Whether buying a house or retiring early, almost everyone has a financial goal they wish to achieve by a certain age. However, only 30% manage to do so. The most common reason? Poor budgeting!

A well-planned monthly budget is the first step to sound money management. It helps control overspending and build savings so that you approach your goals strategically. Yet, 11% of people don’t budget their income, possibly because they don’t have the right tools to get started.

But not anymore—here are 13 free household budget templates to create a budget and make the most of every dollar!

- What are Household Budget Templates?

- What Makes a Good Household Budget Template?

- 13 Household Budget Templates

- 1. ClickUp Simple Budget Template

- 2. ClickUp Personal Budget Template

- 3. ClickUp Personal Budget Plan Template

- 4. ClickUp Budget Report Template

- 5. ClickUp Finance Management Template

- 6. ClickUp College Budget Template

- 7. ClickUp Monthly Expense Report Template

- 8. Excel Personal Monthly Budget Template by Vertex42

- 9. Household Budget Template by Template.Net

- 10. Household Budget Planner Template by Template.Net

- 11. Household Monthly Budget Spreadsheet Template by Template.Net

- 12. Family Grocery Budget Template by Template.Net

- 13. Simple Home Budget Template by Template.Net

- Simplify Money Management with ClickUp’s Household Budget Templates

What are Household Budget Templates?

A household budget template is a pre-designed, customizable document that allows you to track and record your income, savings, expenses, and other financial details. It accounts for every household’s major and minor financial components, such as rent, groceries, and monthly bills, to clearly show your cash inflows and outflows. As a result, you can manage your cash more prudently.

A typical household budget template includes sections like:

- Income sources

- Fixed expenses

- Variable expenses

- Savings

- Summary of total income vs total expenses

🧠 Fun Fact: The word ‘budget’ comes from the Old French ‘bougette,’ a small leather bag.

What Makes a Good Household Budget Template?

Creating a household budget is often stressful and understandably so. You have to consider your income and expenses, visualize your savings goals, and identify areas for improvement to make a real difference. All this can look like a lot to do, but not if you have the right template. Here are some of its qualities:

- Clean layout: Look for a template that features a simple design with organized columns, clear sections, and consistent formatting to make it easy to use and navigate even for beginners ✨

- Customizability: Opt for a template that allows you to tailor categories to your household’s unique needs. For instance, you should be able to add, remove, and rename rows and columns to create a budget that resonates with your household finances ✨

- Financial tracking features: Use a template with built-in financial tracking features. This helps track income, expenses, and savings to ascertain budget variance ✨

- Automation capabilities: Choose a template that uses formulas to automatically fill in essential calculations, such as total income, total expenses, and total savings ✨

- Visual elements: Search for a template with charts, bars, graphs, tables, and other visual elements to display your income, expenses, savings, and more. This minimizes the learning curve, making the budget comprehensible for everyone ✨

➡️ Read More: Free Monthly Budget Templates To Manage Expenses

13 Household Budget Templates

Here are some free household budget templates from ClickUp, the everything app for work, and other platforms to create a budget and take the first steps to efficient financial management:

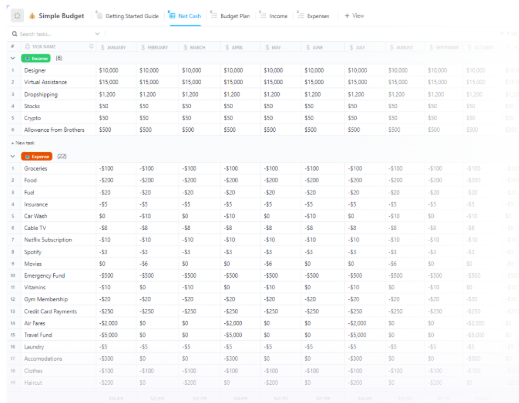

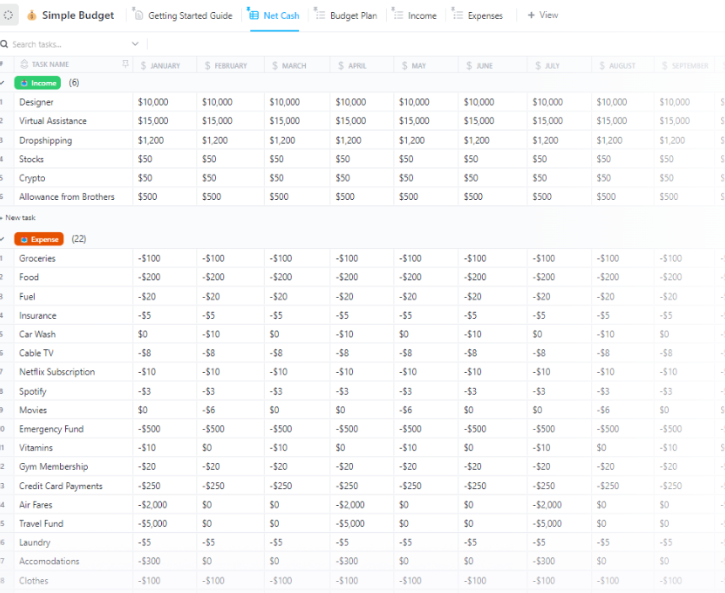

1. ClickUp Simple Budget Template

If this is your first time creating a budget for your household, use the ClickUp Simple Budget Template. It delivers a clutter-free framework for tracking household income, monthly expenses, and savings goals. The clean structure encourages regular updates and easy adaptation to changing financial needs.

Record all your monthly income and expenses to provide a comprehensive overview of your financial standing. Plus, input fixed costs, discretionary spending, and income totals, then monitor monthly changes using built-in views.

Why you’ll love it:

- Categorize income and expenses in a focused, easy-to-use layout

- Visualize budget balances using customizable dashboards and fields

- Review financial summaries through calendar, board, or list views

- Edit, expand, or adjust inputs directly from any device

Ideal for: Individuals and households creating a foundational budgeting routine with straightforward tools.

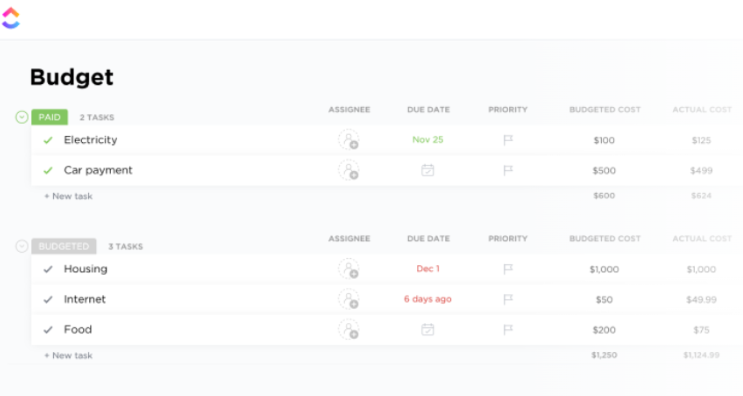

2. ClickUp Personal Budget Template

Are you struggling to manage your personal finances on your own? The ClickUp Personal Budget Template can help.

Specifically tailored for individual use, it’s the best way to reclaim control over your funds. This template tracks your income, expenses, savings, and financial obligations to identify areas to adjust and reduce costs, like a personal finance assistant.

It also lets you prioritize your financial goals and work to achieve them. This encourages healthy budgeting habits and enables you to manage your money more mindfully.

Why you’ll love it:

- Segment and track recurring payments, savings, and lifestyle costs

- Access preset sections for income streams, fixed and flexible expenses, and savings targets

- Receive automated reminders for upcoming payments or budgeting reviews

- Set financial goals with visual indicators and deadlines

Ideal for: Solo professionals, freelancers, and students managing personal expenses, financial goals, and monthly savings.

Here’s what Philip Storry, Senior System Administrator at SYZYGY, had to say about using ClickUp templates for finance:

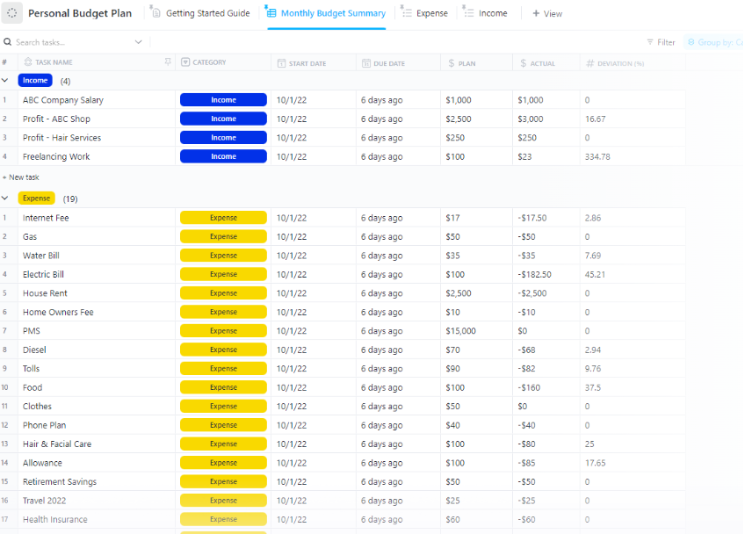

3. ClickUp Personal Budget Plan Template

If there’s something just as tricky as creating a budget, it’s sticking to it. But that’s where the ClickUp Personal Budget Plan Template comes in. It lists your expenses, budgets, and actual spending to see how well you followed your plan.

Additionally, each view supports time-based planning while connecting income and expense trends to larger life goals. By organizing monthly, quarterly, and long-term financial objectives, you can think beyond day-to-day spending.

Why you’ll love it:

- Structure budget planning across timelines, including months and quarters

- Track savings goals, recurring obligations, and future financial plans

- Visualize priorities using Gantt charts, goals, or calendar layouts

- Adjust plans easily as goals change or financial status evolves

Ideal for: Goal-driven individuals and families aiming to structure their financial priorities, track recurring bills, and monitor savings.

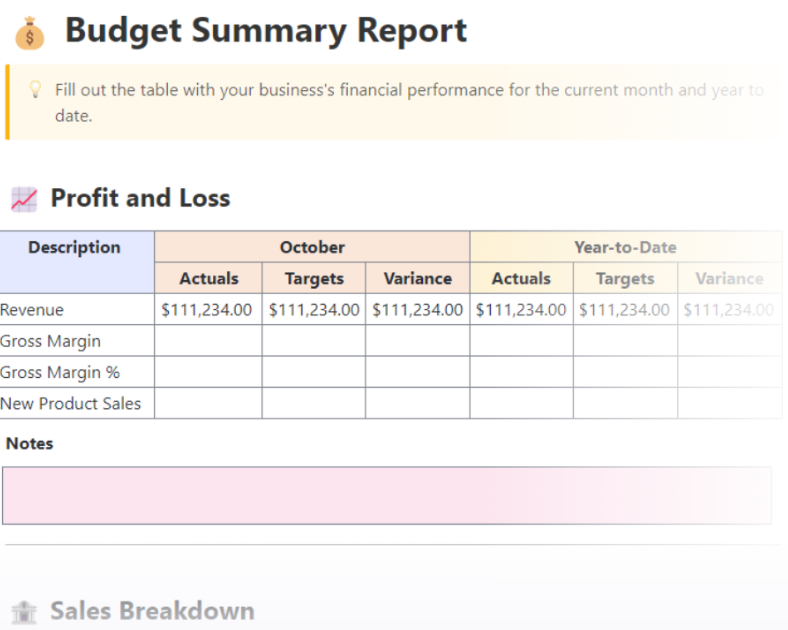

4. ClickUp Budget Report Template

The ClickUp Budget Report Template presents a clear picture of financial performance at the end of each budget cycle. Clean and visually appealing, this template provides a comprehensive overview of your past and present budgets, including their discrepancies and effectiveness so that you can assess your overall financial performance.

Its data-focused design supports accountability, allowing users to evaluate trends and plan corrective actions. Additionally, it lets you track your progress to visualize the average time it will take to hit your financial objectives.

Why you’ll love it:

- Compare budgeted vs. actual amounts across key spending areas

- Use custom dashboards and filters to get insights into financial behavior

- Summarize key financial figures for presentations or reviews

- Export reports for financial reviews or collaborative planning

Ideal for: Budget analysts, finance managers, and personal finance enthusiasts creating detailed financial reports and reviewing spending patterns over time.

💡 Pro Tip: If you are struggling with expense management, implement these simple strategies for efficient tracking and control:

- Real-time tracking 📊

- Create a report with a few clicks⚡

- Tell the story and build bridges 🗣️

- Decision-making with ease ✅

- Invest in your team 🧑💼

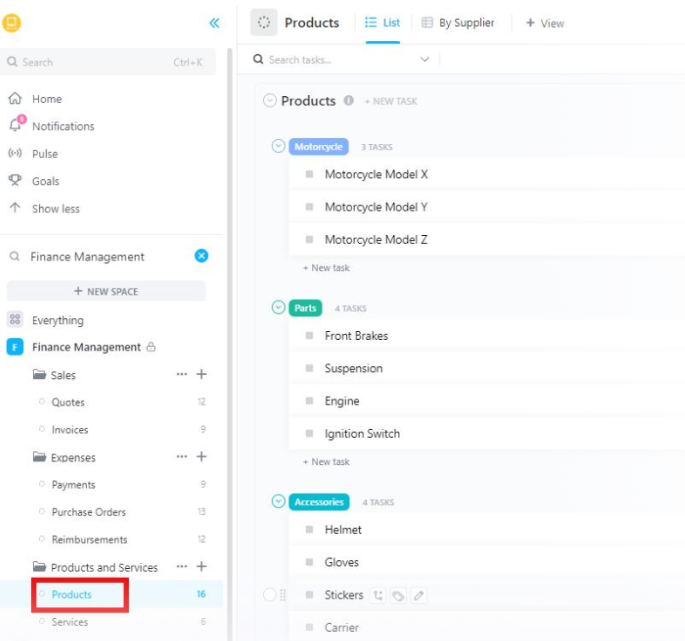

5. ClickUp Finance Management Template

The ClickUp Financial Management Template is not merely for budgeting—it’s an integrated resource to manage every aspect of your finances. From the amount you paid to whom you paid it to, this template tracks and records every expense, allowing you to create similar project budgets.

It uses visual analytics tools like charts, diagrams, and heatmaps to help you analyze your financial performance. Each section supports distinct areas of finance, including recurring payments, emergency planning, and bill management. Moreover, pre-configured automations make routine tracking more consistent and timely.

Why you’ll love it:

- Track short-term bills, long-term liabilities, and multi-source income

- Configure automated alerts for due dates or spending thresholds

- Structure views to reflect household roles and budget areas

- Summarize financial health through interactive dashboards

Ideal for: Small business owners, freelancers, individuals, and families organizing multiple financial tasks and maintaining oversight across all categories.

📮 ClickUp Insight: Context-switching is silently affecting your team’s productivity. Our research shows that 42% of disruptions at work come from juggling platforms, managing emails, and jumping between meetings. What if you could eliminate these costly interruptions?

ClickUp unites your workflows (and chat) under a single, streamlined platform. Launch and manage your tasks across chat, docs, whiteboards, and more—while AI-powered features keep the context connected, searchable, and manageable!

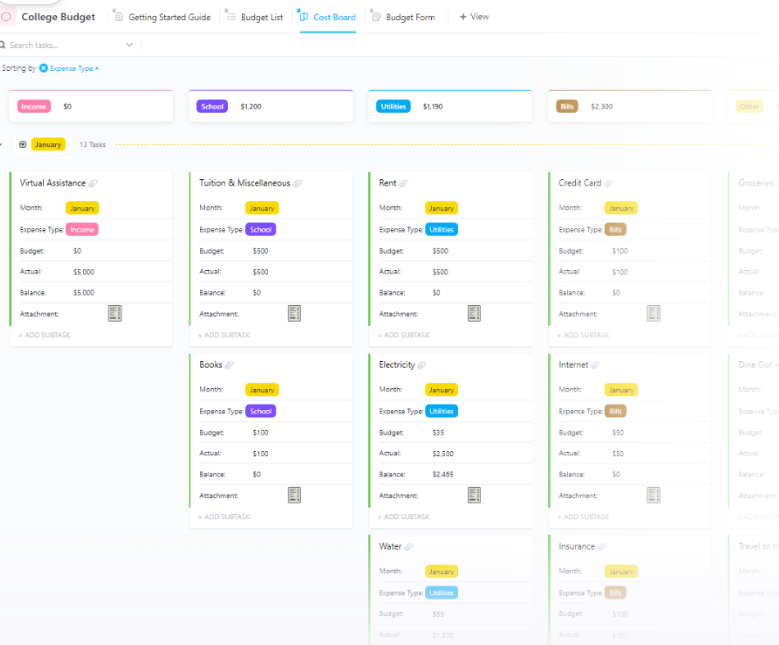

6. ClickUp College Budget Template

The ClickUp College Budget Template equips students with tools to manage tuition, books, living costs, and incidental spending. Its layout addresses common college expenses and aligns them with limited income streams like part-time work or scholarships.

Students can monitor financial decisions in real time and adapt categories based on each semester’s requirements. The structure encourages independent budgeting habits early on. In addition, it automates basic budgeting tasks, such as income tracking, expense forecasting, and monitoring variances.

Why you’ll love it:

- Break down academic, housing, and personal spending by semester or term

- Organize income sources, including grants, family support, and campus jobs

- Flag overspending or balance changes using custom triggers

- Access the template from mobile or desktop while on the go

Ideal for: College students balancing tuition, rent, groceries, and part-time income while tracking semester budgets, financial aid, and student savings goals.

Here’s a quick rundown on how to prioritize tasks like a pro:

7. ClickUp Monthly Expense Report Template

Are you looking for a template to help with short-term budget planning? The ClickUp Monthly Expense Report Template is for you. This template tracks and reports all your monthly expenses—from rent to insurance premiums—so you can understand where your money goes.

It also uses tools to analyze spending trends and forecast future ones. This way, it helps you identify scope for cost savings and make informed, data-driven budgeting decisions.

Here’s why you’ll love it:

- Log expenses by type, review cost trends, and refine budgets

- Use dashboards to display summaries or trends over time

- Share reports with household members for collaborative planning

- Highlights budget variances with color-coded indicators

Ideal for: Professionals, families, and small business teams generating monthly expense summaries and tracking financial patterns over time.

🧠 Fun Fact: Japan has a national obsession with personal budgeting through kakeibo—a budgeting journal technique introduced in 1904 designed to encourage mindful spending and gratitude, which millions still use. 💰

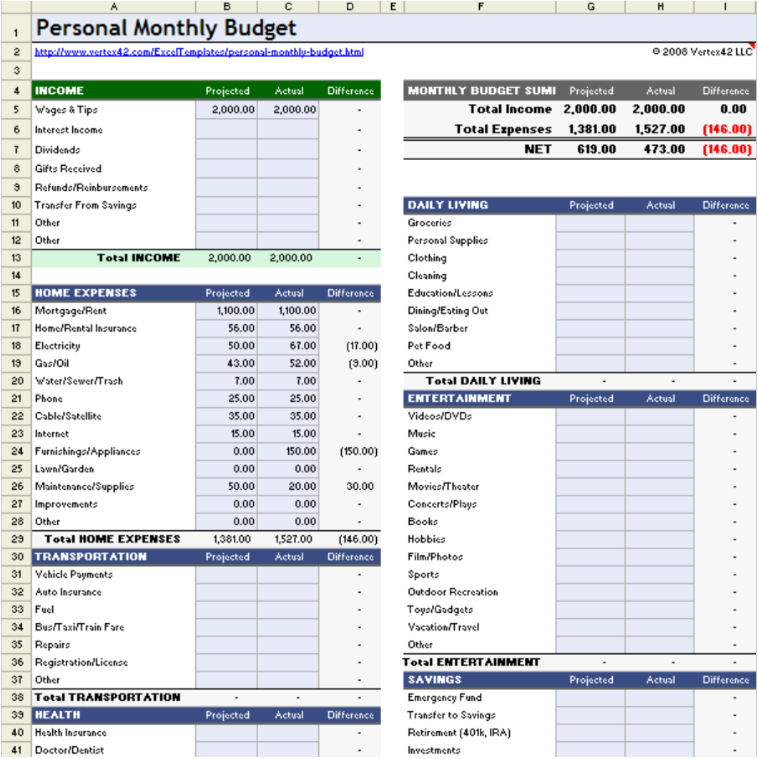

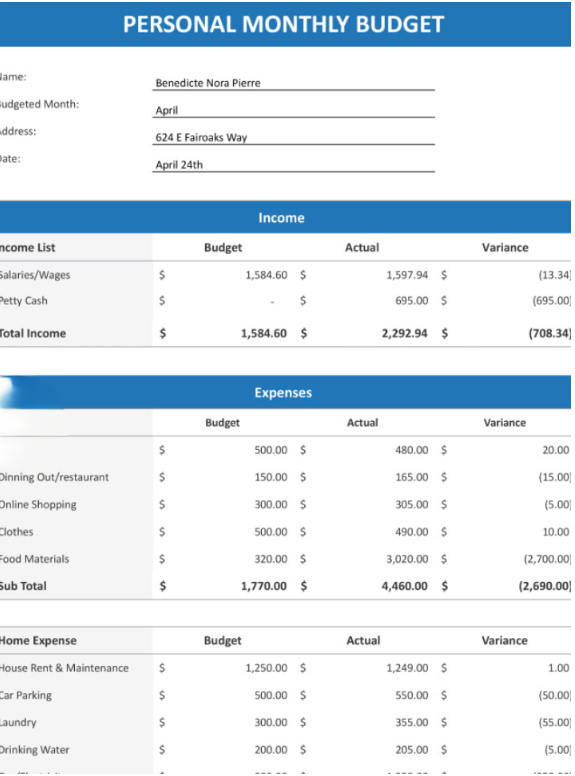

8. Excel Personal Monthly Budget Template by Vertex42

Another free resource, the Excel Personal Monthly Budget Template by Vertex42, lets you create a snapshot of your monthly income and expenses, helping you identify areas where you may be unnecessarily spending. This helps manage expenses and boost savings.

As for ease of use, the template boasts a professional appeal while feeling easy to navigate. It’s also accessible and available for download in Excel and Google Sheets formats. Additionally, prebuilt functions make monthly tracking easier.

Why you’ll love it:

- Adapt columns and labels for your financial habits

- Enter income and expenses with built-in calculation formulas

- Download and reuse month after month with consistent formatting

- Visualize spending patterns with built-in charts and compare planned vs. actual expenses side by side

Ideal for: Traditional spreadsheet users and budget-conscious individuals seeking a reliable, formula-driven budgeting tool.

💡Pro Tip: People often chase big expense cuts, but it’s the daily micro-spends (like coffee runs, delivery fees, or random app subscriptions) that silently eat away at your budget. So, do a monthly micro-leak audit—it’s surprisingly eye-opening. 😲

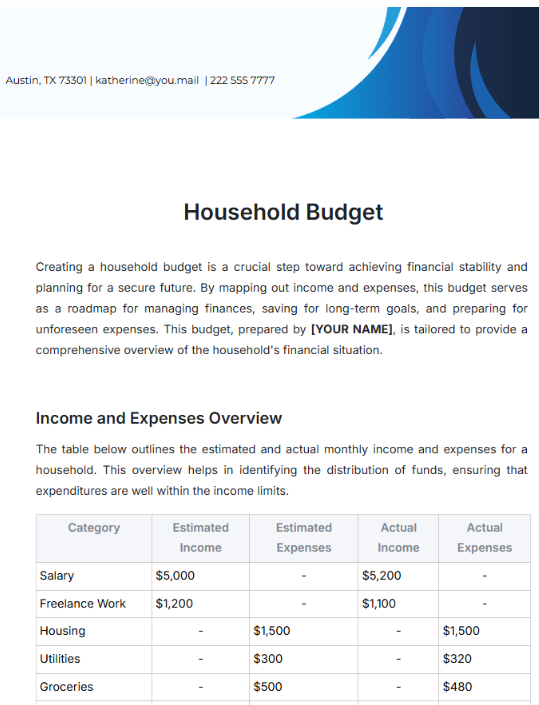

9. Household Budget Template by Template.Net

If you are looking for a template to create a detailed budget for your household, check out the Household Budget Template by Template.Net. Customizable and user-friendly, it provides a complete view of your household budget, including all its various elements: income, expenses, savings, and variance.

It also lists your financial goals and creates an action plan. The template is highly collaborative, so you can easily share it with your family members to seek their input.

Why you’ll love it:

- Allocate income across basic needs, savings, and lifestyle

- Track essential and non-essential expenses separately

- Customize columns and categories to fit any household size

- Monitor savings goals for home improvements or holidays

Ideal for: Families and shared households organizing household finances with a pre-structured, printable budgeting sheet.

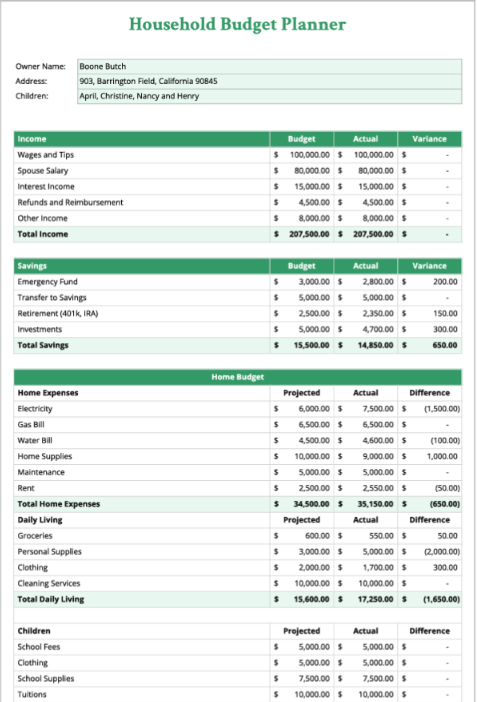

10. Household Budget Planner Template by Template.Net

The Household Budget Planner Template by Template.Net focuses on forward-looking financial organization. A clean layout and professional design let you track and allocate your income to ensure none of your needs go unnoticed.

Besides this, it also breaks down your savings into different categories, such as an emergency fund, retirement, investment, and more, to help you visualize and plan for the future. The template is free to download in multiple formats, including Word, PDF, and Google Sheets.

Why you’ll love it:

- Distribute income across fixed, flexible, and future-facing categories

- Summarize totals and variances for financial review

- Create a clearer financial picture before each budgeting cycle begins

- Visualize cash flow trends with tables and highlights

Ideal for: Households that plan budgets ahead of time and focus on goal-based spending.

➡️ Read More: Best Accounting AI Software and Tools

11. Household Monthly Budget Spreadsheet Template by Template.Net

The Household Monthly Budget Spreadsheet Template by Template.Net provides a multi-column layout for tracking income, fixed expenses, and flexible spending monthly.

It’s designed to support multi-month reviews and help identify long-term patterns, spending gaps, or budget leaks. This template also lets you calculate savings and estimate budgets.

Why you’ll love it:

- View entire months of budgeting data side by side

- Monitor recurring and variable costs using sortable rows

- Highlight savings targets and actual results with color codes

- Export or print summaries for easy financial check-ins

Ideal for: Homeowners, renters, and roommates who share monthly household costs and monitor budgets for groceries, utilities, rent, and leisure activities.

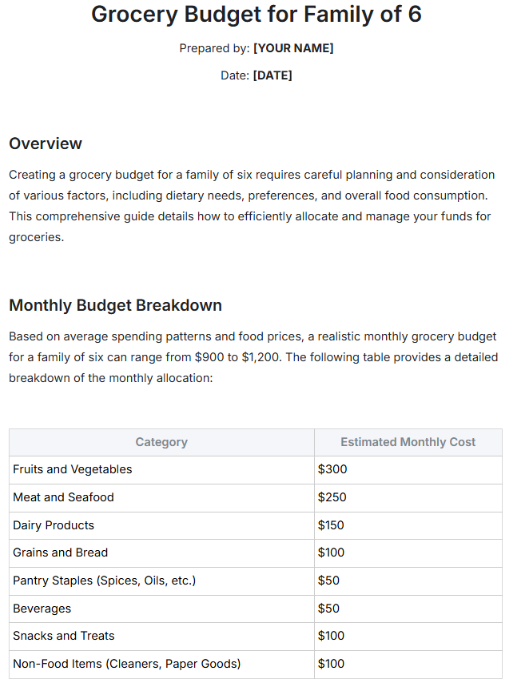

12. Family Grocery Budget Template by Template.Net

Forget complicated spreadsheets—manage your grocery spending easily with the Family Grocery Budget Template by Template.Net. This simple tool helps you plan, track, and control your family’s food expenses with clear sections for budgeting and actual spending.

Perfect for busy families, this template helps keep your food budget under control while promoting better financial habits. Furthermore, it supports list-based budgeting, price comparisons, and tracking actual costs against projected ones.

Why you’ll love it:

- List grocery categories like produce, dairy, and snacks separately

- Calculate total grocery spending against a preset budget

- Identify high-frequency or high-cost items to adjust purchases

- Reduce food waste by tracking quantity and leftovers

Ideal for: Families actively managing food costs through detailed meal and grocery planning.

💡 Pro Tip: Most people budget by planning how to spend their money. Flip it. Decide how much you want to save first, subtract it from your income, and budget what’s left. This approach is called paying yourself first! 😎

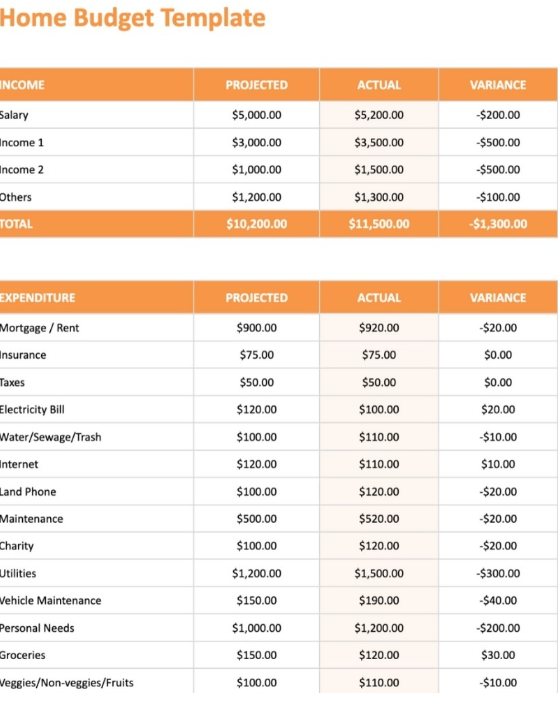

13. Simple Home Budget Template by Template.Net

Managing your home finances doesn’t have to be complicated. The Simple Home Budget Template by Template.Net offers a clear and accessible structure for tracking income and expenses. It focuses on essentials and eliminates unnecessary complexity, making it ideal for users who want speed and ease.

The template’s easy-to-follow structure helps you understand your spending patterns quickly. It even supports weekly, monthly, or quarterly financial summaries, depending on your preferred review cycle.

Why you’ll love it:

- Track essential monthly bills and variable costs

- Monitor savings and debt repayment progress

- Simplify data entry with easy-to-edit cells

- Input income and spending quickly during routine check-ins

Ideal for: Individuals and small families needing an easy-to-edit template for tracking household income and savings.

Simplify Money Management with ClickUp’s Household Budget Templates

A well-planned household budget isn’t just about numbers on a spreadsheet—it’s about gaining control, reducing stress, and making room for the things that truly matter.

Whether you’re a student managing groceries or a family tracking utility bills, the right budget template can transform how you handle money at home. And when it comes to flexible, easy-to-use tools, ClickUp‘s household budget templates and other tools deliver clarity, simplicity, and customization right where you need it.

Ready to take charge of your finances? Explore ClickUp’s free household budget templates today—sign up for a free trial!