Between salaries and traditional benefits (dental, insurance, etc.), employers have an untapped opportunity to differentiate themselves and retain top talent through employee perks or fringe benefits.

If done right, managers can improve employee performance with strategic incentives.

Use this guide as a ready reckoner to set up a superb employee perks program and boost employee retention for your organization.

- Why Offer Employee Perks and Benefits?

- Types of Employee Perks

- Diving Deeper into Employee Perks and Benefits

- Comprehensive Analysis of Right Employee Perks Offered by Competitors

- Best Practices for Offering Employee Perks and Benefits

- Lead a Team of Happy Employees with Well-Aligned Company Perks

- Common FAQs

Why Offer Employee Perks and Benefits?

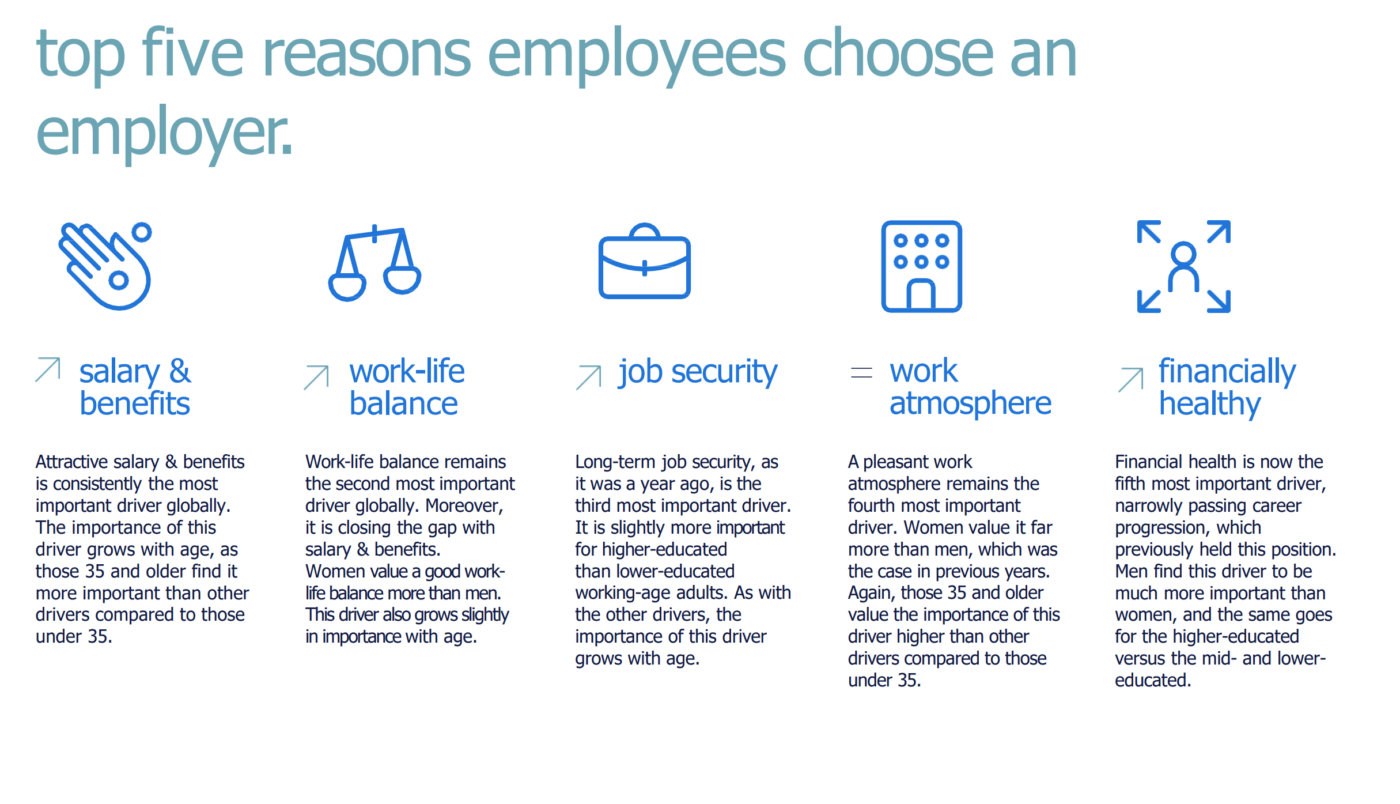

Providing inadequate total compensation is the number one driver of voluntary turnover among employees. Recent data further indicates that these are the most appealing factors about an employer:

- Salary and benefits offering (62%)

- Good work-life balance (58%)

- Overall job satisfaction and security (56%)

Offering employee perks and benefits is a step in the right direction if you want to improve employee retention rates and attract new talent. That’s because perks and benefits:

- Make your employees more productive and happier—whether it’s personalized perks for working mothers, new dads, or recent grads

- Signify that your company puts the employees and their interests first, creating a positive brand image in the employees’ minds and boosting job satisfaction

- Help employees to lead a more balanced and happy life, leading to higher retention

- Attract and retain high-quality talent, as employees’ priorities and interests are covered, such as attractive insurance options

- Act as the differentiator as perks like Toastmasters memberships, book clubs, and company-sponsored sporting events boost employee engagement

- Reduce stress and burnout, leading to higher productivity and job performance

When creating a list of must-have perks for your employees, create a survey and ask the team for input on what matters to them. Hearing the options from your team is the best way to set up an employee perks program that will attract and retain high-performing employees.

What’s the difference between employee benefits and perks?

At the outset, employee perks and benefits seem like the same thing—but they’re not.

The U.S. Department of Labor defines benefits as non-wage compensation provided to employees by their employer. These benefits have been grouped into five categories:

| Category | Benefits |

| Category 1 | Paid leave (vacations, holidays, sick leave) |

| Category 2 | Supplementary pay (premium pay for overtime and work on holidays and weekends, shift differentials, nonproduction bonuses) |

| Category 3 | Retirement (defined benefit and defined contribution plans) |

| Category 4 | Insurance (life insurance, health benefits, short-term disability, and long-term disability insurance) |

| Category 5 | Legally required benefits (Social Security and Medicare, federal and state unemployment insurance taxes, and workers’ compensation) |

In contrast, employee perks go above and beyond salaries and benefits offered by employers.

To make the distinction clearer, here’s a comparison between employee benefits and perks:

| Employee benefits | Employee perks |

| Government-mandated | Nice-to-have incentives like free office lunches, yoga memberships, etc. |

| It is supposed to be outlined in an employee contract | Typically, this is not covered in an employee’s contract |

| Inclusive of financial perks such as health and dental insurance | Expenses that the employee does not fund on their own |

| Not tied to performance | Useful for covering the company culture and values |

| Offered to full-time employees or can be adjusted to specific roles/tenures | Offered to full-time employees and, in some cases, to contractors as well |

Types of Employee Perks

Now, let’s explore the different employee perks you can offer.

The company perks you offer your employees will depend on their individualized needs and preferences. So, before you provide any kind of employee perk, study your employees’ data and characteristics to give them exactly what they want:

- Understand their immediate physical, mental, and emotional needs

- Dive into the factors influencing their life and work

- Learn about their interests, habits, demographics, and aspirations

For instance, a Forbes article claims that older generations favor flexible spending accounts, while younger generations favor health savings accounts. So, make an effort to understand what matters most to your employees.

Once you have the data, you can choose from various essential benefits. Here are a few options worth their weight in gold:

- Health insurance: One of the most sought-after employee benefits, health insurance helps cover medical expenses, including doctor visits, prescriptions, hospital stays, dental insurance, vision insurance, and wellness programs. Around 90% of respondents ranked healthcare as a significant benefit. Think of it as a type of compensation that gives your organization a leg up, as healthier employees would mean fewer sick leaves

- Wellness-related: Aside from health insurance perks, you must also focus on promoting your employees’ well-being through health and wellness programs such as:

- Mandatory breaks (creating nap rooms, tea/coffee stations, etc.)

- Healthy vending machines in the cafeteria

- Reimbursing gym memberships

- Conducting wellness activities like meditation, yoga, etc.

- Standing desks with ergonomic chairs, keypads, etc.

- Free health trackers like Fitbit

- Onsite flu shots periodically

- Running marathons

- Nutrition workshops with a certified nutritionist

- Flexible spending accounts (FSAs): FSAs allow employees to set aside pre-tax dollars to pay for eligible medical expenses incurred during a plan year. This small yet significant move helps employees save money on healthcare costs and reduce their taxable income

- Zipcar: Providing access to Zipcar can be a game-changer for employees, especially in urban areas where car ownership is impractical. This benefit offers convenience and flexibility, allowing employees to travel to work without the headache of owning a car

- Child care: These help ease the burden on working parents—whether on-site child care, subsidies for external care, or flexible hours to accommodate parental responsibilities. This perk shows that your company values work-life balance and supports employees in their family commitments

- Tricare: A health care program for military members, retirees, and their families; it supports employees who have served or are currently serving in the military, ensuring they have access to quality health care for themselves and their families

- Environmental perks: Your employee’s environment and office atmosphere are critical in setting up the right culture, so make sure to offer perks such as:

- Casual dress code

- Gaming room

- Routine company retreats

- Bring your pet to the office day

- Unlimited PTO

- Happy hours and office lunches

- Parking spot for the employee of the month

- Life insurance: Offering life insurance gives employees peace of mind, knowing that their families will be cared for financially after their passing. As a responsible employer, you must:

- Provide different coverage levels based on your employee needs

- Offer the option to add additional coverage for spouses and dependents

Employees view life insurance as a financial safety net that covers key expenses such as funeral costs, outstanding debts, etc. while providing income replacement for dependents.

- Salary perks: Conduct regular salary reviews to ensure that your compensation packages remain competitive in the market. You must also think about performance-based bonuses to reward employees for their hard work—a primary requirement for millennials today

- Employee assistance programs (EAPs): EAPs provide employees access to confidential counseling and support services for personal and work-related issues. The idea is to help employees navigate challenges such as stress, anxiety, relationship issues, and substance abuse without hampering their work

- Family-centered perks: The organization must offer a host of family-centered perks such as:

- Paid paternity leave

- Dedicated room for nursing mothers

- Paid maternity leave beyond eight weeks

- Flexible hours and remote work option

- Pet insurance

- Onsite daycare options

- Company picnic with the employees and their families

- College sponsorship program

- Community-driven perks: Employees want to associate with organizations that actively engage in charitable work. To demonstrate your organization’s willingness towards social causes, embrace the following:

- Give employees paid time off for volunteering

- Conduct programs for charity donation

- Employee development-related perks: Focus on providing perks that help advance your employee’s professional career, such as:

- Mentorship programs

- Tuition reimbursements

- Paid sabbaticals

- Unlimited access to the office library

- Stipends for in-house certifications or external employee development courses

- Paid membership to renowned organizations

- Sponsored traveling to industry conferences for networking

Diving Deeper into Employee Perks and Benefits

Let’s look at a few other must-have employee perks your organization must offer:

The Family and Medical Leave Act (FMLA) of 1993

The FMLA allows eligible employees to take up to 12 weeks of unpaid, job-protected leave for family or medical reasons. This law applies to public agencies, public and private schools, and companies with 50 or more employees within a 75-mile radius.

To be eligible, employees must have worked for their employer for at least 12 months and at least 1,250 hours during the 12 months before the leave.

The FMLA allows employees to take leave for various reasons, such as:

- During the birth or adoption of a child

- When caring for a spouse, child, or parent with a serious health condition

- When their health condition is serious

During FMLA leave, employers must maintain the employee’s health benefits and restore them to the same position on their return.

Retirement savings plans

The retirement savings plans include employer-sponsored plans where employees can contribute a portion of their salary towards retirement savings. Common options include:

- 401(k) plans: Allows employees to save and invest a portion of their paycheck before taxes are taken out. Employers may also choose to match a percentage of the employee’s contributions up to a specific limit

- 403(b): Offered to employees of certain tax-exempt organizations, such as public schools, hospitals, and churches. These plans allow employees to contribute a portion of their salary to their retirement savings on a tax-deferred basis

- 457: Available to employees of state and local governments, as well as some nonprofit organizations. Like 401(k) and 403(b) plans, contributions to a 457 plan are made on a pre-tax basis, and withdrawals are taxed as ordinary income

- Pension plans: Provides retired employees with a fixed monthly income for life, based on a formula that considers factors like salary history and years of service

Employers often match these contributions up to a certain percentage. Other options may include individual retirement accounts (IRAs), which offer tax advantages for retirement savings.

Offering different retirement options to align with your employees’ financial goals and risk tolerance is crucial.

Sick leave plans

Sick leave plans are a vital aspect of employee benefits, allowing employees to take paid time off when they are ill or need to attend medical appointments. With 39% of employees leaving an organization in 2023 for better work-life balance, stressing a robust sick leave policy and preventing employee burnout is critical.

The specifics of sick leave plans will depend on your organizational rules. Some employers offer separate sick leave and vacation time, while others combine them into a single paid time off (PTO) policy.

Annuities in the United States and Parental Leave Rules

Annuities are a popular retirement savings option in the United States. They allow investors to convert savings into a series of regular retirement payments.

There are different types of annuities, including:

- Fixed: Provides a guaranteed interest rate for a specific period, offering a predictable income stream

- Variable: The income stream is linked to the performance of underlying investments, such as mutual funds. This offers the potential for higher returns but also comes with more risk

- Indexed: Provides returns based on the performance of a specific index, such as the S&P 500. They offer the potential for higher returns than fixed annuities with some protection against market downturns

Add an employee-first touch by understanding the nuances, empowering employees to make informed decisions about their retirement savings strategy, and improving the organization’s brand image.

Income Tax in the United States and Insurance Considerations

Income tax in the United States is a complex system that requires employees to report and pay income tax to the federal government and, in some cases, to state and local governments.

The tax system is progressive, meaning employees with higher incomes pay a higher percentage of their income in taxes. The common tax types include:

- Federal income tax: Tax paid on income earned at the federal level. The tax rates vary based on the individual’s income level, with higher earners paying a higher percentage of their income in taxes

- State income tax: Some states also levy an income tax on residents. The rates and rules for state income tax vary by state

- Social Security and Medicare taxes: Fund the Social Security and Medicare programs. Employees and employers each contribute a percentage of the employee’s income to these programs

- Capital gains tax: Tax paid on the profits from selling assets such as stocks, bonds, or real estate. The tax rate depends on how long the asset was held before being sold

When it comes to offering insurance plans, there are multiple options to choose from:

- Disability insurance: Provides income replacement if the policyholder becomes unable to work due to a disability and helps protect against loss of income

- Property and casualty insurance: Protects against the loss or damage of property, such as a home or car

Comprehensive Analysis of Right Employee Perks Offered by Competitors

Let’s move on to understand how companies are upping their workplace perks game:

Case study 1: Perks offered by T-Mobile US and PerkSpot

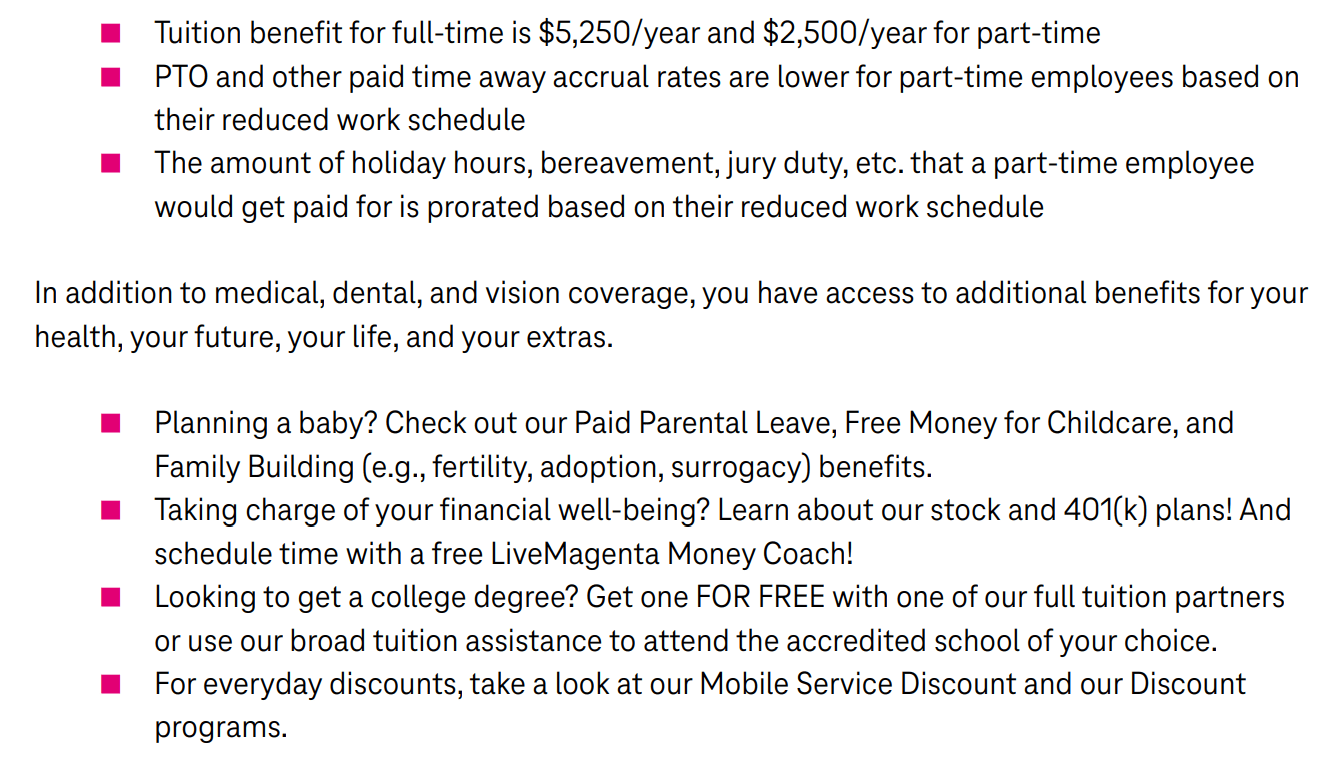

T-Mobile has a comprehensive benefits package grounded in the company’s values. It has curated a guide, offering insights into how they treat their employees. Its benefit programs cover key aspects such as healthcare, family building benefits, life insurance, LiveMagenta, etc., and are applicable for part-time and full-time employees:

Use ClickUp’s Employee Handbook Template to build a comprehensive handbook that details your company’s employee-related information in one place:

You can also invest in an employee perks plan by PerkSpot, a company that partners with employers to provide discounts and deals on various products and services to their employees:

These perks include travel, entertainment, electronics, clothing, and more discounts. The program aims to enhance employee satisfaction and engagement by providing valuable benefits beyond salary and traditional benefits like health insurance.

Case Study 2: Perks at the University of Alabama (Birmingham)

The University of Alabama (Birmingham) has set up the UAB Employee Perks Program, which offers multiple discount agreements with many retailers and businesses. This program allows all the UAB employees to save money by simply being a UAB employee!

Best Practices for Offering Employee Perks and Benefits

Human Resources teams wanting to provide employee perks and benefits need to up their game with the right mix of tools and strategies, such as:

Get your hands on a robust perks template

Hundreds of free HR templates are available for managers to track an employee’s maternity leave, evaluate team performance, recruit productive employees, and more.

ClickUp’s Bonus Matrix Template is one such template; it helps you to:

- Track your team’s performance, rewards, and incentives with powerful analytics and build performance-based bonus plans

- Customize bonus structures according to the individual or team success and ensure fair distribution of perks

- Provide clear goals and expectations for everyone involved

Use HR software to streamline the benefits program

Investing in ClickUp’s Human Resources tool helps managers to:

- Manage all employee activities, including tracking and ensuring that the perks and benefits each employee is entitled to are provided objectively

- Leverage ClickUp’s Custom views and align the employee’s performance information with perks and benefits

Identify the right solution

Managers must also consider using the right tools, particularly if they want to keep their remote teams engaged and productive.

Tools like employee engagement and recognition software highlight who is working on what, how engaged the team is, and whether the leadership rewards employees for their hard work. Based on collated data, the managers can select suitable candidates and set up a value-driven employee perks program.

Finally, communicate the details of your program so that employees can make the most use of it and use the perks to the maximum potential.

Lead a Team of Happy Employees with Well-Aligned Company Perks

You could read all the teamwork quotes, but real teamwork happens when your employees are motivated to work and happy to be part of your organization. The best way to fast-track this is by offering meaningful company perks that encourage employees to use them.

Instead of settling for a ‘one-size-fits-all’ benefits program, study what inspires your employees and investigate their interests to create a personalized and flexible company perks program. Take the next step with one of the best project management tools available today: ClickUp.

Common FAQs

1. What is the meaning of employee perks?

Employee perks are additional benefits that companies offer to employees beyond their regular salary. These perks enhance employee experience, improve morale, and attract and retain talent.

2. What is a workplace perk?

A workplace perk is a benefit that employees receive from their employer in addition to their salary. These perks include health insurance, flexible spending accounts, and childcare assistance.

3. What is an example of a perk?

Some employee perks include tuition reimbursement, cafeteria options, gym membership reimbursement, wellness activities, paid paternity leave, pet insurance, flexible hours, etc.