The banking sector has become increasingly competitive, and customer expectations are high. You need a solution that tracks customer-related interactions and helps customer-facing teams deliver better services.

The solution lies in having the right CRM for banking. A customer relationship management (CRM) solution for the banking industry manages and tracks customer communications to provide better, personalized customer service.

Equipped with these insights, marketing, sales, and customer relationship management teams move items directly into the CRM workflow. These teams know where to locate resources and take the next steps.

The banking CRM software anticipates customer needs and preferences to provide them with the right products, improving customer satisfaction. The result is long-term relationships and recurring revenue from customers.

We’ve compiled a list of CRM for banking solutions based on features, limitations, and pricing to help you make the right choice.

What Should You Look for in Banking CRM Software?

Here are the key features to look for and find the right CRM for banking solutions to help you exceed customer expectations.

- Data management: Choose a customer relationship management solution that allows you to store and analyze contacts, customers, and deals to help you track their progress in the sales pipeline

- Security: Check for security certifications and features like encryption, access control, and regular security updates in the banking CRM software

- Mobile access: If your customers avail your services on their smartphones, your sales reps should also be able to maintain customer relationships on the go

- Analytics: Plain customer data is only meaningful if you can extract insights. Opt for CRM software with built-in performance dashboards to visualize all customer data in one place

- Customization: No two banks are identical. The CRM system for finance management should allow customizations to track your financial goals, manage your accounts, and calculate your profits

- Training and Support: CRM implementation takes time. While implementing online banking solutions, you need access to the CRM’s support and onboarding team to help your internal teams with the CRM workflow whenever they get stuck

- Third-party integrations: Choose the CRM in banking that integrates with your existing tech stack and allows data flow between business sources. This includes marketing tools for customer segmentation, marketing automation tools, other banking software programs, customer retention software, and project management platforms

The 10 Best CRM Software for Banking to Use in 2024

Let’s look at the 10 best banking CRM software that made the list.

1. ClickUp

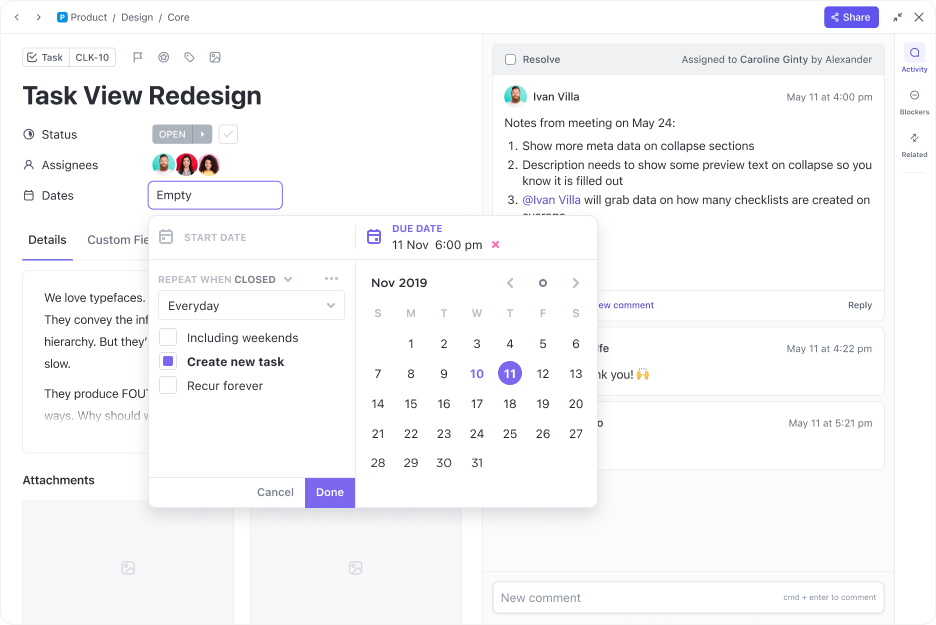

ClickUp empowers sales teams in banks and financial institutions to manage customer relationships in one place. The all-in-one banking CRM helps sales reps understand client relationships in one go by tracking accounts in the form of a List view, Kanban board, and Table view.

ClickUp’s CRM systems streamline customer service processes in banking services by eliminating cross-departmental silos. With complete visibility into the customer journey, teams work together and plan multichannel marketing campaigns to improve customer retention and interactions.

Get complete freedom to customize your CRM strategy according to your marketing campaign performance. Moreover, combine CRM and project management in one place for the best results.

ClickUp best features

- Use the CRM template to collect customer contacts and related data in a structured format and gather actionable insights for future marketing efforts

- Centralize customer outreach from the email hub. Collaborate on deals, send account updates to customers, or start a marketing campaign in one place

- Add links between tasks and documents to track all related work in the sales process

- Set up reminders and follow-ups to automate repetitive tasks, such as sending a survey form after the customer gets in touch with the support rep

- Optimize customer workflows with automation, include trigger status updates based on activity, and assign tasks based on each stage of the pipeline

- Streamline the customer intake process in sales organizations using pre-built forms powered by conditional logic

- Use ClickUp docs to create proposals, wikis, budget proposal templates, conference emails and survey forms quickly

- Create custom reports with high-level views of critical banking sector metrics such as customer lifetime value, average deal size, and recurring revenue and visualize all this over visually appealing dashboards

- 100+ integrations with marketing automation tools, sales forecasting platforms, customer support, customer tracking software, accounting software, and legal software solutions

ClickUp limitations

- Reporting and analytics features could be better

- There’s a learning curve for first-time users

ClickUp pricing

- Free Forever Plan

- Unlimited Plan: $7 per month per member

- Business Plan: $12 per month per member

- Business Plus Plan: $19 per month per member

- Enterprise Plan: Custom pricing

ClickUp ratings and reviews

2. Salesforce – Financial Service Cloud

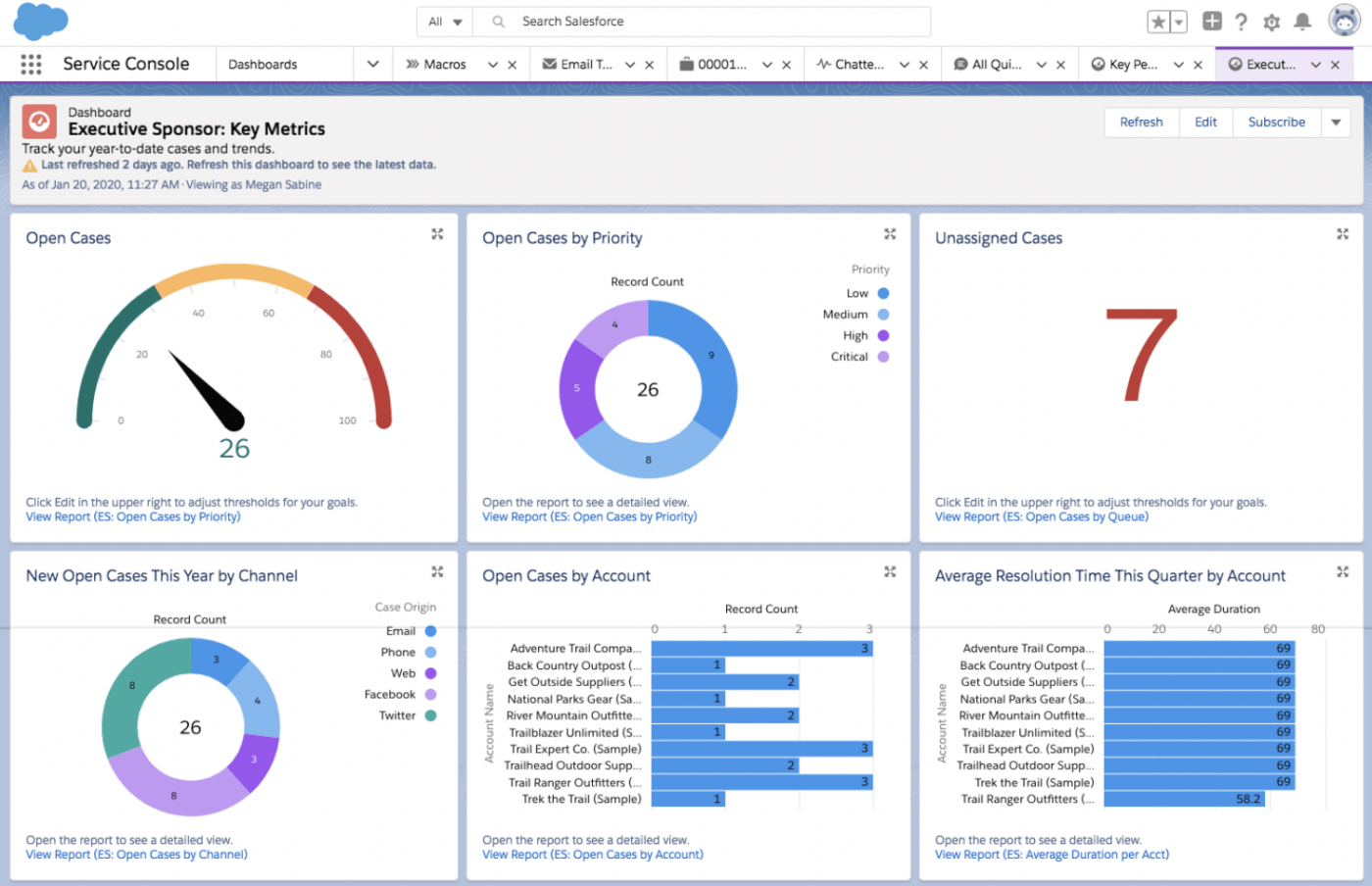

The Salesforce financial service cloud is a banking customer relationship management software that provides a 360-degree view of customers by consolidating customer data from different touchpoints. This information is critical in the banking sector to anticipate products they will likely require, their preferences, and past interactions with different teams to improve customer retention.

In a customer-focused industry like banking, different teams, including lending, insurance, asset management, and customer service, use Salesforce CRM systems to make data-driven decisions.

Financial Service Cloud’s best features

- Proactively engage policyholders during significant events such as purchasing a home

- Unify customer experience across channels and geographies for commercial and consumer businesses

- Integrate data from banking systems, financial planning, portfolio management, and other platforms that support your front-to-back office

Financial Service Cloud’s limitations

- Relatively expensive for small and medium-sized banks

- There’s a learning curve for first-time users

- Implementation requires help from the tech team

Financial Service Cloud pricing

- Custom pricing

Financial Service Cloud ratings and reviews

- G2: 4.2/5 (89 reviews)

- Capterra: Not enough reviews

3. Monday.com

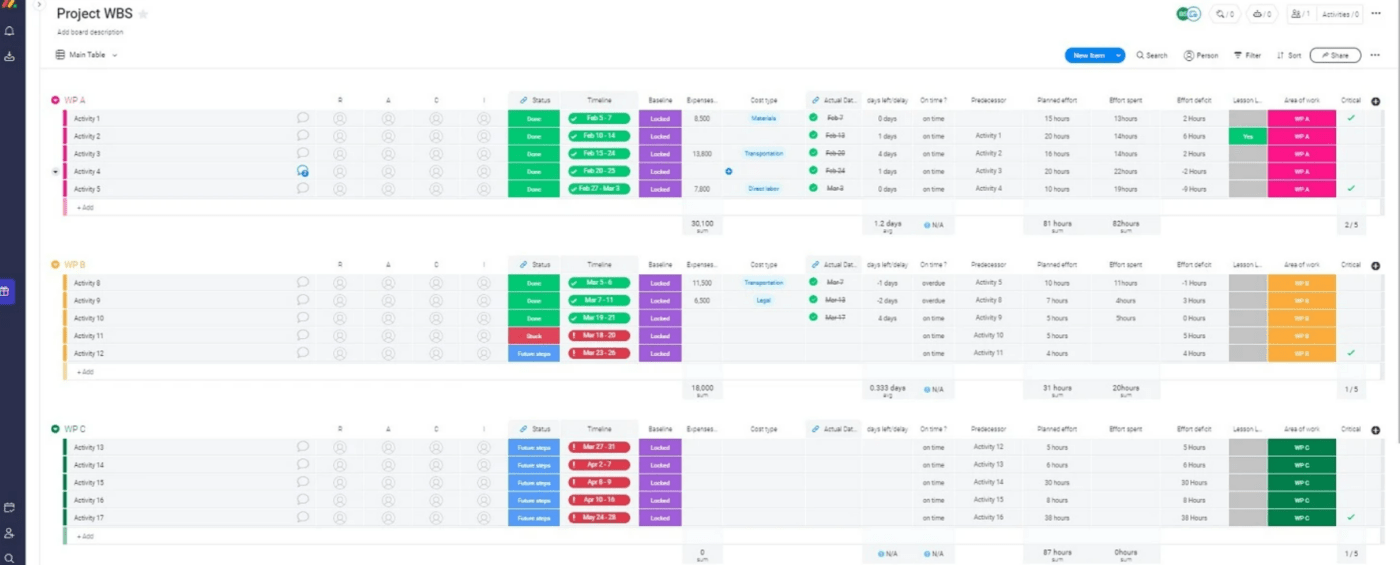

Monday is a CRM solution that functions as a single platform for project management and managing leads and contacts.

Give your team the superpower to review project budgets and prioritize leads using the lead scoring feature simultaneously. Set up automatic reminders to send follow-up emails and customize Kanban boards by adding columns to monitor customers, products, and costs in one go.

Monday.com best features

- Gain insights on customer-related metrics from the dashboard

- Collect feedback to anticipate customer needs using forms and surveys

- Manage leads as part of your pre-sales activities and stay on top of your client collections in the post-sale phase all in one place

- Integrate with 200+ tools in your technology stack and make cross-department collaboration simpler

Monday.com limitations

- Sometimes, the board takes more time than required to load on the screen

- Some customers experience automation issues

Monday.com pricing

- Basic CRM: $10/month per user

- Standard CRM: $14/month per user

- Pro CRM: $24/month per user

- Enterprise CRM: Contact for pricing

Monday.com ratings and reviews

- G2: 4.6/5 (709 reviews)

- Capterra: 4.8/5 (380 reviews)

4. Microsoft Dynamics

Microsoft Dynamics is one of the CRM solutions that uses its AI—Microsoft Sales CoPilot to reduce the sales team’s time on repetitive tasks and focus more on closing deals.

An exciting feature of this CRM software example is that it uses data from the banking CRM software to write contextual emails for customers and summarize meetings. Features like AI scoring models, automated lead summaries, and data visualizations help exceed customer expectations.

Microsoft Dynamics best features

- Automatic data syncing between Microsoft Dynamics Sales and other Microsoft apps

- Automated notifications on customer engagement and upcoming deadlines

- Create sequences of sales action for your team and guide them toward success

- Get tips, information, and suggested answers to customer needs and questions during calls

Microsoft Dynamics limitations

- User interface and reporting features need improvement

- Implementation challenges with entirely computer-generated support

Microsoft Dynamics pricing

- Professional: $65/user/month

- Enterprise: $95/user/month

- Premium: $135/user/month

Microsoft Sales CoPilot is a part of the Enterprise and Premium plan. Professional plan users can avail for an additional $40/user/month

Microsoft Dynamics ratings and reviews

- G2: 3.8/5 (1,577 reviews)

- Capterra: Not enough reviews

5. Oracle Sales

Oracle Sales is a suite of CRM solutions for banks to acquire complete customer data and share intelligent recommendations for personalized marketing campaigns while tracking and managing project budgets.

Sales automation allows reps to spend more time fostering client relationships than updating data on the CRM. The best part is that the CRM system automatically verifies customer addresses and phone numbers and actively monitors data duplication on the sales teams’ behalf.

Set up contests, goals, and team dashboards for sales performance management to analyze the team’s performance and areas of improvement.

Oracle Sales best features

- Personalize marketing strategies, improve collaborations and run what-if scenarios to meet customer expectations

- Generate accurate forecasts and statistical predictions based on your CRM data

- Collate relevant information about customers using past engagements and present the data to your sales team in the form of newsfeed-style content

Oracle Sales limitations

- Confusing and slow-moving for some users

- Software configuration requires technical expertise

Oracle Sales pricing

- Custom pricing

Oracle Sales ratings and reviews

- G2: 4/5 (120 reviews)

- Capterra: 4.3/5 (62 reviews)

6. Engagebay

Engagebay is a mix of CRM, sales automation, helpdesk software, and chat support. The CRM and the automation parts save unlimited contacts and set up processes in auto mode. Helpdesk and chat resolve customer service tickets, as customer satisfaction is critical for meeting customer expectations in the banking sector.

Modern CRM systems help you comprehensively view customer interactions, track customer updates automatically, and share deep insights on cross-sell and up-sell opportunities. Customer service and sales teams make phone calls directly from the system and save the call recording for future reference.

Engagebay best features

- Create sales pipelines for different product categories, geographies, and custom parameters

- Run ABM campaigns for a group of customer accounts

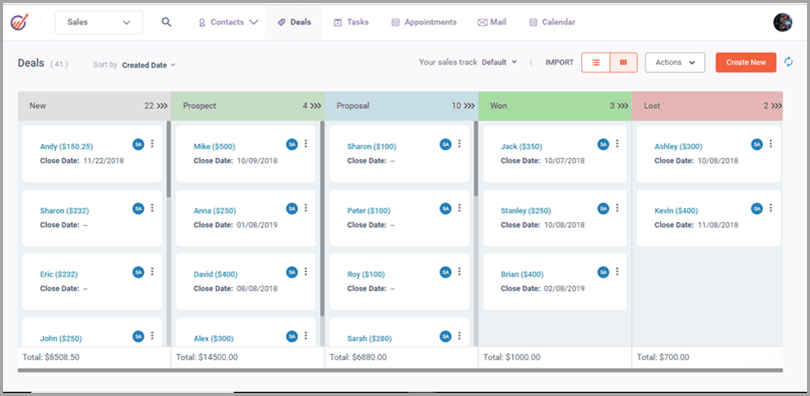

- The list view uses a graphical representation to display future opportunities, and the milestone view allows you to drag and drop CRM deals between milestones

Enagagebay limitations

- Customers have integration issues

- Limited pre-built templates for emails

Enagagebay pricing

- Free

- Basic: $11.04/user/month

- Growth: $42.49/user/month

- Pro: $67.99/user/month

Engagebay ratings and reviews

- G2: 4.6/5 (212 reviews)

- Capterra: 4.6/5 (587 reviews)

7. CRMNEXT

CRMNEXT is a customer relationship management CRM specifically designed for banks and financial institutions.

With multiple teams involved in business processes, including sales, marketing, customer support, and relationship management, data silos only add to the inefficiency. CRM solutions give visibility into what’s happening throughout the customer journey, from the frontline staff in a local bank branch to the leadership.

For example, when there is a new lead for a loan, the customer information is shared with the loan officer almost instantly. The relationship management official recommends personalized product and up-sell opportunities right at the beginning. The C-suite tracks whether the recommendation leads to higher revenue from new users.

CRMNEXT best features

- Guided journeys make account opening quicker

- Integrate the banking CRM with external databases like SQL and Oracle or with REST API

- Built-in safeguards improve data governance and mitigate the risks of incorrect data entry

CRMNEXT limitations

- Multiple bugs in the system

- Customers face slowness in the system as bandwidth increases

CRMNEXT pricing

- Custom pricing

CRMNEXT ratings and reviews

- G2: Not enough reviews

- Capterra: Not enough reviews

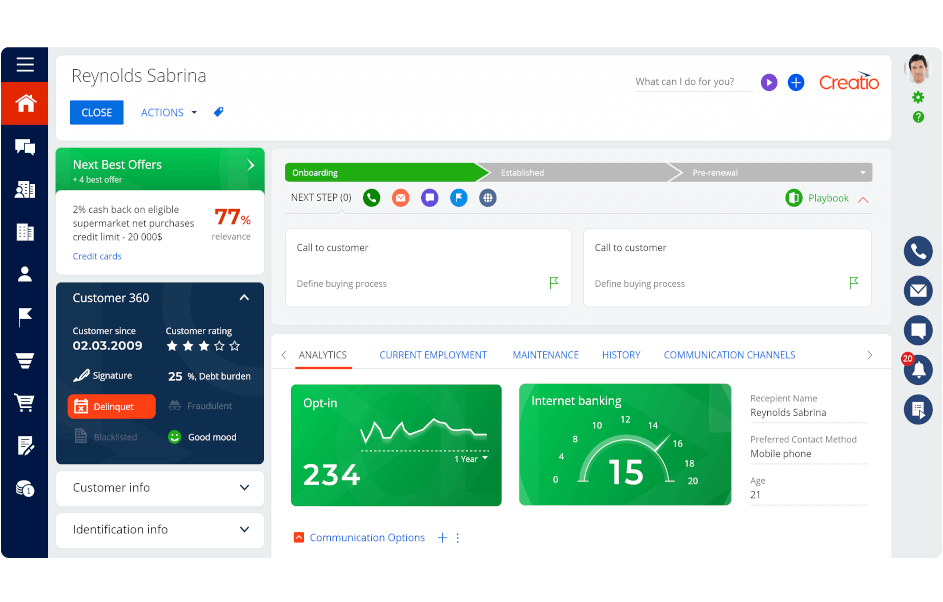

8. Creatio

Creatio is a no-code banking CRM solution that combines marketing, sales, and customer service. All teams gain visibility into customer profiles throughout the customer journey. Marketing teams run marketing campaigns with real-time data from the CRM for banking. The comprehensive automated loyalty bonus program improves customer retention.

Automate your lead cycle to capture, qualify, distribute, process, and handoff. Sales teams use this banking CRM software to create personal productivity dashboards.

Creatio best features

- Coordinated task management with email and calendar integration

- Intelligent Next Best Action (NBA) recommendations, sales playbooks, and decision paths for higher sales efficiency

- Field sales tool to prioritize, service, and execute field visits

Creatio limitations

- Limited options of apps in the Creatio marketplace

- Outdated user interface

Creatio pricing

- Growth: $25/user/month

- Enterprise: $55/user/month

- Unlimited: $85/user/month

This pricing is for the platform only. There is add-on pricing for each product. For example, sales feature costs $15/user/month

Creatio ratings and reviews

- G2: 4.6/5 (240 reviews)

- Capterra: 4.8/5 (109 reviews)

9. Maximizer

The CRM solution Maximizer is designed for sales leaders in the banking industry to access relevant and clean data for actionable insights. Combining tribal knowledge and data-driven insights is a great way to boost customer experience.

Sales leaders use Maximizer’s banking CRM in two ways—first, to view the performance of sales reps and, second, to get real-time alerts on new prospects, leads, and deals.

An automated system identifies opportunities for renewal based on customer behavior and streamlines the process by consolidating the customer lifecycle information.

Maximizer best features

- Store customer data and record customer notes on the same interface for quick access

- Pre-built professional email templates for sales reps to communicate clearly

- Real-time AI recommendations and a customized playbook with sales strategies tailored according to your banking customers

Maximizer limitations

- Numerous features are intimidating for new users

- The interface is not mobile-friendly

Maximizer pricing

- Base edition: Custom pricing

- Sales leader edition: Custom pricing

Maximizer ratings and reviews

- G2: 39/5 (461 reviews)

- Capterra: 4.1/5 (349 reviews)

10. Zoho CRM

The user-friendly banking CRM software Zoho is a single source of truth for managing leads, deals, and accounts.

Banks and financial institutions automate lead generation from multiple platforms like websites, chats, social media, and trade shows. Going a step further, scoring leads in the sales process ensures the lead is assigned to the right salesperson.

Get complete visibility of the deal pipeline, and a robust analytics engine analyzes deals for insights. Set up workflows that are triggered based on pre-decided events to improve the team’s productivity.

Zoho CRM best features

- View leads and opportunities and collaborate with the sales team from mobile phones

- Unlimited email templates to sync sales and email automation

- Collaborate with partners and share insights using the partner portal

Zoho CRM limitations

- The reporting feature needs work

- Users complain of customer support issues

Zoho CRM pricing

- Standard: $14/user/month

- Professional: $23/user/month

- Enterprise: $40/user/month

- Ultimate: $52/user/month

Zoho CRM ratings and reviews

- G2: 4/5 (2,502 reviews)

- Capterra: 4.3/5 (6,533 reviews)

The Best Banking CRM Software Aligns Teams, Improves Customer Retention and Brings Recurring Revenue

A robust CRM in banking has far-reaching benefits, such as improved customer retention and overall experience, more productive teams, and predictable revenue.

Banking CRMs serve multiple purposes across the organization. Craft a marketing strategy around products the customers need and communication plan templates to streamline your business messaging strategy.

Teams have access to relevant customer information. Everyone is aligned on customer relationship management in the sales process.

If you’re just starting, look for a beginner-friendly CRM that centralizes customer information for all teams involved in lead management and customer satisfaction.

Here’s the best recommendation for you.

ClickUp is an easy-to-use, flexible CRM software that gives everyone complete visibility over customer relationships. The Workspace boosts cross-functional collaboration by allowing teams to access relevant information for closing deals or sending marketing communications.

Advanced features like links between tasks, auto-reminders, the AI-powered assistant, and 1000+ integrations make ClickUp the best banking CRM software.

Sign up for a free ClickUp trial.