Free Cash Flow Projection Templates to Plan Your Finances

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

🔍 Did You Know? 82% of small businesses fail, not because they’re unprofitable, but due to poor cash flow management. Even with booming sales, your business could still run into trouble if you’re not regularly forecasting your cash inflows and outflows.

So, how do you stay ahead of the chaos, plan for slow months, and dodge financial surprises before they hit?

Start with the right cash flow projection template—a high-impact tool that clarifies your financial runway, flags risks early, and helps you make smarter decisions.

Stick with us, we’ve rounded up the best free templates to keep your cash flow in check.

Cash flow projection templates are ready-to-use financial tools that help you forecast how money moves in and out of your business over time. Use them to predict when cash hits your account, when payments go out, and how much liquidity you’ll have at any point.

Think of it as a financial GPS for your business. It gives visibility, reduces guesswork, and strengthens your expense management. Instead of starting from scratch every time, use these templates to:

It’s evident that cash flow templates help you plan smarter, spend confidently, and stay liquid. But what separates a great one from the rest? Your specific needs!

Let’s break it down with a quick summary.

| Template Name | Download Template | Best Features | Visual Format |

| ClickUp Finance Management Template | Get free template | Live dashboards, custom fields, transaction tracking, automations | ClickUp List, Dashboard |

| ClickUp Financial Analysis Report Template | Get free template | KPI tracking, auto-generated charts, benchmarking, comments | ClickUp Doc, Dashboard |

| ClickUp Break-Even Analysis Template | Get free template | Profit/loss scenarios, margin analysis, what-if planning | ClickUp List, Doc |

| ClickUp Sales Forecast Template | Get free template | Pipeline tracking, revenue forecasting, real-time updates | ClickUp List, Board |

| ClickUp Business Expenses and Report Template | Get free template | Daily/weekly/monthly tracking, receipts, audit-ready | ClickUp List, Doc |

| ClickUp Budget Template | Get free template | Budget scheduling, spend prioritization, automation | ClickUp List, Doc |

| ClickUp Balance Sheet Template | Get free template | Version history, review tasks, audit notes | ClickUp List, Doc |

| ClickUp Accounting Operations Template | Get free template | Recurring workflows, deadline reminders, cycle review | ClickUp List, Doc |

| ClickUp Accounts Payable Template | Get free template | Vendor tracking, deadline alerts, automation | ClickUp List, Doc |

| ClickUp Cost Analysis Template | Get free template | Cost mapping, projected vs. actual, inefficiency highlights | ClickUp List, Doc |

| 12-Month Cash Flow Forecast Template by Coefficient | Download this template | 12-month timeline, editable fields, charts/dashboards | Google Sheets, Excel |

| Excel Cash Flow Forecast Template by GTreasury | Download this template | Multi-currency, netting/interest rules, policy compliance | Excel |

| Cash Flow Forecast Template by QuickBooks | Download this template | Real-time sync, auto-calc balances, seasonal flagging | Spreadsheet |

| Cash Flow Forecast Template by Conta | Download this template | Monthly columns, customizable, auto-calculations | Spreadsheet |

| Cash Flow Projection Template by NFF | Download this template | Funding source tracking, grant cycles, compliance | Excel |

A standout cash flow projection template does more than list numbers; it powers your financial strategy. The best ones combine simplicity with functionality, striking the right balance between ease of use and detailed insight.

Here’s what to look for in a template that works in the real world:

📍 Best Practice: Choosing the right template is the start—building a repeatable system around it is where the real payoff begins. It helps you assess progress, stay on top of your month-to-month cash flow, and confidently plan.

Want to optimize your system? Start with these tips on how to organize finances like a pro:

ClickUp for Finance brings it all together: cash flow tracking, budgeting, task management, and team collaboration. This way, you spend less time chasing numbers and more time making them count.

Late client payments? Sudden expense spikes? We’ve all been there.

These cash flow projection templates fit the fast pace of real-world operations—whether you’re balancing freelance gigs, scaling a lean startup, or chasing your next funding round.

Let’s explore our top picks to turn unpredictable cash flow into a clear, confident strategy.

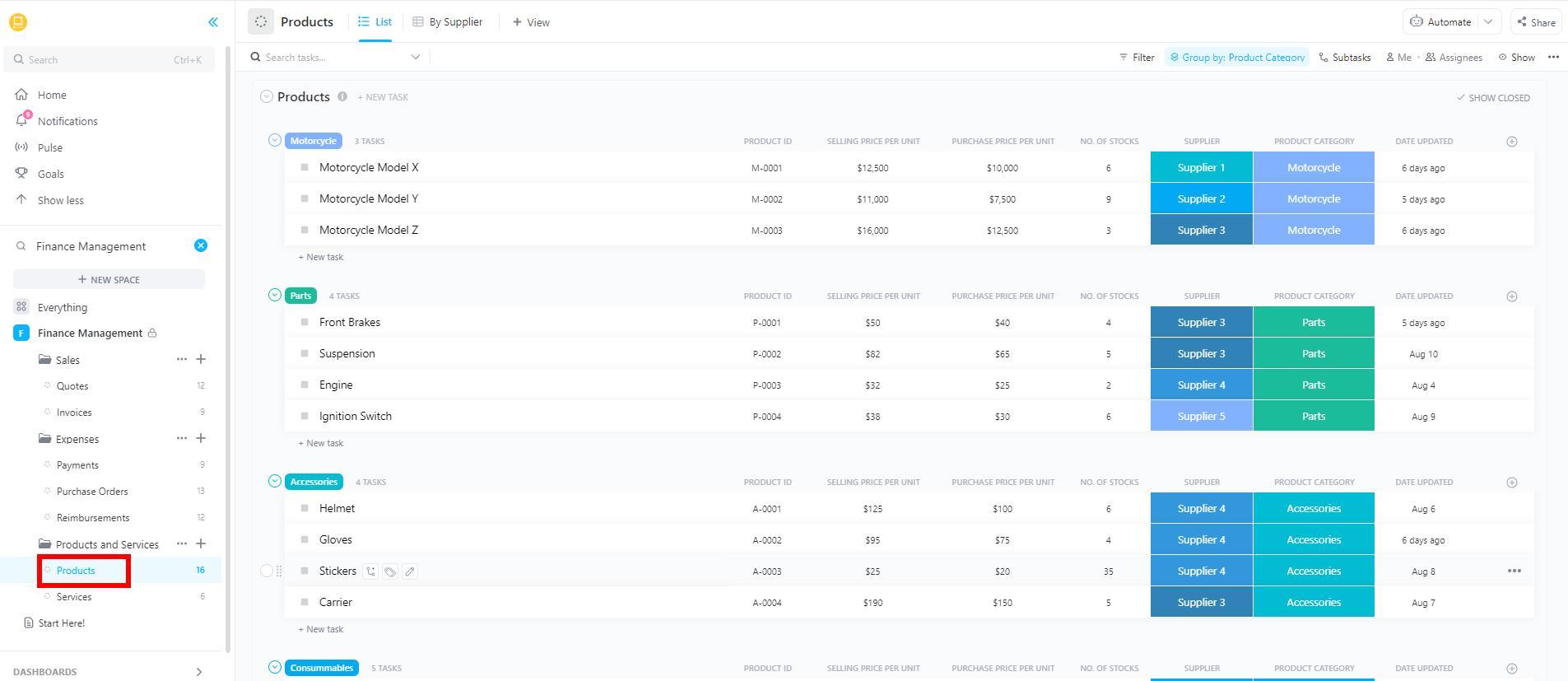

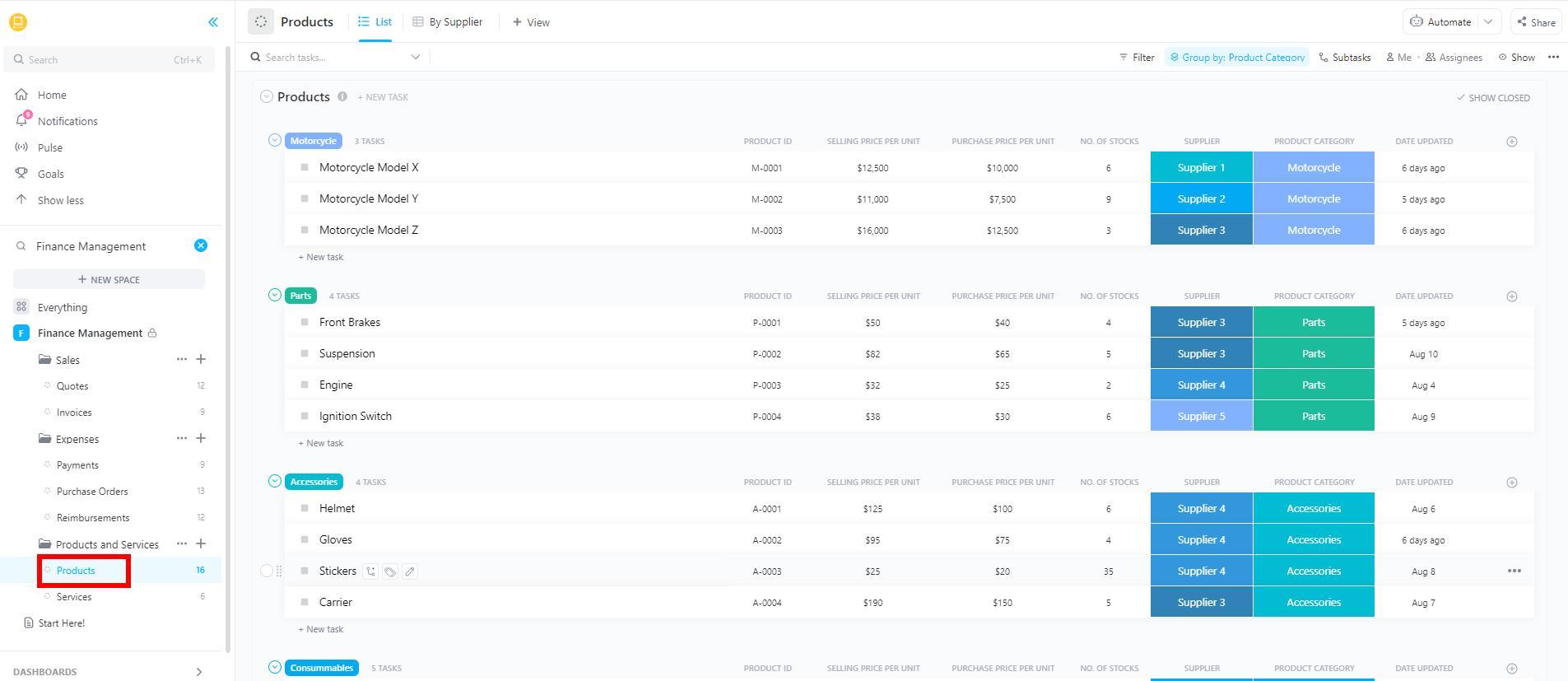

Running a small business means juggling multiple accounts, clients, and cost centers, often without a dedicated finance team. The ClickUp Finance Management Template simplifies the chaos by centralizing everything into one clean, customizable dashboard.

The cash flow template uses Custom Fields to tag transactions, group costs by category, and monitor cash flow by project or date. Set automations to alert your team when cash paid falls short, an invoice goes overdue, or cash outflows exceed budget.

🔑 Ideal for: Founders without a CFO, agencies managing multiple budgets, and startup teams coordinating budget responsibilities.

60% of small businesses that review their financials regularly see higher profitability. But digging through disjointed data and building reports from scratch is a time-killer.

The ClickUp Financial Analysis Report Template allows you to analyze income, expenses, and financial KPIs faster and smarter.

Track trends, compare performance, and auto-generate charts and variance reports without leaving your workspace. Additionally, add comments, assign follow-ups, and export investor (or lender)- ready summaries.

🔑 Ideal for: Small business owners, startup teams, and freelancers who need fast, actionable financial insights without the manual effort.

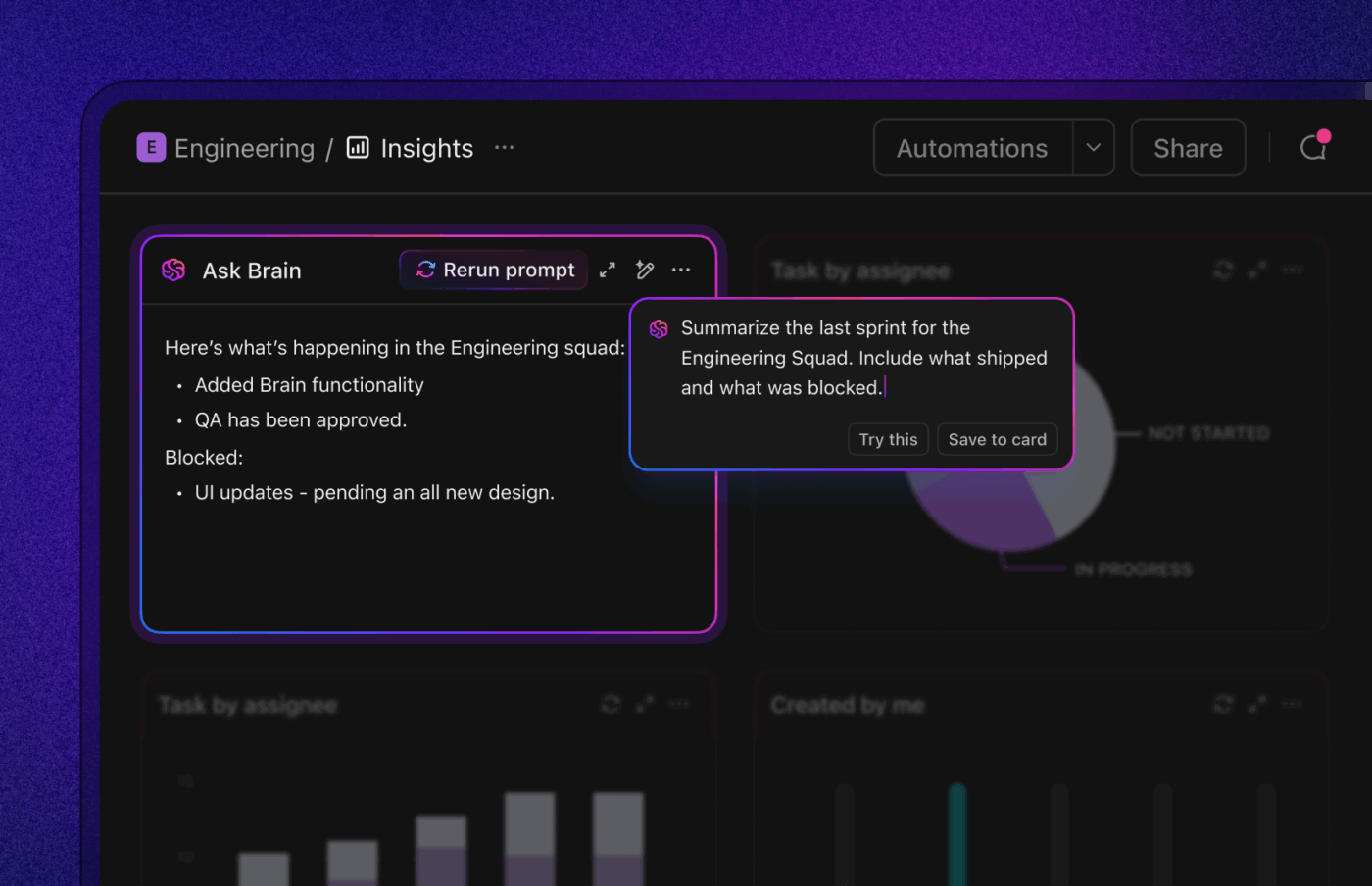

💡 Pro Tip: Simplify your financial review with AI. ClickUp Brain surfaces what matters: cash trends, cost spikes, risks, and high-impact insights. Whether you’re prepping for a review or forecasting, it’s like having a real-time analyst on demand.

Not sure if your pricing is sustainable or scraping by? You’re not alone. This question keeps most founders up at night.

The ClickUp Break-Even Analysis Template is a focused cash flow forecast template built to show exactly when revenue covers costs and when profit kicks in. It allows you to plug in your fixed and variable costs, try different pricing strategies, and test what-if scenarios in one place.

The best part? You can customize views and fields to match your business model and keep insights clear and decision-ready.

🔑 Ideal for: Small business owners and early-stage startups testing new markets, pricing strategies, or figuring out if their business model leads to real profit.

💡 Pro Tip: Block one ‘Cash Flow Day’ each month on your calendar. Use it to update your projections, compare present value vs. forecasts, and tweak your strategy. It’s a simple habit that helps you stay proactive, so cash surprises don’t catch you off guard.

Sales planning isn’t about hitting quotas; it’s about staying ahead of demand, resources, and growth targets. The ClickUp Sales Forecast Template links your pipeline to real outcomes, helping you monitor revenue, deals, and conversion metrics in one place.

Track lead sources, sales targets, and fulfillment costs using Custom Fields. Visualize forecasts by rep, product, or region and tweak assumptions as the market shifts. Everything updates in real time, so your projections always reflect reality.

🔑 Ideal for: Sales directors and revenue operations teams who need to tie sales goals directly to cash flow planning.

➡️ Read More: Free Sales Forecasting Templates in Excel and ClickUp

Here’s how Muhammad Asif Iqbal, Product Manager, Dubizzle Group, has used ClickUp to handle finances effectively:

With finance, we mainly use the boards to manage the requests that have been submitted to us. These go through an internal pipeline within finance and then are transferred to us using buckets that exist on ClickUp. The customizability of these buckets allows us to track them very effectively.

Cash flow problems often start on the expense side. Unexpected costs are one of the biggest financial disruptors for small businesses, and without structured tracking, even the best cash flow projections can fall apart.

The ClickUp Business Expenses and Report Template brings order to the chaos. Track and control your spending in real time so you stay on budget, spot savings, and keep every dollar accounted for.

🔑 Ideal for: Finance teams managing daily expenses, small businesses syncing cash flow projections with real-time spend, and anyone mapping costs to the general ledger.

🧠 Fun Fact: 33.19 million small businesses power 99.9% of the U.S. economy, but most run on tight margins. That’s why cash flow forecast templates aren’t just helpful; they’re the secret weapon for staying afloat and scaling smart.

Managing a growing business means balancing ambition and affordability. The ClickUp Budget Template helps you strike the right balance by providing a flexible, real-time view of your finances.

Break budgets down by team, category, or timeline. Assign owners, set limits, and trigger automations when crossing thresholds. From fixed costs to campaign spend, everything lives in one collaborative space, keeping teams aligned and your cash flow stable.

🔑 Ideal for: Finance managers, operations leads, and cross-functional teams who need to align budgets with cash flow while scaling fast.

➡️ Read More: Free Project Budget Templates in Excel and ClickUp

Your cash flow tells you how money moves, and your balance sheet shows where you stand. The ClickUp Balance Sheet Template gives you a pre-built, customizable layout to track assets, liabilities, and equity without the clutter.

Easily separate current vs. long-term assets and liabilities, add opening balances, and see how your financial position evolves. Use Custom Fields to tag transactions, group by account type, and attach supporting docs where needed.

Best of all? Your ClickUp balance sheet updates as you work, so you always have an updated view of your business’s net worth.

🔑 Ideal for: Accountants, financial analysts, and business owners who need a reliable and dynamic balance sheet integrated with their general ledger.

➡️ Read More: General Ledger Examples & Formats for Accounting

Month-end close, reconciliations, journal entries—project accounting is full of repeatable tasks that demand precision. One delay throws your entire cash flow forecast off track.

The ClickUp Accounting Operations Template keeps things tight and on schedule. From daily logs to quarterly reviews, it turns recurring accounting steps into trackable workflows with assignees, deadlines, and checklists.

Set automated reminders, assign approvals, and keep every stakeholder in sync so nothing slips, your reporting stays clean and clear, and cash flow is aligned.

🔑 Ideal for: Controllers, accounting teams, and finance leads who need structure, accuracy, and speed in project accounting and close operations.

➡️ Read More: Project Accounting Software to Maximize Project ROI

When vendor invoices pile up across emails and spreadsheets, it’s easy to lose track of what’s due until it hits your cash flow. The ClickUp Accounts Payable Template centralizes every invoice, due date, and payment term so you can prioritize outflows.

Customize fields to track vendor contracts, payment cycles, and approval status. Filter by urgency, department, or project to plan payouts around your available cash. With built-in automations and reminders, this cash flow projection template helps you stay in control.

🔑 Ideal for: Finance teams, accountants, and business owners who want tighter AP controls, fewer missed payments, and better alignment between payables and cash flow strategy.

💡 Pro Tip: Closing your books is step one. What you do with that data drives smarter forecasting. The best cash flow projection template uses the right reporting granularity: daily for tight liquidity control, weekly for forecasting your operational runway.

Budget overruns don’t usually come from one big expense; they creep in through small, unchecked costs across teams and timelines. The ClickUp Cost Analysis Template helps you catch them early.

Use it to track every cost line by project, department, or initiative. Compare projected vs. actual spending, evaluate ROI, and surface underperforming areas in real time.

Whether you’re planning next quarter’s spending or justifying a new investment, this cash flow projection template gives you the visibility you need.

🔑 Ideal for: Financial analysts, project managers, and business owners seeking a comprehensive view of costs and benefits to drive strategic decisions.

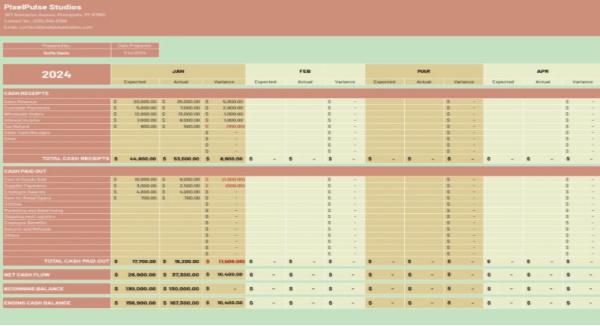

Looking to map out your monetary movement for the year, without complex tools or a steep learning curve? This 12-month Cash Flow Projection Template from Coefficient offers a clear, spreadsheet-based way to plan your income and expenses month by month in Google Sheets or Excel.

The cash flow projection template is ideal for teams that need long-term visibility but want to avoid building from scratch. With editable categories, automatic calculations, and integrated charts, it helps you simplify cash flow projections while keeping reports accurate and shareable.

🔑 Ideal for: Founders, finance teams, and small business owners who want a no-frills way to monitor and forecast adequate cash flow over the next 12 months.

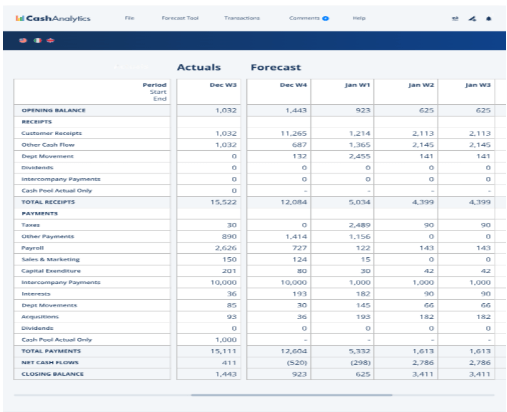

Need more structure for your high-volume financial operations? This Excel-based Cash Flow Project Template is built for precision. It lets you map actual vs. forecasted inflows and outflows on a weekly or monthly basis, giving you full financial visibility over time.

Easily adapt it to your internal reporting requirements, whether you’re tracking tax liabilities, intercompany transfers, or dividend schedules. It’s flexible, formula-ready, and designed for teams that live in spreadsheets but demand enterprise-level clarity.

🔑 Ideal for: Corporate teams, finance controllers, and enterprises that need a tailored, policy-compliant Excel-based cash flow template.

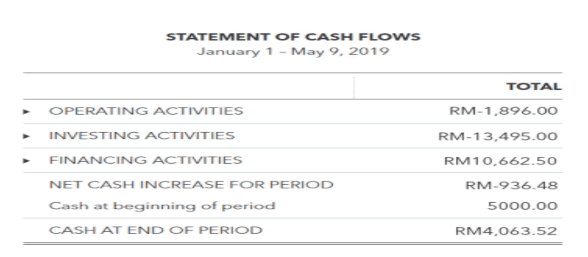

If you’re already using QuickBooks Online, this Cash Flow Forecast Template completes your forecasting. It automatically pulls profit and loss and balance sheet data, generating a forward-looking view based on real trends.

No manual data dumps. Just a clean, spreadsheet-style layout that flags runway gaps, seasonal shifts, and cash shortfalls before they catch you off guard.

🔑 Ideal for: Small business owners and bookkeepers already using QuickBooks who want quick, built-in cash flow forecasting without switching tools.

➡️ Read More: How to Use AI in Accounting (Use Cases & Tools)

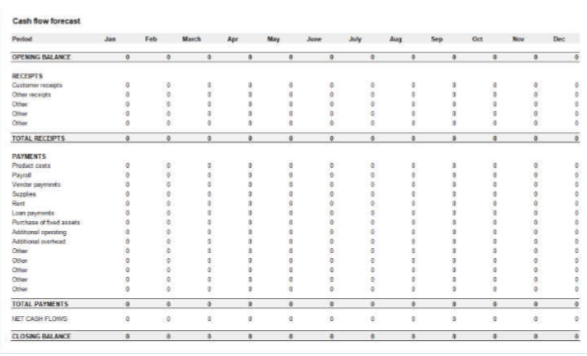

Freelancers and solo operators need a no-frills tool to track incoming invoices and recurring expenses. This Cash Flow Forecast Template from Conta offers a practical, monthly layout that makes it easy to map out invoices, retainer payments, and recurring expenses in one view.

With editable fields and built-in calculations, short-term cash planning is more predictable, even without a dedicated finance team.

🔑 Ideal for: Solopreneurs, consultants, and solo business owners who need a simple, reliable way to stay cash-positive month by month.

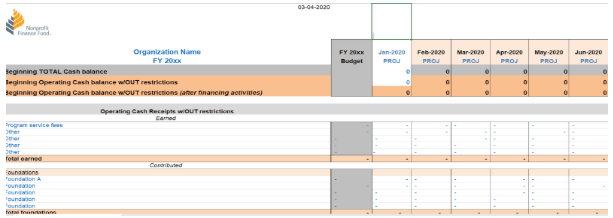

Running a nonprofit often means managing tight cash flow, complex funding streams, and time-bound grants, all while staying focused on your mission. This Excel-based Cash Flow Projection Template from NFF is purpose-built to help nonprofits plan and remain sustainable.

It offers a clear monthly view of income, expenses, and available cash, segmented by funding source and restriction type. Whether you’re awaiting a grant disbursement or mapping spending to a program timeline, it keeps your finances forecast-ready.

🔑 Ideal for: Nonprofits, foundations, and community orgs that need a reliable cash flow template to plan around variable funding and stay mission-aligned.

🔍 Did You Know? MSMEs in the U.S. software industry are 1.7x more productive than peers in other advanced economies due to strong capital, talent, and customer ecosystems built around large firms. It’s a reminder that even small teams can punch above their weight, especially when they back great ideas with strong cash flow planning.

Cash flow isn’t just a metric—it’s a necessity for your business. The right cash flow projection template turns uncertainty into strategy, giving you the clarity, control, and reliability to make smarter financial moves.

ClickUp gives you all-in-one visibility, from budgets and expenses to automated workflows and approvals. The best part? ClickUp’s Free Forever Plan lets small businesses and solopreneurs access these powerful tools without stretching their budgets.

✅ Try ClickUp for free—plan smarter, move faster, and keep your financial planning clear!

© 2026 ClickUp