Expense management software significantly improves your financial operations, unlocks cost-saving opportunities, and ultimately enhances your bottom line. ?

While Ramp has gained popularity for being a user-friendly platform that integrates with various financial platforms, it may not suit all businesses. In that case, you must look for alternatives offering varied features specific to your business needs.

We’ve created a list of expense management software that streamline workflows, automate tasks, and help you achieve financial goals for your organization.

What Should You Look for in Ramp Alternatives?

It helps to keep a feature checklist handy while looking for expense management software. Here are the top functionalities you should keep an eye out for:

- User-friendly interface: The management solutions tool should be easy to navigate for clients or users without technical or e-commerce expertise

- Seamless integrations: The software should integrate seamlessly with your existing management system and bank account

- Automation: Consider a tool that automates payments and accounts tracking

- Cost-effectiveness: Compare payment plans to find the most cost-effective solution that aligns with your budget

- Objectives: Consider features that are essential to your business’s needs and usage requirements

The 10 Best Ramp Alternatives to Use in 2024

Now that we know what to look for in an expense management solution let’s check out the 10 best Ramp alternatives in 2024.

1. QuickBooks Online

QuickBooks Online is a cloud-based accounting software that helps small businesses track their income and employee expenses, send invoices, and pay bills from a single account. It’s a popular choice for small businesses as it’s easy to use and affordable.

One of the standout features of QuickBooks Online is its ability to automate tasks. It automatically captures receipts and uses machine learning to extract data from receipts. It also enters the data into your books using predefined or custom templates.

QuickBooks Online best features

- Use one account to track income and manage expenses and roles easily

- Avoid tax penalties by letting QuickBooks manage all your payday activities, error-free taxes, and filing on time

- Create and send professional-looking invoices that include your company logo and contact information

- Manage expense reporting with better access from mobile devices on the go

- Access and generate a variety of expense reports from templates

QuickBooks Online limitations

- A slight learning curve for users without a finance background

- More expensive than Ramp for businesses with a large number of users

QuickBooks Online pricing

- Free trial for 30 days

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

QuickBooks Online ratings and reviews

- G2: 4.0/5 (3000+ reviews)

- Capterra: 4.3/5 (6000+ reviews)

2. TravelBank

TravelBank is an end-to-end expense management solution that improves expenditure visibility, speeds up expense reporting, and automates data entry. It also makes bill payments and lets you set travel policies to manage travel expenses.

With an exclusive partnership with US Bank, TravelBank supports virtual cards and imports transactions from more than 48,000 personal and corporate cards and banks.

TravelBank best features

- Save time and track expenses by automatically extracting data from receipts using the Optical Character Recognition (OCR) software

- Set up multi-level workflows to approve expenses

- Spend Management: Establish spending limits and restrict the types of expenses to be submitted

- Easily export your expenses to your accounting system

TravelBank limitations

- It’s not as customizable as Ramp or other accounting software

- The user experience needs streamlining due to a large number of features

TravelBank pricing

- Travel: $25 user/month

- Expense: $10 user/month

- Travel & Expense: Custom pricing

TravelBank ratings and reviews

- G2: 4.4/5 (300+ reviews)

- Capterra: 4.7/5 (200+ reviews)

3. Zoho Expense

Expense, Zoho’s expense management software, offers companies a comprehensive set of features, including receipt capture, expense tracking, mileage tracking, and approval workflows.

Zoho Expense offers dedicated editions for the USA, India, the UK, Canada, Australia, the UAE, and Saudi Arabia. You can stay tax-compliant through the tax compliance mandates pre-loaded onto these dedicated editions, enabling you to be audit-ready with expense receipts, audit trails, and policy violation reports.

Zoho Expense best features

- Track employee mileage automatically using integrated GPS tracking

- Monitor how employees are using their corporate credit cards using a Corporate card dashboard

- Automate account reconciliation process and make expense reimbursements via ACH

- Integrate with accounting software for a complete expense management solution experience

Zoho Expense limitations

- Higher-tier plan costs for small businesses with many employees are high due to per-user pricing

- Need to use another platform and import data into business management software due to the lack of a time-tracking feature

Zoho Expense pricing

- Free

- Standard: $3/user per month

- Premium: $5/user per month

- Enterprise: $8/user per month

Zoho Expense ratings and reviews

- G2: 4.5/5 (1000+ reviews)

- Capterra: 4.6/5 (900+ reviews)

4. Spendesk

Spendesk’s single-use virtual cards and cards for recurring subscriptions make it one of the top alternatives to Ramp in reducing company exposure to risk and fraud. One account per customer or employee further reduces risk.

You can also control spending by setting budgets, expense policies, and pre-approval workflows.

Spendesk best features

- Set spend rules per card and individual, and define authorized approvers

- Send employees automatic reminders for expense reporting and track payments in real-time

- Integrate and export transactions and receipts to your accounting software solution

- Keep track of accounts receivable using the central subscription management software

- Control all non-payroll spending by combining cash flows from multiple tools

Spendesk limitations

- Lack of access to a line of credit to businesses

Spendesk pricing

- Free: For four users, including one approver

- Essentials: Custom pricing

- Scale: Custom pricing

- Premium: Custom pricing

Spendesk ratings and reviews

- G2: 4.7/5 (390+ reviews)

- Capterra: 4.8/5 (200+ reviews)

5. Brex

Brex is for companies looking for modern AI accounting software and an expense management platform that leverages integrated artificial intelligence and machine learning.

One of the most innovative features of the platform, the Brex AI assistant answers questions about company policies, spending limits, and other topics. It performs expense tasks such as submitting expense reports and reconciling receipts.

Brex best features

- Track your progress toward budget goals and make adjustments as needed with real-time spending insights

- Integrate your payroll system for faster, automated employee payroll

- Identify potential spending issues with alerts from Brex’s AI

- Manage your financial KPIs with runway forecasting and scenario planning

- Monitor current and future burn rates all in one place for a positive impact on your annual revenue

- Use business credit cards without personal guarantees

Brex limitations

- Lacks integrations with subscription-based business software

- Corporate cards have a complicated reward structure and a high capital requirement for approval

- Approval for business credit cards without personal guarantees usually takes a long time

Brex pricing

- Essentials: $0 user/month

- Premium: $12 user/month

- Enterprise: Custom pricing

Brex ratings and reviews

- G2: 4.7/5 (1000+ reviews)

- Capterra: 4.5/5 (100+ reviews)

6. Webexpenses

Webexpenses streamlines the entire expense lifecycle, from tracking to submission and approval.

This expense management platform is noted for highly customizable pricing for small, medium-sized, and large enterprises.

Webexpenses’ petty cash module is also compatible with the imprest system.

Webexpenses best features

- Improve day-to-day petty cash management by gaining real-time visibility of purchases and expenses

- Save money and increase your tax reclamation fraud checks

- Integrate with your accounting management solution with support for over 50 accounting systems

- Reduce your carbon footprint by tracking your carbon emissions on travel

Webexpenses limitations

- Per-transaction pricing gets expensive for small businesses with a large transaction volume

Webexpenses pricing

- Fixed fee: Custom pricing

- Active usage: Custom pricing

- Custom quote: Custom pricing

Webexpenses ratings and reviews

- G2: 4.5/5 (1000+ reviews)

- Capterra: 4.5/5 (200+ reviews)

7. BILL Spend & Expense

BILL Spend & Expense (formerly Divvy) is an innovative cloud-based solution that streamlines your expense reporting and management processes, allowing businesses of all sizes to gain visibility, control, and rewards.

BILL Spend & Expense differentiates itself from its competitors through its free software and corporate cards and accounts. This helps customers save a lot of time and money.

BILL Spend & Expense best features

- Access credit lines, from $500-$5M to fit your business model and scale as your business grows

- Experience proactive spending controls and fraud protection with BILL Corporate cards with no annual fees and flexible rewards

BILL Spend & Expense limitations

- Lack of extensive integration capabilities

- Does not offer procure-to-pay capabilities like Ramp

BILL Spend & Expense pricing

- Free

BILL Spend & Expense ratings and reviews

- G2: 4.5/5 (1000+ reviews)

- Capterra: 4.7/5 (400+ reviews)

8. Precoro

Precoro provides a centralized platform that integrates with your existing accounting software and finance systems. It promotes data sharing and offers a central view of all your spending.

Precoro’s unique feature is its ability to automate the entire procurement process, from requisition to payment. The streamlined purchase requisition (PR) workflows allow fast PR creation, routing, and approval.

For organizations in construction, this ensures timely procurement decisions and better budget management. It also prevents delays in the supply chain.

Precoro best features

- Automate and generate your purchase orders (PO) from approved PRs

- Manage your construction project budgets and harness powerful inventory management tools

- Generate reports and track discrepancies with three-way purchase order, receipt, and invoice matching

Precoro limitations

- Integration with some accounting solutions is challenging

Precoro pricing

- For smaller teams with ≤20 users: $35/user per month

- For larger teams with >20 users: Custom pricing

Precoro ratings and reviews

- G2: 4.7/5 (100+ reviews)

- Capterra: 4.8/5 (200+ reviews)

9. Expensify

Expensify is a compelling alternative to Ramp, particularly for businesses seeking advanced automation and complex integrated software capabilities. It enables you to streamline processes and enforce policies. You can generate reports that align with your unique workflows.

The sophisticated AI-powered automation engine automatically extracts, categorizes, and digitizes physical receipts and matches expenses to invoices. This significantly reduces manual data entry, saving users time and improving accuracy.

Expensify best features

- Eliminate manual reconciliation and add tags to your expenses with general ledger (GL) codes imported from your accounting software

- Integrate many third-party accounting software, payroll systems, CRMs, and project management tools

Expensify limitations

- Geared for large enterprises, expensive for small and medium-sized businesses

Expensify pricing

- Free

- Collect: $10/user/month

- Control: $18/user/month

- Track: Free for up to 25 SmartScans/month

- Submit: Free for up to 25 SmartScans/month

Expensify ratings and reviews

- G2: 4.2/5 (1200+ reviews)

- Capterra: 4.5/5 (1500+ reviews)

10. Concur

Concur offers integrated travel, expense, and invoice management. Much like Ramp, Concur automates your expense management activities with its extensive management solutions.

You can manage employee expenses through policy enforcement, streamlining travel booking, and facilitating event registration. It provides insights from expense and employee tracking data using customizable dashboards.

Concur best features

- Avoid double payments and late fees with automated invoice matching, reducing manual data entry and eliminating errors

- Capture mileage automatically using from and to addresses or GPS

- Secure your employee’s travel expenses with the automatically generated virtual, single-use credit card

Concur limitations

- Extensive features require user training

- Beginners need time to get used to its user interface and features

Concur pricing

- Custom pricing

Concur ratings and reviews

- G2: 4.0/5 (5000+ reviews)

- Capterra: 4.3/5 (1900+ reviews)

Other Financial Management Tools

While Ramp and its alternatives provide their customers with expense management platforms, ClickUp offers them comprehensive tools to manage overall finances.

ClickUp

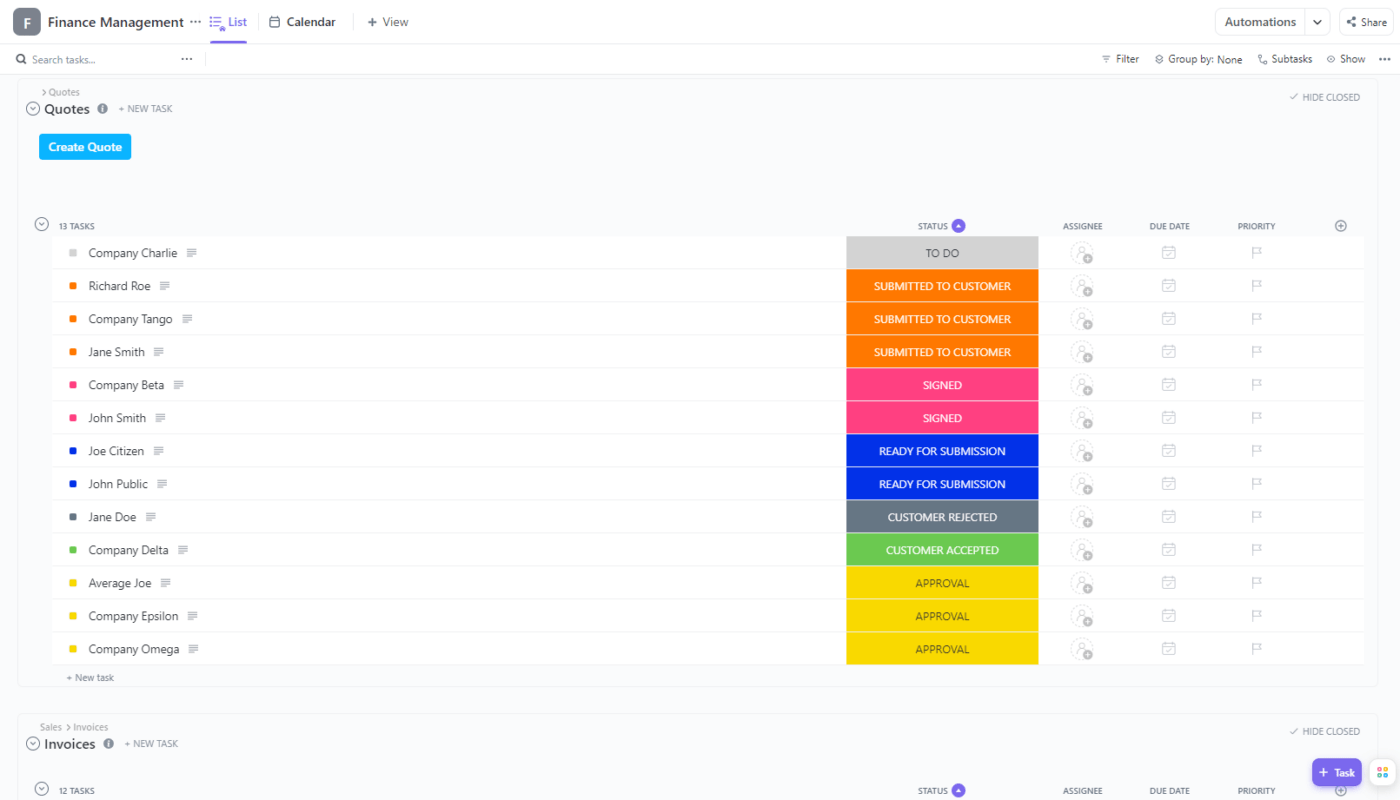

ClickUp isn’t just another project management tool. It’s a comprehensive platform that empowers finance teams like yours. It lets you define clear financial objectives, break them into actionable milestones, and track progress with custom statuses.

ClickUp’s finance software streamlines your workflow by building custom dashboards and conducting powerful calculations. It helps track finance goals and generate reports for enhanced financial management.

ClickUp’s accounting software enables you to manage budgets and accounts through a visual database. Apart from helping to track customers and invoices, it lets you add customizable widgets for payment reminders and special requests. The tool excels in automating routine accounting tasks.

ClickUp is your central hub for all things finance. Connect bank accounts, import transactions, and categorize expenses effortlessly.

Get a bird’s-eye view of your financial health with ClickUp’s Finance Management Template. Track your spending against your budget and set up customized financial goals. Use its 28 Custom Statuses to track your financial projects easily.

Designed to foster a collaborative environment, ClickUp’s finance capabilities exceed these highlights, offering features like budgeting, forecasting, and project management tailored for finance teams.

ClickUp best features

- Share reports with stakeholders, both internally and externally, using ClickUp’s secure platform

- Generate customizable reports in minutes

- Stay on top of accounting calculations like ROI, project profitability, or quarterly earnings with ClickUp’s formula fields

- Receive reminders for recurring tasks and bills

- Enrich your accounts information via custom fields for budgeted amounts, expenses, vendor info, and payment dates

ClickUp limitations

- A slight learning curve for first-time users

ClickUp pricing

- Free Forever

- Unlimited: $7/month per user

- Business: $12/month per user

- Enterprise: Contact for pricing

ClickUp ratings and reviews

- G2: 4.7/5 (9,000+ reviews)

- Capterra: 4.7/5 (3,900+ reviews)

Finding the Efficiency Multiplier

As you navigate your options and seek an efficiency multiplier, holistic workflow optimization will set you up for profitability.

It’s not about swapping one tool for another when exploring alternatives to Ramp. It’s about finding hidden value through diverse solutions, like ClickUp’s feature-rich ecosystem. Think of it as a boost to your workflow that allows you to stay ahead of your competitors.

With its intuitive interface, powerful automation, and robust reporting tools, ClickUp is a worthy go-to solution for streamlined financial management. ?

Remember, the best tools are the ones that take you beyond just solving problems; they elevate your entire journey toward success.