Personal Balance Sheet Templates

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

All of us have financial goals. It could be buying a car, retiring early, taking a month-long vacation, or all of these. But it requires careful financial planning to achieve them.

🧠 Fun Fact: Lack of financial resources and funding options ranked as the number one barrier to achieving goals for 64% of the US Gen Z population in 2023.

When it comes to managing personal finances and creating an investment strategy, most people either find it unnecessary or are debilitated by the idea of evaluating their income, expenses, assets, and liabilities.

Whether you belong to the first lot or the second, personal balance sheet templates are all you need to start making a personal financial statement.

Read on as we enlist the top personal balance sheet templates for managing personal finances. Use these free resources to create financial statements, ascertain your net worth, strategize your next move—everything! ✅️

Let’s start.

Also known as a personal financial statement template, a personal balance sheet template is an editable document that lets you track and determine your financial standing at a specific time. Such templates are pre-formatted and customizable, with dedicated fields for listing assets, liabilities, and net worth—much like the company-standard traditional balance sheet.

🔎 Did You Know? Luca Pacioli, hailed by many as the ‘Father of Accounting, revolutionized financial record-keeping in the late 14th century by introducing the concept of double-entry bookkeeping. This groundbreaking innovation set the foundation for the modern balance sheet we rely on today.

Using these documents, you effortlessly gather useful financial data and details—income, expenditures, debts, loans, investments, etc.—for bookkeeping, forming financial statements, evaluating your financial health, and setting financial goals. 🎯

The idea of a good personal balance sheet template is subjective as it depends on two individual factors—a user’s needs and their subject-matter expertise.

However, these are some attributes that you should look for in a personal financial statement template to ensure it’s high-quality and apt, irrespective of your needs and expertise:

💡 Pro Tip: Create a well-structured financial plan to achieve the peace of mind that comes with being financially prepared for life’s surprises!

Use these free, high-quality resources to calculate your net worth and easily plan your finances.

Imagine a document that accurately and effortlessly indicates what you own and owe, your cash flow status, etc. The ClickUp Personal Balance Sheet Template is that and more.

Easy to use and customize, this template’s main purpose is to give you a clear view of your total liabilities and assets. Effortlessly check everything, from how many loan payments are due or how many short-term investments you have!

But that’s not all!

This template also helps you modify your investment strategy by highlighting your investments in mutual funds, stocks, bonds, etc., and indicating their potential risks and opportunities.

Ideal for: Individuals looking for a simple template to create personal financial statements and track their assets, investments, and net worth.

Do you have your financial goals in place? If so, the ClickUp Personal Balanced Scorecard Template is all you need to get a step closer to achieving them!

This template functions strategically by setting KPIs and tracking them to ensure all your financial moves align with your objectives. Each time you deviate from your objective, the template flags the KPI to keep you disciplined and accountable.

Over time, this improves your relationship with money and helps create a foolproof plan for handling finances.

Ideal for: Individuals searching for a personal financial statement template to set and track financial KPIs for better goal management.

While mainly designed to help small businesses compare their total assets and spending, the ClickUp General Ledger Template can easily generate a personal financial statement.

How? This easy-to-use and customizable template specializes in maintaining accurate ledgers of debit and credit transactions. Thus, it proves useful in managing cash flows—particularly ascertaining sources of cash inflow and outflow. Consequently, the data from the template helps supplement personal financial statement preparation.

Ideal for: People looking to track their financial data to ensure debits and credits match their spending plan. A small business can also use this to help formulate their business plan.

Efficient budgeting is the key to achieving financial objectives. This is where the ClickUp Personal Budget Template helps you make the most of your income. Clean, simple, and organized, this template tracks living expenses such as electricity bills, credit card debt, etc., to show your month-end savings.

This ensures two things. First, every crucial debt or expense is settled promptly. Second, you have a clear picture of your total cash after accounting for all the money you owe, so you know how long it will take to achieve a specific financial goal.

Ideal for: Individuals looking for a simple template to manage personal financial statements, track monthly expenditures, and set savings goals.

The ClickUp Personal Budget Plan Template is similar to the one listed above—just slightly more advanced.

Like the personal budget template, it lets you track your income and expenditures to manage your cash more efficiently. In addition, it specifies details on outstanding debt amounts, due dates, etc., to accurately determine your financial standing and maneuver your plans accordingly.

Ideal for: Individuals seeking a more advanced personal financial statement template to track income, expenses, arrears, and savings goals.

Managing a personal budget can often feel overwhelming, but the ClickUp Personal Finance Management Template is designed to optimize the process. Whether you’re looking to build a personal balance sheet, track your monthly budget, or set financial objectives, this template offers customizable tools to give you full control over your financial health.

Suppose you plan to take out home and car loans. This template will budget for your total income and expenses to help determine how much surplus money you’ll need to pay monthly loan premiums and settle the total debt on time.

Moreover, if you have multiple active loans, this template will also help you keep track of the total amount due to every lender.

Ideal for: Individuals tracking multiple loans and financial statements, planning long-term financial goals, and managing debt payments.

Looking for a personal financial statement template that calculates your net worth on your behalf?

The Personal Balance Sheet Template by Spreadsheet Shoppe should appeal to you. This Excel-based template specifies a negative or positive net worth by comparing assets and liabilities.

The tool is even beneficial for tracking and managing debts and plays a crucial role in evaluating the value of personal assets. By closely monitoring your financial obligations, make informed decisions that lead to better finances.

Ideal for: Individuals looking for a personal financial statement template that calculates net worth by comparing assets and liabilities.

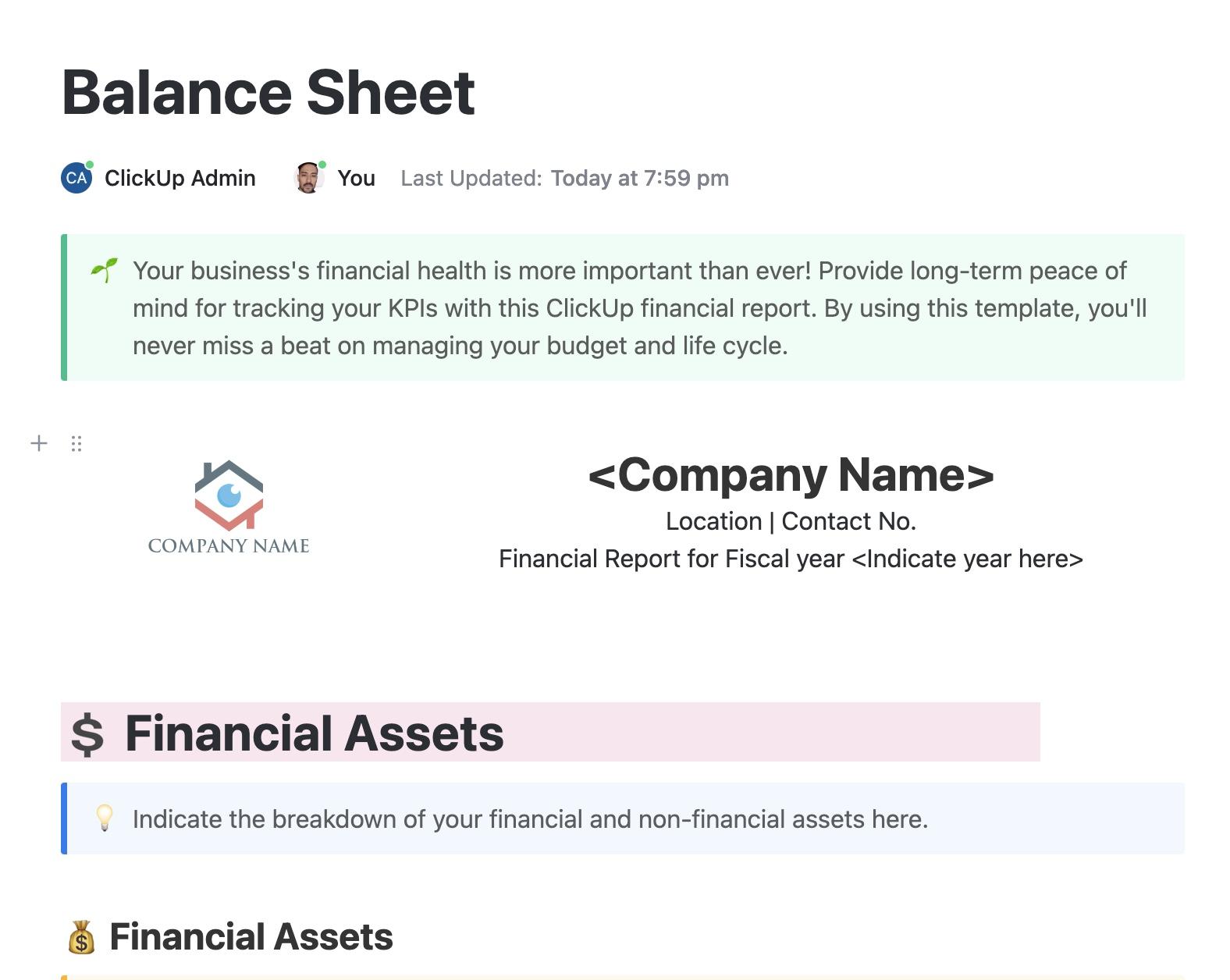

The Personal Financial Statement Template by Vertex42 is a versatile resource.

It is divided into three parts—personal balance sheet, personal cash flow, and personal financial statement. They address all your cash inflows, outflows, liabilities, and assets to generate your financial statement and help you file tax returns.

Additionally, this template proves useful in ascertaining the market value of assets like property, home equity, etc., to help you manage them more efficiently.

Ideal for: Individuals managing retirement accounts and personal financial statements, tracking cash flow, and assessing assets like property and home equity.

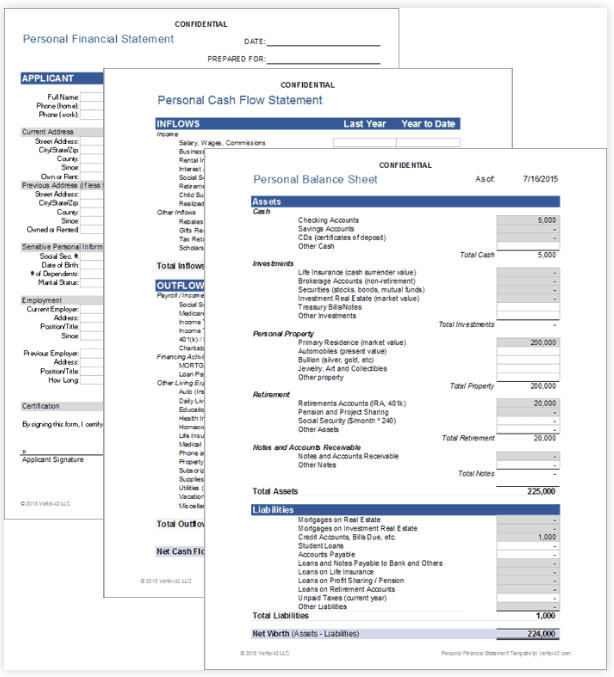

Despite being designed to analyze small business finances, the Startup Balance Sheet Template by Template.net is also useful for simplifying your accounting process.

Use the simple visual design to list and track all your fixed assets, liquid assets, fixed liabilities, current liabilities, and other details to determine the value of your equity. This template also stands out for its ease of use and comprehension.

Ideal for: Small businesses or young professionals just starting and looking for an online template to effortlessly manage assets, liabilities, and equity for better financial planning.

💡 Pro Tip: Personal or business accounting tasks like data entry, invoice processing, or reconciliations often feel tedious and take up a lot of time and effort. The solution? AI tools for accounting and finance! 🤖

Here are the benefits of using AI for accounting needs:

Simplify your workflow, cut costs, and boost your business performance—all with the power of AI! ✨

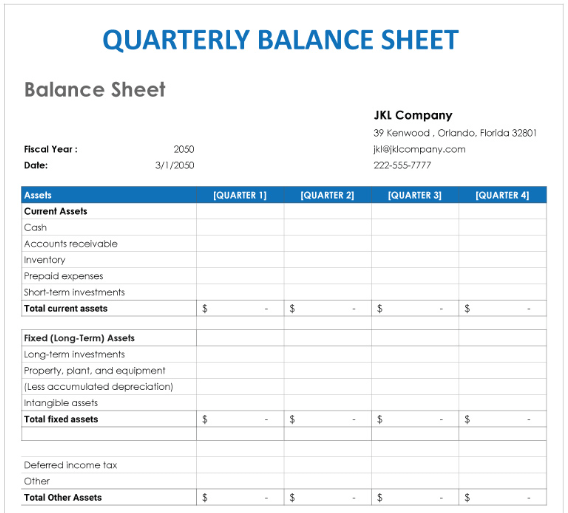

The Quarterly Balance Sheet Template by Template.net is another useful business resource.

This fundamental template consolidates all your fixed assets, current assets, long-term liabilities, short-term liabilities, etc., to give you a quarterly view of your business’s equity. Highly customizable, you can easily use it for personal purposes, i.e., to determine your net worth.

Ideal for: Companies seeking a comprehensive template to track quarterly finances, including assets, liabilities, and equity.

Managing your finances can feel daunting, but is non-negotiable for ensuring financial security.

ClickUp’s Personal Balance Sheet Templates act as a one-stop solution for tracking assets, liabilities, and net worth, clearly depicting your financial standing.

Along with user-friendly features for tracking your financial activity, maintaining documentation, and reminders for making investments and payments, ClickUp can be your personal aide for financial management.

Sign up here for a free ClickUp account today.

© 2025 ClickUp