Free Accounting Journal Templates to Streamline Financial Recordkeeping

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Did you know 64% of small businesses don’t have a dedicated accountant? They tend to manage everything themselves, and that includes bookkeeping!

But when you’re busy running the day-to-day operations, accounting can get sidelined.

A set of good accounting journal templates can make your life easier on the income and expenses front. You don’t have to spend time creating a general ledger from scratch or maintain multiple (and complicated) Excel sheets.

The templates will capture all data in your ledger accounts and organize your finances without incurring an additional cost.

So, here are free accounting journal templates you can use to take control of your business finances without adding another expense to your plate.

Accounting journal templates are pre-structured frameworks that organize your business’s financial transactions. They ensure that all income, expenses, payments, and refunds are documented systematically without you needing to maintain complicated Excel templates and sheets or a physical balance sheet.

For example, when billing a client or making a payment, a journal entry template helps you record those transactions easily in a structured manner.

You can jot down key details like the date, involved accounts, debits and credits, and a brief transaction description.

Properly logged transactions contribute to well-organized financial statements and a cost breakdown structure. You will have the proper data to make informed decisions, reduce the risk of costly errors, and stay prepared for tax season.

👀 Did you know? McKinsey estimates that 75 to 80% of transactional operations, such as general accounting and payment processing, are capable of being automated.

Now that you know what an effective journal entry template should look like, let’s check out some ClickUp templates that fit the bill.

ClickUp is the everything app for work that combines project management, knowledge base, collaboration tools, and everything in between in one customizable space. You can easily tailor it as a project accounting software and track your finances efficiently.

The ability to generate a full, recurring series of events like a month-end accounting closure process has helped that team improve the time to close significantly.

🧠 Fun fact: The accounting firm, PwC has handled Oscar vote counting for 80+ years—because precision really matters in accounting. Your journal entries might not make headlines, but they should be just as award-worthy.

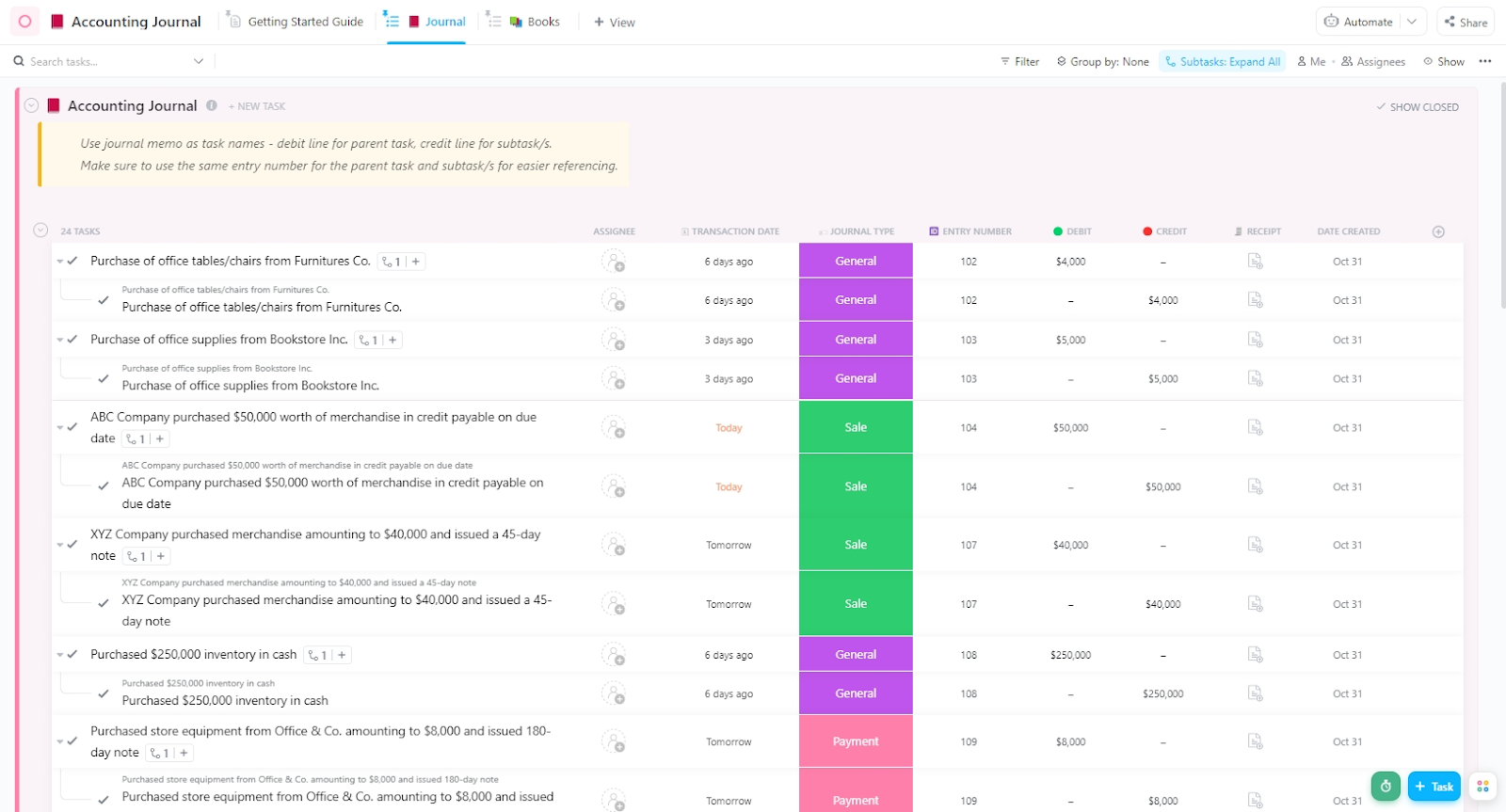

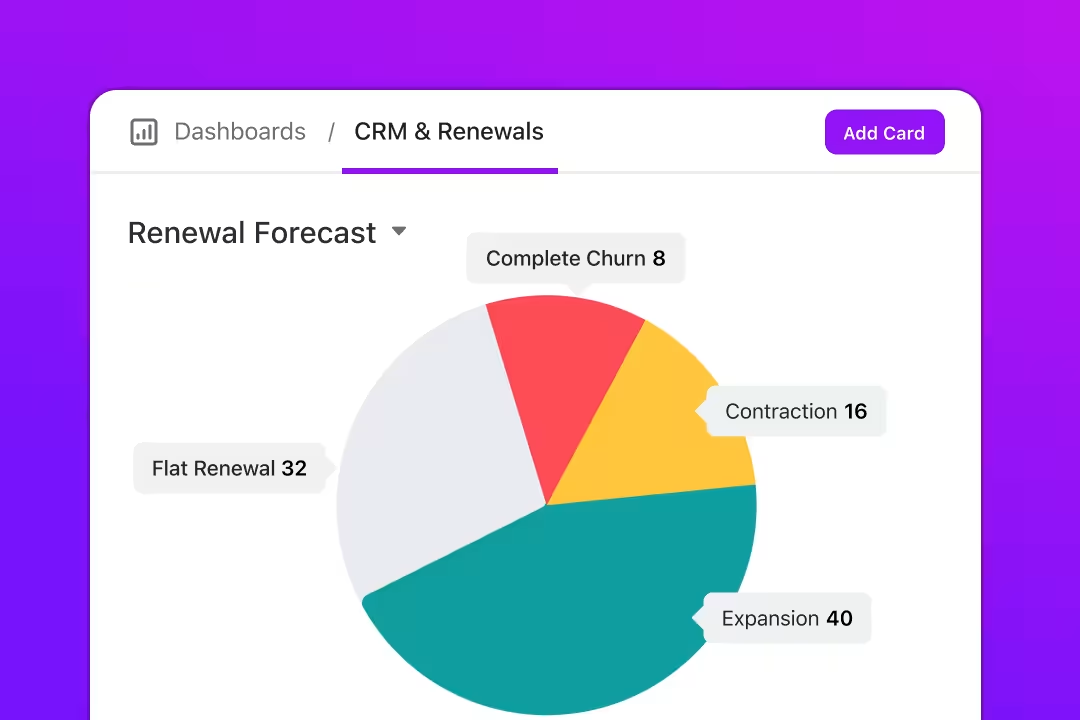

Don’t have the budget for an accountant or fancy accounting software? The ClickUp Accounting Journal Template has got your back. You can track the debit and credit amounts, add receipts for each transaction, assign journal entry numbers for easy search, and more.

With this template, you can:

🎯 Ideal for: Freelancers, solopreneurs, and small businesses to manage accounting without the overhead of traditional software.

Did you know? Reports suggest that 82% of the time, small businesses fail due to a lack of understanding of accounting and poor cash flow management. If you don’t have a structured bookkeeping system in place yet, it’s high time you implemented one.

Here’s a shocking stat: A third of accountants make several errors in journal entries every week, thanks to too many tasks on their plates. This error issue will only worsen if they have to maintain a separate sheet for each payable account.

Help your accounting team identify and rectify these common errors on time before they throw off your entire budget and expenses. The ClickUp Accounting Template solves this problem by keeping every payable account in a categorized List View.

This template helps you:

🎯 Ideal for: Tracking invoices, identifying journal entry errors, and clearing payables on time.

According to ClickUp’s research, a typical knowledge worker has to connect with six people on average to get work done. If you’re maintaining multiple sheets to track expenses, your team will spend more time going back and forth between departments than doing actual work.

Make their job easier with the ClickUp Journal and Ledger Template. This template helps you keep a centralized ledger of debits, credits, and associated expenses in detail.

With this template, you can:

🎯 Ideal for: Staying on top of finances, identifying and correcting manual errors, and preparing audit-ready financial reports daily with minimal effort.

The budget has gone rogue due to poor cash flow management, and you have no idea where to start to make sense of it: that’s a nightmare no business wants to face. The ClickUp Accounting Operations Template is the perfect solution to account for every penny. It helps with accurate project accounting, setting budget goals, and ensuring expense accountability.

You can use this template to:

🎯 Ideal for: Ensuring integrity in every accounting operation across the company.

👀 Did you know? 61% of accountants are currently using AI for data entry and processing. 51% also reported using AI to detect and prevent fraud.

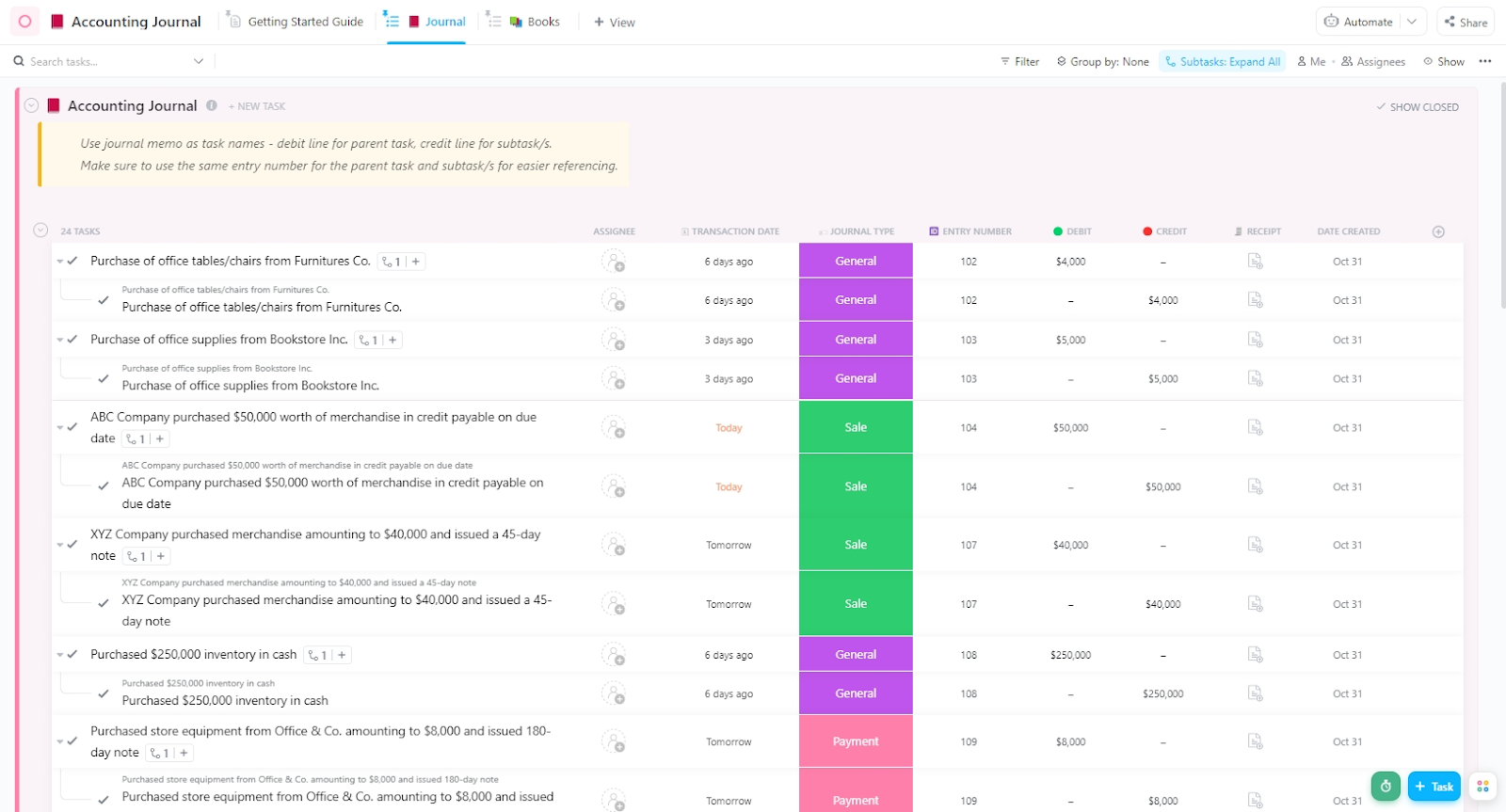

Making smart business decisions is impossible without a clear picture of your current financial standing. Running blind makes it challenging to spot cash flow issues, track liabilities, or confidently plan for growth.

A template like the ClickUp Summary of Financial Accounts Template brings all your financial data, assets, liabilities, and account balances into one easy-to-read dashboard. It helps you monitor trends, spot red flags early, and inform stakeholders with real-time updates.

This template lets you:

🎯 Ideal for: CFOs needing a high-level view of financial health for strategic decisions.

📖 Also Read: General Ledger Examples & Formats for Accounting

A good 19% of expense reports have errors or missing details, each costing an average of $52 and 18 minutes to fix. That’s a lot of time and money, not to mention that verifying and approving each report takes a lot of time and effort.

The ClickUp Business Expense and Report Template is a simple but effective framework that can save time by streamlining expense report approvals. You can assign each report to relevant supervisors and monitor reported discrepancies. It also helps identify cost savings and areas of overspending.

With this template, you can:

🎯 Ideal for: Automating expense report approvals and visualizing your business spending.

💡 Pro Tip: Not sure how to format your accounting entries or which journal type to use? Ask ClickUp Brain to generate a sample accounting journal based on your scenario—it’ll help you structure your entries correctly and speed up your workflow.

When managing multiple transactions, it’s easy to lose track of past payments, especially without a clear audit trail. Searching through emails and spreadsheets for every payment post wastes valuable time and increases the risk of errors.

The ClickUp Payment History Template gives you instant access to all your past payment records in one organized view. You can post, filter, and review every payment with complete context, making audits, reconciliations, and reporting effortless.

This template will help you:

🎯 Ideal for: Bringing clarity and accountability to your financial workflow.

Tracking project budgets is challenging, mainly when expenses are spread across various categories and stakeholders. That’s why, on average, one in six projects sees a 200% cost overrun.

The ClickUp Finance Management Template can help you stay within budget through a customizable dashboard. It allows you to monitor budget allocations, actual spend, and forecasted costs in real time.

Use this template to:

🎯 Ideal for: Project managers, finance teams, and business owners who need a clear view of budgets, spending, and financial goals across multiple projects.

📖 Also Read: How to Use AI in Accounting (Use Cases & Tools)

You don’t need a reminder about how important it is to consistently analyze your revenue and profit. The problem, however, is signing up for those expensive analytics tools when you have a limited budget.

The ClickUp Financial Analysis Report Template is a solid solution. It offers a visual representation of your account journal, so you know exactly how much is coming in, going out, and where you need to improve. You can even use this template for personal investment tracking!

It lets you:

🎯 Ideal for: Startups and freelancers who want clarity on their numbers without the complexity of accounting software.

Due to its ability to create automations, create relevant boards and spaces for literally all teams in a company to work, it provides an immense ability to work between teams and collaborate with ease. All of this comes at a very affordable and reasonable pricing

Managing a bookkeeping firm means handling multiple clients, deadlines, and compliance requirements, all while ensuring accuracy and efficiency.

The ClickUp Bookkeeping Firm Template offers a comprehensive solution to streamline your operations. With features like Custom Statuses, tailored views, and integrated task management, you can organize workflows, track progress, and maintain clear communication with your team and clients.

With this template, you can:

🎯 Ideal for: Freelance bookkeepers looking to stay organized with client work.

If your team is stuck with a paper trail and manual calculations to determine payables, your company’s productivity suffers. Plus, manual processes are error-prone. One wrong date or one misplaced number can send incorrect payments and ruin your relationship and reputation.

Instead of jumping through those hoops, switch to the ClickUp Accounts Payable Template. It will manage your payments’ complete lifecycle accurately.

This template helps you:

🎯 Ideal for: Small business owners and operations managers to streamline their accounts payable process without spreadsheets or paper-based systems.

🧠 Fun fact: Accountants and bankers have their own patron saint—Saint Matthew! He was a tax collector for the Roman Empire before becoming one of Christ’s 12 apostles.

Who wants to cross-check each invoice with billable hours and services before processing them? It’s a very time-consuming process. Plus, you end up with a backlog of invoices that might end up damaging your reputation with clients and delaying cash flow.

The ClickUp Invoice Tracking Template lets you create, send, and track invoices efficiently. With customizable fields, status tracking, and multiple views like Calendar and Invoice by Client, you can monitor due dates, payments received, and outstanding balances in one place.

Use this template to:

🎯 Ideal for: Consultants and agencies working with independent service providers and vendors.

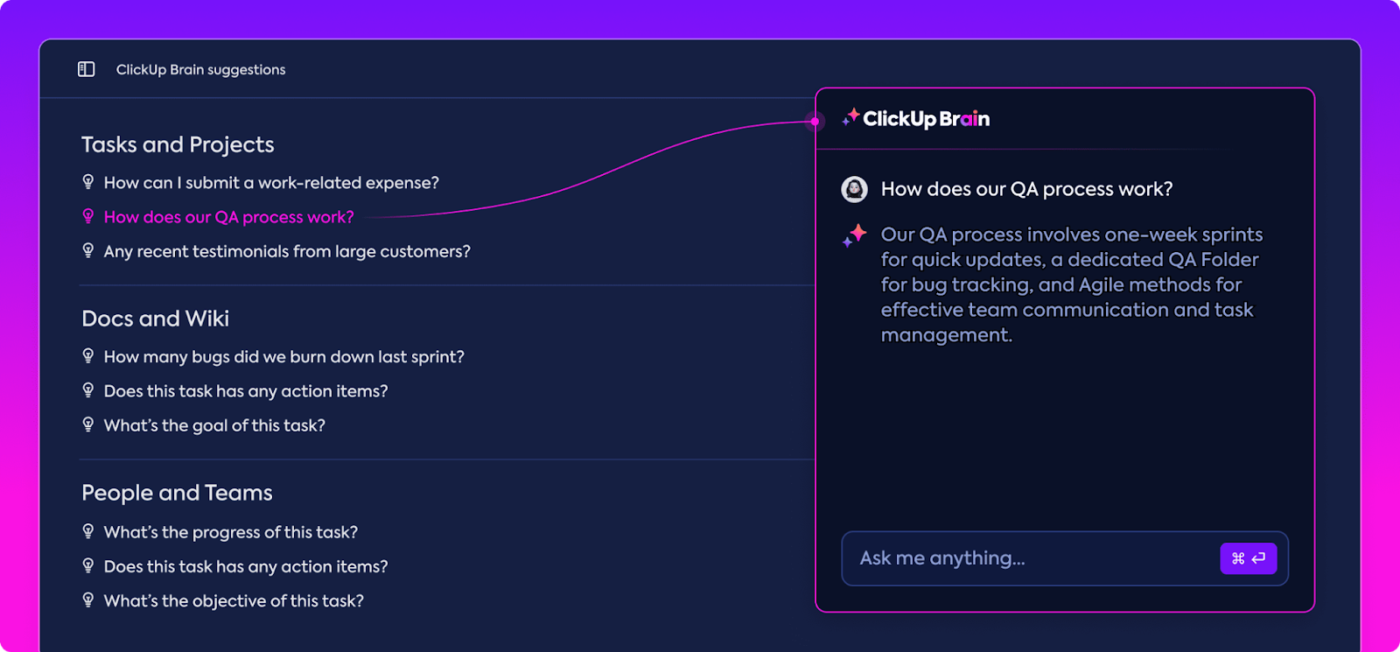

📮 ClickUp Insight: We recently discovered that about 33% of knowledge workers message 1 to 3 people daily to get the context they need. But what if you had all the information documented and readily available?

With ClickUp Brain’s AI Knowledge Manager by your side, context switching becomes a thing of the past. Simply ask the question right from your workspace, and ClickUp Brain will pull up the information from your workspace and/or connected third-party apps!

Trying to piece together your company’s financial standing from scattered data? It’s easy to overlook key figures without a structured view of assets, liabilities, and equity. The ClickUp Balance Sheet Template provides a clean, customizable snapshot of your financial position—perfect for planning, reporting, or impressing investors.

With this template, you can:

🎯 Ideal for: Reviewing company equity and liabilities, and preparing for fundraising and investor meetings.

Now that you’ve explored the best accounting journal templates, how do you pick one?

Detailed profit and loss templates can turn bookkeeping from a tedious task into a stress-free process that brings financial clarity. An ideal journal entry template helps you record transactions accurately, track cash flow, and stay audit-ready without complicated steps. Here are some qualities that make it truly effective:

Managing your business finances doesn’t have to be a headache. Grab the free templates above and make accounting feel as easy as brewing your morning coffee.

With ClickUp, you get all your essential accounting templates in one place, plus powerful features to do even more. Set reminders, track billable hours, and automate routine tasks to boost accuracy and save time.

Sign up with ClickUp and get a consistent view into your company’s income, expenses, and financial health.

© 2026 ClickUp