Creating a Loan Amortization Schedule in Excel (and Smarter Alternatives)

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

If you’re managing loans—whether for clients or personal finances—you know complications can arise quickly. Between juggling due dates, calculating interest, and keeping track of balances, it’s easy for everything to spiral out of control.

A striking 77% of Americans worry about their financial situations, with 45% actively trying to reduce their debts.

Whether you’re a borrower keeping tabs on repayments or a lender handling multiple accounts, being organized helps.

That’s where an amortization schedule comes in as your financial GPS for navigating loans. It provides a clear roadmap for each payment, detailing everything from interest calculations to principal reductions.

The best part? With a loan amortization schedule in Microsoft Excel, you can organize loan data, adjust payment plans, and track your finances—all in one place.

Curious to learn how? Let’s explore creating an efficient amortization schedule in Excel and discover innovative tools to enhance your financial management!

An amortization schedule is a detailed table that outlines the periodic payments over the loan tenure. It breaks down each payment into vital components—amount payable, interest rate, loan term, principal balance, and total interest paid.

It offers a transparent view of your journey, illustrating how your debt decreases until you pay it off. This insight helps you plan your finances, identify opportunities for extra payments, and save on interest over time.

Here’s what you’ll typically find in a loan amortization schedule:

Given the different payment frequencies, grasping how your loans are calculated is essential. Familiarizing yourself with diverse amortization methods equips you to make informed financial decisions.

The amortization method you choose significantly affects how quickly you close your loan and how much interest you’ll owe. Whether you prefer steady EMIs or want to speed up your payoff as your income grows, the right plan makes all the difference.

Let’s break down the most common amortization methods and their impact:

This method is as straightforward as it sounds. Each payment is spread evenly across the loan term, meaning you pay the interest and principal over time. This structure is easy to plan because your payment amount stays consistent from day one to your last payment.

Best use case: Perfect for personal or fixed-rate loans, where reliable payments help with budgeting and cash flow management.

In this method, your early payments are more interest-heavy, with only a small portion going toward the principal balance. As you continue to repay, the outstanding amount decreases.

Since interest is calculated on the remaining balance, the interest portion reduces over time, allowing more of your payment to go toward reducing the total debt.

Best use case: Perfect for student or business loans, this method enables manageable disbursements while paying off more of the principal portion as your income increases.

In annuity amortization, you make equal periodic payments, but the split between interest and principal changes over time. Initially, more of your payment covers interest, but a significant portion goes toward the remaining balance as the loan matures.

There are two types:

Best use case: This method is well-suited for mortgage and installment loans, where consistent payments support long-term financial planning.

In this method, you make smaller contributions toward interest and principal throughout your loan’s term. But, in the end, a large payment is due to cover the remaining balance. This approach reduces your monthly burden but requires careful planning for that final payoff.

Best use case: This is great for real estate investments or short-term loans where you expect a significant lump sum in the future to handle the final payment.

In bullet amortization, you only pay regular interest during the loan term, with the entire principal due as a lump sum at the end. This method is more common in corporate financing and bonds, where borrowers expect a significant cash influx to cover the final payment.

Best use case: Ideal for businesses or projects expecting a large payout at the end of the loan term, giving them flexibility to manage cash flow during the loan period.

An amortization schedule Excel sheet can be a game-changer for loan payments. It simplifies your payment structure and keeps you focused on your financial goals. Let’s check out the incredible advantages of such a schedule!

An investment in knowledge pays the best interest.

Understanding your finances goes beyond numbers to making informed decisions. One effective way to do that is creating an amortization schedule—your strategic tool for taking control of your financial future.

Here’s how it transforms your approach to managing debt:

What’s even better? Creating a loan amortization table in Excel allows you to adjust installments and frequencies to meet your needs.

With these benefits of Excel amortization schedules in mind, let’s see how to create them!

Creating an amortization schedule in Excel helps you track your payments and understand your loan structure. Follow this step-by-step guide to set it up efficiently.

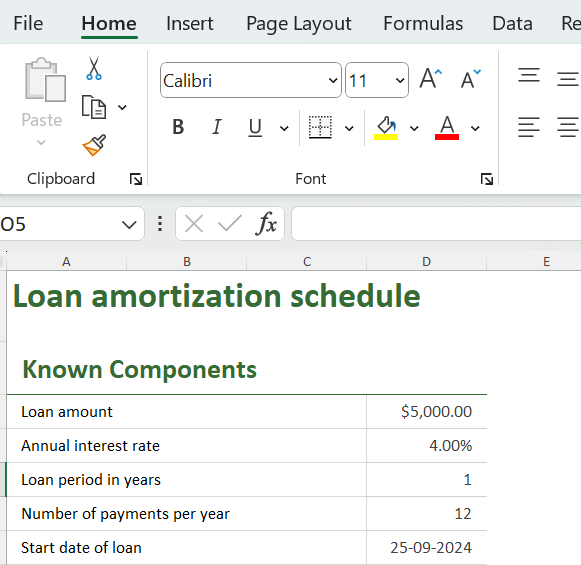

Open a new Excel sheet and create input cells for the known components of your loan. Accurate entries are essential for correct calculations. Include:

For example, suppose you have a total loan amount of $5,000, an interest rate of 4%, and a payment period of one year. Simply add these values to your designated cells to lay the groundwork for building your amortization table.

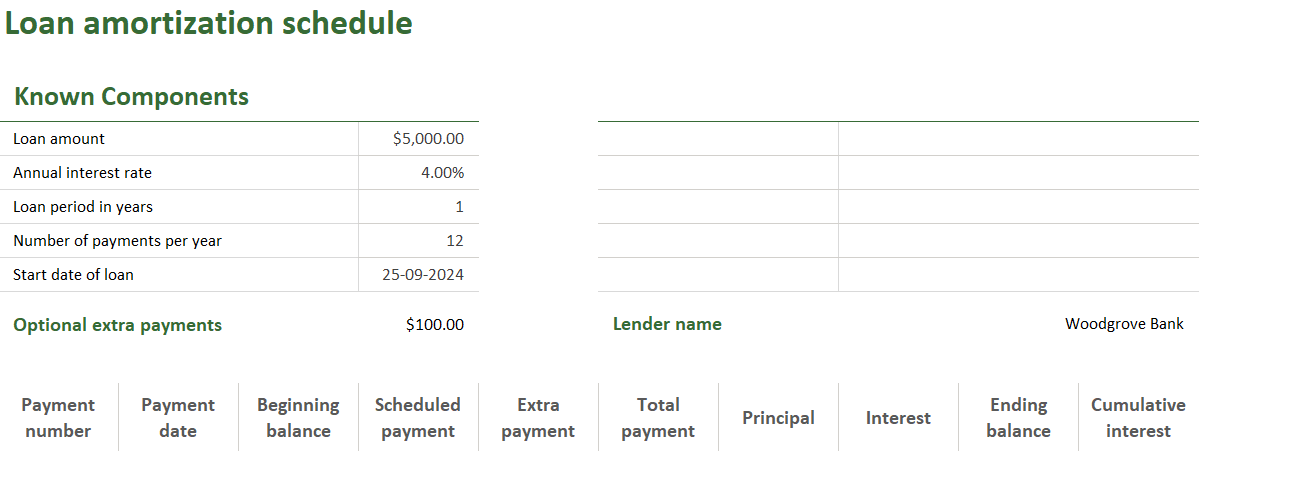

Now, you’re ready to build your table to track payments. In your spreadsheet, set up columns to organize and calculate each payment’s details.

Here’s the structure:

In the first row of the “Scheduled Payment” column (D), use the PMT formula to calculate your monthly payments:

= PMT (AIR / NPY, LPY * NPY, -LA)

It’s time to determine how much of each payment goes toward interest. Use the IPMT function for this calculation:

=IPMT (AIR / NPY, A11, LPY * NPY, -LA)

In this formula:

Now, determine how much payment goes toward reducing the loan balance. For this, use the PPMT function:

=PPMT(AIR / NPY, A11, LPY * NPY, -LA)

In this formula, PPMT calculates the portion of your payment that reduces the loan amount. The other arguments are consistent with those used in the IPMT function.

For example, for the first payment, the formula would look like this:

=PPMT(0.04 / 12, 1, 1 * 12, -5000)

Enter this formula in cell G11 (the Principal Payment column) and drag it down to calculate all payment periods.

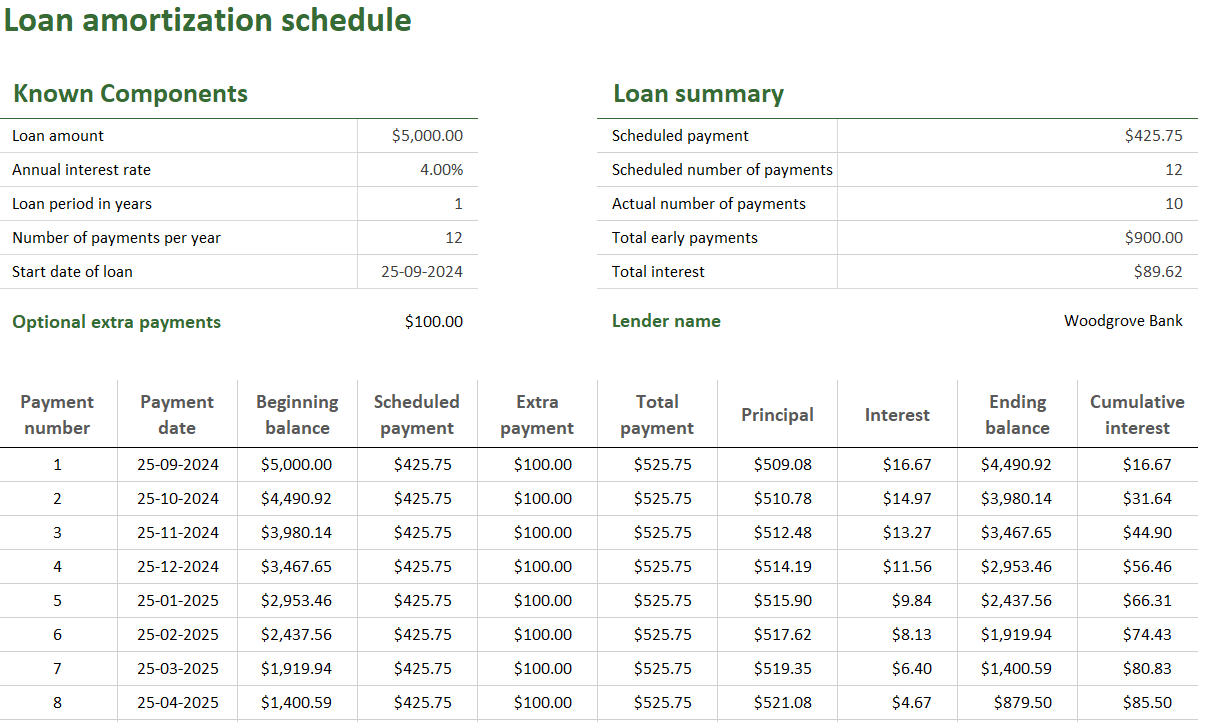

Once your schedule is complete, take a moment to review it. Check that all formulas are working correctly, and ensure the remaining balance reaches zero at the end of the term. If it doesn’t, you may need to adjust your input values.

Here’s what your final amortization table should look like:

Now that you’ve learned how to create a loan amortization schedule in Excel, you might wonder who benefits most from this tool. The great news is that a variety of people can use an amortization schedule:

💡 Pro Tip: Stay ahead in the competitive financial world using a CRM tool to streamline your management process. Track customer interactions and elevate your service delivery. Check out this guide—10 Best CRM for Banking in 2024 for top strategies!

While Excel provides a solid foundation for creating amortization schedules, why settle for basic functionalities? Upgrade your financial management with tools offering deeper insights and greater efficiency.

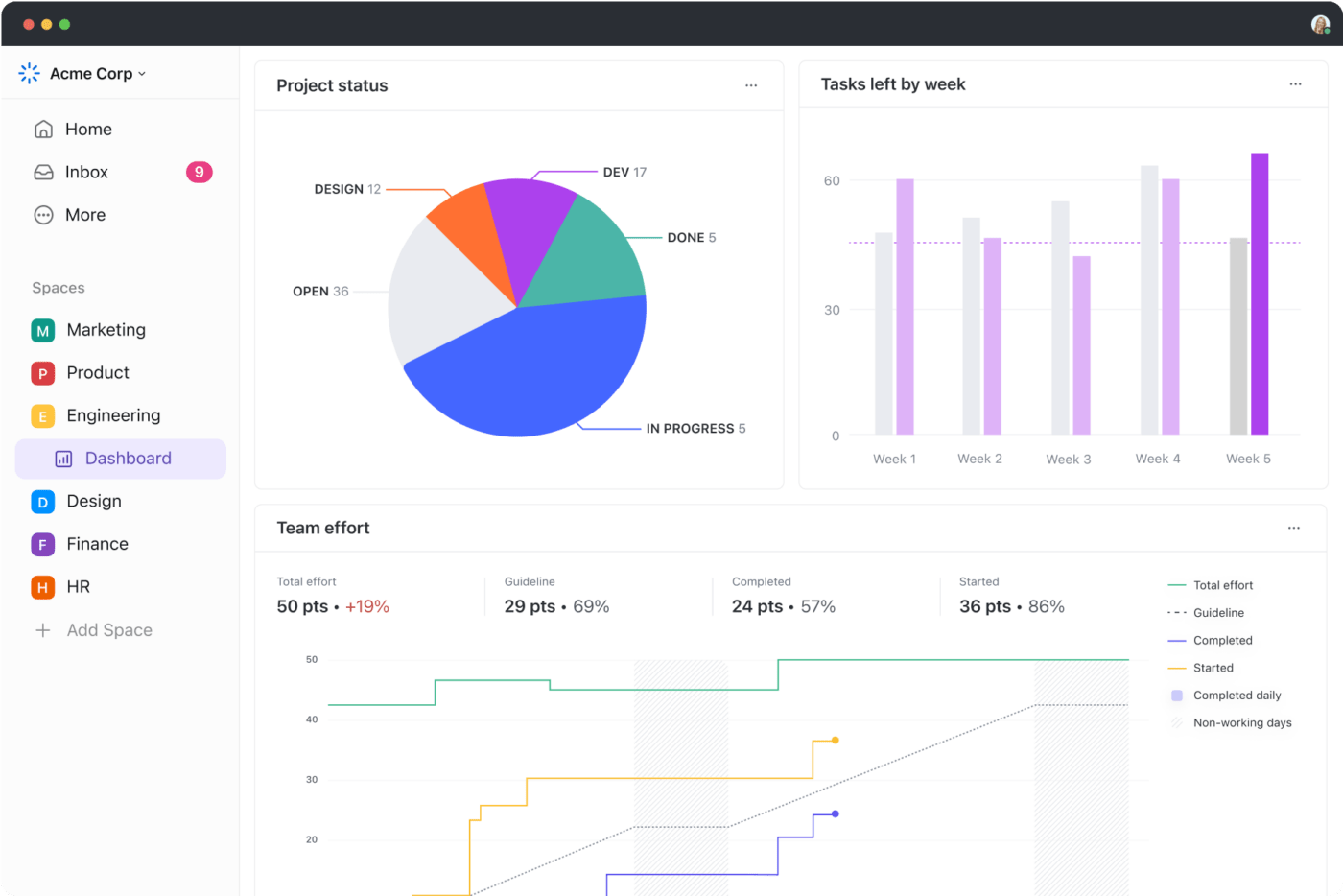

Meet ClickUp, a dynamic productivity and project management platform transforming how high-performing teams operate worldwide. But what makes it one of the best Excel alternatives?

ClickUp is more than a spreadsheet tool—it’s a complete financial management system. It allows you to automate reminders, visualize progress with real-time dashboards, and use advanced formulas for precise calculations.

This powerful combination transforms how you manage your amortization schedules, making loan management faster and more efficient. Here’s how:

Tired of the constant stress of missed payment deadlines? Manual reminders in Excel can be a hassle, often leading to unnecessary complications. But ClickUp Automations makes this process effortless, taking the weight off your shoulders.

With ClickUp, automate payment reminders and schedule notifications ahead of each due date. Create custom workflows that send alerts before each payment, ensuring your loan management runs on autopilot.

For example, if your $1,500 monthly mortgage payment is due on the 1st, automate a notification to remind you three days prior. This proactive setup keeps you organized without the need for constant tracking.

💡 Pro Tip: Use ClickUp’s Formula Fields in your automation to set smart triggers based on specific conditions. Adjust your payment reminders according to changing loan amounts or fluctuating interest rates for enhanced flexibility and efficiency.

Need to calculate the total interest or see how adjusting your payment affects the remaining balance? ClickUp’s Table View allows you to manage your loan amortization schedule like a spreadsheet but with enhanced capabilities.

Track all your loans, payments, and due dates in a structured grid format, making data management intuitive and effective. What’s even better? ClickUp’s Advanced Formulas allow you to perform complex amortization calculations directly within your tasks.

This feature boosts both accuracy and efficiency in your financial tracking. Here’s how to make the most of it:

While Excel organizes data in rows and columns, ClickUp offers a richer experience with interactive dashboards that make complex information easily digestible. Here’s how ClickUp Dashboards helps you:

💡 Pro Tip: Are you a business looking to enhance financial oversight? Use balanced scorecard templates to track crucial metrics like ROI, profit, and revenue. These strategic frameworks focus on your financial goals and highlight improvement areas.

Effective loan management goes beyond visualizing data; it requires actively tracking your financial journey. ClickUp provides robust tools so you can stay informed and make data-driven decisions at every step.

Managing loan agreements doesn’t have to be a chore. ClickUp’s Loan Agreement Template simplifies the process, allowing you to customize the document to fit your needs.

A loan agreement is a legal contract that outlines the terms between the lender and borrower, detailing the amount borrowed, the interest rate, and the repayment schedule. It ensures both parties understand their obligations, preventing confusion and potential disputes.

Here’s why you’ll love this template:

Ideal use case: This is perfect for financial professionals, lenders, and individuals managing personal loans who want to streamline their documentation process and improve communication.

Excel has long been the go-to for creating a loan amortization schedule, offering a reliable way to track payments. But, as your needs evolve, you might find it lacking in flexibility and advanced features.

Enter ClickUp, the all-in-one work management platform. With its powerful Table View for streamlined data management, advanced formulas for precise calculations, and dynamic dashboards for visual insights, ClickUp transforms how you approach loan management.

Ready to break free from the limitations of basic spreadsheets? Get started with ClickUp today and supercharge your financial planning!

© 2026 ClickUp