15 Free Payroll Budget Templates for 2026

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Today’s finance leaders aren’t just tracking payroll—they’re optimizing it.

In an economy where every dollar counts and every headcount decision matters, you can’t afford to rely on back-of-the-envelope math. Most of the slowdowns in payroll planning come from Work Sprawl, where pay data, hours, rates, and approvals live across too many spreadsheets and tools.

You need payroll tools that are strategic, fast, and built for scale. These 15 payroll budget templates help you do just that—whether you’re running a startup or managing an enterprise workforce.

Want to plan, track, and manage payroll expenses across your organization? Payroll budget templates are pre-structured documents or spreadsheets that help you do that.

These tools simplify the payroll process by organizing all relevant payroll data, including wages, salaries, bonuses, taxes, and deductions, into one place for accurate calculating, planning, and reporting. Here’s what else you can expect:

While any payroll budget template logs wages and salaries, a good one delivers built-in logic to calculate, forecast, and track payroll expenses with greater accuracy.

That’s not all. Here are some ways an ideal payroll budget template stands out:

✅ Goes beyond static tables by including automated calculations for taxes, deductions, and the percentage of overtime hours

✅ Provides built-in forecasting tools to project payroll costs based on future scenarios like raises, new hires, or policy changes

✅ Supports integration with accounting systems to reduce manual data entry and sync payroll data across platforms

✅ Offers customizable templates that adapt to different pay structures, pay periods, and business needs

✅ Includes visual dashboards or reporting tools to help managers and finance teams spot trends and compare actual results with planned budgets

Automate repetitive payroll and budgeting tasks in ClickUp to save hours and reduce errors. Learn how to automate workflows step-by-step in less than 5 minutes. ⚡️

Here’s a summary table for all the ClickUp and third-party payroll budget templates:

| Template Name | Download Template | Ideal For | Key Features | Format/Platform |

| ClickUp Payroll Report Template | Get free template | HR & operations teams needing real-time payroll tracking | Centralizes payroll data, visual reports, task assignment for follow-ups | ClickUp Workspace |

| ClickUp Payroll Summary Report Template | Get free template | Teams wanting audit-ready payroll summaries | Consolidates salaries, benefits, deductions, taxes by pay cycle | ClickUp Workspace |

| ClickUp Services Timesheet Template | Get free template | Services-based teams tracking billable hours | Logs hours by service/client, supports resource planning | ClickUp Workspace |

| ClickUp Payment History Template | Get free template | Teams needing a clear audit trail of payroll/vendor payments | Centralizes payment records, filters by payee/project/date | ClickUp Workspace |

| ClickUp Simple Budget Template | Get free template | Small businesses & team leads budgeting payroll & ops costs | Tracks actual vs. projected costs, visual budgeting | ClickUp Workspace |

| ClickUp Business Budget Template | Get free template | Businesses aligning payroll with financial planning | Tracks income, spending, department budgets | ClickUp Workspace |

| ClickUp Project Budget with WBS Template | Get free template | Project teams linking labor costs to deliverables | Work breakdown structure, cost tracking by task | ClickUp Workspace |

| ClickUp Budget Proposal Template | Get free template | Teams presenting payroll in budget requests | Structured inputs, visuals, feedback management | ClickUp Workspace |

| ClickUp Event Budget Template | Get free template | Event teams managing fluctuating payroll/vendor costs | Tracks staffing, vendor fees, spending caps | ClickUp Workspace |

| ClickUp Finance Management Template | Get free template | Teams aligning payroll with overall financial planning | Visual tools for cash flow, forecasting, collaboration | ClickUp Workspace |

| Cash Flow Statement Template by Microsoft | Download this template | Finance teams tracking income/expenses for payroll | 12-month tracking, visual charts, cash flow analysis | Microsoft Excel |

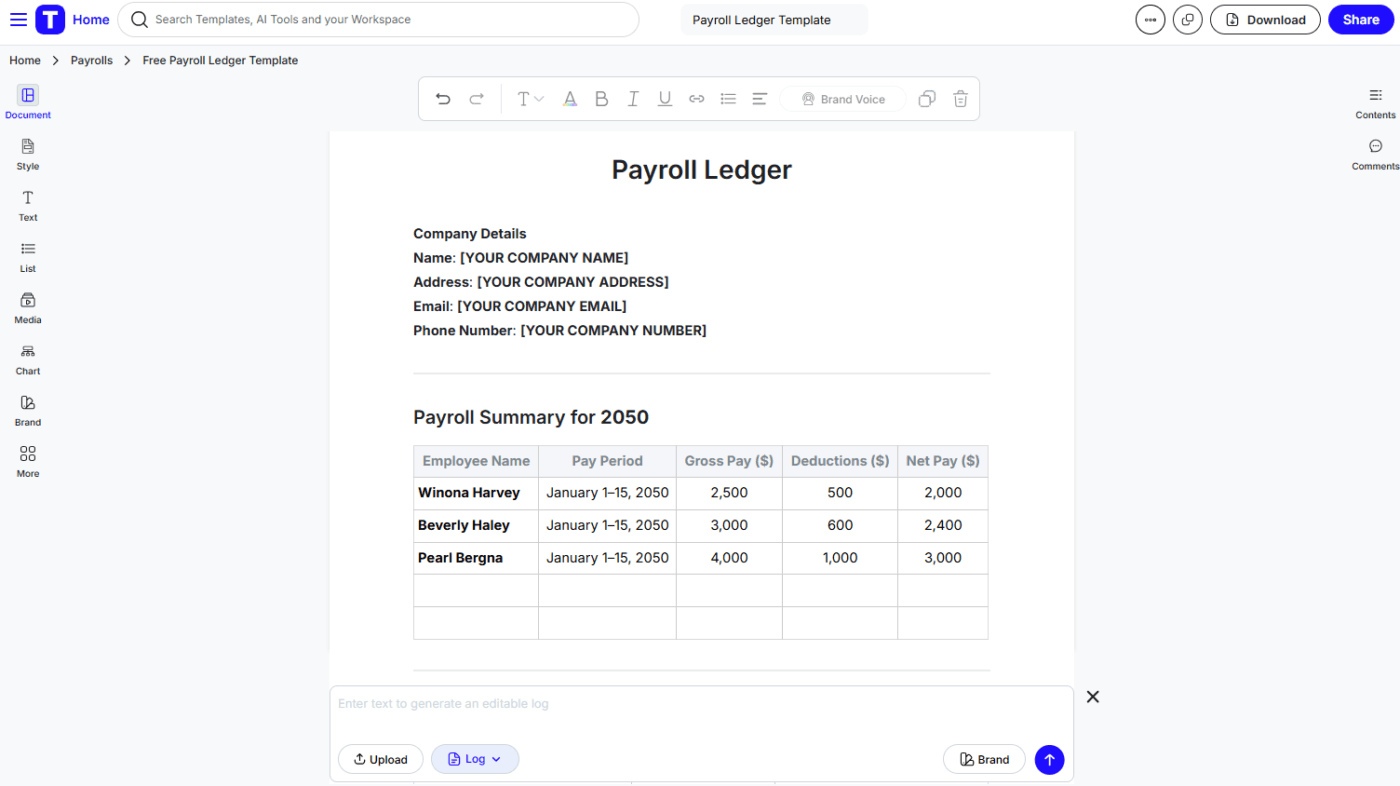

| Payroll Ledger Template by Template.net | Download this template | Teams logging payroll data & deductions | Records gross/net pay, tax contributions, pay periods | Template.net Spreadsheet |

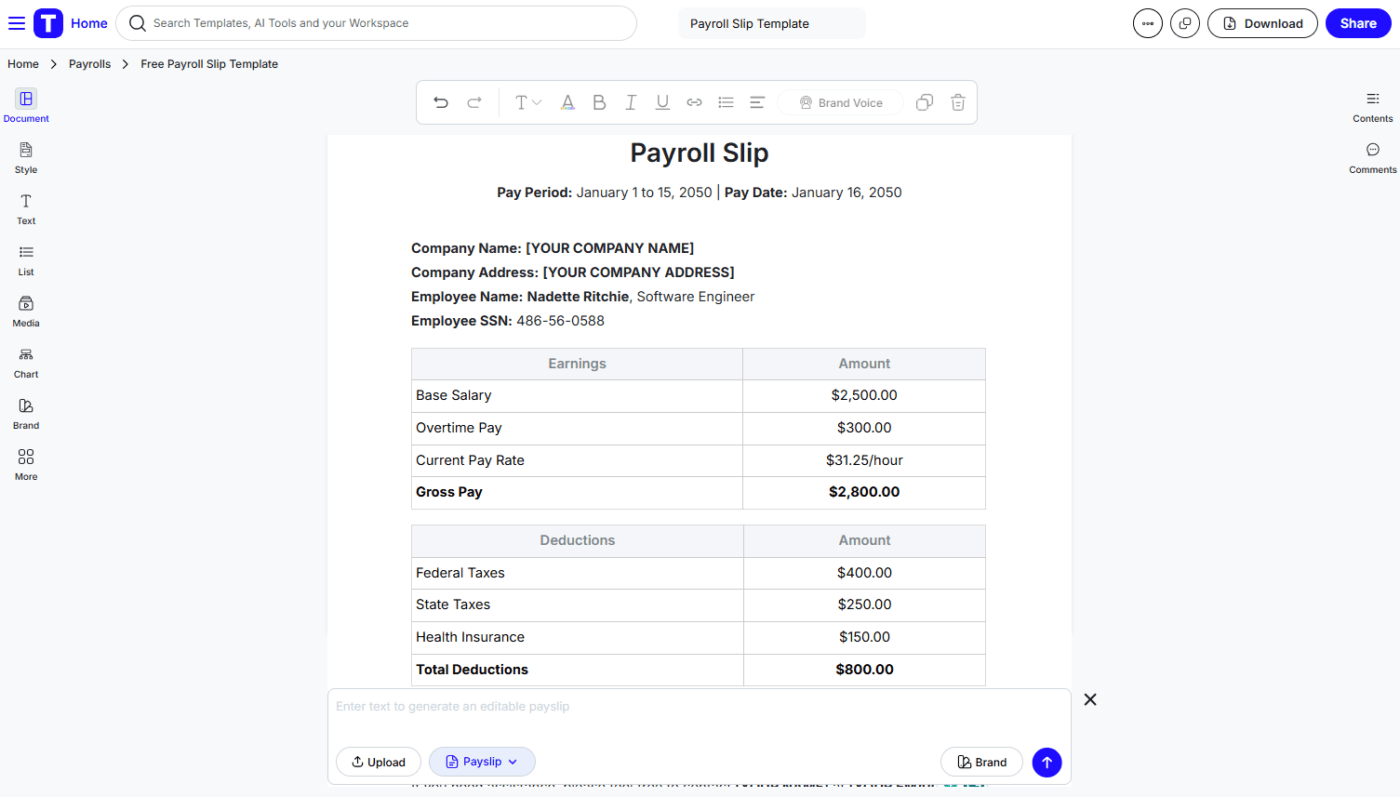

| Payroll Slip Template by Template.net | Download this template | Payroll teams issuing pay breakdowns | Details earnings, deductions, overtime, benefits | Template.net Spreadsheet |

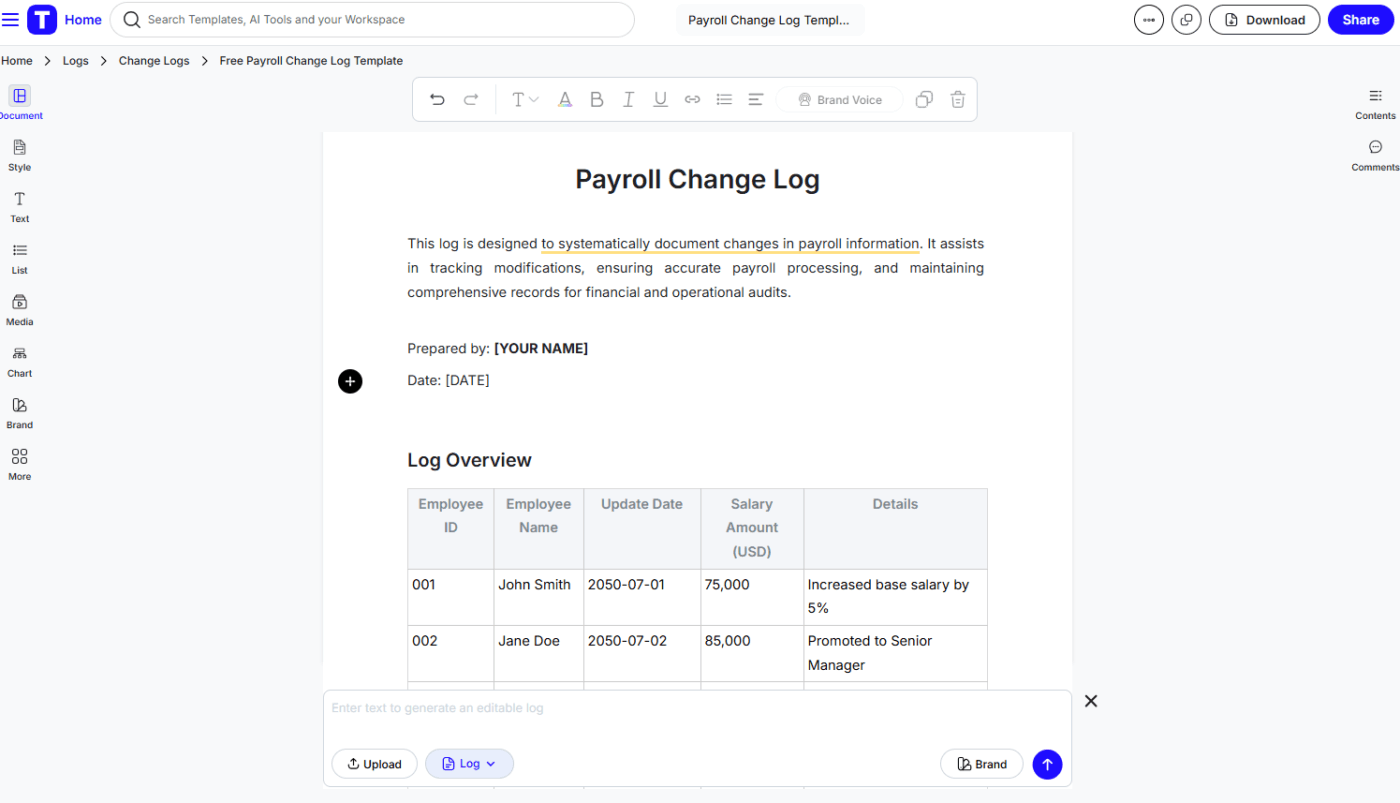

| Payroll Change Log by Template.net | Download this template | HR/finance teams tracking payroll changes | Logs salary/job changes, bonuses, terminations | Template.net Spreadsheet |

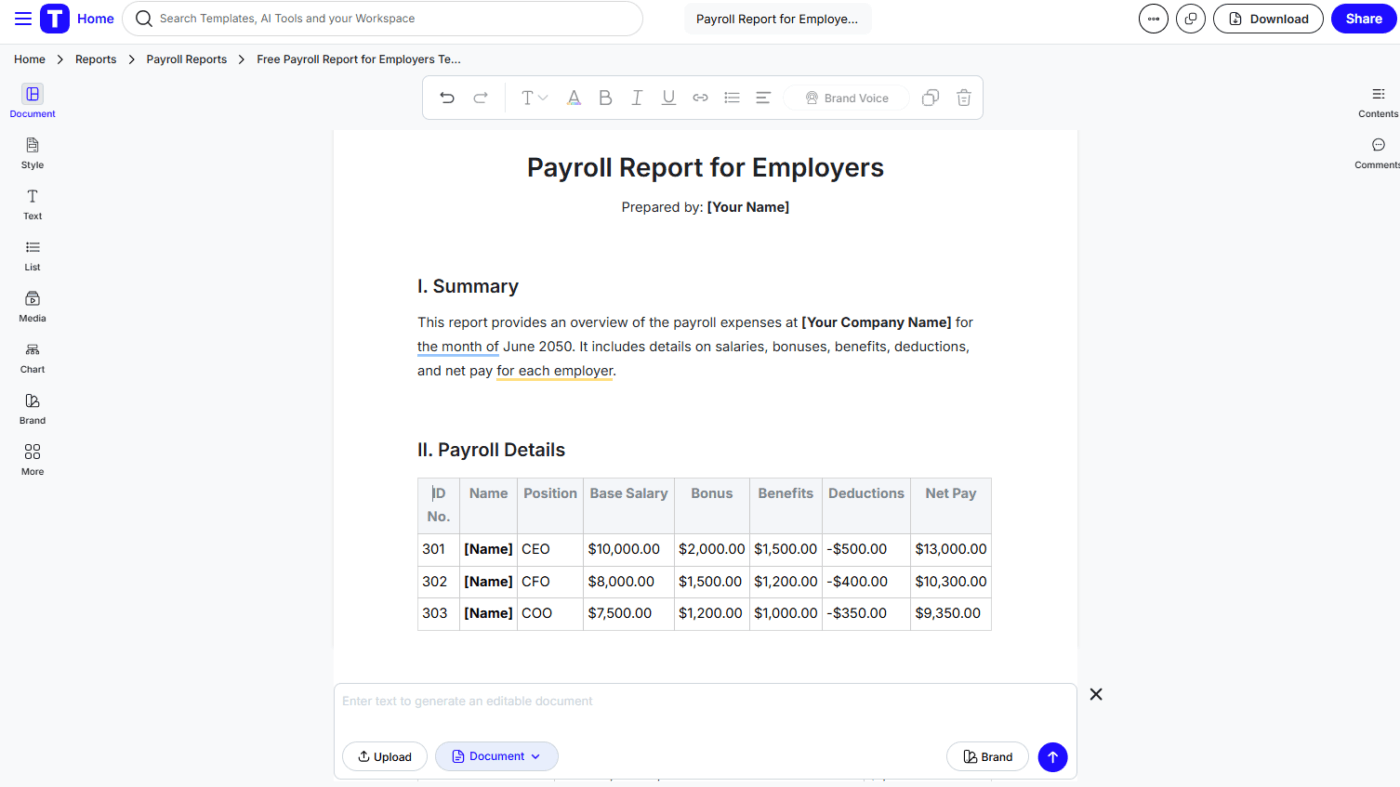

| Payroll Report for Employers by Template.net | Download this template | Finance teams/owners reporting executive payroll | Documents salaries, bonuses, benefits, deductions | Template.net Spreadsheet |

Let’s get started with the list. These templates simplify the payroll process by providing clear categories for tracking employee compensation across each pay period.

Managing payroll across multiple departments often results in disorganized data, as you’re dealing with hourly rates, taxes, and deductions scattered across various spreadsheets. HR and finance teams often waste hours double-checking numbers and chasing down corrections.

The result? Delayed reports, miscommunication, and payroll errors erode employee trust and slow down month-end processes.

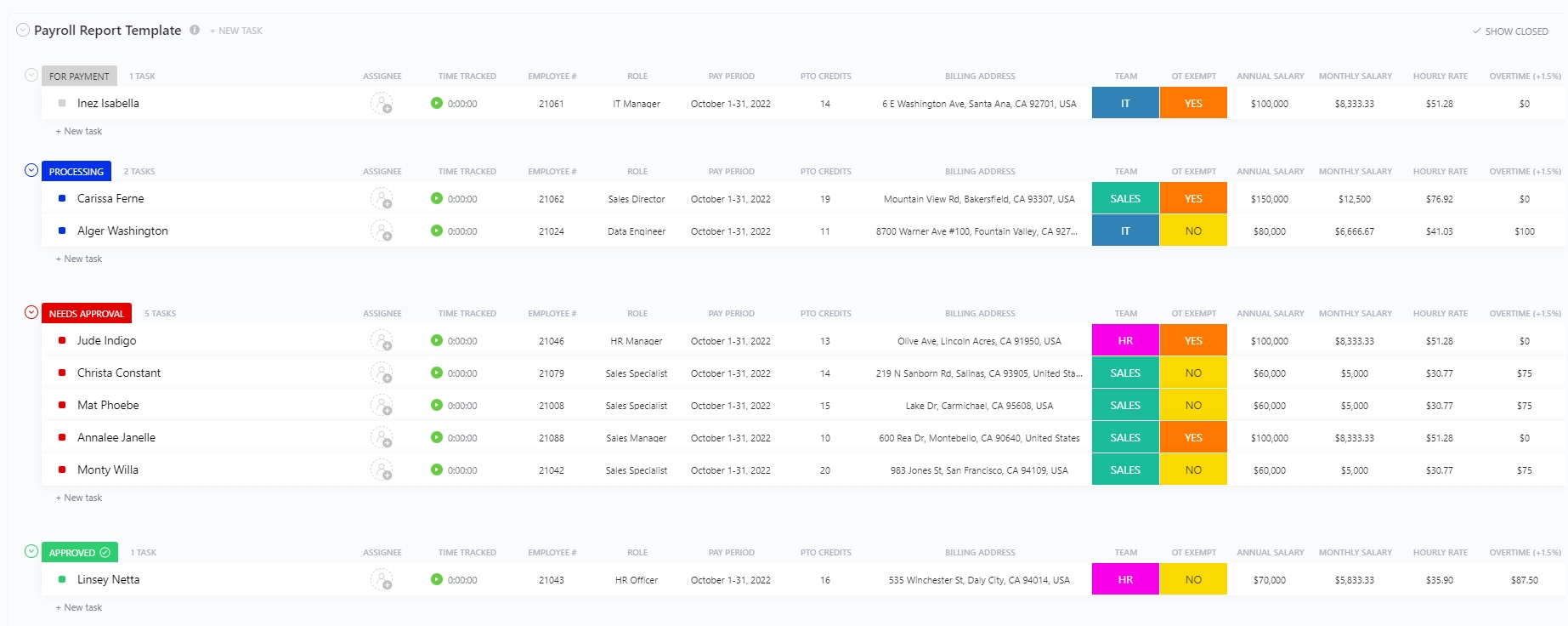

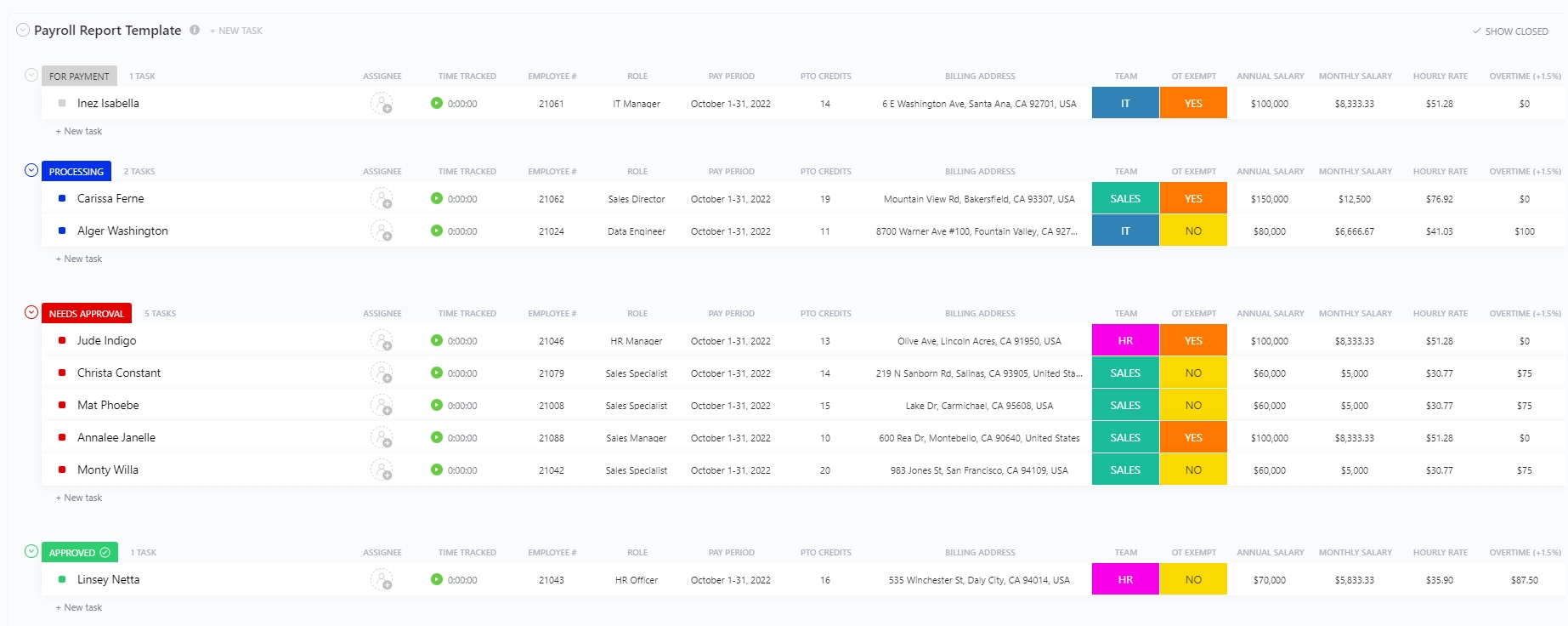

The ClickUp Payroll Report Template addresses this by centralizing everything in one workspace.

Unlike static payroll templates, this template allows users to:

✨ Ideal For: HR and operations teams who’ve outgrown spreadsheets and need real-time control over their payroll tracking.

Summary reports often get less attention than they deserve in a company environment. Many companies focus on processing payroll—not reviewing it—until something goes wrong. A missed deduction, an outdated salary, or a tax error surfaces, and suddenly there’s a scramble to pull together clean, consolidated data.

Without a reliable summary view, finance teams waste hours patching together information from different sources.

The ClickUp Payroll Summary Report Template solves this by giving teams a clear, centralized view of all payroll expenses, organized and audit-ready for every pay period.

This template pulls together salaries, benefits, deductions, and taxes by pay cycle, giving finance and operations teams the visibility they usually have to build manually. Since it’s built inside ClickUp, any inconsistencies can be flagged and followed up on without switching tools or losing context.

✨ Ideal For: Teams that need to stop fixing payroll issues after the fact and start spotting them early.

💡 Pro Tip: Drowning in bills and scattered statements? How to Organize Finances shows you how to create an accurate system that helps you track spending, reduce debt, and finally feel in control.

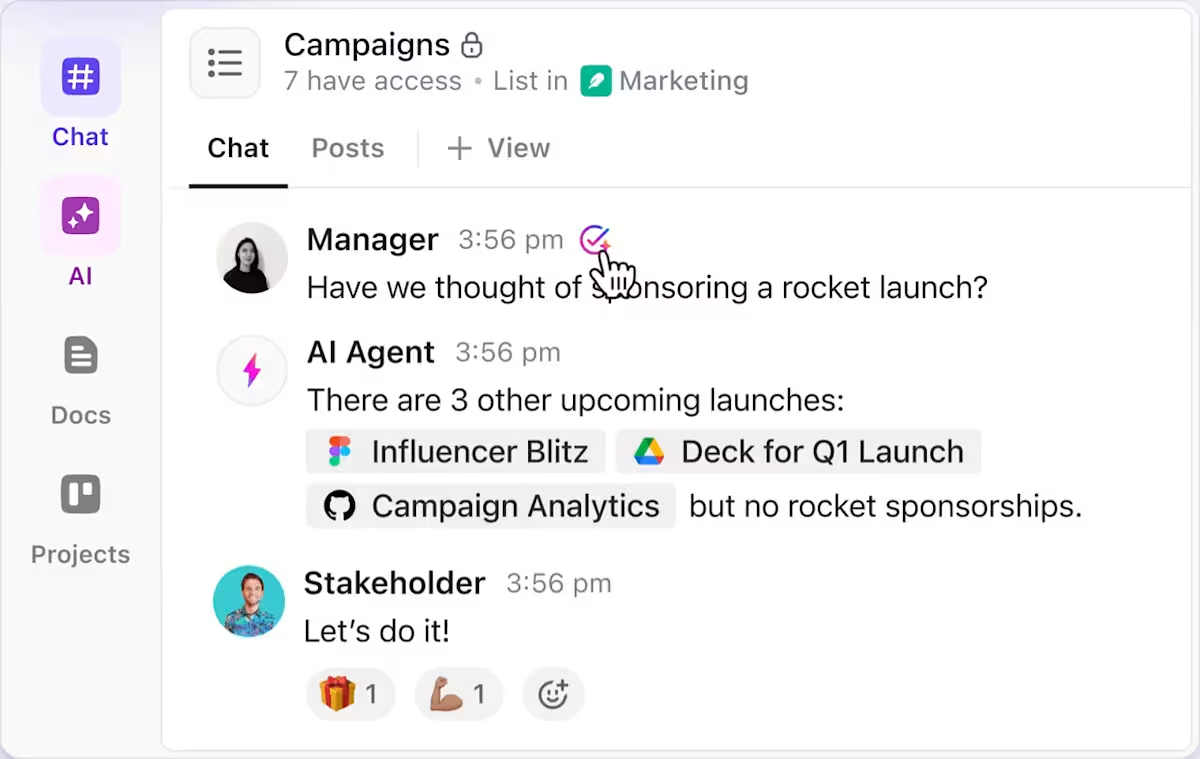

Automate payroll updates with ClickUp Agents

Payroll budgeting depends on details staying accurate as roles, rates, and staffing change. ClickUp Agents can support your workflow by updating fields, organizing pay data, pulling in the latest task or project information, and surfacing changes that need attention. This reduces the risk of manual errors and keeps every payroll template aligned with real activity across your workspace.

Billable hours are the backbone of payroll in services-based businesses. But when time tracking happens across tools (or worse, not at all), it becomes difficult to calculate payroll accurately.

In such a scenario, payroll ends up relying on estimates instead of data.

That’s where the ClickUp Services Timesheet Template proves its value. Built for project-based or client-facing teams, it links logged hours directly to billable tasks, making payroll faster, more accurate, and completely transparent.

Instead of switching between time logs and manual calculations, teams can log hours directly into the workspace and tie them to specific services, clients, or internal projects.

The template also supports resource planning and project allocation, so managers can adjust workloads while keeping payroll costs in check.

✨ Ideal For: Services-based teams that calculate payroll based on tracked hours, not assumptions.

🧠 Did You Know: Global IT spending is projected to surpass $5 trillion—and managing it efficiently starts with smarter budgeting. Explore IT Budgeting Strategies for Improved Financial Management to learn how to streamline spending, improve visibility, and strengthen your financial planning.

Unfortunately, payroll teams still rely on email threads to track outgoing and incoming payments, which makes it challenging to reconcile payroll-related costs or verify when employees, contractors, or vendors were last paid.

The ClickUp Payment History Template helps businesses regain control over that process by centralizing all payment records in one accessible, organized space. The template is especially useful for operations teams who manage both internal payroll and external payments, offering a reliable record of past transactions that payee, project, or date can filter.

Instead of hunting through bank statements or multiple systems, teams can quickly log, review, and reference payment history.

Plus, with sorting features, custom views, and real-time updates, the template simplifies everything from reconciling pay periods to catching late payments

✨ Ideal For: Teams that need a clear audit trail of payments tied to payroll, vendors, or services.

💡 Pro Tip: Want a clear view of your business’s financial health? How to Make a Balance Sheet breaks down the steps to create one so you can make smarter decisions without relying entirely on your accountant.

For many teams, payroll planning begins with a single question: Can we afford this?

But if teams have to chase random docs to track budget, it’s hard to get a clear answer. Managers and finance leads often spend more time piecing together numbers than actually deciding on budget allocations.

The ClickUp Simple Budget Template offers teams a way to take a broader view. It’s designed to make budgeting approachable, especially for those managing multiple categories, including payroll, operations, and project-based spending.

This client budget management template helps track actual costs against projected ones, keeping payroll aligned with broader financial goals.

Teams can log and review payroll expenses alongside other business expenses, catch overspending early, and adjust allocations before the numbers get out of hand.

✨ Ideal For: Small businesses and team leads who need a simple, visual way to budget for payroll alongside other operational costs.

📮 ClickUp Insight: Struggling teams are 4x more likely to juggle 15 or more tools. High-performing teams? They get more done with fewer—often using 9 or less. So why not go all-in on one?

ClickUp brings together your tasks, docs, wikis, chats, meetings, and projects—all in one place. With built-in AI to streamline workflows, it’s the all-in-one platform that helps every team stay aligned, move faster, and focus on what actually matters.

It’s easy for businesses to underestimate how much payroll relies on the bigger budget picture. A decision to delay hiring, cut overtime, or approve bonuses often comes down to more than just payroll. It’s about cash flow, revenue targets, and competing expenses across the company.

When those numbers live in disconnected files or vague projections, payroll planning becomes reactive. Teams start guessing instead of budgeting, which leads to rushed approvals, overspending, or hiring freezes at the wrong time.

The ClickUp Business Budget Template helps prevent those bottlenecks by giving companies a single workspace to track all income, spending, and department-level budgets—including payroll.

You can map out expected payroll expenses, monitor spending trends by month, and adjust in real time as new costs come in. The result is a more informed payroll process—one that fits into the organization’s financial strategy, not just the HR calendar.

✨ Ideal For: Businesses that need to tie payroll decisions to financial planning, cash flow, and cost control across teams.

📖 Also Read: Free Monthly Budget Templates to Manage Expenses

Project budgets often fall apart not because of overspending, but because no one really sees where the money is going.

The absence of a detailed Work Breakdown Structure (WBS) makes it harder to connect the scope with actual payroll expenses, including hourly rates.

The ClickUp Project Budget with WBS Template solves this by giving teams a structured way to plan, price, and monitor every phase of a project.

The template breaks work into manageable units, assigns cost estimates to each task, and lets teams track actual performance against projections, so payroll costs tied to project tasks don’t go unnoticed.

✨ Ideal For: Project-based teams that need to link task planning with labor costs to steer clear of budget surprises.

💡 Pro Tip: Struggling to stand out in a competitive talent market? How to Provide Personalized Employee Perks and Benefits for Happier Employees shows you how to go beyond basic benefits and build a perks program that actually improves retention.

This might be a familiar scenario in your office: Teams pitch new initiatives or request additional resources. Immediately, payroll becomes the hardest part to justify.

It’s one thing to estimate software or equipment costs; it’s another to explain salaries, overtime hours, or new headcount in a way that decision-makers understand and support.

The ClickUp Budget Proposal Template helps prevent those missteps by organizing project costs—including payroll expenses—into a format that’s simple to follow and easier to approve.

This template is especially helpful for proposals that include team expansion or compensation shifts. With structured inputs and built-in visuals, you can present your payroll breakdown with clarity, tie it to outcomes, and keep all feedback in one place.

✨ Ideal For: Teams that need to present payroll costs as part of a bigger budget request without losing clarity or credibility.

👀 Fun Fact: The term “payroll” actually comes from the early practice of keeping employee payment details on handwritten pay rolls — literally rolls or sheets of paper listing who was owed what.

Because these lists were the only source of truth, employers protected them carefully… if they were lost or damaged, nobody could be paid.

Event planning is one of the few areas where labor costs fluctuate dramatically.

Payroll is one of the most challenging expenses to track in real-time due to various factors, such as hourly staff, vendor contracts, and overtime pay for internal teams.

The problem? Teams often overspend before they even realize what went wrong.

The ClickUp Event Budget Template helps teams stay ahead of those issues by organizing every line item in one place, including staffing, vendor fees, and payroll-related costs.

Whether you’re hosting a one-day summit or a multi-day conference, the template lets you set spending caps, track commitments, and adjust allocations as plans evolve.

✨ Ideal For: Event teams managing tight budgets and fluctuating payroll needs across multiple vendors and timelines.

Payroll is one of the largest recurring expenses for any organization, but without complete visibility into how it fits within broader financial activity, it becomes harder to plan accurately.

The result is often short-term thinking: payroll cuts during lean months or rushed approvals during growth cycles, without the data to support either move.

The ClickUp Finance Management Template changes that by bringing payroll into the bigger financial picture.

The template includes visual tools for performance tracking, cash flow management, and forecasting. Because it’s tied to ClickUp’s task and resource planning features, finance teams can collaborate directly with HR or department leads to ensure every payroll adjustment is both timely and aligned with financial goals.

✨ Ideal For: Teams that need to connect payroll to high-level financial planning and improve cross-functional budget visibility.

📖 Also Read: Free Project Budget Templates in Excel and ClickUp

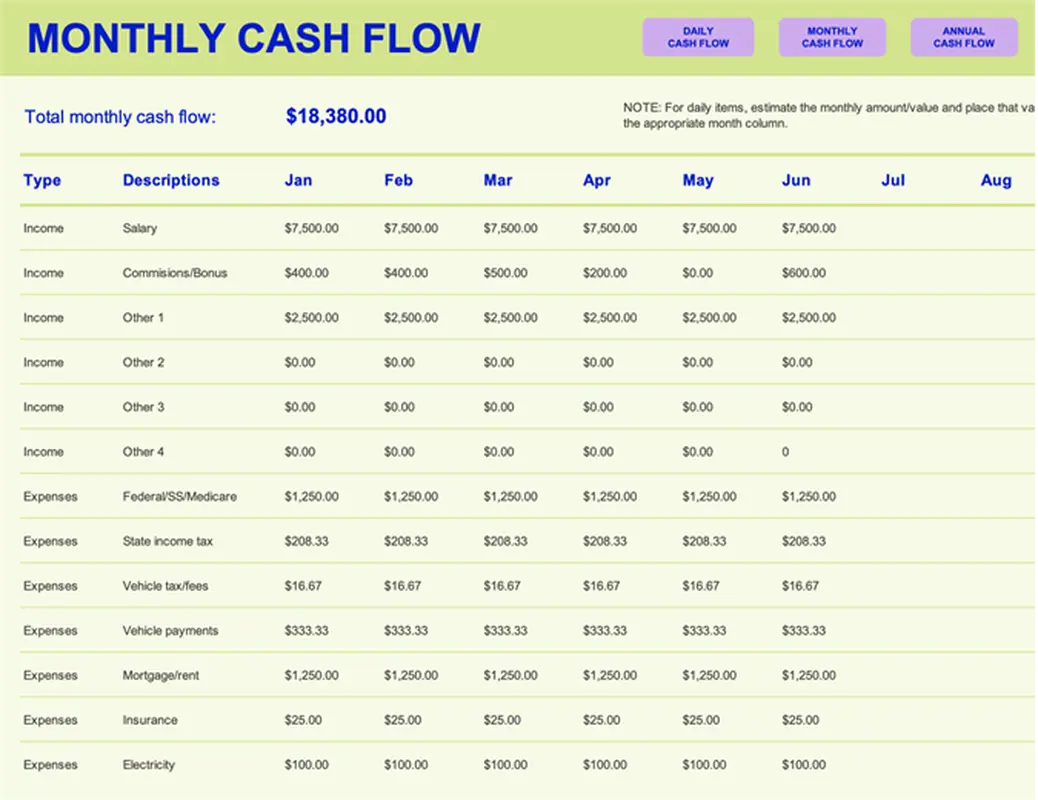

Many businesses don’t realize they have a payroll problem until they run into a cash flow crunch. Maybe a vendor payment comes in late, or a big client delays an invoice, and suddenly, there’s not enough on hand to cover this month’s payroll.

This is not necessarily a result of overspending. Occasionally, it’s just poor visibility.

That’s why templates like this one from Microsoft matter more than they seem. It gives teams a clear view of what’s coming in, what’s going out, and when.

The Cash Flow Statement Template is designed for twelve-month tracking, with space to analyze income, expenses, savings, and discretionary spending.

And the visual charts make it easier to spot patterns and understand how payroll fits into the bigger financial cycle.

✨ Ideal For: Finance teams that need better foresight to keep payroll running smoothly—no surprises, no stress.

💡 Pro Tip: Losing top talent costs more than just time. What’s the True Cost of Employee Turnover to Your Business breaks down how unchecked turnover affects morale, revenue, and growth, and what you can do to stop the cycle.

Payroll just closed for the month when an employee emails saying their paycheck seems wrong. You check the spreadsheet and realize some deductions haven’t been updated, the numbers don’t match, and no one knows how the final amount was calculated. It’s a mess that could’ve been avoided with a proper payroll log.

Now you’re stuck patching things together while trying to stay compliant.

That kind of scenario is precisely why a clear, structured payroll ledger matters. The Payroll Ledger Template from Template.net gives teams a straightforward way to record and review gross pay, tax deductions, and net pay for each employee, sorted by pay period.

It also includes a tax contributions overview, which helps teams double-check withholdings and track recurring tax liabilities over time.

✨ Ideal For: Teams that need a simple, reliable way to log payroll data and resolve pay-related questions without starting from scratch every time.

💡 Pro Tip: Dealing with too many HR tasks with clunky workflows? HR Process Improvement explores tips and strategies that boost efficiency and deliver a better experience for both employees and new hires.

An employee opens their pay stub and sees a number they weren’t expecting. Maybe it’s lower than last time, or a new deduction appears without explanation.

Suddenly, the payroll team is piecing together a breakdown that should have already been clear.

A proper payroll slip aims to prevent precisely that kind of confusion. The Payroll Slip Template from Template.net provides a clear, detailed record of each employee’s earnings, deductions, and net pay for a given pay period.

The template includes key information, such as overtime hours, tax withholdings, and benefits contributions. Plus, its professional layout and editable fields make it easy to generate and distribute slips for each pay date.

✨ Ideal For: Payroll teams that need a clean, transparent way to communicate pay breakdowns and minimize back-and-forth with employees.

📖 Also Read: Free Payroll Templates in Excel & ClickUp

Mid-month payroll changes can be easy to overlook.

A promotion gets approved but isn’t reflected in the next cycle. A termination is processed late, triggering an overpayment. Without a clear, centralized log, updates made in Slack get missed, and payroll accuracy takes the hit.

The Payroll Change Log by Template.net is built for exactly these moments. It gives finance and HR teams a structured way to document every salary adjustment, job title change, bonus, or termination, along with the effective dates and reasons behind them.

Instead of relying on memory or scattered messages, teams can track all modifications in one place, ensuring changes are applied correctly and audit records stay clean.

✨ Ideal For: HR and finance teams managing frequent payroll changes and needing a reliable record for internal coordination and audits.

👀 Fun Fact: One in three small businesses is penalized for payroll mistakes every year, usually due to incorrect tax filings.

Leadership compensation often comes under greater scrutiny—whether it’s from investors, internal stakeholders, or compliance audits.

Without proper documentation, it becomes challenging to answer simple questions like—What was the bonus allocation last quarter? Are salary trends in line with revenue performance?

That’s where the Payroll Report for Employers by Template.net becomes valuable. It’s designed specifically to document and present executive-level payroll expenses in a clear, structured format.

Instead of manually assembling details from separate files, finance teams receive a single report that includes base salaries, bonuses, benefits, deductions, and net pay—all broken down by individual, category, and pay period.

✨ Ideal For: Finance teams and business owners who need a clean, transparent view of executive payroll and benefits for reporting, reviews, or strategic planning.

📖 Also Read: HR Challenges & Solutions for HR Teams

Ultimately, teams and companies operate on payroll, which is essential for the economy. Small problems quickly grow into larger ones if you don’t prepare for them.

Unlike static spreadsheets or siloed software, ClickUp integrates payroll data, budget templates, and team collaboration into a Converged AI Workspace.

Whether it’s finance leads tracking payroll costs, HR updating salary records, or operations monitoring spending by pay period, everyone stays aligned in real time.

As Giuliano Peressini, CTO at Casagrande, puts it,

ClickUp is always a very good choice whenever information has to be shared between multiple people at the same time and whenever there are different teams working on the same subject from different points of view.

For any team responsible for managing payroll across departments, sign up on ClickUp now!

© 2026 ClickUp