An accurate operating budget is a key building block for small business success. It keeps operational costs in check, lays the groundwork for your income statement, and helps track actual performance, ensuring your business’s strategic goals are well within reach.

But here’s the challenge: unless you have strong accounting knowledge or a trusted financial team, your budget may be riddled with errors. Even the most careful analysis or planning can lead you off course when that happens.

So, we provide real-world operating budget examples and templates to help you succeed in your business’s financial planning from the start.

What Is an Operating Budget?

An operating budget is a detailed financial plan that outlines a company’s expected revenue and expenses over a specific period, either monthly, quarterly, or annually.

These revenues and expenses typically pertain to a business’s day-to-day operations, helping organizations plan and manage their resources more efficiently. They also enable them to track actual results and create a comprehensive income statement.

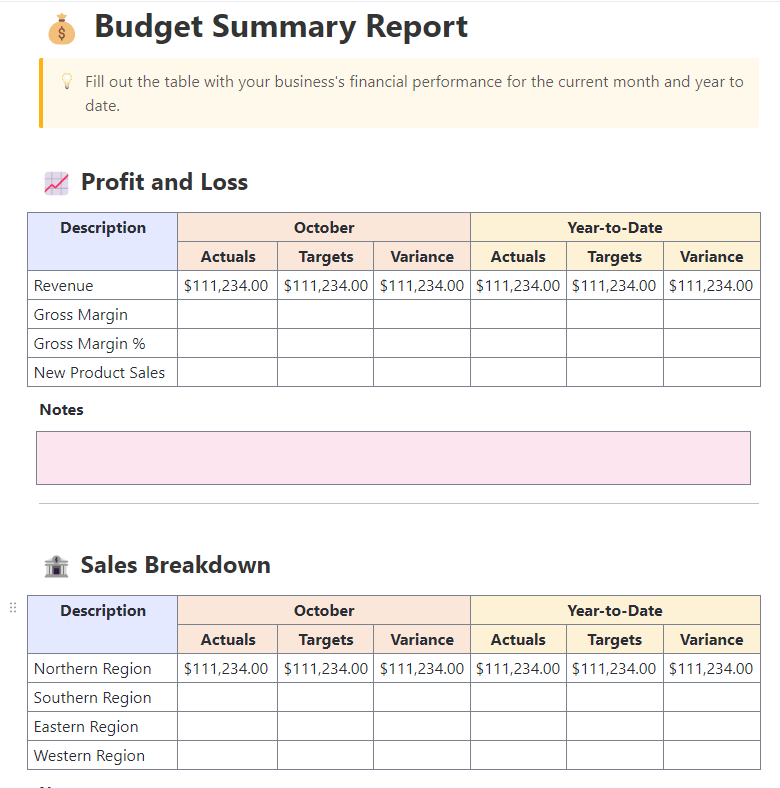

Featured Template

Whether you’re managing a small business or a large enterprise, ClickUp’s Budget Report Template is the perfect tool for optimizing your budgeting process.

This template helps you quickly and accurately create budget reports that:

- Track progress against goals on an ongoing basis

- Provide a detailed overview of your past and present financial performance

- Explain discrepancies between planned and actual spending

5 key components of an operating budget

- Revenue: This refers to the total income the company is expected to generate from sales or services during the specific period

- Cost of Goods Sold (COGS): This includes all direct costs associated with producing the product, such as production costs, raw materials, and labor

- Operating expenses: They include all the daily expenses required to run the business, excluding COGS. They can be of three types:

- Fixed cost: Office rent, property tax, salaries, etc.

- Variable cost: Repairs and maintenance, office supplies, utilities, etc.

- Semi-variable costs: Internet bills, equipment maintenance contracts, overtime pay, etc.

- Non-cash expenses (optional): These are costs that do not involve a direct cash outflow but are recorded for accounting purposes, such as asset amortization and depreciation

- Net operating income: This is the difference between the total revenue and operating expenses (including fixed, semi-variable, and variable expenses) of the business

🔍 Did You Know? Many organizations like Google and Amazon budget for failed experiments, knowing not everything will work. But budgeting for failure ensures they can keep innovating without blowing the bank. 🏦

5 Operating Budget Examples for Businesses & Solopreneurs

As we just saw, an operating budget is made up of five core components. Despite this, it’s capable of serving a different purpose for every business, based on its unique requirements. Here are a few examples of an operating budget.

1. Restaurant operating budget

Running a restaurant involves juggling multiple income streams and various daily expenses. To stay profitable, the owner creates a monthly operating budget that accounts for expected revenue from dine-in, takeout, and catering services.

👀 Purpose: This budget helps project food sales, plan inventory, manage staff schedules, and monitor spending in key operational areas.

💰 Revenue: $80,000 from dine-in, takeout, and catering

💸 COGS: $25,000 (food and beverage supplies)

Operating expenses:

- Salaries: $20,000

- Rent: $5,000

- Utilities: $2,000

- Marketing: $1,500

- Cleaning and maintenance: $1,000

Non-cash expense:

- Depreciation (kitchen equipment, furniture, etc): $2,500

Net operating income: $23,000

2. Retail business operating budget

A small retail store owner plans monthly sales and expenses to ensure the store remains profitable while efficiently managing inventory and staffing costs.

👀 Purpose: This budget supports decisions on purchasing stock, hiring additional staff, and scheduling sales promotions.

💰 Revenue: $60,000 from product sales

💸 COGS: $28,000 (inventory purchases and shipping)

Operating expenses:

- Salaries: $12,000

- Rent: $4,000

- Utilities: $1,200

- Advertising: $2,000

- Store maintenance: $800

Net operating income: $12,000

🧠 Fun Fact: The very first operating budget in recorded history dates back to Ancient Egypt. Scribes tracked grain storage and labor costs on papyrus scrolls over 4,000 years ago. Tracking operating budget is not just modern—it’s an ancient business strategy! 📜

3. Small business operating budget

A small manufacturer estimates production output and sales for the month while carefully budgeting for raw materials, labor, and factory overheads.

👀 Purpose: This helps balance production costs and optimize profitability.

💰 Revenue: $150,000 from product sales

💸 COGS: $70,000 (raw materials and direct labor)

Operating expenses:

- Salaries: $30,000

- Factory rent: $10,000

- Utilities: $3,000

- Equipment maintenance: $4,000

- Office expenses: $1,500

Non-cash expense:

- Asset depreciation: $2,000

Net operating income: $29,500

4. Consulting firm operating budget

A small consulting firm anticipates income from client retainers and projects, factoring in costs for salaries, office space, and business development activities.

👀 Purpose: This budget helps firms keep overheads in check while pursuing new contracts.

💰 Revenue: $90,000 from consulting services

💸 COGS: $10,000 (subcontractors and client expenses)

Operating expenses:

- Employee salaries: $40,000

- Office rent: $7,000

- Marketing: $3,500

- Travel and meetings: $2,000

- Office supplies: $1,000

Net operating income: $26,500

🧠 Fun Fact: In 2007, the Pentagon secretly allocated over $20 million to study UFOs. You heard that right—tracking aliens was part of their operating budget under the line ‘Advanced Aerospace Threat Identification.’ 👽

5. Freelancer operating budget

An independent graphic designer projects monthly revenue from client projects and accounts for expenses such as software subscriptions and workspace rent.

👀 Purpose: This budget helps freelancers manage cash flow and project sales for the upcoming year.

💰 Revenue: $8,000 from client work

💸 COGS: $1,000 (outsourced work and materials)

Operating expenses:

- Software subscriptions: $500

- Co-working space rent: $800

- Marketing and advertising: $200

- Office supplies: $100

Net operating income: $5,400

How to Manage and Track Your Operating Budget

Managing an operating budget isn’t just about setting spending limits—it’s about guiding your business toward financial health. A well-managed budget helps you allocate resources wisely, adapt to financial surprises, and make confident decisions.

Here’s how to do it step by step:

1. Set clear objectives

Operating budgets have many responsibilities—they help control operational costs, enhance resource allocation, and even manage cash flow. However, many organizations forget to define their purpose, which prevents them from truly optimizing it.

So, start by highlighting the objective of your operating budget. This will help you set measurable KPIs and manage your budget more effectively.

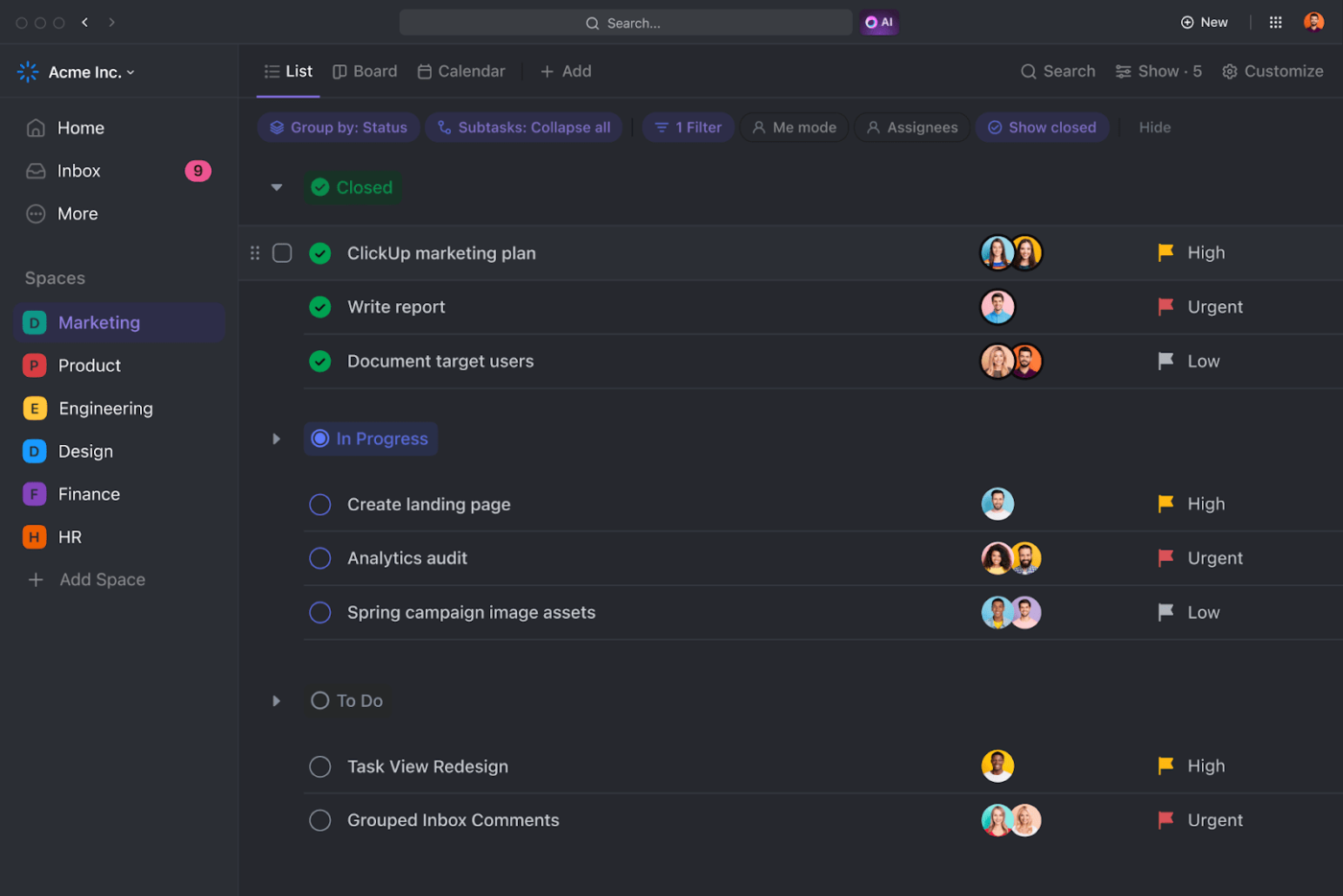

Once you have defined your budget’s purpose, use ClickUp Tasks to achieve it. It breaks down your budget’s main objective into smaller tasks so you and your team can take actionable steps to fulfill it.

You can also prioritize these tasks, assign them to your team members, and set dependencies to ensure seamless management.

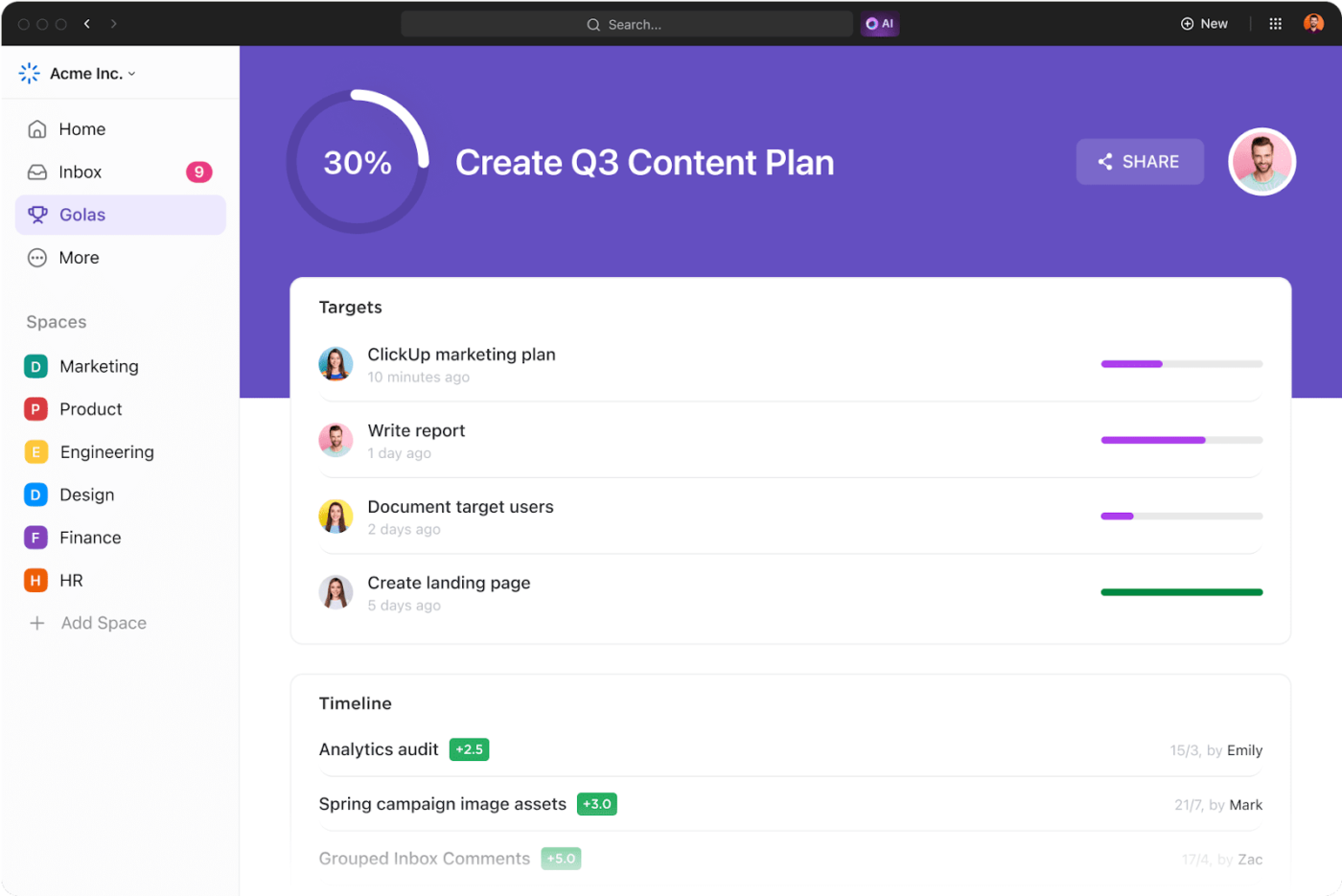

That’s not all! Use ClickUp Goals to stay in sync with the progress of each task. From list to board—utilize a range of views to see how far along you are in achieving your budget goals.

The best part? You can assign specific budget items or financial tasks to different team members to ensure accountability and accuracy. Keep all your operating budget data and progress in one place, making it easier to hit deadlines and financial targets.

2. Break the budget down into categories

Every operating budget has five core components: revenue, COGS, operating expenses, non-cash expenses, and net operating income. To ensure maximum clarity, create line items under each category.

For instance, include your total product sales and service income under the revenue category. Under operating expenses, include every expense related to your business’s core operations.

To better understand, you can further divide operating expenses into three sub-categories: fixed cost, variable cost, and semi-variable cost.

At any cost, avoid lumping everything into generic categories; the more granular your budget is, the easier it will be to monitor and manage.

⏩ Read More: Free Budget Proposal Templates in Excel and ClickUp

3. Choose the right tool to track your budget

The tools you use can make or break your budget management. Small businesses may find Google Sheets or Excel sufficient for basic tracking, especially in the early stages. But for more structured, automated, and visual tracking, ClickUp Dashboards are a powerful option.

With ClickUp Dashboards, you can build customized visual reports that display real-time budget data in charts, graphs, and tables. Project sales, track expenses, and visualize budget progress across departments or periods using flexible widgets.

This makes it easier to spot overspending, compare actuals vs. budgeted figures, and keep financial performance aligned with your goals—all from a single, centralized view.

📮 ClickUp Insight: 78% of our survey respondents make detailed plans as part of their goal-setting processes. However, a surprising 50% don’t track those plans with dedicated tools. 👀

With ClickUp, you seamlessly convert goals into actionable tasks, allowing you to conquer them step by step. Plus, our no-code dashboards provide clear visual representations of your progress, showcasing your progress and giving you more control and visibility over your work. Because “hoping for the best” isn’t a reliable strategy.

💫 Real Results: ClickUp users say they can take on ~10% more work without burning out.

4. Consistently record income and expenses

Tracking consistency is essential for budget accuracy. So, log all revenue and expenditures—either as they happen or on a fixed schedule. This includes sales, rent, salaries, depreciation, etc.

Don’t just record amounts; include dates, vendors, and the purpose of each transaction. This context helps identify spending patterns and justifies future decisions.

5. Monitor actual budget performance

Monitoring actual performance against budgeted figures helps catch and eliminate negative deviations early. So, schedule monthly reviews where you compare budget forecasts with actual data.

Suppose there’s a variance of more than 10%. Don’t let it sit—dig into the reasons behind it. Perhaps costs have risen or sales dipped unexpectedly. These insights help refine your future spending and prompt immediate corrective actions.

Here’s what Muhammad Asif Iqbal, product manager, dubizzle Group, has to say about ClickUp’s finance capabilities:

6. Manage cash flows, not just profits

Many profitable businesses still run into trouble because of cash flow issues. It’s not enough to show a profit on paper—you also need to manage the timing of income and expenses.

For example, a hefty invoice may not be paid for 60 days, while your bills are due in 30 days. So, make it a point to forecast your cash flow at least two to three months in advance.

Delay non-essential purchases during slow months, and consider negotiating better payment terms with vendors to avoid shortfalls.

⏩ Read More: How to Use Project Accounting: Must-Know Principles, Processes, and Tips for Project Teams

7. Set spending limits and approvals

Setting clear spending limits and approval workflows is essential for controlling costs and avoiding budget surprises.

Without proper boundaries, departments may unknowingly overspend on variable costs like marketing campaigns, project management software, or business travel. Approval processes ensure that any significant or unexpected expense is reviewed before funds are committed, helping maintain team accountability.

ClickUp Automations can make this process much more efficient. You can configure automations to instantly notify approvers when a new spending request is submitted or when a task tagged as ‘over budget’ is created.

Automations can also flag tasks that exceed predefined cost thresholds or alert specific team members when a department nears its budget cap. This reduces manual tracking and ensures real-time visibility into financial decisions.

⏩ Read More: How to Apply Project Controls (With Templates)

8. Adjust the budget proactively

Budgets shouldn’t be static. Revisit and revise them regularly, especially when your business changes, such as launching a new product, hiring staff, or reacting to external economic shifts.

Don’t wait until the year ends to correct course. Conduct quarterly reviews to forecast based on updated projections.

💡 Pro Tip: Need a comprehensive platform to manage your business’s finances? Use ClickUp’s Financial Solution! It lets you and your team collaborate and monitor every financial move to ensure every penny gets utilized to its maximum value.

Here’s how it helps:

- Organize all your financial data, including capital budgets and operating expenses, in one centralized workspace 📅

- Track cash flow trends over time using customizable dashboards to ensure you never miss a beat ⏮️

- Collaborate with your finance team in real-time to review budgets, forecasts, and spending limits 💬

- Automate recurring financial tasks like budget approvals, invoice reminders, and reporting cycles 🔁

- Plan for the next fiscal year with detailed timelines, task dependencies, and goal tracking ✍🏻

Operating budget templates

If you’ve never created an operating budget before, you might worry about navigating its intricacies. In addition to the featured template shared above, here are a few additional professional operating budget templates you can use.

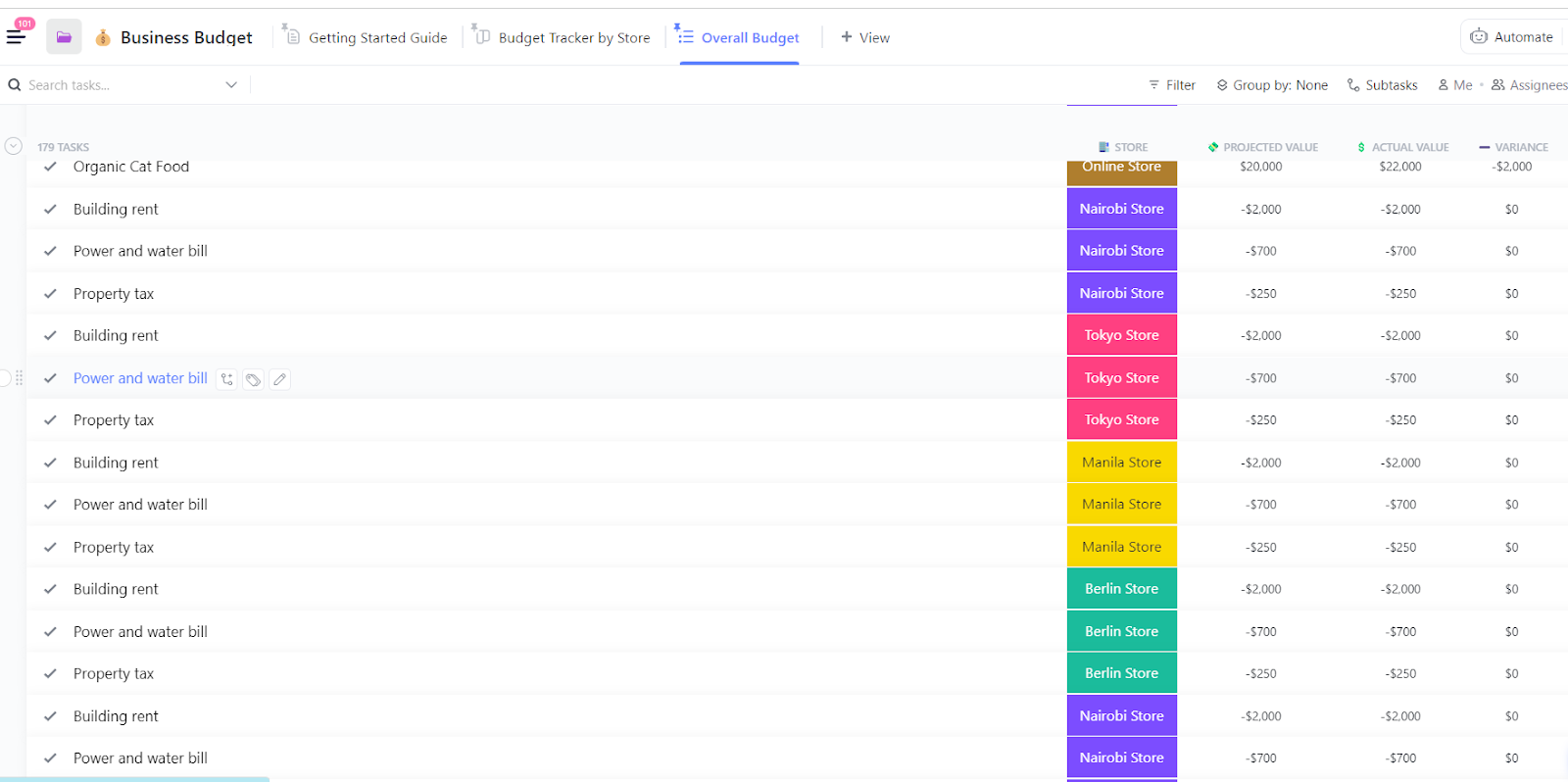

1. ClickUp Business Budget Template

Did your business book a massive loss in its previous income statement? Use the ClickUp Business Budget Template to plan expenses efficiently.

Whether they’re variable or fixed costs, this template lets you forecast and set the budget for each expense. This helps allocate resources more prudently, gauge actual performance against planned performance, and manage expenses for the immediate future.

By presenting the actual figures spent on every expense, you can avoid overspending and seamlessly achieve your business’s strategic objectives.

Here’s why you’ll love it:

- Customize categories and line items to match your business structure

- Visualize the budget for a fiscal year using Kanban, Table, or Calendar views

- Link budgets directly to project scope and milestones for better tracking

- Duplicate and reuse the template for different departments, teams, or clients

🔑 Ideal for: Marketing teams and small business owners who need a template to plan, track, and adjust budgets in sync with their project workflows.

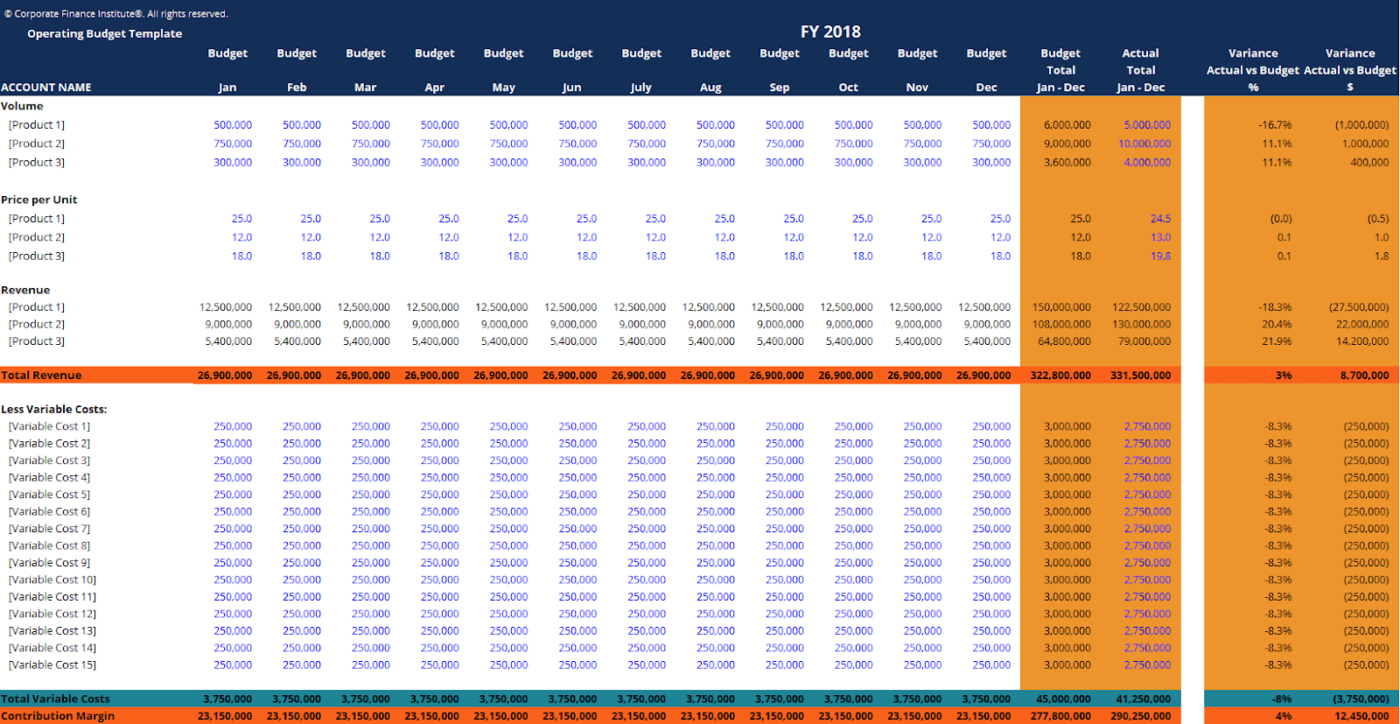

2. Excel Operating Budget Template by Corporate Finance Institute

The Excel Operating Budget Template by Corporate Finance Institute is a free resource for creating operating budgets. It features a professional yet easy-to-navigate layout, allowing you to visualize your project budget without manual calculations and formulas.

Simply forecast revenue by specifying the volume and unit price of your product, reduce fixed costs and variable costs from the figure, and that’s it. The template shows variance from the actual amount to help you identify areas for adjustments.

Here’s why you’ll love it:

- Utilize built-in formulas to calculate anticipated revenue, costs, and net income

- Forecast revenue, fixed costs, and variable costs with monthly and annual views

- Visualize historical trends using automatic charts to manage project budgets efficiently

- Make informed decisions with a structured overview of your operating finances

🔑 Ideal for: Finance teams and department heads looking for a template to manage their operating expenses without advanced software.

💡 Pro Tip: Want a more beginner-friendly monthly budget template for your business? Get the ClickUp Simple Budget Template—it’s professional, efficient, and unbelievably easy to use!

Plan and Manage Your Operating Budget Efficiently With ClickUp

A well-crafted operating budget does more than just track numbers—it drives smarter decisions, aligns your team, and brings you closer to your strategic goals.

By using accurate figures and reviewing actual performance regularly, your budget can become a powerful planning tool instead of just a financial report.

Ready to take the guesswork out of budgeting? Switch to ClickUp. From custom dashboards to real-time collaboration and ready-to-use operating budget templates, ClickUp gives you the tools to plan smarter, execute faster, and stay on track.

Sign up here for a free trial!