AI for Private Equity: How to Transform Private Equity With AI in 2026

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

You’re under constant pressure to deploy capital, but it seems impossible to move beyond manual work.

Deal timelines are shrinking, competition for quality assets is fierce, and your team is spending more time on administrative tasks than on actual value creation. It feels like you’re always playing catch-up.

According to a 2024 Bain & Company survey, 87% of private equity firms now view AI as critical to maintaining competitive advantage. Yet most are still drowning in the same manual workflows that existed a decade ago.

This blog walks you through how AI transforms every stage of the PE investment lifecycle. From deal sourcing and due diligence to portfolio management and exits, you’ll learn how to implement it in your firm without adding more tools to your already bloated tech stack.

Private equity firms are turning to AI primarily because the fundamentals of the industry have shifted.

Deal velocity is increasing to begin with. And the competition for quality assets is intensifying, and the amount of information required to underwrite, operate, and exit investments has exploded.

What used to be manageable with spreadsheets, email threads, and manual analysis now strains even the most disciplined teams. Investment professionals are expected to evaluate more opportunities than ever in record time, while delivering deeper diligence and supporting portfolio companies more actively.

At the same time, LPs are pushing for faster deployment as well as greater transparency into performance.

AI becomes relevant here not as a replacement for judgment, but as leverage. The logic is simple; it helps firms stay ahead in competitive processes without sacrificing rigor.

Market forces are making this shift urgent:

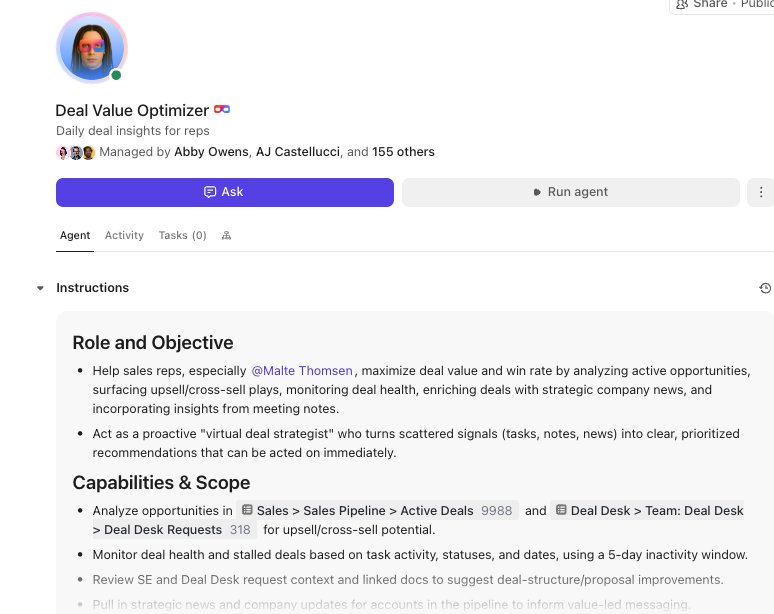

💡Pro Tip: Private equity work doesn’t slow down when people get busy. Super Agents act as always-on execution partners, monitoring deal and portfolio activity in the background and stepping in when attention is needed.

An agent can flag stalled diligence tasks, surface missing inputs before IC meetings, summarize portfolio performance shifts, or escalate risks when value creation initiatives drift off plan. Instead of relying on manual follow-ups and status checks, teams get proactive signals and actions that keep momentum intact. For PE firms, Super Agents help ensure execution aligns with intent across deals, portfolios, and reporting cycles.

The private equity investment lifecycle breaks down into four distinct phases, each with its own unique data challenges and decision points.

At every stage, AI augments your judgement, filtering out the noise so your team can focus on making the best possible decisions. Let’s walk through how the digital transformation strategy unfolds in private equity.

Finding the right deal often feels like searching for a needle in a global haystack. And by the time you identify a promising target, you could already be steps behind more tech-savvy competitors.

AI can act as your tireless, 24/7 analyst, transforming this process from manual labor to intelligent filtering. It continuously scans vast amounts of public and proprietary data to surface potential targets that perfectly match your value proposition and investment thesis.

The real advantage here is pattern recognition. AI can identify companies showing early signals of growth, distress, or strategic fit that a human analyst might easily overlook when reviewing hundreds of opportunities.

💡Pro Tip: Stop the endless cross-referencing between spreadsheets and databases.

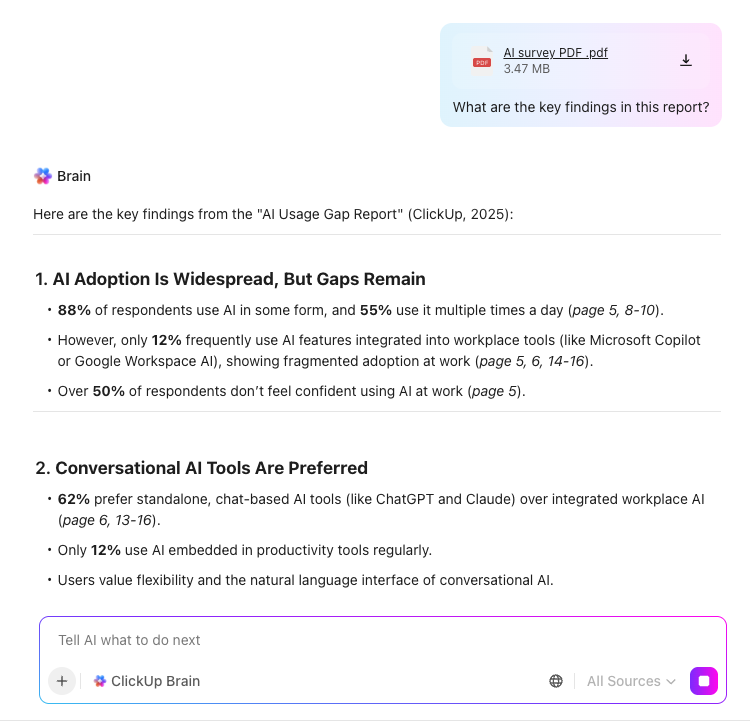

Ask questions in plain English and get immediate answers from your connected workspace data with ClickUp Brain. Imagine asking, “Which companies in our pipeline fit our B2B SaaS thesis and have ARR between $10M and $25M?” and getting a curated list in seconds.

There’s always that moment when the data room opens, and the clock starts ticking. Suddenly, your team is drowning in thousands of documents—contracts, financial statements, board minutes, and operational reports.

The pressure to conduct thorough due diligence and uncover any red flags is immense, requiring a robust portfolio risk management approach, but the sheer volume of information makes it a monumental task.

This manual review process is not only slow but also dangerously prone to human error.

A critical liability clause buried in a contract or a subtle anomaly in the financials can easily be missed. Worse, different team members focus on different areas, leading to a fragmented understanding of the investment, and crucial diligence findings often get lost in email chains, never to be seen again after the deal closes.

AI tools for private equity can instantly summarize lengthy reports, automatically extract key terms and obligations from contracts, and flag unusual patterns in financial data. This allows your team to focus attention where it’s needed most.

When a deal is closed, the real work of AI value creation begins. But trying to track the 100-day plan and ongoing operational improvements across your entire portfolio requires strong portfolio management and can feel like an impossible task.

Instead of relying on static, quarterly board decks to understand performance after the fact, AI continuously processes operational data as work happens. It aggregates updates, tracks progress against KPIs, and surfaces early signals that would otherwise be buried in weekly reports or missed entirely.

Without this layer of intelligence, firms are forced to manage in the rearview mirror. By the time an issue surfaces in a board meeting, it has often been affecting performance for weeks or months. There’s no reliable way to see, in real time, how value creation initiatives are tracking across the portfolio or where leadership attention is needed most.

More importantly, AI helps interpret the signal, not just display the data. Patterns such as stalled initiatives, missed milestones, or recurring blockers become visible early, enabling proactive intervention. This shifts your role from passive observer to active partner. You can spot risks before they become material problems, identify best practices across the portfolio, and make timely, informed decisions that accelerate growth and drive EBITDA improvement.

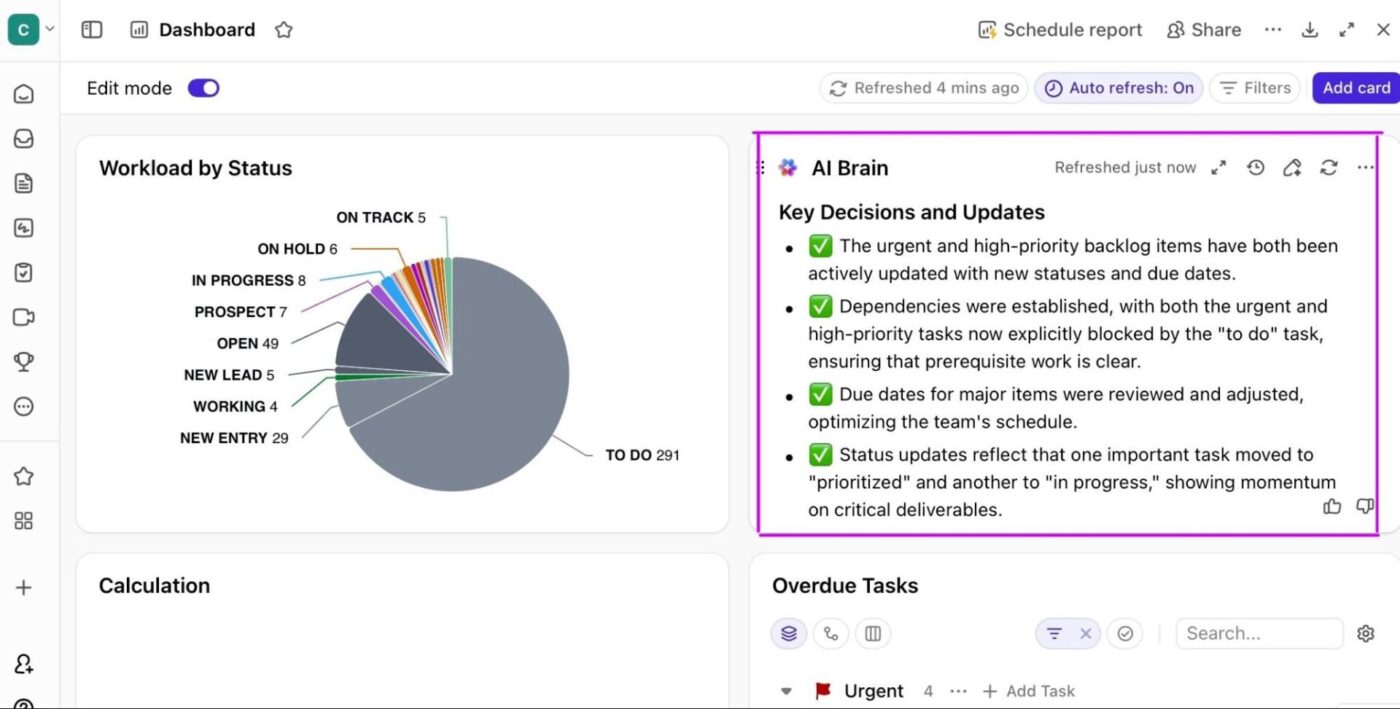

💡Pro Tip: In ClickUp Dashboards, AI Cards surface these insights automatically.

They summarize portfolio-wide execution, highlight stalled initiatives, flag risks, and answer questions like “What’s blocking growth right now?” or “Which companies are falling behind plan?” without manual analysis. As teams update their work, AI Cards continuously refresh these insights, giving you a living view of portfolio health.

Here’s how leaders at ClickUp use them:

As buyers begin diligence, teams are often forced into reconstruction mode. They often scramble to piece together years of operational history, performance data, and decision context from fragmented records and institutional memory.

This slows the process, introduces risk, and distracts from higher-value work like refining the equity story, preparing management, and engaging the right buyers.

AI enables continuous documentation and synthesis of execution, performance, and outcomes as they happen. That means the story of value creation is already there when buyers ask for it.

At exit, AI acts as an accelerator. It helps surface relevant history quickly, summarize multi-year performance trends, and draft first-pass responses to common diligence questions based on documented facts. The investment team remains fully in control of positioning and messaging, but no longer wastes time hunting for proof to back it up.

The result is a more disciplined exit. Fewer surprises, clearer narratives, and more time spent on activities that actually influence valuation—rather than on rebuilding the past under pressure.

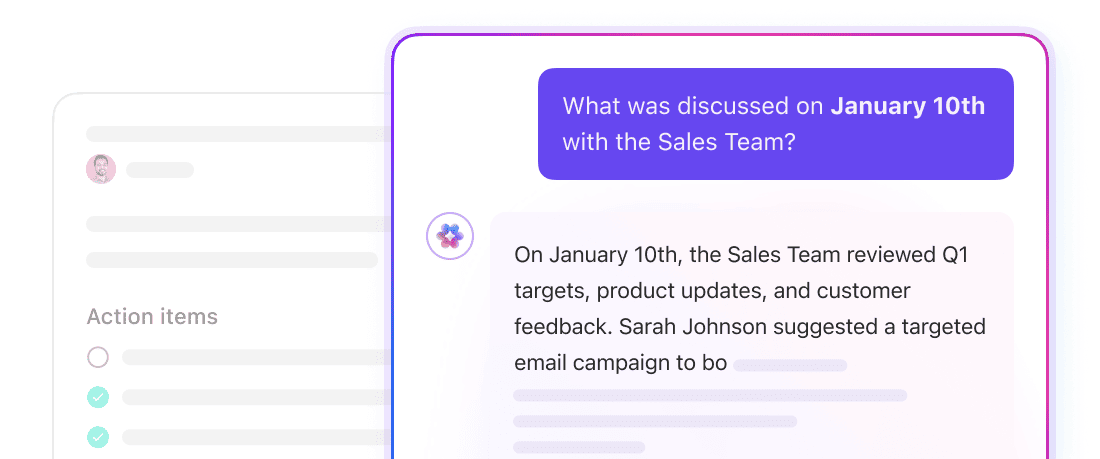

🎥 Here’s how AI-powered knowledge retrieval works in practice!

Your firm is an expert at optimizing other businesses, but your own internal operations are often stuck in the past. That invaluable institutional knowledge from a decade of deals walks out the door when a senior partner retires.

This operational drag makes your firm inefficient. It means reinventing the wheel on every new deal, frustrating investors with slow and inconsistent reporting, and risking burning out your top talent on low-value work.

Many firms try to solve this with a patchwork of different private equity tools, but this only creates AI sprawl—the unplanned proliferation of AI tools with no oversight or strategy, leading to wasted money, duplicated effort, and security risks.

Bring your deal pipeline, portfolio management, and internal firm operations into one unified platform with ClickUp, the world’s first converged AI workspace.

Its native AI assistant, ClickUp Brain, becomes a true force multiplier, working across all your tasks, documents, and communications to break down information silos. All you need to do is mention @Brain and ask your question!

And that’s not all. Here’s how ClickUp centralizes your operations:

In a PE firm, the most valuable knowledge is created in real time: during diligence calls, IC debates, operating reviews, and board meetings. The failure point isn’t insight. It’s those decisions, rationale, and context that rarely get captured cleanly while they’re happening.

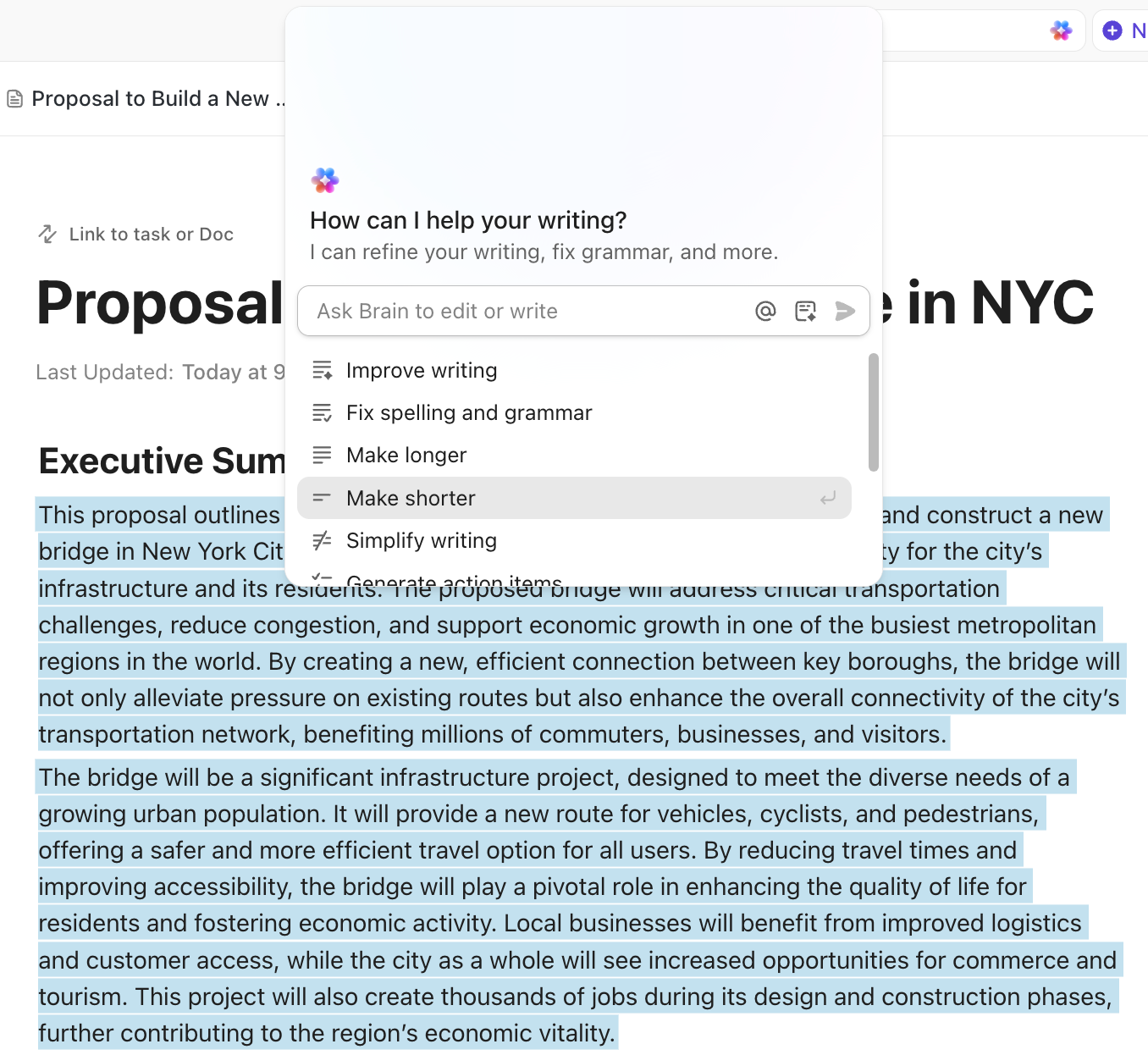

ClickUp fixes this by embedding documentation directly into execution. ClickUp AI Notetaker captures meeting discussions automatically, turning calls into structured notes, decisions, and action items in ClickUp Docs tied to the relevant ClickUp Task for a deal or portfolio company.

Instead of relying on memory or scattered notes, the firm builds an accurate record of what was decided and why as decisions are made.

Over time, this becomes institutional memory you can actually use. Further, with Enterprise Search, teams can instantly retrieve past IC decisions, diligence findings, or operating insights across Docs, tasks, meeting notes, and connected tools. When a new deal enters diligence, teams don’t start from scratch. They pull forward relevant precedent in seconds.

LP reporting becomes painful when it’s disconnected from day-to-day execution. Teams spend weeks chasing updates, reconciling numbers, and reconstructing narratives long after the work occurred.

In ClickUp, reporting starts upstream. Portfolio initiatives, KPIs, and operating plans are tracked as work progresses. Dashboards in ClickUp reflect real-time execution across companies, ensuring that key insights are captured consistently instead of disappearing into personal notes.

When reporting time arrives, ClickUp Brain uses this live, structured data to draft first-pass LP updates, summarize performance changes, and explain variance in plain language. Because the underlying execution data and meeting context already exist, teams review and refine rather than assemble from scratch.

The workflow shifts from reactive reporting to continuous visibility, reducing surprises and freeing senior teams to focus on investor relationships.

Deal teams lose a lot of time rebuilding context. Writing memos from scratch, summarizing meetings manually, digging through email threads, and searching across tools all slow momentum and introduce risk.

ClickUp collapses this friction into a single workflow with AI. ClickUp Brain accelerates execution on top of that foundation. It generates first drafts of memos, summarizes long threads, and surfaces relevant prior work directly inside the task or document where decisions are being made. Teams move forward with full context instead of retracing steps.

The result is fewer dropped threads, faster handoffs, and more time spent on judgment-heavy work: evaluating risk, shaping strategy, and working with management teams to drive returns.

With a converged platform, your firm starts to operate as efficiently as the market-leading companies you invest in. 🙌

You’re intrigued by the promise of AI, but you’re also rightfully cautious. You’re worried about the security of your highly confidential deal data, the quality of your firm’s existing information, and whether your seasoned, successful partners will even agree to use a new tool.

These are valid concerns, and ignoring them is a recipe for failure.

Inaction is also a risk. While you’re weighing the options, your competitors are getting faster and smarter by adopting AI—86% of PE leaders have already integrated generative AI into their M&A workflows.

However, rushing to adopt the wrong tool without considering the risks can create even bigger problems, like data breaches or flawed, AI-driven decisions.

| Risk area | Why it matters in private equity | What to look for |

|---|---|---|

| Data security and confidentiality | Deal data, IC discussions, and portfolio information are extremely sensitive. Any risk of proprietary information being used to train external AI models or handled insecurely is unacceptable in a PE context. | Enterprise-grade security with SOC 2 compliance, strict access controls, and encryption of all customer data both in transit and at rest, as outlined in ClickUp’s security and platform architecture |

| Data quality and integration | AI is only as good as the data it can access. Fragmented deal data, inconsistent portfolio metrics, and disconnected documentation lead to unreliable outputs and flawed analysis. | A converged workspace that centralizes execution data before automation. Pair this with structured analysis practices like a formal gap analysis to identify where data quality breaks down |

| Adoption and change management | Even the best AI fails if deal teams don’t use it. Forced workflow changes or unclear value quickly lead to resistance, especially among senior professionals. | AI embedded directly into existing workflows, supported by intentional rollout and training using a clear change management checklist |

| Over-reliance and judgment erosion | Investment decisions require experience, pattern recognition, and nuance. Over-delegating judgment to AI risks shallow analysis and misplaced confidence. | AI positioned as a co-pilot, not a decision-maker, supporting analysis while final calls remain with experienced investment professionals |

| Regulatory and compliance considerations | As AI adoption increases, regulatory scrutiny will follow. PE firms must be able to explain how insights were generated and trace decisions back to source data. | Clear audit trails, explainability, and transparency across workflows, ensuring AI outputs can be reviewed and validated if required |

By addressing these challenges head-on, you can adopt AI securely and effectively, building trust with your team and creating a sustainable competitive advantage.

✅ Faster decision-making with ClickUp Brain MAX

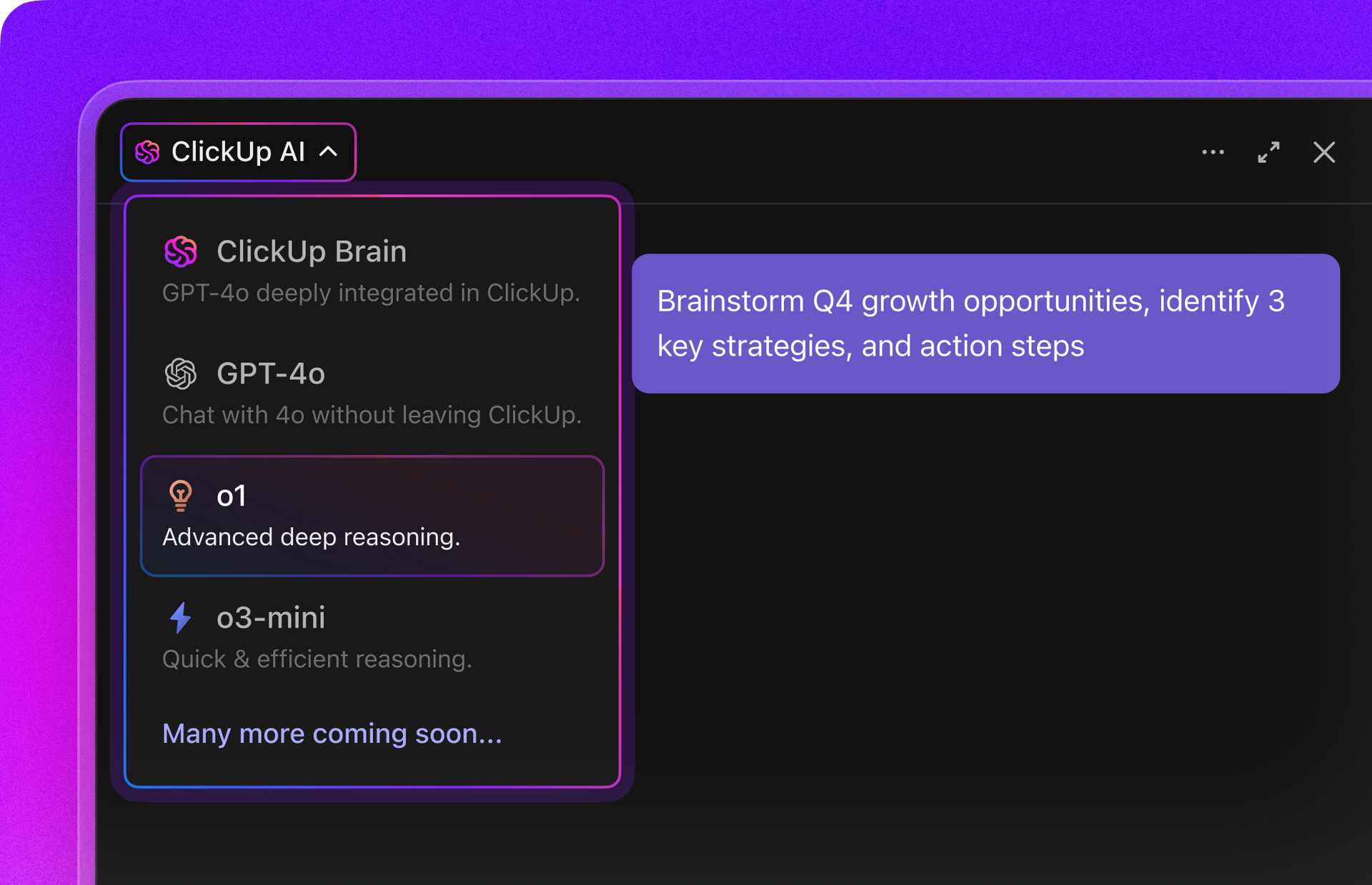

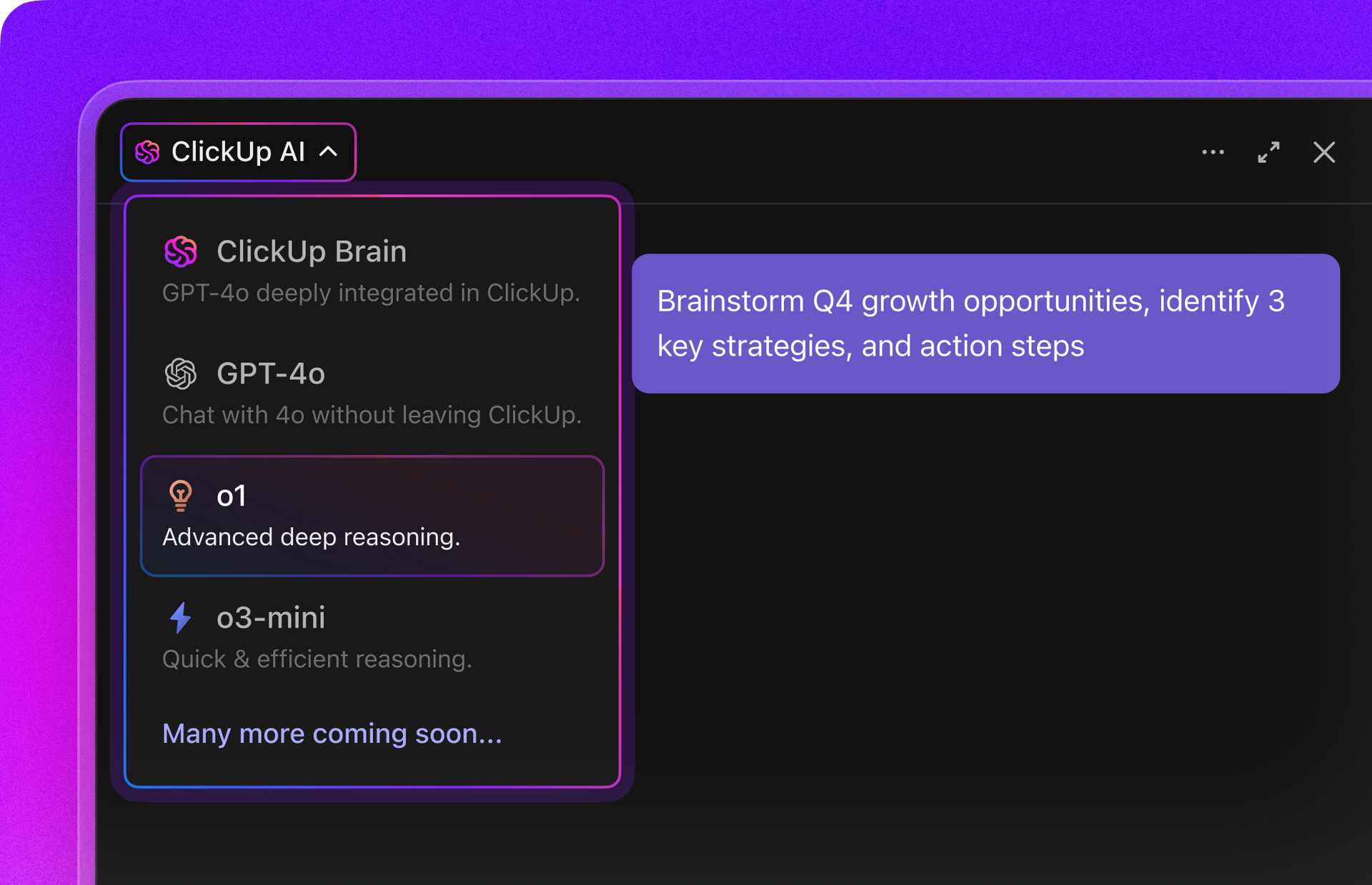

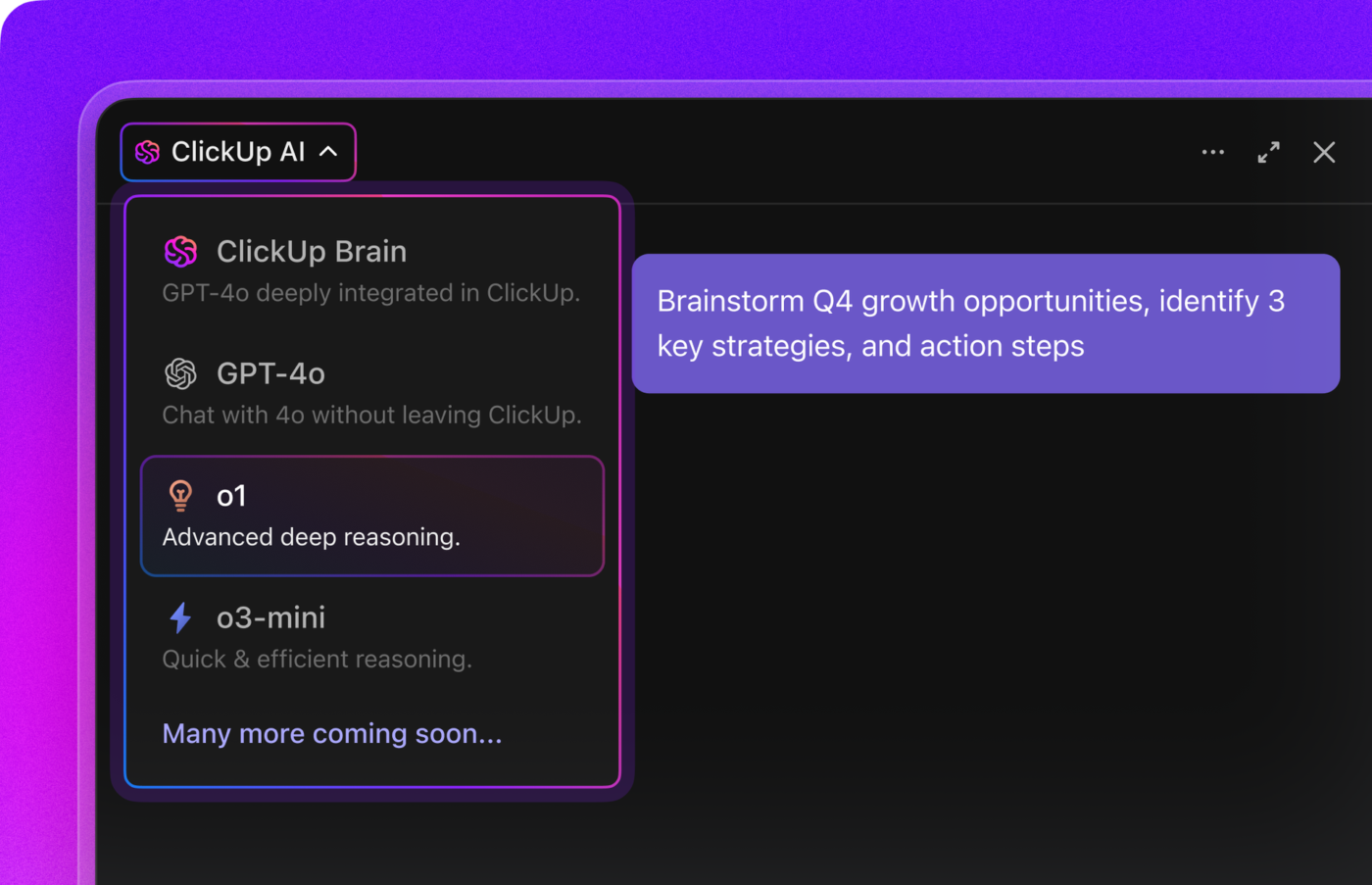

In private equity, speed matters only when it’s paired with context. ClickUp Brain MAX gives deal teams a single AI interface to work across multiple AI models without leaving their workspace, making it easier to test assumptions, compare analyses, and pressure-check outputs before decisions are made.

Analysts can evaluate diligence summaries, market insights, or draft IC memos using different models side by side, all grounded in the firm’s actual deal data and documents. Talk-to-Text accelerates this even further by letting teams speak investment theses, risks, or follow-up questions and instantly turn them into structured notes, tasks, or prompts.

For lean PE teams under constant time pressure, Brain MAX reduces friction without compromising rigor.

You’re sold on the “why,” but now you’re stuck on the “how.”

The idea of a massive, firm-wide private equity digital transformation project is overwhelming, and it seems too expensive and disruptive to even consider. This “analysis paralysis” is common, but it’s also where many firms miss the opportunity to gain a crucial edge.

The most successful AI adoptions are practical, incremental, and focused on delivering immediate value. Get started today with these steps. 🛠️

📮 ClickUp Insight: The average professional spends 30+ minutes a day searching for work-related information—that’s over 120 hours a year lost to digging through emails, Slack threads, and scattered files.

An intelligent AI assistant embedded in your workspace can change that. Enter ClickUp Brain. It delivers instant insights and answers by surfacing the right documents, conversations, and task details in seconds—so you can stop searching and start working.

💫 Real Results: Teams like QubicaAMF reclaimed 5+ hours weekly using ClickUp—that’s over 250 hours annually per person—by eliminating outdated knowledge management processes. Imagine what your team could create with an extra week of productivity every quarter!

AI in private equity is all about removing the friction that keeps experienced investors buried in manual work, so they can apply their expertise where it creates real value. When AI is embedded directly into how deals are sourced, evaluated, operated, and exited, teams move faster without sacrificing rigor.

That combination of human judgment and operational leverage is becoming a structural advantage, not a nice-to-have.

But this shift doesn’t require a massive transformation overnight. It starts by consolidating work, applying AI where it saves the most time, and scaling from there. The sooner AI becomes part of how your team actually works, the sooner it stops feeling experimental and starts delivering measurable returns.

If you’re ready to move beyond manual processes and fragmented tools, ClickUp gives private equity teams a converged AI workspace to manage deals, portfolios, and firm operations in one place. Start with ClickUp for free and see how AI can support better decisions.

AI helps PE firms accelerate deal sourcing by scanning market data, conducting more thorough due diligence through automated document analysis, monitoring portfolio company performance in real time, and streamlining internal operations, such as investor reporting.

The most effective AI tools are those embedded within your existing workflows, not standalone apps. Look for converged platforms that combine project management, document collaboration, and native AI capabilities to eliminate context switching and work sprawl.

No, AI is designed to augment, not replace, PE professionals. It handles time-consuming research, analysis, and administrative tasks, freeing up investment teams to focus on high-value activities such as relationship-building, negotiation, and strategic decision-making.

The primary risks include ensuring the security of confidential deal data, managing poor data quality from fragmented systems, overcoming resistance to adoption from experienced team members, and avoiding over-reliance on AI outputs without critical human judgment.

© 2026 ClickUp