Top Retirement Planning Spreadsheet Templates for Effective Budgeting

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Retirement can mean enjoying the rewards of your hard work by relaxing and fulfilling your long-deferred dreams now that you have the time.

Some may see retirement as the power to choose to work instead of seeing it as a compulsion. Either way, early retirement planning is the best way to ensure your golden years are filled with financial stability.

Despite this, only 36% of US adults feel that their retirement plan is on track.

The solution? Retirement planning templates. They’re ready to use, so you can start your plan instantly. They simplify your retirement strategy and help you manage how you build your savings.

To begin, we’ll cover 7 templates that you can apply to spreadhseets. Then, we’ll do you one better and introduce a few ClickUp templates that will take your retirement planning up a notch.

Let’s go!

Here are the top six spreadsheet templates you can use to start planning your retirement:

ClickUp simplifies retirement planning with task tracking, automation, and collaboration—way better than traditional tools. Here are the 8 templates:

Before reviewing top templates, here’s what all effective retirement planning spreadsheet templates should offer:

🎯 Bonus: Need a smooth employee transition and handover? Check out these 10 succession planning strategies (with templates!). 📝

With these key elements in mind, here are the top six spreadsheet templates for retirement planning:

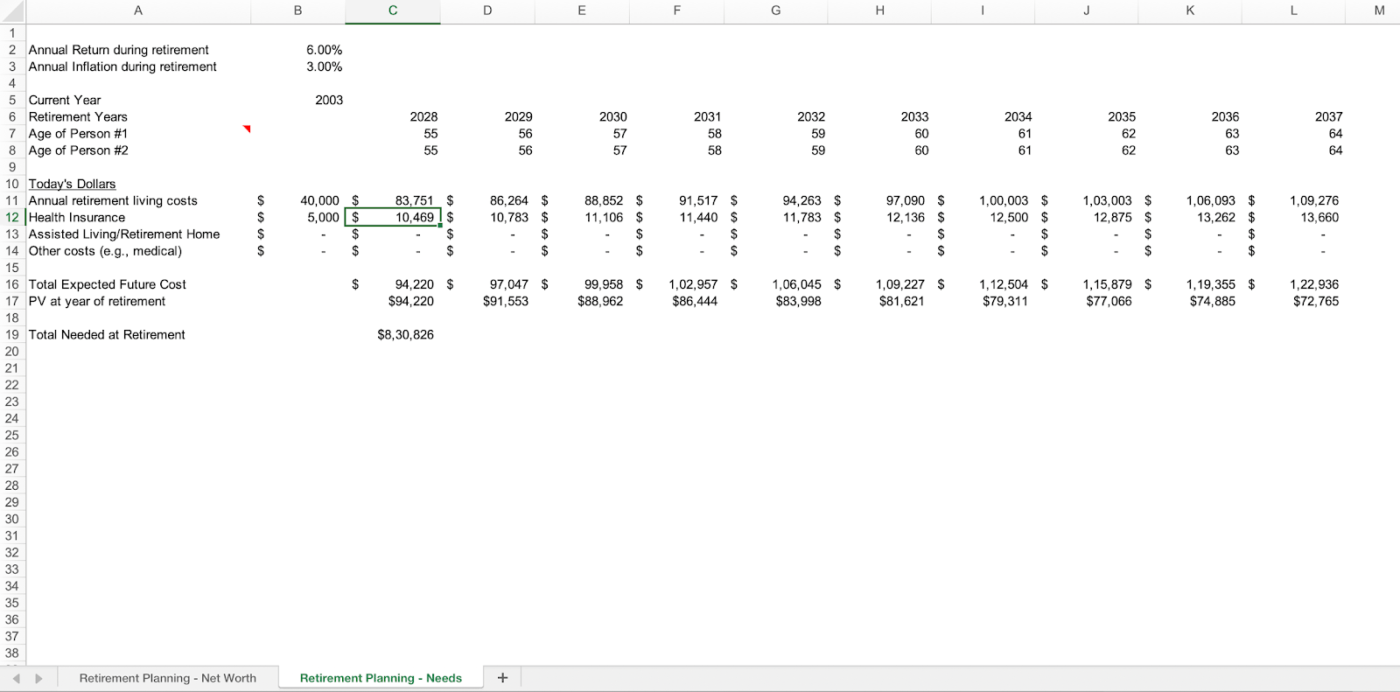

The Yearly Retirement Plan Template by Excel Templates is designed for logical retirement planning through two key worksheets.

The needs worksheet estimates retirement needs, covering health insurance, living costs, and inflation. The second worksheet projects net worth using assumptions on returns, contributions, and tax deductions. This sheet also visualizes salary changes and net retirement values.

🌟 Ideal for: Calculating annual retirement needs and focusing on detailed net worth projections over time.

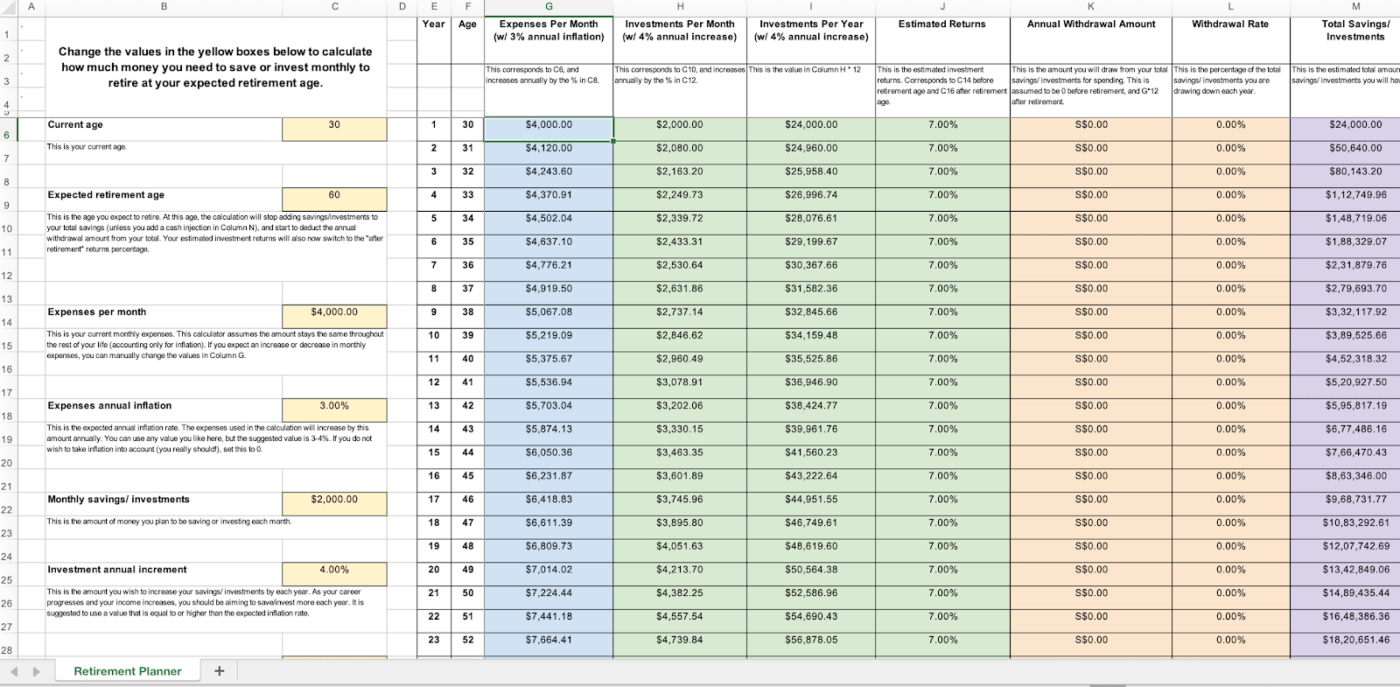

This Reddit User’s Retirement Planner Spreadsheet Template is perfect for assessing your savings. The template comes in a single worksheet, making everything easy to access.

It includes fields for age, monthly investments, current savings, and retirement age. Once you enter this information, the colorful columns on the right reflect your savings growth over time. The template has details for each cell and column to clarify the data flow.

🌟 Ideal for: Simple retirement savings projections with minimal data entry.

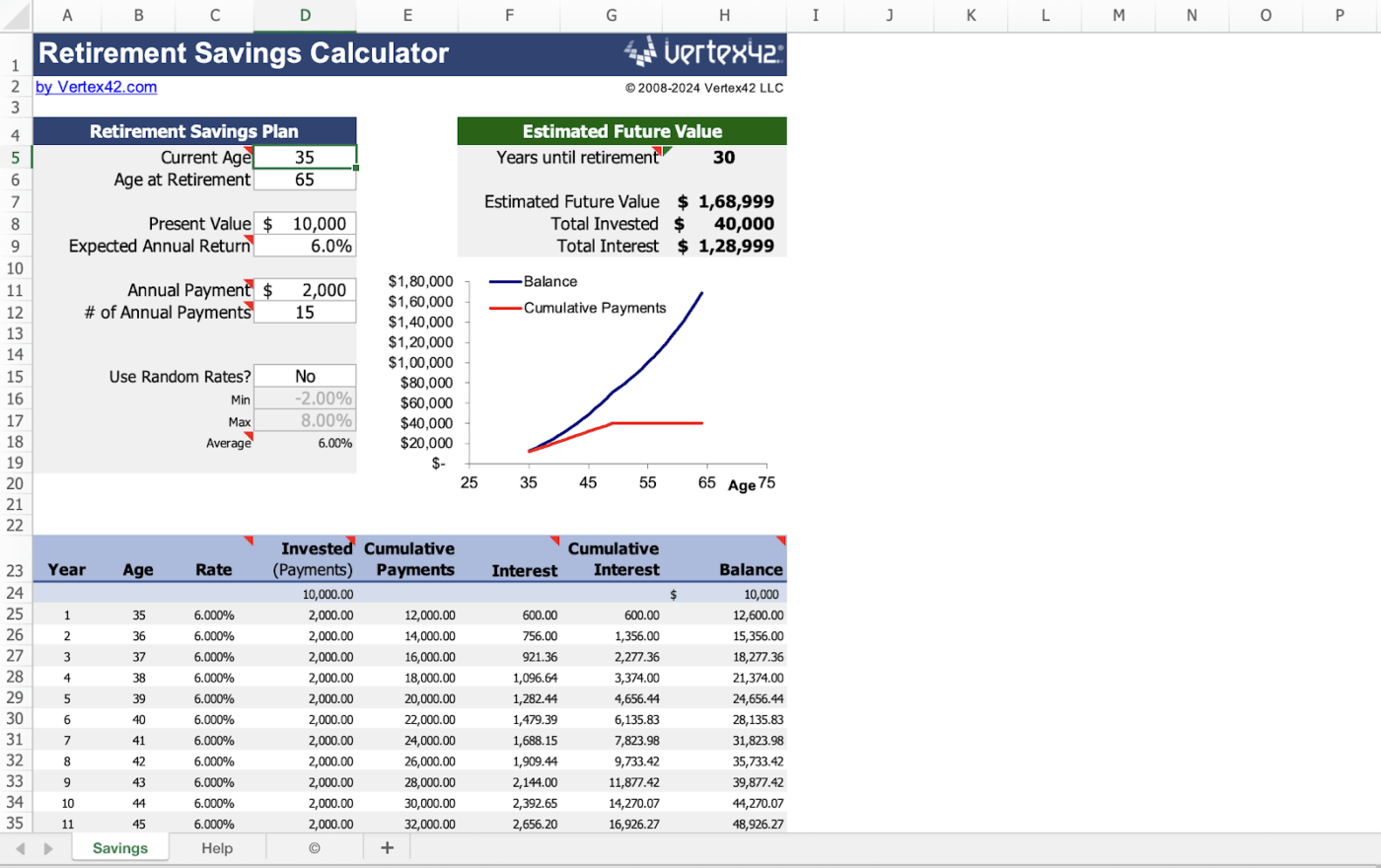

The Retirement Savings Calculator Template by Vertex42 combines quick visualizations with detailed calculations. It accepts inputs like goals, interest rates, and annual payments to generate a line graph and table showing how your balance and dues develop.

The template comes with a summary that displays balance years and your investments’ estimated future value. The Help worksheet clears up doubts if the solution gets difficult to understand.

🌟 Ideal for: Professionals who want a visualization of retirement savings and who prefer quick access to adjusting details like interest rates.

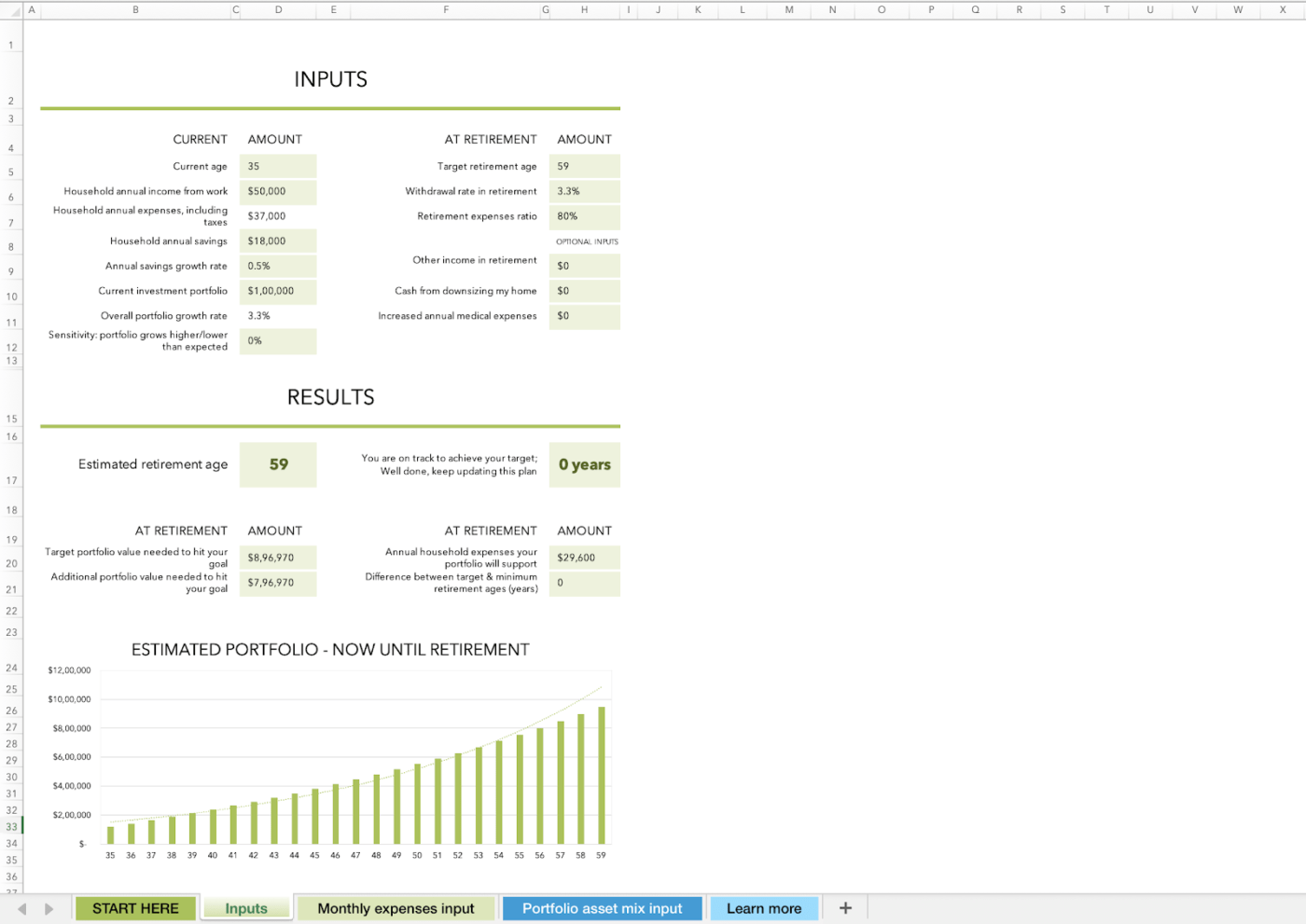

The FIRE Estimator Template by Microsoft facilitates the Financial Independence and Retire Early (FIRE) lifestyle through three key worksheets.

The first worksheet tracks monthly expenses like housing, loans, transportation, and food. The second one calculates overall portfolio growth rates for assets like cash, stocks, and bonds.

The Input sheet ties it all together with its simple retirement calculator, which reviews your goals, expenses, and assets. The template confirms the estimated retirement age and final portfolio value.

🌟 Ideal for: Individuals planning an early retirement with detailed expense and growth tracking.

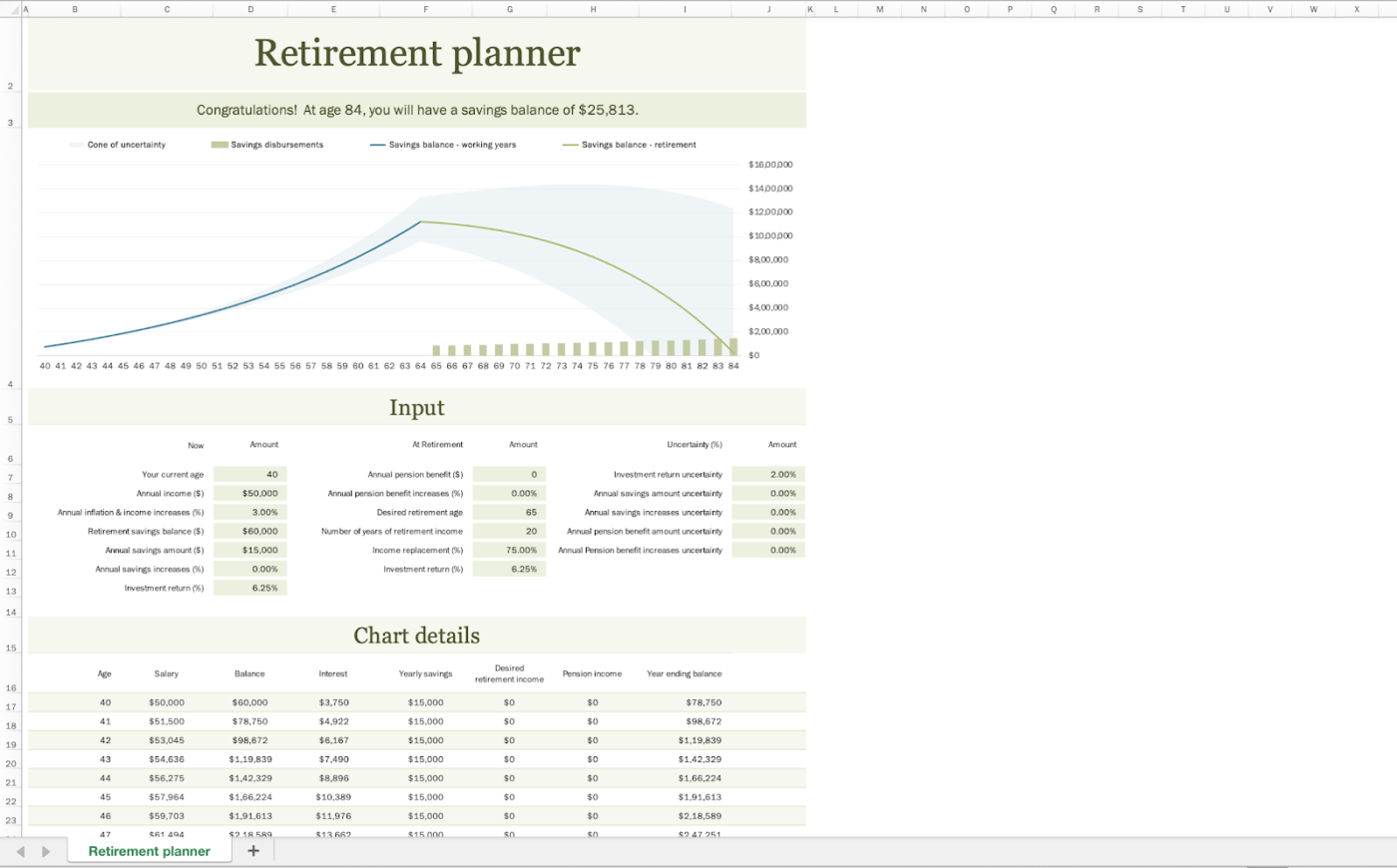

Looking to plan your post-retirement income? Microsoft’s Retirement Financial Planner Template is a simple and effective option.

In addition to retirement goal details, this template maps your expected income, disbursement years, and income replacement rate after retirement. It also lets you map the risk of investment returns.

Its table lists savings, interest, retirement income, and year-end balance to review growth and savings rates. The template’s detailed combination graph visually tracks expected trends, risks, and uncertainties.

🌟 Ideal for: Mapping consistent post-retirement income and the factors affecting it.

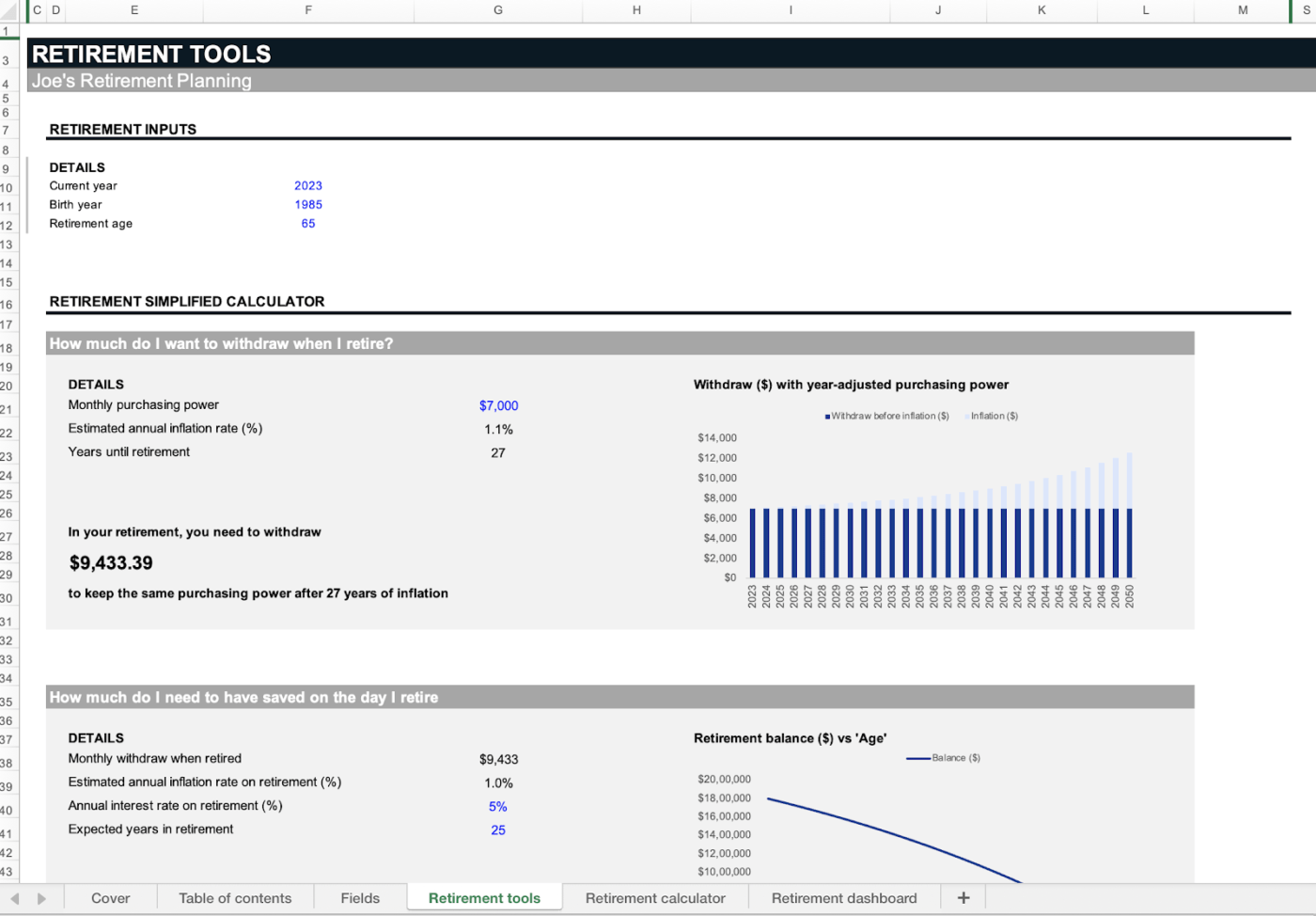

YouExec’s Personal Retirement Planner Template is an interactive retirement planning spreadsheet. It includes a table of contents for easy navigation and a field sheet to add names and estimated inflation rates.

With birth year, retirement age, and a few key inputs, the template instantly generates ideal withdrawal amounts and required savings. The insights are displayed in clear lines and bar graphs.

The template features a detailed retirement calculator covering income, withdrawal fees, and 401(k) details that the dashboard sheet converts to customizable insights. Bonus? It’s available in both Microsoft Excel and Google Sheets.

🌟 Ideal for: Teams and professionals needing basic retirement tools and customizable dashboards on a spreadsheet interface.

🎯 Bonus: Explore the 15 best Excel budget templates if you are looking for spreadsheet-style budgeting solutions that help you plan out your retirement savings seamlessly. 🗂️

Sure, Google Sheets computes data sets and simplifies insights, but using the tool has its limitations.

Here are a few drawbacks of this spreadsheet solution:

With Google Sheets’ evident limitations, looking for alternatives is essential. Retirement planning naturally has a project element that requires much of what spreadsheets lack.

In terms of long-term goals or project management, ClickUp is most likely the best choice you’ll find.

Want a breakdown of why ClickUp is a superior choice? Here’s a quick comparison:

| Feature | Google Sheets/Excel | ClickUp |

|---|---|---|

| Task Management | ❌ Not built for task tracking. No scheduling features for retirement goals. Lacks notification features | ✅ Built-in task management. Schedule specific retirement planning actions. Automated reminders feature |

| Automation | ➖ Limited to basic formulas and manual adjustments | ✅ Has a dedicated AI tool, ClickUp Brain, for simulations, automated summaries, and task status changes |

| Scenario Planning | ❌ Complex setup for “what-if” scenarios and has limited flexibility | ✅ Scenario planning with customizable workflows and templates to test various retirement plans |

| Collaboration | ➖ Basic real-time editing | ✅ Collaborative tools with tagging, messaging, commenting, and task assignments. Features live editing, ideal for co-planning retirements |

| Visual Dashboard | ➖ Basic charts, no project-based view | ✅ Rich dashboards for goal tracking and intuitive progress visualization |

Clearly, ClickUp is more comprehensive than Excel or Google Sheets for budgets, finance planning, or securing your future.

So, let’s explore a few ClickUp retirement planning templates that may suit your requirements better.

Want to get a head start on your retirement finances? The ClickUp Retirement Finance Management Template is a solution for every person. This template includes organized lists to simplify managing retirement funds.

The assets folder tracks your retirement accounts, investment values, and growth, simplifying real-time monitoring of your portfolio and savings.

The expenses folder manages essential costs, such as healthcare, insurance, living expenses, and other recurring bills. It even has reminder features to ensure timely payment.

🌟 Ideal for: Those looking for comprehensive yet segmented sections to map retirement finances.

The ClickUp Retirement Goal Setting Template is a powerful solution for confident and focused retirement planning. It starts with a dedicated form to help create specific, measurable, and aligned retirement objectives.

Each goal is instantly visualized in structured tables for easy progress tracking.

The template provides detailed views of objectives, milestones, and actions to help assess aspects such as ideal retirement age and financial health. It maps each retirement goal’s effort to prioritize and focus on achieving it.

🌟 Ideal for: Setting and visualizing retirement goals with built-in task management.

The ClickUp Retirement Checklist Template is an all-purpose document that maps every aspect of retirement.

The template starts with a list of your post-retirement financial and non-financial goals. This page records anything that needs savings, from road trips to pension plans.

The template connects finance planning with bucket list desires, hobbies, and travel destinations. Its finance page records salary details, current financial positions, and cash flow analysis.

🌟 Ideal for: Organizing retirement goals, activities, and financial needs in one place.

Reviewing how financially ready you are to retire? The ClickUp Retirement Gap Analysis Template provides a visuals-first approach to actionable insights.

With its canvas-style layout, this whiteboard template displays your current finances alongside retirement goals. It also has data fields dedicated to recording any gaps and action plans.

Want to add details for better insights? The template has ample space for adding tables or reports, like account information or portfolio value projections.

🌟 Ideal for: Prioritizing action plans for any gaps in their retirement readiness.

💡 Pro Tip: Explore how to organize your finances if you’re looking to improve the structure and flow of your financial plans and records for a better retirement plan. 📊

The ClickUp Retirement Budget Plan Template is perfect for keeping retirement finances straightforward. It includes custom views focused on budget summaries, income sources, and expenses, and it even has a getting-started guide to improve usability.

The income view maps savings, while the expense view informs you of ongoing and post-retirement costs. This allows you to create budgets that align with your desired retirement lifestyle.

🌟 Ideal for: Those looking to manage both monthly finances and retirement budgets with real-time deviation tracking.

💡 Pro Tip: Explore the top 10 monthly budget templates to optimize your month-on-month finances so you can retire stress-free with balanced budgets. 💸

Manage your retirement budget effortlessly with the ClickUp Personal Retirement Budget Template.

The template keeps you on top of your personal goals, retirement savings, and expense payments by category. It includes a detailed guide and video for new users to kickstart their budgeting journey.

Track your retirement contributions and planned withdrawals in calendar format. It comes in a task list view for comparing retirement budgets, actual expenses, and remaining balances, perfect for distinguishing between fixed and variable costs.

🌟 Ideal for: Those focusing on achieving a personalized and specific lifestyle during retirement.

ClickUp Retirement Financial Analysis Template is a one-page document that helps devise retirement strategies. The template covers seven clear sections detailing every element of the strategy, including investment essentials, risk analysis, and results status.

The solution presents stunning bar graphs for cash flow analysis, liquidity ratios, and debt levels. The template equips users with a description of what each section means for informed and effective retirement plans.

🌟 Ideal for: Conducting in-depth financial analysis and improving retirement readiness and fund management.

Looking to incorporate retirement milestones and strategies into future finances? ClickUp’s Retirement Roadmap Whiteboard Template is a powerful solution. This template presents key data fields on a vibrant canvas, making retirement planning engaging and organized.

Each milestone is displayed across month-by-month phases, helping you prioritize retirement goals. The template allows instant task creation from any element on the canvas, simplifying action steps.

Whether for brainstorming, planning, or communication, it transforms retirement planning into a clear, actionable strategy.

🌟 Ideal for: Those who need a visual roadmap for retirement. Also great for professionals wanting to efficiently achieve their retirement goals, timelines, and financial checkpoints.

🎯 Bonus: Is someone on the team moving away or retiring? Check out farewell messages for colleagues to make their last day memorable.🧵

With sound retirement planning, you can secure all your goals and dreams for when you finally decide to stap away from full-time work.

Getting the right tool is a great way to simplifying something so crucial. With the ready-to-use spreadsheet templates we’ve covered in this guide, you can create your retirement plan in no time

But are spreadsheets the right fit for your dreams and needs? Perhaps. But their limitations in analytics, insights, and adaptability make them cumbersome.

That’s where ClickUp helps with its dedicated task management, automation, and AI-powered insights. Its templates are a great partner for retirement strategy and a much better choice for securing your future.

Sign up with ClickUp today!

© 2026 ClickUp