Calculate VAT and currency exchange rates for international trips automatically

Concur limitations

- Too many options available to estimate final pricing

- Restarts the process to fix some in-process issues

Concur pricing

- Custom pricing

Concur ratings and reviews

- G2: 4/5 (5000+ reviews)

- Capterra: 4.3/5 (1900+ reviews)

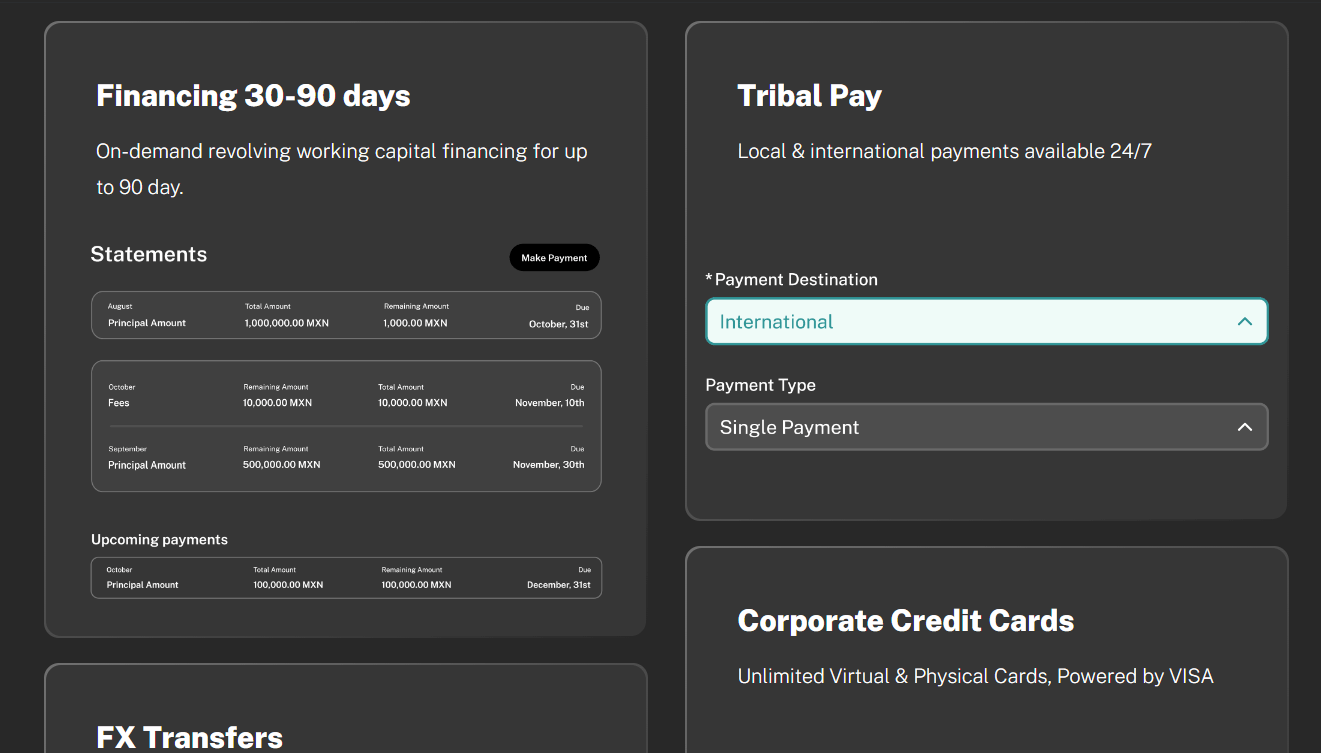

9. Tribal Credit

Tribal Credit is a corporate card for start-ups and medium-sized enterprises (SMEs).

It monitors and analyzes your business operation in real-time through your dashboard. The dashboard gets activated when you provide the last three months’ bank statements, your company’s article of incorporation, and your tax ID number.

The expense management platform is noted for offering lines of business credit as high as $1,000,000.

Tribal Credit best features

- You have the option to get secure cards issued in local currency

- Track real-time expenses with advanced tools

- Access relevant discounts and networking opportunities as a part of global start-up communities

Tribal Credit limitations

- Slow evaluation of the team’s expenditure

- Non-familiar tracking and reporting options

Tribal Credit pricing

- Free

Tribal Credit ratings and reviews

- G2: Not enough reviews

- Capterra: Not listed

10. Ramp

Ramp provides corporate card and spend management solutions specially designed for mid-market finance teams.

It allows you to set reminders for repayments and missing items and an auto-lock option for potential suspicious transactions.

The software creates custom workflows with pre-set budget templates. You can also set auto-limits and submission requirements on all your corporate cards.

Ramp best features

- Set reminders for repayments, missing items, and auto-lock cards for doubtful transactions

- Integrate directly with third-party apps like Asana

- Access real-time data to avoid overspending on your budget

- Generate AI-created reports for accurate analysis

Ramp limitations

- Long processing time

Ramp pricing

- Ramp: $0/month per user

- Ramp Plus: $12/month per user

- Ramp Enterprise: Custom pricing

Ramp ratings and reviews

- G2: 4.8/5 (1,800+ reviews)

- Capterra: 4.9/5 (100+ reviews)

Other Finance Management Tools

While Brex and similar expense management software handle financial tasks and reports, project management platforms like ClickUp focus on task management and collaboration among team members for smooth project completion with maximum productivity.

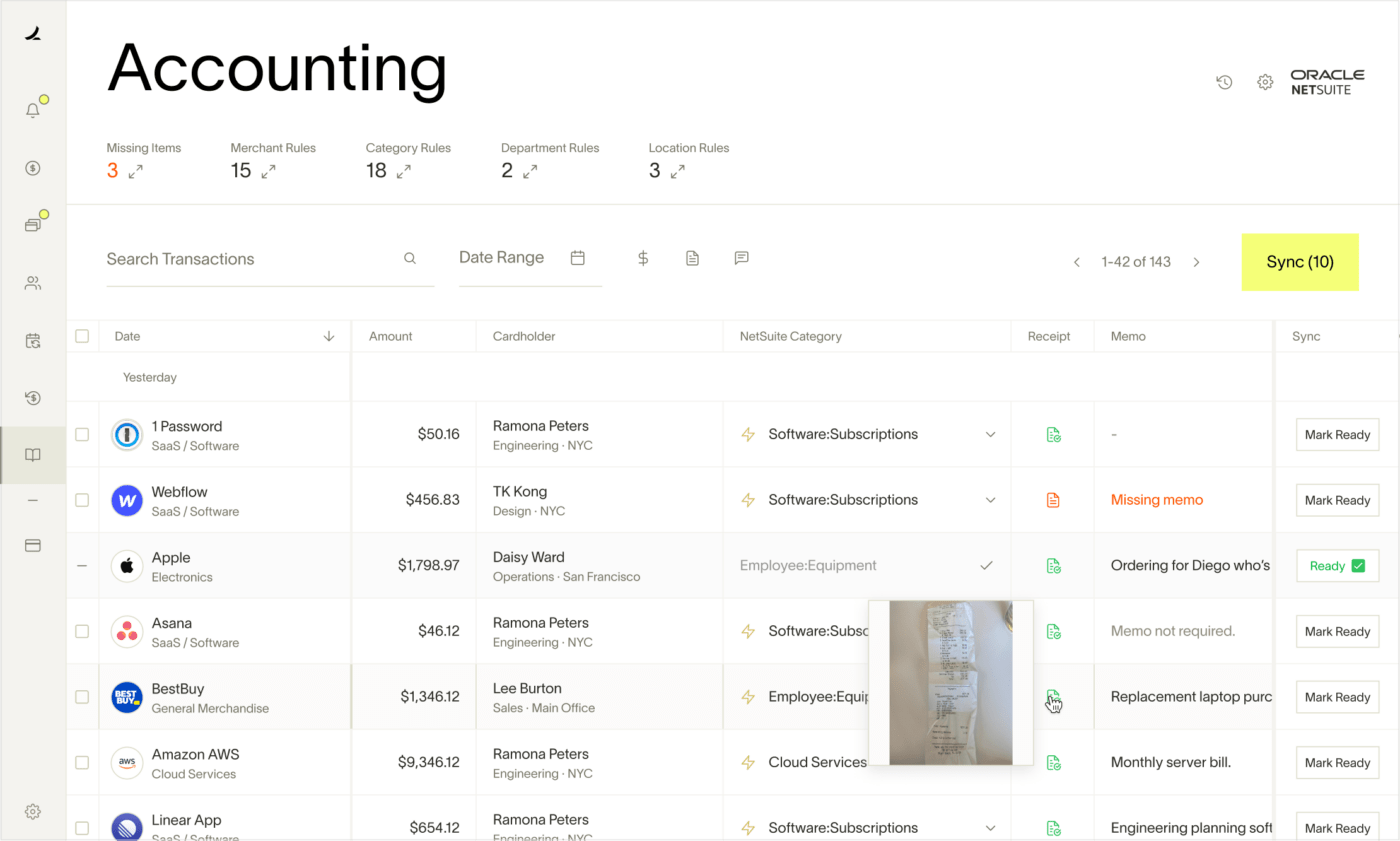

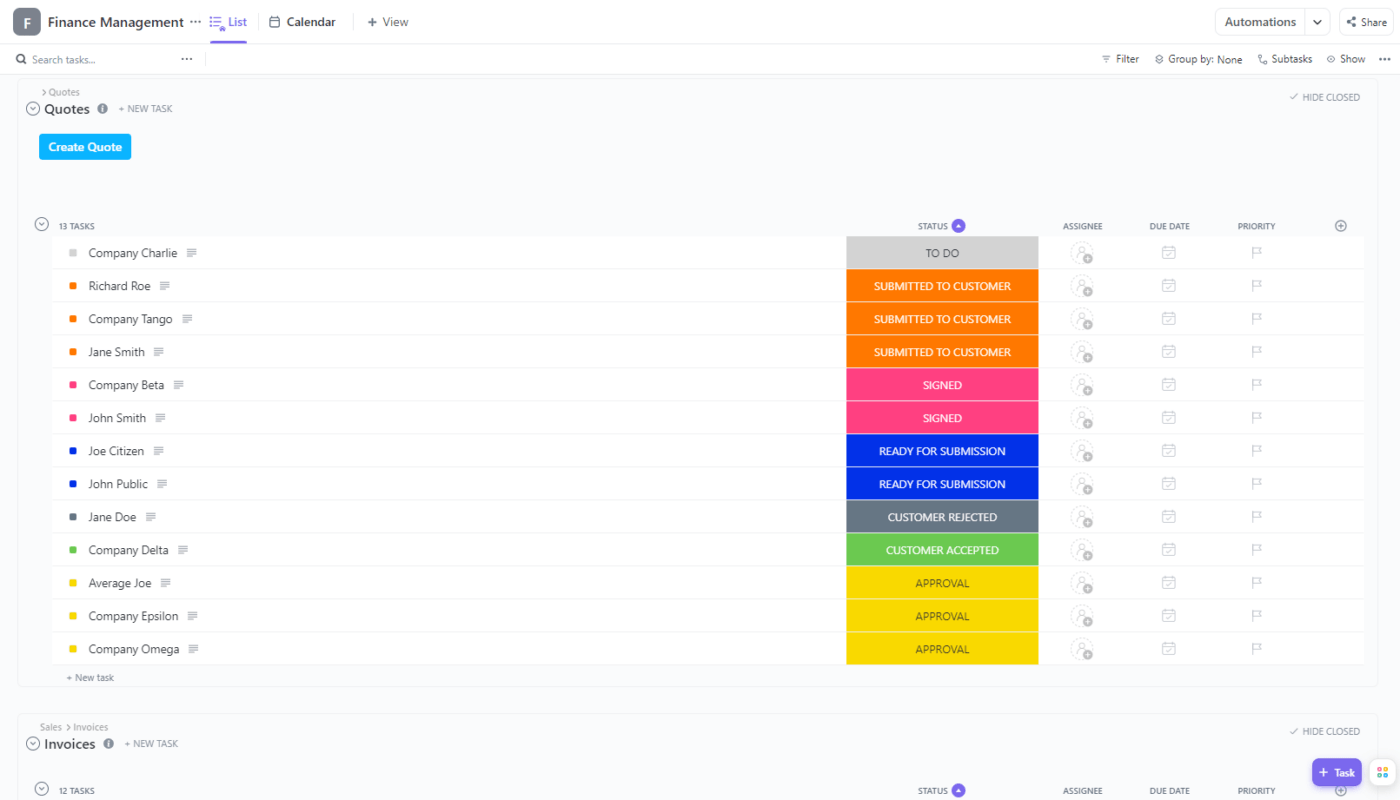

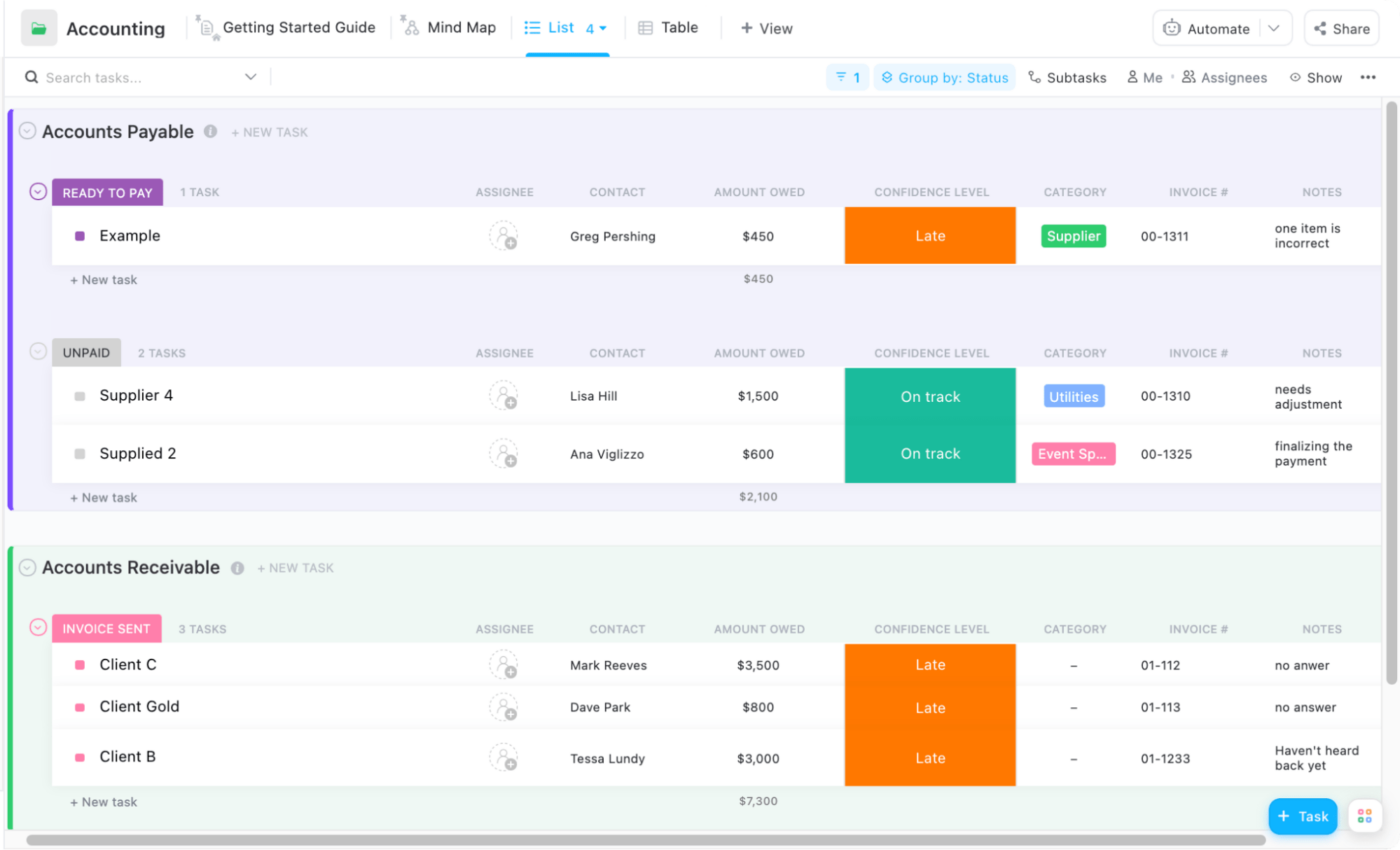

ClickUp

Use ClickUp’s Finance Management Templates to manage your financial tasks efficiently. With these templates, your finance teams will easily track financial KPIs, manage their accounts, and calculate their profits and expenses.

Manage Finance and Expenses with ClickUp

All you need is to sign up for ClickUp Finance Management Templates. Apply this template to the space or folder you want to work on. Add relevant team members, and your Workspace is ready.

ClickUp also helps track and manage your clients with shareable reports created with ClickUp’s Accounting Project Management Software.

You will also be able to track and manage project budgets for clients with spreadsheets organized into a visual database using the tool. These spreadsheets allow you to link tasks, attach or embed any documents, and export data.

ClickUp best features

- Work with custom financial management templates

- Track and manage client accounts and reports with ClickUp’s accounting and finance management tool, automation, and reminder tools

- Create and share detailed reports with the time resources tracking with visually organized spreadsheets

- Manage invoices, payment reminders, and more with highly visual dashboards

- Automate accounting tasks for reporting, team collaboration, and work assignments

- Enjoy 1000+ integration options with time tracking, cloud storage, developers, and calendar

ClickUp limitations

- No extra credits or rewards for using ClickUp

- Learning curve for new users

ClickUp pricing

- Free Forever

- Unlimited: $7/month per user

- Business: $12/month per user

- Enterprise: Contact for pricing

ClickUp ratings and reviews

- G2: 4.7/5 (9,000+ reviews)

- Capterra: 4.7/5 (3,000+ reviews)

Combine Expense Management with Finance Management Tools

Choosing the right alternative to Brex depends on the needs of your team and business. Specialized tools will cater to your unique needs. But tools like ClickUp will help you keep your employees and clients updated with all the information and manage multiple projects.

You get the maximum outcomes when you streamline your process in one place. With features like task collaborations, integrations, and workflow customization, ClickUp focuses on solving different aspects of your finance project management. Try ClickUp today! 🎉

Questions? Comments? Visit our Help Center for support.