Types of Accountants: Roles, Responsibilities, & Career Paths

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Before computers, spreadsheets, or even paper, accountants were already keeping businesses afloat. 💪🏼

Whether you’re exploring career options or looking to hire an expert, understanding the types of accountants is key to knowing who does what.

Today, the field has evolved into a financial management powerhouse, with accountants influencing everything from corporate strategy to fraud investigations.

However, not all accountants handle the same responsibilities. They also don’t make the same in yearly income 💰.

If you’re considering a career in accounting or looking to specialize in an accounting field, you’ve come to the right place. Let’s break it down.

Every business wants to make money—but how do they know if they actually are? That’s where accounting steps in. It’s the behind-the-scenes playbook that keeps finances in check, ensuring companies aren’t just making wild guesses about profits, taxes, or expenses.

Accounting is more than just tracking numbers. It’s about making sense of money—where it’s coming from, where it’s going, and what needs to happen next.

A business without accounting is like a car without a dashboard. Sure, you can drive, but you have no idea how fast you’re going, how much fuel you have left, or if your engine is about to overheat.

🔮 Bonus: Keep scrolling to check out amazing career opportunities in accounting and how to bag them!

Think of accountants as financial strategists. They record transactions and interpret them, forecast trends, and save businesses from costly mistakes.

Depending on their specialty, accountants wear different hats like:

👀 Did You Know? The earliest records of accounting date back 7,000 years to ancient Mesopotamia, where merchants tracked financial transactions on clay tablets.

At their core, accountants are the financial glue that holds businesses together. Whether working in public accounting firms, corporations, or government agencies, their expertise keeps the economy running smoothly.

Next, let’s break down the types of accountants and their unique roles.

Not all accountants do the same thing. Some are number-crunching detectives, some are tax wizards, and others are financial strategists for billion-dollar companies and help startups make a case to get millions of dollars in funding.

If you’re considering a career in accounting or looking to hire the right expert, it’s important to know the different types of accountants and what they actually do.

Let’s start with two major players in the accounting world: Public Accountants and Management Accountants.

Public accountants are the Swiss Army knives of the accounting world. They don’t just specialize in one area. They do tax accounting, financial audits, consulting, and financial statement preparation for businesses and individuals.

If you’ve ever had your taxes done by a certified public accountant (CPA), you’ve worked with a public accountant.

Public accountants earn between $51,000 and $143,000 annually, with CPAs making up to 25% more than non-certified accountants.

If you want variety in your work and the flexibility to move across industries, public accounting is a great career path. Many certified public accountant (CPA) holders start here before transitioning to specialized roles.

Ever wonder how businesses decide when to expand, invest, or cut costs? That’s the work of management accountants (also known as managerial accountants). Instead of preparing taxes or auditing finances, they focus on financial planning, budgeting, and guiding major business decisions.

Publicly available data suggests that management accountants earn an average annual salary of approximately $71,821, with entry-level positions starting around $56,000 and experienced professionals earning up to $110,000.

If you like financial accounting but also want to be involved in business strategy, this is your lane. Management accountants influence high-level decisions that shape a company’s future.

These two accounting roles cover a lot of ground, but they’re just the beginning. Next up, we’ll dive into the forensic accountants cracking financial crimes and government accountants handling public funds.

📖 Also Read: Best AI Tools for Accounting & Finance

Some accountants crunch numbers. Forensic accountants crack cases. These financial detectives don’t just prepare financial statements. They follow the money, investigating fraud, embezzlement, and even money laundering.

📽️ If you’ve ever seen a courtroom drama where financial records expose a crime, chances are, a forensic accountant was behind the scenes making it happen.

Forensic accountants earn between $44,200 and $108,000 annually, depending on experience and expertise.

If you love puzzles, solving crimes, and have a knack for numbers, forensic accounting is one of the most exciting types of accounting jobs out there.

Think taxes, public spending, and ensuring government funds go exactly where they’re supposed to 👀/

Government accountants track public funds, manage budgets for federal agencies, and ensure taxpayer dollars are spent wisely.

They’re the ones making sure cities have funds for roads, schools, and infrastructure without going into financial chaos.

Government accountants earn an average salary of $65,812 per year as per internet estimates.

If you want a stable career with national impact, government accountants play a critical role in financial oversight. It’s a rewarding field where you ensure funds are used responsibly—no shady spending allowed!

Forensic and government accountants each play a unique role—one fights fraud, and the other protects public finances. Up next, we’ll explore internal auditors keeping businesses accountable and external auditors ensuring financial integrity across industries.

Some accountants keep track of money. Internal auditors keep track of everything—expenses, risks, compliance, and whether a company’s financial controls actually work. If there’s a weak spot in a company’s financial system, internal auditors are the ones who find it before it becomes a disaster.

Imagine a business losing thousands due to unnoticed billing errors. Or an employee slipping in unauthorized expenses. Internal auditors catch these issues, ensuring companies don’t just follow the rules—they stay financially healthy.

Internal auditors earn an average salary ranging from $60,000 to $100,000 per year, depending on experience and industry.

If you love analyzing details and spotting financial risks before they spiral out of control, internal auditing is a powerful and in-demand career path.

👀 Did You Know? The foundation of modern accounting—double-entry bookkeeping—was first documented in 1494 by Luca Pacioli, a mathematician and Franciscan friar

His book, Summa de Arithmetica, introduced the principles of debit and credit that accountants still use today. You could call him the father of financial record-keeping!

While internal auditors work inside a company, external auditors take an outsider’s perspective.

Their job? To verify financial statements, confirm compliance, and ensure businesses aren’t misleading investors, regulators, or the public. They’re like financial referees—making sure everything is fair and accurate.

Ever heard of a company “cooking the books” to inflate profits? External auditors step in to stop that before things get out of hand. Publicly traded companies and government organizations must undergo external audits to confirm their financial integrity.

External auditors earn an average annual salary of $100,607, with most salaries ranging from $92,113 to $109,931, depending on skill level and experience.

If you enjoy investigating financial reports, working independently, and holding businesses accountable, external auditing offers strong career growth and variety.

Internal and external auditors both focus on financial integrity, but one works inside the company, while the other ensures accountability from the outside.

Up next, we’ll explore how cost accountants keep businesses profitable and how investment accountants manage financial assets.

📖 Bonus Read: How to Bill a Client Efficiently?

Every business wants to make a profit—but how do they know if they’re spending wisely? That’s where cost accountants come in.

They break down production expenses, find ways to cut costs, and make sure businesses are pricing their products correctly. If a company is losing money without knowing why, a cost accountant is the one who figures it out.

Ever wondered why two coffee shops sell the same latte at different prices? A cost accountant probably ran the numbers, factoring in rent, labor, materials, and profit margins to ensure one café stays in business while the other struggles.

Cost accountants earn an average annual salary of $80,000, with entry-level positions starting at $67,500 and experienced professionals making up to $100,000, as per online data.

If you’re detail-oriented and love finding ways to make businesses more profitable, cost accounting is a strategic and rewarding career path.

Some accountants track expenses, while others track how money makes money—that’s the job of investment accountants.

They specialize in managing financial assets, ensuring compliance with regulations, and handling financial transactions for investment firms, hedge funds, and asset management companies.

If you’ve ever invested in stocks, real estate, or mutual funds, an investment accountant was working behind the scenes, ensuring everything was accurately recorded and reported.

Investment accountants earn an average annual salary of $78,273, with salaries typically ranging from $70,791 to $87,000 based on experience and location.

If you have an interest in finance and investing, this role combines accounting expertise with high-stakes money management.

Cost accountants keep businesses profitable, and investment accountants help grow financial assets. Up next, we’ll cover nonprofit accountants managing donations and financial transparency.

Running a nonprofit isn’t just about passion—it’s about keeping finances in check while ensuring every dollar is spent with purpose. That’s where nonprofit accountants come in.

They handle donations, grants, and budgets while making sure funds are used transparently and effectively. Unlike corporate accountants, who focus on profits, nonprofit accountants focus on financial accountability and compliance with public funds regulations.

Ever wondered how charities, foundations, and NGOs manage massive fundraising campaigns? A nonprofit accountant ensures that money goes where it’s supposed to whether that’s funding scholarships, providing disaster relief, or supporting medical research.

Nonprofit accountants earn an average annual salary of $61,627, with top earners making up to $83,000 depending on experience and location.

If you’re passionate about making a difference but also love numbers, nonprofit accounting lets you combine finance with social impact.

That wraps up the major types of accountants and how they shape different industries. Whether you’re analyzing financial statements, tracking public funds, or managing investment portfolios, accountants play a critical role in every sector.

Next, let’s look at the essential skills that set top accountants apart.

If you think accounting is just about balancing the books, think again. Today’s accountants are financial strategists, risk managers, and tech-driven problem solvers. You’re expected to spot fraud before it happens, help businesses make million-dollar decisions, and ensure every financial record is airtight.

So, what separates a top-tier accountant from someone just pushing numbers around? Let’s break it down.

Numbers don’t lie, but people do make mistakes. A single misplaced decimal or missing transaction can lead to serious financial consequences.

Imagine submitting a tax report where a $10,000 deduction suddenly turns into $100,000—good luck explaining that to the IRS.

Every financial decision is based on data. If that data isn’t accurate, businesses could lose money, face audits, or make terrible investment choices. Accountants who catch errors before they cause damage are worth their weight in gold.

If you only record transactions but don’t analyze them, you’re just a human calculator. Great accountants don’t just report numbers but they interpret them, find patterns, and predict business trends before anyone else does.

Businesses rely on accountants to help them make smart financial moves. Without analysis, financial reports are just stacks of numbers with no real meaning.

Accounting isn’t about manually entering numbers all day. If you’re still relying only on Excel, you’re already behind. The best accountants know how to leverage automation, AI, and financial software to work smarter, not harder.

Why does this skill help?

Technology makes accounting faster, more efficient, and less prone to human error. Businesses are shifting to cloud-based platforms, and accountants who don’t adapt will struggle to keep up.

To learn more about how you can increase your efficiency at work with automation, check this video out 👇

Most people don’t enjoy talking about finance, and many find the subject hard to understand. Your job as an accountant is to take complex financial data and turn it into clear, actionable insights that business leaders can actually use.

It doesn’t matter how much financial knowledge you have if no one can understand what you’re saying. Being able to explain cash flow, tax strategies, or profit margins in simple, non-boring language makes you an asset to any company.

A business is losing money every month but can’t figure out why. A tax report doesn’t match up with financial records. An investor needs to know whether a company is worth buying. These are all problems accountants solve daily.

Finding mistakes isn’t enough; accountants who can fix financial issues before they become disasters are invaluable. Whether you’re handling cash flow, fraud detection, or budgeting, problem-solving is a must-have skill.

📖 Read More: How to Make a Balance Sheet?

Consider this to be the primary, non-negotiable skill for a career in finance.

Accounting scandals like those at Enron and Wirecard didn’t happen by accident. They happened because people in charge of financial records chose to manipulate the numbers. No matter how skilled you are, nothing ruins an accounting career faster than a lack of integrity.

Clients and businesses trust accountants with millions of dollars in financial transactions. Once that trust is broken, it’s almost impossible to rebuild. Ethical accountants protect themselves, their companies, and their clients from legal trouble.

Accounting is all about protecting it, growing it, and making smart decisions with it.

These skills don’t just help you land a job; they make you the kind of accountant that businesses can’t afford to lose. Now that you know what it takes, let’s look at how to advance your accounting career through education and certifications.

If you’re serious about accounting, your career should be something you build strategically. The right education, certifications, and experience will shape your growth, boost your earning potential, and open doors to senior roles.

So, how do you go from learning the basics to becoming an industry expert? Let’s break it down.

Accounting degrees aren’t just about meeting job requirements. They lay the groundwork for everything you’ll do in your career.

Here’s what you need to know:

While a bachelor’s degree is the most common path, real-world experience and certifications often matter just as much and sometimes even more.

Earning a certification is one of the fastest ways to level up your career.

Some of the most valuable options include:

Each certification has different requirements, but they all make you more valuable in the job market and increase your salary potential.

Degrees and certifications look great on a resume, but practical experience is what makes you a strong candidate.

If you’re just getting started, focus on:

The combination of formal education and real-world application is what moves your career forward.

⚡️Template Archive: Free Bookkeeping Templates in Excel and ClickUp

Finding the best accounting roles requires more than just sending out resumes. Today’s accountants need to leverage technology, track job applications efficiently, and stay ahead of industry trends.

To keep your job search organized, use the ClickUp Job Search Template to:

With a structured job search approach, you’re not just waiting for opportunities; you’re actively creating them.

📖 Also Read: Best Resume Format: Tips + Examples

A career in accounting isn’t about staying in the same position forever. Whether you want to become a CFO, financial controller, or tax director, advancing your career requires continuous learning and professional development.

⚡️Template Archive: Top Career Map Templates to Create a Clear Career Roadmap

Every step in your accounting career, from education to certifications, real-world experience, and leadership development, shapes your future opportunities. The more intentional you are about these choices, the faster you’ll move up the ranks.

Now, let’s dig into how ClickUp helps accountants and finance teams streamline their work, stay compliant, and manage financial processes seamlessly.

Accounting isn’t just about numbers—it’s about deadlines, compliance, and making sense of endless financial records. A single missing document or overlooked tax deadline can turn into a costly headache.

That’s where ClickUp comes in. From organizing financial reports to automating workflows, ClickUp helps accountants stay efficient and stress-free.

Every accounting process comes with a to-do list like filing taxes, reconciling bank statements, preparing financial statements and missing just one step can cause chaos. Stay ahead of audits, tax deadlines, and financial reporting with ClickUp Tasks. It keeps everything in one place so you never scramble to find what’s due next.

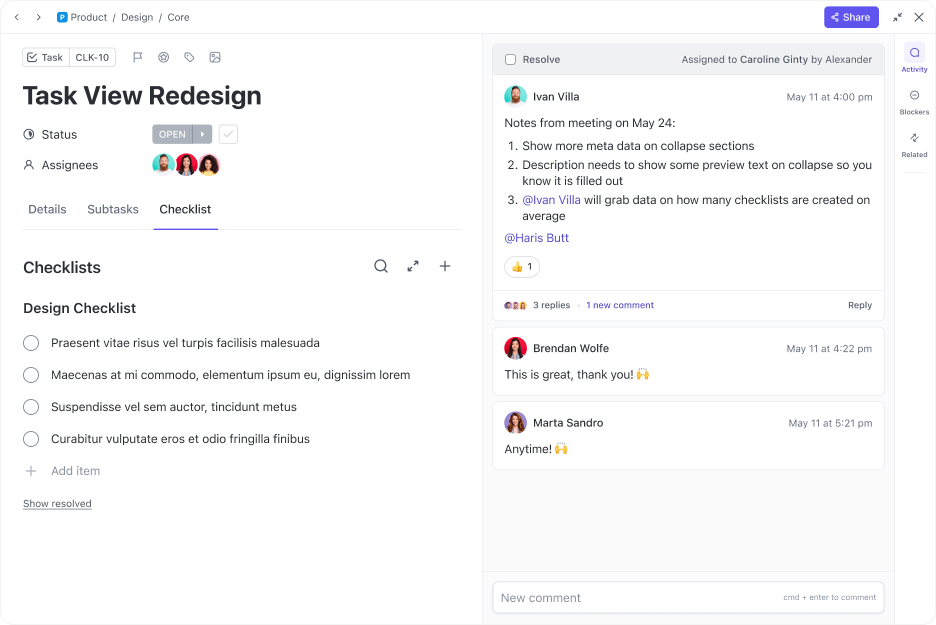

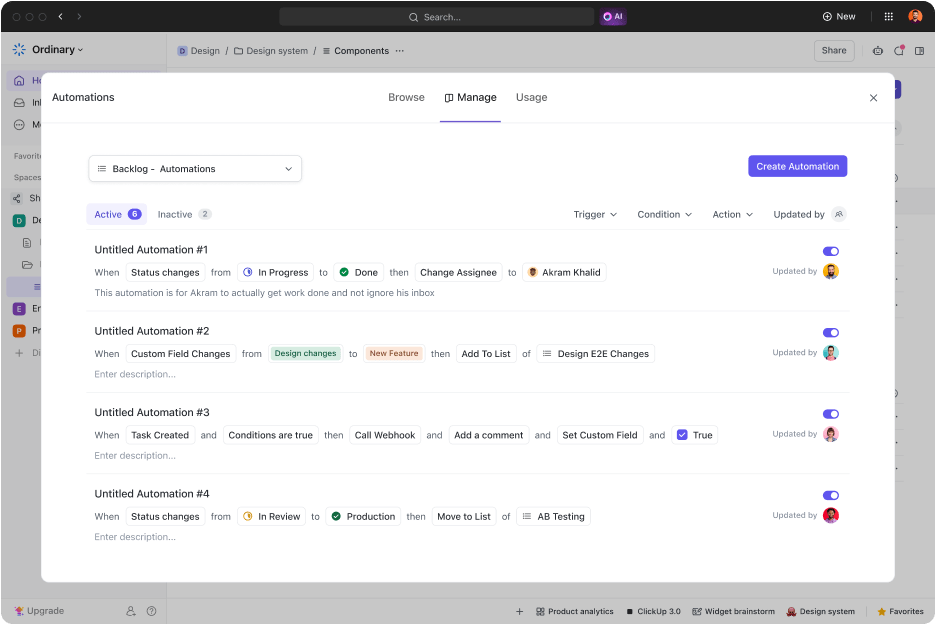

Accounting teams juggle approvals, invoice tracking, and compliance checks. Cut down manual work with ClickUp Automations. It removes the need for manual follow-ups and redundant data entry by streamlining recurring accounting tasks.

Between audit trails, compliance guidelines, and client financial records, accountants handle a mountain of paperwork. Keep financial policies, reports, and client notes organized with ClickUp.

ClickUp Docs centralizes everything, making it easy to collaborate, track updates, and maintain financial documentation in one secure place.

📖 Also Read: Best Workplace Communication Tools and Software

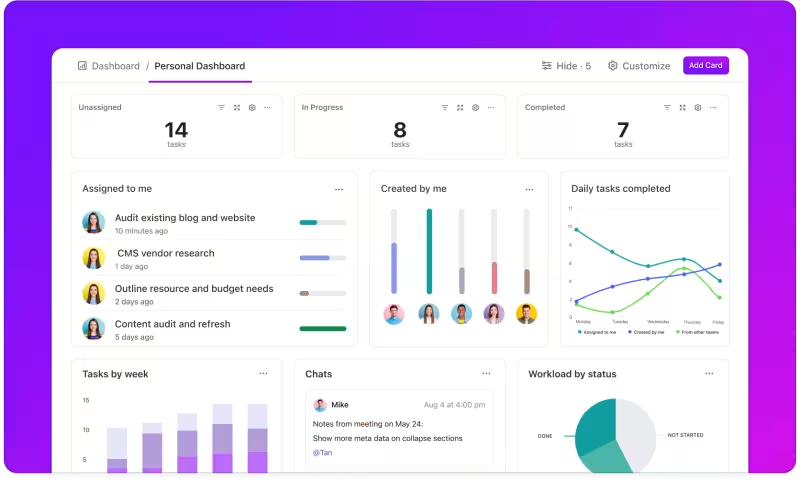

Manually building financial reports from multiple spreadsheets is slow and prone to errors. ClickUp Dashboards turn raw financial data into real-time, visual insights so you can track budgets, monitor cash flow, and analyze expenses at a glance. Get real-time insights into budgets, expenses, and financial performance

Switching between multiple accounting platforms wastes time. With ClickUp Integrations, you can sync ClickUp with QuickBooks, Xero, and other finance tools. This keeps financial data connected and workflows seamless.

Keeping financial records accurate and audit-ready is a challenge, especially when managing high volumes of transactions. The ClickUp Accounting Journal Template streamlines daily bookkeeping by ensuring every transaction is logged, categorized, and easy to track.

📌 Use this template to:

To further streamline financial workflows, you can also explore the ClickUp Accounting Template for broader finance management needs.

With ClickUp, accounting teams can cut down on manual work, automate approvals, and keep financial records structured—all in one platform. Whether you’re managing corporate finances, tax filings, or nonprofit funding, ClickUp simplifies the process and gives you back valuable time.

⚡️Template Archive: Free General Ledger Templates for Accounting in Excel & ClickUp

From financial planning to risk management, accountants play a crucial role in ensuring financial health and compliance with generally accepted accounting principles.

Whether you’re analyzing financial data, managing tax returns, or preparing financial reports, mastering accounting principles and leveraging the right tools will set you apart.

Ready to take control of your accounting workflows? Sign up for ClickUp today!

© 2026 ClickUp