Creating a budget is the first step of money management, whether you’re considering business expenses or assessing your personal spending.

Microsoft Excel is often the preferred tool to manage finances. With a few formulae, you can do a cost-benefit analysis to launch a new product, track income and expenses, or calculate your retirement corpus.

The best part is you don’t always have to start from scratch. With free budget templates, you just have to key in your details to gain visibility of your financial health. We’ve compiled a list of 15 free budget templates in Excel and ClickUp to make your job easier.

- Monthly Excel Family Budget Template

- Excel Simple Monthly Budget Template

- Excel Expense Report Template

- Excel Personal Budget Template

- Excel Budget Summary Template

- ClickUp Simple Budget Template

- ClickUp Business Budget Template

- ClickUp Budget Proposal Template

- ClickUp Personal Monthly Budget Template

- ClickUp Event Budget Template

- ClickUp Project Management Budget Template

- ClickUp Project Budget with WBS Template

- ClickUp Marketing Budget Template

- ClickUp Film Budget Template

- ClickUp College Budget Template

What to Look for in Excel Budget Templates?

Look for the following features in Excel budget templates to gauge whether they can cater to your needs:

- User-friendly interface: Microsoft Excel is a highly user-friendly spreadsheet editor; the template should retain these qualities. It should offer a clear and intuitive layout that makes it easy to input numbers and understand financial data

- Specificity: Since different users have different requirements, the budget templates must match your specific requirements and applications for greater convenience

- Comprehensive: Look for a template that holistically covers all aspects of financial management. Check for financial metrics like income, expenses, savings, investments, debt, liabilities, margins, etc. that align with your requirement

- Customizability: It must offer a high degree of customization and allow users to modify categories, add or remove sections, tweak formulae as per their unique financial requirements, and more

- Automation: Look for templates with built-in formulae, functions, and macros that perform all the computation with little to no manual intervention to save time and reduce errors

- Data visualization: Consider templates that visually represent your financial data through interactive charts and graphs to make it easier to analyze financial trends or make informed data-driven decisions

- Financial reporting: Opt for a template that generates detailed financial reports, as it helps maintain compliance and transparency through an auditable log

- Compatibility: Ensure that the template is compatible with the version of Microsoft Excel in use. Also, check for its compatibility with other applications, software, or devices that you may integrate it with for financial management

- Accessibility: Select a template that is readily accessible across various devices. Don’t just view it from the lens of compatibility but also check how it renders across multiple screens for ease of use

- Security: Since you’ll be storing sensitive financial data in your Excel budget templates, you want it to be safe and secure. Look for features such as encryption or password protection to safeguard your critical data from unauthorized access

Best Free Excel Budget Templates (Monthly, Weekly, Personal, & More)

Now that we understand what to look for, here are five excellent Excel spreadsheet templates to help you manage your budget:

1. Monthly Excel Family Budget Template

Manage your family’s finances effortlessly with this Excel Family Budget Template.

It puts you in charge of your family’s financial well-being. Simply enter your spending details in the appropriate tab of this monthly budget template and let it do its work. The family budget planner helps you track your monthly income, gain insights into your spending behavior, and keep track of your savings goals.

Customize the categories under the Monthly Expenses tab depending on your family’s needs and spending. The Expenses Summary tab offers a detailed breakdown of your cash flow and financial goals.

Ideal for: Building a simple budget for your family’s finances.

2. Excel Simple Monthly Budget Template

The Excel Simple Monthly Budget Template places you in the driver’s seat while managing your budget.

This easy-to-use monthly budget template is designed to make budgeting a breeze. Use it to compare your monthly income to your expenses and the corresponding surplus or deficit. It grants visibility into where your money goes and how to optimize your budget to meet your goals.

Whether you manage your monthly budget or plan for the future, this tool can easily meld with your financial aspirations. Use it to make smart and informed decisions about your money.

Ideal for: Monthly budget planning for individuals and families.

3. Excel Expense Report Template

The Excel Expense Report Template simplifies financial tracking. It is a powerful tool for tracking expenses and comparing the budgeted costs with the actual values. Customize this expense tracker to align with your needs by adding or deleting columns or modifying the expense categories across different headers.

This expense report template offers excellent versatility, flexibility, and convenience, allowing you to monitor business expenses and personal finance. Stay on your budget and make better expense-related decisions with this free budget template.

Ideal for: Tracking expenses and identifying instances of overspending.

4. Excel Personal Budget Template

Prioritize financial health and well-being with this Excel Personal Budget Template. It is a comprehensive tool to track your monthly expenditures and liabilities, such as travel expenses, housing loans, etc.

This personal budget sheet automates financial calculations and grants greater control over your finances as you quickly get an overview of what you do with your money.

Whether you wish to maximize your income through savings or bridge the gap between projected costs and actual expenses, this budget template aligns with your personal financial goals.

Ideal for: Tracking monthly expenses along set financial goals.

5. Excel Budget Summary Template

Stay updated on your business’s finances with this Excel Budget Summary Template.

It is a powerful tool for cost management, allowing you to track income and expenses, project revenue, and more. It has various business expense categories and a handy chart summarizing budgetary details.

Use it to monitor your company’s financial performance and health by comparing the projected and actual spending, tracking personnel costs, and identifying areas of improvement. This business budget template streamlines financial management to make your business more profitable.

Ideal for: Getting a quick overview of various types of business expenses

Limitations of Using Excel Budget Templates

While Excel budget templates offer many benefits, they also have limitations. Here is an overview of some challenges you might face while using Excel budget templates:

- Manual Data Entry: Although a powerhouse of complex computations, Excel budget templates still require you to enter your financial data manually. Manual data entry is prone to errors and inaccuracies that can affect the usability of the free budget template

- Limited Collaboration: Unless you’re using Microsoft 365 online, your options for collaborating on the Excel budget templates are severely limited. Your regular Excel file gets stored locally, so you cannot share and sync the file with your team or family members

- Version Control: Speaking of copies, managing multiple versions of Excel files takes a lot of work. The lack of collaboration and version control leads to confusion and inconsistencies in data, bleeding into inaccuracies or data obsolescence

- Lack of Integrations: Microsoft Excel may not necessarily integrate with your existing tech stack, software platforms, or other financial tools. As a result, you’ll have to import and export the data manually, which gives rise to data siloes and workflow inefficiency

- Limited Reporting Capabilities: While Excel does possess basic reporting features and data visualization tools, these may fall short if you’re looking for a comprehensive solution. With these limited features, compared to financial management solutions, you’ll have to put in manual effort to generate reports, analyze trends, etc.

- Data Security Risks: Since Excel prevents data centralization, you must maintain multiple local copies and share them over email, subjecting the files to security threats. These files are more vulnerable to corruption, accidental loss, unauthorized access, data compromise, and other such risks

- Scalability: Scalability is a significant issue in Excel, especially in business applications. While it can handle large volumes of data and complex financial scenarios on a small scale, its capabilities may not grow at a rate similar to that of the business’ budgeting needs

Related: Google Sheets Budget Templates

10 Free Excel Budget Template Alternatives

While the five best free budget templates in Microsoft Excel are attractive options, the above limitations may have you looking for ‘something more.’ Fortunately, we’ve got 10 additional budget templates that make for compelling Excel alternatives.

From managing project budgets to budgeting for events, here is our list of 10 free templates for you to try:

1. ClickUp Simple Budget Template

The ClickUp Simple Budget Template makes budgeting easy. It offers clarity, organization, and efficiency in financial management minus the cognitive load of handling multiple variables.

Use it as a personal budget template or a business tool for tracking expenses. This versatile budget planner molds to your individualistic requirements. Behind this versatility lies an intuitive structure and user-friendly interface, which helps track transactions, cashflows, and budgets.

In addition to making finances data-driven, it converts financial information into visual illustrations.

Graphically depicting different budget categories empowers individuals and businesses to identify trends, optimize budgets, and achieve financial goals.

Ideal for: Tracking individual income and expenses in an easy-to-read format.

2. ClickUp Business Budget Template

Super-charge your business with this ClickUp Business Budget Template that simplifies money management for businesses of all shapes and sizes. Whether you run a startup or a conglomerate, this budget planner offloads financial and administrative tasks so you and your staff can focus on business growth.

The template accepts basic inputs regarding your financial goals, while the budget is calculated automatically with absolute detail and granularity.

Use this balance sheet to track the actual performance of your business against the planned targets and execute cost-saving strategies or optimize expenses for long-term growth. It also organizes financial data, making it a historical record to benchmark financial performance.

Ideal for: Tracking the financial performance of your business against planned goals.

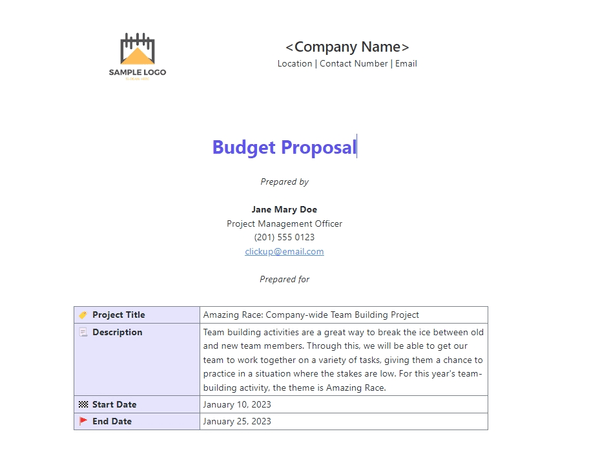

3. ClickUp Budget Proposal Template

Creating a budget proposal is a daunting task. However, it is necessary for businesses, organizations, consultants, and freelancers seeking funds and project approvals.

Fortunately, the ClickUp Budget Proposal Template aids the process by maintaining financial data accuracy, consistency, and clarity to craft a compelling proposal that wins opportunities.

To deliver such outcomes, the project’s cost components are broken down to make a robust and data-driven case. It also presents all the information in a visual, easy-to-understand format, which improves your chances of securing funds and approvals. These insights empower stakeholders to make informed decisions about the project’s feasibility.

Its usability extends beyond pitching proposals, as you can use it as a roadmap to track progress, engage stakeholders, and identify areas of improvement.

Ideal for: Preparing budget proposals for projects

4. ClickUp Personal Monthly Budget Template

The ClickUp Personal Budget Template is a reliable companion in your financial journey. Whether you wish to calculate your net worth or manage your household budget, this monthly budget planner is a highly customizable tool for delivering financial independence and empowerment.

This money manager template tracks your personal and household expenses to clarify your spending patterns and the status of your savings account. Once aware of these parameters, you’ll find it easier to plan and prioritize your short-term and long-term financial goals.

Whether planning a vacation or building an emergency fund, you can make informed decisions using this template.

Ideal for: Keeping track of personal expenses in relation to budgeted costs.

5. ClickUp Event Budget Template

Event budgeting is quite challenging. Ensuring success requires meticulous planning and organization, followed by dynamic and hands-on execution.

However, managing event budgets can be a breeze with the ClickUp Event Budget Template. This comprehensive template is suited for various events, from corporate webinars to trade events.

It acts as a centralized hub for setting goals, tracking expenses, and allocating or reallocating budgets. It keeps a log of the fixed costs while maintaining flexibility for unprecedented yet critical expenses.

Managing the event budget allows you to plan unforgettable events while confidently ensuring cost savings wherever possible.

Ideal for: Centrally managing the budget for an event with all related costs.

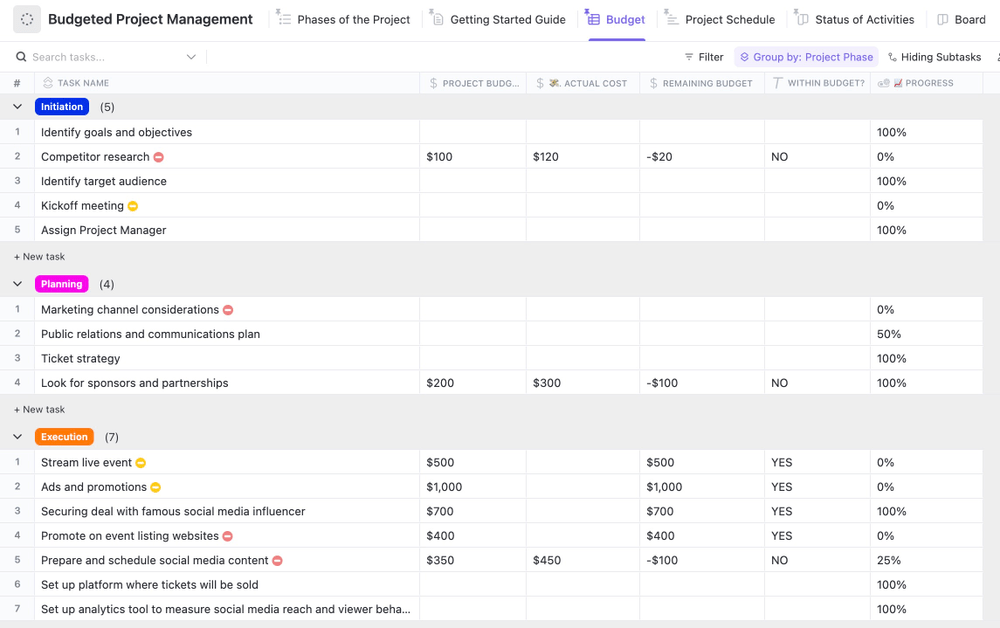

6. ClickUp Project Management Budget Template

ClickUp specializes in project management, so how can we miss out on project budget templates? After all, budget is one of the primary constraints to impact any project.

The ClickUp Project Management Budget Template is your unofficial CFO for managing projects while staying within budget. It enables project managers to track expenses and balance priorities, resources, and timelines.

It sequentially organizes a project into phases, allowing managers to navigate interdependencies, budgetary constraints, and resource requirements. Such logical organization of the project also provides real-time expense and progress tracking for maximum budget utilization.

Tailor this template depending on your diverse project needs, and you will be on the course for success.

Ideal for: Efficient budget forecasting and management of company projects.

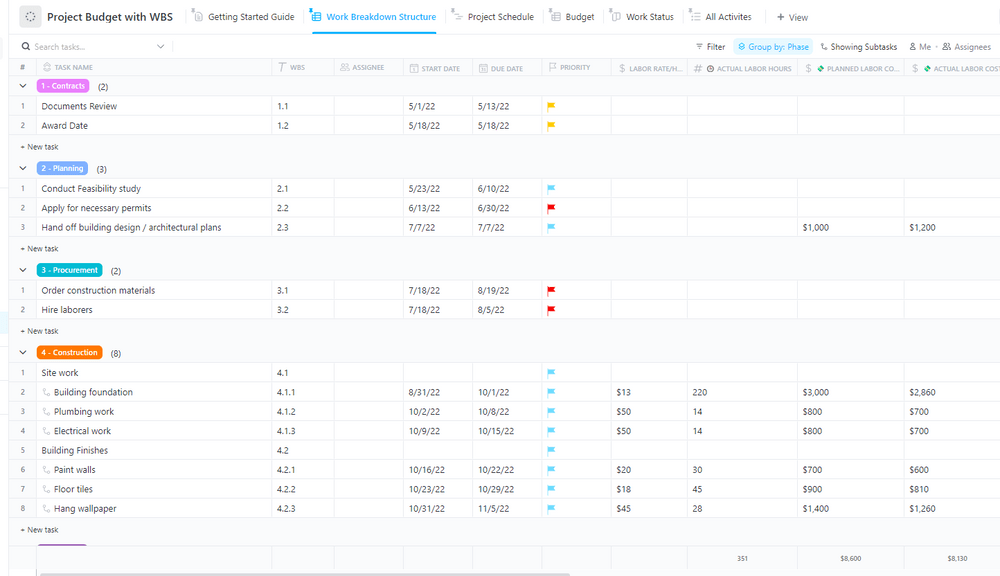

7. ClickUp Project Budget with WBS Template

While managing budgets in small-scale projects is comparatively easier, things can get messy for larger ones. To address this problem, project managers rely on tools like work breakdown structure (WBS) to tackle complexities and interdependencies.

The ClickUp Project Budget with WBS Template does precisely that—it breaks down monolithic tasks into smaller, manageable activities and maps the corresponding budgetary requirements. For instance, you can distribute the yearly budget across 12 monthly budget planners to exercise finer control over your budget.

While this example illustrates the WBS across a timeline, the project budget software can break down budgets across different activities, milestones, features, or specifications. Either way, the template helps you stay on track and within budget, from planning to execution.

Ideal for: Managing budgets of complex projects with multiple activities and stages.

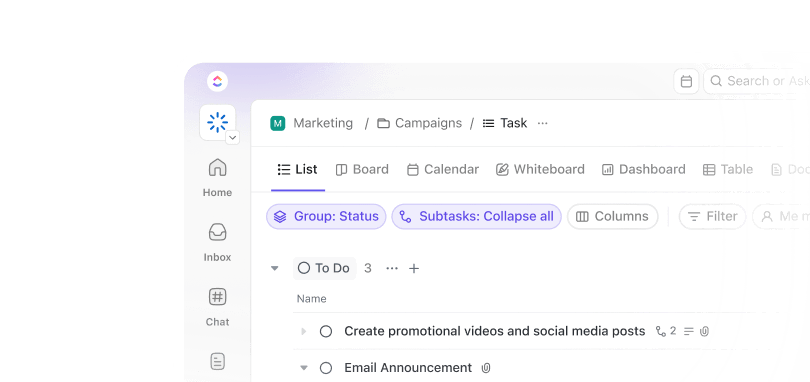

8. ClickUp Marketing Budget Template

Managing a marketing budget is a tricky job. A single misstep can trigger a marketing budget avalanche. Alternatively, one right move can compound your investments and offer multi-fold returns.

With the ClickUp Marketing Budget Template, make data-backed, strategic decisions. It offers a holistic view of all your omnichannel marketing activities and computes the costs per channel. It also identifies areas for improvement and fuels intelligent decisions for resource reallocation.

The template offers significant customizations to accommodate your specific online and offline marketing requirements. This capability is backed by real-time performance tracking, which helps you monitor various marketing metrics and KPIs.

Infuse visibility, efficiency, and effectiveness in your marketing campaigns with this intuitive template.

Ideal for: Ensuring the maxium ROI from money spent on different marketing activities.

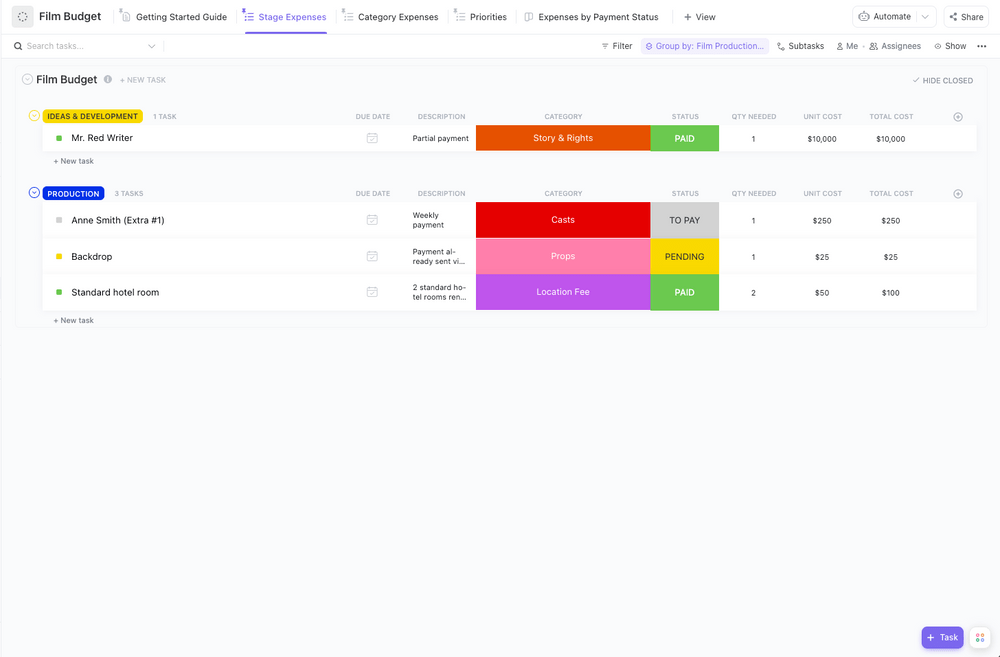

9. ClickUp Film Budget Template

Not all of us are Steven Spielberg or James Cameron to be blessed with virtually endless budgets for our creative pursuits. And for that, you’ll be grateful for the ClickUp Film Budget Template.

This easy-to-use template allows filmmakers to explore the depths of visual arts and creativity without tripping on the boundaries of budgets. It offers a detailed breakdown of the costs through the pre-production, production, and post-production stages so that investors can analyze the film’s financial viability.

Whether managing one-time equipment rental costs, pro rata rates to cast and crew, or even incidental expenses, you can maintain control over the budget.

Leave the number-crunching to such budget spreadsheets and focus on captivating and delighting your audiences.

Ideal for: Managing a film’s budget across pre-production, production, and post-production phases.

10. ClickUp College Budget Template

Managing a budget as a college student is hard—we get it. Balancing the academic, personal, and social life can leave you switching from fancy eats to fast food to dorm ramen.

For this reason, we’ve created the ClickUp College Budget Template to make college life easier. The template covers all aspects of the college experience and streamlines budgeting to lend greater clarity to your financial situation.

From tracking tuition fees and education loans to managing daily living expenses, you can make informed decisions that align with your budgets. You will be in greater control of how much money you spend on what and how you can save money without compromising your lifestyle.

The template instills financial discipline and responsibility even as you transition beyond academics and enter the workforce—making it an indispensable tool for personal development.

Ideal for: Efficiently tracking and managing expenses as a student.

Best Practices for Using a Budget Template

- Before you decide to use a specific template to manage your budget, make sure you can trust the source. Only rely on known tools and websites, so you can avoid malware and phishing scams

- Get something that suits your needs and will fit into your existing routines and apps, such as any expense-tracking software you might be using

- Plug in accurate numbers instead of making ‘guesstimates’ for the most realistic output. If required, refer to credit card and bank statements, monthly invoices, previous years’ expenses, and so on. Tools like ClickUp can pull in your data from linked apps, reducing the changes of errors

- Review your budget periodically to know what’s working and what needs to change. Make sure you update it after any major changes in your financial situation

- Create separate budgets for business and personal expenses

Helpful reads about managing finances

Track Finances With Excel Budget Templates

Microsoft Excel has long been a budgeting staple, as evidenced by our free Excel budget templates list. While these offer the basic functionality of income tracking, spending analysis, and dynamic budgeting, their limitations are undeniable.

We recommend using ClickUp instead for your budgeting needs. The ten budget templates from ClickUp offer a better understanding of your finances and act as a robust framework to create detailed budgets, optimize expenses, and save time and resources.

Get started with ClickUp to move several steps closer to your financial goals! Sign up for free today!