Free Money Management Templates in Excel to Optimize Expenses

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Saving money doesn’t have to be a tedious chore. A ready-to-use money management template can make all the difference.

Using a money management template on Microsoft Excel is a popular first step for many of us. To help you find the best fit, we’ve curated the top 10 Excel templates available today.

We’ll also cover some ClickUp alternatives, a powerful project management solution that could further simplify your finance management.

Here are the top 10 money management Excel templates to track budgets, expenses, and financial goals efficiently.

ClickUp’s alternative templates for a more dynamic and automated approach to budgeting.

Money management Excel templates get you started on budgeting. Here are five key aspects essential for every template to be effective:

With the key elements in mind, here are 10 Excel money management templates to get you started:

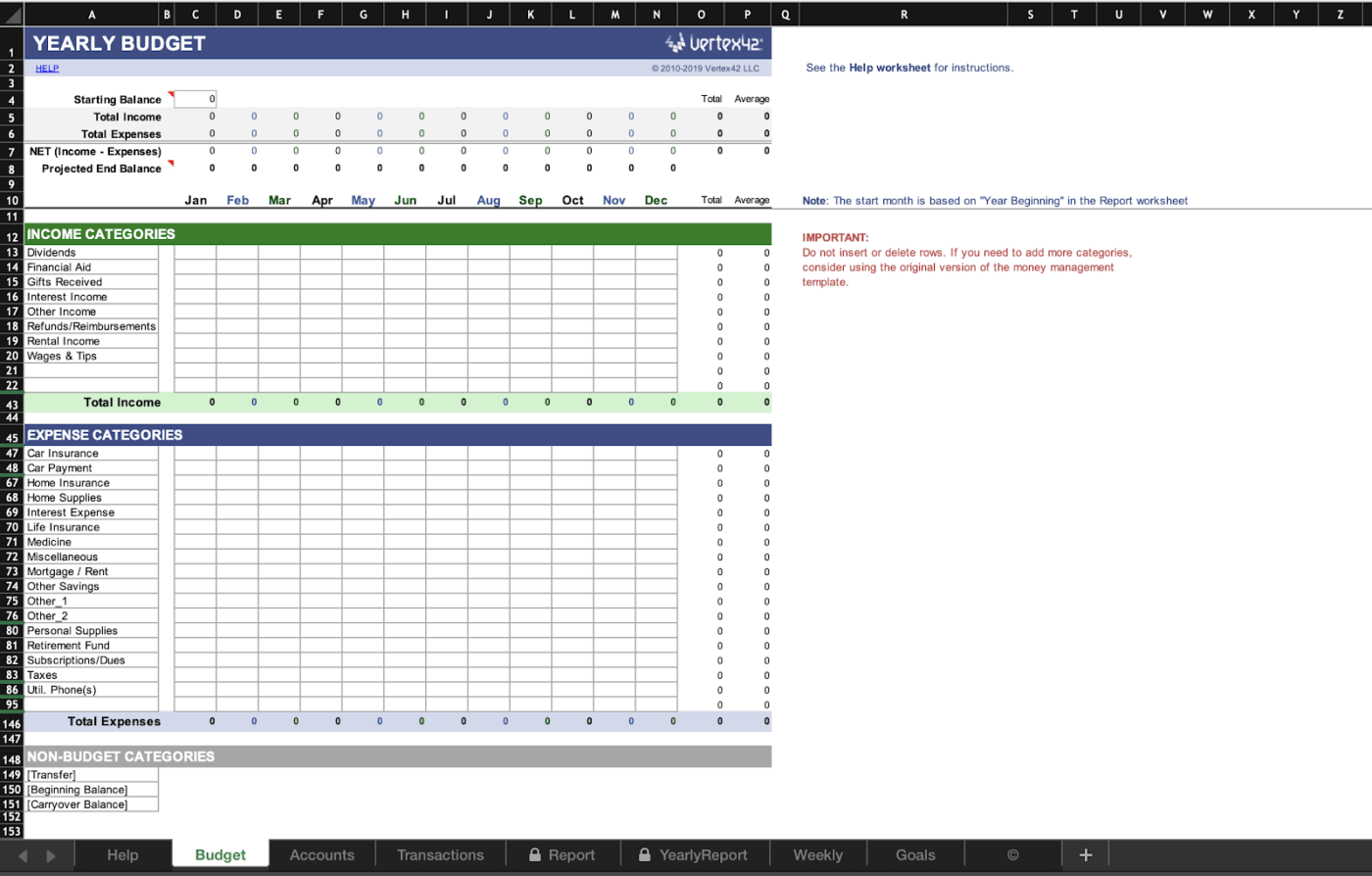

Vertex42’s Money Management Template is a solution built to visualize finances on a granular level.

It comes with formula-packed worksheets for your transactions, goals, and reports and a comprehensive help section for a hassle-free start.

The Excel budget template also has two reporting worksheets to picture the overall image and a section to record and track your accounts.

Ideal for: Individuals aiming to gain control over their finances and improve budgeting

The Basic Personal Budget Template by Microsoft is a quick money management solution. It offers clear worksheets for tracking monthly income and expenses. The template also provides an expense sheet to detail your spending and generate a total.

With its clean layout and easy-to-use format, this Excel money management template is perfect for organizing finances for the future.

Ideal for: Anyone seeking a straightforward tool for effective personal financial management

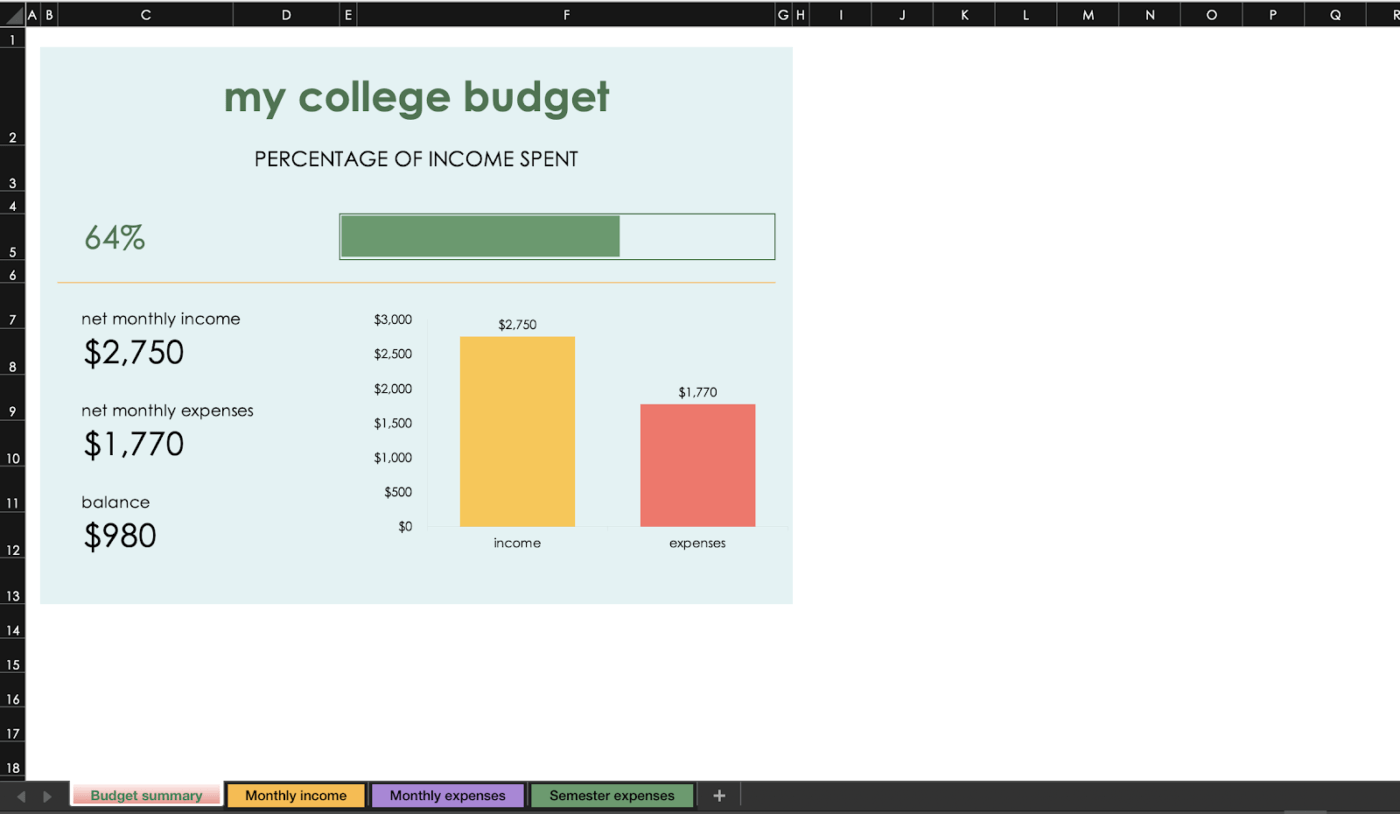

Microsoft’s My College Budget Template is designed to help students manage their money. One of its standout features is its colorful charts and graphs, which make it easy to see where money goes.

It tracks monthly income, expenses, and even semester expenses to record regular educational expenditures. This way, you start on top of your budget throughout the school year.

It’s great for making and adapting financial decisions without affecting your main goal.

Ideal for: College students who want to manage their finances throughout the academic year

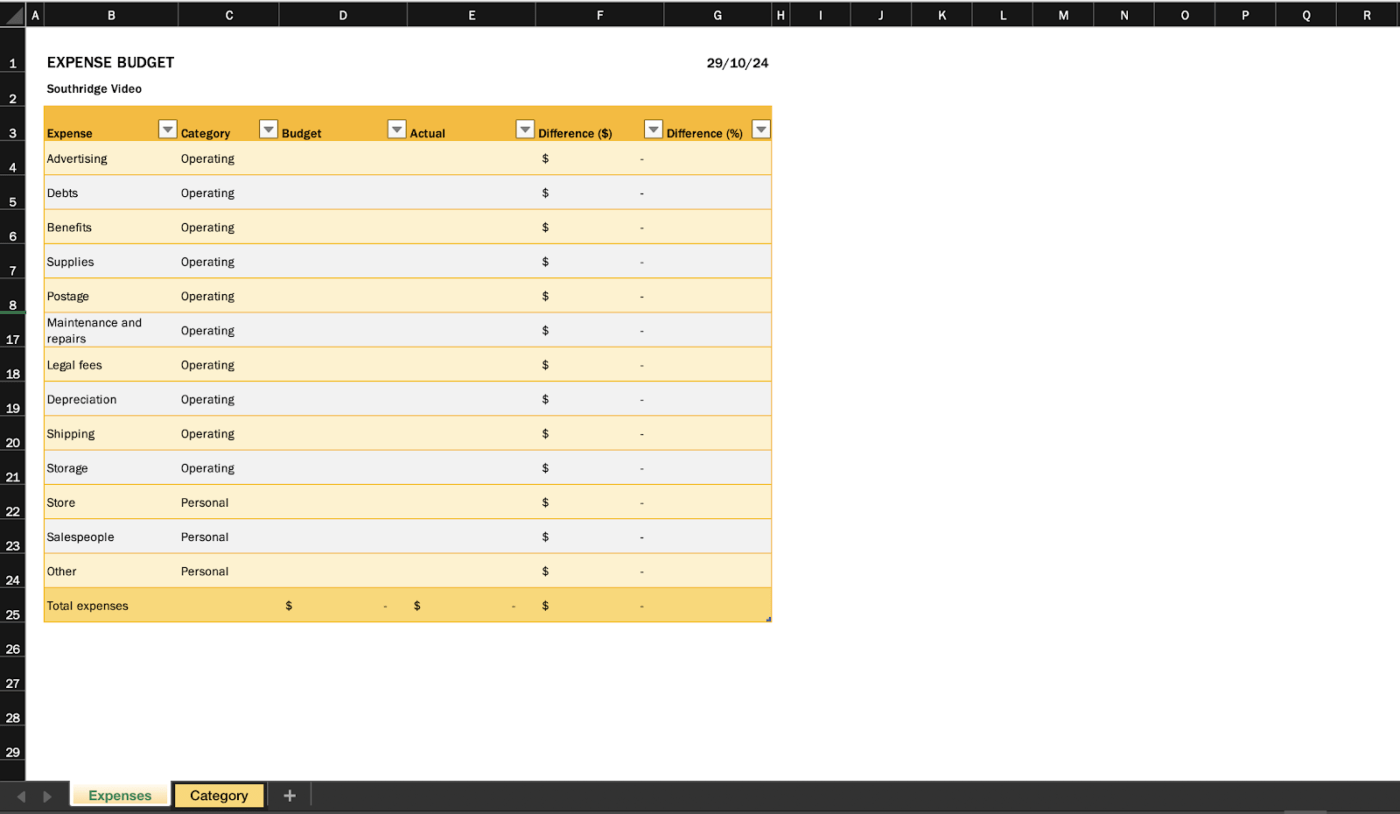

Microsoft’s Expense Budget Template is perfect for planning expenses for a professional or personal project. It delivers all key insights on a single page, focusing on expense management.

This template helps you record every expense and link to a pre-defined list of expense categories.

Ideal for: Professionals managing project expenses or personal budgets

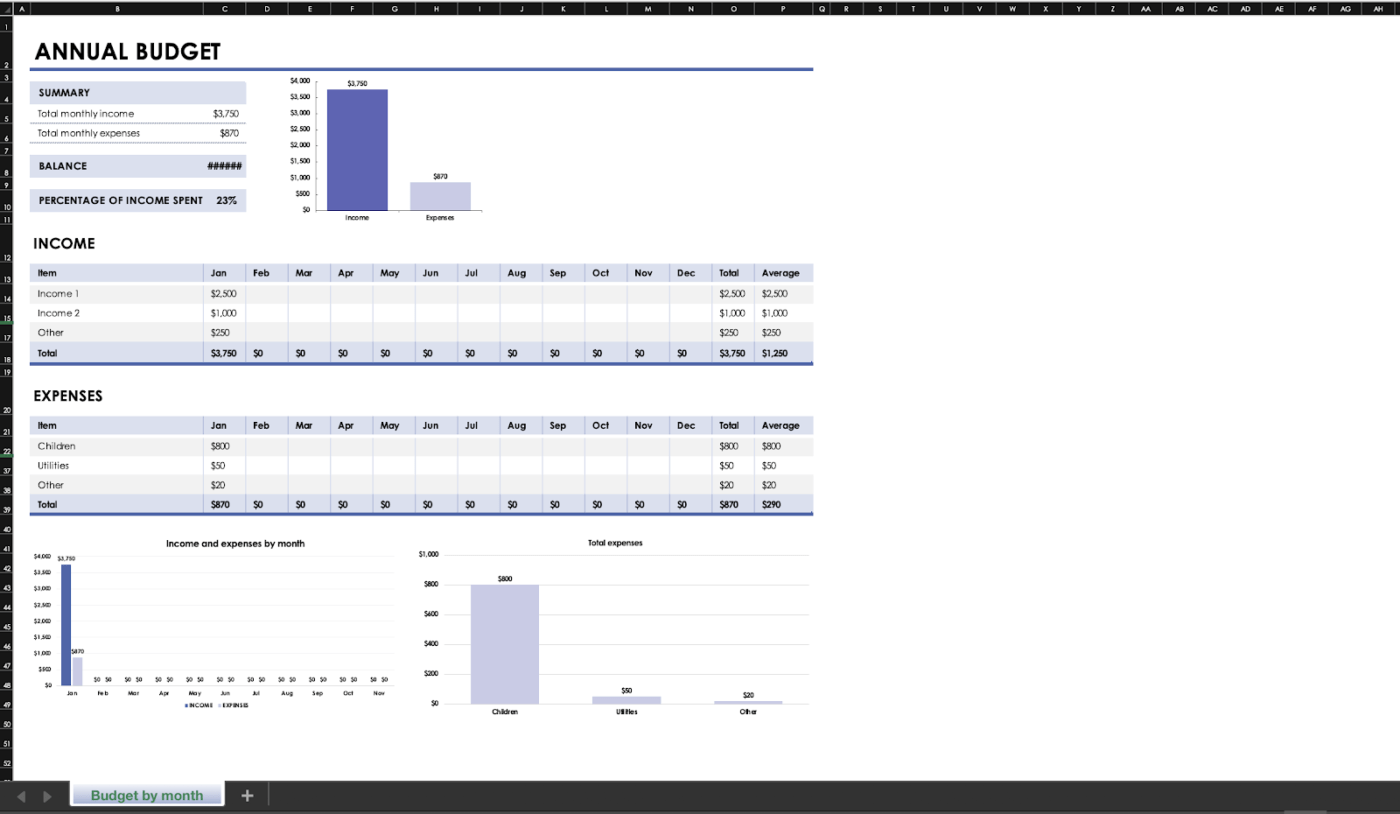

Next is the Simple Annual Budget Template by Microsoft, a one-page solution that captures the details of your yearly budget. It features a neat table at the top left summarizing totals and balances.

The template follows up with income and expense tables packed with pre-filled formulas. This simplifies calculation and gives you a clear picture of your performance.

Ideal for: Anyone looking for a comprehensive annual financial snapshot

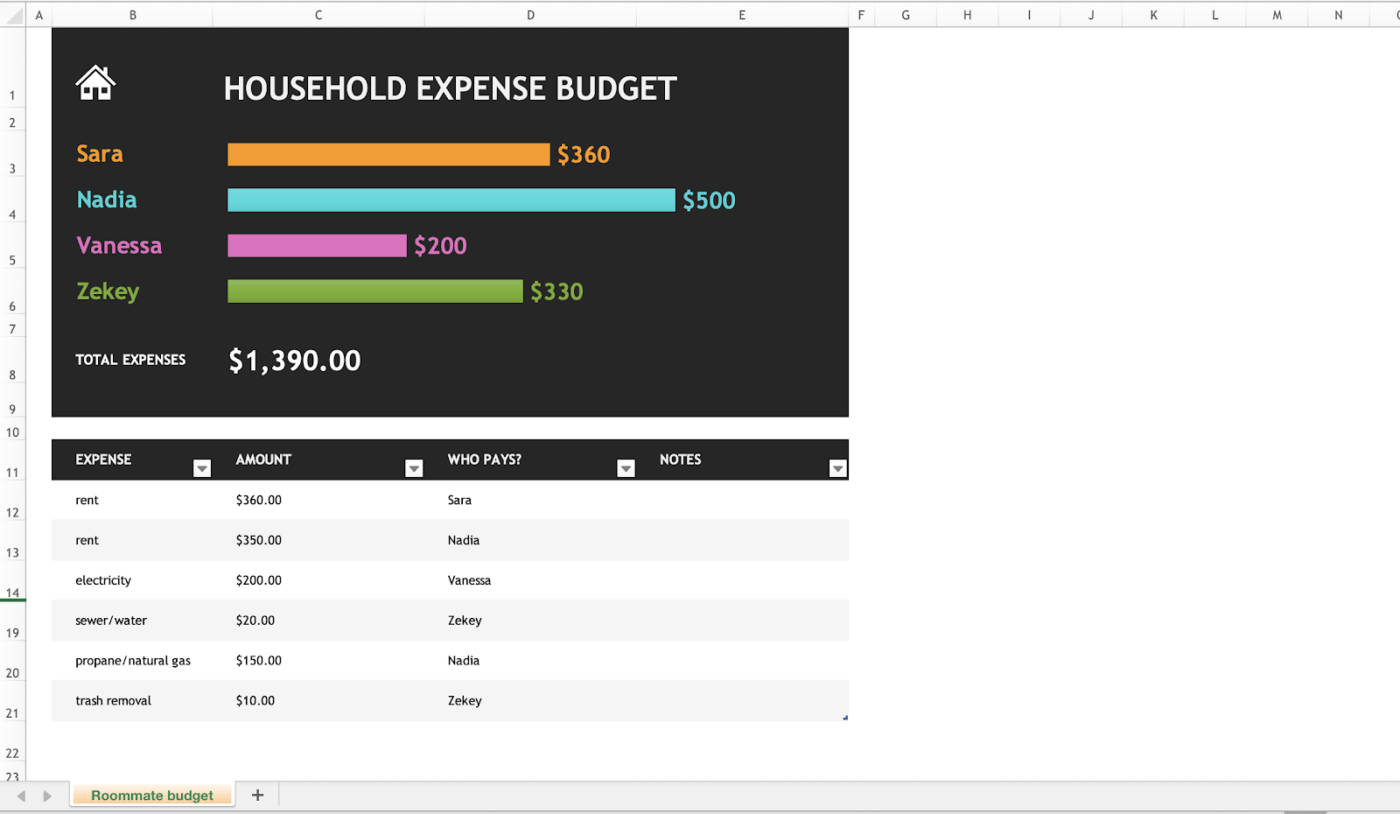

Want to control your shared household expenses? Microsoft’s Household Expense Budget Template can make life simpler. It is designed to map how much roommates spend on the home.

The template has a table to record expenses, value, who paid, and notes. It also has a quick bar chart that visualizes roommate-wise expenditures.

Ideal for: Roommates looking to track and manage shared living costs

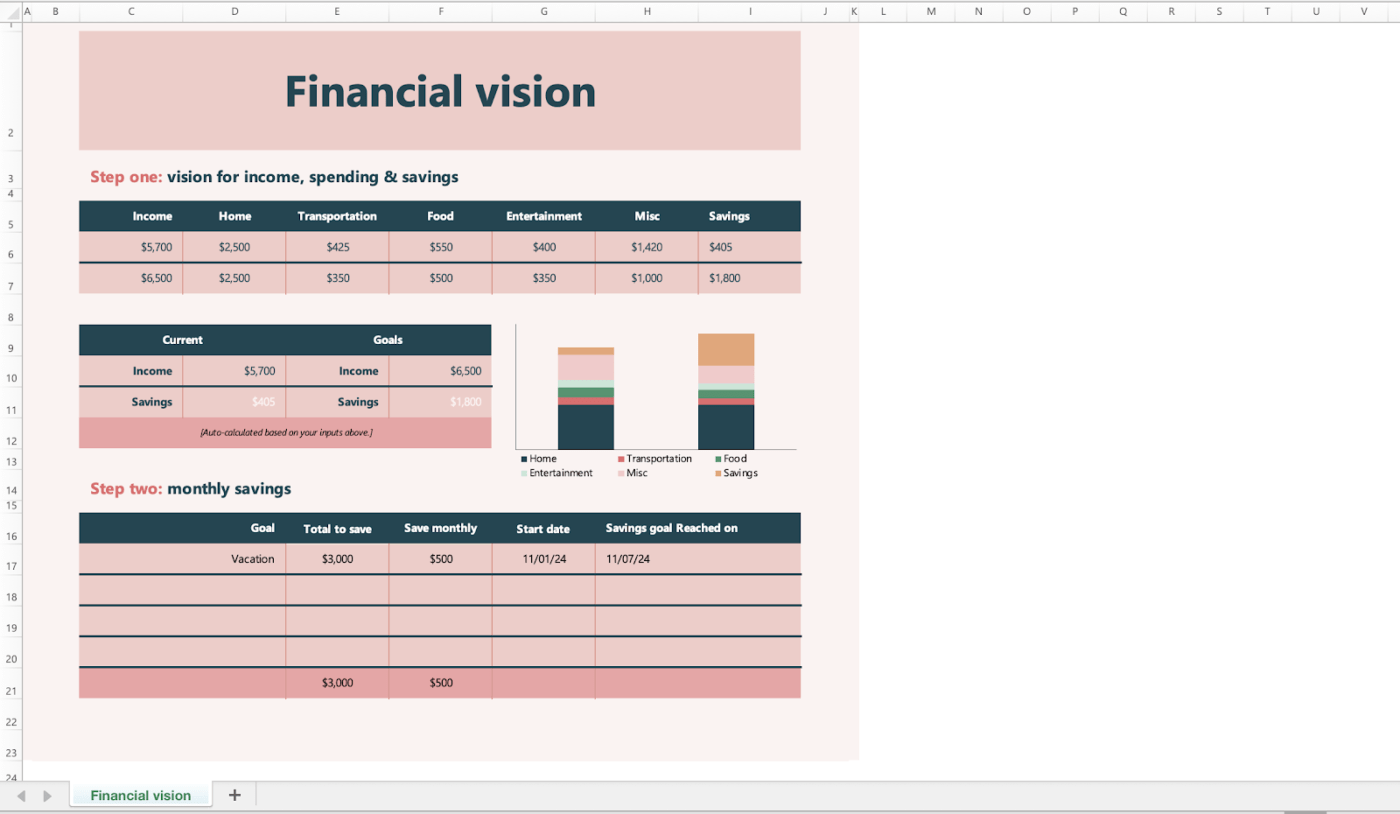

The Financial Vision Template by Microsoft is great for visualizing clear saving goals. It presents your financial plans and vision in two clear steps.

The first step lets you record your income, category-wise expenses, and savings. Here, you can also jot down your current values and goals. Another section in this step summarizes these details in a table and stacked bar graph.

The template’s second step features a table to map your monthly saving plans. This includes monthly saving goals, total value, monthly breakup, start date, and achieved date.

Ideal for: Individuals focused on visualizing and achieving their financial aspirations

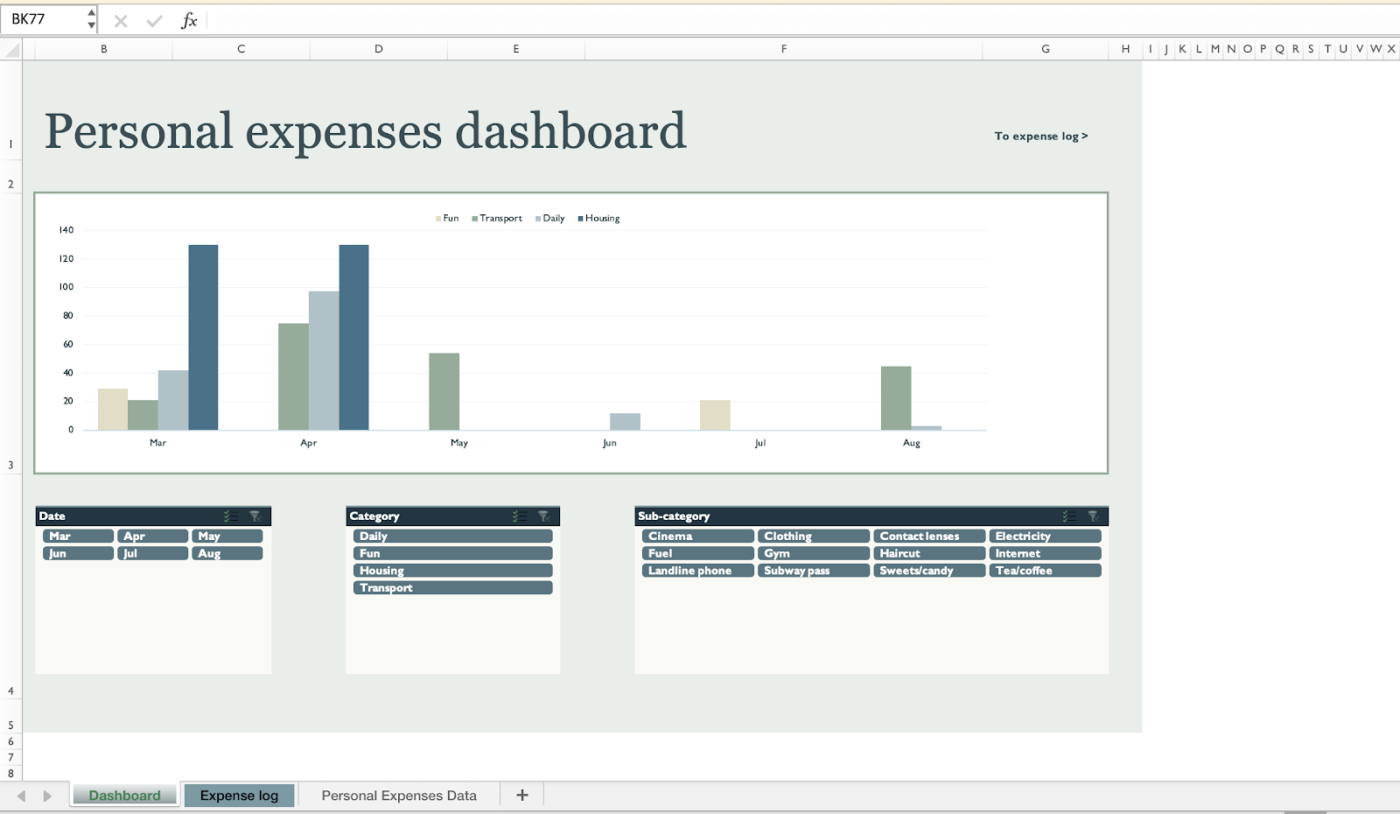

With Microsoft’s Personal Expenses Dashboard Template, spotting areas for better budgeting becomes straightforward. The template tracks personal expenses with an engaging, easy-to-use dashboard. It displays monthly expenses across housing, transportation, and fun categories.

Besides, it features a dedicated sheet with a pivot chart for clear spending visualization. Overall, the solution is well-suited for visual summaries and informed financial decisions.

Ideal for: Anyone wanting to gain insights into their spending habits for informed decision-making

➡️ Read More: Are you searching for solutions to focus on your bottom line? Find out 10 balance sheet templates.

The Revenue Projection Template by Vena is designed to visualize and forecast earnings after expenses. It provides a structured framework to input product, material, sale, and production cost details.

The template also includes built-in trend graphs, averages, and totals. This helps analyze historical data seamlessly and create clear insights. Along with the latest developments, this template facilitates accurate strategies and forecasts.

Ideal for: Businesses looking to forecast revenue accurately and refine financial strategies.

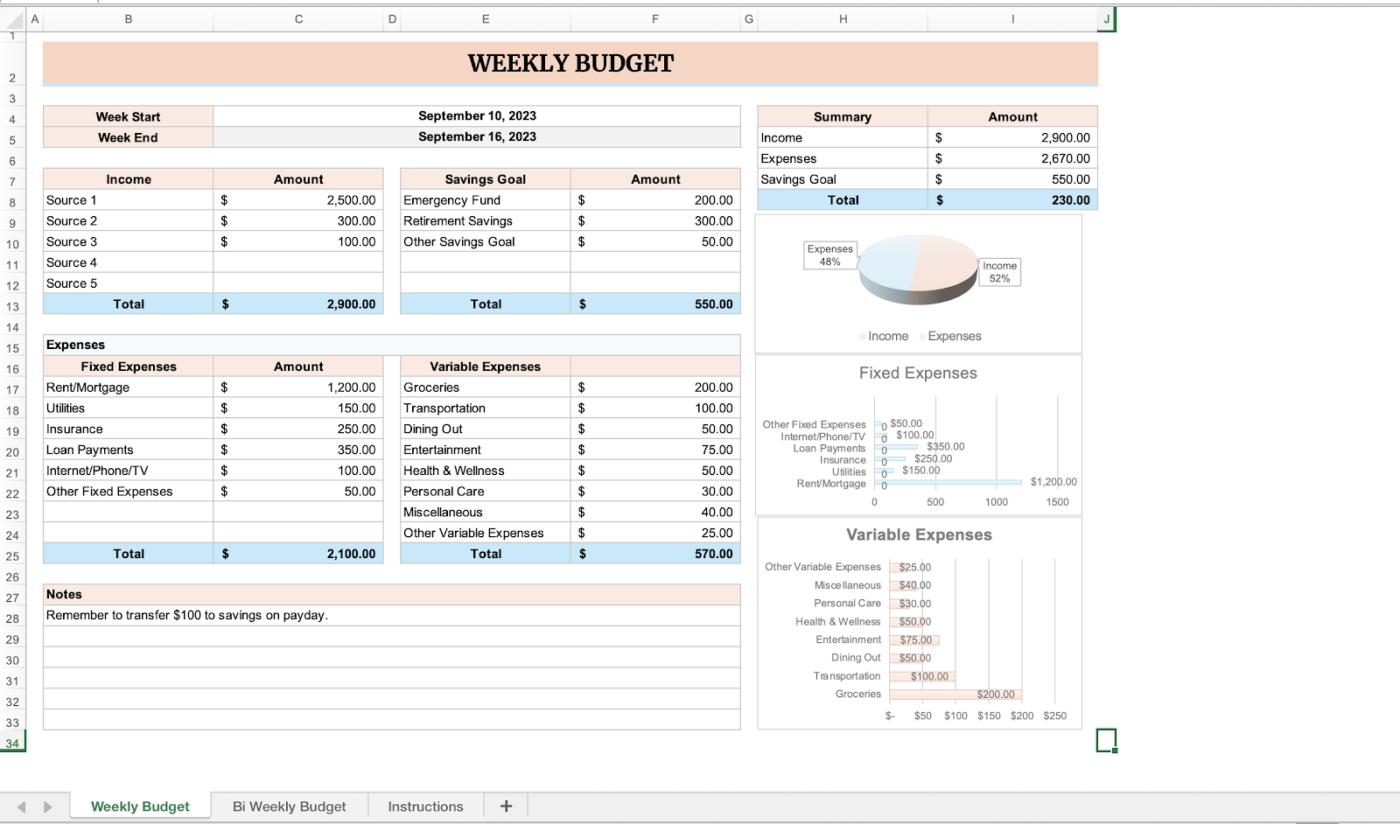

Template.net’s Bi Weekly Budget Template is designed to plan finances over shorter periods.

Each worksheet displays income and savings goals at the top to keep priorities clear. It then provides space for fixed expenses (like rent) and variable costs (like groceries).

A summary section outlines goals, income, and expenses, with a pie chart for instant distribution insights. The template’s notes section helps track ad hoc situations effectively.

This solution is also available as a Google Sheets budget template if you need a different platform.

Ideal for: Individuals seeking to manage their budget more frequently for better financial control

Excel is a powerful tool for calculation and analysis. While it’s a beginner-friendly tool for money management, Excel falls short in some aspects.

Here are a few drawbacks of using it as a money management platform:

Due to these limitations, Excel can be cumbersome for effective money management, especially in collaborative or dynamic budgeting scenarios.

Given these limitations, Excel can be time-consuming as a money management tool. When looking for an Excel alternative for money management, it’s vital to focus on tasks, calendars, and automation.

No more crunching numbers in data cells.

This is where ClickUp enters the chat. It’s easily better than Excel and many other Google Sheet alternatives.

Want to know how? Here’s a quick comparison.

| Feature | ClickUp | Excel |

|---|---|---|

| Task Management | ✅ Built-in task management with status tracking | ❌ Limited to manual task creation and tracking |

| Budgeting Templates | ✅ Ready-to-use budgeting templates for teams | ✅ Basic budget spreadsheets available |

| Calendar Integration | ✅ Integrated calendar for tracking deadlines | ❌ Requires manual setup or external integration |

| Automation | ✅ Automated workflows for approvals, reminders, and updates | ❌ Limited automation, requires VBA or add-ins |

| Collaboration | ✅ Real-time team collaboration and comments | ❌ Limited collaboration and requires cloud storage |

| Customizable Dashboards | ✅ Interactive dashboards to track expenses and budgets | ❌ Custom dashboards are limited and manual |

| Approval Workflows | ✅ Built-in workflows for approvals and routing | ❌ No native workflow support and needs a manual setup |

| Accessibility | ✅ Available on desktop, mobile, and web | ❌ Desktop and web, mobile access through cloud |

| Integration with Other Tools | ✅ Easily integrates with accounting tools and CRMs | ❌ Limited integrations and often require third-party tools |

| User-Friendliness | ✅ Intuitive interface, minimal training required | ✅ Intuitive but may have a steep learning curve |

With that cleared up, here are a few alternative money management templates.

The ClickUp Simple Budget Template is quite straightforward and in-depth. The solution instantly saves budget information with 16 pre-designed Custom Fields.

It also keeps progress tracking easy with two clear task statuses, New Entry and Complete. If you need to focus on income and expenses, the template presents categorized details in dedicated custom views.

Whether you work with a team or family, ClickUp lets you assign tasks, track time, and create dependencies.

Ideal for: Individuals or small teams who need straightforward, categorized budget tracking

➡️ Read More: Explore 10 general ledger templates to enhance your financial reporting and drive accountability.

ClickUp Finance Management Template facilitates all aspects of a company’s bottom line. It comes packed with pre-designed lists.

The Product folder visualizes ID, selling value, and purchase price to review material pricing. This section even maps stock and supplier details.

Its Expense folder also covers all types of dues, including employee payments, reimbursements, purchase orders, and supply contacts. For inflow and profits, the sales space tracks invoices and ongoing business.

This solution helps you focus on timely payments and positive earnings after tax.

Ideal for: Small businesses, account teams, and professionals who want to improve any financial activity or process

Want to optimize your store’s overheads? The ClickUp’s Business Budget Template makes the process effortless. It drives efficient profit management through clear task lists. The template has sections on salaries, cost of goods, and sales.

Its Salary List records employee names, roles, and monthly take-home amounts and even has fields for manager details and bonuses.

The Operational Expenses List details all costs. Your team can add new items using a user-friendly form for expense and approver information.

Ideal for: Business owners who want a clear view of overhead and revenue on a yearly or monthly basis

➡️ Read More: If you need a more comprehensive focus on your accounting solutions, here are 10 Bookkeeping templates.

ClickUp’s Personal Budget Template nurtures effective budgeting habits. It includes a clear guide and a detailed video tutorial.

The solution’s $$ Due view represents dues in calendar format for effective payment tracking. It also comes with a Board View to visualize budget elements by category. This feature is perfect for identifying the nature of expenses.

If you need detailed tracking, its Task List View records the budget plan, actual, and balance. It also lets you record priority levels and expenses as fixed or variable.

Ideal for: Individuals who’ve begun focusing on personal finances and those who prefer intuitive tracking of savings and spending

➡️ Read More: For a template focusing on student activities, the ClickUp College Budget Template is another great personal budgeting choice.

Looking to simplify your upcoming events? Choose the ClickUp Event Budget Template. It combines event finances and planning to bring all aspects of your event into one space.

The template’s Venue list maps essential contact details and addresses. It groups these fields by activity, such as lodging, entertainment, and catering. In addition to venues, the template has a dedicated list of key event activities and related expenses.

The solution also includes an Event Summary List to cover the budget, audience, event type, date, and details. The Calendar View in this event space is ideal for tracking timelines at a glance.

Ideal for: Event planning teams who need centralized control of execution and finances

💈Bonus Tip: If you are a filmmaker or producer and want to follow a budgeting style similar to event planning, check out the ClickUp Film Budget Template.

It helps you:

ClickUp Project Management Budget Template is built to organize budgets from planning to project delivery.

The solution comes with nine Custom Fields that help track the development of your defined budget. It also offers Custom Views to visualize progress according to the project phases and schedules.

It includes data fields like priority levels, assignees, progress bars, and task duration. This template is perfect for managing the remaining funds per activity in real time.

Ideal for: Project managers looking for real-time budget tracking across tasks and those who need a simple interface in their budget templates

Blend budgeting into your work breakdown structures with the ClickUp Project Budget with WBS Template. This solution enables you to assign budget values to each project task. It features custom fields for WBS sequences, priority levels, and statuses.

The template’s Budget View provides a clear summary for managers and leads. It helps them assess whether tasks are within budget and understand cost variances.

Ideal for: Complex projects requiring budget visibility aligned with task sequences

The ClickUp Marketing Budget Template is essential for businesses aiming for cost-efficient marketing. Its Timeline View enables teams to follow a precise project sequence, tracking and anticipating all activity expenses. A customizable cost tracker monitors expenses and facilitates resource allocation.

The template’s Campaign-specific Expense View maximizes ROI. Additionally, it tracks marketing goals and impact levels, helping teams optimize their efforts and drive effective results.

Ideal for: Marketing teams aiming for cost-effective and data-driven campaigns

Need to facilitate reimbursements and organize accounting documents? The ClickUp Expense Report Template simplifies it in seconds.

This template enables team members to document essential details like expense types. It has sections for an expense breakdown table, receipt uploads, and approver signatures.

Account planning teams can also easily integrate this template into workflows. This helps route the document to managers for swift approvals.

Ideal for: Businesses with frequent employee reimbursements and operational expenses

➡️ Read More: 7 Free Sales Account Planning Templates

Budgeting clarifies targets and boosts earnings. With the right money management template, the process becomes simpler and more effective.

The 10 Excel templates discussed are a solid starting point for managing financial health. However, Excel’s shortcomings, such as basic visualization and lack of task management, make it less effective.

Comprehensive money management requires task management, reminders, and visualizations—all features at which ClickUp excels. 🌟

So what are you waiting for? Sign up for ClickUp today!

© 2026 ClickUp