Risk is inevitable in business. From sea-faring merchants of yore protecting their goods from pirates to modern companies fighting cybercriminals, risk mitigation strategies are fundamental to any business.

The opportunity costs of not having a risk mitigation strategy can be extremely high. KMPG estimates that large companies lose 1.5% of their profits due to poor risk management strategies.

Organizations must have a thoughtful and future-proof risk mitigation strategy to prevent loss of profits, reputation, and compliance. In this blog post, we discuss why and how.

What is Risk?

Risk is the uncertainty or unpredictability associated with running a business, which can result in a loss of some kind. The loss itself need not be monetary alone. It can come in various forms, such as:

Financial risk: Organizations face financial risk when they are liable to lose money if it materializes. This could be loss of potential sales, fines/penalties from authorities, losing business to competition, etc.

Legal or compliance risks: The risks arising from non-compliance with regulatory standards can be very high. Such risks throw businesses open to lawsuits or regularity fines.

Operational risks: When something that should run smoothly doesn’t, it creates operational risk. This could be a critical machinery facing failure or the cloud environment going down. It could also disrupt collaboration in the workplace, hindering effective project delivery.

Security risks: The security of the people, space, assets, and products of an organization is critical. Threats can come from a natural disaster, an unexpected attacker, or a hacker.

Reputational risks: When a company’s reputation can be affected by someone’s actions, it creates a risk. For example, an (inadvertently) racist ad campaign or an employee’s uncouth behavior can impact a company’s reputation.

What is Risk Mitigation?

Risk mitigation is a strategic process to identify, control, and eliminate potential threats that could adversely affect an organization. It is an integral part of a business strategy to strengthen its resilience and responsiveness. Here’s what a good risk mitigation process should look like.

Identify

Be a detective and sniff out potential risks, be it financial, operational, or logistical. To do this, set up systems. For example, operational risks around technology can be identified through continuous monitoring and regular vulnerability assessment and penetration testing (VAPT).

Rate

Once you’ve identified your threats, perform a thorough risk assessment and prioritize for response. You can do this by answering two important questions:

- Likelihood: How likely is this risk to materialize?

- Impact: How much will this risk impact the business if it does occur?

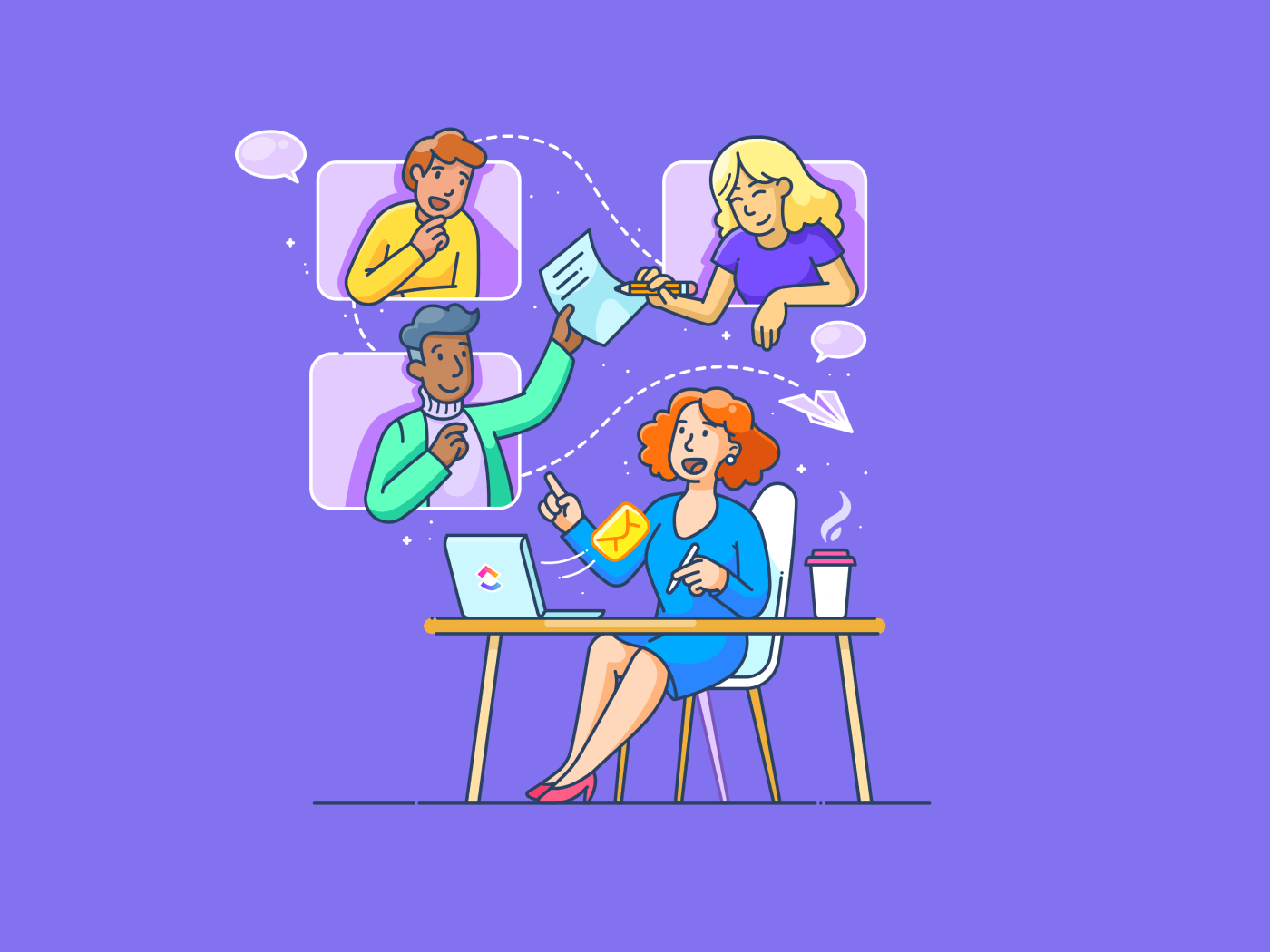

Rate every identified risk based on severity and design the action plan. Choose from ClickUp’s risk assessment templates to get started. Or start your own.

For example, a vulnerability in your customer database (which carries financial, reputational, and compliance risks) would be a significantly higher priority than a typographical error in a social media post (which carries reputational risk). Prioritize them accordingly and set timelines.

Mitigate

Based on the priorities, deal with the risks, and take them head-on. Create a risk mitigation plan (which we discuss in detail later in this blog post).

Monitor

Risks don’t go away once you identify and mitigate them. Businesses face new risks from all directions every day. So, continuously monitor your risks and the effectiveness of your risk mitigation plan. Review the process once every 3-6 months with all stakeholders.

You might think, “But I am not a hotshot business with huge resources. Is all this really necessary?” Well, yes!

Why is Risk Mitigation Important?

Irrespective of a business’s size, location, products, or revenue, a good risk mitigation strategy protects the organization and safeguards its interests.

A well-executed strategy can mitigate risk by

- Enabling proactive identification, assessment, and management of risks

- Predicting future risks and facilitating preventative measures

- Preventing avoidable financial losses

- Avoiding scrambling of resources and responses when the threat materializes

- Saving the additional cost of risk management and corrective measures

- Making space for experimentation and innovation

- Increasing business resilience and shareholder value

To mitigate risk effectively, you need a plan. Let’s see how you can build that.

What is a Risk Mitigation Plan?

A risk mitigation plan is a comprehensive framework that helps you deal with all kinds of potential risks. It is like a trusty umbrella on a rainy day, allowing you to dance in the rain while staying dry!

It typically comprises the following.

An overall approach to risk management: What do you define as a risk? Will you be preventative or reactive? Will your responses be offensive or defensive? How will you absorb the impact of your risks?

Identified risks: Make a list of risks you expect to encounter. Make this specific and practical. Instead of listing ‘change in regulation,’ define this as ‘the Digital Operational Resilience Act is expected to come into effect in 2024.’

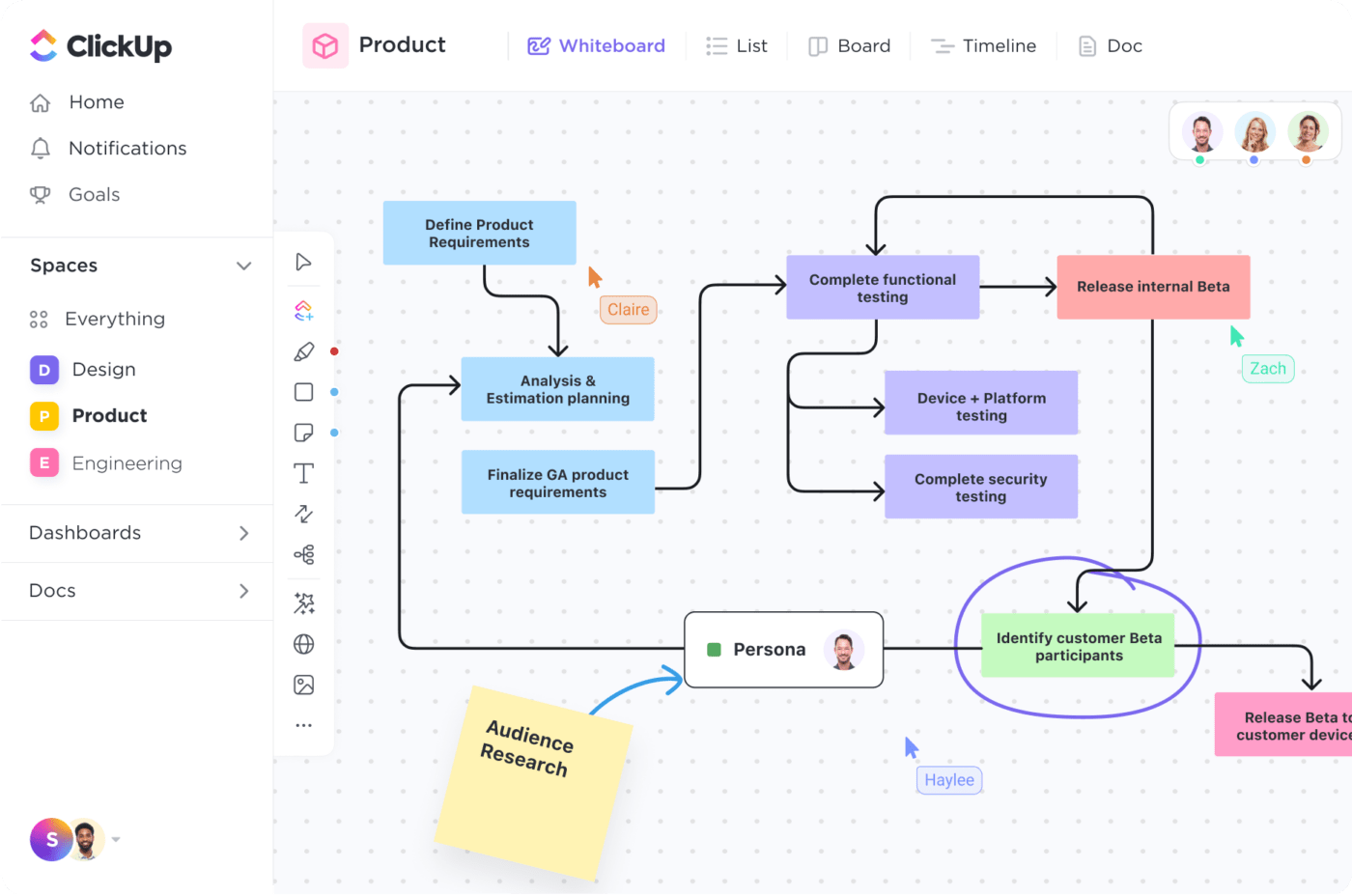

Risk mitigation strategy: Clearly outline how you would address every potential risk. A visual risk mitigation workflow can help bring the entire team on board the process. It will also help them remember the steps or easily access the workflow should they need it.

Include what you would do to prevent the risk from occurring and how you would respond if it materializes.

Actionable measures: Define specific actions to implement the risk mitigation strategy.

- Assign responsibilities to team members

- Set aside budgets to mitigate identified risks

- Define timelines for each action item

Monitoring and review: Formulate a regular review process (once a quarter at least) to assess if your risk mitigation plan works. Measure effectiveness based on pre-determined metrics, such as cost savings, customer satisfaction, etc.

Now that you’ve understood the concept let’s explore practical ways to create your risk mitigation strategy.

10 Risk Mitigation Strategies for Your Business

1. Accepting inevitable risks

Not all risks need to be eliminated or even mitigated. Sometimes, the likelihood of a risk occurring might be too low. Or the cost of mitigating the risk might be higher than its impact. In such cases, you acknowledge its existence and let it be, a strategy called risk acceptance.

The simplest example is the risk of a particular team member leaving the organization. In most cases, this is inevitable, so the risk is accepted. When it happens, the role shall be backfilled.

2. Transferring risks to a third party

As the name suggests, this strategy shifts the risk from you to another entity. The classic example is purchasing theft or fire insurance for your business. In project management, this might be having resources on the bench or keeping contractors on the rolls.

Organizations follow risk transference as a strategy when the impact of its materialization is high. While you implement this strategy, be mindful that the costs can be high, too. For instance, insurance is a regular payout, whether or not the risk materializes.

3. Avoiding risky situations altogether

At the other end of risk management strategies is risk avoidance. Here, you will steer clear of projects/activities that involve said risk. This strategy is employed in situations where the impact of the risk is exceptionally high.

Clear examples would be abstaining from hiring a candidate with a criminal record or setting up an office in a country going through political turmoil. In each case, the cost of failure is too high even to take the risk.

4. Sharing risk based on organizational tolerance

Here, you distribute the risk across multiple parties. For example, a venture capital firm invests a part of the investment sought by a startup instead of the whole sum. They decide how much to invest based on their risk tolerance, i.e., the investment they can lose comfortably.

When each investor decides their investment this way, the risk is shared among them, breaking the fall should it occur.

5. Managing risks strategically

Risk management, also known as risk buffering, is when you have a backup of everything you need (people, time, goods) for times of crisis. If that brings to mind a doomsday prepper, it need not be that radical.

Businesses regularly maintain disaster recovery systems or backups for data in case something goes down. Maintaining a healthy cash flow that covers salaries for the next few months is also a perfect example.

Purpose-designed risk management software can help devise the right action plan for every kind of risk a business might encounter.

6. Diversifying for protection from risks

Going by the adage, don’t put all your eggs in one basket; diversification distributes your risk or dependence across multiple options, reducing risk exposure and consequences. It is a very commonly used risk mitigation strategy.

Organizations regularly engage multiple contractors for similar jobs to diversify the risk of any of them shutting down. Venture capitalists diversify their investments across various startups. Consultants and freelancers work with multiple customers if one downsizes or terminates the contract.

7. Adopting an agile approach

The practice of Agile, in itself, is an effective risk mitigation strategy. The traditional way was spending years and millions of dollars to build a product before taking it to the market, which poses a considerable risk of failure.

On the other hand, Agile teams launch a minimum viable product (MVP) and build incrementally, taking into account market response regularly. This increases the chances of success as it is built on the feedback of customers and the performance of the product. Other technology teams release beta versions for developers and later the public before a full-on launch.

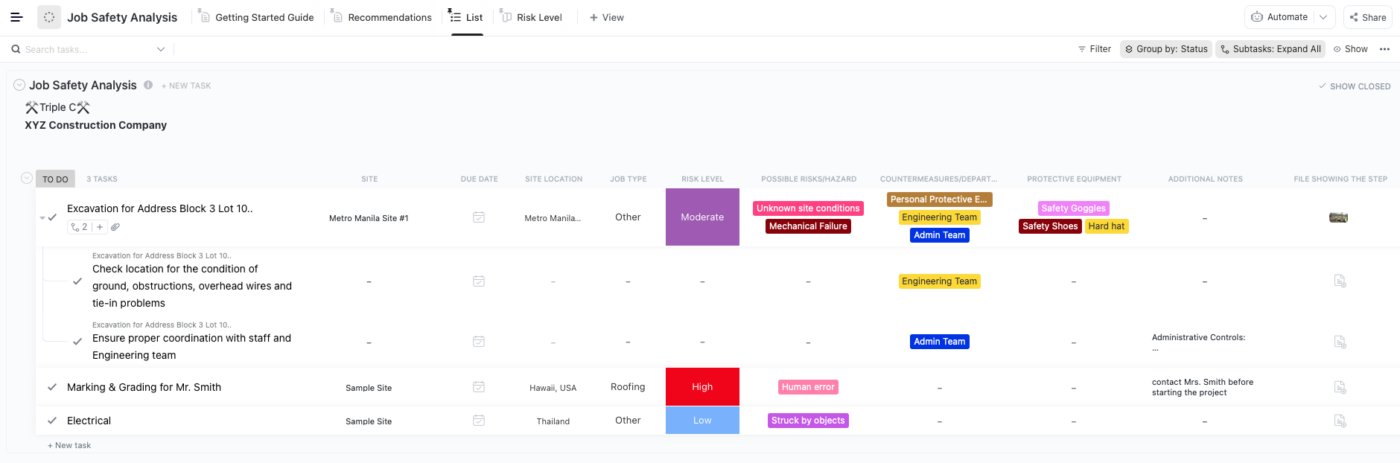

8. Using a task management software

This risk management strategy relies on tools and processes to eliminate operational risks. Good task management software can help organize all the work in a hierarchical, interconnected, and contextual way, improving operational efficiency within the team.

ClickUp’s task management software is designed to achieve precisely this. With ClickUp, you can:

- Organize tasks and sub-tasks into projects, helping you manage multiple projects effectively

- Prioritize work based on factors relevant to the business

- Assign users to each task, ensuring accountability

- Add priorities, tags, and dependencies to tasks

- Provide complete visibility to every stakeholder

- Track time for each task to ensure productivity and profitability

A project management tool like ClickUp provides clarity to all parties involved. It eliminates the risk of misunderstandings, missed timelines, or incurring additional costs. It brings together all resources, eliminating the need for endless meetings and the risks of unproductive time. 🙌

9. Monitoring project progress

You run strategic, operational, and financial risks if the project doesn’t progress as intended. A robust risk monitoring mechanism can mitigate that.

Regular monitoring can help:

- Track if the project is on time

- Set clear project objectives

- Identify gaps or issues in case of delay

- Make amends like assigning additional resources or pushing deadlines

- Collaborate with team members about their performance and the adjustments needed

using this template

ClickUp’s Project Monitoring and Control Plan template helps managers ensure that projects are completed on time, within budget, and with the expected quality.

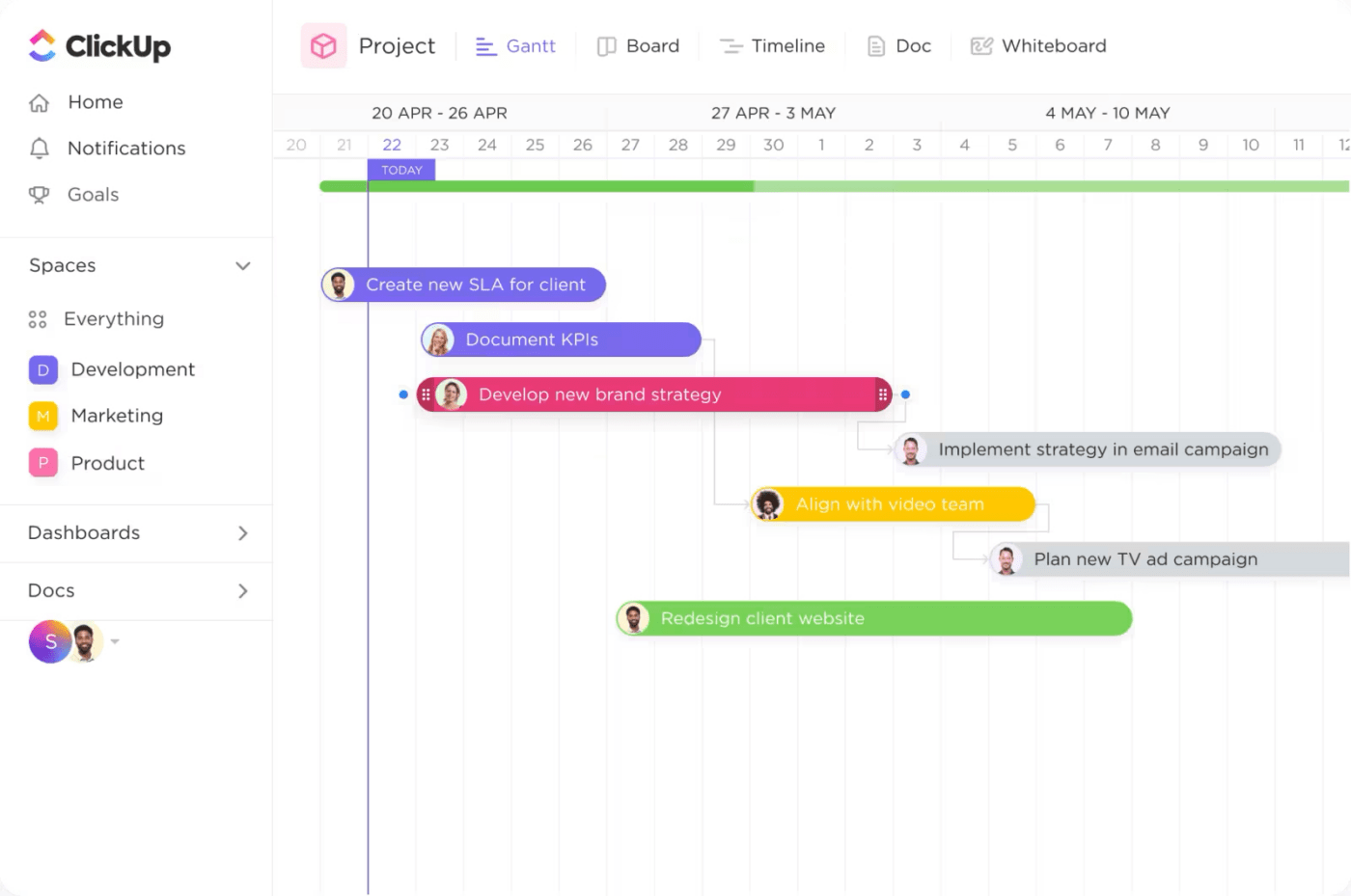

ClickUp can protect you from a lot more operational risks. The ClickUp Dashboard offers real-time project tracking. The workload view lets you understand who is doing what and assign tasks appropriately. The Gantt chart view visualizes the timeline to help on-time delivery.

You can manage goals and budgets all in one place. You can also use it as a collaboration app to facilitate meaningful, timely, contextual communication among team members.

10. Set attainable goals

Mitigating the risk of failure begins with setting yourself up for success. Setting attainable goals is fundamental to that. Bring your team together and set goals that everyone thinks are achievable. Make them visible to everyone on the team—you can use several goal-tracking apps for this purpose.

Include buffer time and effort to prevent last-minute rush. Review your goals occasionally and adjust them if they become unattainable.

Don’t know where to start? We’ve got you covered with Clickup’s goals dashboard! You can set goals that are numerical, monetary, true/false, and task completion. You can also set targets for each sprint or time. You can foster a collaborative work environment with every team member driving towards the same goals.

Mitigate Various Kinds of Operational Risks with ClickUp

In every organization, operational risks are unavoidable. Team members will resign. Tasks will get delayed. Time estimates will be wrong. People may miss a critical point in a user story. Complex dependencies will require extra effort.

These risks can’t be avoided but can be mitigated and managed with good project management software.

ClickUp’s project management features are designed to address all this and more. It helps project management teams build operational efficiency to save time by making people more productive. See how you can mitigate risks with ClickUp. Sign up for free today!