10 Free Bookkeeping Templates in Excel and ClickUp

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

If the thought of managing your business finances makes you break out in a cold sweat, then you’re off to a great start by looking into bookkeeping templates. The good news is, regardless of your level of expertise or experience, getting started with these templates is pretty easy and straightforward. ✨

So without further ado, let’s dive into the world of bookkeeping and account planning templates and discover the 10 free gems in Excel, ClickUp, and Google Sheets that will bring more organization and stability to your bookkeeping process.

A bookkeeping template is a pre-designed framework that makes it easy to organize, track, and visualize your daily transactions so you can stay on top of your business’s financial health. 💸

These templates come with predefined columns, formulas, and customized features to cater to specific bookkeeping needs—taking the guesswork out of setting up and allowing you to dive straight into your bookkeeping activities.

From tracking income statement docs and expenses to maintaining a budget and generating financial reports, these templates will streamline your bookkeeping process, save you from stress, and free up valuable time to focus on high-value activities in your business.

Bookkeeping can be challenging on its own, and the last thing you want is to choose templates that add more complexity to the process. So as you evaluate different templates, be sure to look out for the following key areas:

Now that you have an idea of what to look for in a bookkeeping template, let’s dig into the meat of this article. Here is our list of the top 10 templates for bookkeeping—they will help you stay on top of your financial position all year round.

Managing bookkeeping tasks for multiple clients can feel like spinning plates on a dozen different poles!

Enter the Bookkeeping Firm Template by ClickUp, designed to help your bookkeeping firm manage clients’ financial data and records, stay on top of deadlines, and ensure seamless collaboration with both your team and clients.

This template is packaged in a folder that you can easily duplicate for each client on your roster. The folder has tasks grouped under three lists: Client Onboarding, Monthly Action Items, and Yearly Action Items.

The tasks within the lists can have one of four statuses—open, in progress, stuck, and closed—to visualize your progress, identify resource constraints, and ensure no task slips through the cracks. There are custom fields (aka columns) like assignee, priority, and a progress bar that automatically updates as subtasks are marked complete.

That’s not all … there are also multiple ways to view your lists. Switch to the Kanban board view to move tasks along your workflow stages, the Calendar view for tracking upcoming deadlines, and the Docs view for document storage and collaboration—whether it’s a cash-flow statement, balance sheet, or general financial data.

This template handles the heavy lifting of managing multiple clients, so you can focus on what you do best—getting work done and keeping your clients happy!

When it comes to offering your bookkeeping services, no two clients are the same. While one client may need extra hands on deck with their accounting software, another client may be looking to outsource their entire accounting operations.

The Bookkeeping Pricing Template by ClickUp lets you create a custom quote for each client’s needs and ensures you’re paid accordingly. It’s like a menu of different charges and services you can offer to your clients.

That can range from your base rate to more specialized services like credit card reconciliation and a cash flow statement. You can customize this “menu” to align with your bookkeeping firm’s offerings, and create custom duplicates to send out to potential clients.

For each item, there are custom fields to set the unit, unit price, total price, service type (e.g., income statement, price list, payroll processing, bookkeeping service, etc.), and billing cycle (e.g., monthly, quarterly, and yearly). Plus, there’s a helpful Getting Started Doc to help you navigate the template so you can start making edits.

Now you can sleep well at night knowing that each client’s needs will be well taken care of and you’ll be well-compensated for your efforts.

Check out these quote templates!

If your business buys or sells products or services on credit, then the Accounting Template by ClickUp is for you. This two-in-one template is made up of Accounts Payable, which lets you track the payments owed to your vendors and suppliers, and Accounts Receivable for tracking balances owed to you.

The template lets you capture key details like client name, contact, invoice number, cash flow, amount owed, payment method, and due date. You can also set a confidence level to evaluate the likelihood of payments and collections across your balance sheet.

This lets you identify and resolve potential issues that could affect your cash flow. And there’s the handy notes feature, perfect for providing additional context or important information about a transaction.

Like any ClickUp template, you can customize this one to suit your needs. Whether you want to add progress bars and formulas or set up reminders for upcoming payments, it’s all possible.

With this type of balance sheet template in hand, you can ensure a smooth and steady cash flow in your business and stay on top of your financial transactions and health.

When applied to the business world, the Pareto principle (aka the 80/20 rule) states that 80% of your revenue comes from just 20% of your clients. So imagine the difference you can make in your business if you could identify and prioritize these valuable clients, giving them the attention they deserve. Well, with ClickUp’s Large Account Management Process Template, you can do exactly that!

This template lets you identify your top clients (aka ”large accounts”), so you can create tailored strategies to nurture these relationships for long-term success.

It’s very easy to use and for starters, it has five main tasks in a work breakdown structure (WBS)—from identifying key accounts you want to focus on to implementing and monitoring your plans for their growth and success.

You can assign tasks to team members and set task complexity and priority levels. And of course, ClickUp doesn’t disappoint when it comes to offering dynamic views for visualizing progress. The Kanban view makes it easy to move tasks from start to completion.

On the other hand, the timeline view lets you visualize task durations, and the Gantt view takes this further by displaying task flow and dependencies. Use this template to strategically focus your resources on nurturing strong relationships with your top clients.

The result? Increased customer satisfaction, higher retention rates, and ultimately a significant boost in sales.

Keeping a detailed record of every single business transaction shouldn’t feel like rocket science, even in the absence of accounting software.

ClickUp’s Accounting Journal Template makes this process a breeze by using the double-entry method for recording all your business transactions. Just enter the debit balance details first, followed by the credit balance—by adding their entry number, transaction date, journal type (General, Sale, Payment, Receipt, and more), and receipt file.

But here’s the real gem: the “Books List” view. It lets you visualize the transactions, grouped by their journal type. This is very helpful for identifying trends like frequent transactions in specific areas like sales or expenses and also makes it easy and quick to retrieve information from specific journal types.

If you want to maintain accurate financial statements and records and save yourself from lots of headaches and stress, then this accounts template is a must-have in your toolkit.

The ClickUp Budget Report Template—designed in ClickUp Docs—helps you craft reports by highlighting your business’s monthly and yearly performance and budget summary.

The budget summary is further broken down into the Profit & Loss, Sales Breakdown, Expenses, Balance Sheet, and Competitive Summary sections for a comprehensive overview of your business’s financial performance.

And the best part? ClickUp automatically generates a table of contents, which makes it easy to navigate to different sections of the document. In addition, working in ClickUp’s Docs environment offers great flexibility from embedding external content (e.g., Google Drive, Sheets, YouTube, Figma, etc.) to customizing your account template and appearance to suit your business brand and guidelines.

When you’re done preparing the budget dashboard or balance sheet, you can share it with key stakeholders via a link or export it as a PDF file, ready to be sent via email or printed as a hard copy. You can supplement this with a sales report for reviewing and reporting sales goals and performance.

This simple budget template by ClickUp simplifies your budget estimation process so you can stay on top of your finances.

The Simple Budget Template by ClickUp makes it easy to create monthly and yearly estimates for your business’s income, cash flow, and expenses.

Set income estimates for the different services you offer and business investments you’ve made. You can also set expense estimates across multiple categories like Health, Transportation, Vacations, and Liabilities—all you need to do is enter the monthly estimates for each income and expense item and let the subtotals column automatically run the sums for you.

If you want a more detailed breakdown, you can either switch to the Income List or Expense List view to visualize your income and expenses grouped by their respective sources and sinks.

This balance sheet template—combined with effective project budget management—has many benefits, such as helping you optimize resource allocation, prevent overspending, and make informed decisions on where to invest or cut back.

While the previous template lets you create budget estimates, this Excel bookkeeping template lets you record and track your actual income and expenses, so you can stay within the estimated budget as best you can.

This income statement template has four versions to choose from:

Each of these workbooks is made up of separate sheets for each month to track your income and expenses across seven income accounts and 20 expense accounts.

You also get an income statement (aka profit and loss report) for a pulse on your business’s net income and profitability and a bank reconciliation worksheet for ensuring accuracy and alignment between your recorded transactions and bank statements. If you’re looking for free Excel bookkeeping templates, this is a great choice.

Without a structured system for expense tracking—especially when you have a team—you run the risk of errors, oversights, and disorganized financial records.

This Excel bookkeeping template makes it easy for employees to record and claim business expenses incurred out of pocket. These expenses can be tracked across multiple categories like travel, mileage, parking, telephone, and office items.

Each line item in this Excel accounting template allows for capturing essential details. Date of expense? Check. Customer or supplier information? Absolutely. Receipt or invoice number? You got it. A clear description, accounts code, and the amount spent? It’s all there.

This expense report template makes it easy for your staff to reclaim their money and for your business to keep accurate expense records.

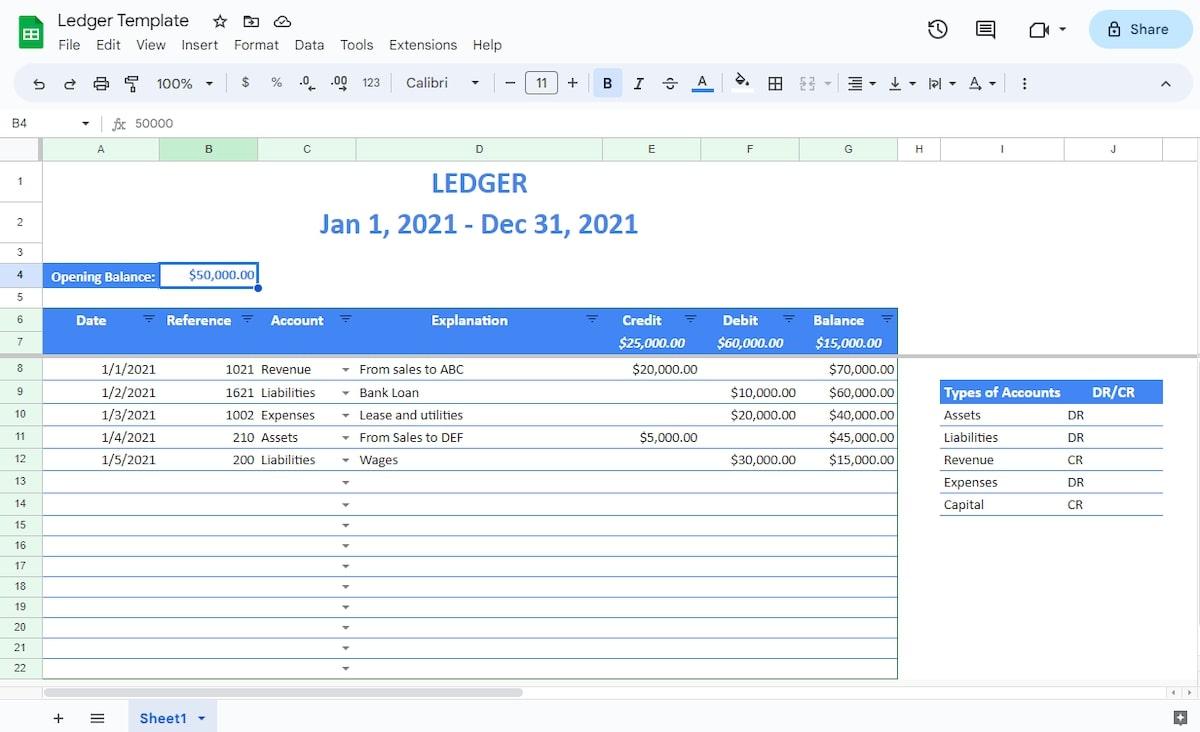

This general ledger template goes hand-in-hand with ClickUp’s Accounting Journal Template.

While the journal records daily transactions (arranged in chronological order by date), the ledger template is a summary of those transactions (within an accounting period) grouped under the following account types: assets, liabilities, revenue, expenses, and capital.

This template has seven column types to help you capture key transaction details: date, reference, account, explanation, credit, debit, and balance. You can easily make duplicates of the template to record ledgers for separate accounting periods to get a better idea of your financial position.

When maintained properly, this bookkeeping spreadsheet template provides a solid foundation for crafting accurate trial balances and financial statements for further analysis and decision-making.

Whether you’re a freelancer, entrepreneur, small business owner, or part of a dynamic startup, these 10 templates will simplify your bookkeeping system and keep accurate financial reports. But remember to choose the ClickUp, Sheets, or Excel template that aligns best with your business requirements and customize them as needed. 🛠️

When working in a bookkeeping software like ClickUp, you’ll have access to pre-formatted columns that make it easy to capture different data types, in addition to multiple dynamic views that give you unlimited flexibility to visualize your data. And with the click of a button, you can import Microsoft Excel and CSV files into ClickUp or export your ClickUp data to CSV or Excel format, giving you the best of both worlds. 🌻

Explore ClickUp’s extensive template library for a wide range of tools to streamline your business management and operations.

© 2026 ClickUp