Construction accounting is a world of its own, where every project, payment, and cost has its own rhythm.

Unlike traditional accounting, it’s shaped by moving timelines, shifting budgets, and the unpredictable nature of the construction industry itself.

If you run a construction business or oversee its finances, you already know: the numbers behind each project can make or break the next big opportunity. Keeping track isn’t just about following rules but building a system that works as hard as your crews do.

In this guide, you’ll uncover the core principles, smarter techniques, essential tools, and real-world strategies that make construction accounting the backbone of sustainable growth

Understanding Why Construction Accounting is Unique

Construction accounting stands apart from regular business accounting because of its need to manage constantly moving projects, shifting costs, and long-term contracts. Every project operates on its own timeline, with its own financial structure, making traditional methods ineffective without adjustments.

What sets construction accounting apart

- Project-based structure: Construction operations revolve around individual projects, each needing dedicated tracking for job cost, contract revenue recognition, and financial reporting

- Extended timelines and complex contracts: Construction projects often span multiple months or years, requiring the use of specialized revenue recognition methods like the completed contract method and the percentage of completion method

- Fluctuating project costs: Construction companies need active monitoring of actual costs, estimated costs, labor costs, material costs, and indirect costs to protect profitability

- Irregular cash flow patterns: Cash flow management becomes critical because payments depend on milestones and project progress, not fixed schedules

- Strict compliance with accounting standards: Financial reporting must align with generally accepted accounting principles while tracking revenue and expenses across multiple accounting periods

Construction companies that build their accounting systems around these realities gain better control over financial health, project profitability, and business sustainability.

📖 Read More: How to Start a Construction Company

👀 Did You Know? Over 4,500 years ago, Egyptian inspector Merer kept daily logbooks tracking the transportation of limestone for the Great Pyramid of Giza.

These papyrus records, discovered near the Red Sea, reveal early project management techniques including labor tracking, material logistics, and coordinated construction timelines.

Fundamental Components of Construction Accounting

Solid construction accounting is about building a financial system that reflects how projects move, shift, and evolve. Whether you’re reviewing your monthly financial statements or tracking material costs for a single project, understanding the core components is non-negotiable.

Key elements you need to master

- Job costing: Track every cost tied to labor, materials, equipment costs, and subcontractors at the project level to understand true profitability

- Revenue recognition: Apply the right method, whether the percentage of completion method or completed contract method. Base this on the contract structure and project timeline

- Financial statements: Generate accurate balance sheets, income statements, and cash flow statements tailored to the realities of the construction industry

- Direct and indirect costs: Differentiate project-specific direct costs, like material costs and labor costs. From the overhead costs, like insurance, administrative expenses, and equipment depreciation

- Cash flow management: Monitor the timing of cash inflows and outflows closely, especially when contract billing and project progress don’t perfectly align

- Cost categories and project costs: Break expenses into logical cost categories like actual costs, estimated costs, and ongoing costs to maintain clarity throughout the project

When these components work together, construction companies can track financial health more accurately and recognize revenue correctly. They can also manage project profitability more effectively and plan for sustainable growth across multiple accounting periods.

⚡ Template Archive: Free Construction Management Templates

Advanced Construction Accounting Techniques

Getting the basics right is important, but mastering advanced techniques is what separates financially strong construction firms from the rest. These practices help you forecast better, handle financial risks early, and protect project profitability even when projects don’t go as planned.

Techniques you should prioritize

- Work in progress (WIP) reporting: Monitor the difference between billed amounts and actual project progress to catch cash flow issues, underbilling, or overbilling before they escalate

- Overhead allocation: Spread indirect costs fairly across projects based on labor hours, material usage, or equipment costs to avoid distorting individual project profitability

- Accurate forecasting with estimated costs: Track project progress against estimated costs in real time, helping you predict final project costs and adjust resource allocation when needed

- Revenue recognition planning: Choose the appropriate revenue recognition method, like the percentage of completion method or the completed contract method, to match your financial reporting needs and project structures

- Construction in progress report (CIP): Keep updated records of ongoing costs on incomplete projects to maintain visibility across multiple accounting periods and support better cash flow management

- Handling collective bargaining agreements: Incorporate labor costs tied to union contracts or specialized labor agreements into job cost tracking to maintain financial accuracy

Construction financial managers who integrate these techniques into daily operations can strengthen financial health, minimize surprises at project completion, and make informed decisions across the entire project lifecycle.

To sharpen these practices even further, investing in professional development can make a major difference. Explore essential construction certifications that can help you build stronger financial, project management, and leadership skills for long-term success.

Implementing Construction Accounting Software

Construction accounting relies on precision, and the right software turns that precision into a daily habit. A strong system gives you real-time insights, tighter control over project costs, and fewer surprises during financial reporting.

Finding the right fit starts with understanding what features your business actually needs.

Key features to look for in a construction accounting system

Choosing the right construction accounting software can define how efficiently you manage costs, recognize revenue, and maintain project profitability. It’s not just about basic bookkeeping; rather, your system needs to adapt to complex projects and shifting financial realities.

Look for these essential features:

- Job costing tools: Track project-specific labor costs, material costs, equipment costs, and subcontractor expenses in real time

- Cash flow management: Monitor incoming and outgoing cash tied to project milestones to avoid gaps that delay operations

- Revenue recognition flexibility: Support for both the completed contract method and the percentage of completion method, so you can align billing with project progress

- Financial reporting capabilities: Generate detailed reports like construction industry balance sheets, construction in progress reports, and project profitability analyses

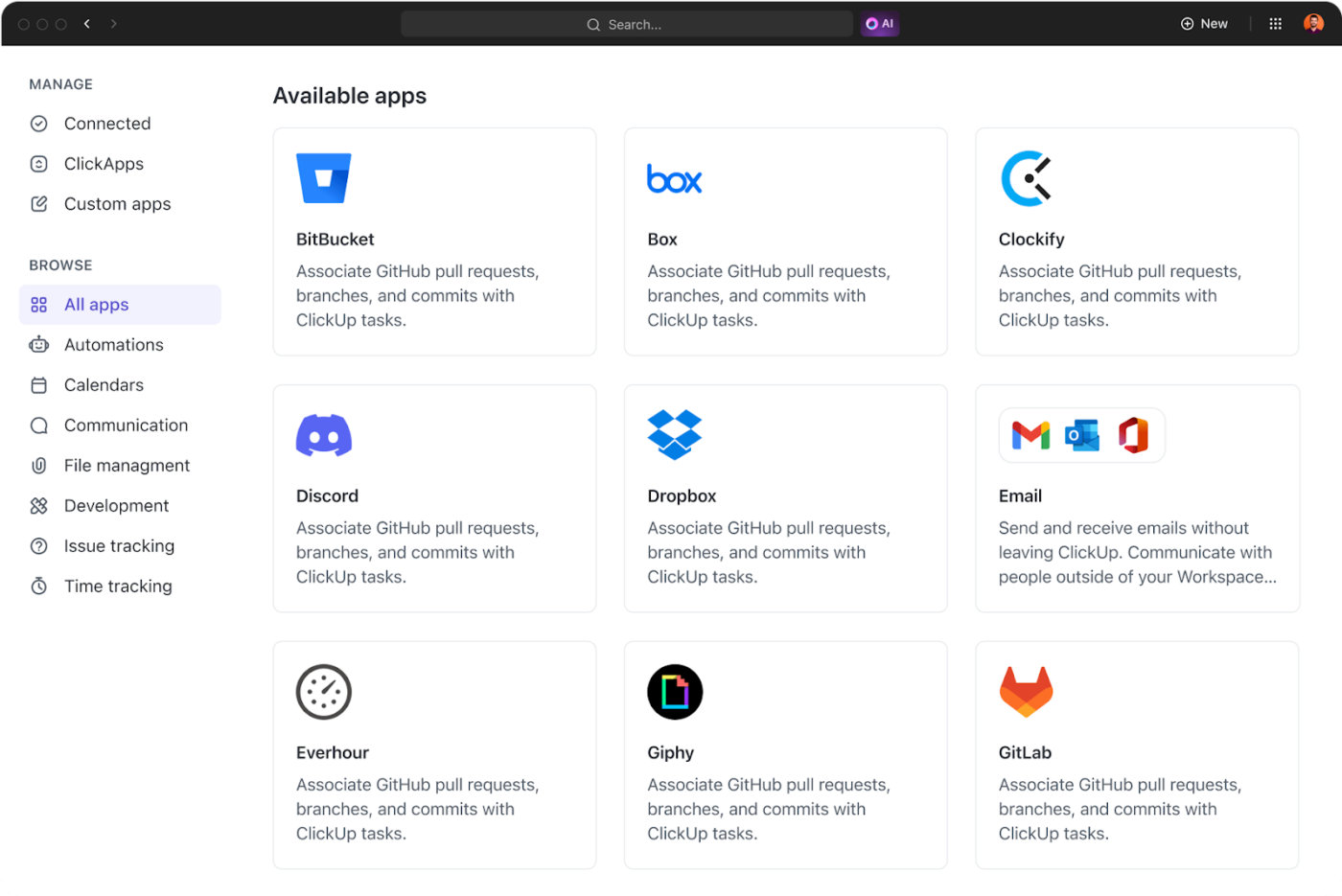

- Integration options: Seamless connection with project management platforms, payroll systems, and CRM tools to centralize construction operations

- Mobile access and field entry: Enable project managers and field teams to track financial data and update job costs directly from the site

Choosing software that combines these features ensures better financial management, accurate tracking, and stronger decision-making across every project you handle.

📖 Also Read: How to Use Project Accounting

How to select the most suitable software for your business

No two construction companies operate the same way. This means that the best accounting software for your business needs to match your project scale, contract types, and financial goals.

Here’s what to focus on when choosing:

- Business size and project complexity: A small firm managing local projects may not need the same system as a company handling multi-million dollar builds across different states

- Revenue recognition needs: Ensure the platform supports the revenue recognition method you primarily use. Whether it’s the completed contract method or the percentage of completion method

- Customization and scalability: Look for software that adapts to different contract structures, cost tracking methods, and project lifecycles as your business grows

- Integration capabilities: Prioritize platforms that connect smoothly with project management tools, payroll systems, and CRM platforms. So your financial data isn’t trapped in silos

- Ease of use and support: A system that’s powerful but complicated won’t help if your team struggles to use it daily. Reliable support and an intuitive interface are non-negotiables

Choosing the right tool means balancing advanced functionality with everyday usability. So you stay focused on building, not wrestling with systems.

📖 Read More: Best Construction Project Management Software

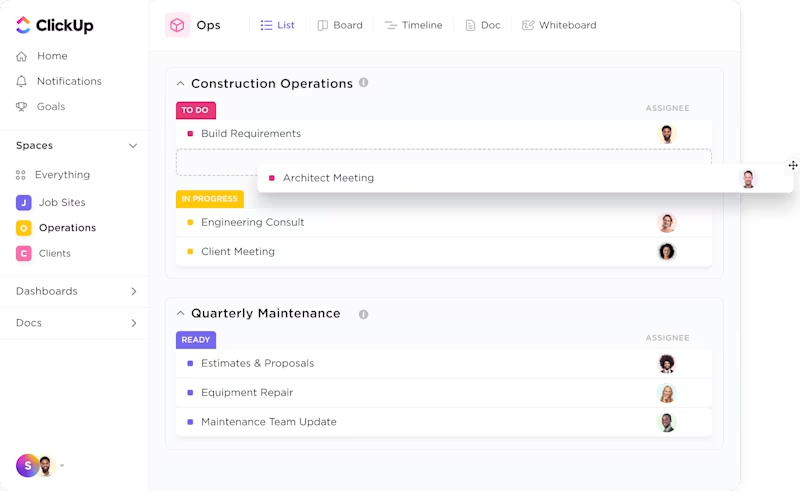

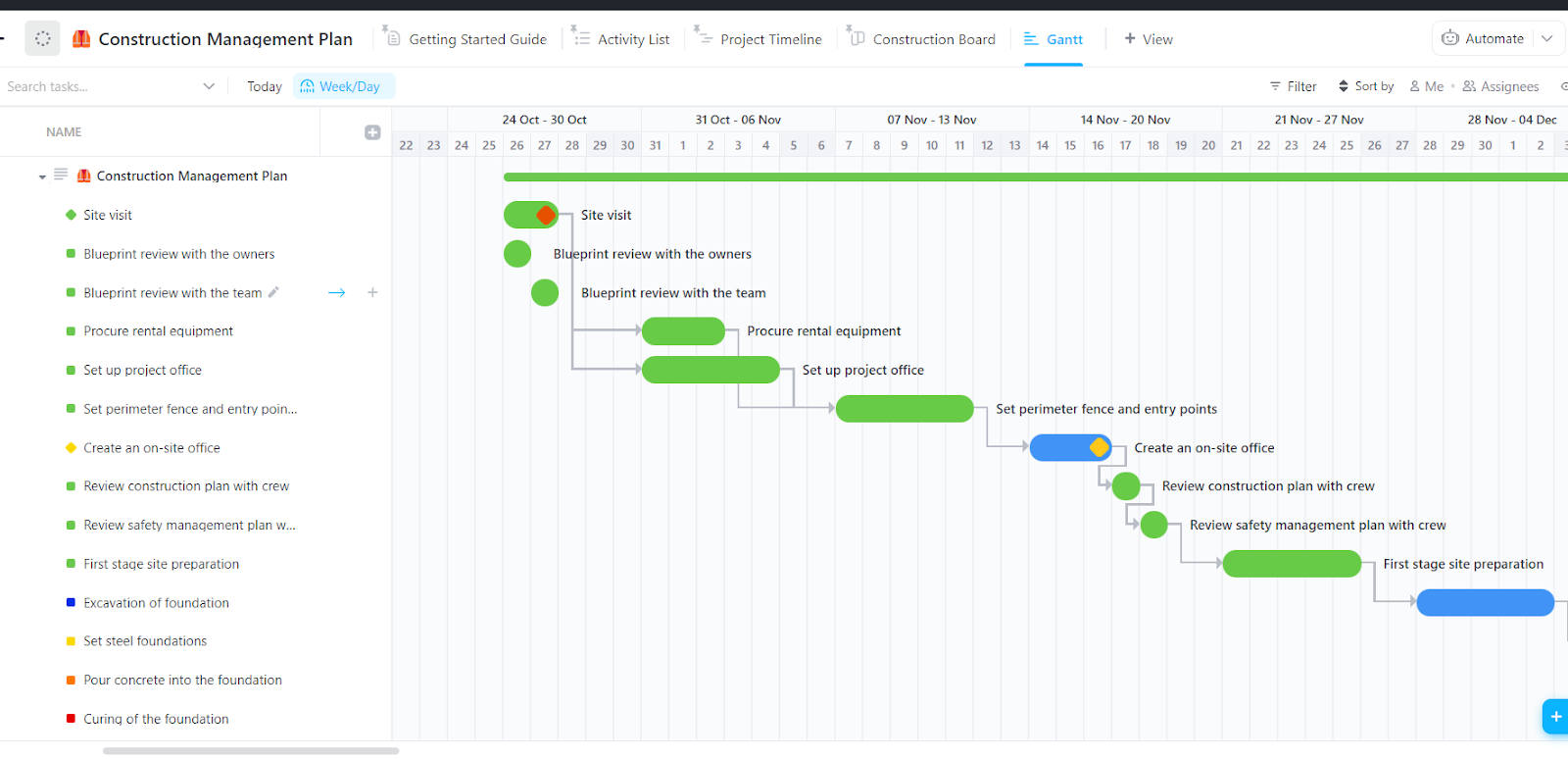

Leveraging ClickUp for construction accounting

Managing financial data across multiple projects gets complicated fast without the right tools in place. Delays, missed costs, and reporting gaps directly impact cash flow and overall financial health. That’s where a platform like ClickUp gives construction companies an edge. By offering real-time visibility and tighter control over job costs, budgets, and workflows.

Real-time financial tracking

Keeping real-time visibility over project finances is crucial to prevent overruns and missed billing opportunities. Tools like ClickUp Dashboards help construction teams monitor project costs, cash flow, billing statuses, and estimated costs. All without relying on disconnected spreadsheets.

By connecting site updates to financial reporting, you can spot budget risks early, adjust forecasts faster, and protect project profitability at every stage.

Streamlined workflows and financial management

Managing construction finances gets messy when operations and accounting platforms don’t speak to each other. Using ClickUp Integrations, you can connect project management tools, time tracking apps, CRM platforms, and financial software, creating a centralized hub for project and financial data.

This seamless flow reduces data entry errors, improves financial reporting accuracy, and helps construction businesses make decisions based on a complete view of project operations.

📮ClickUp Insight: 92% of knowledge workers risk losing important decisions scattered across chat, email, and spreadsheets. Without a unified system for capturing and tracking decisions, critical business insights get lost in the digital noise.

With ClickUp’s Task Management capabilities, you never have to worry about this. Create tasks from chat, task comments, docs, and emails with a single click!

Accurate job costing with time tracking

Accurate job costing starts with precise labor tracking. With ClickUp Time Tracking, field teams and project managers can log hours directly against specific projects and cost codes in real time.

This detailed tracking improves job cost sheets, supports better cash flow management, and gives construction financial managers a clear view of actual costs versus estimates before project closeout.

Overcoming Common Challenges in Construction Accounting

Even with strong systems in place, construction companies run into specific accounting challenges that can delay payments, impact profitability, or distort reporting. Addressing them early keeps financial operations clean, predictable, and sustainable.

Handling change orders without losing financial control

Change orders can quickly derail budgets if they aren’t managed tightly. Each adjustment adds new material costs, labor hours, or project timelines that ripple across job cost sheets.

The smartest way to stay in control is to link approved change orders directly to your financial system. Update project budgets, billing schedules, and cash flow forecasts immediately as changes occur.

Managing financial visibility across multiple active projects

Tracking financial health on a single job is manageable, but doing it across five or ten projects gets complicated fast. Without consolidated dashboards and real-time financial reporting, overspending or billing delays can slip through unnoticed.

Construction companies can solve this by standardizing financial templates and using centralized tools. To monitor actual costs, project profitability, and revenue recognition across all active contracts.

⚡ Template Archive: Free General Ledger Templates for Accounting in Excel & ClickUp

Avoiding delays caused by subcontractor billing gaps

Subcontractor delays in submitting invoices cause major headaches at project closeouts, often pushing revenue recognition and final project costs into later periods.

To prevent financial reporting issues, construction firms should enforce clear subcontractor billing deadlines tied to project milestones. They should also supplement billing with field-based cost tracking to record incurred but unbilled expenses in real time.

⚡️ Bonus Template: ClickUp’s Construction Management Template makes it easier for construction managers to manage their operations in one place with pre-built custom statuses, views, documents, and custom fields.

Building Stronger Financial Systems

Strong construction accounting practices give you more than financial records. They drive project profitability, smarter cash flow management, and faster decision-making. Clear systems around job costs, financial reporting, construction contracts, and project tracking create more predictability in an industry built on moving targets.

Choosing the right technology and workflows helps construction companies improve project outcomes, strengthen financial health, and build more sustainable operations across every project they manage.

Try ClickUp today to simplify financial tracking, streamline project oversight, and support stronger construction operations.