You worked hard to close that mortgage—so why did your top client just go with a competitor?

Simple: You didn’t follow up and maintain the relationship.

The brutal truth is that loan officers who don’t nurture existing clients lose repeat business and referrals. But here’s the fix—a powerful mortgage customer relationship management (CRM) system

74% of businesses say CRM software strengthens client relationships by making customer data more accessible.

The mortgage industry is complex enough without your tech stack holding you back. The right mortgage CRM system automates follow-ups, centralizes data, and keeps deals moving.

So, whether you’re comparing specific CRMs such as HubSpot vs. Monday or searching for a third all-in-one solution, this blog post will show you the best mortgage CRM software platforms to help turn one-time borrowers into lifelong clients.

- What Should You Look for in a Mortgage CRM?

- Top Mortgage CRM Tools at a Glance

- The 10 Best Mortgage CRM Tools

- How we review software at ClickUp

- 1. ClickUp (Best for streamlining mortgage pipeline and team collaboration)

- 2. Jungo (Best for Salesforce integration and mortgage marketing)

- 3. Surefire CRM (Best for automated relationship nurturing)

- 4. Pipedrive (Best for visually optimizing mortgage sales pipelines)

- 5. BNTouch Mortgage CRM (Best for all-in-one mortgage marketing)

- 6. Velocify (Best for sales automation in mortgage lending)

- 7. NextWave (Best for customizable sales and marketing automation)

- 8. Shape (Best for complete Mortgage automation)

- 9. Aidium (Best for AI-driven lead management)

- 10. Salesforce Financial Services Cloud (Best for enterprise-level mortgage automation)

What Should You Look for in a Mortgage CRM?

Before diving into our top picks for mortgage CRM software, let’s discuss what separates the wheat from the chaff. The ideal CRM system should be more than just a glorified spreadsheet. Here’s what matters:

- Lead management: Choose a CRM that captures leads from multiple sources, nurtures them with automation, and tracks both clients and referral partners in one place to boost conversions

- Automation: Look for a CRM that automates repetitive tasks, frees up time for closing deals, and drives repeat clients for your mortgage business

- Integrations: Choose a tool that connects with your Loan Origination System [LOS] and mortgage industry tools. When your CRM integrates with your LOS, all borrower data, loan status updates, and communications are centralized. With integration, you can trigger automated workflows based on LOS events. For example, when a loan status changes to “approved,” your CRM can automatically send personalized next-step emails or update internal task lists

- Customizable dashboards: Opt for a platform that lets you tailor dashboards to track key metrics, providing real-time insights for data-driven decisions. A loan officer, a processor, and a branch manager all care about different metrics. Custom dashboards let each person focus on their KPIs—no distractions, just actionable insights

- Compliance and security: Ensure your CRM meets The Real Estate Settlement Procedures Act [RESPA], TILA-RESPA Integrated Disclosures [TRID], and other industry regulations to keep your business compliant

- Marketing Automation: Choose a CRM with built-in tools for email marketing and other marketing CRM software capabilities to keep your pipeline full

💡 Pro Tip: Look for a CRM that offers mobile accessibility. Loan officers who manage pipelines and client interactions from anywhere have higher chances of closing more deals.

Top Mortgage CRM Tools at a Glance

| Tool | Key features | Best for | Pricing* |

|---|---|---|---|

| ClickUp | AI-powered task and pipeline management, custom fields, CRM templates, email integration, map view, dashboards, automations | Small to enterprise mortgage teams managing leads, listings, and team collaboration | Free plan available; Paid plans start at $7/user/month; Custom pricing for enterprises |

| Jungo | Built on Salesforce, LOS integration (Encompass, Calyx Point), marketing templates, automated post-close programs | Enterprise teams using Salesforce who need built-in mortgage marketing and client retention | No free plan; Paid plans start at $119/user/month; Custom pricing for enterprises |

| Surefire CRM | Omnichannel automation (email, text, print), 1000+ compliance-ready assets, built-in audit support | Mortgage brokers and loan officers at small to mid-sized firms focused on automated relationship nurturing | No free plan; Custom pricing only |

| Pipedrive | Kanban-style pipeline view, AI follow-up prompts, 400+ integrations, real-time sales reporting | Small to mid-sized loan officers visualizing pipelines and optimizing close rates | Free trial available; Paid plans start at $19/user/month; Enterprise plan available at $99/user/month |

| BNTouch Mortgage CRM | All-in-one system with POS, mobile app, video and SMS marketing, digital 1003 app | Mortgage professionals and agencies of all sizes wanting a full-stack CRM and marketing suite | No free plan; Paid plans start at $165/month for individuals; Team and Enterprise plans with custom pricing |

| Velocify | Lead routing and prioritization, multi-channel communication, AI sales dialer, LOS integrations | Mid-sized to large mortgage sales teams needing automation and follow-up at scale | No free plan; Custom pricing only |

| NextWave | Custom dashboards, mobile CRM, lead tracking, partner management, skill-based routing | Small to mid-sized mortgage lenders wanting configurable automation and tracking | No free plan; Custom pricing only |

| Shape | 500+ built-in features, AI scoring, email/SMS automations, LOS/POS integrations | Small to mid-sized mortgage brokers and lenders seeking end-to-end automation | No free plan; Custom pricing only |

| Aidium | AI lead scoring, drag-and-drop campaigns, Canva integration, intuitive UI | Small to mid-sized teams looking for smart, simplified lead management | No free plan; Custom pricing only |

| Salesforce Financial Services Cloud | AI personalization, document collection, automation, loan collaboration tools | Enterprise mortgage institutions needing scalable, compliant mortgage CRM infrastructure | Free 30-day trial available; Paid plans start at $300/user/month; Custom industry pricing available (up to $180K/year) |

The 10 Best Mortgage CRM Tools

Ready to turn missed opportunities into more loans? You need a CRM option that helps you simplify workflows, drive repeat business, and keep you compliant.

👀 Did You Know? 63% of financial organizations want to invest in workflow automation technology like CRM.

Let’s break down 10 of the best mortgage CRM solutions in the market, highlighting their key strengths and weaknesses to help you make an informed decision.

How we review software at ClickUp

Our editorial team follows a transparent, research-backed, and vendor-neutral process, so you can trust that our recommendations are based on real product value.

Here’s a detailed rundown of how we review software at ClickUp.

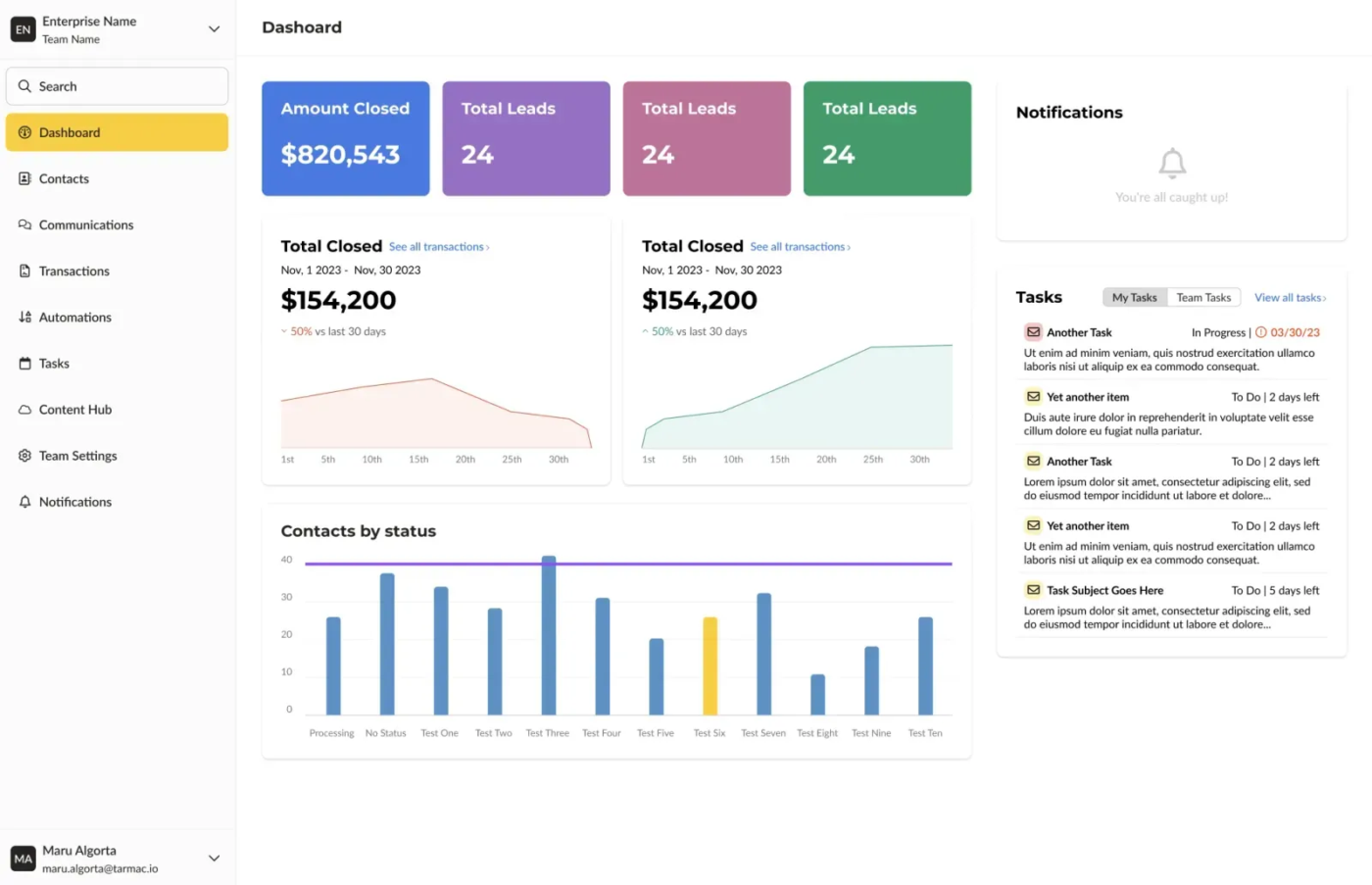

1. ClickUp (Best for streamlining mortgage pipeline and team collaboration)

ClickUp, the everything app for work, combines the best of project management with CRM solutions to create a unified command center for your mortgage process—and, is, therefore, number one on our list!

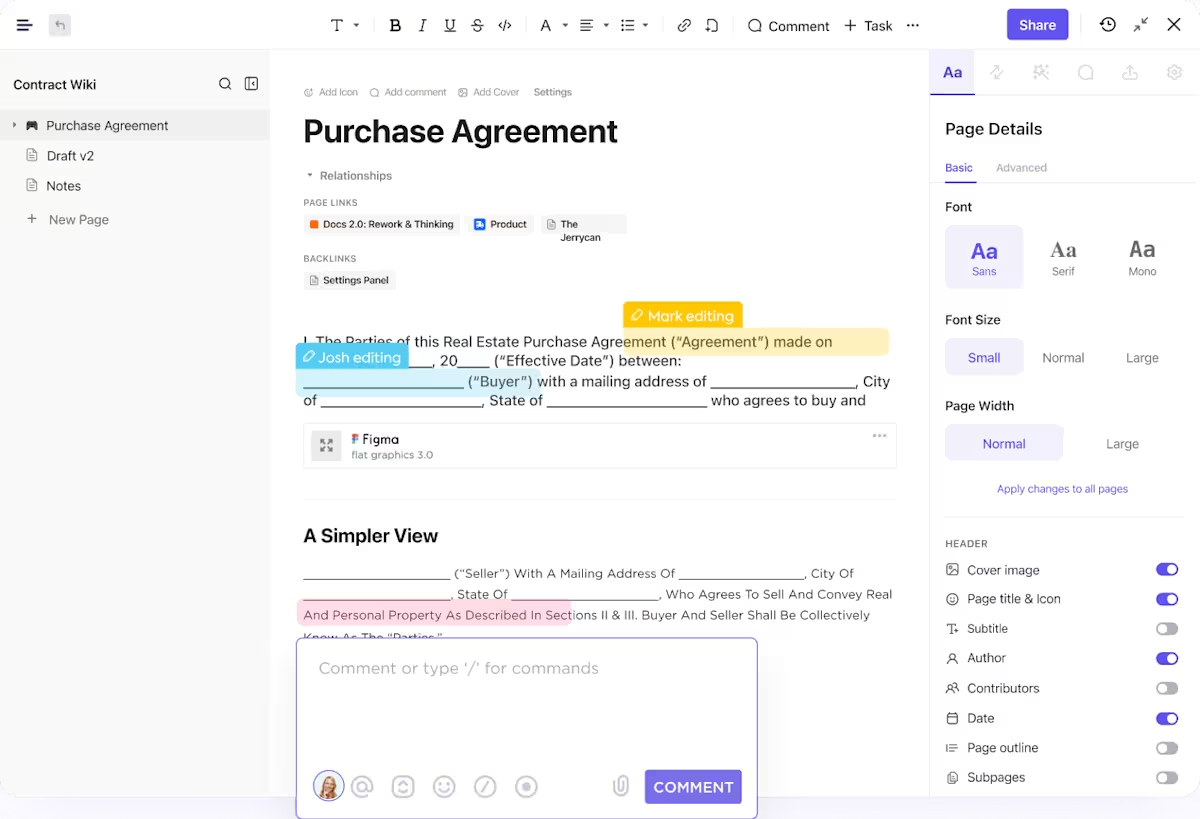

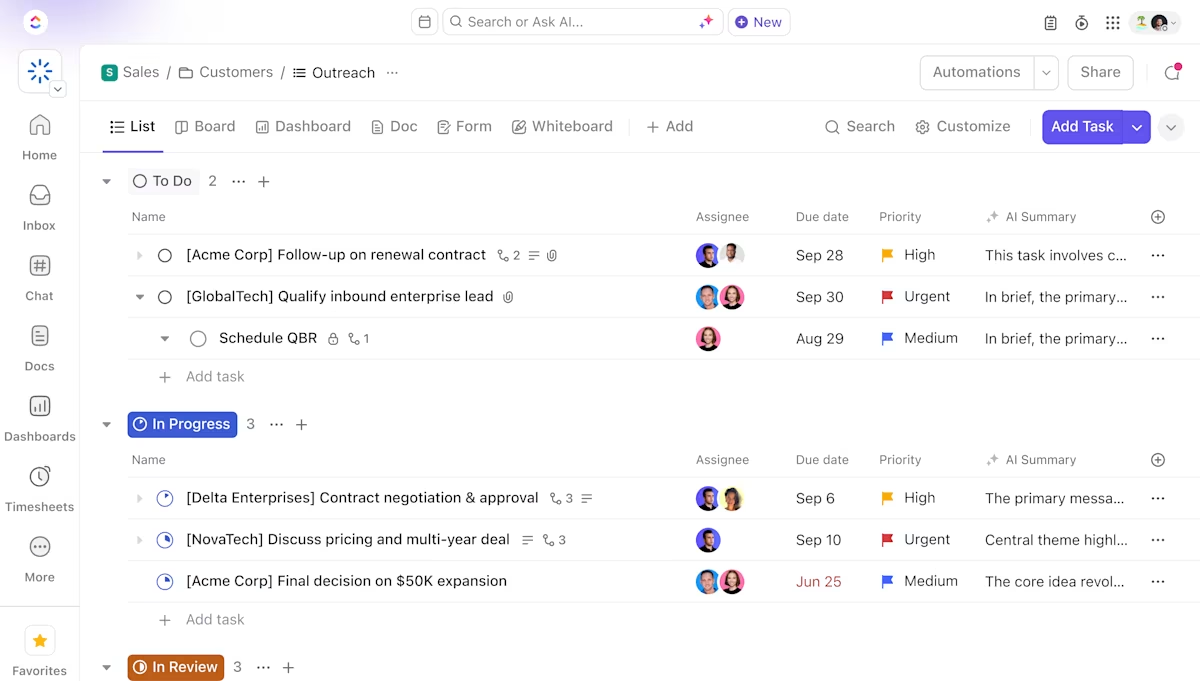

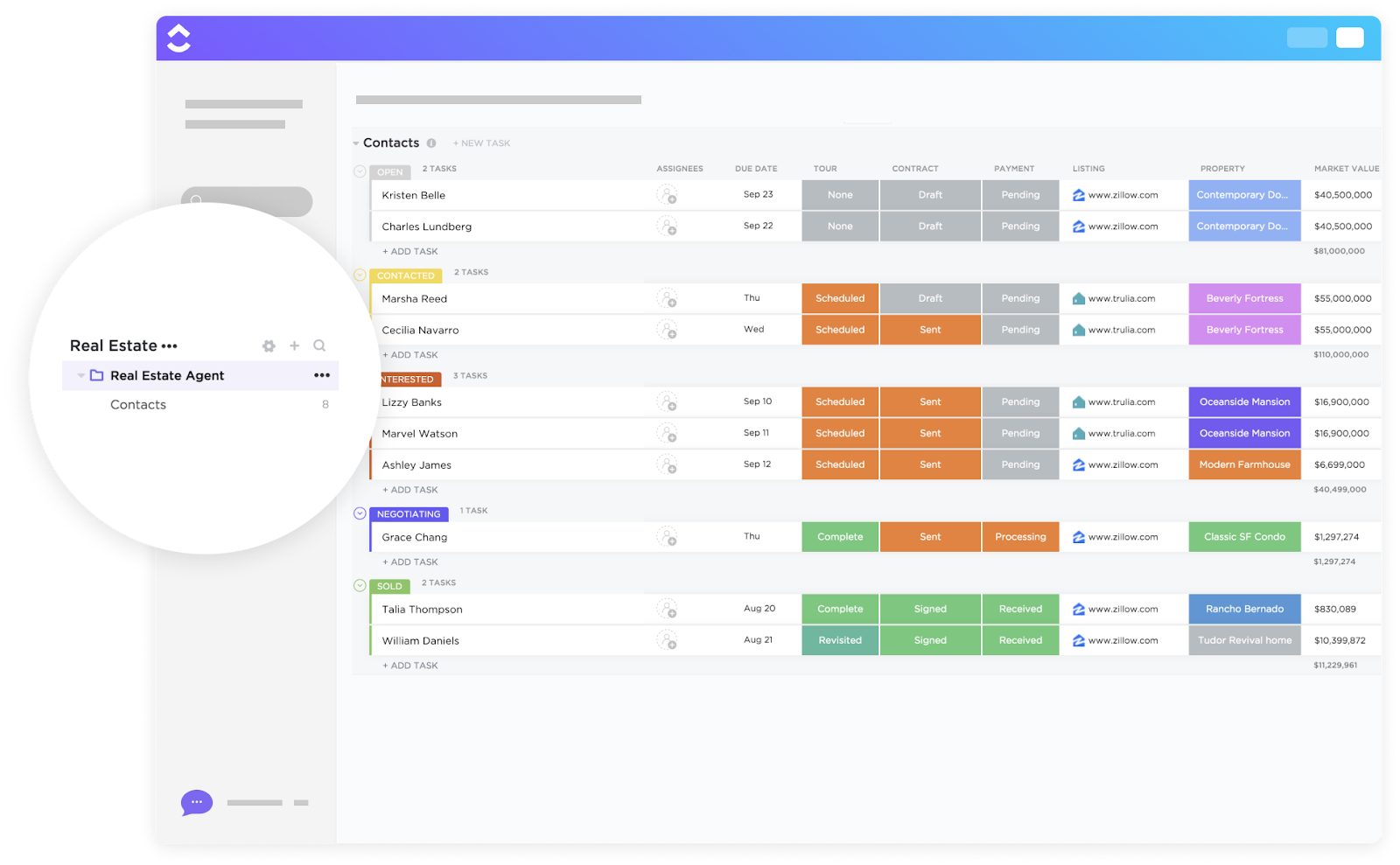

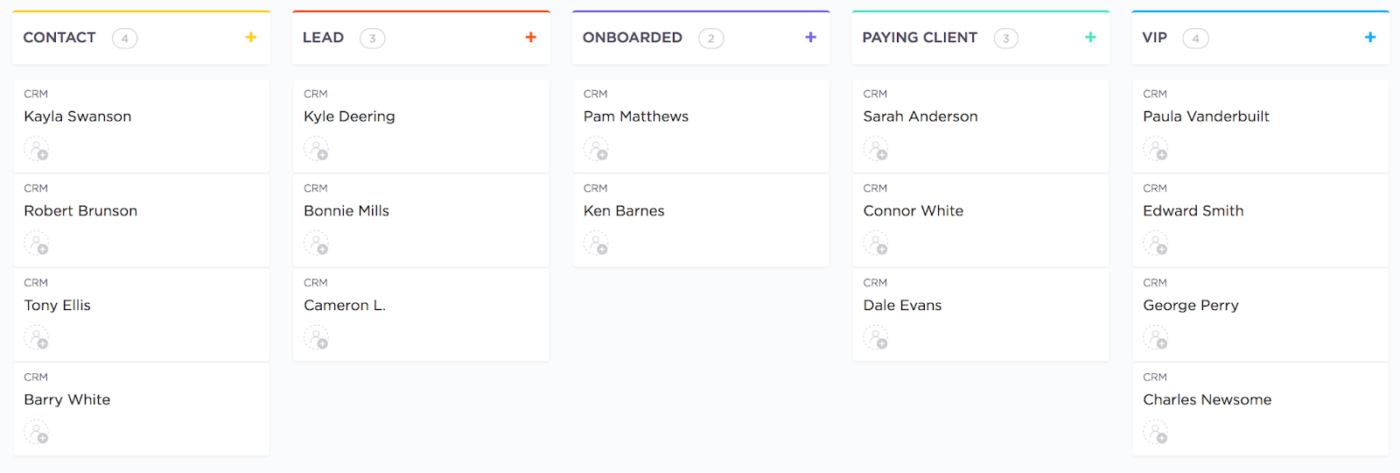

Whether you’re tracking leads, managing pipelines, or coordinating with your team, ClickUp for Real Estate Teams gives you complete control over your workflow. It’s flexible and highly customizable to cross-functional teams for intuitive lead management.

Managing clients, loan applications, and team tasks can get overwhelming, and no two systems look alike. But with ClickUp, you can tailor everything. ClickUp’s Custom Task Statuses and Custom Fields fit your unique mortgage pipeline to track loan types, credit scores, lead sources, and more—no rigid structures, just a CRM that works the way you do.

ClickUp also offers multiple views to help visualize your process. Whether you prefer the List View, Board View, Gantt View, or Table View, you can track applications, manage client communication, and oversee marketing campaigns however suits you best.

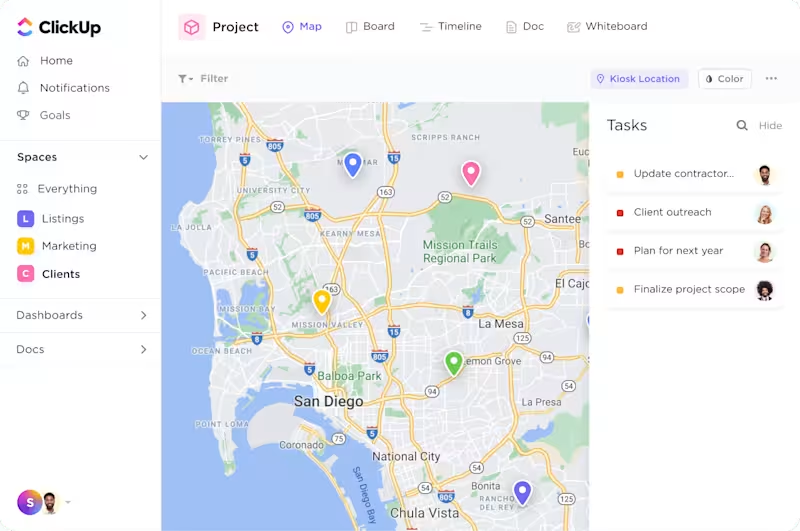

Want to send listings to your client? ClickUp has you covered. With the ClickUp Map View, you can map out all your listings so your clients can see their exact locations. You can also color-code them according to their price range and create templates for later.

📮 ClickUp Insight: Low-performing teams are 4 times more likely to juggle 15+ tools, while high-performing teams maintain efficiency by limiting their toolkit to 9 or fewer platforms. But how about using one platform?

As the everything app for work, ClickUp brings your tasks, projects, docs, wikis, chat, and calls under a single platform, complete with AI-powered workflows. Ready to work smarter? ClickUp works for every team, makes work visible, and allows you to focus on what matters while AI handles the rest.

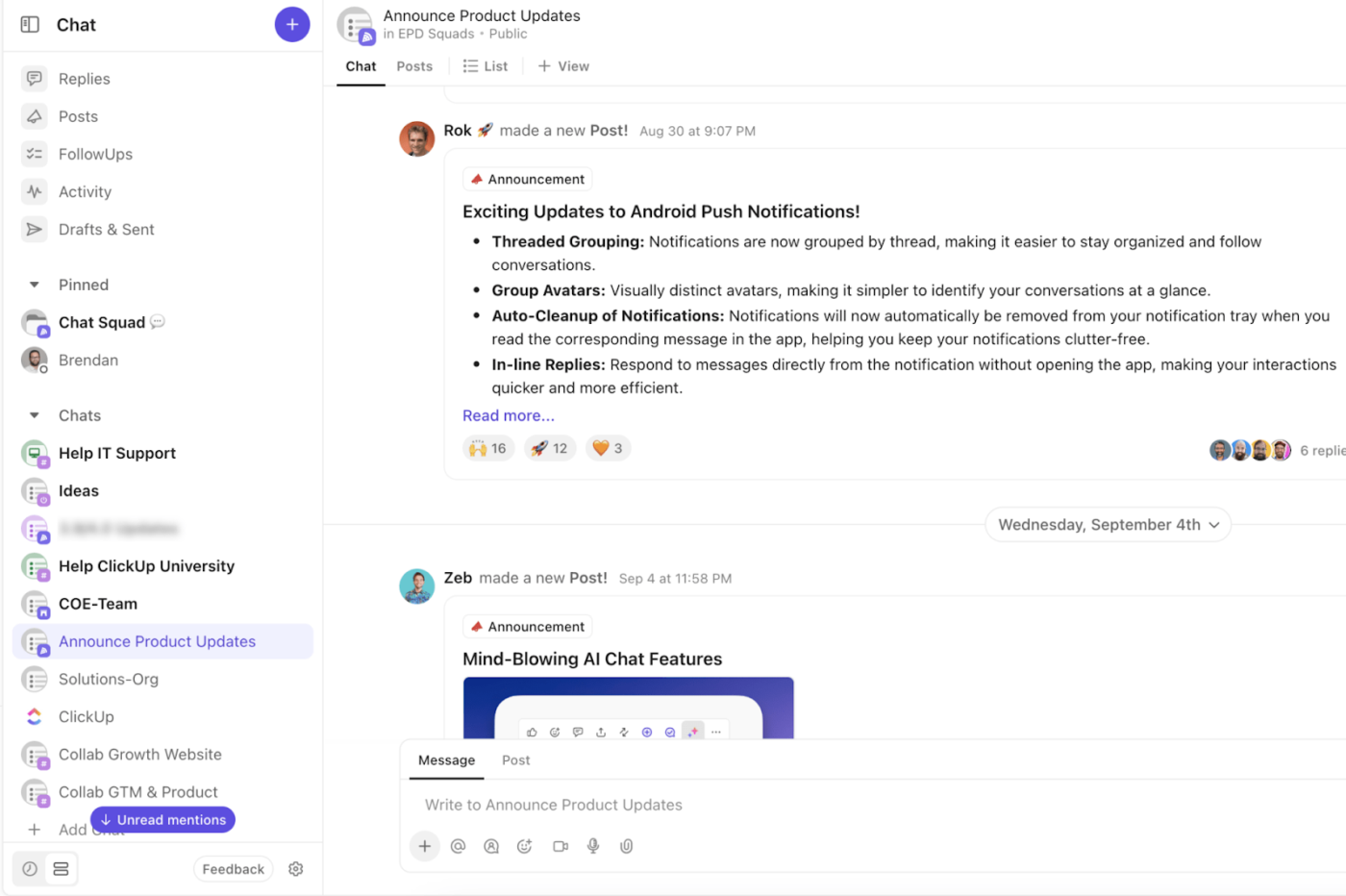

Using fragmented collaboration tools makes workflows more complex than they need to be. But with ClickUp, you can assign tasks, drop comments, or even converse with your team to keep everyone on the same page with ClickUp Chat—no more chasing emails.

Bonus: you can create and assign tasks right from the chat messages!

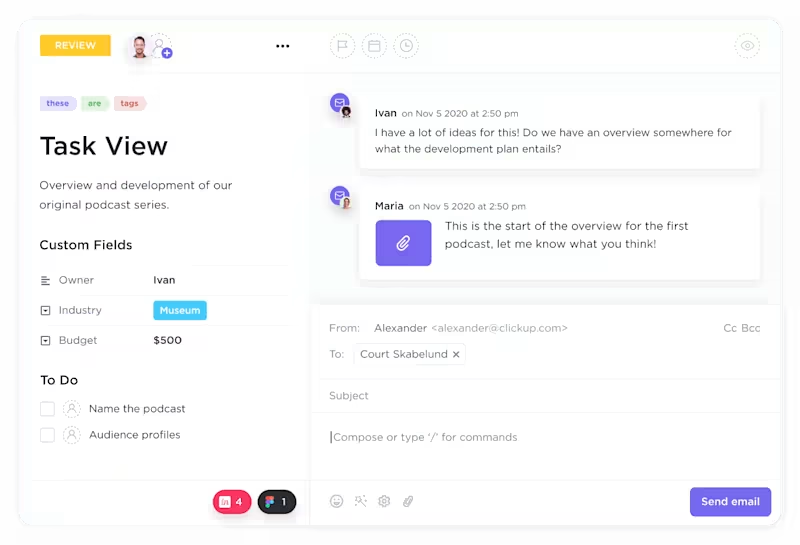

If you think you’ll still need to switch tabs for emails, ClickUp fixes that, too! Whether you use Outlook or Gmail, you can draft and send emails from within ClickUp. So, all your lead and client nurturing happens right where you need it—inside your CRM.

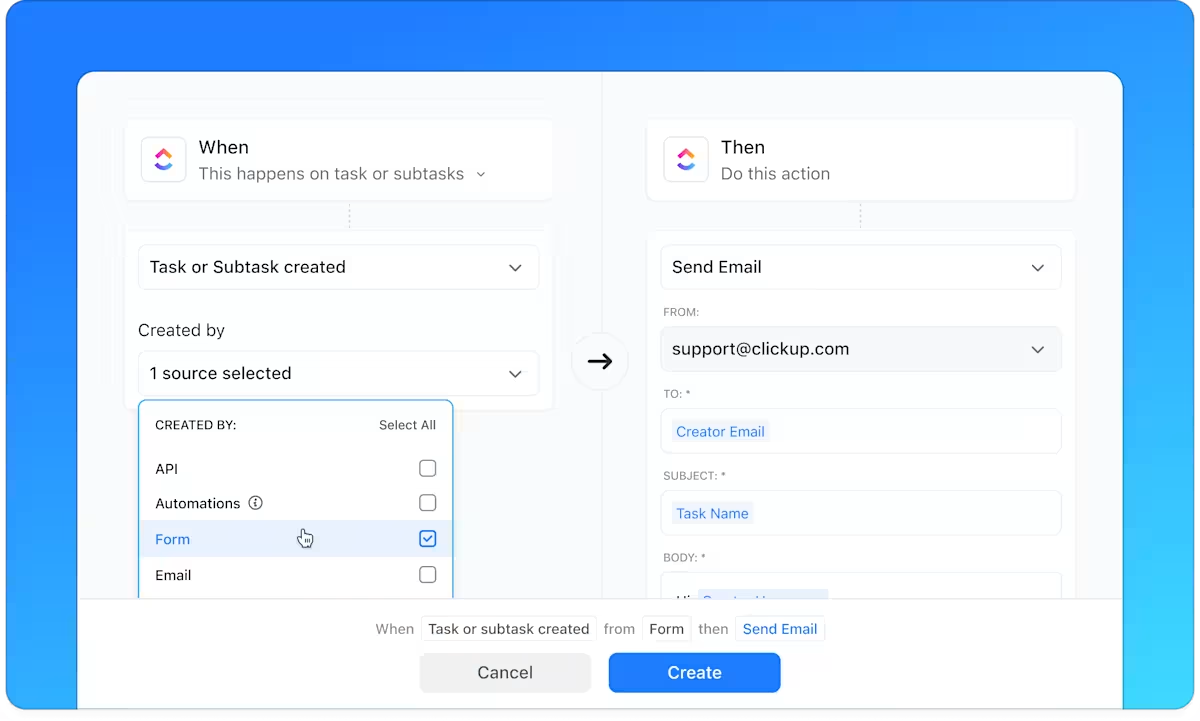

And what good is a CRM without automation? ClickUp Automations save you serious time by creating custom triggers for follow-ups, task assignments, and reminders so you can focus on closing deals instead of repetitive admin work.

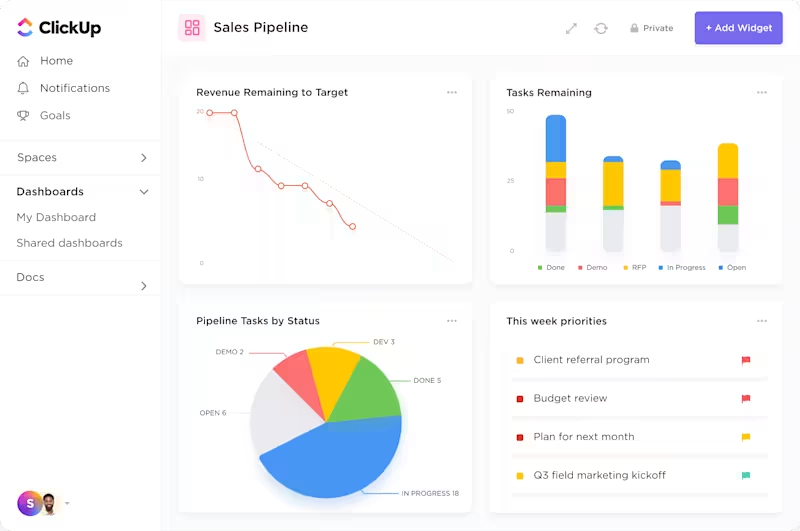

Now for the most critical part—the metrics! Head to ClickUp Dashboards for a centralized view of key metrics, sales performance, and client interactions. With 50+ dashboard cards, you can give each team member what they need:

- Loan officers can view the lead activity and pipeline health

- Processors see pending tasks by the due date

- Managers track conversion rates, funding volumes, and task completion

You get a real-time snapshot of your business to track progress, spot trends, and make smarter decisions.

Setting up a new CRM sounds like a lot of work. But you don’t need to start from scratch. You can get started quickly with the ClickUp CRM Template, which gives you a ready-to-use workspace you can access right now!

If you’re someone who has been managing all their leads on a spreadsheet, the ClickUp Real Estate Spreadsheet Template can be the perfect launchpad. This template lets you stay organized and plan by keeping leads, clients, properties, and deals in one place in a familiar format.

- Track progress on each property with Custom Statuses like Cancelled, Sold, and To Sell

- Access information in five different views, including a Getting Started guide

- Improve real estate tracking with time tracking capabilities, tags, dependency warnings, and email integration

If you’re looking for a CRM template that also helps you manage your transactions, check out the ClickUp Real Estate Agent Template. It helps manage your entire workflow while giving you an overview of your commissions.

Here’s what makes this template stand out:

- Track client progress with 15 statuses like Open, Contacted, and Contract Received

- Use Custom Fields to store key client and property details for easy access

- Automate commission calculations to keep earnings in check

The best part is that even when you scale your business, ClickUp scales by your side! So, if you want an intelligent, customizable, and free real estate CRM to simplify your workflow and improve customer relationships, ClickUp CRM is a no-brainer.

ClickUp best features

- Connect ClickUp with 1,000+ tools and platforms

- Summarize conversations, track progress, and refine writing with the built-in AI-powered assistant ClickUp Brain

- Create centralized loan documents with version history and customizable permissions using ClickUp Docs

- Use ClickUp Forms to collect borrower info or new lead inquiries

- Set ClickUp Reminders for check-ins at 30, 60, or 90 days post-close

ClickUp limitations

- Some views aren’t available on the mobile app (yet!)

- Comes with a learning curve

ClickUp pricing

ClickUp ratings and reviews

- G2: 4.7/5 (10,000+ reviews)

- Capterra: 4.6/5 (4,000+ reviews)

What real-life users are saying about ClickUp

📚 Also Read: ClickUp vs. Hubspot: Which CRM Tool Is Best?

2. Jungo (Best for Salesforce integration and mortgage marketing)

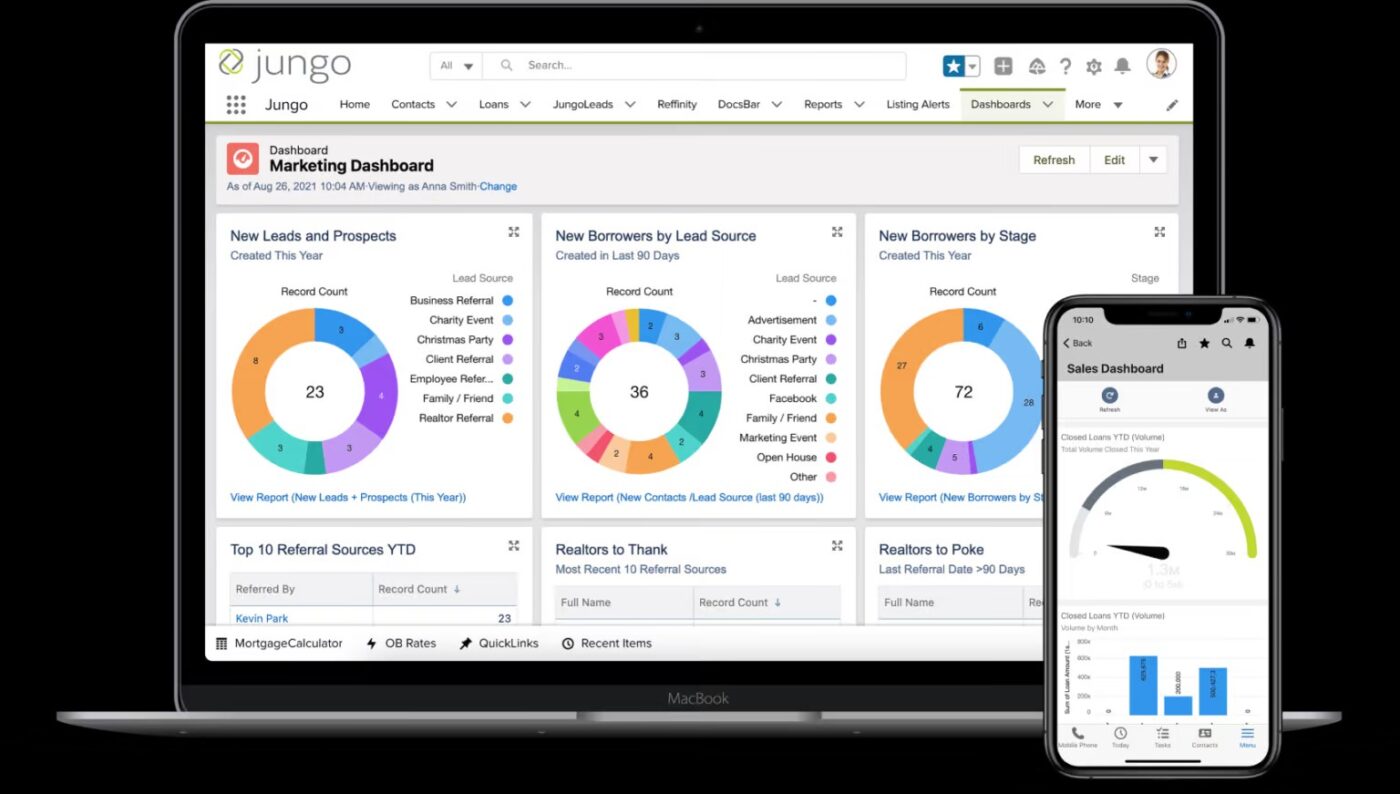

Jungo is a CRM for enterprises that want an all-in-one solution to automate workflows, boost marketing efforts, and simplify collaboration.

Built on Salesforce, it integrates with top mortgage tools, letting you manage leads, loans, and client relationships from a single login. It’s built to enhance productivity across your entire network—clients, prospects, referral partners, and team members—while offering full access to Salesforce and AppExchange to save time and costs.

Jungo best features

- Eliminate duplicate data entry with LOS systems like Encompass, Calyx Point, and LendingPad

- Access pre-built marketing content, email campaigns, video marketing, and co-marketing tools

- Track key metrics with live data and detailed reports using customizable dashboards

- Automate post-close client marketing with the Concierge Program, sending personalized gifts and cards to boost loyalty

Jungo Limitations

- Functionality is dependent on Salesforce

- Limited customization options for complex workflows

Jungo pricing

- Jungo Mortgage App: $119/ month per user

- Jungo Bundle: $149/ month per user

- Jungo Enterprise: Custom pricing

Jungo ratings and reviews

- G2: 4.5/5 (20+ reviews)

- Capterra: 4.2/5 (120+ reviews)

What real-life users are saying about Jungo

3. Surefire CRM (Best for automated relationship nurturing)

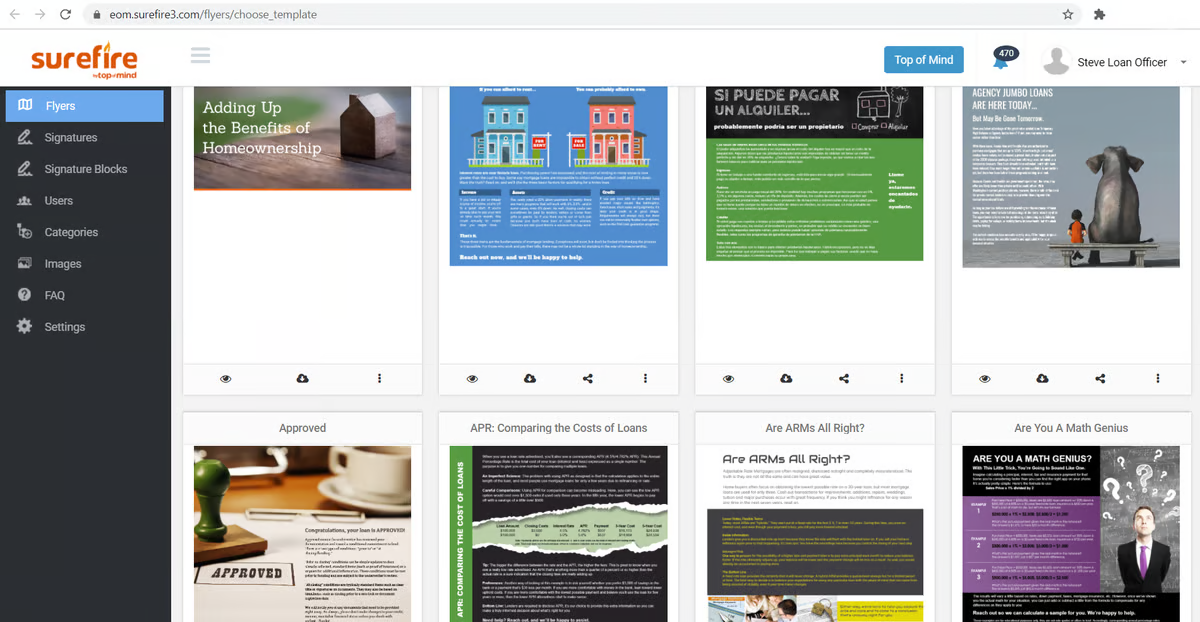

Have you ever wished you could automate nurturing your client relationships? Surefire CRM makes it possible! It’s designed to help mortgage professionals secure new deals, cultivate repeat business, and solidify those all-important referrals.

It’s a solid CRM solution for service businesses that automates lead nurturing, multi-channel marketing, and compliance in one place. Its ‘set-it-and-forget-it’ automation helps you build and maintain relationships with ease.

Surefire CRM best features

- Engage clients through social media, email, text, and print with omnichannel marketing automation

- Access 1,000+ compliance-ready content pieces to power your marketing

- Automate follow-ups to nurture leads throughout the loan process and post-close outreach

- Stay audit-ready with built-in RESPA, TCPA, and CCPA compliance tools

Surefire CRM Limitations

- Fewer customization options for self-service reporting

- Limited integration capabilities

Surefire CRM pricing

- Custom pricing

Surefire CRM ratings and reviews

- G2: 4/5 (20+ reviews)

- Capterra: 4.5/5 (50+ reviews)

🧠 Fun Fact: In the mid-20th century, American homeowners celebrated paying off their mortgage by holding a “mortgage burning” party, symbolically incinerating the loan document to mark their financial achievement.

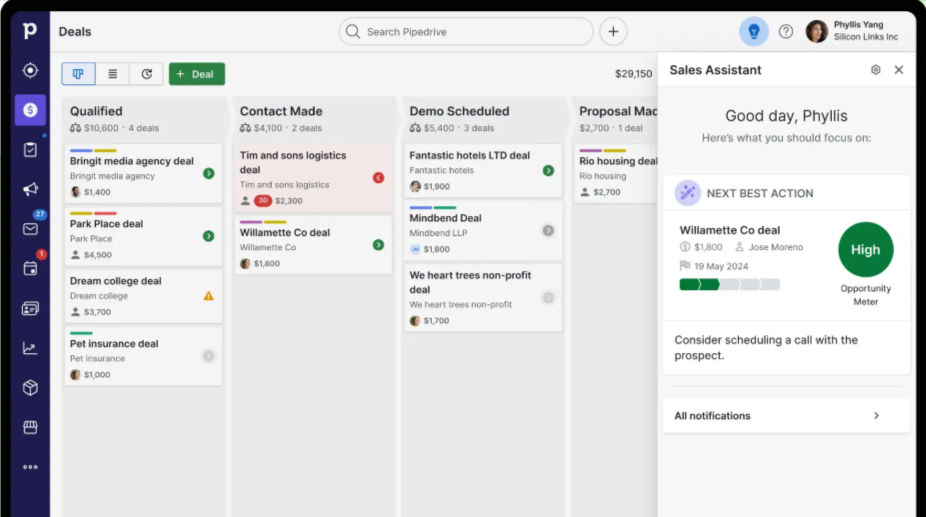

4. Pipedrive (Best for visually optimizing mortgage sales pipelines)

If you’re looking for a CRM solution for consulting that helps you track leads, automate follow-ups, and close more deals, Pipedrive is a popular choice.

This Kanban-style CRM lets you visualize and manage your mortgage pipeline with AI-powered automation, customizable workflows, and real-time sales insights. Pipedrive simplifies the entire mortgage process so you can focus on what you do best—closing more loans.

Pipedrive best features

- Keep clients engaged with AI-driven prompts and automated follow-ups

- Optimize conversion strategies with real-time sales insights and custom reports

- Connect with 400+ apps, including popular loan origination systems [LOS]

Pipedrive Limitations

- Initial setup and customization can require time and effort

- Advanced reporting and AI capabilities are limited to higher-priced plans

Pipedrive pricing

- Essential: $19/ month per user

- Advanced: $34/ month per user

- Professional: $64/ month per user

- Power: $74/ month per user

- Enterprise: $99/ month per user

Pipedrive ratings and reviews

- G2: 4.3/5 (2,300+ reviews)

- Capterra: 4.5/5 (3,000+ reviews)

What real-life users are saying about Pipedrive

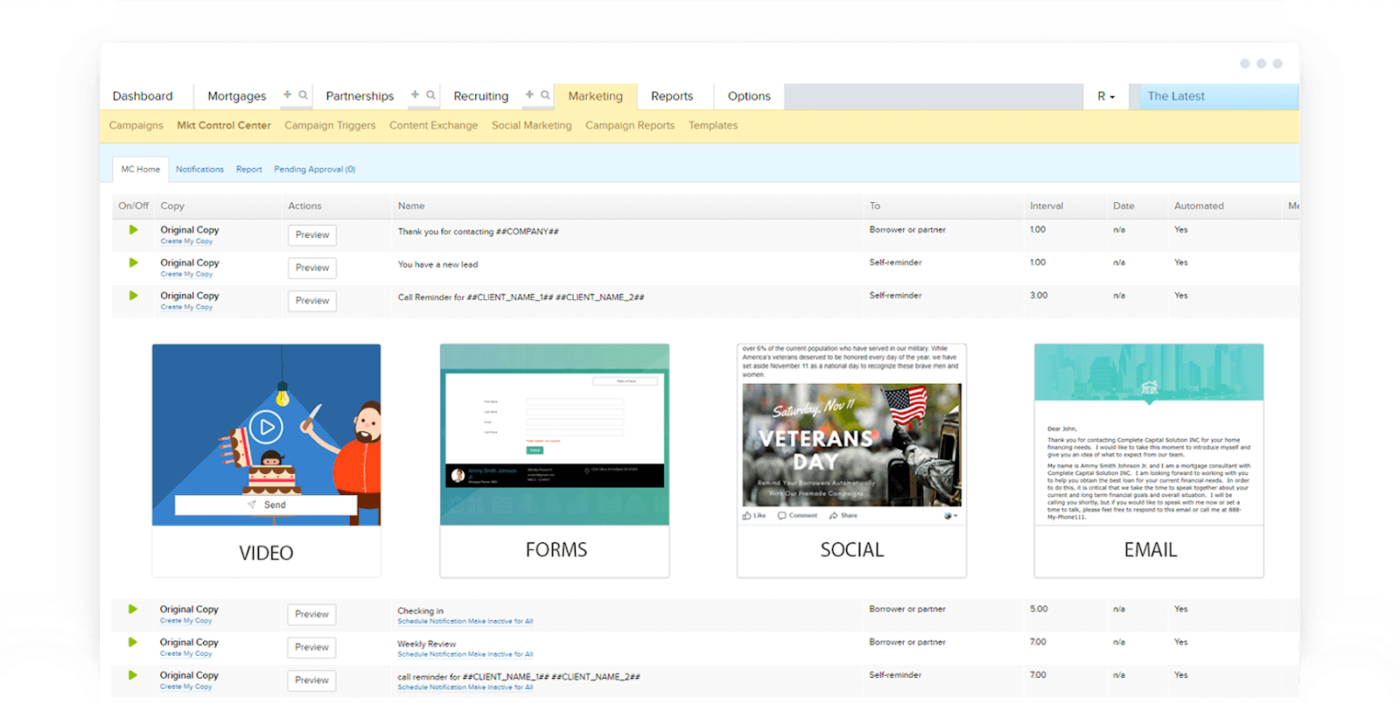

5. BNTouch Mortgage CRM (Best for all-in-one mortgage marketing)

Juggling leads, loans, and marketing can feel like a three-ring circus in the mortgage world. BNTouch Mortgage CRM helps bring order to the chaos.

It’s a complete digital mortgage system that combines CRM, marketing, and POS tools, making it a great Perfex CRM alternative for those seeking an all-in-one solution. Its user-friendly mobile app and secure cloud storage make it a go-to solution for businesses of all sizes.

BNTouch Mortgage CRM best features

- Automate email, SMS, and video marketing, plus access curated social media content

- Manage lead distribution by capturing leads from various sources, including social media

- Access over 35 mortgage-specific tools, including a digital 1003 application

- Manage your CRM from anywhere with the user-friendly mobile app

BNTouch Mortgage CRM Limitations

- Limited customization options

- Some users find initial navigation challenging

BNTouch Mortgage CRM pricing

- Individual: $165/ month + $125 activation fee

- Team: Starts at $190/ month for two users + $95 activation fee per user

- Enterprise: Custom pricing

BNTouch Mortgage CRM ratings and reviews

- G2: 4.5/5 (50+ reviews)

- Capterra: 4.5/5 (80+ reviews)

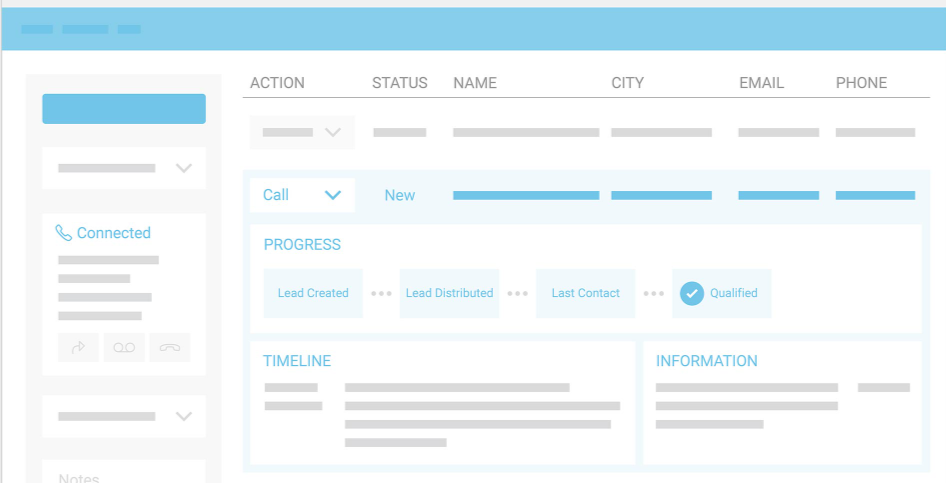

6. Velocify (Best for sales automation in mortgage lending)

Velocify is a strong CRM for mortgage professionals who want to close more loans with less hassle. As part of ICE Mortgage Technology, this platform helps loan officers stay organized, automate follow-ups, and manage leads from over 1,400 sources.

Whether looking to optimize your sales process or enhance borrower engagement, Velocify ensures no lead falls through the cracks. It’s a good fit for growing mortgage teams that need a CRM for structured workflows and automation.

Velocify best features

- Capture, distribute, and prioritize leads automatically for faster follow-ups

- Reduce the number of manual tasks with automated multi-channel communication to keep prospects engaged

- Make more calls, track conversations, and boost conversions with the AI-powered Dial-IQ sales dialer

- Customize workflows to match your mortgage business needs

Velocify Limitations

- Some users experience occasional dialer glitches

Velocify pricing

- Custom pricing

Velocify ratings and reviews

- G2: Not enough reviews

- Capterra: 4.5/5 (230+ reviews)

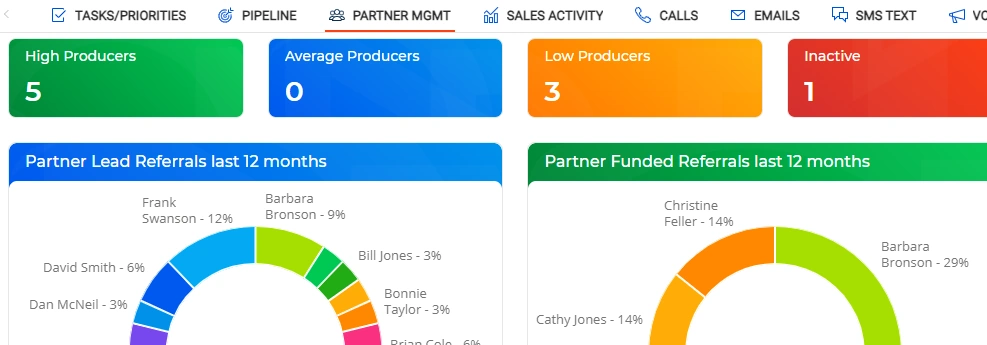

7. NextWave (Best for customizable sales and marketing automation)

Nextwave CRM by CRMnow is a suitable choice for loan officers, residential mortgage bankers, and wholesale lenders who want to optimize sales and marketing automation.

Designed especially for the mortgage industry, it offers automated lead tracking, milestone updates, and personalized marketing touchpoints to enhance productivity and profitability. It helps you prioritize simple pipelines and partner management while keeping your sales team on track.

NextWave best features

- Access tasks, deals, partner activity, and key metrics with customizable dashboards

- Automate lead distribution with skill-based routing and track loan progress in real time

- Strengthen referral relationships with SMS, email, and voicemail updates

- Manage your mortgage business anytime with a fully functional mobile app

NextWave Limitations

- Customizing workflows might require a significant time investment

NextWave pricing

- Custom pricing

NextWave ratings and reviews

- G2: Not enough reviews

- Capterra: Not enough reviews

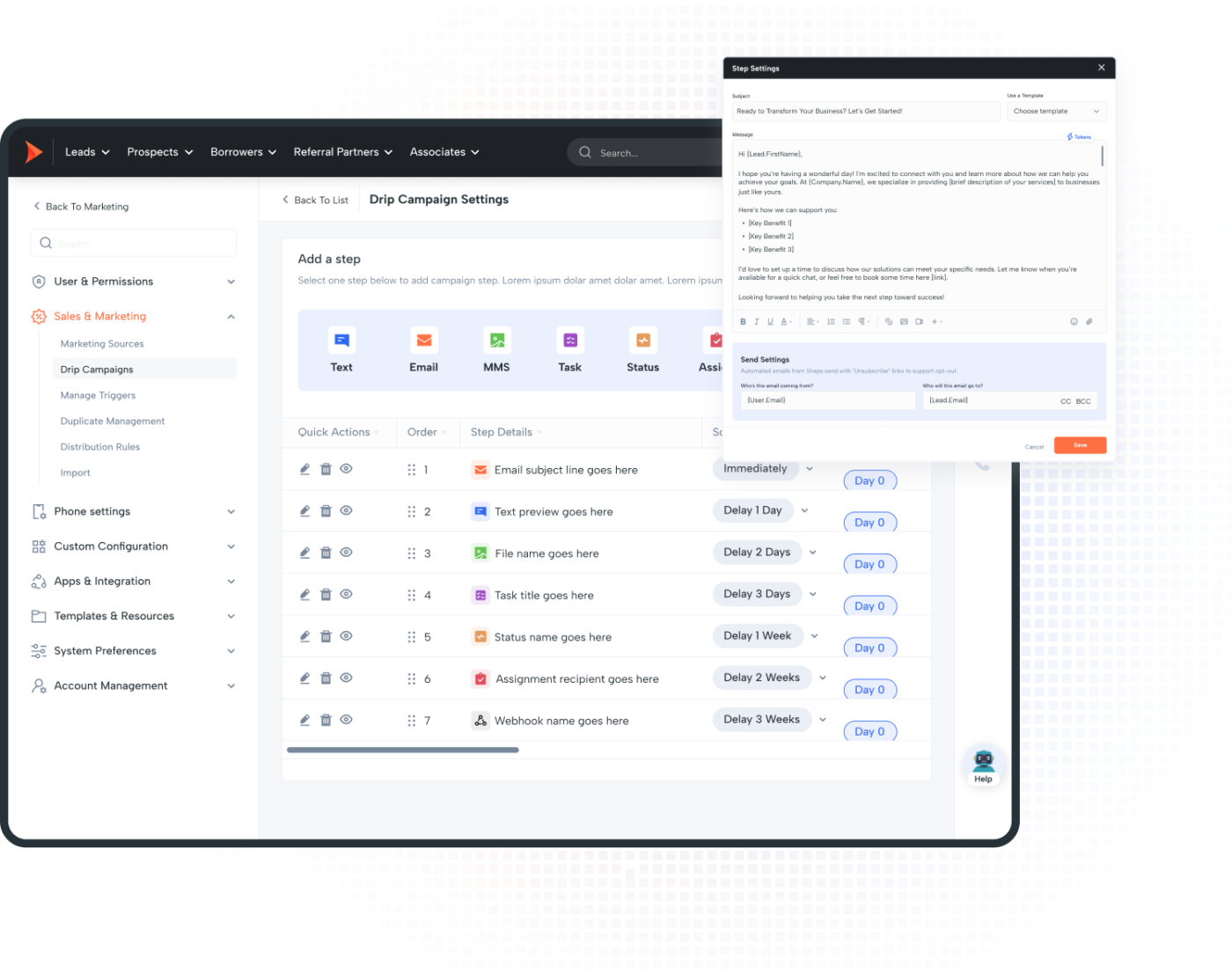

8. Shape (Best for complete Mortgage automation)

Want a feature-packed, AI-driven mortgage solution? Shape CRM is a standout choice. Explicitly designed for mortgage brokers, lenders, and loan officers, it simplifies everything from origination and sales to marketing automation, all in one platform.

With 500+ built-in features, Shape lets you manage leads, automate follow-ups, and integrate seamlessly with POS and LOS systems. Whether scaling your mortgage business or optimizing lead conversions, Shape’s all-in-one approach saves time and boosts efficiency.

Shape best features

- Access an integrated CRM, dialer, email/text automation, POS, LOS integrations, and pre-built CRO websites

- Improve decision-making with automated call transcripts, AI scoring, compliance checks, and score-based alerts

- Run automated drip campaigns with pre-built email, text, and status update sequences

- Boost conversions with survey-style lead funnels and conversion-optimized landing pages

Shape Limitations

- Limited advanced features for large enterprises

- Some users have experienced inefficient customer support

Shape pricing

- Custom pricing

Shape ratings and reviews

- G2: 4.9/5 (95+ reviews)

- Capterra: 4.8/5 (40+ reviews)

What real-life users are saying about Shape

9. Aidium (Best for AI-driven lead management)

Sometimes, simplicity is the way to go for a CRM. Even better if it comes bundled with effortless automations. Aidium is one such tool built to maximize lead conversion.

It offers AI-powered lead scoring, intelligent automation, and integrations to help you effectively manage and grow your pipeline. Whether you’re tracking referrals, nurturing leads, or running marketing campaigns, Aidium provides the tools to increase efficiency and close more deals in an easy-to-use interface.

Aidium best features

- Automate follow-ups, reminders, and communications to improve response times

- Use AI to identify high-potential leads and fine-tune your marketing efforts

- Create and launch marketing campaigns with an intuitive no-code drag-and-drop tool

- Design eye-catching marketing materials directly within the CRM with a Canva integration

Aidium Limitations

- Some customers have complained about slow customer support

- Might be expensive for small businesses

Aidium pricing

- Custom pricing

Aidium ratings and reviews

- G2: Not enough reviews

- Capterra: Not enough reviews

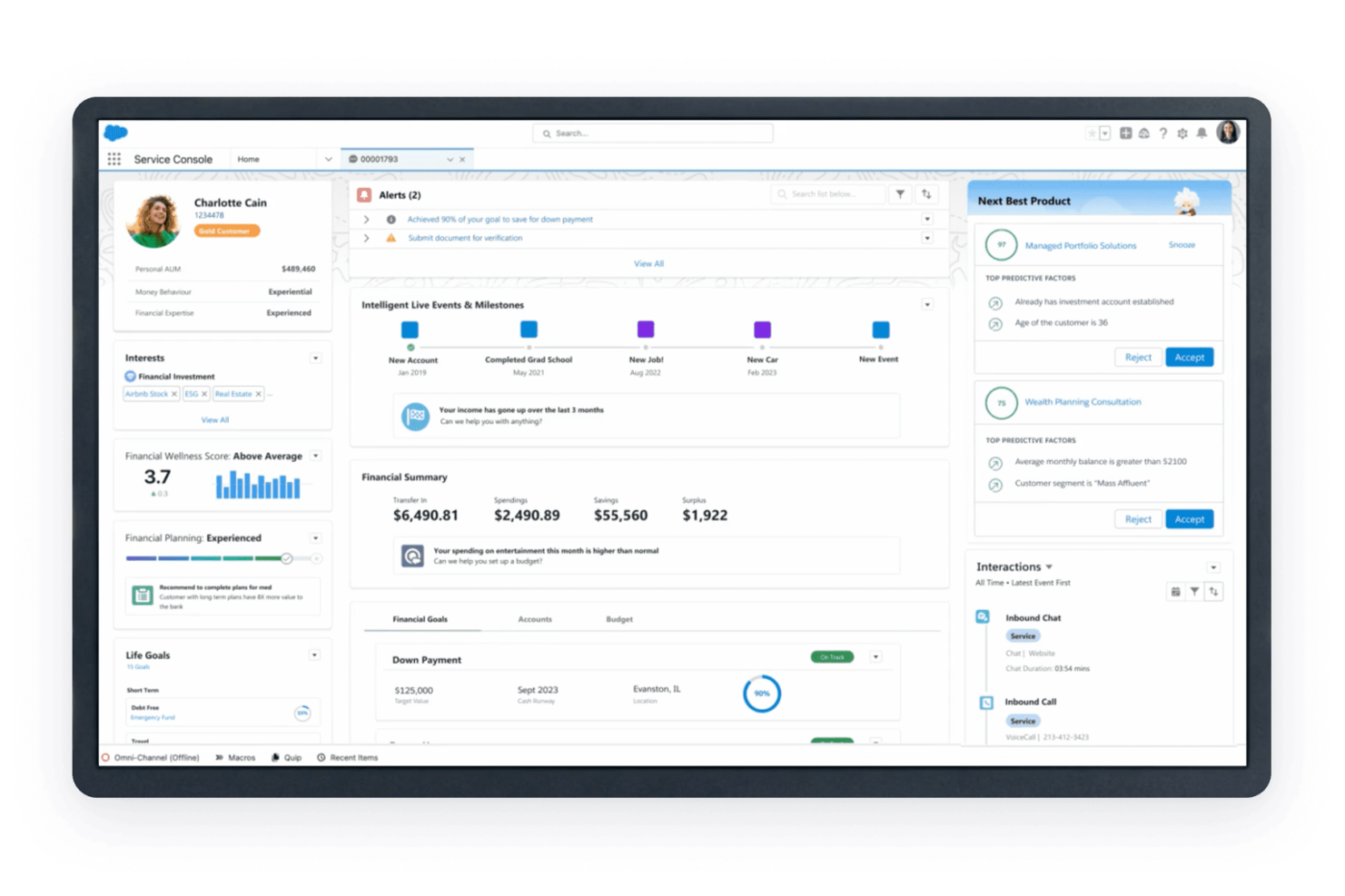

10. Salesforce Financial Services Cloud (Best for enterprise-level mortgage automation)

Salesforce Financial Services Cloud (FSC) delivers an all-in-one solution for managing borrowers, automating workflows, and personalizing client interactions. It’s ideal for large mortgage lenders, financial institutions, and high-volume loan officers.

The AI-driven insights and automation help you optimize loan processing and improve borrower experiences. Built-in reporting tools and easy integrations help you scale your business while maintaining compliance and efficiency.

Salesforce Financial Services Cloud best features

- Streamline loan applications with intuitive data collection and document management

- Provide tailored recommendations and financial insights with AI-powered personalization

- Reduce manual work and enhance accuracy with automated underwriting workflows

- Improve collaboration between loan officers, borrowers, brokers, and real estate agents

Salesforce Financial Services Cloud Limitations

- A steep learning curve; using the tool well requires extensive training

- Higher price than other CRM options

Salesforce Financial Services Cloud pricing

- Free: 30-day trial

- Sales: $300/ month per user (billed annually)

- Service: $300/ month per user (billed annually)

- Sales and Service: $325/ month per user (billed annually)

- Einstein 1 for Sales and Service: $700/ month per user (billed annually)

- Insurance Product Administration: $180,000/ year per org. (billed annually)

- Insurance Policy Administration: $42,000/ $10 million GWP (billed annually)

- Insurance Claims Management: $27,000/ $10 million GWP (billed annually)

Salesforce Financial Services Cloud ratings and reviews

- G2: 4.2/5 (90+ reviews)

- Capterra: Not enough reviews

What real-life users are saying about Salesforce Financial Services Cloud

💡 Pro Tip: Once you’ve chosen your CRM, invest in proper training for your team to ensure they understand how to use it effectively. Encourage adoption by highlighting the benefits for individual mortgage loan officers, not just the company.

No More Loan-ly Days with ClickUp!

Mortgage CRMs are a lifesaver, giving loan officers real-time visibility into every lead, loan stage, and follow-up task—all in one dashboard.

All these tools offer something special, but ClickUp? It’s the whole package—CRM and project management in one sleek platform. With features like automated reminders, Custom Fields for credit scores and loan types, and centralized doc storage, nothing slips through the cracks.

Does it get better than this? We think not. But don’t just take our word for it. Sign up for a free ClickUp account today and try it yourself!