Free Operations Budget Templates to Plan & Manage Business Expenses

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Managing business finances effectively requires careful planning, and an operations budget is a crucial tool for this.

Why? Because an operations budget helps you allocate resources, track expenses, and ensure financial stability.

🔎 Did You Know? Adults with a financial strategy feel twice as confident in their ability to meet their financial goals compared to those without a strategy (81% vs. 41%, respectively)

Using well-structured operations budget templates, you streamline your budgeting process, maintain control over cash flow, and make informed decisions. Moreover, due to its structured format, an operations budget template helps you collect and categorize all the data to ensure accurate budgeting.

Let us explore some free operations budget templates to keep your business on track.

An operations budget template is a structured format for planning, tracking, and managing a business’s operational expenses and revenue over a specific period. It provides a clear financial overview to help with decision-making and cost control.

Here are the standard elements of operations budget templates:

➡️ Read More: Best Goal Tracking Apps (Free & Paid)

Here’s a list of top free operations budget templates to list the expenses and profit accurately and make data-driven decisions:

Maintaining a budget is essential to achieving a goal efficiently, but keeping track of it can be challenging. This ClickUp Simple Budget Template ensures an easy budgeting process by visually representing your budgeting categories.

The template makes the process effortless and organized. It includes easy-to-follow instructions for tracking expenses and an exportable spreadsheet. Monitor your financial activities to gain insights into how you should allocate the budget and find areas to cut costs for efficient budget optimization.

Here’s why you’ll like it:

Ideal for: Teams and individuals looking to set realistic goals and identify opportunities to save money.

🎁 Bonus: Does managing budgets and expenses seem complex? Use free Google Sheets expense tracker templates to optimize your finances.

Here’s how they help:

Work Breakdown Structure (WBS) is a system that efficiently budgets a project into manageable tasks, simplifying cost identification and resource allocation. Using this system, the ClickUp Project Budget Template with WBS (Work Breakdown Structure) is your go-to solution for organizing costs across different project phases.

This template helps you align your financial planning with project milestones, ensuring you never exceed your budget. By breaking down project costs into manageable components, you track labor, materials, overhead, and contingencies separately.

Here’s why you’ll like it:

Ideal for: Project managers, construction teams, engineering firms, and anyone handling multi-phase projects.

The ClickUp Business Budget Template helps businesses of all sizes effortlessly manage revenues, expenses, and financial projections. By taking a structured approach to tracking operating costs, payroll, and investments, it ensures sustainable financial health.

This template allows you to categorize expenses, compare projected vs. actual spending, and forecast financial performance. Whether you’re a startup or a well-established business, it keeps your cash flow in check while supporting smarter financial decisions.

What does Arnold Rogers, Customer Support Manager at Launch Control, think about using ClickUp?

We have integrated with Intercom, Stripe, ChurnZero, Slack, Gmail, ProfitWell, etc. This enables us to track finances, retention, reporting, and customer details in one space, as we can pull information from all the tools we use and compile them in ClickUp for ease of use without getting all departments involved and taking time from their schedules.

Here’s why you’ll like it:

Ideal for: Entrepreneurs, finance teams, CFOs, and business owners seeking structured budget management to plan finances and boost profits.

💡 Pro Tip: Using project budget templates to create a reliable plan helps avoid inaccurate project estimates.

Stay on top of event expenses with the ClickUp Event Budget Template. This template helps you keep track of every financial detail—venue costs, catering, marketing, and unexpected expenses—ensuring you deliver a successful event without exceeding your budget.

The template helps you assign related tasks, create budget categories, and organize invoices from the vendors for efficient planning. Using the built-in cost-tracking features, adjust your spending as needed. Additionally, assess the effectiveness of your marketing efforts.

Here’s why you’ll like it:

Ideal for: Event planners, wedding coordinators, corporate teams, and non-profits looking to plan, manage, and cut costs associated with an event.

Here’s a quick rundown on using ClickUp for large event planning:

To ensure that the marketing expenses are allocated efficiently, you need an organized system to track and manage spending. This ClickUp Marketing Budget Template helps you take charge of the marketing budget and visualize what is working and what isn’t to ensure proper resource allocation.

The marketing budget template provides visibility of all the financial resources available, so you can forecast marketing spending and track ROI from marketing investments. To align expenses with the budget, the template even lets you set alerts and updates when overspending.

Here’s why you’ll like it:

Ideal for: Marketing professionals who want to set goals and track expenses.

📮 ClickUp Insight: 92% of workers use inconsistent methods to track action items.

This results in missed decisions and delayed execution. With ClickUp’s Task Management Solution, you can maintain seamless conversion of conversations into tasks—ensuring that your team can act fast.

When creating a budget proposal, you must ensure that your stakeholders completely understand the plan. The ClickUp Budget Proposal Template ensures that your presentations effectively convey your plan.

The template’s consistent and accurate format helps you save time and communicate your budget plan effectively. It provides a simple roadmap to track success and aids in reducing the risks of errors in your budget proposal.

Here’s why you’ll like it:

Ideal for: Finance teams, department heads, startup founders, and project managers pitching budgets.

💡 Pro Tip: With AI-powered tools like ClickUp Brain, you can:

Managing personal finances has never been easier. The ClickUp Personal Budget Template helps you track income, expenses, savings, and financial goals in one place.

This template allows users to categorize expenses, set spending limits, and visualize their financial progress effortlessly. You can set goals, calculate net income and expenses, and allocate income efficiently to different expenses. Whether you’re planning for short-term expenses or long-term financial stability, this tool keeps everything organized.

Here’s why you’ll like it:

Ideal for: Individuals, students, families, and anyone looking to manage personal finances effectively and increase savings.

Tracking and reporting the budget is time-consuming and prone to errors without a structured format. This ClickUp Budget Report Template provides a structured format to optimize the budgeting process.

This template helps businesses and project teams maintain transparency and accountability by centralizing all financial data into a single, easy-to-read format. It effortlessly keeps stakeholders informed by using automated calculations and real-time updates.

Moreover, the template maintains accuracy and consistency across different departments to provide a detailed overview of the financial position.

Here’s why you’ll like it:

Ideal for: Finance teams, project managers, business owners, and anyone responsible for budget oversight and financial performance review.

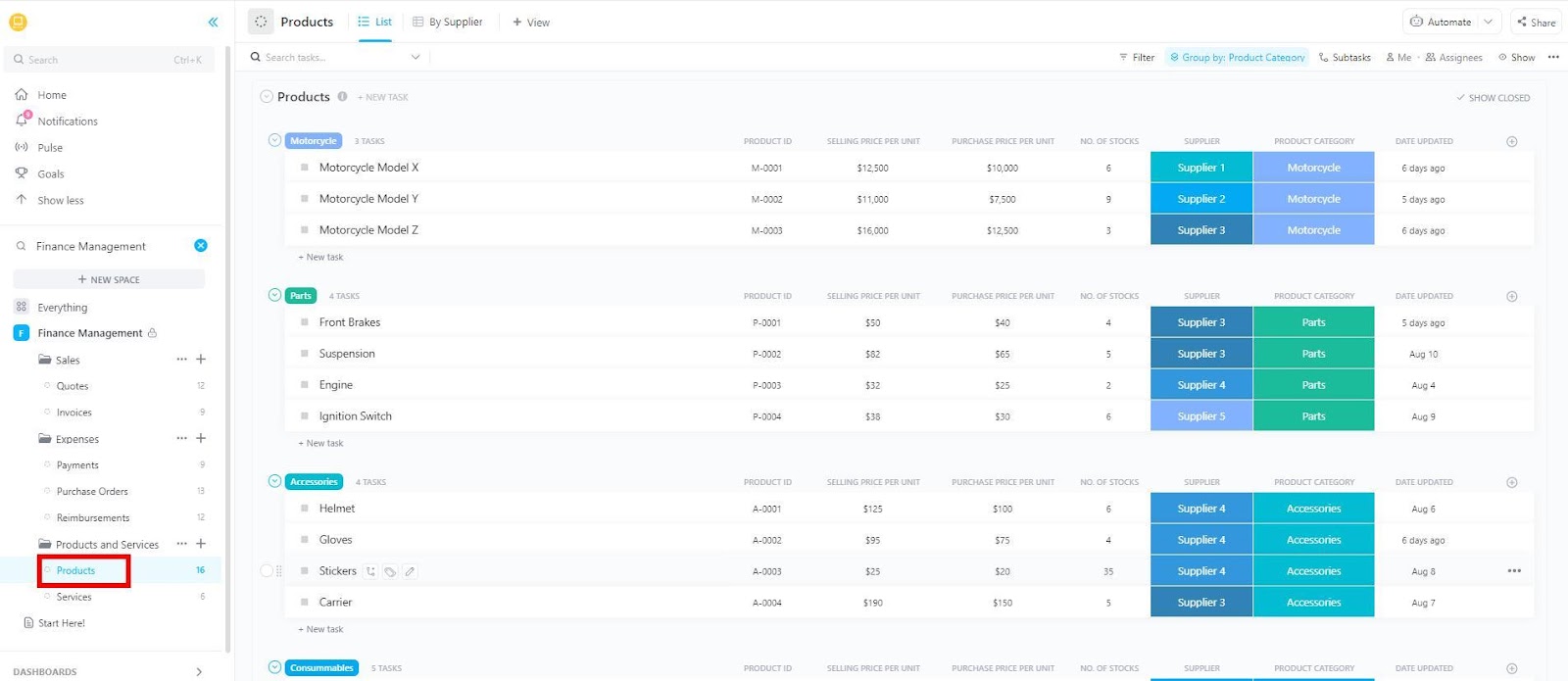

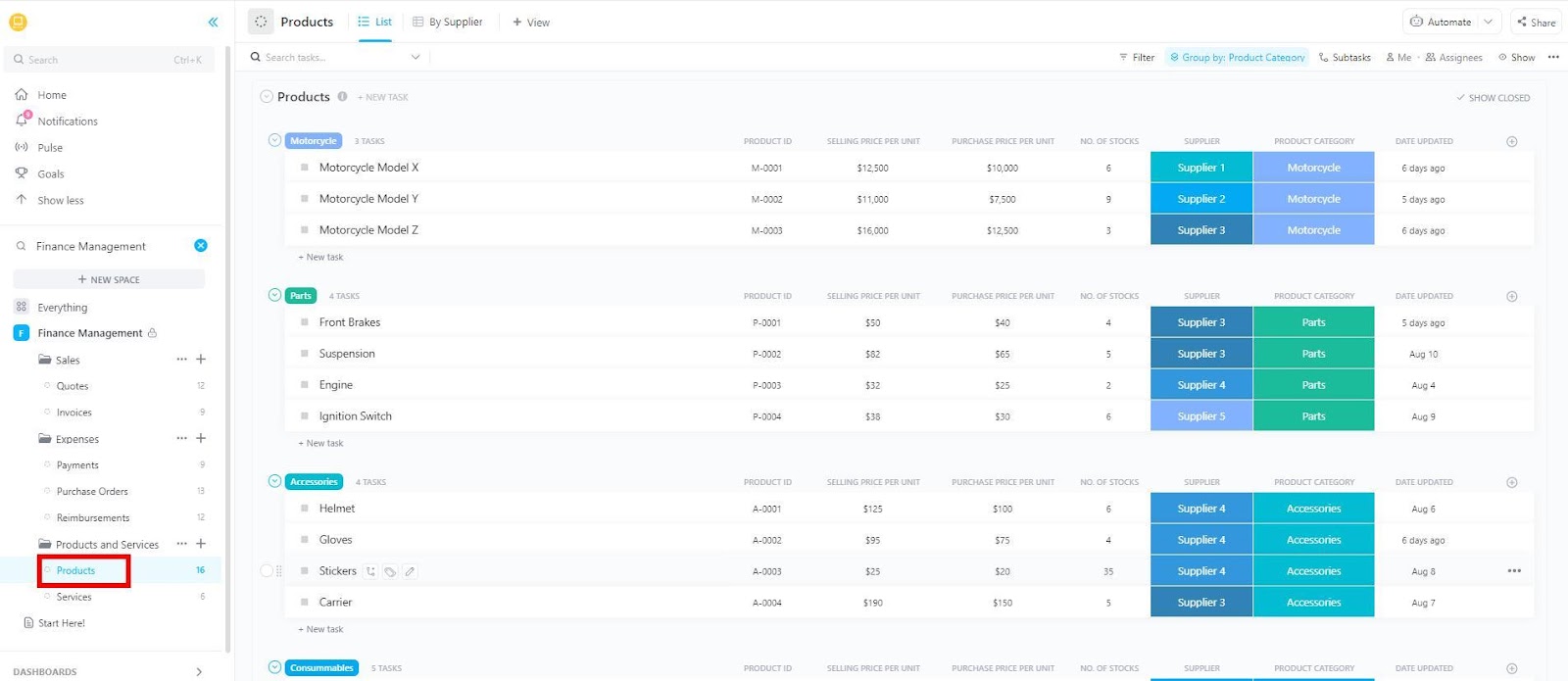

Effective finance management requires organization and clarity. The ClickUp Finance Management Template helps businesses, entrepreneurs, and individuals maintain financial stability by tracking income, expenses, cash flow, and economic goals in one structured system.

Optimize financial planning, set budgeting priorities, and monitor financial performance over time. The template is a comprehensive tool to maintain long-term financial health while ensuring financial data is always accessible.

Here’s why you’ll like it:

Ideal for: CFOs, accountants, entrepreneurs, and individuals managing multiple financial sources and looking to handle cash flows effectively.

💡 Pro Tip: Keeping expenses in check is more than just tracking numbers—it’s about making smart financial choices that fuel growth. Here’s how to level up your expense management game:

Balancing priorities, resources, and timelines while staying under the set budget is a tough task. The ClickUp Budgeted Project Management Template ensures that every aspect of a project is aligned with financial constraints, helping teams track budgets, control costs, and maintain profitability.

This template enables project managers to set budget limits, allocate resources effectively, and prevent cost overruns. It provides the right tools to organize tasks into sequential phases, prioritize according to budget limits, and track costs and progress in real time.

Here’s why you’ll like it:

Ideal for: Project managers, finance teams, and organizations handling cost-sensitive projects that want to balance cost and resources.

Staying within budget is critical to project success. The ClickUp Project Cost Management Template allows teams to monitor every financial aspect of their projects, guaranteeing better cost control and economic efficiency.

This template helps break down project costs, forecast financial needs, and analyze spending trends to improve financial planning. Plus, you get full visibility of the project to ensure strategic decision-making. This information can later be used as a benchmark to plan upcoming projects and monitor cost trends in the long term.

Here’s why you’ll like it:

Ideal for: Project managers looking to manage budgets, track costs, and keep everyone aligned.

Take a look at some of the best practices for setting up projects:

The ClickUp Monthly Expense Report Template makes it easy to document, analyze, and review all expenses, ensuring better financial discipline.

With this template, you categorize expenses, track spending patterns, and generate reports—activities essential for reporting expenses accurately and identifying areas for cost-saving.

Here’s why you’ll like it:

Ideal for: Businesses, freelancers, families, and anyone who wants to track expenses efficiently.

🎁 Bonus:

Are you tired of chasing spreadsheets and guessing where your money’s going? ClickUp isn’t just for projects—it’s your secret weapon for financial clarity. Here’s how ClickUp for Finance helps:

🧠 Fun Fact: According to recent reports, it’s estimated that somewhere between 1.1 and 1.5 billion people around the globe use Microsoft Excel.

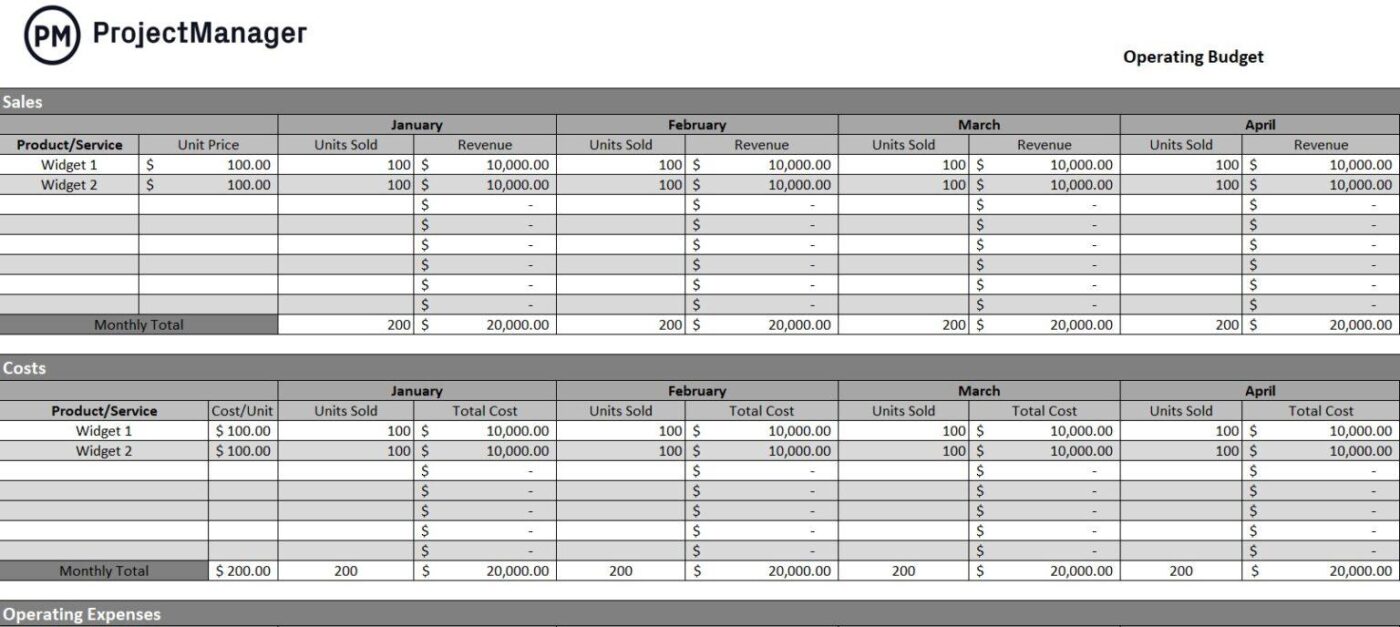

For those who prefer working in spreadsheets, the Excel Operating Budget Template by Project Manager offers a structured approach to managing an operating budget in Excel. This template is made to track operational costs and forecast revenue streams in a detailed and customizable spreadsheet format.

Furthermore, this Excel template enables granular financial tracking, ensuring that every aspect of an operating budget is accounted for accurately.

Here’s why you’ll like it:

Ideal for: Project managers, finance teams, and professionals who prefer Excel-based financial tracking.

Looking for more templates? Check out ClickUp’s template archive for finance and accounting teams ⚡️

A good operations budget template should be structured, clear, and easy to use. It should help you manage finances efficiently while adapting to the business needs of both large and small businesses.

Here’s what you should look for while assessing operations budget templates:

📚 Also Read: How to Use Project Accounting: Must-Know Principles, Processes, and Tips for Project Teams

Creating an operations budget might seem complex—but with structured operations budget templates, you can accurately track expenses, allocate resources, and optimize your financial position.

You might be tempted to search for a free Excel template, but ClickUp offers a more dynamic solution. It makes managing operations budgets simple while eliminating the limitations of static spreadsheets.

In addition to offering free templates, ClickUp also lets you do everything from day-to-day task management and team communication to documentation and progress tracking. All in one intuitive, AI-powered platform.

Whether you want to optimize business or personal finances, ClickUp ensures that every expense and income stream is accounted for.

Don’t let inaccurate budget estimates slow your success—sign up for ClickUp today and make every penny count! 🚀

© 2026 ClickUp