Small Business Bookkeeping Template to Simplify Finance Handling

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Beware of little expenses; a small leak will sink a great ship.

‘The leak’ probably might hide in a messy spreadsheet, quietly draining your profits.

In small business bookkeeping, precision is power, and templates are the unsung heroes that make it possible. From tracking income to monitoring cash flow, a good spreadsheet can save your balance sheet from total chaos.

Templates streamline your bookkeeping process, reduce data entry errors, and make tax season slightly less soul-crushing.

To make your life easier (and your records cleaner), we’ve rounded up the best small business bookkeeping templates to simplify accounting, clarify your financial standpoint, and give you back time to run your business.

Why wrestle with complex accounting software when these free small business bookkeeping templates can keep your business’s financial health in check?

Here’s a quick summary for you:

| Template Name | Download Template | Best Features | Ideal For | Visual Format |

| ClickUp Bookkeeping Firm Template | Get free template | Custom dashboards, workflow automation, CRM, task mgmt | Bookkeeping firms, small businesses needing all-in-one tracking | ClickUp List, Dashboard |

| ClickUp Accounting Template | Get free template | Income/payments, cash flow, calendar/board/grid views | Small business owners, solo accountants | ClickUp List, Calendar, Board |

| ClickUp Accounting Journal Template | Get free template | Standardized entries, status tracking, audit trails | Accountants, business owners needing clean records | ClickUp List, Doc |

| ClickUp Accounts Payable Template | Get free template | Custom fields, payment stages, process views, time tracking | Finance teams, small businesses tracking payables | ClickUp List, Board |

| ClickUp Budget Report Template | Get free template | Custom fields, Gantt/calendar views, workload, subtasks | Finance teams, dept heads, small businesses | ClickUp List, Gantt, Calendar |

| ClickUp Monthly Expense Report Template | Get free template | Tagging, status, calendar/Gantt, reminders | Teams, small businesses needing monthly overviews | ClickUp List, Calendar, Gantt |

| ClickUp Small Business Expense Report Template | Get free template | Transaction attributes, real-time visibility, tax-ready | Business owners, solo operators | ClickUp List, Calendar, Gantt |

| ClickUp Balance Sheet Template | Get free template | Custom fields, categories, list/Gantt/calendar, collab | Entrepreneurs, finance leads, small businesses | ClickUp List, Gantt, Calendar |

| ClickUp Finance Management Template | Get free template | 28 statuses, custom fields, dashboard, cost tracking | Business teams managing complex finances | ClickUp List, Calendar, Dashboard |

| ClickUp End of Day Cash Register Report Template | Get free template | Custom fields, status, reminders, list/calendar, doc sharing | Business owners, retail teams reconciling cash | ClickUp List, Calendar |

Small business bookkeeping templates are pre-built spreadsheet tools designed to help small businesses track income, record transactions, and manage accounts with minimal effort.

Here’s how they help small businesses stay in sync:

✅ Simplify the bookkeeping process with ready-to-use formats

✅ Track income, business expenses, and financial transactions.

✅ Generate accurate income statements, balance sheets, and cash flow statements

✅ Reduce errors in data entry and improve consistency across financial reports

✅ Maintain clear records of accounts payable, customer payments, and business transactions

✅ Save time during tax season by having clean, audit-ready statements

The best small business bookkeeping templates streamline financial data management while providing sufficient structure to support effective bookkeeping.

Let’s break down the other essential features a solid bookkeeping template should offer:

Now that you are familiar with the idea of bookkeeping templates, you should look for the best ones for your small business.

Here are the best templates to simplify every stage of your bookkeeping process.

Whether you’re after a simple spreadsheet, a client-ready format, or a smart tool for beginner bookkeeping, there’s a template here that fits.

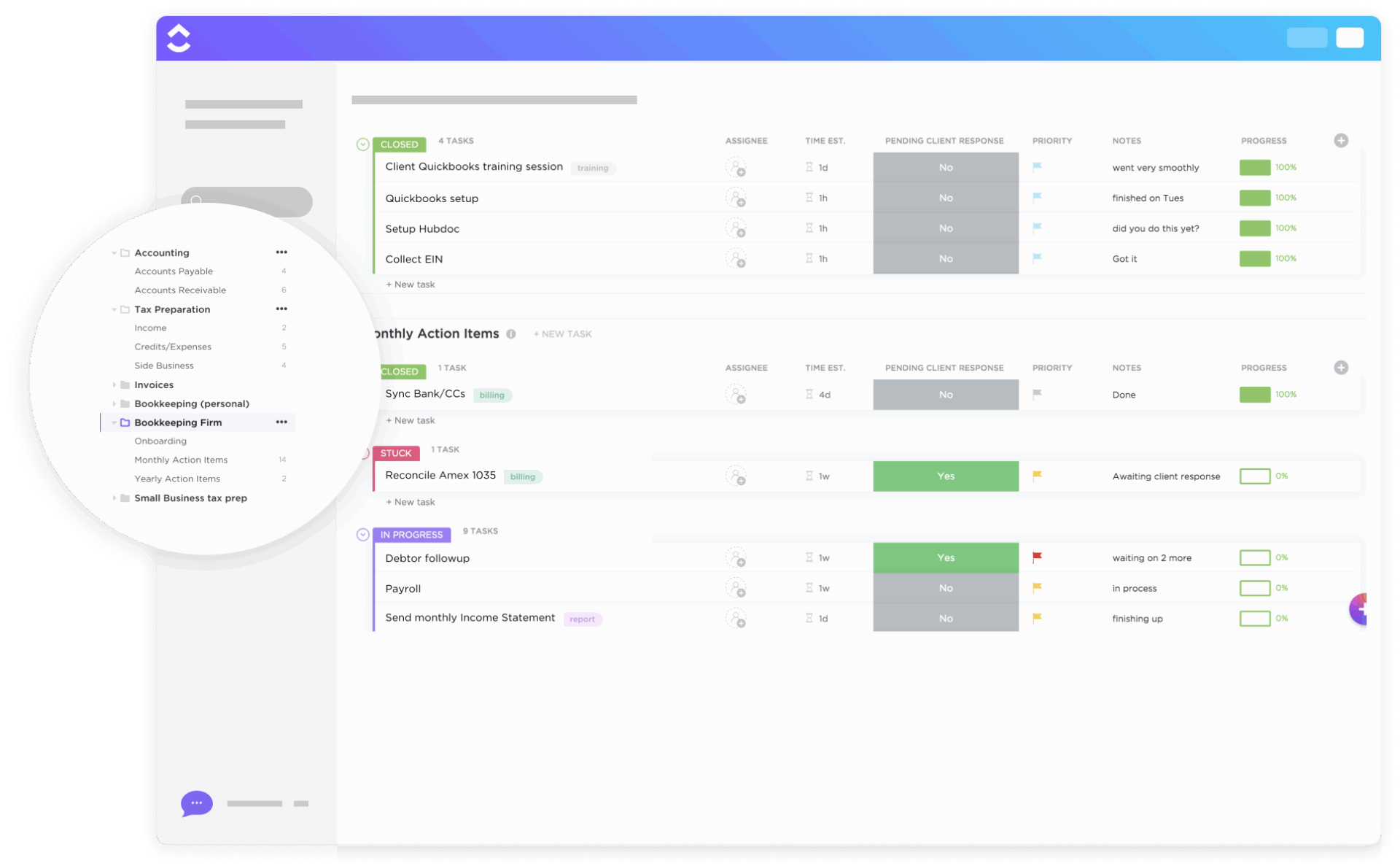

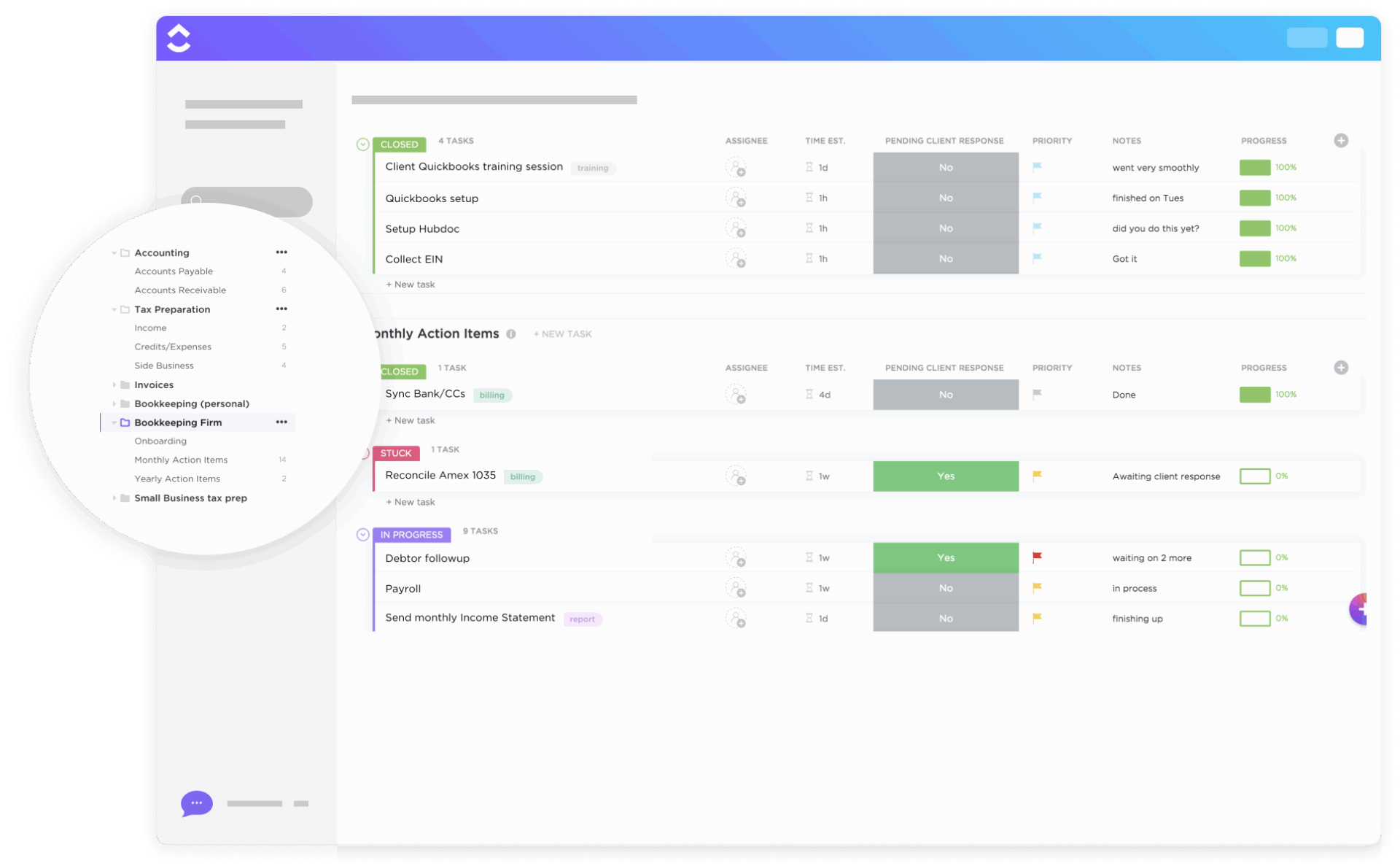

Ever tried to track financial data using five spreadsheets, three sticky notes, and a rapidly fraying memory? The ClickUp Bookkeeping Firm Template brings your bookkeeping process into one centralized system that’s clean, consistent, and actually usable.

✨ Ideal For: Bookkeeping firms and small businesses who want an efficient, all-in-one bookkeeping system that tracks transactions, simplifies reporting, and reduces errors across the board.

💡 Pro Tip: Struggling to maintain accurate records? These general ledger templates help you track debits, credits, and every line item without the spreadsheet headache.

📮 ClickUp Insight: 1 in 5 people say over 80% of their workday is spent on repetitive tasks. Another 20% say at least 40% of their day is eaten up by the same rinse-and-repeat work.

With ClickUp AI Agents, those repetitive, time-draining tasks get automated. From setting up recurring tasks to sending reminders and generating reports, ClickUp turns busywork into background noise so your team can focus on work that actually moves the needle. Watch here.👇🏼

Staying ahead of accounts payable, accounts receivable, and invoice numbers shouldn’t feel like herding spreadsheets. The ClickUp Accounting Template helps you manage income, outstanding payments, and upcoming financial transactions, all in one clean, customizable workspace.

✨ Ideal For: Small business owners and solo accountants who need a customizable system to track financial data, keep tabs on accounts, and avoid scrambling at tax season.

AI fields can be a game-changer for small businesses when it comes to bookkeeping. By automatically capturing, categorizing, and updating financial data, AI fields reduce the need for manual data entry and minimize human error.

This means business owners can spend less time on tedious paperwork and more time focusing on growth. AI fields can also spot patterns, flag inconsistencies, and generate real-time insights, making it easier to track expenses, manage invoices, and stay on top of cash flow. Ultimately, AI-powered bookkeeping helps small businesses stay organized, make smarter financial decisions, and free up valuable resources for what matters most.

📖 Also Read: How to Use Project Accounting

Manual journals and inconsistent entries can derail even the most basic bookkeeping system. One missed transaction date or mismatched entry number, and suddenly your trial balance is off by three decimal points and a migraine. The ClickUp Accounting Journal Template eliminates that chaos.

✨ Ideal For: Accountants and business owners who want cleaner entries, better audit trails, and consistent bookkeeping templates without starting from scratch.

➡️ Curious how ClickUp stacks up against other project management tools? Check out this video where we tested and reviewed the top 15👇🏻

🧠 Fun Fact: Bookkeeping is older than the wheel—Mesopotamians were tracking grain and livestock over 7,000 years ago. Clay tablets were the original spreadsheets.

Late vendor payments and scattered due dates can wreck cash flow. The ClickUp Accounts Payable Template helps you stay ahead of accounts payable by giving you a centralized, visual system to manage every pending financial transaction.

✨ Ideal For: Finance teams and small businesses that need structured, accurate tracking for outgoing transactions and a better grip on cash flow forecasting.

💡 Pro Tip: Want to simplify expense reporting? These Excel expense report templates offer clean, customizable layouts for tracking business expenses with clarity and speed.

Tired of juggling conflicting numbers from different departments? The ClickUp Budget Report Template brings everyone onto the same financial page.

✨ Ideal For: Finance teams, department heads, and small businesses that want to make better financial decisions, prevent overspending, and create budget reports that actually make sense to everyone.

💡 Pro Tip: Want to modernize your finance workflows? Learn how to use AI in accounting to automate data entry, analyze trends, and close your cash books faster.

Trying to recall where your money went at the end of the month? Not ideal.

The ClickUp Monthly Expense Report Template helps you track business expenses, analyze cash flow, and spot savings opportunities without relying on memory or messy receipts.

✨ Ideal For: Teams and small businesses that need clear monthly overviews to stay accountable, reduce unnecessary spending, and maintain better visibility into their financial position.

📖 Also Read: 18 Time Management Tips for Business Owners

🧠 Fun Fact: Al Capone wasn’t jailed for mob crimes, as he went down for tax evasion, exposed by bookkeeping errors.

If your idea of expense reporting still involves scanning receipts into a chaotic folder, it’s time to upgrade. The ClickUp Small Business Expense Report Template gives you a structured way to track business expenses, stay compliant, and make smarter spending decisions.

✨ Ideal For: Business owners and solo operators who want to track expenses precisely, generate clean reports, and stay ahead of government filing requirements.

💡 Pro Tip: Tracking costs shouldn’t feel like detective work. This business expense report in Excel helps you break down spending, log receipts, and prep for tax season with ease.

A clean balance sheet is non-negotiable when you’re trying to understand your financial position or pitch your business to investors. The ClickUp Balance Sheet Template helps you track assets, liabilities, and equity all in one place, with fewer manual updates and more built-in structure.

✨ Ideal For: Entrepreneurs, finance leads, and small businesses who need a reliable, well-structured balance sheet template for regular reporting, stakeholder reviews, or internal planning.

📖 Also Read: How to Organize Finances

🧠 Fun Fact: Double-entry bookkeeping was made famous in 1494 by Luca Pacioli—a monk who also happened to be BFFs with Leonardo da Vinci. Balance sheets? Renaissance-level genius.

Financial tracking can spiral fast when you’re juggling budgets, cash flow, and dozens of scattered sheets. The ClickUp Finance Management Template pulls it all together, making your bookkeeping system more visual, centralized, and effective.

✨ Ideal For: Business teams managing complex financial projects who want structured bookkeeping templates with better oversight on spending, budgets, and long-term financial planning.

💡 Pro Tip: Not sure how to structure your financial logs? These general ledger examples walk you through practical use cases to sharpen your tracking and stay audit-ready.

Ever second-guessed your cash drawer at the end of the day? The ClickUp End of Day Cash Register Report Template gives you the confidence that every cash payment is accounted for—no mental math required.

✨ Ideal For: Business owners and retail teams who want clean, verified cash register records, accurate financial data, and peace of mind after every shift.

📖 Also Read: How AI Can Help Small Businesses

A survey revealed that only 48% of small business owners feel confident about filing their taxes accurately. That’s not just a stat but a signal.

Unclear records, missing receipts, and inconsistent tracking can snowball into financial stress, audit anxiety, or worse —missed growth opportunities. That’s exactly where bookkeeping templates step in.

“Accounting is the language of business, and you have to be as comfortable with that as your native language.” says Warren Buffett, and ClickUp can help you master it.

From tracking income and business expenses to generating statements and managing cash flow, ClickUp’s templates offer a structured, easy-to-use system built for real business needs and not accounting degrees.

Whether you’re logging customer payments, building out a balance sheet, or automating accounts payable, ClickUp helps you turn financial chaos into clean, accurate, and audit-ready records.

As users often share, these templates create a repeatable, scalable bookkeeping process that grows with your business.

Sign up on ClickUp to avail free bookkeeping templates and keep your books (and your stress levels) in check.

The easiest way to do bookkeeping for a small business is to separate your business and personal finances by opening a dedicated business bank account. Using accounting software to automate tasks like invoicing, expense tracking, and financial reporting can also simplify the process and reduce manual errors. Regularly updating your records and keeping all financial documents organized will help maintain accuracy and make tax preparation easier.

Yes, many small businesses start by managing their own bookkeeping using spreadsheets or basic accounting software. This approach is cost-effective for very small businesses. However, as your business grows and transactions become more complex, you may want to consider hiring a professional bookkeeper or accountant to ensure accuracy and save time.

There are several free bookkeeping software options available for small businesses. Popular choices include ClickUp and Wave, which offer invoicing, expense tracking, and financial reporting, as well as open-source programs. These tools can help you manage your finances without the cost of paid software.

To do small business bookkeeping in Excel, create spreadsheets to track your income, expenses, and generate basic financial reports. You’ll need to manually enter and update your data regularly. While this method is cost-effective and flexible, it requires careful organization and consistency to ensure your records are accurate and complete.

© 2026 ClickUp