10 Best Small Business Budgeting Software in 2026

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Small businesses often face tight budgets and limited resources, making every financial decision critical. While traditional budgeting methods help, they are slow, prone to errors, and need more flexibility.

If you are considering switching from conventional bookkeeping to specialized budgeting software, you’re headed in the right direction.

A business budgeting tool will give you the insights to cut unnecessary spending and reach profitability faster. It will help you plan your small business budget to determine the sales volume to break even, the reserves you need to create, and when to hire more people.

We have listed today’s top 10 small business budgeting software options, features, pricing, and ratings.

Let’s explore the key features to look for in budgeting software for small businesses. These features ensure the tool will meet your current and future needs as your business grows:

Now that you know the features and functionalities to look for in business budgeting software, here’s the list of the top 10 small business budgeting software.

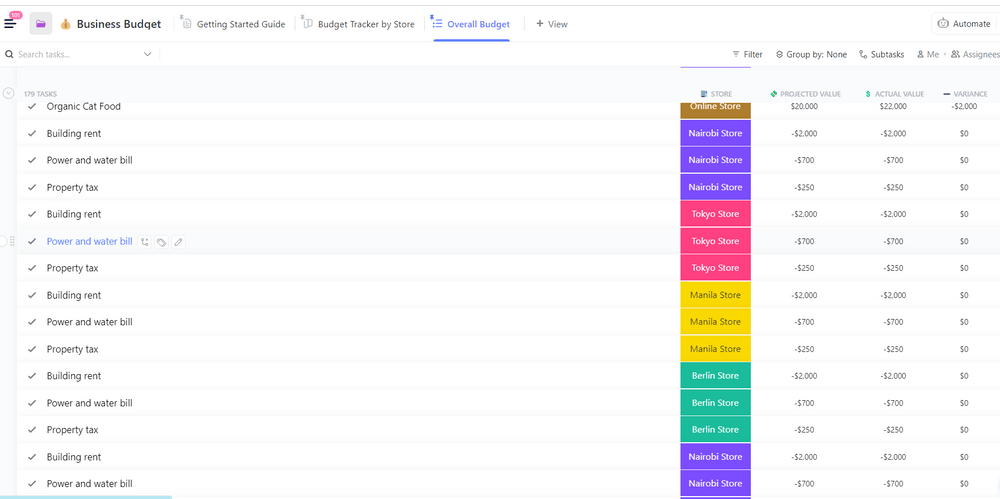

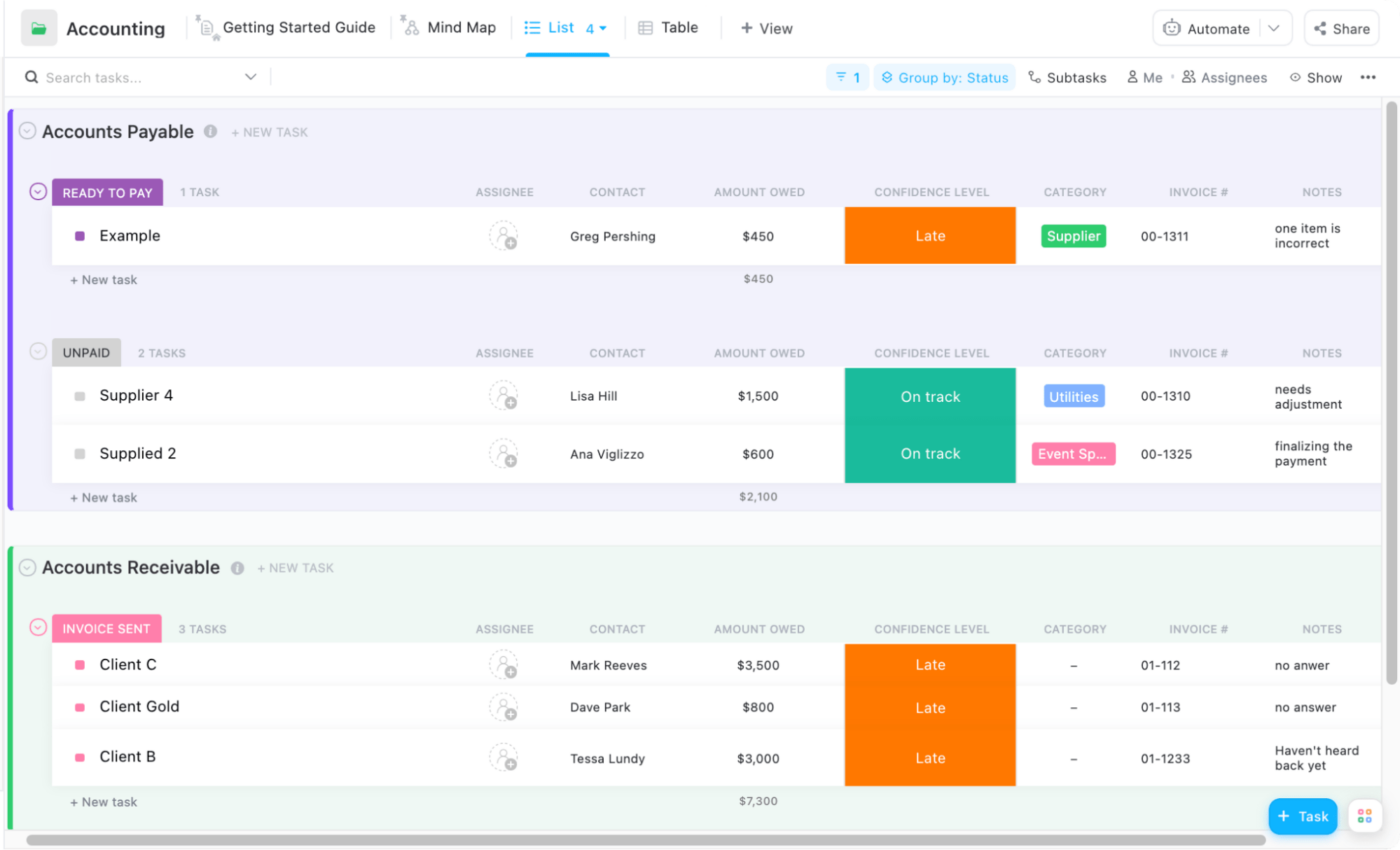

ClickUp combines all your company’s different functions into a single platform. Visualize all related tasks on one dashboard: marketing, finance, project management, or HR, and make changes in real-time.

Save time with AI-driven tasks and automation to focus on what’s crucial.

ClickUp’s accounting and finance project management software sets itself apart as a top-tier budgeting software that lets you perform complex financial calculations and planning efficiently. The software solution monitors your financial goals, oversees your accounts, and calculates your profits.

ClickUp’s templates for finance and accounting, real-time expense tracking, and collaborative budget management software are some of its robust budgeting features. It integrates versatile project management features with comprehensive budgeting tools.

Businesses managing multiple projects prefer ClickUp to ensure organized and efficient budgeting processes.

Want to consolidate tools and set your small business up for success in 2026? Check out our step by step playbook

Budgyt simplifies financial planning while maintaining the granular details of your data.

This cloud-based budgeting application lets you streamline your budgeting processes through an intuitive interface, automate expense categorization, and get insightful financial reports.

It ensures easy data manipulation with drag-and-drop functionality. Budgyt’s API allows integration with popular financial accounting software. It currently supports Quickbooks, Xero, and ConnectWise.

Add-ons pricing

BudgetPulse offers free-to-use and cloud-based accounting software fit for personal use.

BudgetPulse provides basic functionalities for personal financial management. Users manually import their transactions into printable charts, reports, and graphs to understand their expenses better. It also helps users set goals and track progress toward managing their money effectively.

FreshBooks offers unlimited, automated, and customizable invoices and expense entries. It accepts credit card payments online and ACH bank transfers. Its project budgeting templates save time and cost for freelancers and small businesses.

With over 100 app integrations, FreshBooks simplifies invoicing and expense management tasks.

A notable benefit of its Plus plan is that it reduces accounting errors with the double-entry accounting reports feature.

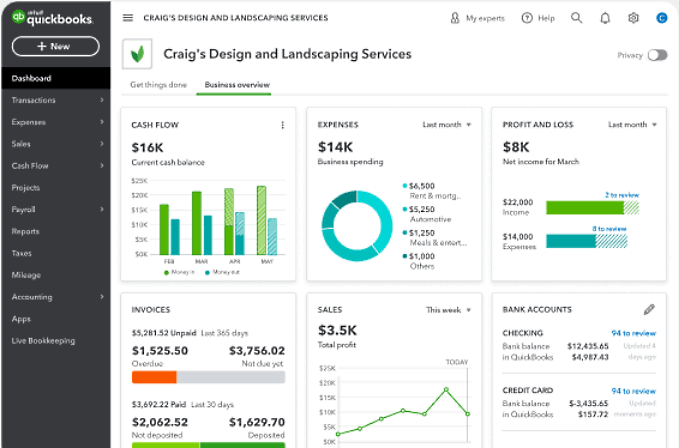

QuickBooks offers free guided setup with every QuickBooks Online plan. It lets you streamline your processes, including expenses, invoices, payments, receipt capture, and reporting.

Users leverage its AI-driven cloud-based features to track and manage everything from time and costs to salaries and employee benefits.

It supports 700+ third-party apps available on the QuickBooks App Store.

Built from the ground up for the real-time needs of cloud-dependent businesses, Xero is an accounting solution with payroll, workforce management, and expense management capabilities.

It promotes collaboration, internally and externally, with unlimited logins for each subscription tier.

Xero’s 800+ connected apps (including Square, Constant Contact, and ADP) help small businesses seamlessly perform business operations and financial management.

With its intuitive sales automation and iOS, Android, and Windows support, Zoho Books lets you streamline your transactions, track cash flows, and automate business processes.

You will also be able to connect your existing CRM, inventory, and subscription systems and generate quotes and invoices on the go.

Zoho Books connects to your bank and lets you fetch daily transactions in real time, implement payment reminders, and report scheduling and workflow triggers. It helps you create customer success case studies.

Scoro’s detailed budget breakdowns, project cost tracking, and profitability analysis capabilities help enhance productivity and deliver projects on time. Scoro’s data-driven insights and analytics help you drive growth further by identifying areas of improvement.

Scoro specializes in catering to service-based businesses that handle a lot of disconnected systems and changing workloads that diminish profit margins.

It eliminates the need to switch between tools and helps you manage projects, invoicing, and reporting from a single solution.

Onboarding pricing

Spendesk is a spending management platform that offers complete visibility into your company’s expenditures.

It enhances your real-time spending visibility, implements budget controls, and automates expense approvals, saving time and money across the entire spending cycle. Spendesk combines and controls all cash flows and processes from multiple tools from a single source. It gives you control over all non-payroll spending.

Float is a cash flow forecasting software specially designed for project-based businesses. It helps you stay one step ahead of potential cash shortages or surpluses, easily plan scenarios, and save valuable time by tracking cash flow across projects.

Float’s real-time integration with Xero, Quickbooks Online, and FreeAgent provides daily, weekly, and monthly cash flow forecasting.

Small business owners’ unique needs and preferences being met are essential in selecting the best budgeting software. While it’s crucial to opt for features that help with budgeting, investing in a tool that offers much more is worthwhile.

ClickUp takes care of all your budgeting needs and is an all-in-one solution that tackles multiple challenges you come across as your business grows.

ClickUp helps teams work more efficiently and collaboratively with its connected workflows, intuitive docs, real-time dashboards, and other features. This unified platform helps teams move faster, work smarter, and save valuable time.

Users with ClickUp’s Free Forever plan can access many templates, views, and customization options. Ready to give it a try? Sign up for ClickUp now!

© 2026 ClickUp