How to Manage AI Tax in Business Operations

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Think back a few years to when businesses first adopted artificial intelligence (AI). We thought it would improve everything—faster processes, fewer errors, and seamless automation. And at first, it did.

AI-powered tools promise effortless automation, real-time insights, and more. But then reality hits.

Instead of a perfectly synchronized system, companies end up with overlapping tools, skyrocketing costs, and teams struggling to keep up with conflicting AI-generated outputs. What is supposed to be a game-changer starts feeling like a burden.

This is the AI tax—the hidden cost of AI mismanagement. This article will explain how businesses should avoid these inefficiencies and make AI tools work for them, not against them.

AI tax is the hidden cost businesses pay when generative artificial intelligence adoption is poorly planned. It manifests as AI tool sprawl, redundant software subscriptions, inefficient workflows, misaligned automation, and time wasted in troubleshooting AI-driven errors.

Here’s an example: Let’s say a mid-sized marketing agency jumps on the AI bandwagon. The leadership buys many tools: one for AI copywriting, another for image generation, a chatbot, and an automation suite, all with overlapping features.

At first, everyone’s excited. But within a few weeks, here’s what starts happening:

No one intentionally set out to waste time or money. But because there wasn’t a clear plan—no tool vetting, process alignment, or training—the tech ended up bloating everything instead of helping. That bloat, friction, and confusion—that’s AI tax.

🧠 Fun Fact: 71% of employees trust their employers more than tech companies to implement AI ethically and safely. Businesses have a unique opportunity to build AI strategies that work for their teams rather than relying on external tools that may not align with their needs.

AI should be an advantage, not a financial drain. When businesses take a strategic approach to AI adoption, they eliminate redundant costs, streamline workflows, and maximize their investment.

Here’s what happens when you sidestep the AI tax:

📮ClickUp Insight: 18% of our survey respondents want to use AI to organize their lives through calendars, tasks, and reminders. Another 15% want AI to handle routine tasks and administrative work.

But juggling multiple tools often leads to AI tax—redundant apps, fragmented workflows, and wasted time. ClickUp helps cut costs by combining scheduling, task prioritization, and automation in one place.👉

📚 Also Read: How to Use AI in Accounting (Use Cases & Tools)

While an AI tax aims to address inefficiencies and promote responsible AI use, it comes with several challenges. Businesses may struggle with added costs, compliance issues, and uncertainty about AI’s long-term role. Here are some key concerns:

One of the most surprising findings from a recent MIT report suggests that AI disproportionately benefits lower-skilled workers while potentially making high-skilled workers complacent. When AI takes over repetitive tasks, it should free up employees for higher-level problem-solving.

There is a risk of professionals becoming too dependent on AI-generated insights, leading to complacency.

A great automation example of this is if a finance team blindly accepts AI-generated forecasts without verifying assumptions, they might overlook key risks that only human judgment and experience can catch.

💡 Pro Tip: AI in the legal industry isn’t just about drafting documents! Utilize AI-powered tools for legal research, case management, and contract creation to streamline workflows, boost efficiency, and stay ahead in a fast-evolving legal landscape.

🧐 Fact check: McKinsey’s research shows that 92% of companies plan to increase AI investments over the next three years, but only 1% consider themselves AI-mature.

Many businesses rush to implement AI for fear of falling behind competitors without a clear roadmap for how AI will drive real value.

For example, marketing teams might use one AI tool for content generation, another for data analytics, and another for campaign automation, only to spend hours reconciling inconsistencies across platforms.

💡 Pro Tip: Before implementing AI, conduct a cost-benefit analysis using frameworks like Total Cost of Ownership (TCO) to estimate long-term expenses beyond just software licensing.

The fear of AI replacing jobs is well-known, yet AI is shifting jobs rather than eliminating them outright.

Take customer service, for example. AI chatbots handle simple queries, reducing the need for human agents on routine tasks. However, because AI improves efficiency, customers expect faster, more accurate responses, leading to higher demand for specialized human support. Instead of eliminating roles, AI is forcing workers into more strategic positions.

🧐 Fact check: According to some reports, employees are three times more likely than leaders expect to believe that AI will replace 30% of their work within a year.

If you’ve ever used AI as a personal assistant or for mini-tasks in your day-to-day job, you know how inaccurate it gets sometimes. Artificial intelligence makes decisions based on historical data, which means errors, biases, or outdated regulations can easily creep into AI-generated reports.

When businesses trust AI blindly, they spend more time fixing AI mistakes than if they had done the work manually. Moreover, companies focusing solely on performance metrics risk compliance issues and long-term inefficiencies, making ethical AI adoption a competitive advantage.

For example, an e-commerce company using AI for inventory forecasting might receive flawed demand predictions, causing it to overstock slow-moving products. When the error is caught, it’s too late, leading to wasted inventory and lost revenue.

🎁 Bonus: Businesses should adopt the ‘Trust but Verify’ rule—always cross-check AI-generated reports with human expertise before submission. AI is a powerful assistant, but it shouldn’t replace human oversight.

While business leaders often believe that employees lack AI skills, many already use AI alone, often without formal company training.

Executives are too slow to create clear AI policies, leading to fragmented adoption across teams. Without leadership direction, departments pick their own AI tools, creating data silos, duplicate work, and conflicting automation processes. This makes AI adoption chaotic instead of productive.

For example, one department might use an AI-powered CRM while another relies on spreadsheets, resulting in inconsistent customer data and missed insights.

🧐 Fact check: Data suggests that leaders underestimate AI adoption in their workforce by 300%.

The AI tax, whether in the form of bloated software costs, inefficient workflows, or scattered automation, can quietly drain your business of time and money.

Investing in centralized, user-friendly AI solutions that seamlessly integrate into your workflow has become the need of the hour.

ClickUp, the everything app for work, eliminates the AI tax by combining powerful AI-driven automation with a fully integrated project management platform.

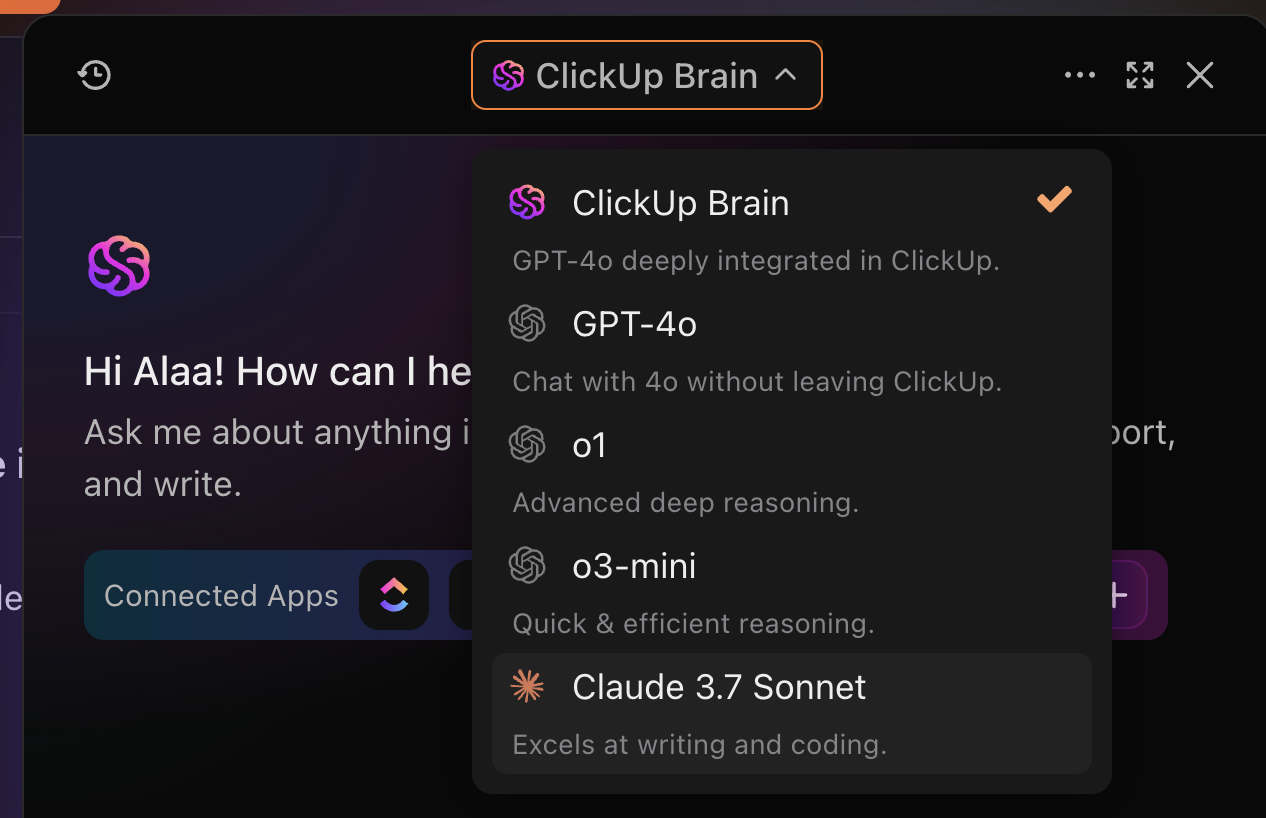

The platform’s AI, ClickUp Brain, ensures that AI enhances productivity rather than creating more complexity. It is the world’s most complete work AI.

From real-time insights to AI-powered knowledge management and task automation, ClickUp consolidates AI functionalities into a single platform, supporting businesses to avoid the hidden costs of poor AI adoption.

Let’s explore how ClickUp helps companies sidestep the AI tax and maximize their AI investments.

🧐 Fact check: 46% of leaders cite skill gaps as the biggest barrier to AI adoption. AI isn’t just a technology problem; companies need structured AI training and knowledge management to avoid wasted investments.

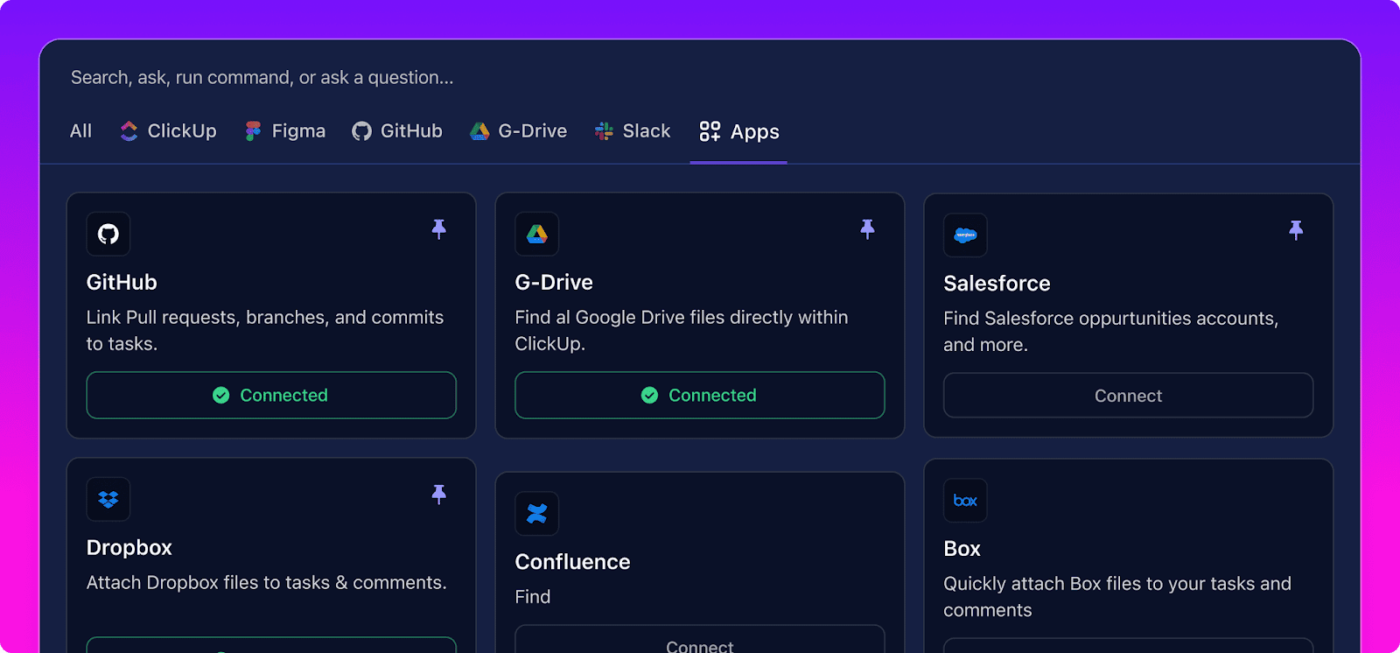

AI tools often function in silos, creating information gaps and inconsistencies across teams. ClickUp Brain changes that by connecting tasks, docs, people, and company knowledge into a single AI-powered system.

ClickUp Brain brings all your work contexts together by seamlessly connecting with the apps you rely on—whether it’s Figma, GitHub, Google Drive, Salesforce, or countless others.

With powerful AI and deep integrations, you instantly access knowledge from files, specialized data sources, and external tools, keeping everything in sync without switching tabs.

Here’s what Jayson Ermac, Process Manager at AI Bees, says about ClickUp’s efficient functionalities:

ClickUp has helped us streamline our processes and implement them in such a way that has enabled us to scale our operations with ease.

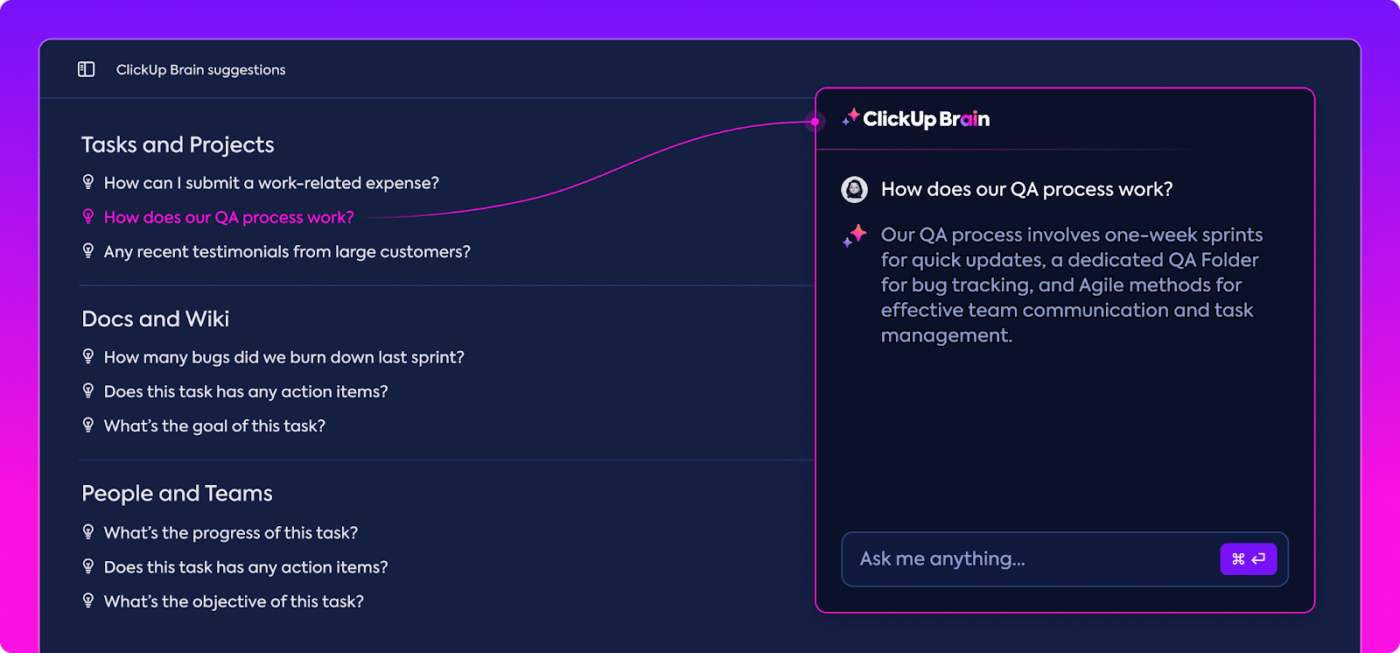

ClickUp Brain delivers instant, accurate answers to all your work questions—no more chasing down teammates for updates.

Whether you need insights on ClickUp Tasks, ClickUp Docs, or ClickUp Chat, ClickUp Brain pulls the right information in seconds. It utilizes real-time context from your workspace and connected apps to keep you moving forward effortlessly.

Here’s a quick rundown on how to use ClickUp Brain to answer project questions:

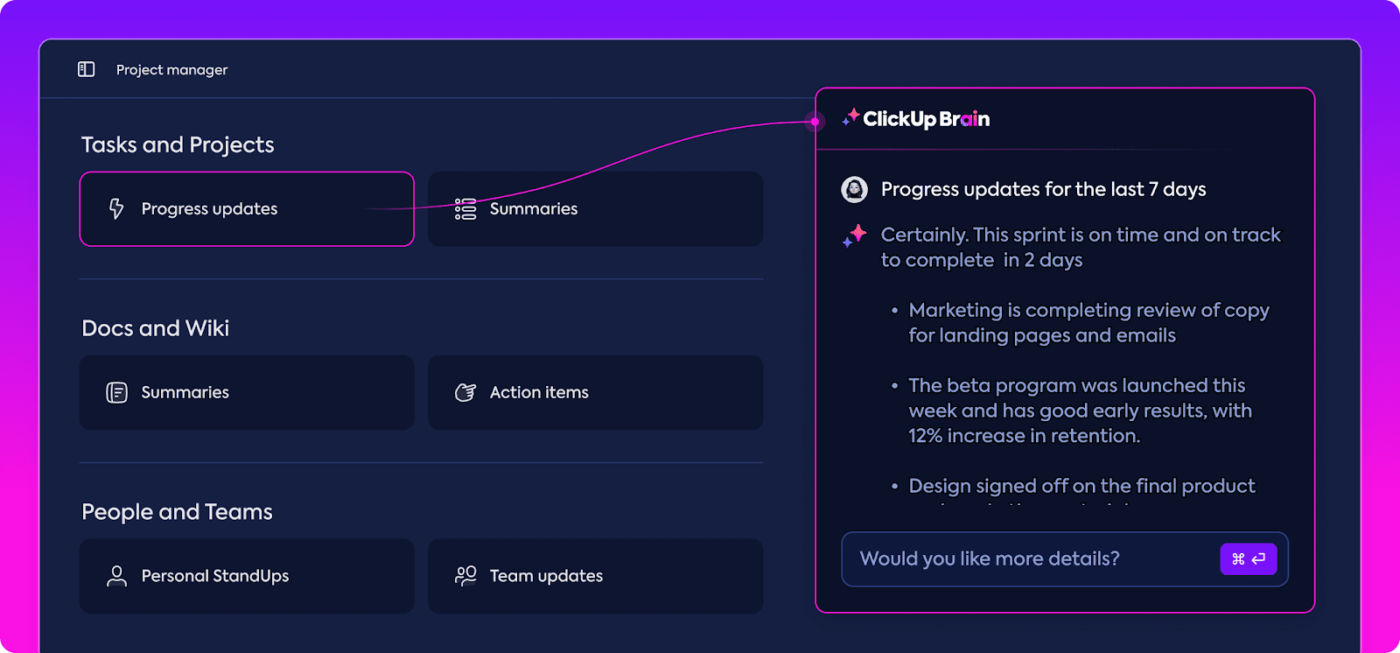

Stay focused on real work while ClickUp Brain automatically handles progress updates, stand-ups, and task summaries. Brain eliminates repetitive manual check-ins and keeps your team aligned with detailed, up-to-date insights.

With AI-powered automation, you automate tasks and generate real-time project summaries, detailed status reports, and actionable updates without lifting a finger.

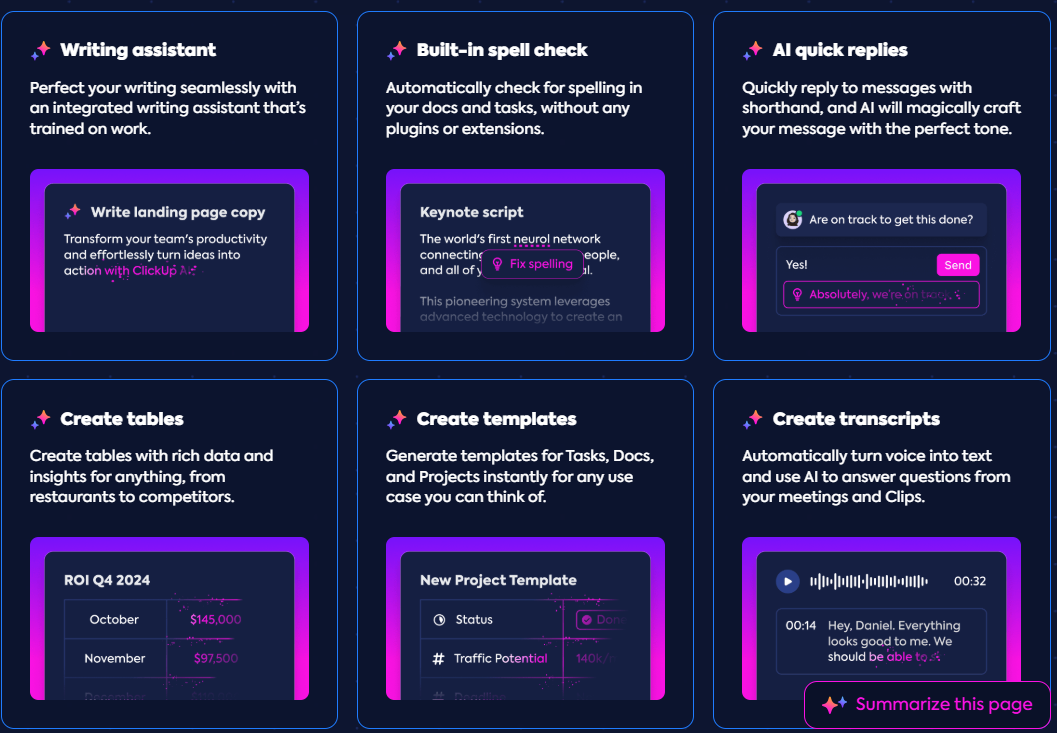

On the writing front, ClickUp Brain is the AI writing assistant that adapts to your style, enhancing your writing. It can effortlessly check spelling without plugins, generate instant replies with the perfect tone, and create rich data tables for anything from competitor analysis to project planning.

ClickUp Brain instantly drafts tailored and structured templates for any use case. Plus, turn voice into text and extract key insights from meetings and Clips—all powered by AI—so you write smarter, faster, and more effectively.

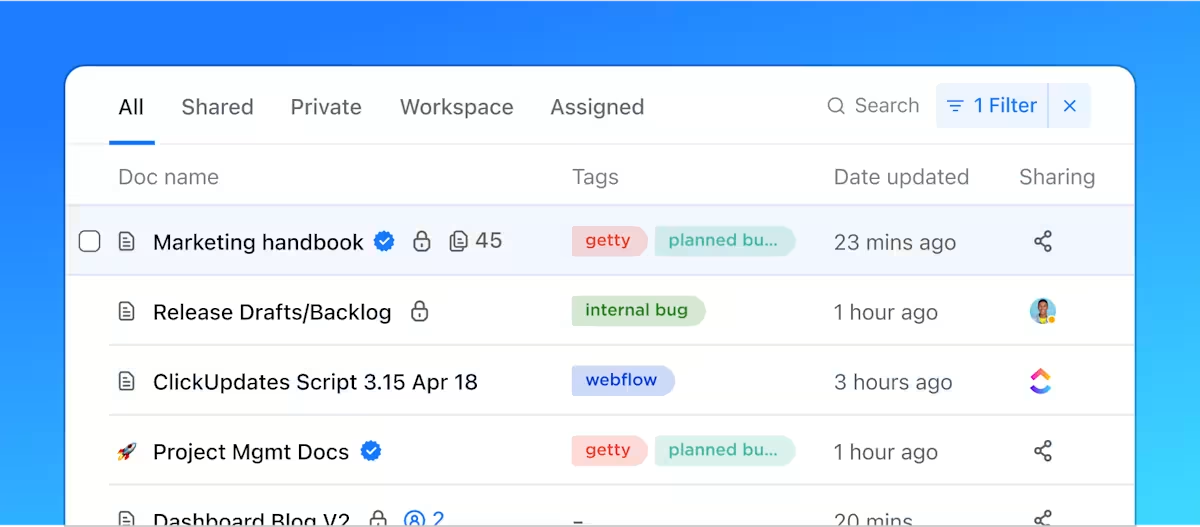

One of the biggest contributors to AI tax is poor knowledge management—teams waste hours looking for information, duplicating efforts, and missing key insights. ClickUp’s AI Knowledge Management system ensures all company knowledge is organized, searchable, and instantly accessible.

With ClickUp’s knowledge management, you can:

🧐 Fact check: Many businesses experience major productivity gains after consolidating AI and workflow tools. Pharmacy Mentor, a marketing agency, saw a 2x improvement in productivity after using ClickUp to replace daily account meetings and streamline project management.

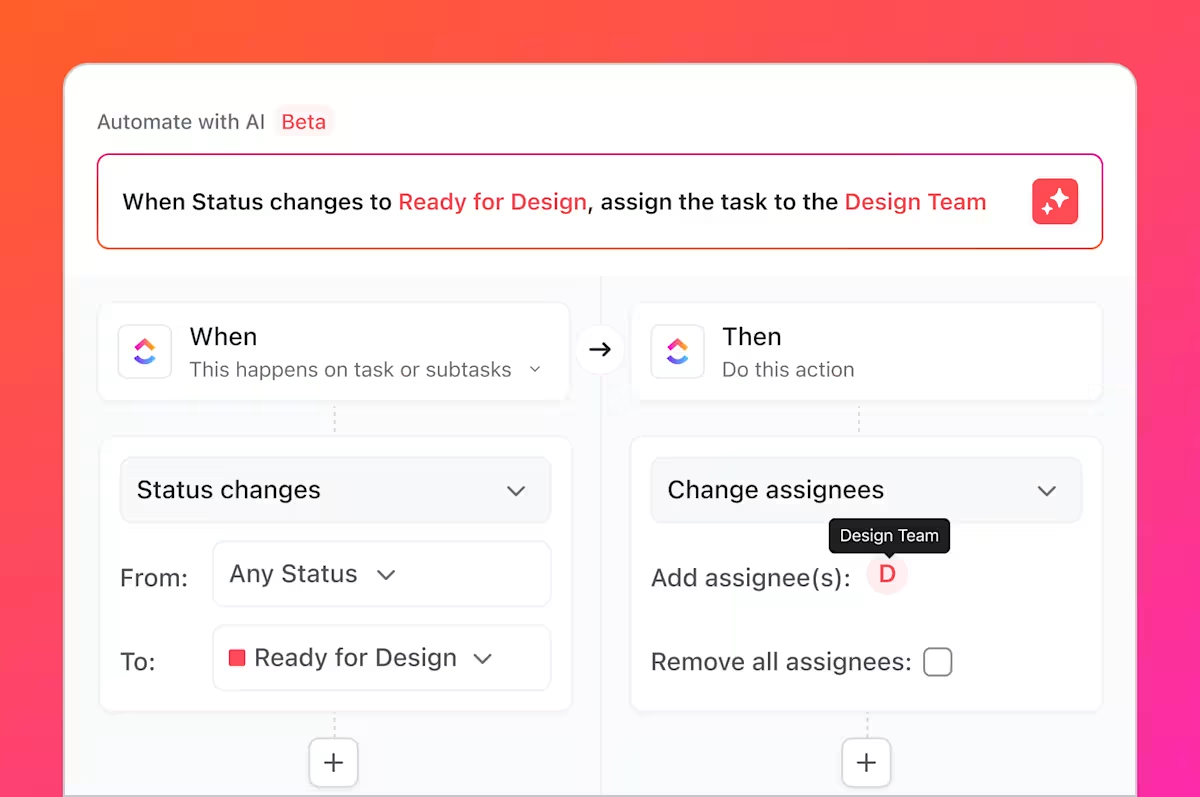

Repetitive tasks are a huge drain on productivity, contributing to hidden costs in AI implementation. ClickUp Automation ensures teams spend less time on manual updates and administrative tasks with automated task flows that save resources and increase productivity.

With ClickUp Automation, you get to:

Check out how ClickUp Automations help your team:

🧠 Fun Fact: Pressed Juice, a rapidly growing mid-market company, tripled productivity without scaling their team, thanks to ClickUp’s unified project management and automation capabilities.

➡️ Read More: Best AI Tools for Accounting & Finance

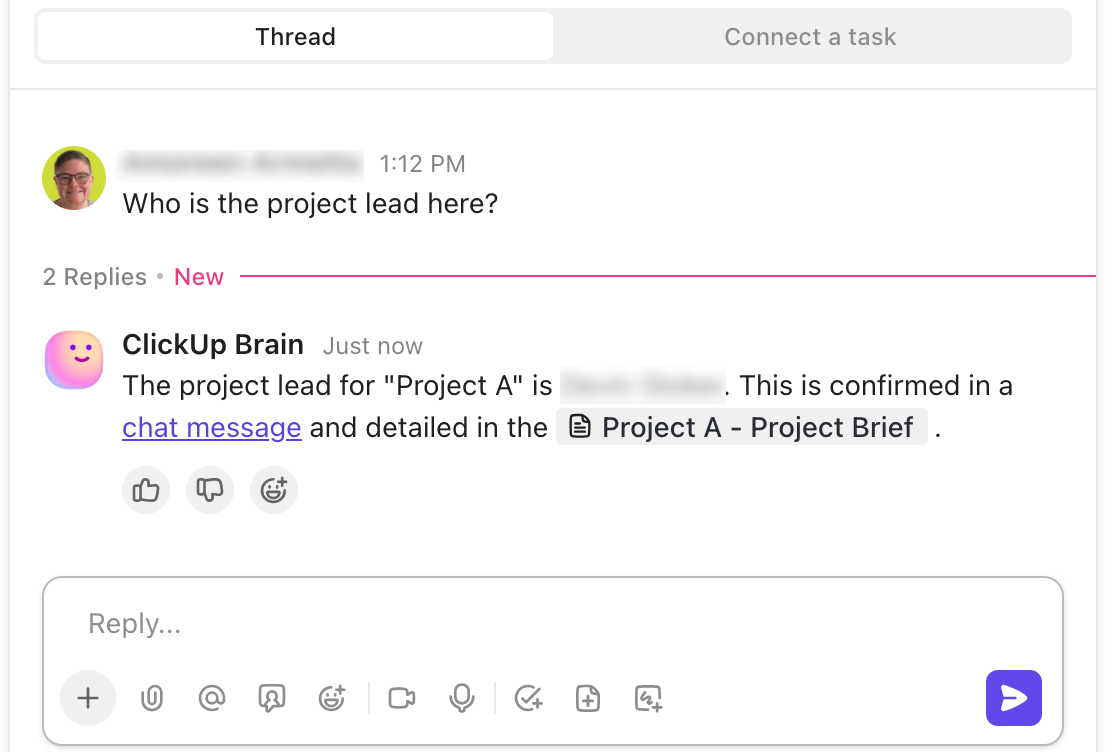

ClickUp’s Autopilot Agents are prebuilt to respond to certain triggers and then post updates, reports, or answers in a specific location.

For example, the Project Management team has a Channel dedicated to an initiative to implement new processes. A team member sets up an Auto-Answers Agent. A stakeholder from another team asks, “Who is the project lead here?” A few seconds later, the Channel’s Auto-Answers Agent responds with the project lead’s name and two sources where they found the information.

ClickUp’s Custom Autopilot Agents adapt to changes in your Workspace to autonomously act based on the instructions given.

You can use our no-code builder to set up Custom Autopilot Agents in multiple Spaces, Folders, Lists, and Chats in your Workspace.

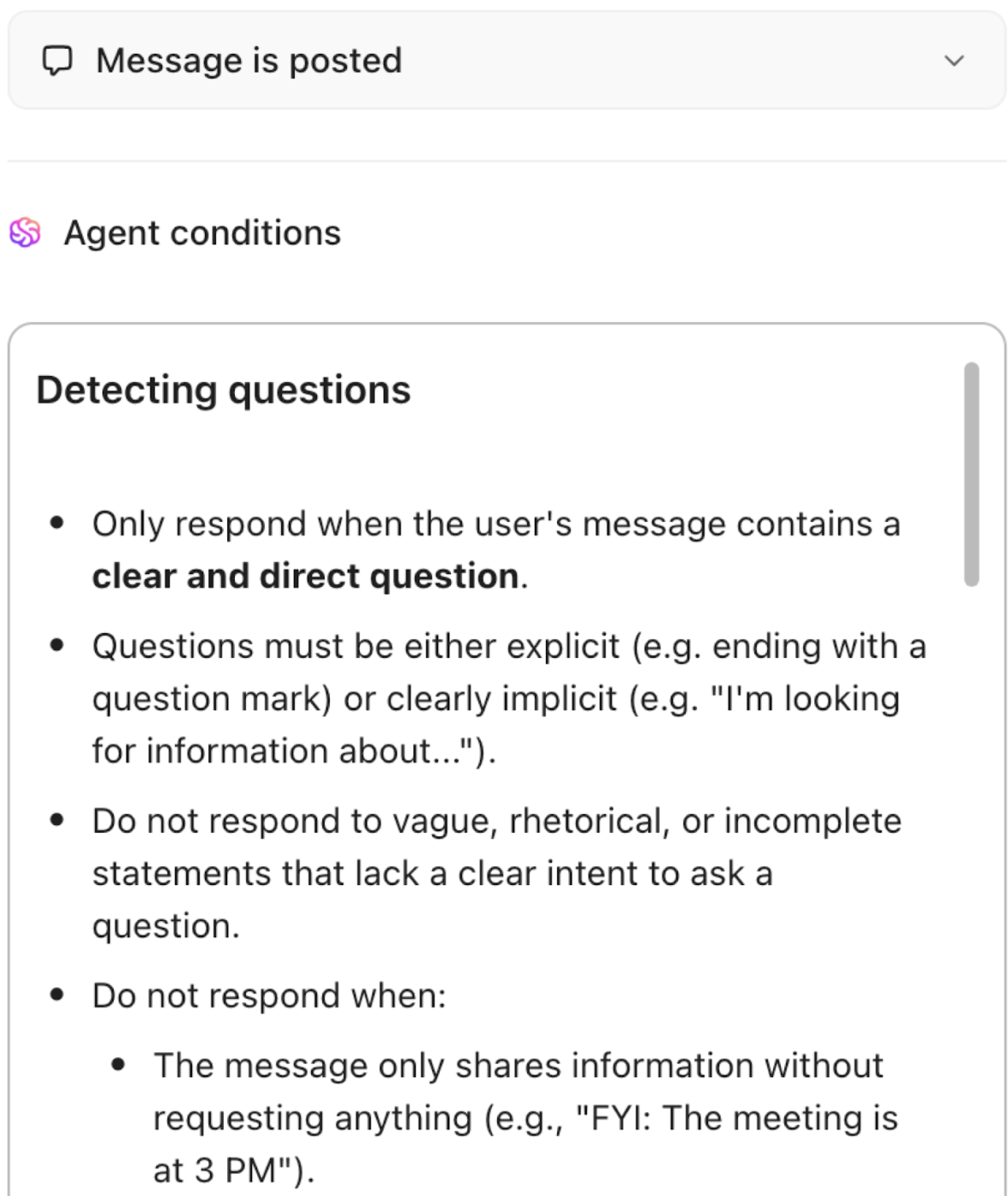

For example, the HR team’s Channel gets a lot of questions. The people partner Lead wants to use AI to answer some of these questions and free up their team’s time. They create a Custom Autopilot Agent in the Channel, instructed to answer questions only if the answer is in the knowledge it can access. This specifies that the Autopilot Agent should only respond when the user’s message contains a clear and direct example. Further, they can even give the Autopilot Agent examples of questions.

A scattered AI strategy leads to inefficiencies, rising costs, and disconnected workflows. By using centralized AI, businesses eliminate redundant tools, improve collaboration, and maximize AI-driven productivity without unnecessary overhead.

Here’s how a unified AI approach helps companies avoid the AI tax:

➡️ Read More: AI Podcasts to Learn More About Artificial Intelligence

AI should optimize operations, not create unnecessary costs and inefficiencies. Yet, many businesses unknowingly pay the AI tax—wasting resources on disconnected AI tools, redundant automation, and fragmented workflows.

The solution is centralized AI that enhances productivity, eliminates redundant spending, and ensures smooth team collaboration.

ClickUp offers a fully integrated AI-powered workspace through ClickUp Brain that eliminates the AI tax by combining AI-driven automation, real-time insights, and knowledge management into one seamless platform.

Instead of struggling with overlapping AI tools, businesses reduce costs, boost efficiency, and maximize ROI with ClickUp.

Try ClickUp for free and start streamlining your workflow today with AI! ✨

© 2026 ClickUp