How to Use AI in Accounting (Use Cases & Tools)

Sorry, there were no results found for “”

Sorry, there were no results found for “”

Sorry, there were no results found for “”

If there’s one thing the business world is excited about in 2024, it has to be using AI to become more efficient—in newer and unexpected ways!

AI’s presence can be felt in every industry, from personalized recommendations on streaming services to self-driving cars. It rapidly learns from humans and transforms that knowledge to reshape our work processes.

The accounting industry is no exception. As data drives the business world, accounting forms and accountants increasingly seek ways to leverage AI to improve efficiency and accuracy.

To understand how artificial intelligence can be used in accounting, we’ll explore various AI tools that make accounting processes and workflows faster and more accurate.

The accounting industry is undergoing a significant transformation driven by the strategic application of AI technologies.

This integration leverages machine learning algorithms and natural language processing to automate and elevate various accounting functions.

AI’s impact extends across various tasks, including financial reporting and project accounting management. It streamlines audits and ensures compliance by proactively detecting fraudulent activity and conducting in-depth data analysis.

Will AI replace accountants?

While AI excels at automating various tasks, it can’t entirely replace human accountants.

Core human skills such as sound judgment, open communication, and critical thinking remain essential for effective accounting practices.

Certified Public Accountants (CPAs) continue to be indispensable for navigating complex accounting issues and decision-making. Through human oversight and intervention, they ensure the accuracy and ethical application of accounting principles.

AI in accounting has several uses. This article lists the most prominent ones.

AI accounting software transforms how accountants approach daily tasks, from data entry to strategic decision-making.

While making results more accurate, accounting professionals get more done in less time, focusing on things that need their undivided attention.

Let’s delve into five specific use cases where AI is revolutionizing the accounting processes:

AI can analyze vast financial data, discerning hidden patterns and identifying potential risks humans may miss.

AI-powered predictive analytics is a transformative technology that affects the roles of accountants and finance professionals. By automating the often tedious task of report generation, financial professionals can dedicate their expertise to a more strategic function: evaluation.

However, remember that AI outputs require careful human attention. Ultimately, accountants must meticulously assess the accuracy and reliability of the generated predictions.

This evaluation process should encompass benchmarking against established outcomes, employing cross-validation techniques, utilizing appropriate metrics, and critically scrutinizing potential biases within the data or algorithms.

Through this rigorous evaluation, human expertise ensures that AI insights are effectively harnessed to drive informed decision-making.

Traditional audit processes can be lengthy and resource-intensive. AI can streamline the process by automating data extraction, sampling, and risk assessment tasks. This allows auditors to dedicate their expertise to more complex areas while improving the overall efficiency and effectiveness of audits.

AI can be used to analyze historical audit data to identify areas of recurring weakness, enabling a more proactive approach to ensuring ongoing compliance.

Fraudulent activity can pose a significant financial threat, often going undetected until significant damage is done. AI acts as a powerful tool in the fight against fraud.

Advanced algorithms can analyze spending patterns and identify unusual transactions or activities that deviate from established norms. This enables proactive detection and investigation, minimizing financial losses.

Case study: Using AI to shut down active money mule accounts

One of Europe’s largest digital banks was targeted by a money laundering scheme using fake online classified ads. Their fraud team struggled to keep up with the criminals who were opening and quickly draining money mule accounts.

Feedzai, a company that provides AI-powered fraud and financial crime solutions, utilized AI in two key ways to combat this challenge:

This combination of AI techniques allowed the bank to:

By leveraging AI, the bank shut down over 400 money mule accounts and provided valuable information to the police to investigate the criminal network.

Repetitive tasks have historically limited accounting professionals, consuming valuable hours that could be better spent on strategic analysis.

Invoice and receipt data entry, bank reconciliation, and general ledger upkeep are tasks that are now ready for robotic process automation.

Adept at pattern recognition and data extraction, AI algorithms can automate processes with laser-focused precision. This liberates accountants from tedious tasks such as manual data manipulation and significantly minimizes the inherent risk of human error.

Pro-tip: Use these 10 free bookkeeping templates in Excel and ClickUp to speed up your processes and achieve accurate reconciliation every time.

Financial data integrity is paramount in accounting. AI excels at analyzing vast datasets with pinpoint accuracy.

Machine learning algorithms can be trained to identify inconsistencies, outliers, and potential errors in financial transactions. This proactive approach significantly reduces the likelihood of errors slipping through the cracks, safeguarding the integrity of financial records.

Case study: Deloitte tax automation using AI and machine learning

Deloitte partnered with Kortical to use AI in their tax processes. The project aimed to automate tasks and improve efficiency. Deloitte provided the domain expertise and data, while Kortical offered its AI platform and data science capabilities. Kortical built a machine learning model that could automatically apply tax law and structure client data, reducing the human processing time from 5 hours to 6 minutes, a 50x improvement. This project took 6 months and achieved human-level accuracy (in excess of 90%) in tax computations.

These are just a few examples of AI revolutionizing the accounting profession. As AI technology evolves, we can expect even more innovative applications to emerge, further transforming how accounting is practiced.

Is there an AI-powered accounting project management software that can do it all?

ClickUp can alleviate the burden of repetitive tasks and core processes to a large extent, if not completely.

As a work and productivity management platform, it caters to every industry, big or small. With specialized solutions for different departments, you can accomplish every little task—from task management to time tracking—on a single platform with ClickUp.

Let’s look at how ClickUp helps accountants and finance professionals.

ClickUp’s Accounting Project Management Software can be used in a million ways when combined with the platform’s AI capabilities.

Efficiently track every financial move and maintain a complete audit trail with ClickUp Brain’s AI accounting tools.

The system logs all financial activities and shares key updates with stakeholders regularly, ensuring a complete and accurate record for audits and regulatory compliance purposes.

From cutting down manual labor with automation to using AI’s natural language processing capabilities for summarization, let’s see how you can leverage these tools every step of the way.

Let’s first see how ClickUp Brain can help improve your accounting team’s efficiency and accuracy:

From Fortune 500 CFOs and freelance CPAs to large-scale accounting firms, anyone can use ClickUp Brain with a paid ClickUp plan!

ClickUp’s Accounting Project Management Software boasts robust features that empower accounting teams to manage people and projects effectively.

Create a central hub for all project communication and collaboration. Accounting professionals can share documents, files, and notes within projects, eliminating information silos and ensuring everyone stays on the same page.

You can assign Tasks in ClickUp to specific accounting managers with clear deadlines and priorities. Real-time updates and progress tracking keep everyone informed about ongoing work, creating accountability and ensuring projects stay on schedule.

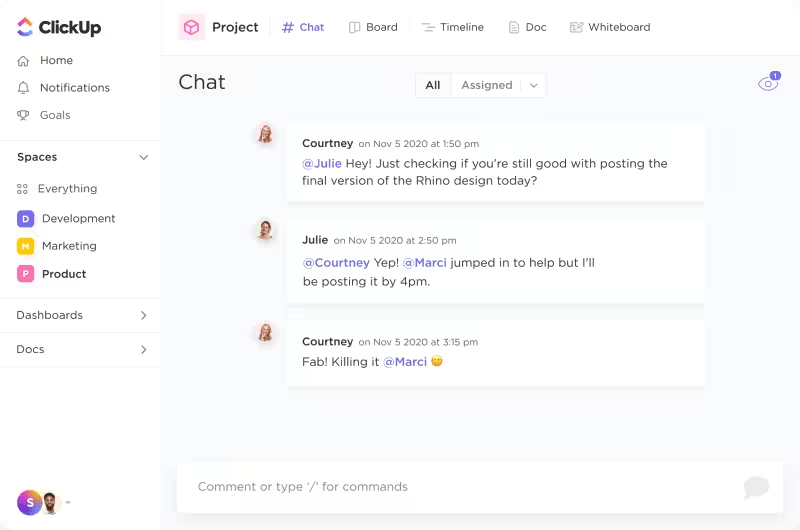

The ClickUp Chat view provides a handy, real-time chat system for easy team communication. Discussions can be threaded within specific projects, making room for focused, context-aware communication without cluttering email inboxes.

You can also share docs, receive instant feedback, and embed videos or links to specific information.

Switch between 15+ flexible views to create customized workflows, from graphs to table spreadsheet presentations. This leads to easy task delegation and progress tracking.

The best part of ClickUp’s unique capabilities is that you can create secure client portals within projects to manage external partners and retain them over time.

Clients can access relevant documents, reports, and project updates without direct access to your internal system. This is helpful for smaller accounting firms with budgets to hire limited resources.

You can send automated emails or reminders to clients about upcoming deadlines or meetings to ensure they stay informed and engaged throughout the project lifecycle.

You can use 1000+ customizable, ready-to-use ClickUp templates for various needs—accounting, creative design, social media management, agency management, blog post creation, HR, and recruitment.

You can generate templates using ClickUp Brain and ClickUp Docs for any use case you can think of!

For instance, use the ClickUp Accounting SOP Template to ensure your account teams adhere to your firm’s standard operating procedures.

Take control of scattered financial processes! This template offers a comprehensive solution that streamlines SOP creation, communication, and collaboration, ensuring your accounting department operates efficiently.

Juggling business finances can feel like a constant game of catch-up!

Tracking transactions, payments, and credits is time-consuming. ClickUp’s Accounting Journal Template can act as your digital bookkeeping template.

This powerful template captures every business transaction with pinpoint accuracy. Think beyond simple entries, as it allows you to record transactions that impact multiple accounts simultaneously:

Looking for an all-in-one template to simplify your financial processes? Try ClickUp’s Accounting Template.

This template manages your entire pipeline—from recording invoices and tracking income to predicting future revenue. No more chasing late payments, as you can easily stay on top of accounts receivable and payable.

But it gets better! Within the same platform, you can book meetings, seamlessly switch between 9+ customizable views, and leverage custom tags and statuses. Thus, you can maximize your productivity and gain real-time insights into your sales performance without leaving ClickUp.

AI’s remarkable ability to automate repetitive tasks combined with a versatile tool like ClickUp frees accountants from the mundane, granting them the valuable gift of time.

This newfound efficiency empowers them to shift their focus towards areas where human expertise reigns supreme: insightful analysis, strategic guidance, and informed decision-making.

The tide is turning for accountants. Supported by AI, the profession is poised for an evolution.

Wile reactions vary, one thing is certain: significant change is on the horizon. The next decade will witness a transformation in accounting roles, demanding a new skill set from professionals.

However, the best part is that ClickUp Brain’s natural language processing allows accountants to leverage it without learning coding techniques. Accounting jobs will resemble those of data scientists and engineers, unlocking profound financial insights. The key to navigating this evolution lies in embracing change.

Adopting AI-powered tools like ClickUp early on will help you stay ahead of the curve. Sign up for ClickUp today!

© 2026 ClickUp