11 Free Bill Organizer Templates To Track Your Expenses Better

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

If you’re looking for a simpler way to organize bills and receipts, a bill organizer template is just what you need. It’s much more efficient than putting all your bills in a binder.

Rather than scanning your monthly bills to create digital copies, a bill organizer template allows you to adopt a systematic approach to your expense tracking and financial management processes.

Simply attach copies of the bill payment to the template and let the workflow do its thing.

Whether you’re a working professional, a team leader, or a student, with a monthly bill organizer template, you’ll likely see an immediate improvement in your budget tracking and expense reporting.

In this article, we’ll discuss how to choose a free bill organizer template and explore ten templates for tracking expenses, streamlining finances, managing bills, and avoiding late payments.

A bill organizer template helps you plan bill payments to be paid on time, avoiding late fees and interest. It contains columns and fields for recording due dates, bill descriptions, amounts, etc. This includes one-time and recurring bills, as well as automatic payments debited from your bank account every month.

Bill organizer templates capture information on all your bills and invoices in one place, providing better control over your monthly budget and allowing the surplus funds to be allocated to future payments.

You could use a printable monthly bill organizer template, an online version, or a combination of the two, depending on your preferences.

If you have different departments using multiple expense tracking formats, keeping track of everything can get complicated—when managing project budgets.

Bill organizer templates offer a standardized structure for tracking expenses, saving time and effort. For managers, they simplify analyzing multiple bills and provide insights into your cash flow position and enable improved organization-wide expense management.

Choosing among the hundreds of bill organizer templates available online is easier if you know what to look for. A good bill organizer is:

Here are ClickUp’s 11 free bill organizer templates that will make personal budgeting and business expense tracking a breeze:

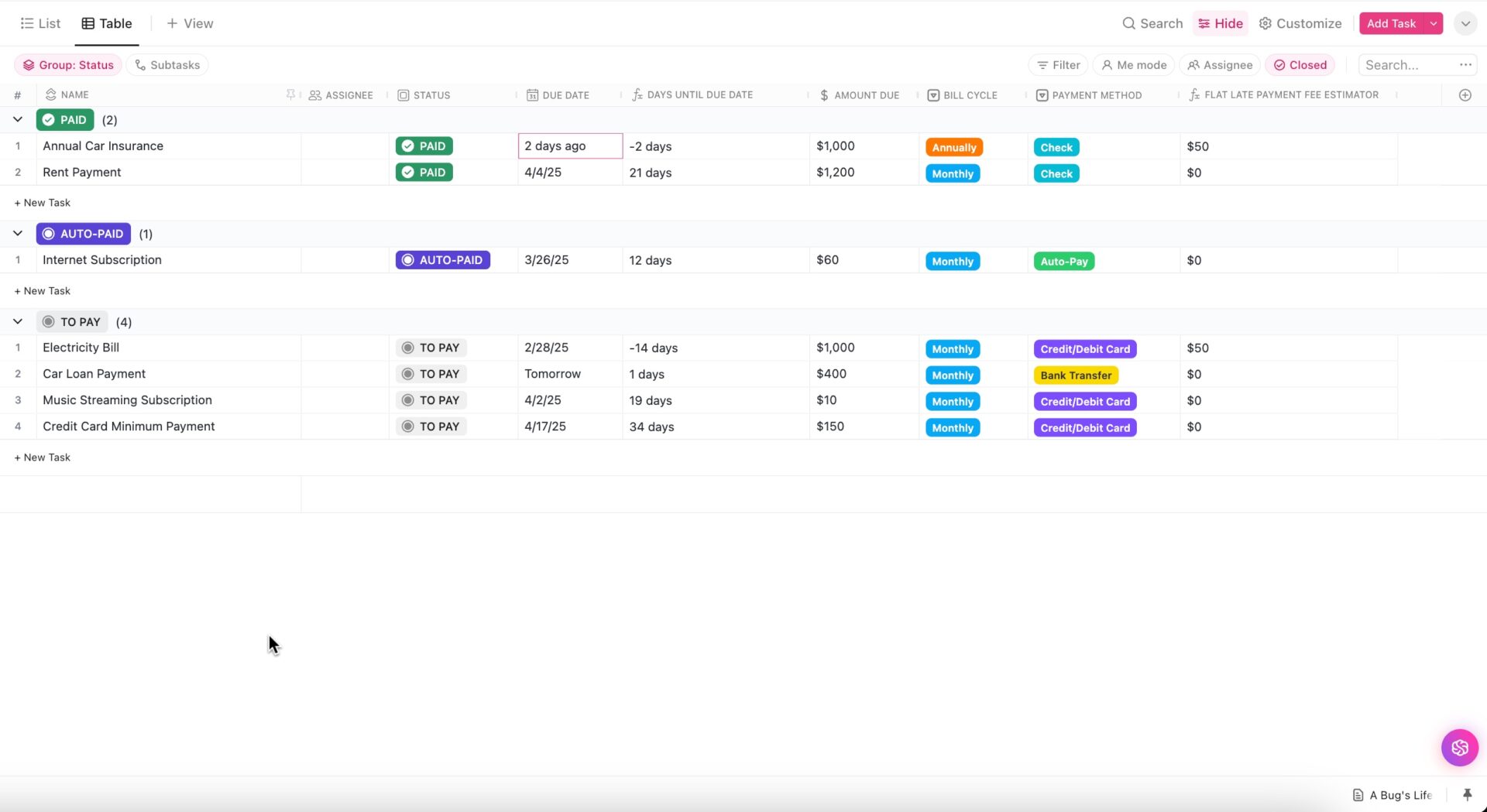

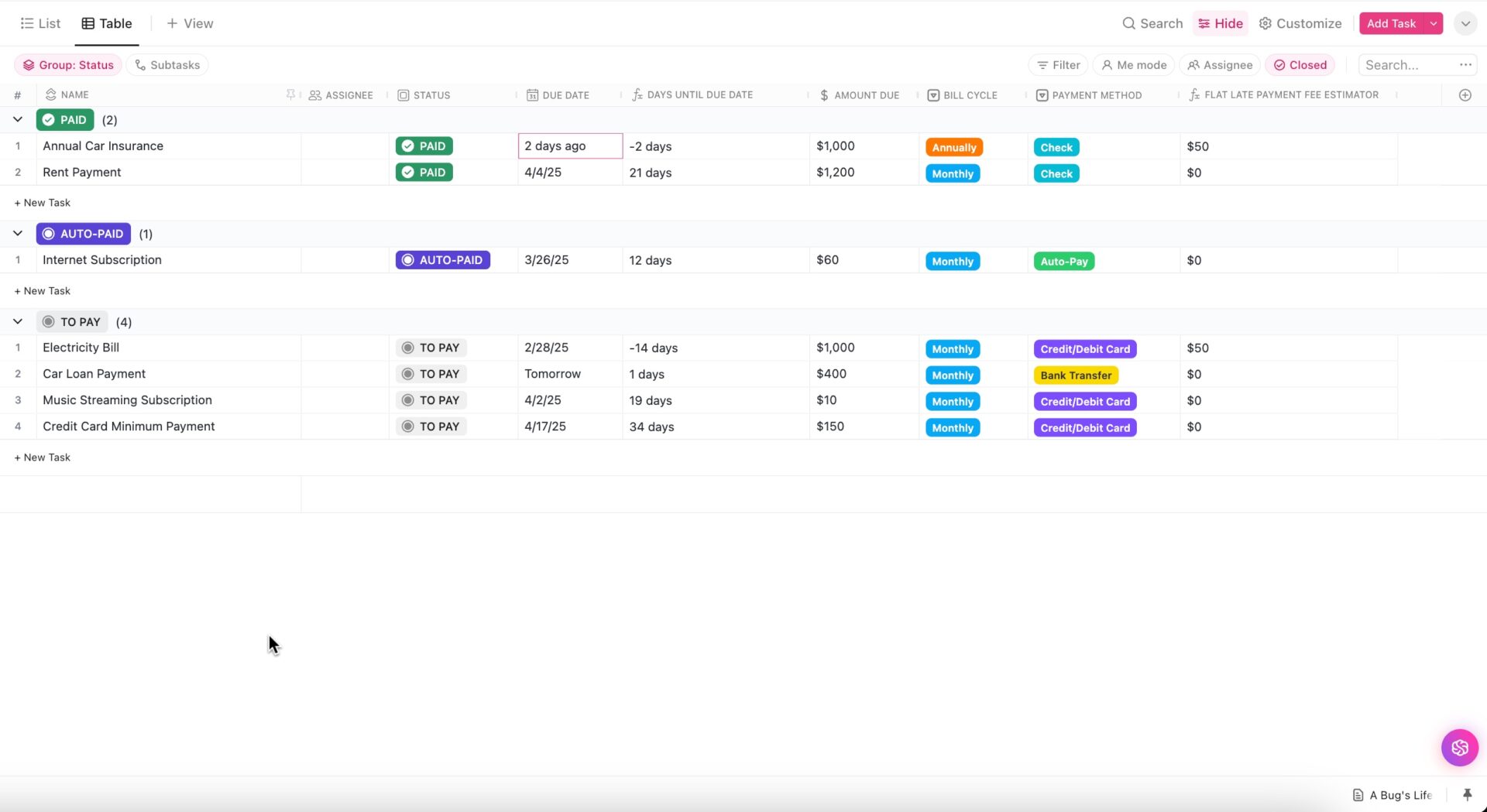

Streamline your bill management process with ClickUp’s Bill Organizer Template in Table View. This template allows you to conveniently track, manage, and organize your bills in an easy-to-read table format. With separate columns for bill descriptions, due dates, amounts, and payment status, it leaves no room for missed payment or late fees.

Moreover, the Table View enables sorting and filtering of bills according to various parameters like categories, priorities, or due dates, bringing an unparalleled level of organization to your financial management efforts.

Just like all ClickUp templates, it’s designed to be seamlessly integrated into other workflows. Add custom fields for additional data, use reminders for upcoming bills, and enjoy collaborative features that bring team transparency to your expense management process.

ClickUp’s Personal Budget Template gives you an up-front overview of all your bills and income sources. It shows expenses by category or due date to help you identify exactly where you overspend.

Think of it as a budget planner and bill organizer rolled into one, calculating the percentage difference between budgeted and actual spending for better decision-making.

The template has dedicated folders for tracking monthly income and expenses, which can be useful when filing taxes or processing returns—instantly look up the bill amount or transaction date and have all the information at your fingertips.

Whether you are a consultant or online business owner, keeping track of multiple invoices is no easy task. ClickUp’s Invoices Template lets you:

It gives you a quick overview of all invoices, breaking them down by client or due date. Customer contact information is displayed alongside each entry, so you don’t have to switch between CRM and other tools.

If a payment is delayed, add notes to the template via custom fields and organize all your invoices.

This template doubles up as an invoice generator, allowing you to build a complete invoicing workflow with custom branding and automatic total calculations when you bill a client.

Pro tip💡: Using ClickUp Docs and custom fields, you can save client details and auto-fill them for future invoices. If your bill payment rates change, you simply update one field and replicate changes across the rest.

From tuition to groceries, managing monthly bills as a college student requires prioritization. One way to do this correctly is to separate recurring monthly expenses—including automatic payments—from one-time bills. Next, you can rank them according to the payment amounts and due dates.

This helps you avoid late fees and manage other monthly expenses.

ClickUp’s College Budget Template provides an overview of your expenses, breaks them down into different categories, and lets you set thresholds for each.

For example, if you allocate $2000 for tuition, it’ll show your actual spending and how much money you’re left with at the end of the month to allocate to upcoming bills.

This one has many features you’d associate with a monthly bill organizer template, such as due date tracking, expense categorization, and custom views, helping you avoid a cash crunch.

When team members submit their expense reports, you should be able to process bills correctly so there’s no business impact. After all, taxes and any other charges included in the total amount must add up.

ClickUp’s Business Expense and Report Template is far more advanced than your average expense tracker. It lets employees attach multiple bill copies to the expense report for easy verification. As a manager, you can filter for different departments, expense types, etc., to simplify processing.

The list and table views allow you to compare department trends—saving time and streamlining financial management.

Consider using ClickUp’s Task Management Software for financial analysts to simplify financial data analysis and reporting. Here’s how:

Employees often have multiple expenses, such as taking clients out on lunch meetings, paying for gas and parking, etc., associated with one account or event. The ClickUp Expenses Report Template helps you track these and more.

It has multiple columns for each expense item, with the totals calculated automatically. Depending on your organization’s reimbursement policy, you can attach bill receipts. To make processing easier, you can categorize bills by date or amount. This capability makes the template a bill organizer in its own right.

The template also includes a section for employees to enter details like department and reporting manager. If you need to discuss reimbursement-related issues during team meetings, you can present the data via ClickUp’s Gantt View and print hard copies to pass around the room.

Alternatively, tag the team member via @mentions using ClickUp Chat View for real-time collaboration. This is a perfect option for remote teams and consultants. It saves you a ton of time that would otherwise be spent in to-and-fro emails asking for more information.

ClickUp’s Monthly Expense Report Template ensures you don’t forget important information, like dates, when filing expense reports. The fields are customizable, allowing you to add details like purchase order numbers easily.

The summary section gives a high-level overview of business expenses by type for a given month, with filters for due dates, priority levels, etc. This makes it easier for managers to track specific expense items, build reports, and make better decisions.

The best part is that with this purchase order template, you can standardize expense reports across different teams and departments, saving you hours on data validation.

Read more: Using AI for accounting: Use cases and tools

ClickUp’s Simple Budget Template lets you set financial goals and monitor actual spending by category in one place. With a bill tracker template like this, you can schedule payments around the same time you get paid.

With custom views, you can tell if you’re going to be short of funds and make alternative arrangements. This simple template helps you streamline your finances by tracking expenses versus income, and you’ll be able to allocate money wisely and find room for savings.

Use this handy bill organizer to categorize expense items by type, due dates, etc., and simplify your budget planning. It also shows in percentage terms any expenses where you may have exceeded budget.

Pro tip 💡: If you ever forget to review your budget, the template will send you a friendly reminder. For this, set a recurring task within ClickUp.

If incoming payments get delayed, you may need credit to tide over an immediate shortfall. However, some customers are more likely to pay on time than others. If you can tell how many payments are likely to be made by a certain date, you may not need loans or other forms of finance.

ClickUp’s Accounting Template is a bill organizer that allows you to add your monthly bills and invoices in one place. Once you’ve plugged in all the details, it automatically tracks due dates, payment amounts, and invoice numbers.

Every time you follow up on a payment, simply add notes against each entry. The template will assign a probability score or ‘confidence level’ based on whether the payment will likely be made on time.

Use this template to close the gap between payments you owe vendors and settle bills without affecting your business’s day-to-day functioning.

Bonus: Google Sheets expense tracking templates!

Your bookkeeper would certainly appreciate you using ClickUp’s Accounting Journal Template. It records all your expenses and income in journal entry format with easy cross-referencing across accounts.

This detailed data entry format makes it easier to balance income and expenses, improving accounting accuracy and giving you a clear picture of your business’s financial situation. From tax planning to audits and project accounting, this template makes all tasks more efficient.

Plus, it also helps you determine if your current projects are profitable. You can add descriptions on each page for easy reference. If something needs expert attention, you can assign specific entries or tasks to your bookkeeper or other team members for review.

The Excel Simple Monthly Budget Template places you in the driver’s seat while managing your budget.

This monthly budget template is designed to make budgeting a breeze. Use it to compare your monthly income to your expenses and the corresponding surplus or deficit. It grants visibility into where your money goes and how to optimize your budget to meet your goals.

Whether you manage your monthly budget or plan for the future, this tool can easily meld with your financial aspirations. Use it to make smart and informed decisions about your money.

Ideal for: Monthly budget planning for individuals and families.

Bill organizer templates give you a ready framework to build your finances. If you’ve been looking for a way to separate personal and business budgeting to save money, start with one of these.

The advantage of ClickUp templates is their scalability over traditional alternatives like Microsoft Excel, Google Sheets, and traditional spreadsheet software. The best part? These are free, printable templates, so you can download and try them out at no risk.

With dedicated ClickUp templates for many tasks—including budget templates, project budget templates, and more—you can switch to a cleaner, more efficient way of managing monthly bills, automating payments, and growing your business.

Sign up on ClickUp for free, download these free bill organizer templates and gain control over your incoming and outgoing payments.

© 2026 ClickUp